Market Overview

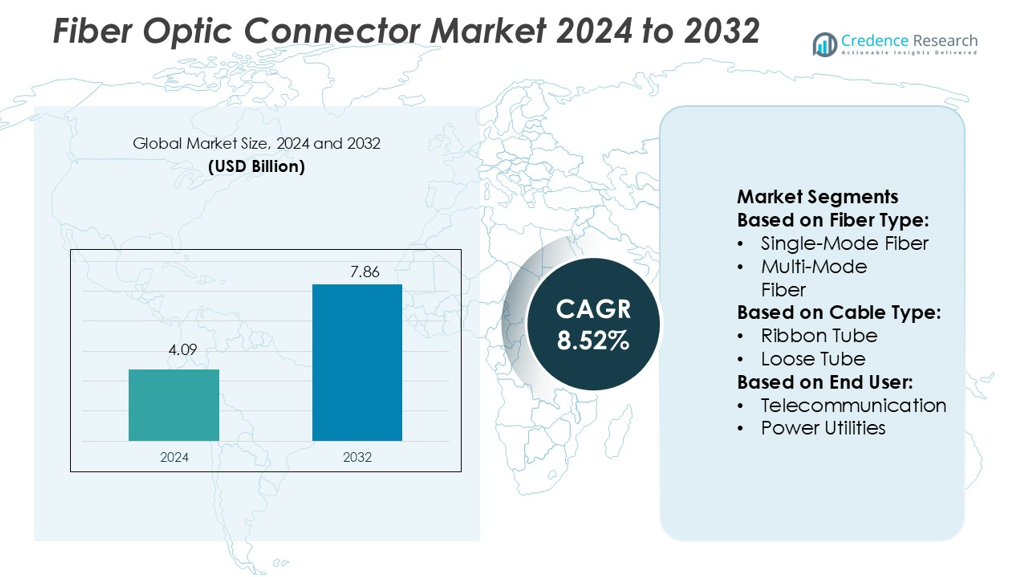

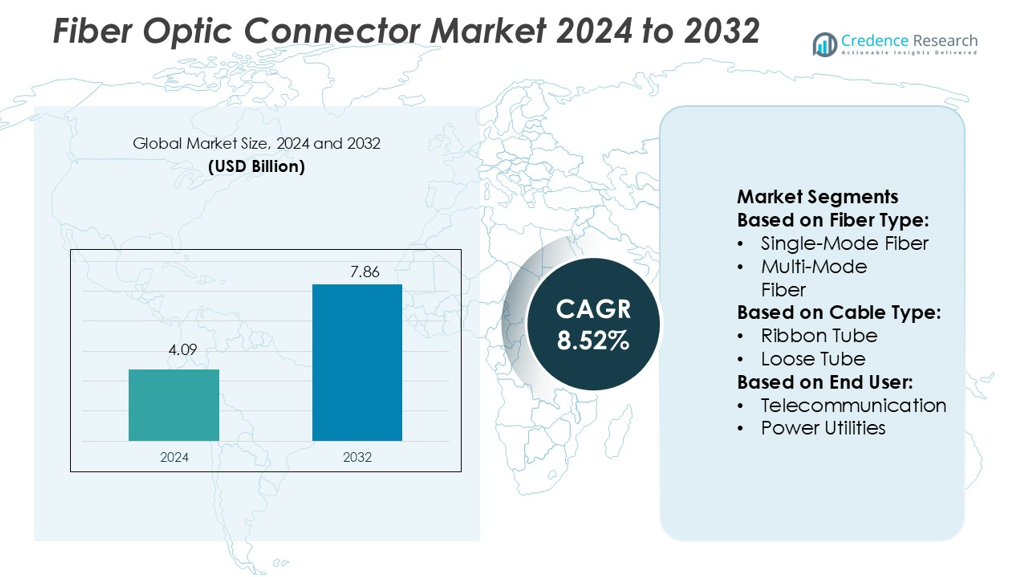

Fiber Optic Connector Market size was valued USD 4.09 billion in 2024 and is anticipated to reach USD 7.86 billion by 2032, at a CAGR of 8.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fiber Optic Connector Market Size 2024 |

USD 4.09 billion |

| Fiber Optic Connector Market, CAGR |

8.52% |

| Fiber Optic Connector Market Size 2032 |

USD 7.86 billion |

The Fiber Optic Connector Market is shaped by top players including Fischer Connectors, 3M, Corning Incorporated, Aptiv, Glenair, AVX, Amphenol, Douglas Electrical Components, Foxconn, and Ametek. These companies lead through advanced product development, strategic collaborations, and large-scale manufacturing capabilities. They focus on delivering high-density, low-loss, and high-performance connector solutions to meet rising demand from telecom, data center, and industrial sectors. North America leads the market with a 39.2% share, supported by strong 5G deployments, data center expansion, and government-backed broadband initiatives. Continuous innovation, infrastructure investments, and expanding fiber networks reinforce this regional dominance in the global market.

Market Insights

- The Fiber Optic Connector Market was valued at USD 4.09 billion in 2024 and is projected to reach USD 7.86 billion by 2032, growing at a CAGR of 8.52%.

- Rising 5G deployments, cloud expansion, and FTTH rollouts are key market drivers, boosting demand for high-density and low-loss connectors across telecom and enterprise networks.

- Growing adoption of advanced connector designs, miniaturized components, and sustainable manufacturing practices defines major market trends.

- Intense competition among global manufacturers drives innovation, while high installation costs and complex maintenance processes act as key restraints.

- North America leads with a 39.2% regional share, followed by Europe and Asia Pacific, while single-mode fiber holds the largest segment share, supported by high-speed data transmission and extensive infrastructure upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fiber Type

Single-mode fiber holds the dominant market share in the Fiber Optic Connector Market. Its popularity stems from its low signal loss and high bandwidth capacity, making it ideal for long-distance transmission. This fiber type supports 5G networks, hyperscale data centers, and cloud infrastructure growth. Multi-mode fiber remains relevant for shorter distances and lower-cost installations, especially in enterprise LANs and data rooms. However, rising demand for high-speed internet and large-scale communication networks continues to push single-mode fiber adoption in both developed and emerging markets.

- For instance, Fischer’s FiberOptic series connectors deliver IP68 sealing when mated, ensuring robust environmental protection. The connectors are rated for thousands of mating cycles, though the specific rating varies by model.

By Cable Type

Loose tube cables lead the market due to their durability, flexibility, and suitability for outdoor environments. This design protects fibers against moisture and temperature variations, supporting telecommunication and power utility infrastructure. Ribbon tube cables are gaining traction for high-density data centers because they enable faster splicing and installation. Tight buffered and central core cables serve specialized indoor and industrial applications. The preference for loose tube solutions is driven by large-scale network expansion projects and the growing need for reliable long-haul connectivity.

- For instance, Corning’s ALTOS® loose tube gel-free cable 096FU4-T4101D20 supports 96 fibers configured as 8 tubes × 12 fibers per tube; its nominal outer diameter is 12.2 mm and the cable has a long-term tensile strength of 890 N.

By End User

Telecommunication dominates the end-user segment, holding the largest market share. The rapid expansion of 5G networks, fiber-to-the-home (FTTH) deployments, and rising data traffic strongly support this lead. Power utilities and defense sectors follow, adopting fiber connectors for secure and high-speed communication links. Industrial and medical applications are growing steadily due to automation and advanced diagnostics. However, telecom operators remain the primary demand drivers, as they require scalable and high-performance infrastructure to support global connectivity needs.

Key Growth Drivers

Rising Demand for High-Speed Data Transmission

The growing use of fiber optic connectors is driven by the need for faster and more stable data transfer. High-bandwidth applications in telecommunications, cloud computing, and enterprise networks increase the demand for reliable interconnections. Fiber connectors enable low-loss transmission, essential for supporting 5G networks and high-density data centers. The push for faster internet speeds and real-time services fuels their adoption. Telecom operators, hyperscale data centers, and ISPs use advanced connector solutions to enhance performance and network scalability, driving strong market growth.

- For instance, Aptiv’s Automatable Module Ethernet Connector (AMEC) supports 1 Gbit/sec data over the same PCB footprint as its 100 Mbit/sec version, enabling seamless upgrades.

Expansion of Data Centers and 5G Infrastructure

Global investments in 5G rollouts and data center expansions are major growth drivers. Telecom operators and hyperscale companies deploy high-capacity fiber networks to handle massive data traffic. Fiber optic connectors are essential for ensuring low latency and high throughput across critical links. New edge computing facilities also boost connector demand to support distributed architectures. Governments and private companies are actively funding infrastructure upgrades, accelerating fiber adoption in urban and industrial regions worldwide.

- For instance, Glenair’s High Density (GHD) fiber optic system uses a size 18 genderless terminus with nearly double the density of standard MIL-DTL-38999 systems, achieving typical insertion loss of 0.3 dB and guaranteed below 0.5 dB.

Growing Adoption in Industrial and Defense Applications

Fiber optic connectors are increasingly used in industrial automation, defense, and military systems. These sectors require secure, high-speed, and interference-resistant communication. Fiber connectors provide stable transmission in harsh environments and critical operations. Industrial robotics, power utilities, and defense communications rely on these components for mission-critical applications. Their compact size, durability, and low signal loss make them ideal for demanding environments, further supporting market expansion.

Key Trends & Opportunities

Rapid Growth of Fiber-to-the-Home (FTTH)

The expansion of FTTH networks creates new opportunities for connector manufacturers. Governments and telecom providers are investing in last-mile fiber deployments to boost broadband access. Connectors enable quick installations, reduced signal loss, and easy network maintenance. As consumer demand for ultra-fast internet grows, FTTH penetration is expected to rise significantly. This trend encourages the development of cost-efficient, compact, and high-performance connector solutions tailored for residential and small-business networks.

- For instance, AVX’s connector portfolio focuses largely on electronic interconnects (wire-to-board, FFC/FPC, etc.). These connectors are available with fine pitches down to 0.4 mm and operating temperatures from –40 °C to +125 °C in some IDC and board-to-board series.

Emergence of Advanced Connector Technologies

Manufacturers are introducing next-generation connector types to support faster, more reliable connectivity. Developments like expanded beam connectors and multi-fiber push-on (MPO) solutions increase installation efficiency and reduce network downtime. These technologies also support higher fiber counts and improved alignment precision. Growing automation in data centers and rising bandwidth needs push vendors to innovate. This opens opportunities for suppliers to provide specialized, high-density connectors for evolving network architectures.

- For instance, Amphenol’s TACBEAM® expanded beam connector supports up to 4 channels in single-mode or multimode versions, with insertion loss ≤ 2.5 dB for single-mode and ≤ 2.0 dB for multimode, and mating durability exceeding 2,000 cycles.

Integration with AI and Cloud Ecosystems

The rapid growth of AI-driven workloads and cloud ecosystems increases the need for robust fiber networks. Connectors designed for AI and cloud data centers focus on minimizing latency and optimizing high-speed interconnections. Edge deployments also rely on compact connector systems to support distributed infrastructure. This integration fuels demand for advanced, scalable, and low-maintenance connector solutions in hyperscale environments.

Key Challenges

High Initial Investment Costs

Despite strong benefits, the installation of fiber optic networks involves significant capital expenditure. High-quality connectors, installation tools, and skilled labor increase deployment costs. Smaller telecom operators and enterprises often face budget limitations, slowing adoption rates. Upgrading legacy copper-based infrastructure to fiber also adds complexity and cost. These financial barriers pose a major challenge for rapid market expansion, especially in developing regions.

Complex Installation and Maintenance Processes

Fiber optic connectors require precise handling and installation to ensure minimal signal loss. Improper alignment or contamination can lead to performance issues. Skilled technicians and specialized tools are needed for network deployment and maintenance. This increases operational complexity and cost. In regions lacking technical expertise, these challenges can lead to longer installation timelines and reduced network reliability, limiting market penetration.

Regional Analysis

North America

North America leads the Fiber Optic Connector Market with a 39.2% share. Strong broadband infrastructure, early 5G adoption, and high data center concentration support this dominance. The U.S. and Canada invest heavily in advanced fiber networks to enable low-latency communication and AI-driven workloads. Hyperscale data centers and telecom operators drive large-scale deployments to meet bandwidth demand. Major players also invest in edge and cloud connectivity, boosting connector usage. Robust government initiatives and rising enterprise digitalization sustain market growth across IT, healthcare, defense, and industrial automation sectors.

Europe

Europe holds a 27.4% share of the Fiber Optic Connector Market, supported by strong broadband initiatives and sustainable infrastructure goals. Countries such as Germany, France, and the U.K. are rapidly upgrading network backbones to meet 5G and cloud demands. EU-backed digital transformation programs encourage fiber expansion in urban and rural areas. Telecom and enterprise networks rely on high-performance connectors to ensure reliability and low signal loss. The rising number of smart city projects and manufacturing automation further strengthen market adoption. Increased investment in renewable-powered data centers enhances long-term growth potential.

Asia Pacific

Asia Pacific accounts for 24.8% of the Fiber Optic Connector Market, driven by rapid digitalization and massive infrastructure development. China, Japan, South Korea, and India are major contributors, with extensive 5G rollouts and FTTH deployments. High internet penetration and rising demand for cloud services increase the need for high-density connectors. Governments actively support broadband programs and smart city initiatives to expand connectivity. The strong presence of electronic manufacturing hubs also drives adoption in industrial automation. Competitive pricing and rapid urban expansion make Asia Pacific a key growth engine in this market.

Latin America

Latin America represents a 5.1% share of the Fiber Optic Connector Market, supported by increasing network modernization projects. Countries such as Brazil, Mexico, and Chile invest in broadband expansion and edge infrastructure to improve connectivity. Rising cloud adoption and telecom upgrades boost demand for reliable connectors. Several governments also encourage private partnerships to enhance regional fiber coverage. The growing number of data center facilities and smart service deployments supports steady market growth. Although the pace of adoption is moderate, strategic investments indicate strong future potential across the region.

Middle East & Africa

The Middle East & Africa account for 3.5% of the Fiber Optic Connector Market, driven by growing digital infrastructure investments. Gulf countries, including the UAE and Saudi Arabia, are expanding fiber networks to support smart city and 5G initiatives. Governments are focusing on strengthening backbone connectivity and cloud ecosystems. Increasing hyperscale and colocation data center projects also boost connector adoption. In Africa, fiber deployments remain in early stages but show rising momentum due to international investments. Despite infrastructure gaps, the region holds strong growth potential as digital transformation accelerates.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Fiber Type:

- Single-Mode Fiber

- Multi-Mode Fiber

By Cable Type:

By End User:

- Telecommunication

- Power Utilities

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Fiber Optic Connector Market features strong competition among key players such as Fischer Connectors, 3M, Corning Incorporated, Aptiv, Glenair, AVX, Amphenol, Douglas Electrical Components, Foxconn, and Ametek. The Fiber Optic Connector Market is characterized by intense competition, rapid innovation, and expanding global footprints. Companies are focusing on developing advanced connector technologies that enable higher bandwidth, lower signal loss, and faster data transfer. Strategic investments in automation and precision engineering are improving product quality and scalability. Many manufacturers are also prioritizing sustainability and energy efficiency to align with evolving network infrastructure standards. The growing adoption of 5G, cloud computing, and AI-driven applications fuels demand for high-density, compact, and reliable connectors. Firms are expanding their global presence through partnerships, acquisitions, and enhanced distribution networks to strengthen their competitive edge.

Key Player Analysis

Recent Developments

- In August 2025, Amphenol acquired CommScope’s Connectivity and Cable Solutions (CCS) business. This acquisition significantly expands the company’s fiber optic interconnect capabilities, especially for AI-driven data centers and broadband networks.

- In July 2025, Kyocera AVX introduced the 6780-000 Series IP20 T1 Industrial Single-Pair Ethernet (SPE) connectors, which support fiber optic cable assemblies for industrial automation and smart grid applications. These connectors offer space and weight savings while improving reliability and efficiency in harsh environments.

- In March 2025, 3M partnered with Sumitomo Electric through an assembly agreement, allowing Sumitomo to offer optical fiber connectivity products that include 3M’s Expanded Beam Optical (EBO) interconnect technology. Designed for large data centers and edge computing, this technology offers scalable, high-performance connections with lower maintenance due to its reduced sensitivity to contamination.

- In March 2024, FIT Hon Teng (Foxconn’s interconnect division) partnered with MediaTek to develop Co-Packaged Optics (CPO) solutions. These integrate fiber optic transceivers directly into ASICs, enhancing bandwidth and reducing latency in data centers. FIT’s CPO sockets are part of its 800G–1600G optical connector portfolio.

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Cable Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for fiber optic connectors will grow steadily with expanding 5G networks.

- Data center modernization will drive strong adoption of high-density connector solutions.

- FTTH deployments will increase connector usage in residential and small business networks.

- Automation and smart manufacturing will enhance connector production efficiency.

- Advanced connector designs will support AI-driven and cloud-based workloads.

- Miniaturized and ruggedized connectors will see rising demand in industrial applications.

- Sustainable and energy-efficient solutions will gain more focus from manufacturers.

- Emerging markets will accelerate adoption through broadband infrastructure investments.

- Integration with next-generation communication technologies will expand market opportunities.

- Strategic partnerships and acquisitions will strengthen global market positioning.