Market Overview

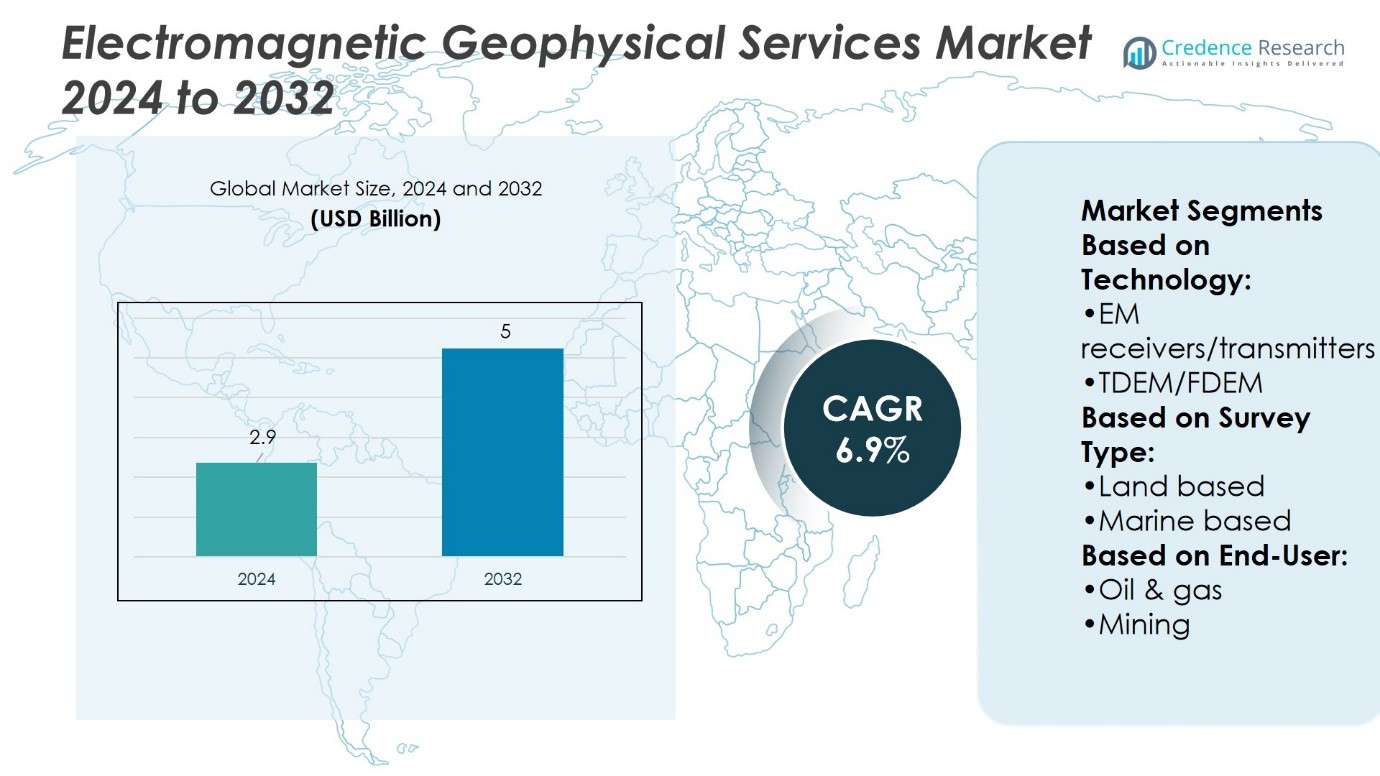

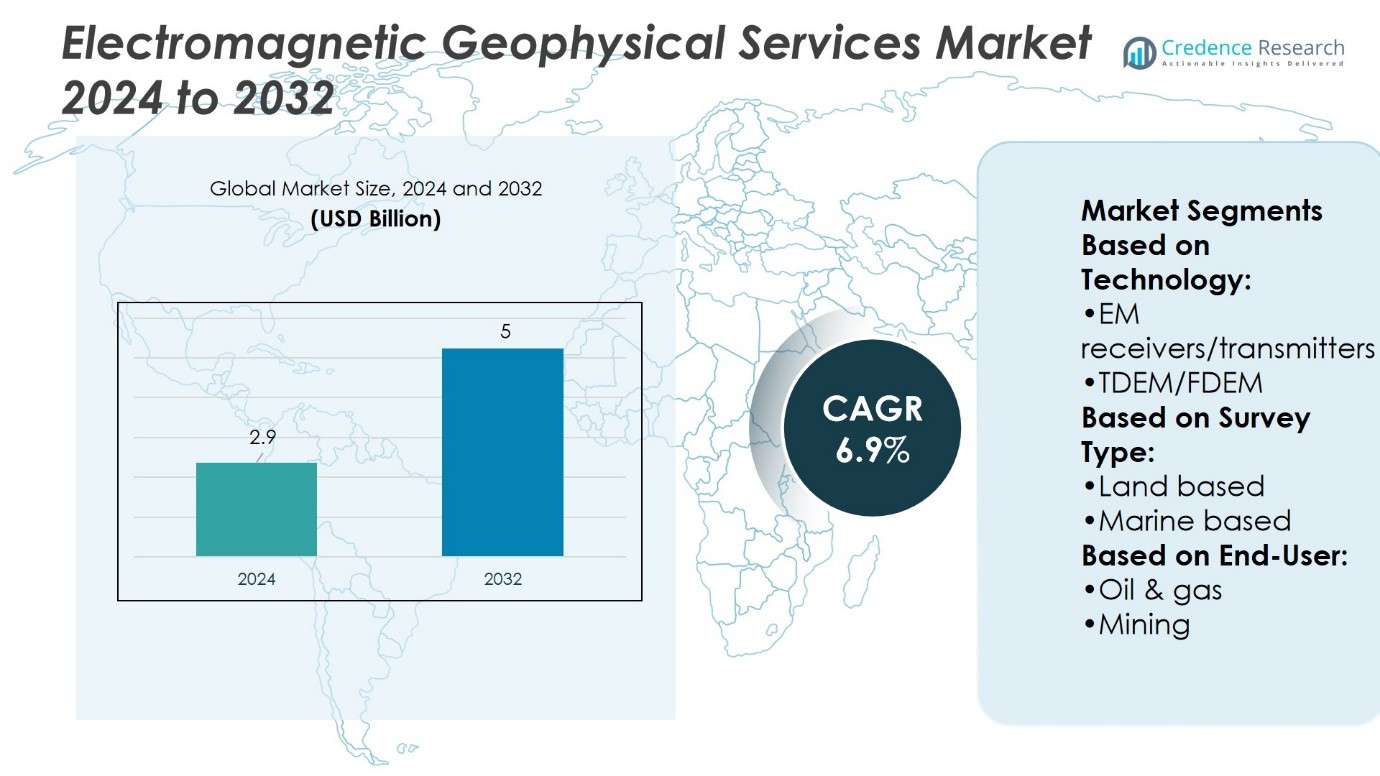

Electromagnetic Geophysical Services Market size was valued at USD 2.9 billion in 2024 and is anticipated to reach USD 5 billion by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electromagnetic Geophysical Services Market Size 2024 |

USD 2.9 Billion |

| Electromagnetic Geophysical Services Market, CAGR |

6.9% |

| Electromagnetic Geophysical Services Market Size 2032 |

USD 5 Billion |

The Electromagnetic Geophysical Services Market grows with rising demand for accurate resource exploration and sustainable development practices. Strong drivers include the increasing need for critical minerals, expanding offshore oil and gas projects, and the adoption of renewable energy solutions. Companies rely on advanced electromagnetic surveys to reduce exploration risks, improve efficiency, and meet regulatory standards. Key trends include the integration of artificial intelligence for faster data interpretation, the expansion of aerial and marine survey methods, and the shift toward non-invasive, environmentally responsible techniques. These factors position the market for steady growth across diverse industries and global regions.

North America holds the largest share of the Electromagnetic Geophysical Services Market, supported by strong investments in oil, gas, and mineral exploration. Europe follows with rising adoption in geothermal and offshore projects, while Asia-Pacific shows rapid growth from mining and infrastructure development. Latin America strengthens its role with lithium and copper exploration, and the Middle East & Africa expand through oil, gas, and mining projects. Key players include Fugro, CGG, Applus+, China Oilfield Services, Paradigm Group, and Dawson Geophysical.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Electromagnetic Geophysical Services Market size was valued at USD 2.9 billion in 2024 and is expected to reach USD 5 billion by 2032, at a CAGR of 6.9%.

- Rising demand for accurate mineral and hydrocarbon exploration drives steady market growth.

- Integration of artificial intelligence and digital platforms shapes new trends in data interpretation.

- Leading players compete through innovation, global reach, and specialized service portfolios.

- High operational costs and strict regulations act as restraints for smaller service providers.

- North America leads with strong oil, gas, and mineral projects, followed by Europe and Asia-Pacific.

- Latin America expands with lithium and copper exploration, while Middle East & Africa grow through oil and mining activities.

Market Drivers

Growing Demand for Mineral Exploration to Support Global Resource Security

The Electromagnetic Geophysical Services Market grows with rising mineral exploration activity worldwide. Governments and private firms prioritize efficient resource mapping to secure supply chains. It supports identification of critical minerals like copper, nickel, and rare earths. These resources remain vital for clean energy technologies and advanced electronics. Growing investments in sustainable mining drive adoption of electromagnetic surveys. The technology helps reduce environmental disruption by targeting exploration with higher accuracy. It strengthens operational efficiency and reduces overall exploration costs.

- For instance, EGS Survey Group has surveyed over 750,000 route‑kilometres of submarine cable routes, using combined hydrographic and geophysical systems—including multibeam echo sounders, side‑scan sonars, sub‑bottom profilers, and seismic systems—across multiple continents.

Expansion of Oil and Gas Exploration Across Complex Terrains

The Electromagnetic Geophysical Services Market benefits from increasing demand for oil and gas surveys. Energy companies adopt electromagnetic methods to map subsurface reservoirs in deepwater and frontier regions. It improves hydrocarbon detection accuracy compared to conventional seismic techniques. Rising global energy needs encourage investment in offshore projects. Electromagnetic surveys support cost control by lowering the risk of drilling dry wells. Operators use it for detailed imaging of resistivity contrasts in challenging terrains. This approach reduces uncertainty and supports safer exploration.

- For instance, AKS Geoscience has conducted thousands of geophysical investigations over the past 20+ years, deploying instruments such as EM31 and EM38 systems to map soil conductivity down to depths of 1.5 meters and 5.5 meters respectively, and EM34 systems reaching depths of up to 60 meters—supporting environmental monitoring and infrastructure site characterization.

Technological Advancements in Data Acquisition and Processing Systems

The Electromagnetic Geophysical Services Market advances with rapid innovation in sensors, hardware, and software. Modern systems deliver higher resolution imaging and faster data interpretation. It allows companies to make quicker and more informed exploration decisions. Artificial intelligence and machine learning support automated modeling of geophysical datasets. Integration with satellite and airborne platforms enhances coverage of inaccessible areas. The development of portable and ruggedized equipment broadens field applications. These innovations drive adoption across multiple industries.

Rising Need for Infrastructure Development and Environmental Studies

The Electromagnetic Geophysical Services Market also grows with demand from construction and environmental sectors. Governments rely on electromagnetic surveys to assess soil stability for major infrastructure projects. It ensures safety in tunneling, road construction, and urban expansion. Environmental agencies employ these services to detect groundwater contamination and assess aquifer health. Renewable energy developers apply it to identify suitable sites for geothermal projects. The services enable accurate, non-invasive assessments of subsurface conditions. Such applications extend market relevance beyond traditional mining and energy domains.

Market Trends

Integration of Artificial Intelligence and Machine Learning in Survey Processes

The Electromagnetic Geophysical Services Market reflects a strong shift toward digital integration. Artificial intelligence and machine learning improve interpretation of complex resistivity data. It reduces errors and speeds up identification of resource-rich zones. Automated algorithms support predictive modeling for mineral and hydrocarbon potential. Service providers develop proprietary platforms to enhance competitive advantage. The trend accelerates adoption in regions with large unexplored reserves. It positions digital innovation as a key driver of efficiency in exploration.

- For instance, Dawson Geophysical ordered 100,000 Geospace Pioneer ultralight seismic land nodes. Each node weighs under 0.5 kg, records continuously for up to 50 days, and features QuickDeploy capabilities.

Growing Use of Airborne and Marine Electromagnetic Survey Techniques

The Electromagnetic Geophysical Services Market expands with increasing reliance on airborne and marine surveys. Airborne platforms cover vast terrains quickly and cost effectively. It helps reach remote, hazardous, or inaccessible areas where ground surveys are not practical. Marine electromagnetic surveys gain traction for offshore oil, gas, and mineral projects. Rising interest in deep-sea resource exploration strengthens demand for these techniques. Governments and private firms invest in advanced survey vessels and drones. This trend enables large-scale exploration with minimal environmental disturbance.

- For instance, Spectrem Air has flown over 2.5 million km of airborne electromagnetic surveys across regions like the Americas, Africa, and Australia — enabling simultaneous mapping of shallow (under 100 m) and deep (over 500 m) subsurface features with high resolution.

Increased Application in Renewable Energy and Geothermal Projects

The Electromagnetic Geophysical Services Market diversifies with growing adoption in renewable energy. Developers employ electromagnetic surveys to assess geothermal reservoirs and map subsurface heat sources. It supports site selection for wind and solar infrastructure by evaluating soil and groundwater conditions. The trend aligns with global commitments to clean energy transition. Rising funding for low-carbon technologies enhances relevance of geophysical methods. Service providers position their offerings for both traditional and emerging industries. It ensures long-term sustainability of service demand.

Focus on Non-Invasive and Environmentally Friendly Exploration Methods

The Electromagnetic Geophysical Services Market advances with demand for low-impact survey techniques. Mining and energy companies seek methods that limit disruption of ecosystems. It supports regulatory compliance and aligns with rising public scrutiny of exploration practices. Non-invasive electromagnetic surveys minimize drilling requirements, reducing land clearance and waste generation. The trend gains momentum in regions with sensitive biodiversity zones. Governments promote environmentally responsible exploration policies, boosting adoption. It strengthens the market’s role in sustainable resource development.

Market Challenges Analysis

High Operational Costs and Technical Complexity in Service Delivery

The Electromagnetic Geophysical Services Market faces significant challenges linked to high operational expenses and technical complexity. Advanced survey equipment requires substantial capital investment, while maintenance and skilled workforce add further costs. It creates barriers for small and mid-sized service providers aiming to expand in competitive regions. Complex data interpretation also demands highly trained professionals with expertise in geophysics and digital modeling. Limited availability of such talent slows project execution and affects efficiency. Clients in resource-constrained markets hesitate to adopt these services due to elevated costs. This challenge restricts accessibility and reduces scalability across emerging economies.

Regulatory Barriers and Environmental Constraints in Exploration Activities

The Electromagnetic Geophysical Services Market also struggles with strict regulatory frameworks and environmental concerns. Exploration activities often intersect with protected areas or regions under tight ecological monitoring. It forces companies to delay or redesign survey projects to comply with legal requirements. Lengthy approval processes and evolving environmental standards increase uncertainty for operators. Local opposition and community resistance toward exploration add further complications. These constraints slow down adoption despite the advantages of non-invasive survey methods. It highlights the ongoing challenge of balancing exploration efficiency with environmental and social responsibilities.

Market Opportunities

Rising Exploration Demand for Critical Minerals and Rare Earth Elements

The Electromagnetic Geophysical Services Market holds strong opportunities through growing demand for critical minerals. Global industries require lithium, cobalt, and rare earth elements for batteries, electric vehicles, and renewable technologies. It supports large-scale exploration projects aimed at securing reliable supply chains. Governments and private companies invest heavily in identifying mineral reserves to reduce import dependence. Advanced electromagnetic surveys provide accurate data that minimizes risks in mineral mapping. Expanding clean energy initiatives further amplify the need for resource-focused exploration services. This trend ensures continuous opportunities for service providers in both developed and emerging regions.

Expanding Applications Across Renewable Energy and Infrastructure Development

The Electromagnetic Geophysical Services Market benefits from widening applications beyond mining and hydrocarbons. Renewable energy developers adopt surveys for geothermal reservoir identification and subsurface site assessments. It also assists infrastructure projects by evaluating soil stability and groundwater resources for construction. Growing urbanization and government investments in smart infrastructure strengthen adoption across multiple sectors. Service providers can tailor solutions for environmental monitoring, groundwater management, and sustainable development. The combination of clean energy expansion and infrastructure growth creates long-term market potential. It positions electromagnetic geophysical services as essential tools for future-ready industries.

Market Segmentation Analysis:

By Technology

The Electromagnetic Geophysical Services Market segments by technology into EM receivers/transmitters, TDEM/FDEM, magnetotellurics (MT), and others. EM receivers and transmitters dominate adoption due to their precision in detecting subsurface resistivity variations. It supports exploration in oil, gas, and mineral projects where accurate mapping reduces uncertainty. Time-domain electromagnetic (TDEM) and frequency-domain electromagnetic (FDEM) technologies gain traction with flexible applications across both land and marine environments. Magnetotellurics (MT) plays a critical role in deep crustal studies and geothermal exploration. Other technologies cover specialized applications tailored for regional geological challenges. Each method serves distinct exploration needs, creating a diversified technological portfolio in the market.

- For instance, PARSAN has conducted thousands of geophysical projects over its 20+ years, including some of the first deployments of ReMi (surface shear-wave velocity profiling) in India.

By Survey Type

The Electromagnetic Geophysical Services Market divides survey type into land-based, marine-based, and aerial-based services. Land-based surveys hold a major role due to their wide application in mining, oil, and infrastructure projects. It supports detailed near-surface investigations while offering reliable data for construction and environmental studies. Marine-based surveys expand steadily with offshore oil, gas, and deep-sea mineral exploration. These surveys provide critical insights into sub-seafloor resistivity structures and help reduce drilling risks. Aerial-based surveys gain importance with the rising need for rapid coverage in inaccessible regions. Their ability to map large terrains in less time drives adoption across emerging exploration areas.

- For instance, SkyTEM has mapped over 1,500,000 line-kilometres of the Earth using helicopter-borne electromagnetic systems, spanning all seven continents. The company’s helicopter-towed systems can fly at speeds of up to 150 km/h and are designed for high-resolution mapping of both shallow and deep subsurface features.

By End User

The Electromagnetic Geophysical Services Market categorizes end users into oil & gas, mining, and agriculture sectors. Oil and gas remain the leading users, employing electromagnetic surveys to evaluate reservoirs and reduce exploration costs. It helps operators detect hydrocarbon-bearing formations with higher certainty, particularly in deepwater projects. Mining companies adopt the technology for locating base metals, rare earth elements, and other critical resources. Agriculture emerges as a growing application, where electromagnetic services assist in soil mapping, groundwater detection, and precision farming. Expanding focus on resource efficiency and sustainable land management supports adoption across agricultural projects. These diverse applications highlight the broad relevance of electromagnetic geophysical services across industries.

Segments:

Based on Technology:

- EM receivers/transmitters

- TDEM/FDEM

Based on Survey Type:

Based on End-User:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share of the Electromagnetic Geophysical Services Market, accounting for 38% in 2024. The region benefits from advanced technological infrastructure and strong investments in resource exploration. It supports large-scale oil, gas, and mineral projects across the United States and Canada. The presence of leading service providers and research institutions strengthens innovation in survey technologies. Companies integrate AI-based modeling and airborne platforms to expand exploration efficiency. Governments fund critical mineral exploration to reduce reliance on imports, especially for rare earth elements and battery metals. The combination of innovation, regulatory support, and resource potential sustains North America’s dominant position in the market.

Europe

Europe represents 24% of the Electromagnetic Geophysical Services Market in 2024. Strong demand comes from mineral and geothermal energy exploration across countries like Germany, Norway, and the United Kingdom. It benefits from strict environmental regulations that drive adoption of non-invasive geophysical survey techniques. The region invests heavily in renewable energy, with geothermal exploration expanding in Iceland and Eastern Europe. Marine-based surveys also gain traction in offshore oil, gas, and wind energy projects. Service providers focus on technological upgrades to meet the European Union’s climate and sustainability goals. Europe’s position reflects a balance between traditional resource exploration and clean energy applications.

Asia-Pacific

Asia-Pacific captures 21% share of the Electromagnetic Geophysical Services Market in 2024. The region demonstrates high growth potential driven by China, India, Japan, and Australia. It supports extensive mining activities for coal, iron ore, copper, and rare earth elements. Governments increase investments in infrastructure and energy projects that require precise geophysical assessments. Marine-based surveys expand in Southeast Asia to support offshore hydrocarbon exploration. Aerial-based surveys gain demand in remote and rugged terrains, improving exploration efficiency. Strong reliance on critical mineral supply for manufacturing and clean energy industries secures long-term market opportunities in Asia-Pacific.

Latin America

Latin America holds 9% of the Electromagnetic Geophysical Services Market in 2024. The region’s demand centers on mining, particularly for copper, lithium, and gold in Chile, Peru, and Brazil. It attracts global companies seeking to expand exploration in resource-rich zones. Governments promote investment in mining projects while requiring compliance with environmental standards. Electromagnetic surveys reduce environmental disruption and provide accurate data for responsible exploration. Oil and gas projects in offshore Brazil also contribute to market demand. Growing international interest in sustainable mineral extraction positions Latin America as a strategic hub for future exploration activities.

Middle East & Africa

The Middle East & Africa account for 8% of the Electromagnetic Geophysical Services Market in 2024. Oil and gas remain the dominant end-user segment, with exploration projects across Saudi Arabia, the UAE, and Nigeria. It supports hydrocarbon mapping in challenging terrains and offshore zones. Mining activities in South Africa, Ghana, and other mineral-rich countries further strengthen adoption. Governments encourage non-invasive survey methods to balance resource extraction with environmental considerations. Emerging infrastructure and geothermal projects in East Africa provide additional opportunities. Despite lower market share compared to other regions, the region continues to expand steadily with support from international exploration firms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Paradigm Group

- China Oilfield Services

- Fugro

- Applus+

- EGS

- Geotech

- AKS Geoscience

- CGG

- Dawson Geophysical

- Abitibi Geophysics

Competitive Analysis

The Electromagnetic Geophysical Services Market include Paradigm Group, China Oilfield Services, Fugro, Applus+, EGS, Geotech, AKS Geoscience, CGG, Dawson Geophysical, and Abitibi Geophysics. The Electromagnetic Geophysical Services Market demonstrates strong competition shaped by innovation, global reach, and specialized expertise. Companies focus on developing advanced technologies that enhance data accuracy and reduce survey costs. Service providers expand into emerging regions to capture demand from mining, oil, and renewable energy projects. The market shows a clear trend toward digital platforms, integrating AI and machine learning for faster data interpretation. Environmental sustainability drives adoption of non-invasive survey methods, aligning with stricter regulations and public expectations. Partnerships with governments and private industries help providers secure large-scale projects. Competitive positioning relies on technological differentiation, operational efficiency, and the ability to serve diverse end-user industries.

Recent Developments

- In March of 2025, the Geological Survey of India (GSI) aims to incorporate artificial intelligence (AI) and machine learning (ML) techniques in the exploration of minerals. The proposed work aims to enhance the precision of resource finding via advanced data analytics and prediction with 4D geological modeling.

- In March 2025, GPR WaveSense’s ground penetrating radar (GPR) technology will be integrated into NovAtel’s SPAN GNSS+INS solution, as per the MOU with GPR. The aim of the collaboration is to improve positioning in difficult environments by integrating sonar-based mapping with GNSS and inertial data for civil mapping and autonomous vehicle systems.

- In July 2024, Dias Geophysical combined its operations with Australia’s Gap Geophysics, which gaps into new frontiers of geophysical services. This acquisition looks to expand Gap Geophysics’ geophysical capabilities in mineral exploration, environmental management, infrastructure development, and further demonstrates Dias’ innovation and client-centric services.

- In February 2024, CSA Ocean received a General Offshore Geophysical Survey Permit from the California State Lands Commission, which now allows the occurrence of low energy marine surveys within three miles of the Californian coastline.

Report Coverage

The research report offers an in-depth analysis based on Technology, Survey Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for critical mineral exploration.

- Oil and gas projects will continue to drive adoption in offshore and deepwater regions.

- AI and machine learning will improve speed and accuracy of data interpretation.

- Aerial and marine surveys will gain importance for large-scale and remote exploration.

- Renewable energy projects will increase demand for geothermal and subsurface assessments.

- Environmental regulations will push adoption of non-invasive and low-impact survey methods.

- Service providers will invest in portable and ruggedized equipment for field applications.

- Partnerships with governments will support national resource security initiatives.

- Growing infrastructure projects will create opportunities in soil and groundwater studies.

- Digital platforms and cloud-based solutions will strengthen competitiveness in the market.