Market Overview

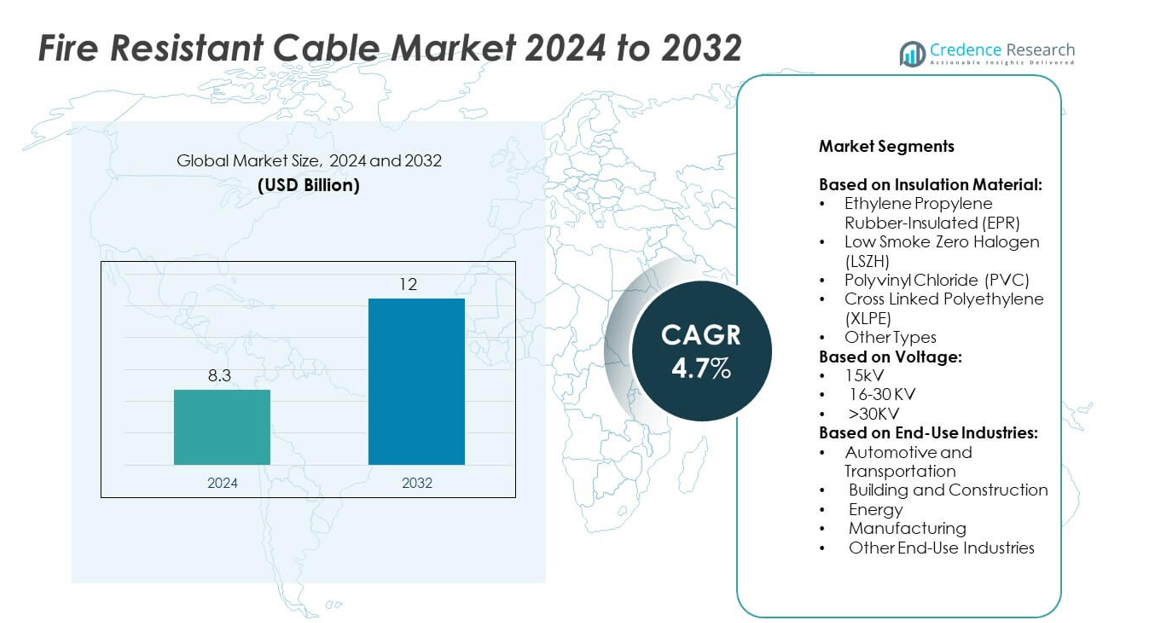

Fire Resistant Cable Market size was valued at USD 8.3 billion in 2024 and is anticipated to reach USD 12 billion by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fire Resistant Cable Market Size 2024 |

USD 8.3 billion |

| Fire Resistant Cable Market, CAGR |

4.7% |

| Fire Resistant Cable Market Size 2032 |

USD 12 billion |

The Fire Resistant Cable market grows due to stricter fire safety regulations, rising infrastructure investments, and expanding renewable energy projects. Demand increases across commercial buildings, transportation, and data centers where uninterrupted operations and safety are critical. Trends such as adoption of LSZH materials, hybrid cable designs, and smart grid deployment support this growth. Manufacturers focus on compliance, durability, and compact designs to meet evolving standards. Industrial automation and energy modernization further reinforce long-term demand for certified fire-resistant wiring systems.

Asia Pacific leads the Fire Resistant Cable market, supported by large-scale infrastructure, power distribution, and industrial expansion. North America and Europe follow with strong regulatory enforcement and high safety standards in commercial and public facilities. Latin America and the Middle East & Africa show growing demand driven by transport upgrades and energy investments. Key players operating across these regions include Prysmian SpA, Nexans SA, LS Cable & System Ltd., and El Sewedy Electric Company, offering certified solutions tailored to local safety requirements.

Market Insights

- Fire Resistant Cable market was valued at USD 8.3 billion in 2024 and is projected to reach USD 12 billion by 2032, growing at a CAGR of 4.7%.

- Rising enforcement of fire safety codes in buildings, tunnels, and industrial plants drives market demand.

- LSZH and XLPE cables are gaining traction due to their low-toxicity, high-performance insulation properties.

- Major companies compete on certifications, customized solutions, and strong regional distribution networks.

- High production cost and complex compliance testing slow adoption in price-sensitive or unregulated markets.

- Asia Pacific leads in volume due to infrastructure growth, while Europe and North America show steady demand from retrofitting and smart infrastructure.

- Latin America and the Middle East & Africa offer emerging opportunities through energy projects and public infrastructure investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Fire Safety Regulations Across Industrial and Commercial Infrastructure Projects

Fire safety codes are becoming stricter in industrial and commercial buildings. Regulatory authorities enforce mandatory use of fire-resistant materials, including specialized cabling systems. These regulations directly drive demand for fire resistant cables in construction, transportation, and energy sectors. Fire Resistant Cable market benefits from this rising regulatory pressure, especially in high-risk environments like tunnels, airports, and power plants. Governments and insurance firms increasingly mandate compliance to limit property damage and life risks. In Europe and North America, updated safety protocols accelerate retrofitting of older buildings with compliant wiring. It ensures long-term market growth tied to evolving building safety laws.

- For instance, Nexans developed its Alsecure PLUS multi-core fire-resistant cable, which features 110 °C rated insulation and sheath. The cable is Fire Rated to AS/NZS 3013 and meets international standards such as IEC 60332-3 for flame propagation.

Expanding Energy and Power Distribution Projects Demand Reliable Fire-Proof Cabling Systems

Growth in energy infrastructure requires fire-resistant cable systems for uninterrupted power transmission. It is essential in nuclear plants, substations, and renewable energy installations where safety and uptime are critical. Fire Resistant Cable market sees higher adoption in projects requiring flame-retardant and low-smoke materials. Power utilities and EPC contractors prioritize fire-tested solutions to meet operational safety standards. Use of fire-resistant wiring reduces risk of downtime and damage from electrical fires. Large-scale grid modernization and smart energy rollouts also expand the application scope. It supports the transition to secure and sustainable energy systems.

- For instance, Tratos supplies its Firesafe fire-resistant cables, meeting standards such as BS 7629 and BS 7846, for critical infrastructures like hospitals, rail stations, and offshore platforms. These cables ensure the continuity of essential services, including fire detection, alarm, and emergency lighting systems, during fire events.

Rising Urbanization and Transport Network Development Encourage Fire-Protected Wiring Integration

Urban transit systems increasingly require advanced fire safety measures. Metro rail, underground tunnels, airports, and smart buildings need certified fire resistant cabling for operational safety. Fire Resistant Cable market expands with rising investments in public infrastructure and real estate. Urban planning bodies and municipal corporations include fire-risk mitigation in design requirements. High-density zones with human traffic enforce use of cables that withstand fire for extended periods. It promotes longer evacuation times and reduces risk of total system failure.

Growing Awareness of Asset Protection and Business Continuity Fuels Adoption in Data Centers and Industries

Industrial automation and data center operations prioritize uninterrupted functionality. Any fire-related outage causes revenue loss, equipment damage, and safety violations. Fire Resistant Cable market serves this need by offering performance stability during high heat or flame exposure. IT parks, oil refineries, and chemical plants invest in high-integrity cabling to protect mission-critical systems. Business continuity planning now includes upgraded fire-resistant infrastructure. It reflects the shift toward proactive risk reduction in critical operations.

Market Trends

Rising Integration of Low-Smoke Zero-Halogen (LSZH) Materials in Cable Manufacturing

Low-Smoke Zero-Halogen (LSZH) materials are gaining traction for their safety and environmental benefits. These materials release minimal toxic gases when exposed to fire, reducing health hazards during evacuation. Manufacturers invest in LSZH-based designs to meet strict safety codes and green building standards. Fire Resistant Cable market reflects this trend with a surge in product lines focused on halogen-free insulation and jacketing. It supports demand from data centers, commercial buildings, and transportation hubs. LSZH cables also appeal to developers targeting LEED or BREEAM certifications. The growing push for safer, non-toxic cabling reinforces long-term adoption of LSZH solutions.

- For instance, the LSZH materials for cable sheathing developed by Angreen meet CPR EN50575 classifications such as B2ca, Cca, Dca, and Eca, enabling high flame-retardant ratings and drop-test performance even in high-voltage harness applications at temperatures up to 125 °C.

Emergence of Multi-Core and Hybrid Cable Designs for Compact and Versatile Installations

Design innovations are transforming traditional fire-resistant cables into multi-core and hybrid variants. These advanced cables support signal and power transmission within one jacket, optimizing space and installation time. It benefits industries facing space constraints, including marine, aerospace, and industrial automation sectors. Fire Resistant Cable market responds to this need by offering compact solutions without compromising fire endurance. Hybrid cable configurations reduce clutter in control panels and distribution networks. Engineers value the flexibility and simplified routing these designs provide. Rising complexity of electrical systems accelerates demand for integrated cable formats.

- For instance, CommScope offers a range of hybrid cables under its Constellation™ and FiberREACH™ brands. The Constellation™ Plenum Hybrid Fault-Managed Power Cable (Part Number 760255005) is specifically available in North America and contains 16 fibers and 8 conductor 16 AWG twisted pairs.

Increasing Use of Fire-Resistant Cables in Renewable and Sustainable Energy Systems

Renewable energy facilities now require high-performance fire-resistant wiring to meet reliability standards. Wind farms, solar parks, and hydrogen plants prioritize cables that withstand high temperatures and resist fire spread. Fire Resistant Cable market aligns with this shift, offering products tailored for harsh outdoor and thermal conditions. It meets the need for safety in decentralized and often remote installations. These cables support sustainability goals while maintaining system integrity. The transition to green energy continues to open new application areas across global markets.

Shift Toward Digital Cable Testing, Certification, and Remote Monitoring Technologies

Digitalization plays a key role in cable testing and lifecycle management. Manufacturers adopt advanced tools for real-time fire resistance testing, performance analysis, and compliance reporting. It reduces time-to-market for certified fire-resistant cables and ensures accuracy in meeting international norms. Fire Resistant Cable market reflects this evolution by integrating digital quality control systems in production. Remote monitoring also helps end-users track cable aging and predict replacement timelines. The trend improves safety, reduces downtime, and enhances product transparency for industrial buyers.

Market Challenges Analysis

High Production Costs and Complex Compliance Requirements Impact Pricing and Margins

Fire-resistant cable production involves costly raw materials and stringent testing processes. Meeting international safety standards such as IEC 60331 or BS 6387 requires specialized compounds and high-temperature insulation. It raises manufacturing costs and limits pricing flexibility in price-sensitive markets. Fire Resistant Cable market faces pressure from low-cost alternatives that do not meet fire safety norms. Smaller players struggle to balance quality and profitability while competing with large-scale producers. Lengthy certification procedures and region-specific regulations add to cost and time challenges. These factors often delay project timelines and discourage new entrants.

Lack of End-User Awareness and Technical Skillset Hampers Optimal Adoption in Emerging Regions

Many construction firms and industrial users in emerging markets still prefer standard cables due to lower initial costs. Limited awareness of the life-saving and asset-protecting value of fire-resistant cables restricts their broader application. Fire Resistant Cable market finds it difficult to grow in regions where fire safety regulations are weak or loosely enforced. It is further challenged by a lack of trained installers who understand specialized handling and layout practices. Incorrect installation often leads to cable failure, reducing trust in certified products. Building consistent education and training programs remains a critical industry need to close this knowledge gap.

Market Opportunities

Growing Retrofit Demand in Aging Infrastructure and Compliance-Driven Facility Upgrades

Many public and private buildings still rely on outdated cabling that fails to meet current fire safety codes. Aging infrastructure across transport, healthcare, and education sectors creates strong demand for fire-resistant cable upgrades. Fire Resistant Cable market stands to benefit from mandatory retrofitting initiatives in developed and developing economies. It offers long-term growth potential as facility managers invest in risk reduction and insurance compliance. Fire incidents in older structures have pushed governments to mandate certified cable replacement. This opens new opportunities for suppliers offering ready-to-install, pre-certified fire-resistant solutions. Urban redevelopment projects also prioritize fire safety in their planning guidelines.

Expansion of High-Risk Industrial Zones and Urban Smart Infrastructure Projects

Fire-prone industries such as oil and gas, chemicals, and manufacturing continue to expand in emerging regions. These zones require reliable fire-resistant cabling for both safety and regulatory compliance. Fire Resistant Cable market gains new ground in large-scale industrial parks and smart city infrastructure. It addresses demand from smart grid systems, intelligent transport, and automated building networks. Developers increasingly include fire-proof wiring in their baseline project specifications. The rise of smart and connected infrastructure creates sustained need for high-performance, fire-rated electrical components.

Market Segmentation Analysis:

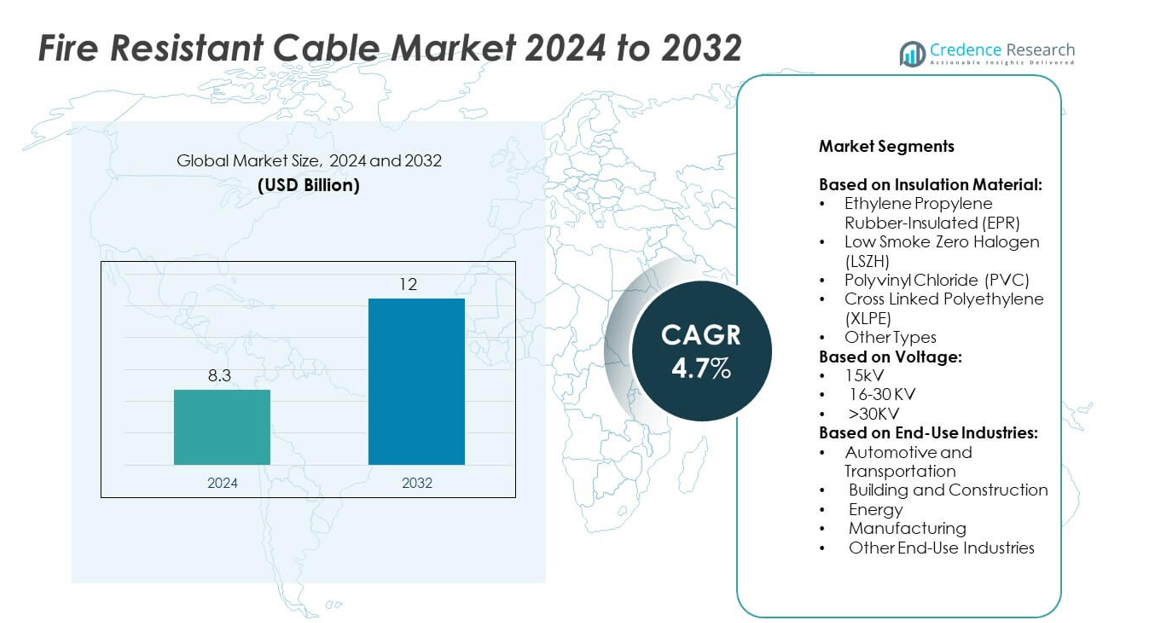

By Insulation Material:

Low Smoke Zero Halogen (LSZH) leads the segment due to rising adoption in public infrastructure. It emits minimal smoke and toxic fumes, making it ideal for confined spaces like tunnels and airports. Cross Linked Polyethylene (XLPE) offers superior thermal stability and finds strong use in power and industrial sectors. Ethylene Propylene Rubber-Insulated (EPR) cables show consistent demand in applications needing flexibility and moisture resistance. Polyvinyl Chloride (PVC) continues to serve cost-sensitive projects despite declining preference due to halogen content. Other insulation types cater to niche applications, including hybrid and high-temperature environments. Fire Resistant Cable market benefits from this diversity in insulation options tailored to safety, cost, and performance.

- For instance, Angreen’s LSZH cross-linked polyethylene insulation meets UL 94 V-0 flame-retardant requirements and helps cables maintain over 60% light transmittance during BS/EN 61034-1/2 smoke density tests, ensuring better visibility during fire events.

By Voltage:

The 15kV segment holds a strong share due to its application in low to medium-voltage distribution networks. It supports critical operations in buildings, utilities, and small industrial units. The 16–30kV range sees rising adoption in regional grid expansion and mid-scale energy installations. Fire Resistant Cable market sees high-voltage cables above 30kV gain traction in transmission, wind farms, and large factories. These segments require superior insulation and fire resistance to ensure system integrity. Rising power loads and safety codes drive growth in all three categories. Each voltage range addresses different infrastructure scales and risk profiles.

- For instance, the North Sea Link is an HVDC submarine connection spanning 720 km between Norway and the UK and operates at ±515 kV to transmit power efficiently over the long distance. The project, which became operational in 2021, was the longest subsea interconnector in the world at the time of its commissioning.

By End-Use Industries:

Building and construction dominates due to strict fire codes in commercial, residential, and public infrastructure. Energy sector follows with growing installations of renewables and substations demanding heat- and flame-resistant cables. Manufacturing facilities use fire-resistant wiring for safety in high-temperature or volatile environments. Automotive and transportation sectors use it in trains, metros, and airports where fire safety is non-negotiable. Other industries such as data centers and defense adopt these cables to protect assets and ensure operational continuity. Fire-resistant solutions continue to penetrate diversified industrial segments driven by regulation and risk mitigation.

Segments:

Based on Insulation Material:

- Ethylene Propylene Rubber-Insulated (EPR)

- Low Smoke Zero Halogen (LSZH)

- Polyvinyl Chloride (PVC)

- Cross Linked Polyethylene (XLPE)

- Other Types

Based on Voltage:

Based on End-Use Industries:

- Automotive and Transportation

- Building and Construction

- Energy

- Manufacturing

- Other End-Use Industries

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 27.3% of the global Fire Resistant Cable market share in 2024. The region benefits from advanced infrastructure, strong regulatory enforcement, and high awareness of fire safety standards. The United States leads adoption across commercial construction, power transmission, and data center applications. Stricter building codes enforced by agencies such as the National Fire Protection Association (NFPA) drive the demand for low-smoke, halogen-free, and high-temperature cables. Investments in retrofitting aging grid infrastructure and expanding public transportation further push cable replacement with fire-resistant alternatives. Canada contributes steadily, especially in industrial safety upgrades in energy, mining, and transportation sectors. Smart city initiatives and digital infrastructure modernization also require cables that maintain integrity during fire exposure, positioning North America as a mature and steady growth market.

Europe

Europe held 24.6% of the global Fire Resistant Cable market in 2024, driven by robust regulatory frameworks and advanced safety mandates. Countries like Germany, the United Kingdom, France, and the Nordic region have mandatory cable fire performance standards aligned with CPR (Construction Product Regulation). The region sees high adoption in railway projects, airports, tunnels, and renewable energy infrastructure. Fire-resistant LSZH and XLPE cables are highly preferred to meet sustainability and safety targets. Large infrastructure renovation projects and multi-dwelling developments also contribute to steady product uptake. Demand is further supported by insurance-driven mandates in commercial properties and industrial parks. Europe’s focus on energy-efficient and safe construction continues to sustain long-term demand for advanced fire-resistant wiring systems.

Asia Pacific

Asia Pacific led the global Fire Resistant Cable market with a dominant share of 33.8% in 2024. China, Japan, India, and South Korea are key contributors, supported by rapid urbanization, industrial growth, and massive infrastructure investments. China’s large-scale metro rail projects, industrial parks, and data centers drive high-volume demand. India’s emphasis on smart cities, power distribution upgrades, and public safety improvements fuels sustained market expansion. South Korea and Japan maintain high fire safety benchmarks across real estate and energy sectors. Across Southeast Asia, rising construction and manufacturing activity boosts adoption of fire-tested cable solutions. Growing export of certified cables from regional manufacturers adds to supply chain competitiveness. Regional governments promote local sourcing and standardization, helping accelerate product approvals and deployment.

Latin America

Latin America captured 8.1% of the global Fire Resistant Cable market in 2024, with Brazil and Mexico emerging as primary demand centers. Industrial safety modernization and transport infrastructure upgrades are key growth drivers. Brazil’s energy sector, including thermal and hydroelectric plants, increasingly uses XLPE and LSZH cables for flame containment and system reliability. Mexico supports fire-resistant wiring through infrastructure investments in airport terminals, metro systems, and public utilities. Other nations like Chile, Colombia, and Argentina are adopting improved safety codes that align with international benchmarks. Although budget constraints pose challenges, international funding for public projects boosts cable demand. Rising awareness of fire hazards in residential and commercial construction is expected to further open opportunities.

Middle East & Africa

Middle East & Africa accounted for 6.2% of the global Fire Resistant Cable market in 2024, supported by infrastructure megaprojects in the Gulf region and energy sector growth across Africa. The UAE, Saudi Arabia, and Qatar continue to invest in fire-compliant cabling across high-rise buildings, airports, metros, and stadiums. Adoption is strong in oil and gas operations where extreme heat and fire risks are prevalent. Africa shows gradual growth as energy access and industrial zones expand. Government-led housing and electrification programs include basic fire protection requirements, increasing cable quality standards. Regional emphasis on smart and safe urban development is expected to drive consistent, though gradual, demand for certified fire-resistant solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tratos Limited

- Leoni AG

- General Cable Corporation

- Relemac Technologies Pvt Ltd.

- Universal Cable (M) Bhd.

- LS Cable & System Ltd.

- El Sewedy Electric Company

- NKT A/S

- TPC Wire & Cable Corp

- Prysmian SpA

- Nexans SA

Competitive Analysis

The leading players in the Fire Resistant Cable market include Tratos Limited, Leoni AG, General Cable Corporation, Relemac Technologies Pvt Ltd., Universal Cable (M) Bhd., LS Cable & System Ltd., El Sewedy Electric Company, NKT A/S, TPC Wire & Cable Corp, Prysmian SpA, and Nexans SA. These companies compete through product innovation, global certifications, and region-specific solutions tailored to evolving fire safety standards. Many focus on expanding their LSZH and XLPE product lines to meet rising demand from transport, energy, and data center applications. Strategic mergers and acquisitions help broaden market reach and improve access to key infrastructure projects. Several players maintain strong relationships with governments and EPC contractors, allowing them to secure long-term supply contracts. Investment in R&D and automated manufacturing also enhances cable performance, durability, and compliance. In regions such as Asia Pacific and the Middle East, players strengthen their position by establishing local production hubs and distribution networks. Market leaders prioritize compliance with IEC and BS fire standards and offer solutions tested for high thermal and mechanical stress. As global fire safety regulations tighten, companies with advanced testing capabilities and proven track records are better positioned to capture market share across construction, industrial, and energy verticals.

Recent Developments

- In 2025, Nexans SA developed and inaugurated Stella Nova, its new Center of Excellence in Hanover, Germany.

- In 2025, LS Cable & System Ltd., Completed construction of its fifth submarine cable plant in Donghae City, boosting HDVC submarine cables production capacity over fourfold, now operating the largest HVDC cable production facility in Asia.

- In 2025, Prysmian SpA approved mid-term targets and 2025-2028 strategic plan emphasizing growth, profitability, and transformation into solutions provider focusing on electrification and sustainability.

Report Coverage

The research report offers an in-depth analysis based on Insulation Material, Voltage, End-Use Industries and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fire-resistant cables will grow with stricter global fire safety regulations.

- Smart city projects will increase adoption in high-rise buildings and transit systems.

- Renewable energy installations will create long-term demand for heat-resistant cable solutions.

- Data center expansion will require low-smoke, halogen-free wiring for equipment protection.

- Retrofitting of aging infrastructure will support steady replacement of outdated cable systems.

- Industrial automation will push demand for flexible, fire-rated cabling in control systems.

- Advancements in insulation materials will improve cable performance and durability.

- Emerging economies will adopt fire-resistant standards in residential and public sectors.

- Manufacturers will focus on compact, multi-core designs for space-constrained environments.

- Supply chains will shift toward localized production to meet regional compliance norms.