Market Overview:

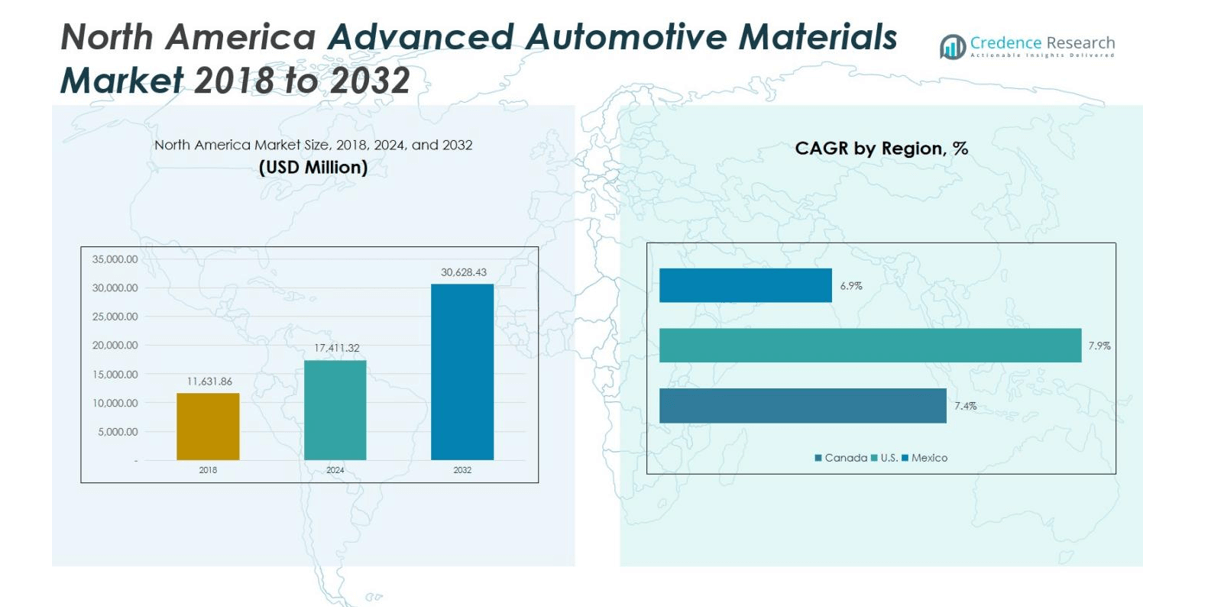

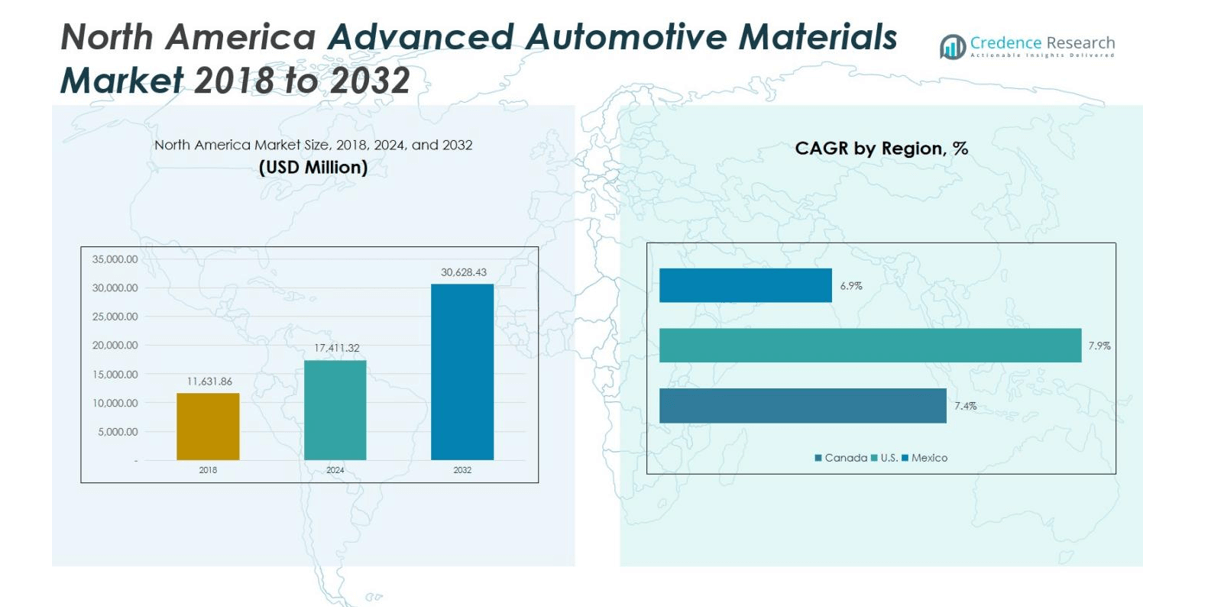

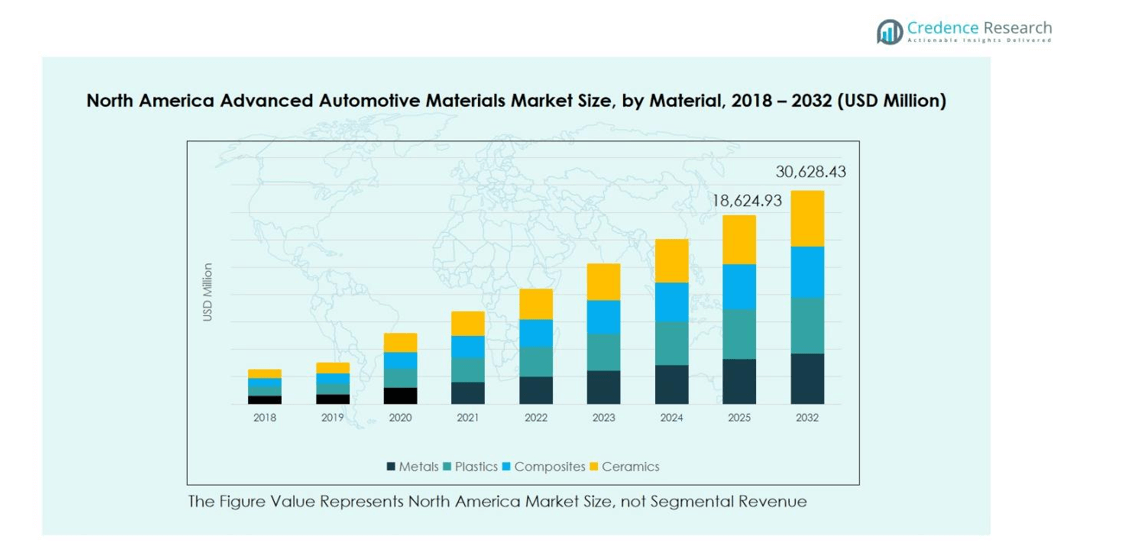

North America Advanced Automotive Materials Market size was valued at USD 11,631.86 million in 2018, grew to USD 17,411.32 million in 2024, and is anticipated to reach USD 30,628.43 million by 2032, at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Advanced Automotive Materials Market Size 2024 |

USD 17,411.32 million |

| North America Advanced Automotive Materials Market, CAGR |

7.1% |

| North America Advanced Automotive Materials Market Size 2032 |

USD 30,628.43 million |

The competitive landscape of the North America Advanced Automotive Materials Market is shaped by prominent players such as BASF SE, Toray Industries Inc., DuPont de Nemours Inc., Novelis Inc., Exxon Mobil Corporation, ArcelorMittal, Mitsubishi Chemical Corporation, and 3M Company. These companies focus on innovation, lightweight material development, and strategic collaborations to strengthen their market positions. Advanced alloys, composites, and sustainable polymers remain key product areas driving competition. Among the regional markets, the United States dominates the North America Advanced Automotive Materials Market with a 65% share, driven by high vehicle production, technological advancement, and early adoption of EV and hybrid platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Advanced Automotive Materials Market was valued at USD 17,411.32 million in 2024 and is projected to reach USD 30,628.43 million by 2032, growing at a CAGR of 7.1% during the forecast period.

- The market growth is primarily driven by increasing demand for lightweight and fuel-efficient vehicles, alongside the rising adoption of electric and hybrid vehicles that require advanced material integration for improved performance and safety.

- A key trend includes growing investments in sustainable and recyclable materials, with automakers prioritizing bio-based polymers and advanced composites to meet environmental regulations and enhance efficiency.

- The competitive landscape is dominated by major players such as BASF SE, DuPont de Nemours Inc., Toray Industries Inc., Novelis Inc., and ArcelorMittal, who focus on innovation, partnerships, and R&D expansion to maintain their market edge.

- Regionally, the United States holds 65% of the market share, while metals account for 42% of the material segment due to their strength and cost-effectiveness.

Market Segmentation Analysis:

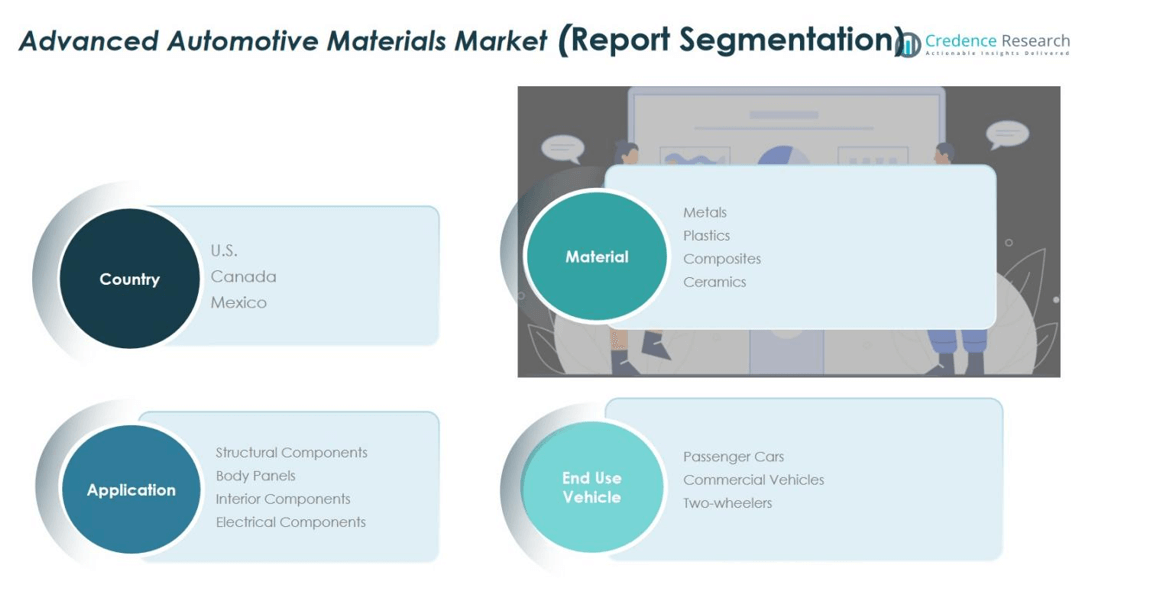

By Material:

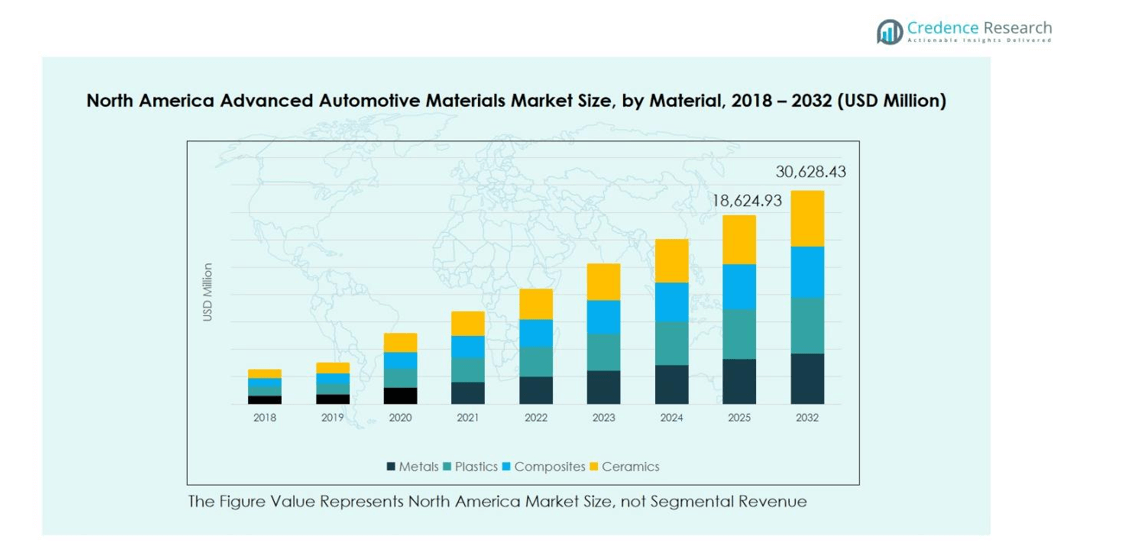

Metals dominate the North America advanced automotive materials market, accounting for 42% of the material segment. The preference for lightweight, high-strength alloys in structural and body components drives their adoption, enabling improved fuel efficiency and vehicle performance. Plastics follow with a 28% share, propelled by their versatility and cost-effectiveness in interior and exterior components. Composites hold around 20% due to their high strength-to-weight ratio, increasingly used in premium and electric vehicles. Ceramics represent 10%, primarily in specialized applications like engine components and braking systems where heat resistance is critical.

- For instance, Ford utilizes advanced high-strength steel in its F-150 pickup, reducing frame weight by nearly 60 pounds while improving crash safety and durability.

By Application:

Structural components lead the application segment with a market share of 35%, driven by the growing demand for lighter, more fuel-efficient vehicles. Advanced metals and composites are extensively used to enhance vehicle rigidity while reducing weight. Body panels follow at 27%, leveraging plastics and composites for design flexibility and corrosion resistance. Interior components account for 23%, supported by plastics and lightweight composites improving cabin comfort. Electrical components make up 15%, reflecting the increasing integration of electronics and EV powertrain systems, which require thermally stable and lightweight materials.

- For instance, Henkel supplies structural adhesives and tape solutions for automotive manufacturing, enabling high-strength bonding in body structures and interior components, with a focus on lightweight and durable assemblies.

By End Use Vehicles:

Passenger cars dominate the end-use vehicle segment with a 55% share, reflecting their volume production and growing demand for fuel efficiency and safety. Metals and plastics are widely applied in chassis, body panels, and interior components, enhancing performance and comfort. Commercial vehicles hold a 30% share, driven by the adoption of lightweight materials to improve payload capacity and reduce fuel costs. Two-wheelers represent 15%, with plastics and composites being preferred for body panels and structural frames, enabling cost-effective, durable, and lightweight designs suitable for urban mobility.

Key Growth Drivers

Increasing Demand for Lightweight Vehicles

The growing emphasis on fuel efficiency and reduced carbon emissions is driving the adoption of lightweight advanced automotive materials in North America. Metals, composites, and plastics are increasingly used to replace traditional steel, enabling vehicle weight reduction without compromising strength or safety. Passenger cars and commercial vehicles are the primary beneficiaries, as manufacturers strive to meet stringent government fuel economy standards. This focus on lightweighting enhances performance, handling, and operational cost efficiency, positioning lightweight materials as a critical growth driver in the regional market.

- For instance, General Motors employs automated fiber placement technology to optimize carbon fiber composites in chassis and body components, achieving considerable weight reductions without sacrificing structural integrity.

Expansion of Electric Vehicles (EVs)

The rapid growth of the electric vehicle segment is fueling demand for advanced materials that improve battery efficiency, structural integrity, and vehicle range. Composites and lightweight metals are extensively used in EV chassis, body panels, and interior components to offset the weight of batteries while maintaining safety standards. North American automakers are increasingly investing in material innovation to enhance EV performance and cost-effectiveness. The integration of advanced materials in EV manufacturing is expected to accelerate, making this technological shift a primary driver for market growth.

- For instance, General Motors’ Ultium battery platform uses advanced materials and AI-driven battery management to optimize performance and durability, contributing to extended range and faster charging.

Technological Advancements in Material Engineering

Innovations in high-performance alloys, engineering plastics, and fiber-reinforced composites are expanding applications in North America’s automotive sector. These materials offer superior durability, thermal stability, and corrosion resistance, enabling manufacturers to meet evolving consumer expectations for safety, comfort, and design flexibility. Advanced material engineering also facilitates modular production and reduced maintenance costs. Automotive suppliers are leveraging these innovations to deliver competitive products, supporting wider adoption across passenger cars, commercial vehicles, and two-wheelers, making technological advancements a pivotal driver of market expansion.

Key Trends & Opportunities

Integration of Smart and Functional Materials

The incorporation of smart and functional materials, such as self-healing composites and thermally conductive plastics, is transforming vehicle design and performance. These materials improve durability, safety, and energy efficiency while allowing greater flexibility in design and lightweighting. North American manufacturers are increasingly adopting these solutions to differentiate products in a competitive market. As regulatory standards for emissions and safety become stricter, the integration of functional materials provides both a trend and an opportunity to enhance vehicle performance and appeal to environmentally conscious consumers.

- For instance, BMW’s iX model features a self-healing polyurethane coating on its kidney grille that can repair minor collision damage over time, enhancing durability and aesthetics.

Shift Towards Sustainable and Recycled Materials

Sustainability initiatives are driving automakers to adopt recycled metals, bio-based plastics, and eco-friendly composites in vehicle production. North American manufacturers are increasingly incorporating these materials to reduce environmental impact while maintaining performance and cost-efficiency. The rising awareness of circular economy principles and consumer preference for sustainable vehicles presents an opportunity for advanced materials suppliers. By leveraging recycled and renewable materials, companies can comply with regulations and position themselves as innovators in the sustainable automotive market, creating long-term growth potential.

- For instance, Hyundai Motor’s 2025 Sustainability Report highlights its Car-to-Car Project, which incorporates recycled materials from end-of-life vehicles into new car production, helping reduce environmental impact while maintaining quality.

Key Challenges

High Production Costs of Advanced Materials

Despite their performance benefits, advanced automotive materials often carry higher production and processing costs compared to conventional steel or aluminum. Composites and high-performance plastics require specialized manufacturing techniques, increasing overall vehicle costs. This can limit adoption, especially in cost-sensitive segments such as two-wheelers and entry-level passenger cars. North American manufacturers must balance material benefits with affordability to maintain market competitiveness. High costs also pose challenges for scaling production, requiring ongoing innovation in manufacturing efficiency and economies of scale to ensure broader market penetration.

Supply Chain and Material Availability Constraints

The availability of high-grade metals, composites, and specialty plastics can be affected by supply chain disruptions, geopolitical tensions, and fluctuating raw material prices. Such constraints impact production schedules and increase procurement costs for North American automakers. Limited local sourcing options for advanced materials can create dependency on imports, raising vulnerability to international market fluctuations. Ensuring consistent supply while maintaining quality standards is critical for sustaining growth. Manufacturers must invest in strategic partnerships, inventory management, and alternative material development to mitigate supply chain risks and maintain production continuity.

Regional Analysis

United States

The United States holds the largest share of the North America advanced automotive materials market at 65%. Strong automotive manufacturing infrastructure, robust R&D capabilities, and high adoption of electric and hybrid vehicles drive demand for metals, composites, and advanced plastics. Government regulations promoting fuel efficiency and emissions reduction further encourage lightweight and high-performance material usage. Passenger cars dominate material consumption, followed by commercial vehicles, with structural components and body panels being the primary applications. Investments by leading manufacturers in lightweighting and material innovation strengthen the U.S. market, making it the primary regional contributor to North America’s growth trajectory.

Canada

Canada contributes 20% to the North America advanced automotive materials market, driven by growing production of passenger cars and commercial vehicles, especially in Ontario and Quebec. Advanced metals and plastics are extensively used in body panels, interior components, and structural parts, supporting lightweighting and safety requirements. Increasing adoption of electric vehicles and stringent emissions standards are boosting the use of composites and high-performance materials. Local partnerships between automakers and material suppliers further enhance technological integration. The Canadian market continues to benefit from a stable automotive supply chain, government incentives for sustainable mobility, and rising demand for innovative material solutions.

Mexico

Mexico accounts for 15% of the North America advanced automotive materials market, reflecting its role as a key automotive manufacturing hub for passenger cars and commercial vehicles. Demand is driven by lightweight metals and plastics for structural components, interior fittings, and body panels. Mexico’s competitive labor costs, proximity to the U.S. market, and participation in trade agreements encourage foreign investments and automotive exports. Increasing focus on electric vehicle assembly and adoption of innovative materials is creating opportunities for composites and advanced polymers. Strong OEM presence and material supplier networks position Mexico as a growing contributor to the regional market.

Market Segmentations:

By Material

- Metals

- Plastics

- Composites

- Ceramics

By Application

- Structural Components

- Body Panel

- Interior Components

- Electrical Components

By End Use Vehicles

- Passenger Cars

- Commercial Vehicles

- Two-wheelers

By Region

- United States

- Canada

- Mexico

Competitive Landscape

The competitive landscape of the North America advanced automotive materials market is dominated by key players such as BASF SE, Toray Industries, DuPont de Nemours, Novelis Inc., Wolverine Advanced Materials, Exxon Mobil Corporation, Mitsubishi Chemical Corporation, ArcelorMittal, and 3M Company. These companies focus on product innovation, strategic partnerships, and expansion of production capacities to strengthen their market positions. Investments in lightweight metals, high-performance plastics, and composites enable them to meet evolving automotive safety, fuel efficiency, and sustainability requirements. Mergers, acquisitions, and collaborations with OEMs enhance their technological capabilities and supply chain efficiency. The increasing emphasis on electric vehicles and the demand for smart, functional, and sustainable materials drive competitive differentiation. Overall, market players leverage R&D, material innovation, and regional manufacturing presence to capture growth opportunities and maintain a strong foothold in the North American automotive materials landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Toray Industries, Inc.

- DuPont de Nemours, Inc.

- Novelis Inc.

- Wolverine Advanced Materials LLC

- Exxon Mobil Corporation

- Mitsubishi Chemical Corporation

- ArcelorMittal

- 3M Company

- Other Key Players

Recent Developments

- In June 2025, Novelis Inc. entered a collaboration with The Future is NEUTRAL to enhance the production of automotive-skin aluminum alloy containing over 95% recycled content, including 50% post-consumer vehicle scrap.

- In April 2025, Teijin Automotive Technologies North America was acquired by AURELIUS Investment Advisory, marking a strategic move to expand lightweight composite manufacturing capabilities in the region.

- On May 14, 2025, Tata AutoComp Systems Ltd. entered a joint venture with Katcon Global in Mexico to produce advanced composite materials tailored for the North American automotive sector.

- In August 5, 2025, NextSource Materials Inc. and Mitsubishi Chemical Corporation executed a binding multi-year offtake agreement to supply approximately 9,000 tpa of SuperFlake® graphite anode material for the North American EV market.

Report Coverage

The research report offers an in-depth analysis based on Material, Application, End Use Vehicle and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to increasing demand for lightweight and fuel-efficient vehicles.

- Expansion of electric vehicle production will drive higher adoption of advanced metals, composites, and plastics.

- Technological innovations in high-performance and smart materials will create new applications across automotive components.

- Growing focus on sustainability will accelerate the use of recycled and bio-based materials.

- Structural components and body panels will continue to dominate material consumption in passenger cars and commercial vehicles.

- Integration of functional materials will enhance vehicle safety, energy efficiency, and design flexibility.

- Rising adoption of composites and lightweight metals will support emission reduction targets.

- Strategic partnerships and collaborations between material suppliers and automakers will strengthen market growth.

- Regional manufacturing hubs in the U.S., Canada, and Mexico will expand production capacity.

- Investment in R&D will drive continuous innovation, improving performance and reducing manufacturing costs.