Market Overview

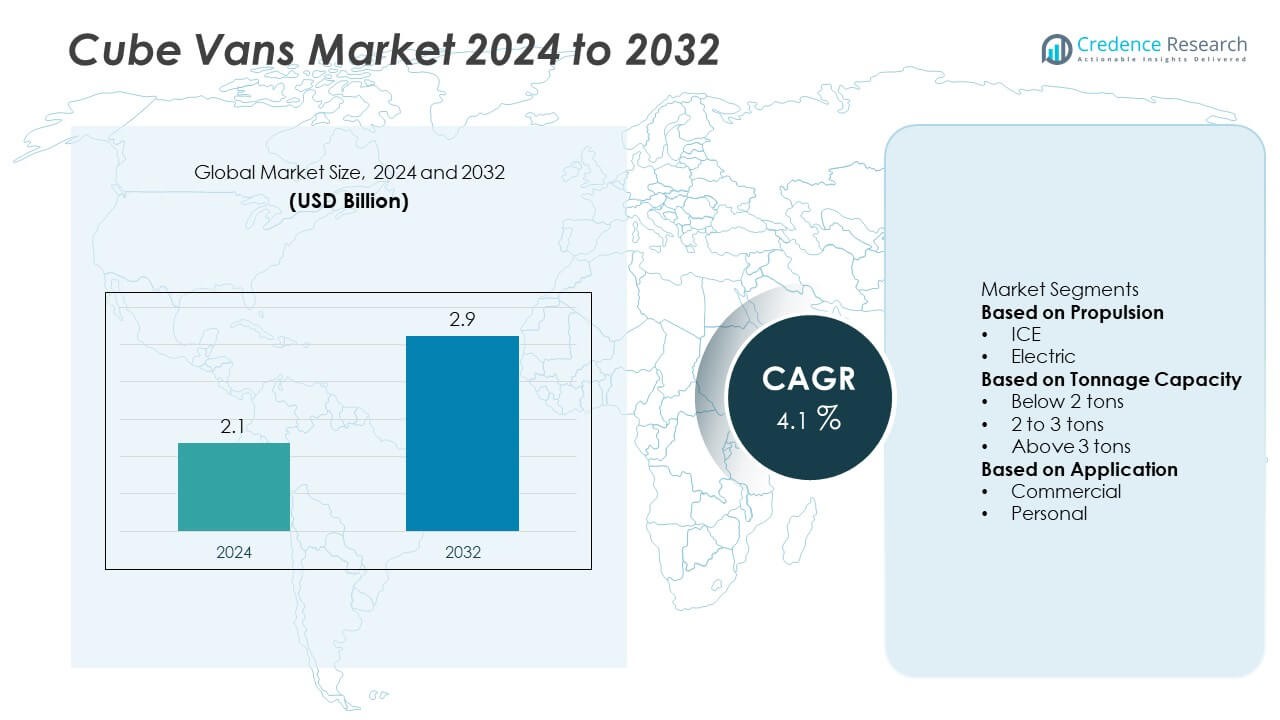

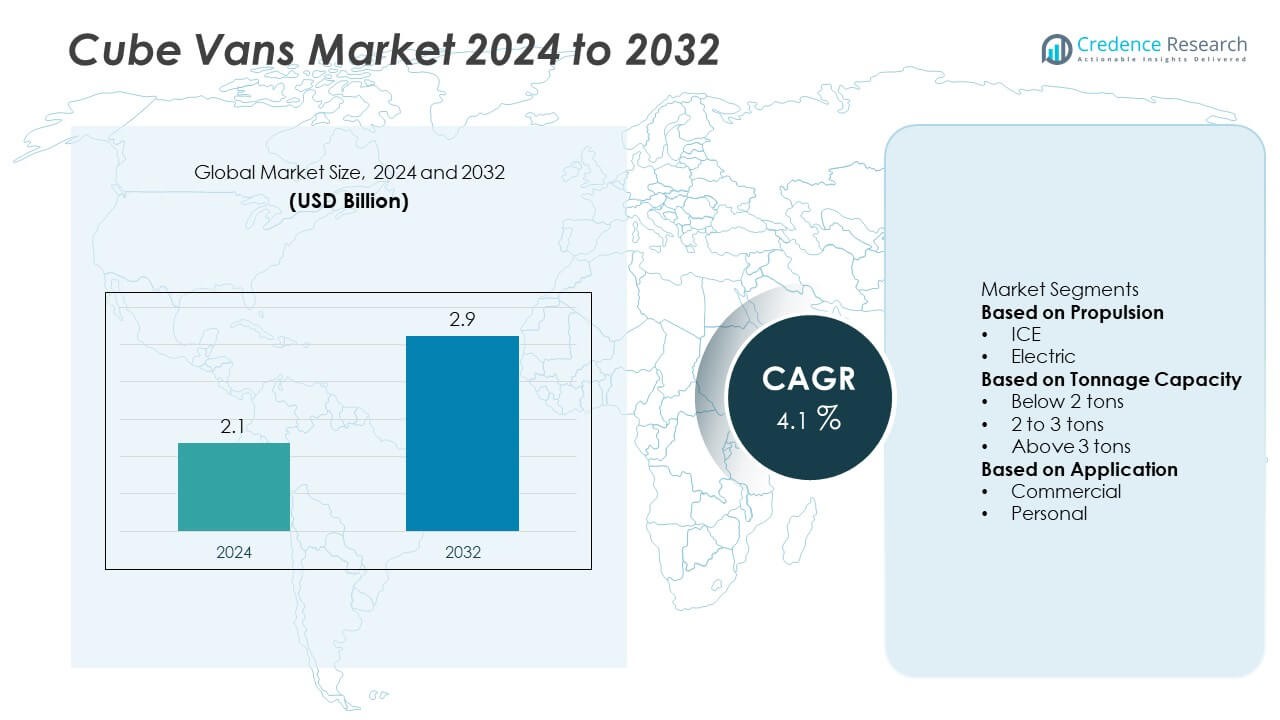

The Cube Vans market was valued at USD 2.1 billion in 2024 and is projected to reach USD 2.9 billion by 2032, expanding at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cube Vans market Size 2024 |

USD 2.1 Billion |

| Cube Vans market, CAGR |

4.1% |

| Cube Vans market Size 2032 |

USD 2.9 Billion |

The Cube Vans market is led by major players including Toyota Motor Corporation, Renault, Mercedes-Benz Group AG, Isuzu, Volkswagen AG, Hyundai Motor Corporation, Ford Motor Company, Stellantis NV, Nissan Motor Co. Ltd, and General Motors Company. These companies dominate through strong global production networks, extensive dealer bases, and innovations in electric and fuel-efficient models. North America emerged as the leading region in 2024, capturing 38% of the total market share, supported by advanced logistics infrastructure and growing last-mile delivery demand. Europe followed with 32%, driven by sustainability regulations and the rapid adoption of electric cube vans across commercial fleets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cube Vans market was valued at USD 2.1 billion in 2024 and is projected to reach USD 2.9 billion by 2032, growing at a CAGR of 4.1% during the forecast period.

- Growing e-commerce activity and the expansion of last-mile delivery networks are driving strong demand for cube vans with enhanced cargo capacity and fuel efficiency.

- Electric and connected cube vans are emerging as key trends, with major manufacturers introducing smart, low-emission models for urban transport and logistics.

- The market is competitive, with leading companies such as Toyota, Renault, Mercedes-Benz, Volkswagen, and Ford investing in vehicle electrification, modular designs, and fleet management technologies.

- North America leads the global market with a 38% share, followed by Europe at 32% and Asia-Pacific at 21%; by propulsion, ICE vans dominate with 72% share, while the 2 to 3-ton capacity segment holds 49%, reflecting strong commercial adoption.

Market Segmentation Analysis:

By Propulsion

The internal combustion engine (ICE) segment dominated the Cube Vans market in 2024, accounting for nearly 72% of total revenue. ICE-powered vans remain preferred due to their established infrastructure, high payload capacity, and lower upfront costs. Fleet operators favor these models for intercity logistics and long-haul delivery where refueling speed is critical. However, the electric segment is gaining momentum, supported by zero-emission mandates and rising fuel costs. The growing adoption of lithium-ion batteries and expansion of public charging networks will steadily increase electric van penetration during the forecast period.

- For instance, Ford Motor Company’s Transit diesel variant, with its 2.0-liter EcoBlue engine, can offer up to 185 PS (182 horsepower) and 415 Nm of torque in some configurations, while certain rear-wheel-drive models can achieve a maximum braked towing capacity of up to 3,500 kilograms.

By Tonnage Capacity

Cube vans with a 2 to 3 tons capacity held the dominant share of about 49% in 2024. This category offers an optimal balance between payload efficiency, maneuverability, and operational cost, making it ideal for parcel delivery, urban transport, and small-scale logistics. Below 2-ton vans serve micro-delivery and service fleets, while above 3-ton variants are used for industrial and construction applications. The mid-tonnage vans are in high demand from e-commerce and courier firms, which rely on them for high-frequency deliveries within congested metropolitan areas.

- For instance, the largest Mercedes-Benz Sprinter diesel panel van provides a payload capacity of up to 2,372 kilograms on a 5.0-tonne gross vehicle weight (GVW) and a maximum load volume of 17 cubic meters, enabling logistics companies like DHL and Amazon to perform parcel deliveries on last-mile routes.

By Application

The commercial segment accounted for approximately 85% of Cube Vans market share in 2024, reflecting the strong role of logistics, retail, and utility sectors. These vehicles are widely used by courier services, mobile workshops, and rental fleets due to their large cargo volume and adaptability. The rise in last-mile delivery and growing small business mobility needs are major growth drivers. The personal-use segment, though smaller, is expanding as consumers adopt cube vans for lifestyle and recreational conversions, particularly in North America and Europe.

Key Growth Drivers

Expansion of E-commerce and Last-Mile Delivery

The rise of e-commerce continues to boost demand for cube vans across logistics and retail sectors. Businesses depend on these vehicles for fast and flexible deliveries within cities. Their large storage capacity and compact design make them ideal for urban operations. Logistics providers are increasingly upgrading fleets with fuel-efficient and connected vans to handle growing delivery volumes. Collaboration between automakers and delivery companies is also expanding, improving access to purpose-built vehicles for high-frequency routes.

- For instance, Stellantis NV partnered with Amazon to provide thousands of electric Ram ProMaster vans, with Amazon becoming the first commercial customer. These vans, designed with input from Amazon, feature telematics systems for route efficiency and real-time diagnostics, integrating with AWS cloud services.

Growing Demand for Compact Commercial Vehicles

Businesses are adopting smaller, more efficient commercial vehicles for urban logistics. Cube vans offer high cargo volume while remaining easy to maneuver in dense traffic. Their customizable interiors support various commercial needs, from courier transport to on-site services. Small enterprises favor cube vans for their low maintenance costs and adaptability to different industries. The increasing number of city-based service providers further strengthens demand for these practical and reliable vehicles.

- For instance, Renault’s Kangoo Van E-Tech features a 45 kWh battery, which delivers up to a 300-kilometer (186 miles) WLTP driving range. It offers up to a 4.2 cubic meter cargo volume in its long-wheelbase version, and the optional Easy Inside Rack allows for carrying long items while leaving floor space clear. This makes it a suitable vehicle for compact urban delivery operations.

Shift Toward Electrification and Sustainability

Environmental regulations and sustainability goals are encouraging the adoption of electric cube vans. Automakers are investing in battery-powered models with longer range and quick charging capability. Fleet operators value these vehicles for their low emissions and reduced operating costs. Incentives such as tax rebates and emission credits support the shift toward greener transport. Electric cube vans are becoming central to eco-friendly logistics and urban delivery strategies worldwide.

Key Trends & Opportunities

Integration of Telematics and Fleet Management Solutions

Connected technology is transforming how fleet operators manage cube vans. Telematics systems now enable real-time tracking, driver monitoring, and predictive maintenance. These solutions improve efficiency, reduce downtime, and enhance safety. Logistics firms are using data-driven tools to optimize delivery routes and reduce fuel use. This trend presents strong opportunities for partnerships between automakers and digital solution providers focused on intelligent fleet operations.

- For instance, Ford Motor Company’s Ford Pro Intelligence platform connects over 650,000 commercial vehicles globally, collecting more than 30 million data points per day to monitor fuel consumption, engine performance, and driver behavior. The system reduces unplanned maintenance incidents by up to 20% through predictive analytics integration.

Rise of Custom-Built and Specialty Vans

Customization is emerging as a major trend in the cube vans market. Businesses seek vehicles tailored to specific purposes such as refrigerated delivery, mobile repair, or retail display. Manufacturers and upfitters are responding with modular designs and flexible configurations. These specialized builds allow operators to enhance productivity and brand identity. The shift toward custom-built solutions also opens new business avenues for suppliers and bodybuilders serving niche sectors.

- For instance, Mercedes-Benz Group AG collaborated with Thermo King on a prototype for a refrigerated eSprinter, the eSprinter Pharma, to enable zero-emission urban deliveries for the pharmaceutical industry.

Expansion Across Emerging Economies

Developing regions are becoming key markets for cube van manufacturers. Economic growth, rising entrepreneurship, and expanding logistics networks create strong demand for reliable transport vehicles. Local assembly operations and dealership expansion are improving affordability and availability. These markets offer significant potential for both conventional and electric models, particularly as urbanization and small business activity continue to rise.

Key Challenges

High Cost of Electric Models

Electric cube vans remain costly compared to conventional ones due to expensive batteries and limited scale of production. Many small fleet operators hesitate to invest despite long-term savings. The upfront expense slows adoption, especially in developing economies. Manufacturers are working to reduce production costs and improve affordability through local sourcing and technology partnerships. Broader cost reductions are essential for mass adoption of electric cube vans.

Lack of Supporting Infrastructure and Regulation Gaps

Inadequate charging infrastructure and inconsistent regulations hinder market growth. Many regions lack sufficient public charging stations, restricting fleet deployment. Diverse emission and safety standards across countries complicate production and distribution strategies. Manufacturers also face challenges meeting varying local certification requirements. Coordinated infrastructure development and harmonized regulations are vital to support wider adoption of cube vans globally.

Regional Analysis

North America

North America held the largest share of 38% in the cube vans market in 2024. The region benefits from strong logistics infrastructure, high e-commerce activity, and widespread fleet modernization. Demand is driven by courier services, rental fleets, and last-mile delivery networks that rely on versatile transport vehicles. The U.S. leads adoption due to strong manufacturing capabilities and commercial fleet renewal programs. Electric cube vans are gaining traction as companies aim to meet emission reduction targets and qualify for federal incentives. Canada contributes further through growing logistics startups and cross-border trade activities.

Europe

Europe captured a 32% share of the cube vans market in 2024, supported by high adoption of sustainable mobility solutions. Strict emission regulations and city access restrictions accelerate the shift toward electric and hybrid vans. Major countries like Germany, France, and the United Kingdom lead in commercial fleet electrification and van customization. Urban logistics expansion, coupled with efficient infrastructure, enhances regional growth. Rising demand for compact delivery vehicles from e-commerce and postal services strengthens market penetration. The European Union’s green transport policies and investment in charging infrastructure continue to shape future market development.

Asia-Pacific

Asia-Pacific accounted for 21% of the cube vans market share in 2024, driven by growing industrialization and urbanization. Rapid e-commerce growth in China, Japan, and India fuels high demand for delivery vans. Local manufacturers are expanding production capacity and offering affordable models suited to regional logistics needs. Governments are promoting electric vehicle adoption through incentives and charging network expansion. The rise of small and medium businesses engaged in retail, construction, and service sectors further supports market expansion. Increasing urban congestion and environmental awareness are accelerating the transition toward compact, energy-efficient cube vans.

Latin America

Latin America represented a 6% share of the cube vans market in 2024. Market growth is supported by increasing small business activity and improving logistics infrastructure across Brazil, Mexico, and Chile. Expanding retail and delivery sectors are boosting demand for versatile commercial vehicles. Manufacturers are focusing on affordable models with durable engines and lower maintenance costs to attract cost-conscious buyers. Government initiatives supporting local assembly and import duty relaxations are improving availability. However, limited electric vehicle infrastructure remains a restraint, though regional interest in clean mobility is gradually increasing among logistics operators.

Middle East & Africa

The Middle East and Africa held a 3% market share in 2024, with rising demand from construction, oilfield, and logistics sectors. The Gulf countries are investing in commercial transport fleets as part of broader economic diversification plans. Growing retail distribution and cross-border trade enhance vehicle demand in the region. South Africa and the UAE are witnessing higher adoption of light-duty vans for service and delivery applications. Although electric models remain limited, sustainability initiatives are expected to influence future fleet purchases. Ongoing infrastructure expansion and urban development projects will support steady market growth ahead.

Market Segmentations:

By Propulsion

By Tonnage Capacity

- Below 2 tons

- 2 to 3 tons

- Above 3 tons

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cube Vans market features leading players such as Toyota Motor Corporation, Renault, Mercedes-Benz Group AG, Isuzu, Volkswagen AG, Hyundai Motor Corporation, Ford Motor Company, Stellantis NV, Nissan Motor Co. Ltd, and General Motors Company. These companies focus on expanding product portfolios, advancing electric and hybrid technologies, and improving vehicle efficiency to meet evolving logistics demands. Manufacturers are investing in modular chassis designs, lightweight materials, and digital fleet management integration to enhance operational performance. Strategic partnerships with logistics and e-commerce providers strengthen market reach, while collaborations with battery and charging infrastructure firms accelerate electrification efforts. Continuous innovation in range capability, connectivity, and driver-assist systems remains central to maintaining a competitive edge. Regional assembly expansion and tailored financing solutions further help brands capture emerging market opportunities and support growing demand for sustainable urban mobility solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Mercedes-Benz Group AG announced that it will discontinue its small van models (Citan and T-Class) by mid-2026 to focus on midsize and large van segments.

- In January 2025, Renault (via Flexis JV) received letters of intent from ten European logistics operators for 15,000 electric vans, to be delivered starting in 2026.

- In 2025, Volkswagen AG / Renault-Volvo JV Flexis showed its electric van lineup using an 800-volt skateboard platform that supports 20-minute charging up to 80 % for urban van use.

Report Coverage

The research report offers an in-depth analysis based on Propulsion, Tonnage Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Electric cube vans will gain wider adoption as fleets transition toward zero-emission operations.

- Automakers will focus on improving battery range, charging speed, and overall vehicle efficiency.

- Integration of telematics and AI-based fleet management will enhance route optimization and performance.

- Lightweight materials and modular chassis designs will improve payload capacity and fuel economy.

- Custom-built vans for specific industries such as food delivery and mobile services will see higher demand.

- Partnerships between automakers and logistics providers will expand distribution networks globally.

- Growth in e-commerce and last-mile delivery will continue to drive fleet expansion in urban areas.

- Emerging markets in Asia-Pacific and Latin America will experience stronger cube van adoption.

- Government incentives and green mobility policies will accelerate the shift to electric and hybrid models.

- Continuous digitalization and connectivity features will redefine efficiency, safety, and fleet monitoring standards.