Market Overview

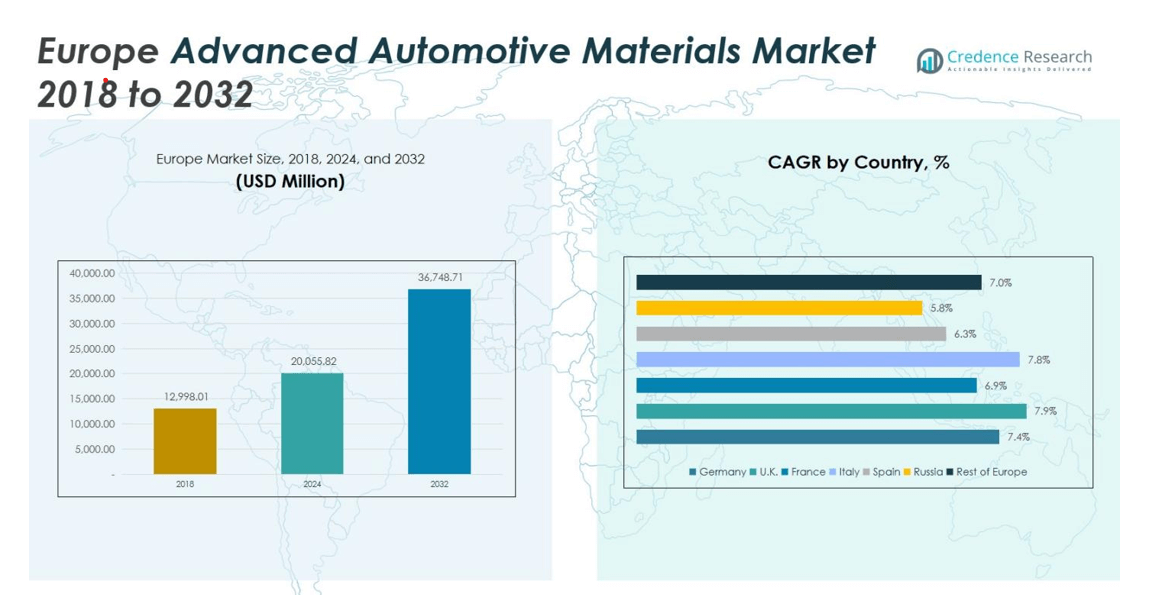

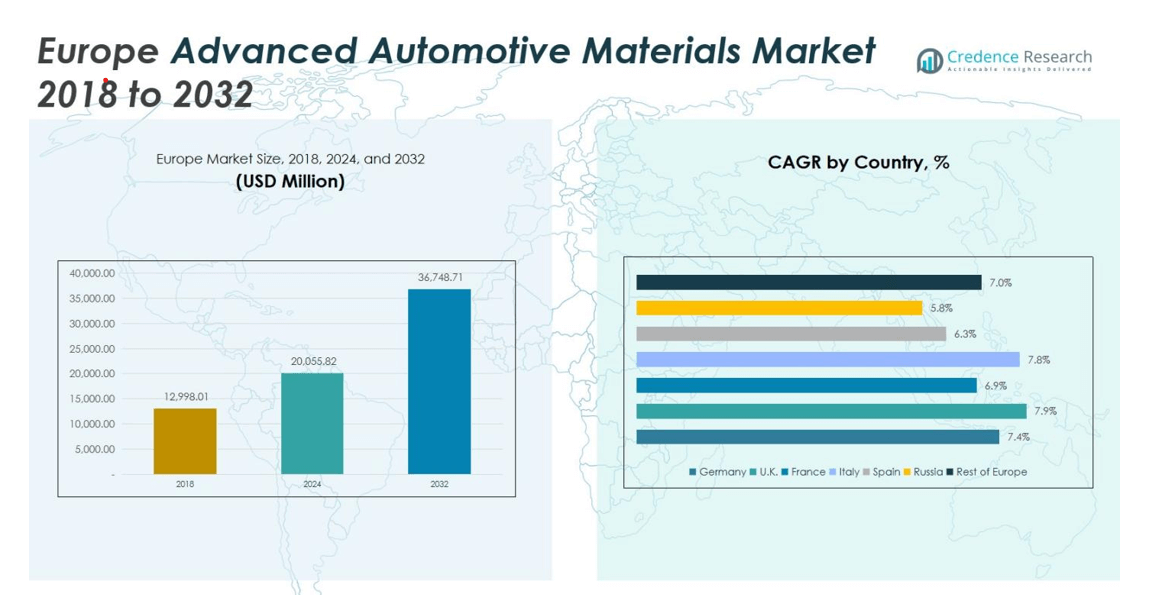

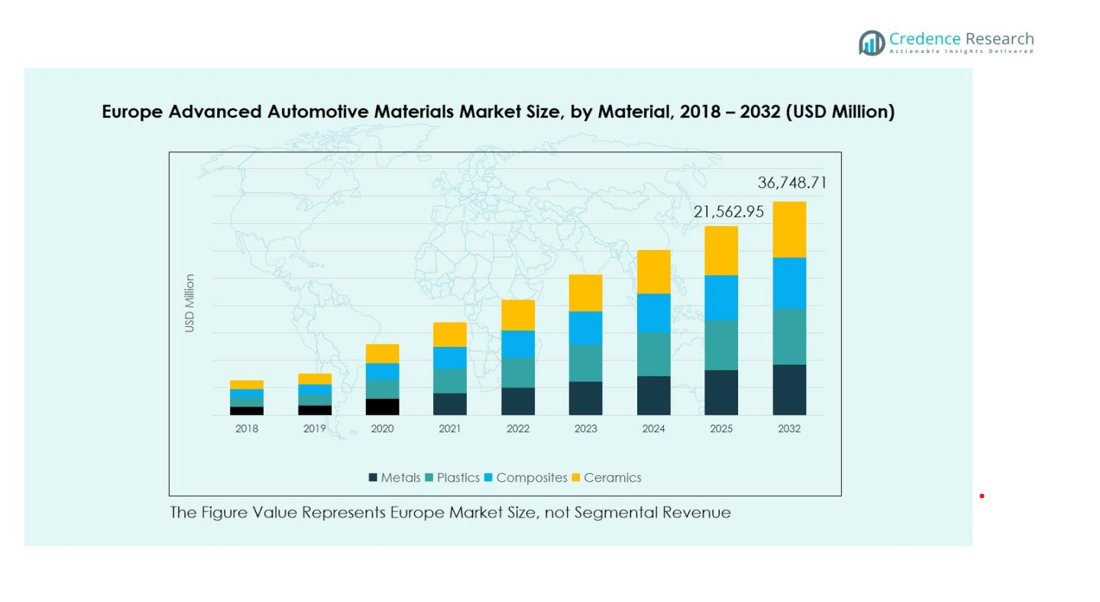

Europe Advanced Automotive Materials Market size was valued at USD 12,998.01 Million in 2018 to USD 20,055.82 million in 2024 and is anticipated to reach USD 36,748.71 Million by 2032, at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Advanced Automotive Materials Market Size 2024 |

USD 20,055.82 million |

| Europe Advanced Automotive Materials Market, CAGR |

7.6% |

| Europe Advanced Automotive Materials Market Size 2032 |

USD 36,748.71 Million |

The Europe Advanced Automotive Materials Market is highly competitive, led by key players including BASF SE, Toray Industries, DuPont de Nemours, Novelis Inc., Wolverine Advanced Materials, Exxon Mobil, Mitsubishi Chemical, Plansee SE, and 3M Company. These companies focus on developing lightweight metals, high-performance composites, and advanced polymers to meet growing demand across passenger cars, commercial vehicles, and electric mobility segments. Germany leads the regional market with a 22% share, driven by its strong automotive manufacturing base and continuous investment in R&D and advanced materials. The United Kingdom and France follow with 14% and 12% market shares, respectively, supported by regulatory incentives for lightweighting and sustainable material adoption. Metals dominate the material segment with 42% share, while structural components capture 38% of the application segment. The competitive landscape fosters innovation, strategic collaborations, and expansion, enabling leading players to maintain significant influence across Europe.

Market Insights

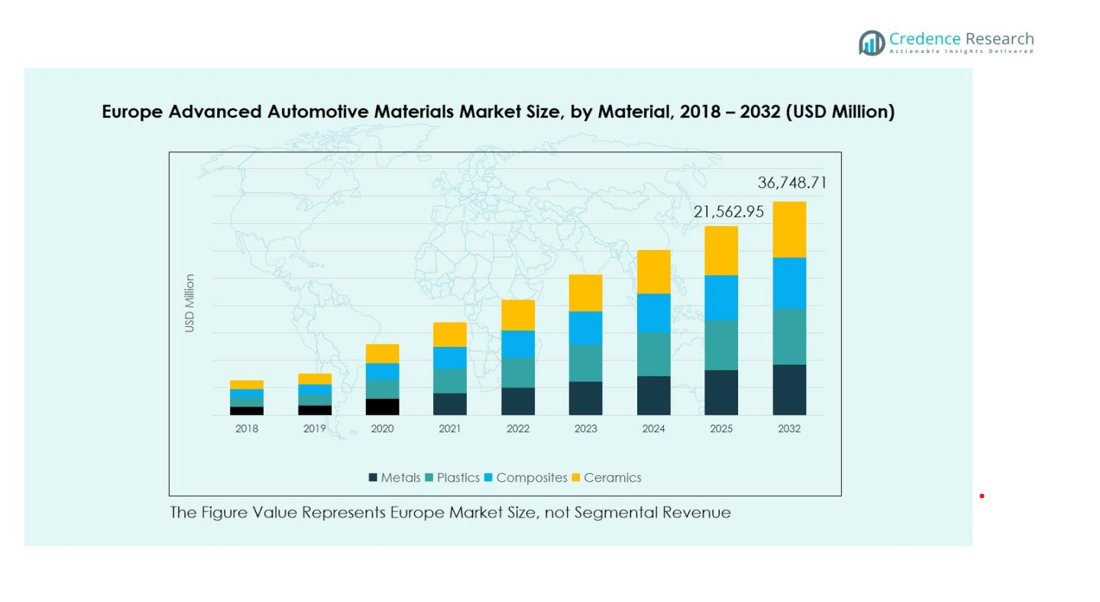

- Europe Advanced Automotive Materials Market size was valued at USD 20,055.82 Million in 2024 and is anticipated to reach USD 36,748.71 Million by 2032, growing at a CAGR of 7.6% during the forecast period. Metals dominate the material segment with a 42% share, followed by plastics at 28%.

- The market is driven by rising demand for lightweight, fuel-efficient vehicles, stricter emission regulations, and adoption of advanced materials in electric and hybrid vehicles across passenger cars, commercial vehicles, and two-wheelers.

- Key trends include the growth of electric and hybrid vehicles, increasing use of high-performance composites and smart multifunctional materials, and integration of eco-friendly and recyclable materials to meet sustainability initiatives.

- Competitive analysis shows leading players such as BASF SE, Toray Industries, DuPont de Nemours, and Novelis Inc., focusing on R&D, strategic partnerships, and expansion to maintain market dominance.

- Germany holds the largest regional share at 22%, followed by the UK at 14% and France at 12%, while structural components capture 38% of application share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material:

Metals dominate the Europe advanced automotive materials market, accounting for approximately 42% of the material segment share in 2024. Steel and aluminum remain the most utilized metals due to their high strength-to-weight ratio, cost efficiency, and recyclability. Plastics hold the second-largest share at around 28%, driven by their lightweight properties and adaptability for complex automotive designs. Composites contribute nearly 18%, favored for high-performance structural applications, while ceramics account for 12%, primarily used in specialized high-temperature and wear-resistant components. Increasing demand for lightweight vehicles and stringent emissions regulations are key drivers across all material sub-segments.

By Application:

Structural components represent the largest application segment in Europe, capturing nearly 38% of the market share. Their dominance is driven by the need for enhanced vehicle safety, rigidity, and reduced weight to comply with emissions norms. Body panels follow with a 25% share, benefitting from materials like aluminum and composites for lightweight and aesthetic designs. Interior components hold 22% of the segment, supported by plastics and composites for ergonomic and durable solutions. Electrical components contribute 15%, rising due to the growth of electric and hybrid vehicles and increasing demand for lightweight conductive materials.

- For instance, BASF’s Licity® anode binders for lithium-ion batteries enhance electric vehicle battery performance by increasing charge cycles and adhesion, supporting European automakers’ sustainability goals in EV manufacturing.

By End Use Vehicle:

Passenger cars lead the Europe advanced automotive materials market, representing approximately 55% of the end-use vehicle segment. The growth is driven by rising consumer demand for fuel-efficient, lightweight, and environmentally friendly vehicles. Commercial vehicles account for 30%, where durability and load-bearing capacity drive the selection of metals and composites. Two-wheelers hold a 15% share, with lightweight plastics and composites supporting performance and maneuverability. Overall, regulatory pressure for emissions reduction and the shift toward electric mobility are primary drivers influencing material adoption across all vehicle types.

- For instance, the BCPR project in Southern Europe developed a lightweight, recyclable thermoplastic composite e-bike frame weighing 18-19 kg, using recycled materials from aerogenerator wings and fishing nets.

Key Growth Drivers

Lightweight Vehicle Demand

The rising emphasis on fuel efficiency and emissions reduction has significantly driven demand for lightweight automotive materials in Europe. Metals such as aluminum, high-strength steel, and advanced composites are increasingly adopted to reduce vehicle weight without compromising safety. This trend is reinforced by strict European regulations on carbon emissions and fuel economy. Manufacturers are investing in innovative material solutions to meet regulatory requirements while maintaining vehicle performance, making lightweighting a primary growth driver for the advanced automotive materials market across passenger cars, commercial vehicles, and two-wheelers.

- For instance, ArcelorMittal has launched a new generation of advanced high-strength steels aimed at electric vehicles, targeting lightweight automotive designs that maintain crash resistance and durability under stricter European emission regulations.

Technological Advancements in Materials

Rapid innovation in material science, including high-performance composites, advanced polymers, and ceramics, is propelling market growth. These materials offer enhanced strength, durability, and thermal stability while reducing weight. Development of multifunctional materials that integrate structural and electrical properties is further expanding application possibilities. Automotive manufacturers are leveraging these advancements to improve vehicle efficiency, safety, and performance. As electric vehicles (EVs) gain traction, the demand for materials with superior energy efficiency and thermal management properties strengthens this market driver.

- For instance, CeramTec, in collaboration with the Fraunhofer Institute, has developed ceramic cooling solutions with applied metallisation for power modules in electric vehicle drive inverters, enhancing thermal management by efficiently cooling silicon carbide (SiC) chips to improve the performance and reliability of power electronics.

Regulatory Compliance and Sustainability Initiatives

European governments and industry bodies are enforcing stringent regulations on emissions, recyclability, and sustainability, encouraging automakers to adopt advanced materials. Use of recyclable metals, eco-friendly polymers, and lightweight composites helps meet regulatory targets and reduce environmental impact. Sustainability initiatives, including circular economy practices, promote the integration of recycled and bio-based materials in automotive production. Compliance with these standards not only ensures legal adherence but also improves brand reputation and consumer preference, driving consistent demand for advanced automotive materials across all vehicle segments.

Key Trends & Opportunities

Growth of Electric and Hybrid Vehicles

The transition to electric and hybrid vehicles is reshaping material demand in the European automotive market. EVs require lightweight, thermally stable, and high-strength materials to maximize battery efficiency, range, and safety. This trend creates opportunities for advanced composites, high-strength plastics, and specialized metals. Manufacturers are exploring innovative solutions for battery enclosures, chassis, and body panels. The increasing government incentives and consumer adoption of EVs amplify this opportunity, positioning advanced automotive materials as a critical component in the evolving mobility landscape.

- For instance, Covestro’s Makrolon® and Bayblend® thermoplastic resins are used in electric vehicle battery enclosures, offering high precision, flame-retardant performance, and thermal management to enhance battery safety and manufacturing efficiency.

Integration of Smart and Multifunctional Materials

Automotive manufacturers are increasingly adopting smart materials that offer multifunctionality, such as self-healing polymers, conductive composites, and high-performance ceramics. These materials enable enhanced vehicle safety, connectivity, and energy efficiency. Applications include structural components with embedded sensors, lightweight interior panels, and heat-resistant engine parts. The integration of such materials presents significant growth opportunities, allowing manufacturers to differentiate products while addressing regulatory and performance requirements, thereby expanding market potential across passenger cars, commercial vehicles, and two-wheelers.

- For instance, advanced ceramics like yttria-stabilized zirconia are employed in high-temperature engine parts and fuel system components due to their exceptional heat resistance and durability, enhancing engine performance and component lifespan.

Key Challenges

High Production Costs of Advanced Materials

Advanced metals, composites, and ceramics often involve complex manufacturing processes, resulting in higher production costs compared to conventional materials. These costs can limit widespread adoption, especially in price-sensitive segments such as entry-level passenger cars and two-wheelers. Manufacturers face the challenge of balancing performance benefits with economic feasibility. Although long-term efficiency and sustainability gains exist, upfront investment in research, production, and integration of advanced materials remains a barrier to market growth, requiring strategic planning and cost-optimization measures.

Supply Chain and Raw Material Constraints

The Europe advanced automotive materials market faces challenges related to supply chain stability and raw material availability. Dependence on specialized metals, high-grade polymers, and composites exposes manufacturers to price volatility, geopolitical risks, and potential shortages. Disruptions in raw material supply can delay production timelines and increase costs, affecting market dynamics. Efficient sourcing strategies, diversification of suppliers, and investment in recycling initiatives are critical to overcoming these constraints and ensuring consistent growth in the region’s advanced automotive materials market.

Regional Analysis

Germany

Germany leads the Europe advanced automotive materials market, holding a 22% share in 2024. The country’s dominance is driven by its strong automotive industry, home to major OEMs and suppliers focusing on lightweighting and high-performance materials. Demand for metals, composites, and plastics in passenger cars and commercial vehicles is rising due to strict emission regulations and sustainability initiatives. Advanced manufacturing technologies and continuous R&D investments support the adoption of innovative materials. Structural components and body panels are the primary applications, while passenger cars represent the largest end-use segment, ensuring Germany remains a key contributor to regional market growth.

United Kingdom

The United Kingdom accounts for 14% of the Europe advanced automotive materials market. Growth is fueled by increasing production of lightweight vehicles and the transition toward electric and hybrid models. High adoption of advanced plastics and composites for interior components, body panels, and structural elements supports market expansion. Government incentives for electric mobility and stringent CO2 emission targets encourage OEMs to integrate sustainable and high-performance materials. Commercial vehicles and passenger cars dominate the end-use segments. Rising investments in material innovation and manufacturing efficiency position the UK as a critical market for advanced automotive materials within Europe.

France

France contributes 12% to the Europe advanced automotive materials market. The country benefits from a robust automotive sector emphasizing lightweighting, energy efficiency, and sustainability. Aluminum, high-strength steel, and composite adoption is growing across body panels, structural components, and interior parts. Passenger cars dominate the end-use segment, while the increasing production of electric vehicles drives demand for thermally stable and high-strength materials. Government policies supporting low-emission vehicles and recycling initiatives further accelerate market growth. France’s focus on material innovation and collaboration with leading OEMs and suppliers reinforces its position as a significant player in Europe’s advanced automotive materials landscape.

Italy

Italy holds a 9% share in the Europe advanced automotive materials market. Growth is supported by the country’s strong automotive manufacturing and design industries, emphasizing lightweight and durable materials. Composites and plastics are increasingly adopted for interior and body applications, while metals dominate structural components. Passenger cars remain the largest end-use segment, complemented by commercial vehicle demand. The adoption of electric and hybrid vehicles, alongside government incentives for sustainable manufacturing, fuels market expansion. Italy’s focus on advanced materials for high-performance and luxury vehicles enhances technological development, reinforcing its role in driving regional growth in advanced automotive materials.

Spain

Spain represents 7% of the Europe advanced automotive materials market. The country’s growth is driven by rising production of passenger cars and commercial vehicles, with emphasis on lightweight metals and high-performance plastics. Composites are increasingly utilized for structural and body components, responding to regulatory pressure on fuel efficiency and emissions reduction. The expansion of electric vehicle manufacturing supports demand for advanced materials with thermal stability and strength. Collaboration between OEMs and suppliers for sustainable material solutions further accelerates adoption. Spain’s strategic investments in advanced automotive manufacturing and regulatory compliance position it as a key contributor to Europe’s overall market development.

Russia

Russia accounts for 5% of the Europe advanced automotive materials market. Market growth is primarily supported by passenger and commercial vehicle production, with metals and plastics forming the bulk of material consumption. Composites and ceramics are gradually gaining traction for structural and high-performance applications. Increasing demand for fuel-efficient and durable vehicles drives adoption, while government policies on automotive modernization and emission reduction create favorable conditions. Despite geopolitical and supply chain challenges, investment in advanced material technologies and collaboration with European suppliers ensures steady growth. Russia’s focus on cost-efficient yet high-performance materials supports its role as a regional market participant.

Rest of Europe

The Rest of Europe holds a combined 31% market share, encompassing countries including the Netherlands, Belgium, Sweden, and Poland. Growth is driven by rising automotive production, lightweighting initiatives, and the shift toward electric mobility. Metals, plastics, and composites dominate material consumption across structural components, body panels, and interior applications. Passenger cars lead end-use demand, with commercial vehicles following closely. Government regulations on emissions, sustainability, and recycling encourage advanced material adoption. Investments in R&D, cross-border collaborations, and innovative manufacturing practices in these countries are key drivers supporting the continued expansion of advanced automotive materials in the wider European market.

Market Segmentations:

By Material

- Metals

- Plastics

- Composites

- Ceramics

By Application

- Structural Components

- Body Panels

- Interior Components

- Electrical Components

By End Use Vehicle

- Passenger Cars

- Commercial Vehicles

- Two-wheelers

By Region

- Germany

- United Kindom

- France

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

Competitive landscape in the Europe advanced automotive materials market features major players including BASF SE, Toray Industries, DuPont de Nemours, Novelis Inc., Wolverine Advanced Materials, Exxon Mobil, Mitsubishi Chemical, Plansee SE, and 3M Company. The market is highly competitive, driven by continuous technological innovation, strategic partnerships, and expansion of production capacities. Leading companies focus on developing lightweight metals, high-performance composites, and advanced polymers to meet the growing demand from passenger cars, commercial vehicles, and electric mobility segments. Mergers, acquisitions, and joint ventures are common strategies to strengthen regional presence and enhance product portfolios. Investments in R&D, sustainability initiatives, and advanced manufacturing capabilities allow key players to differentiate their offerings and address regulatory requirements. The competitive intensity fosters innovation while maintaining high barriers for new entrants, ensuring established players retain significant influence over Europe’s advanced automotive materials market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Toray Industries, Inc.

- DuPont de Nemours, Inc.

- Novelis Inc.

- Wolverine Advanced Materials LLC

- Exxon Mobil Corporation

- Mitsubishi Chemical Corporation

- Plansee SE

- 3M Company

- Other Key Players

Recent Developments

- In September 2025, BASF, in collaboration with Porsche and BEST, successfully completed a pilot project focused on recycling mixed waste from end-of-life vehicles, advancing sustainable practices in automotive manufacturing.

- In February 2025, Toray Advanced Composites signed a long-term supply agreement with Airborne Aerospace B.V. to provide advanced composite materials for aerospace applications, strengthening its European market presence.

- In August 2025, Dutch investment firm Berk Partners acquired a majority stake in Ganzeboom, a Dutch company specializing in transmission components and reconditioning solutions for the European automotive aftermarket

Report Coverage

The research report offers an in-depth analysis based on Material, Application, End Use Vehicle and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily, driven by rising demand for lightweight and fuel-efficient vehicles.

- Electric and hybrid vehicle adoption will increase the use of advanced metals, plastics, and composites.

- Regulatory pressure on emissions and sustainability will continue to boost material innovation.

- High-performance composites and polymers will see wider application in structural and body components.

- Passenger cars will remain the dominant end-use segment, followed by commercial vehicles and two-wheelers.

- Investment in R&D for multifunctional and smart materials will accelerate market expansion.

- Advanced ceramics will gain traction in high-temperature and wear-resistant applications.

- Collaborations, mergers, and partnerships among key players will strengthen regional presence.

- Adoption of recyclable and eco-friendly materials will rise in response to environmental initiatives.

- Lightweighting technologies and material substitution will remain central to automotive design trends.