Market Overview

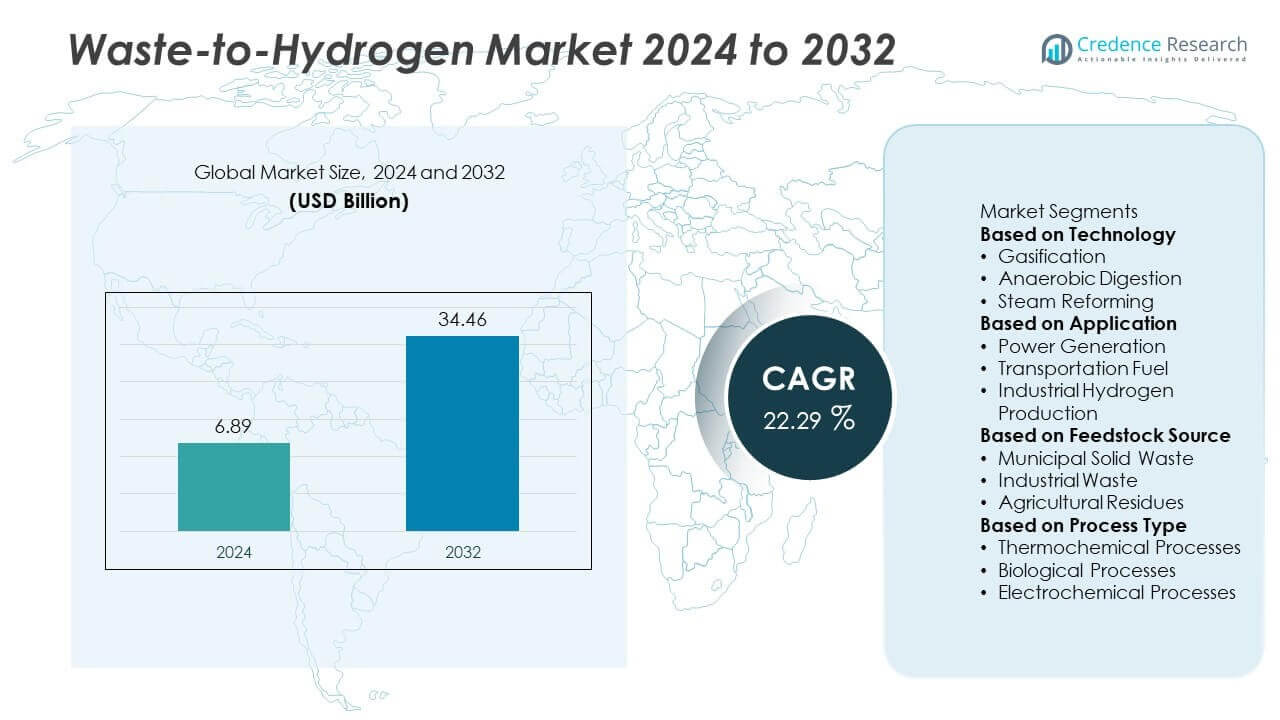

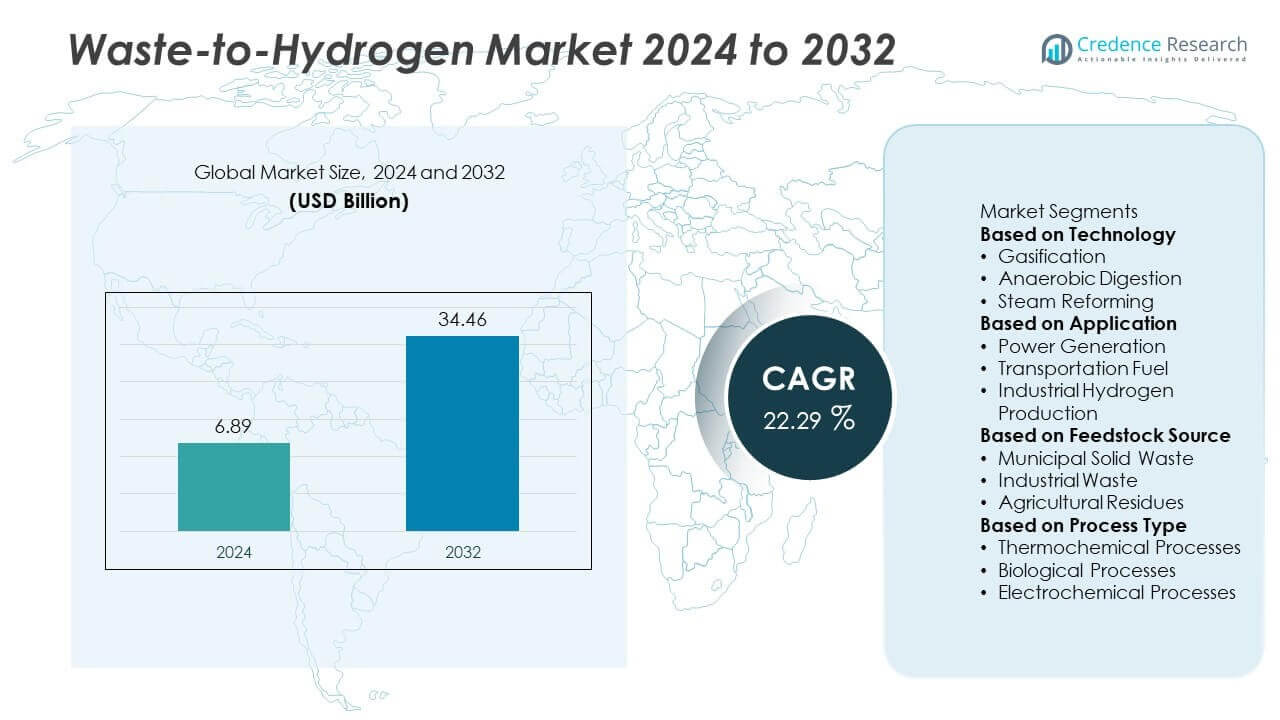

The Waste-to-Hydrogen Market size was valued at USD 6.89 billion in 2024 and is projected to reach USD 34.46 billion by 2032, growing at a CAGR of 22.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Waste-to-Hydrogen Market Size 2024 |

USD 6.89 Billion |

| Waste-to-Hydrogen Markett, CAGR |

22.29% |

| Waste-to-Hydrogen Market Size 2032 |

USD 34.46 Billion |

The Waste-to-Hydrogen Market grows through strong drivers and evolving trends that support its rapid adoption. Rising demand for clean hydrogen as an alternative fuel and government incentives accelerate large-scale investments. It addresses dual challenges of renewable energy needs and sustainable waste management.

The Waste-to-Hydrogen Market demonstrates strong geographical growth across major regions, supported by government initiatives and sustainability goals. North America leads with advanced infrastructure and projects that integrate hydrogen production with municipal waste management. Europe follows with strict environmental regulations and strong policy frameworks that encourage waste valorization and hydrogen adoption in transportation and industry. Asia-Pacific records the fastest momentum, driven by large-scale urbanization, high waste volumes, and national hydrogen roadmaps in China, Japan, and South Korea. Latin America and the Middle East & Africa show emerging potential through pilot projects supported by international investments and circular economy initiatives. Key players driving this market include Siemens, Brightmark, ENGIE, and Waste Management, alongside innovators such as ThyssenKrupp and Ballard Power Systems. Their focus on partnerships, technological advancements, and large-scale project announcements strengthens the global position of waste-to-hydrogen solutions in both energy and environmental strategies.

Market Insights

- The Waste-to-Hydrogen Market was valued at USD 6.89 billion in 2024 and is projected to reach USD 34.46 billion by 2032, growing at a CAGR of 22.29%.

- Rising demand for clean hydrogen as a fuel source drives large-scale adoption across industries and municipalities.

- Governments worldwide introduce incentives, tax credits, and hydrogen roadmaps that strengthen project development and private investments.

- Technological advancements in gasification, pyrolysis, and plasma arc processes improve efficiency, scalability, and emission reduction.

- Leading companies such as Siemens, Brightmark, ENGIE, and Waste Management compete through partnerships, innovation, and regional expansion.

- High capital requirements, long approval cycles, and regulatory inconsistencies act as restraints for smaller developers.

- North America and Europe remain strong markets with established projects, Asia-Pacific emerges as the fastest-growing region, while Latin America and the Middle East & Africa show gradual adoption through pilot initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Clean Hydrogen as an Alternative Fuel Source

The Waste-to-Hydrogen Market benefits from the rising global demand for clean hydrogen as a sustainable fuel. Governments and industries are investing in hydrogen projects to reduce dependence on fossil fuels. It supports decarbonization goals in transportation, power generation, and industrial use. Hydrogen from waste offers a dual benefit of energy production and waste reduction. The growing interest in hydrogen fuel cells in mobility applications enhances market prospects. It aligns with long-term climate strategies set by international agreements.

- For instance, Brightmark announced a new plastics recycling facility in Thomaston, Georgia in April 2024, projected to process over 400,000 tons of plastic annually. This is distinct from its Ashley, Indiana, plant, which had a 100,000-ton capacity and faced operational issues before its subsidiaries filed for bankruptcy in March 2025.

Government Policies and Incentives Encouraging Hydrogen Adoption

Government support plays a critical role in driving the Waste-to-Hydrogen Market. Regulatory frameworks and subsidies are introduced to encourage large-scale hydrogen production from waste streams. It fosters partnerships between public institutions and private companies to accelerate project development. Tax benefits and carbon credits incentivize investments in waste-to-hydrogen infrastructure. Policies focused on reducing greenhouse gas emissions strengthen adoption in heavy industries. It ensures the market receives financial and institutional backing to expand rapidly.

- For instance, in June 2025 Snam secured €24 million in co-financing from the European Commission under the CEF Energy programme to develop the Italian Hydrogen Backbone, integrating hydrogen—including waste-derived hydrogen—into national infrastructure.

Technological Advancements Enhancing Conversion Efficiency and Scalability

Continuous innovation drives growth in the Waste-to-Hydrogen Market by improving efficiency and scalability. Advanced gasification, pyrolysis, and plasma arc technologies are making hydrogen production more cost-effective. It enables better conversion rates from municipal and industrial waste sources. Integration of digital monitoring and automation increases operational reliability. Enhanced technologies reduce carbon footprints compared to traditional hydrogen production. It strengthens industry confidence in deploying large-scale waste-to-hydrogen plants.

Growing Focus on Circular Economy and Sustainable Waste Management

The Waste-to-Hydrogen Market gains momentum from the global push for circular economy models. Converting waste into hydrogen directly supports sustainable waste management practices. It reduces landfill dependency while creating value from discarded materials. Municipalities adopt waste-to-hydrogen solutions to address rising urban waste volumes. The approach aligns with corporate sustainability goals and zero-waste initiatives. It positions waste-to-hydrogen technology as a practical bridge between energy transition and waste reduction.

Market Trends

Integration of Hydrogen into Transportation and Mobility Applications

The Waste-to-Hydrogen Market is witnessing strong momentum through its integration into mobility solutions. Hydrogen-powered buses, trucks, and trains are gaining acceptance as low-emission transport options. It addresses the rising demand for clean energy in urban centers with strict emission norms. Public transport systems in Europe and Asia are investing in hydrogen fleets. The trend creates opportunities for localized waste-to-hydrogen plants near urban hubs. It supports governments in meeting zero-emission targets within the transport sector.

- For instance, Ballard delivered three 100 kW fuel cell modules for a push boat in Berlin, and more recently secured orders for 70 engines for buses in both the UK and Germany.

Expansion of Industrial Applications Beyond Energy Generation

Industrial sectors are emerging as significant adopters of the Waste-to-Hydrogen Market. Heavy industries such as steel, cement, and chemicals are testing hydrogen as a clean substitute for fossil fuels. It reduces carbon intensity in high-emission production processes. Partnerships between industrial players and technology providers expand pilot projects into full-scale plants. Growing industrial demand highlights hydrogen’s role in hard-to-abate sectors. It reinforces the market’s importance beyond transportation and power generation.

- For instance, ThyssenKrupp nucera integrated new electrolysis assets acquired from Green Hydrogen Systems, scaling its alkaline electrolyzer production to support multi-hundred-megawatt industrial hydrogen projects for steel and chemical sectors.

Strategic Collaborations and Large-Scale Project Announcements

The Waste-to-Hydrogen Market is shaped by increasing collaborations among technology firms, governments, and energy companies. Strategic partnerships drive funding and knowledge-sharing to accelerate project deployment. It enables scaling of pilot facilities into commercial production plants. Global energy companies are investing in regional hubs to establish hydrogen corridors. Announcements of multi-million-ton projects highlight the long-term commitment to this technology. It demonstrates confidence in hydrogen’s role within the broader clean energy mix.

Rising Focus on Decentralized and Localized Energy Models

The Waste-to-Hydrogen Market reflects a rising preference for decentralized energy solutions. Smaller waste-to-hydrogen plants are being developed near waste sources and consumption points. It ensures reduced transportation costs and improved efficiency in hydrogen distribution. Urban municipalities see this approach as a way to manage waste sustainably. Decentralized systems also enhance energy security by reducing reliance on centralized grids. It positions waste-to-hydrogen as a flexible solution for both developed and emerging markets.

Market Challenges Analysis

High Capital Requirements and Complex Infrastructure Development

The Waste-to-Hydrogen Market faces significant barriers due to high initial investment needs. Construction of gasification or plasma arc plants requires substantial financial resources and advanced engineering expertise. It limits participation of smaller companies and municipalities with restricted budgets. Long project development cycles and lengthy approval processes further delay implementation. The lack of established hydrogen distribution infrastructure adds to the challenge. It raises concerns about the economic feasibility of projects in developing regions.

Technological, Regulatory, and Feedstock-Related Uncertainties

The Waste-to-Hydrogen Market also struggles with technological and regulatory uncertainties. Variability in waste feedstock quality complicates stable hydrogen production processes. It requires advanced sorting and pre-treatment systems, which increase operational costs. Regulatory inconsistencies across regions hinder cross-border project development. Safety standards for hydrogen handling remain fragmented, delaying widespread adoption. It creates uncertainty for investors and technology providers seeking long-term stability.

Market Opportunities

Expansion of Green Hydrogen Ecosystem and Net-Zero Commitments

The Waste-to-Hydrogen Market presents opportunities through the global shift toward net-zero targets. Countries are scaling up green hydrogen ecosystems to decarbonize transportation, power, and heavy industries. It positions waste-to-hydrogen technology as a vital contributor to national energy roadmaps. Strong government commitments create funding channels for pilot projects and commercial-scale facilities. International energy companies are seeking strategic entry into circular economy solutions. It paves the way for long-term growth and market expansion.

Urban Waste Management Integration and Decentralized Energy Solutions

The Waste-to-Hydrogen Market benefits from rising urbanization and mounting municipal waste volumes. Cities are adopting waste-to-hydrogen systems to transform waste liabilities into clean energy resources. It offers municipalities a dual benefit of sustainable disposal and hydrogen supply for local use. Decentralized plants near waste sources reduce transport costs and enhance efficiency. Growing adoption of microgrids and localized energy hubs further boosts demand. It positions waste-to-hydrogen solutions as scalable models for both developed and emerging economies.

Market Segmentation Analysis:

By Technology

The Waste-to-Hydrogen Market is segmented by technology into gasification, pyrolysis, and plasma arc processes. Gasification leads adoption due to its proven ability to convert municipal solid waste into hydrogen-rich syngas. It offers scalability and cost-efficiency for large plants. Pyrolysis is gaining traction because of its suitability for diverse feedstock, including plastics and industrial residues. Plasma arc technology, though capital-intensive, provides higher conversion efficiency and reduced emissions, making it attractive for advanced projects. It is expected to grow in relevance as industries demand cleaner hydrogen production technologies.

- For instance, in July 2024 Siemens partnered with Boson Energy to scale waste gasification technology capable of processing 40,000 tons of non-recyclable waste annually into hydrogen-rich syngas for mobility and power applications.

By Application

The Waste-to-Hydrogen Market by application includes power generation, transportation, and industrial use. Power generation holds a strong share due to rising demand for renewable energy integration into grids. It enables utilities to reduce reliance on coal and natural gas. Transportation represents a rapidly expanding segment with the rise of hydrogen fuel cell vehicles and urban fleet conversions. Industrial use is expanding as steel, cement, and chemical industries explore hydrogen as a replacement for fossil fuels. It reflects the versatility of waste-to-hydrogen solutions across multiple sectors.

- For instance, in March 2025 EnviTec Biogas commissioned a U.S. facility in South Dakota processing over 300,000 gallons of dairy waste daily to produce 483 scfm of renewable gas, which can be upgraded to hydrogen for industrial and transportation applications.

By Feedstock Source

The Waste-to-Hydrogen Market also divides by feedstock source into municipal solid waste, agricultural waste, and industrial waste. Municipal solid waste dominates as urban centers face growing waste volumes and landfill pressures. It offers municipalities a sustainable method for waste disposal while generating hydrogen. Agricultural waste is becoming important in regions with high crop residue generation, offering additional revenue streams for farmers. Industrial waste contributes through byproducts and residues that are suitable for hydrogen production. It highlights the adaptability of waste-to-hydrogen technologies to local resource availability.

Segments:

Based on Technology

- Gasification

- Anaerobic Digestion

- Steam Reforming

Based on Application

- Power Generation

- Transportation Fuel

- Industrial Hydrogen Production

Based on Feedstock Source

- Municipal Solid Waste

- Industrial Waste

- Agricultural Residues

Based on Process Type

- Thermochemical Processes

- Biological Processes

- Electrochemical Processes

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 36% share of the Waste-to-Hydrogen Market, supported by advanced waste management infrastructure and strong government incentives. The United States leads with significant investments in hydrogen production facilities integrated with municipal waste streams. It benefits from supportive policies such as tax credits and state-level funding for clean hydrogen hubs. Canada is also expanding projects to align with national decarbonization commitments and growing interest in hydrogen mobility. Partnerships between technology firms and waste management companies strengthen the regional landscape. It positions North America as a frontrunner in scaling commercial waste-to-hydrogen projects. The region is expected to maintain its leadership with rising demand from both industrial users and the transport sector.

Europe

Europe holds a 30% share of the Waste-to-Hydrogen Market, driven by strict environmental regulations and ambitious net-zero targets. Germany, the UK, and France lead adoption through projects focused on waste valorization and hydrogen fuel production. It benefits from the European Union’s Hydrogen Strategy, which emphasizes sustainable hydrogen from diverse feedstock sources. Strong emphasis on reducing landfill usage encourages municipalities to adopt waste-to-hydrogen systems. The growth of hydrogen fuel cell buses and rail projects further accelerates demand. It ensures Europe remains a key growth region supported by both policy frameworks and corporate commitments to sustainability. The regional market outlook remains strong due to continued integration into industrial and mobility sectors.

Asia-Pacific

Asia-Pacific commands a 24% share of the Waste-to-Hydrogen Market, with China, Japan, and South Korea driving growth. China leverages its large municipal waste volumes and strong policy backing for hydrogen energy. Japan focuses on hydrogen mobility, supported by investments in waste-to-hydrogen plants for fueling stations. It also benefits from South Korea’s hydrogen economy roadmap that integrates waste valorization technologies. Growing urbanization in India and Southeast Asia creates opportunities for localized waste-to-hydrogen projects. Regional governments see this technology as both an energy solution and a waste management tool. It positions Asia-Pacific as the fastest-growing region with strong demand from energy, transport, and municipal sectors.

Latin America

Latin America contributes a 6% share to the Waste-to-Hydrogen Market, reflecting early-stage adoption but rising interest. Brazil leads with initiatives focused on agricultural waste-to-hydrogen projects, given the region’s abundant biomass resources. It benefits from growing collaboration with international investors and technology providers. Mexico is exploring waste-to-hydrogen projects to reduce landfill dependency and meet clean energy targets. Urban waste growth across major cities creates favorable conditions for pilot-scale adoption. It highlights the region’s potential for expanding renewable energy integration through waste valorization. The outlook remains positive with gradual policy support and private sector participation.

Middle East & Africa

The Middle East & Africa account for a 4% share of the Waste-to-Hydrogen Market, supported by rising diversification strategies in the energy sector. Gulf countries such as Saudi Arabia and the UAE are exploring waste-to-hydrogen as part of their clean energy initiatives. It complements large-scale renewable projects in solar and wind to meet green hydrogen export goals. Africa, led by South Africa, shows potential through projects converting municipal and industrial waste into hydrogen. Limited infrastructure and funding challenges slow wider adoption across the region. It remains an emerging market where strategic investments and international partnerships will be crucial. Long-term potential is tied to national decarbonization roadmaps and circular economy ambitions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Brightmark

- Siemens

- McKinsey Company

- Ballard Power Systems

- ENGIE

- EnviTec Biogas

- Linde

- ThyssenKrupp

- Waste Management

- Snam

Competitive Analysis

The competitive landscape of the Waste-to-Hydrogen Market features key players such as Siemens, ENGIE, Brightmark, Waste Management, ThyssenKrupp, Ballard Power Systems, Linde, EnviTec Biogas, Snam, and McKinsey Company. These companies focus on scaling waste-to-hydrogen technologies through strategic collaborations, pilot projects, and commercial-scale plants. They leverage strong expertise in energy infrastructure, waste management, and clean hydrogen solutions to expand their global presence. Partnerships with governments and municipalities enable them to align projects with decarbonization roadmaps and circular economy goals. Many invest in advanced processes such as gasification, pyrolysis, and plasma arc systems to improve conversion efficiency and reduce carbon emissions. Competition intensifies as players expand across multiple regions, with Europe and Asia-Pacific witnessing rapid project launches. Companies also engage in joint ventures and technology-sharing agreements to strengthen technical capabilities. This focus on innovation, sustainability, and large-scale deployment positions them to capture growing demand across power generation, transportation, and industrial applications.

Recent Developments

- In June 2025, ThyssenKrupp nucera agreed to acquire key technology assets from Green Hydrogen Systems (GHS). These assets include electrolysis-related intellectual property and testing capabilities, enhancing their green hydrogen development capacity.

- In June 2025, Snam secured a €24 million co-financing agreement with the European Commission under the CEF Energy programme. The funding supports the development of the Italian Hydrogen Backbone, aimed at integrating hydrogen into national energy infrastructure.

- In July 2024, Siemens signed a memorandum of understanding with Boson Energy to support waste-to-hydrogen (Waste‑to‑X) technology.

- In May 2024, Ballard Power Systems entered a collaboration with Element 1 to develop hydrogen power solutions using on-demand hydrogen technologies. The focus spans applications in heavy-duty transport, marine, and off-road sectors.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, Feedstock Source, Process Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for clean hydrogen in multiple industries.

- Governments will continue to support projects with policies and financial incentives.

- Technology innovations will improve efficiency and reduce costs of hydrogen production.

- Transportation will see faster adoption of hydrogen from waste for fuel cell vehicles.

- Industrial users will integrate waste-to-hydrogen into steel, cement, and chemical processes.

- Municipalities will adopt decentralized plants to manage urban waste sustainably.

- Strategic partnerships will accelerate large-scale project development across regions.

- Circular economy goals will strengthen the role of waste-to-hydrogen in sustainability plans.

- Emerging economies will invest in pilot projects to build scalable energy models.

- Global net-zero commitments will position waste-to-hydrogen as a core clean energy solution.