Market Overview

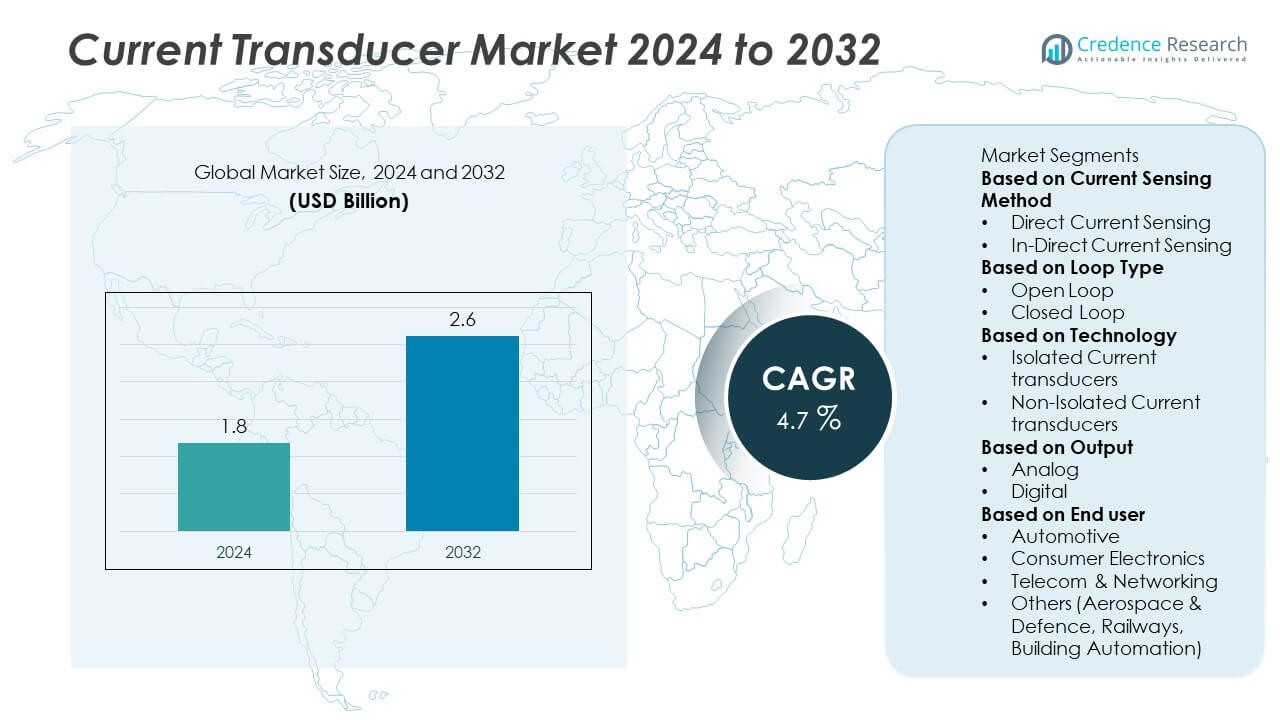

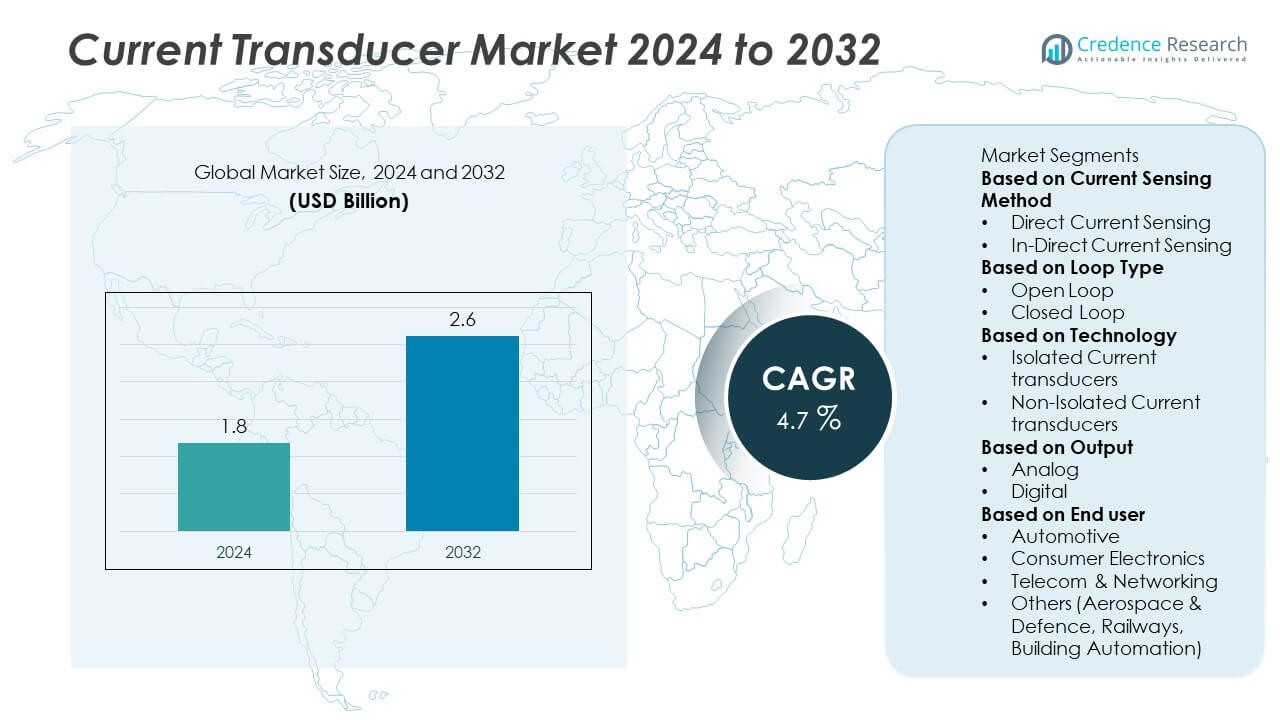

The current transducer market was valued at USD 1.8 billion in 2024 and is projected to reach USD 2.6 billion by 2032, growing at a CAGR of 4.7 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Current Transducer Market Size 2024 |

USD 1.8 Billion |

| Current Transducer Market, CAGR |

4.7 % |

| Current Transducer Market Size 2032 |

USD 2.6 Billion |

The current transducer market is led by key players including NK Technologies, Siemens AG, Johnson Controls FDC, Hobart, Veris Industries, ABB, Topstek Inc., Texas Instrument Inc., CR Magnetic, and Johnson Control Inc. These companies dominate through technological innovation, high-accuracy sensing products, and strong presence across industrial, energy, and automotive sectors. North America emerged as the leading region in 2024, holding 36 percent of the global market share, driven by smart grid expansion and industrial automation. Europe followed with 30 percent share, supported by renewable energy initiatives and stringent efficiency standards, while Asia Pacific accounted for 25 percent due to rapid industrial growth and EV infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The current transducer market was valued at USD 1.8 billion in 2024 and is projected to reach USD 2.6 billion by 2032, growing at a CAGR of 4.7 percent during the forecast period.

- Growth is driven by rising demand for precise current measurement in renewable energy systems, electric vehicles, and industrial automation applications requiring real-time monitoring and efficiency control.

- Key trends include increasing adoption of isolated and closed-loop transducers, integration of IoT-enabled sensing, and miniaturized designs supporting compact and energy-efficient systems.

- Leading players such as ABB, Siemens AG, and Texas Instrument Inc. are focusing on innovation, partnerships, and product diversification, while high manufacturing costs and calibration challenges act as key restraints.

- North America led the market with 36 percent share in 2024, followed by Europe at 30 percent and Asia Pacific at 25 percent; indirect sensing and isolated transducer segments accounted for 67 and 72 percent shares, respectively.

Market Segmentation Analysis:

By Current Sensing Method

The indirect current sensing segment dominated the current transducer market in 2024, holding around 67 percent share. This dominance is driven by its safety, high accuracy, and non-intrusive measurement capabilities. Indirect methods use magnetic field-based detection, minimizing energy loss and equipment wear. These sensors are preferred in renewable energy, electric vehicles, and industrial automation for monitoring current without direct electrical contact. The growing shift toward energy-efficient and digitally connected systems continues to strengthen demand for indirect sensing transducers across both AC and DC applications.

- For instance, ABB’s AdvaSense Rogowski coil sensors, such as the KECA 80 D85, can be rated for continuous thermal currents up to 4,000 amperes and offer high metering accuracy up to class 0.2S, enabling precise monitoring in renewable power systems and industrial drives.

By Loop Type

The closed-loop segment accounted for the largest market share of 61 percent in 2024. Closed-loop transducers are favored for their superior precision, faster response times, and better linearity compared to open-loop models. They are widely adopted in applications requiring high dynamic performance, such as motor drives, power converters, and industrial control systems. Their ability to maintain stable output under variable load conditions enhances reliability. Increasing adoption in electric propulsion systems and renewable energy inverters continues to fuel the expansion of closed-loop current transducers globally.

- For instance, NK Technologies ATR-LS series AC current transducers combine a current transformer and a True RMS signal conditioner in a split-core package and measure up to 1,600 amperes.

By Technology

The isolated current transducers segment led the market in 2024, capturing about 72 percent share. These transducers provide galvanic isolation between the primary circuit and the measuring system, ensuring operator safety and system protection. They are essential in power electronics, grid monitoring, and EV charging stations where insulation and noise immunity are critical. The rising integration of isolated transducers in smart grids and industrial IoT environments supports their growth. Their capability to deliver accurate readings under high-voltage conditions makes them indispensable for energy management and automation sectors.

Key Growth Drivers

Rising Adoption of Renewable Energy Systems

The expansion of renewable energy infrastructure is a key growth driver for the current transducer market. Solar and wind power systems require precise current measurement for monitoring inverter performance, fault detection, and grid integration. Current transducers enhance efficiency and ensure stable energy conversion. As nations accelerate renewable capacity additions, demand for reliable sensing technologies grows steadily. The transition to decentralized power generation and smart grid networks further increases the use of current transducers in maintaining safe and efficient energy distribution.

- For instance, Siemens AG’s SINAMICS drive systems use integrated current sensing technologies for motor control and monitoring. Siemens also offers external solutions, such as its SICAM T transducers, which can measure electrical quantities, including current, and support monitoring and control functions.

Increasing Demand for Industrial Automation

Industrial automation is driving widespread deployment of current transducers for process control and equipment protection. These devices enable accurate current monitoring in variable frequency drives, motors, and power supplies. As factories adopt digital control systems and robotics, current transducers support real-time diagnostics and predictive maintenance. The rising emphasis on operational efficiency and energy optimization strengthens their integration in automated manufacturing systems. This trend aligns with Industry 4.0 initiatives emphasizing intelligent monitoring and advanced electrical safety solutions.

- For instance, ABB’s ACS880 industrial drive platform employs Direct Torque Control (DTC) for precise control across a wide range of motor types. The drives include advanced diagnostics and built-in service functions, which can be combined with ABB’s digital tools for remote condition monitoring to improve equipment uptime and enable predictive maintenance.

Growing Electric Vehicle and Charging Infrastructure

The rapid growth of electric vehicles is significantly boosting demand for current transducers. These components are crucial for battery management systems, traction inverters, and fast-charging stations. Their ability to deliver precise current measurement ensures safe and efficient power flow in high-voltage circuits. As EV adoption accelerates worldwide, manufacturers increasingly deploy isolated and closed-loop transducers for performance reliability. Government incentives for EV charging infrastructure expansion further support this demand, positioning current transducers as essential components in the evolving e-mobility ecosystem.

Key Trends & Opportunities

Integration of Smart Sensing and IoT Connectivity

Current transducers are increasingly integrated with IoT-enabled platforms for remote monitoring and analytics. Smart sensors provide real-time current data that enhances predictive maintenance and asset optimization. This connectivity supports data-driven decision-making in power and automation sectors. The combination of wireless transmission and cloud-based analysis enables continuous system performance evaluation. As digital transformation advances, the use of intelligent current transducers with communication interfaces like Modbus and CAN bus is expected to expand across industrial and energy applications.

- For instance, NK Technologies developed its 4–20 mA loop-powered current transducers compatible with Modbus RTU networks, capable of transmitting continuous current data from up to 32 monitored circuits. The system integrates with SCADA and PLC architectures, enabling centralized IoT-based diagnostics for power distribution and automation systems.

Advancements in Compact and High-Efficiency Designs

Manufacturers are developing smaller, more efficient current transducers that meet the space and power constraints of modern electronics. Miniaturized Hall-effect sensors and advanced magnetic core materials improve accuracy and thermal stability. Compact designs support integration in electric vehicles, renewable energy converters, and consumer electronics. This trend caters to rising demand for lightweight, high-performance components that enhance system flexibility and reduce installation costs. The development of low-power, high-speed current transducers opens new opportunities in portable and energy-sensitive applications.

- For instance, Texas Instruments introduced its TMCS1123 Hall-effect current sensor featuring low primary conductor resistance, a 250 kHz bandwidth, and a compact size. Its design minimizes power loss and allows integration in motor-control and battery-management systems. It comes in an SOIC package measuring 10.3 mm × 10.3 mm.

Key Challenges

High Cost of Precision Transducers

The advanced materials and calibration processes required for high-accuracy current transducers significantly increase their cost. For small and medium enterprises, the price barrier limits adoption in large-scale automation or energy systems. Complex installation and maintenance requirements add to operational expenses. As markets shift toward high-precision monitoring, balancing cost and performance becomes critical. Manufacturers are focusing on cost-effective design innovations and mass production techniques to make precision transducers more accessible without compromising accuracy or reliability.

Temperature Sensitivity and Signal Drift Issues

Temperature fluctuations and electromagnetic interference can affect the accuracy and stability of current transducers. Drift in signal output under varying conditions limits their long-term reliability in harsh industrial environments. These challenges are particularly prominent in high-power and outdoor applications such as renewable energy and electric vehicles. Continuous R&D in temperature compensation, magnetic shielding, and material engineering is essential to address these issues. Improved design resilience will be vital for enhancing performance consistency and expanding operational lifespan.

Regional Analysis

North America

North America held the largest share of 36 percent in the current transducer market in 2024. The region’s growth is driven by strong adoption of automation, electric vehicles, and renewable power systems. The United States leads with extensive investments in smart grid infrastructure and energy management systems. High integration of current transducers in industrial drives, EV charging stations, and solar inverters supports market dominance. Canada’s focus on sustainable energy and electrification further accelerates demand. Ongoing modernization of power networks and stringent energy efficiency standards continue to strengthen the regional market outlook.

Europe

Europe accounted for 30 percent of the global market in 2024, supported by its advanced industrial base and strong renewable energy adoption. Germany, France, and the United Kingdom are major contributors, emphasizing high-precision current sensing for automation and green energy systems. The region’s commitment to reducing carbon emissions encourages integration of transducers in wind turbines, solar converters, and EV infrastructure. Government incentives for electrification and smart manufacturing drive technological innovation. The growing presence of leading sensor manufacturers in Europe further enhances the region’s role in shaping global current measurement solutions.

Asia Pacific

Asia Pacific captured 25 percent of the current transducer market in 2024, driven by rapid industrialization and expanding renewable power projects. China, Japan, and South Korea lead the region with large-scale deployment of transducers in electric vehicles, robotics, and grid monitoring systems. India’s increasing focus on industrial automation and power distribution upgrades also supports market expansion. The availability of low-cost manufacturing and growing investments in energy-efficient technologies boost regional competitiveness. Rising government initiatives promoting clean energy and domestic electronics production continue to position Asia Pacific as a fast-growing market.

Latin America

Latin America represented 6 percent of the market in 2024, driven by expanding power generation and transmission projects. Brazil and Mexico are key contributors, integrating current transducers into renewable energy facilities and industrial applications. The growing demand for energy efficiency and modernization of outdated electrical infrastructure fuels adoption. Regional efforts to attract foreign investments in smart grid technologies are increasing. Although market penetration remains moderate, favorable government policies supporting industrial automation and energy reform are expected to stimulate long-term growth across Latin American economies.

Middle East & Africa

The Middle East and Africa held a market share of 3 percent in 2024, reflecting emerging adoption of current transducers in industrial and energy sectors. Gulf countries such as Saudi Arabia and the United Arab Emirates are investing heavily in renewable energy and grid automation. These initiatives boost demand for precise current measurement in power systems and EV infrastructure. In Africa, South Africa and Egypt are expanding their energy distribution networks with improved monitoring systems. Growing awareness of energy management and sustainability continues to create gradual market opportunities in the region.

Market Segmentations:

By Current Sensing Method

- Direct Current Sensing

- In-Direct Current Sensing

By Loop Type

By Technology

- Isolated Current transducers

- Non-Isolated Current transducers

By Output

By End user

- Automotive

- Consumer Electronics

- Telecom & Networking

- Others (Aerospace & Defence, Railways, Building Automation)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the current transducer market is defined by technological innovation, product reliability, and strategic expansion across power, automation, and energy industries. Key players such as NK Technologies, Siemens AG, Johnson Controls FDC, Hobart, Veris Industries, ABB, Topstek Inc., Texas Instrument Inc., CR Magnetic, and Johnson Control Inc. are leading the market through advanced sensing technologies and diversified product portfolios. These companies focus on precision, energy efficiency, and enhanced performance in demanding applications such as renewable energy, industrial drives, and electric vehicle systems. Continuous investment in R&D supports innovations in Hall-effect sensors, isolation techniques, and digital signal processing. Manufacturers are also forming strategic partnerships with utility providers and automation companies to expand their global footprint. As competition intensifies, firms emphasize cost optimization, compact designs, and high-accuracy measurement solutions to meet evolving industrial and environmental standards across key regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2023, CR Magnetics released the CR9500 current sensor series, providing a 0–5 V DC proportional output for monitoring AC loads. Each sensor is factory-calibrated for accuracy within ±1% across the full current range.

- In June 2023, NK Technologies expanded its ATPR AC transducer series, combining a true-RMS signal conditioner and current transformer in one module. The system enables precise measurement in variable-frequency motor drives and HVAC control panels.

- In February 2023, NK Technologies introduced its AT series AC current transducer with jumper-selectable input ranges up to 400 A and analog outputs of 4–20 mA, 0–5 V, or 0–10 V, optimizing flexibility for OEM integrations.

- In 2023, ABB enhanced its AdvaSense sensor portfolio, adding Rogowski coil-based models capable of measuring up to 4,000 A RMS for digital substations and power distribution automation.

Report Coverage

The research report offers an in-depth analysis based on Current Sensing Method, Loop Type, Technology, Output, End user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-precision current transducers will rise with the growth of smart grids.

- Integration of AI and IoT will enhance data accuracy and real-time performance monitoring.

- Compact and energy-efficient transducer designs will gain wider adoption across industries.

- Expansion of electric vehicle infrastructure will create strong opportunities for isolated transducers.

- Renewable energy projects will drive continuous demand for high-reliability sensing solutions.

- Manufacturers will focus on developing cost-effective and digitally connected transducer models.

- Collaborations between sensor manufacturers and automation firms will strengthen market innovation.

- Adoption of silicon-based and magnetic-core technologies will improve sensitivity and stability.

- Asia Pacific will emerge as a key production and consumption hub for advanced transducers.

- Regulatory emphasis on energy efficiency and system safety will support long-term market growth.