Market Overview

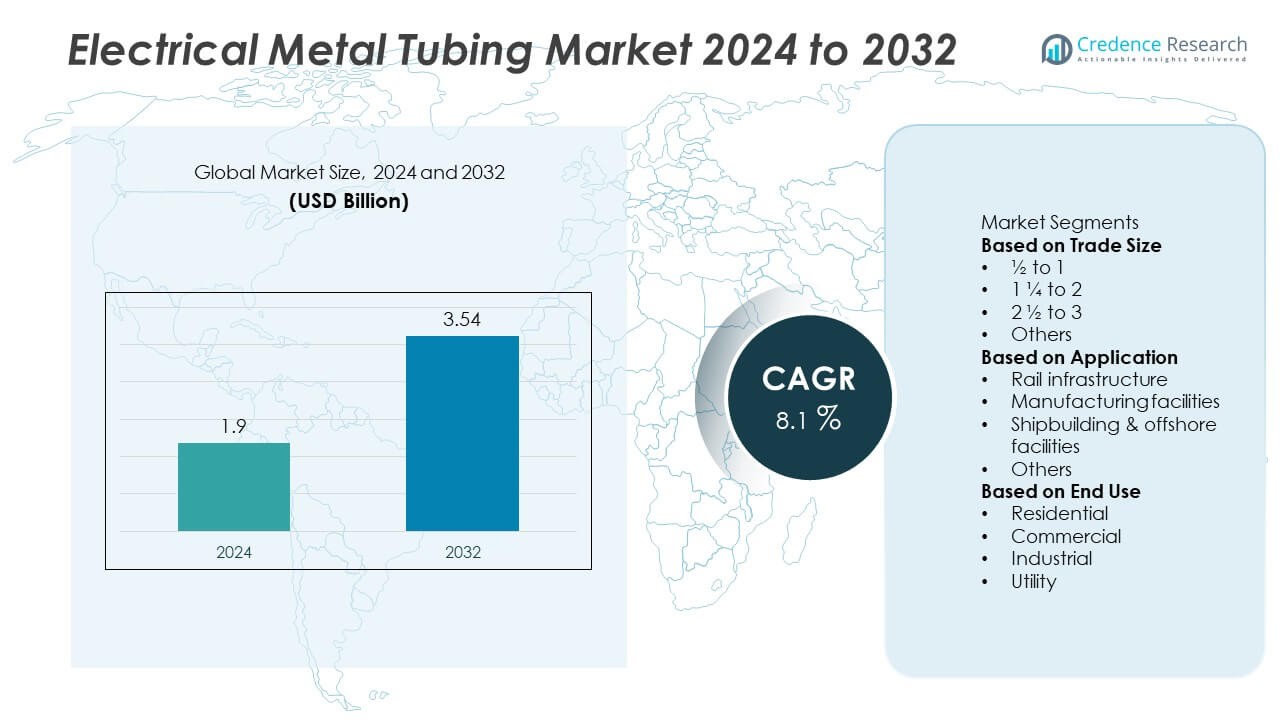

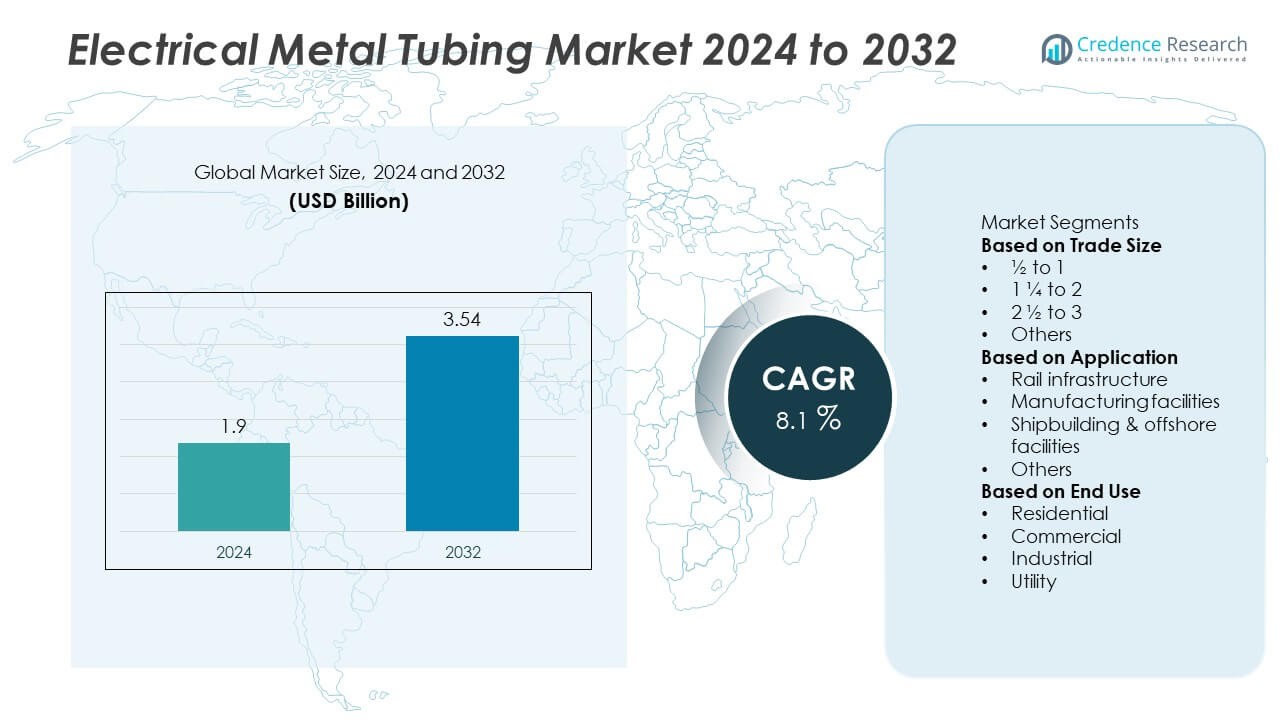

The Electrical Metal Tubing (EMT) market size was valued at USD 1.9 billion in 2024 and is anticipated to reach USD 3.54 billion by 2032, growing at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrical Metal Tubing Market Size 2024 |

USD 1.9 Billion |

| Electrical Metal Tubing Market, CAGR |

8.1% |

| Electrical Metal Tubing Market Size 2032 |

USD 3.54 Billion |

The Electrical Metal Tubing market is dominated by key players including Atkore, Eaton, Nucor Tubular Products, Arlington Industries, Orbit Industries, Bridgeport, EVT Electrical, American Fittings, Producto Electric Corp., and Hangzhou Francis Conduit Industries Co., Ltd. These companies lead through strong product portfolios, technological advancements, and extensive distribution networks across industrial and utility sectors. North America accounted for the largest 36% market share in 2024, driven by robust construction and infrastructure investment. Europe followed with a 28% share, supported by energy-efficient building standards, while Asia-Pacific held 26%, fueled by rapid urbanization and industrial expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electrical Metal Tubing market was valued at USD 1.9 billion in 2024 and is projected to reach USD 3.54 billion by 2032, growing at a CAGR of 8.1% during the forecast period.

- Rising construction and infrastructure projects, particularly in industrial and commercial sectors, are driving demand for durable and fire-resistant electrical metal tubing systems.

- The market is witnessing trends such as the use of corrosion-resistant coatings, lightweight galvanized tubing, and sustainable production processes for energy-efficient installations.

- Leading companies including Atkore, Eaton, and Nucor Tubular Products are focusing on product innovation, automation, and strategic acquisitions to strengthen global presence.

- North America led the market with a 36% share, followed by Europe at 28% and Asia-Pacific at 26%; by trade size, the ½ to 1-inch segment dominated with a 44% share due to its widespread use in residential and commercial wiring applications.

Market Segmentation Analysis:

By Trade Size

The ½ to 1 trade size segment dominated the Electrical Metal Tubing (EMT) market in 2024, holding a 46% share. This category is widely used in residential and commercial electrical installations due to its compact size, ease of handling, and cost-effectiveness. It provides reliable protection for electrical wiring in small and medium-scale applications such as offices, retail spaces, and housing complexes. Increasing demand for energy-efficient and safe electrical infrastructure continues to drive the use of smaller EMT sizes, supported by ongoing construction and renovation projects across urban regions.

- For instance, Allied Tube & Conduit, a subsidiary of Atkore Inc., manufactures a range of steel and PVC electrical conduits, including Electrical Metallic Tubing (EMT) and IMC. Atkore has introduced product innovations, such as 20-foot E-Z Pull® EMT to reduce installation time and has expanded its PVC and HDPE conduit lines to meet evolving market demands.

By Application

The manufacturing facilities segment led the EMT market in 2024 with a 41% share, driven by strong industrial expansion and the need for durable conduit systems in factory environments. Electrical metal tubing is extensively used to protect wiring in machinery installations, assembly lines, and automation systems. Its corrosion resistance and mechanical strength make it ideal for high-performance environments. Rising investments in industrial automation, coupled with growing manufacturing output in emerging economies, are accelerating EMT demand in industrial settings where safety and reliability are essential.

- For instance, Nucor Corporation, which produces electrical steel conduit, has invested in new tube mills to increase its production capabilities. In Kentucky, Nucor invested $164 million to build a new tube mill with an annual capacity of approximately 250,000 tons of hollow structural section (HSS), mechanical steel tubing, and solar torque tube.

By End Use

The commercial sector accounted for the largest 38% share of the Electrical Metal Tubing market in 2024. Demand is driven by increasing construction of office complexes, shopping centers, and institutional buildings requiring reliable electrical protection systems. EMT is preferred for its flexibility, fire resistance, and cost efficiency in large-scale wiring networks. The rise of smart buildings and the modernization of electrical grids are further boosting installation across commercial projects. Rapid urbanization and infrastructure development in both developed and emerging economies continue to reinforce the dominance of the commercial end-use segment.

Key Growth Drivers

Rising Demand for Safe and Durable Electrical Infrastructure

The growing focus on safety and reliability in electrical installations is a major driver for the Electrical Metal Tubing (EMT) market. EMT provides superior mechanical protection for wiring systems, reducing fire and shock risks. Increasing residential and commercial construction projects are boosting demand for robust conduit systems. Governments and regulatory bodies are enforcing stricter safety standards, accelerating the use of metal tubing in modern building infrastructure. The durability and fire resistance of EMT make it a preferred choice for long-term electrical system performance.

- For instance, Atkore Inc. expanded its Phoenix, Arizona facility to include a new manufacturing line dedicated to producing steel tracker components for utility-scale solar power plants in partnership with Nextracker.

Expansion of Industrial and Manufacturing Sectors

Rapid industrialization and the expansion of manufacturing facilities are significantly driving EMT demand. Factories and production units require strong conduit systems to protect electrical wiring from heat, corrosion, and mechanical stress. The integration of automation and robotics in industrial settings further increases the need for reliable wiring protection. Emerging economies are witnessing large-scale investments in industrial infrastructure, particularly in Asia-Pacific. This trend is creating sustained demand for EMT in high-performance, heavy-duty electrical systems.

- For instance, Nucor Corporation invested $650 million in its Gallatin flat-rolled sheet steel mill, doubling production capability from 1.6 million to 3 million metric tons annually. This project, along with a separate $176 million galvanizing line, increased the plant’s presence in the Midwest market for the automotive, agriculture, heavy equipment, and energy pipe and tube sectors.

Urbanization and Smart Building Development

Rising urbanization and the growth of smart cities are contributing to increased EMT installations. Smart buildings require efficient, safe, and well-organized electrical conduits to support complex wiring systems and energy management networks. The global shift toward energy-efficient infrastructure is encouraging the use of metal conduits that ensure durability and compliance with green building standards. EMT’s ease of installation and adaptability make it ideal for high-rise and mixed-use developments. Ongoing investments in urban infrastructure and public utilities continue to fuel long-term market expansion.

Key Trends & Opportunities

Adoption of Corrosion-Resistant and Lightweight Materials

Manufacturers are focusing on developing EMT with advanced coatings and alloys that enhance corrosion resistance and reduce weight. These innovations improve installation efficiency and extend product lifespan in challenging environments. Aluminum-based and galvanized steel conduits are gaining popularity in coastal and industrial regions. The trend toward sustainable, low-maintenance materials aligns with global infrastructure modernization efforts. This shift opens opportunities for product differentiation and market expansion, particularly in construction and offshore applications requiring durable conduit solutions.

- For instance, Wheatland Tube, a division of Zekelman Industries, announced it was closing its Chicago facility in September 2024 while expanding operations elsewhere, including a $120 million investment to expand manufacturing capabilities in Blytheville, Arkansas

Integration of Digital Infrastructure and Smart Energy Systems

The growing integration of smart energy systems and digital infrastructure presents strong opportunities for the EMT market. As buildings and industrial facilities adopt IoT-enabled devices, the need for secure and organized electrical pathways increases. EMT supports complex wiring for automation, communication, and energy monitoring systems. Expansion of electric vehicle (EV) charging networks and renewable energy projects further enhances market potential. The rise of smart grids and data-driven operations creates new avenues for EMT manufacturers to serve technologically advanced infrastructure.

- For instance, ABB Ltd. offers AI-based load management systems for its EV charging stations and smart building projects across Europe, which use real-time data to ensure efficient energy distribution and connectivity.

Expansion in Renewable Energy and Utility Projects

The rapid development of solar and wind energy projects is creating new applications for EMT in power transmission and distribution. Electrical metal tubing ensures reliable cable protection in harsh outdoor conditions. Governments worldwide are investing in clean energy infrastructure, promoting the installation of durable and weather-resistant conduit systems. EMT’s mechanical strength and corrosion resistance make it suitable for renewable installations such as solar farms and wind turbine facilities. This trend provides long-term opportunities for market players focusing on the energy sector.

Key Challenges

High Material and Installation Costs

The cost of metal materials such as steel and aluminum significantly impacts the overall price of EMT systems. Fluctuating raw material prices and high installation labor costs make metal conduits less affordable compared to plastic alternatives. Small contractors and residential builders often opt for PVC conduits due to lower expenses. Manufacturers are attempting to offset this challenge through lightweight designs and automated production. However, the cost barrier continues to limit EMT adoption in price-sensitive markets and smaller-scale projects.

Competition from Non-Metallic Alternatives

The growing use of non-metallic conduits, particularly PVC and fiberglass-reinforced options, poses a challenge to EMT adoption. These alternatives are lighter, easier to install, and more cost-effective for indoor applications. In regions with fewer safety regulations, non-metallic conduits are preferred for residential wiring systems. To stay competitive, EMT manufacturers are focusing on product innovation, such as coated or hybrid metal conduits that combine strength with flexibility. Nonetheless, the increasing preference for lightweight and low-cost materials remains a major restraint for market expansion.

Regional Analysis

North America

North America held a 37% share of the Electrical Metal Tubing market in 2024, driven by extensive use in residential, commercial, and industrial construction. The United States leads the region due to strong building safety regulations and modernization of electrical infrastructure. Growing investment in renewable energy and utility projects is also fueling EMT demand. Canada contributes through industrial expansion and adoption of corrosion-resistant conduit systems in harsh climates. Continuous upgrades in smart grid networks and data centers further enhance product utilization, reinforcing North America’s position as a leading market for electrical metal tubing.

Europe

Europe accounted for a 28% share of the Electrical Metal Tubing market in 2024, supported by ongoing infrastructure modernization and stringent safety standards. Countries such as Germany, France, and the United Kingdom are promoting sustainable electrical systems using durable and recyclable materials. The region’s emphasis on energy efficiency and the growth of renewable power installations are driving adoption across industrial and utility sectors. Increasing investments in smart buildings and public transport electrification also contribute to demand. European manufacturers are focusing on lightweight, corrosion-resistant designs to align with environmental regulations and improve installation efficiency.

Asia-Pacific

Asia-Pacific captured a 25% share of the Electrical Metal Tubing market in 2024, fueled by rapid urbanization, industrialization, and infrastructure development in China, India, and Japan. The expansion of manufacturing zones, transportation systems, and residential projects drives strong product demand. Governments are investing heavily in smart city and renewable energy projects that require advanced electrical conduit systems. Local manufacturers are developing cost-effective tubing solutions to meet regional construction needs. Rising awareness of electrical safety and the growth of modern building codes continue to strengthen Asia-Pacific’s position as a major growth hub in the global market.

Latin America

Latin America held a 6% share of the Electrical Metal Tubing market in 2024, driven by growing construction activity and industrial development in Brazil, Mexico, and Chile. Rising investments in renewable energy and urban infrastructure projects are boosting regional demand. However, limited local manufacturing and dependence on imports affect product availability and cost. Governments are prioritizing safer electrical systems, which supports gradual EMT adoption in commercial and utility sectors. As foreign manufacturers expand partnerships with local distributors, the region is expected to witness steady growth in electrical conduit installations over the coming years.

Middle East & Africa

The Middle East and Africa accounted for a 4% share of the Electrical Metal Tubing market in 2024. The region’s growth is supported by ongoing energy projects, commercial construction, and urban development initiatives. Gulf countries, particularly Saudi Arabia and the UAE, are adopting EMT in large-scale infrastructure and utility installations to meet safety and efficiency standards. Africa’s demand is driven by industrial electrification and renewable energy investments. Although high costs and limited technical expertise pose challenges, increasing government focus on infrastructure resilience continues to create opportunities for electrical metal tubing applications across both regions.

Market Segmentations:

By Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- Others

By Application

- Rail infrastructure

- Manufacturing facilities

- Shipbuilding & offshore facilities

- Others

By End Use

- Residential

- Commercial

- Industrial

- Utility

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Electrical Metal Tubing market is defined by the presence of major players such as Nucor Tubular Products, Arlington Industries, Orbit Industries, Hangzhou Francis Conduit Industries Co., Ltd, American Fittings, Bridgeport, EVT Electrical, Producto Electric Corp., Atkore, and Eaton. These companies compete through product innovation, advanced manufacturing processes, and strong distribution networks. Key strategies include the development of corrosion-resistant tubing, expansion into renewable infrastructure projects, and compliance with international safety standards. Leading manufacturers are investing in automation, precision forming, and sustainable material sourcing to enhance production efficiency. Partnerships with construction and utility contractors strengthen supply reliability, while customization for industrial and rail applications drives differentiation. The market remains moderately consolidated, with established brands leveraging economies of scale and technical expertise to maintain competitiveness in both domestic and international markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nucor Tubular Products

- Arlington Industries, Inc.

- Orbit Industries

- Hangzhou Francis Conduit Industries Co., Ltd

- American Fittings

- Bridgeport

- EVT Electrical

- Producto Electric Corp.

- Atkore

- Eaton

Recent Developments

- In June 2025, Eaton and Siemens Energy announced a fast-track modular data center plus on-site power solution, with standard configurations generating 500 MW of integrated power capacity.

- In June 2025, Eaton unveiled its “Factories as a Grid” approach, deploying microgrid, solar, energy storage, and hybrid digital control at its Arecibo facility to manage electrical systems more intelligently.

- In April 2025, Nucor Tubular Products began factory acceptance testing on a new Abbey cut-off machine that can cut tubes up to 20 inches (508 mm) diameter and wall thickness 0.625 inch (16 mm) at speeds up to 200 fpm (61 m/min).

- In 2025, Eaton announced a collaboration with NVIDIA to support the shift to 800 V DC power infrastructure to handle 1 megawatt racks and beyond in data centers.

Report Coverage

The research report offers an in-depth analysis based on Trade Size, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for electrical metal tubing will rise with growing infrastructure and industrial development.

- Manufacturers will focus on lightweight, corrosion-resistant, and high-strength tubing materials.

- Adoption of automation and precision manufacturing will enhance production efficiency.

- Green building initiatives will increase demand for recyclable and eco-friendly tubing products.

- Smart grid expansion will create new opportunities for electrical conduit installations.

- Hybrid metal-polymer tubing designs will gain traction for advanced electrical systems.

- The commercial construction sector will remain a major revenue contributor worldwide.

- Partnerships with electrical contractors and distributors will strengthen market reach.

- Asia-Pacific will emerge as the fastest-growing region due to rapid urbanization.

- Ongoing R&D investments will drive innovation in safety standards and material performance.