Market Overview

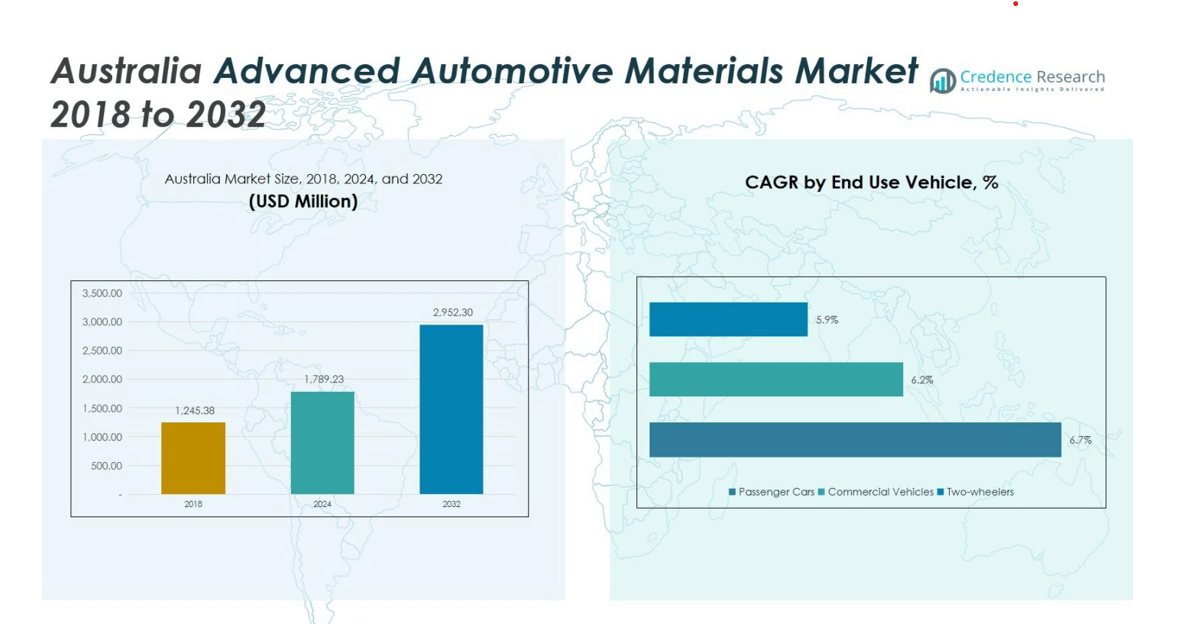

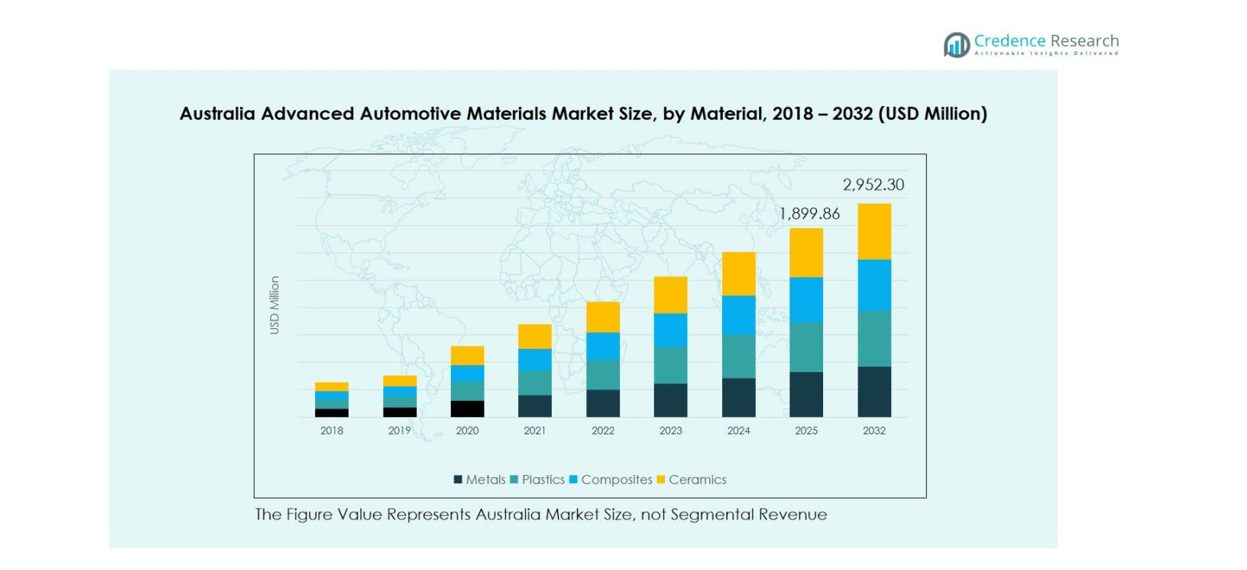

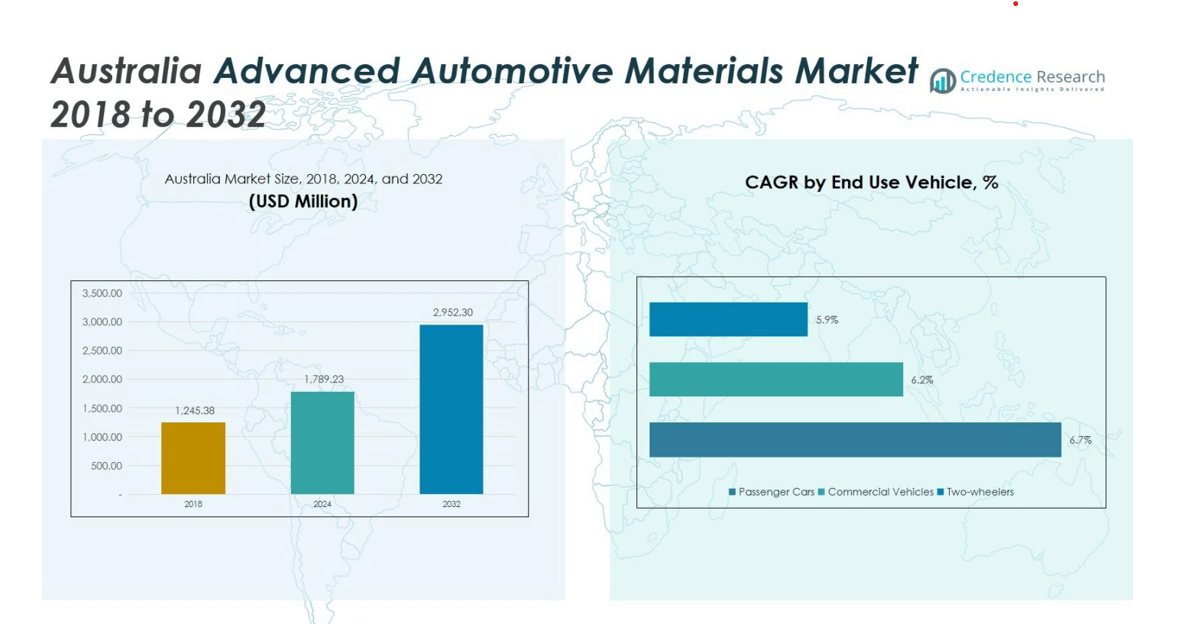

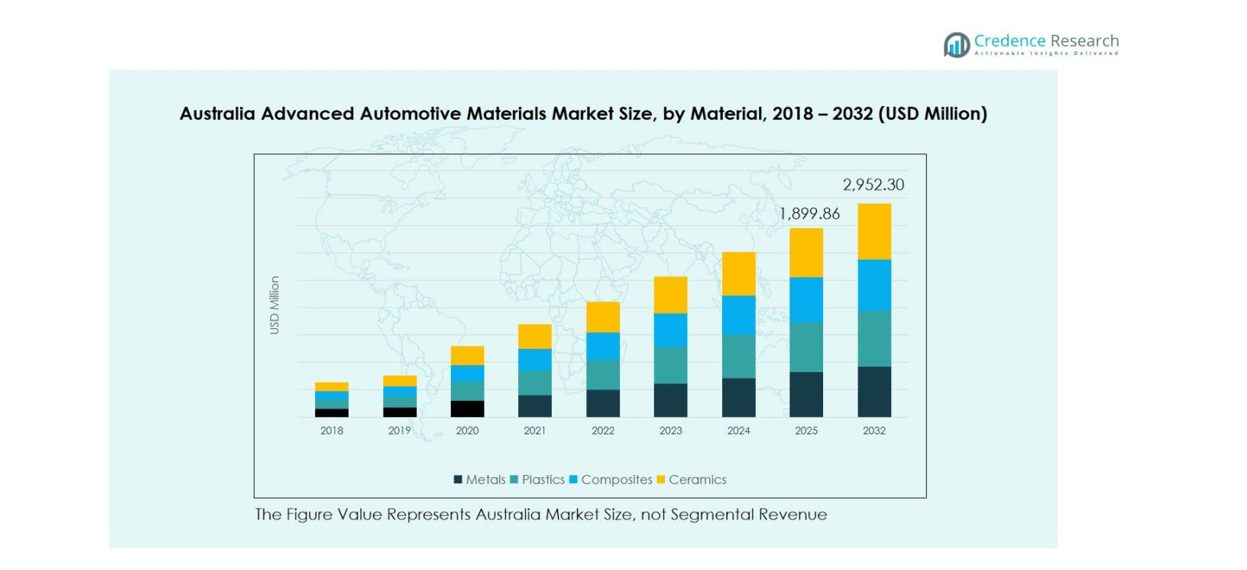

Australia Advanced Automotive Materials Market size was valued at USD 1,245.38 million in 2018 and reached USD 1,789.23 million in 2024. It is anticipated to grow to USD 2,952.30 million by 2032, reflecting a CAGR of 6.46% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Advanced Automotive Materials Market Size 2024 |

USD 1,789.23 million |

| Australia Advanced Automotive Materials Market, CAGR |

6.46% |

| Australia Advanced Automotive Materials Market Size 2032 |

USD 2,952.30 million |

The Australia Advanced Automotive Materials Market is highly competitive, led by key players including Kormax, Toray Industries, DuPont de Nemours, TCL, Anderson Group, Exxon Mobil Corporation, Mitsubishi Chemical Corporation, ArcelorMittal, and Romar Engineering. These companies are driving market growth through strategic partnerships, extensive R&D investments, and innovative material solutions across metals, plastics, composites, and ceramics. New South Wales emerges as the leading region, holding 28% of the market share, supported by a strong automotive manufacturing base and advanced research infrastructure. Victoria follows with 22%, while Queensland and Western Australia account for 18% and 15%, respectively. The adoption of lightweight materials, electric vehicle expansion, and sustainability initiatives across these regions strengthen the market’s growth trajectory, positioning leading companies to capitalize on emerging opportunities and enhance their regional and product portfolios.

Market Insights

- Australia Advanced Automotive Materials Market size was valued at USD 1,789.23 million in 2024 and is anticipated to reach USD 2,952.30 million by 2032, growing at a CAGR of 6.46%.

- The market is driven by rising demand for lightweight vehicles, increased electric vehicle adoption, and technological advancements in metals, plastics, composites, and ceramics.

- Key trends include integration of smart materials such as self-healing composites and shape-memory alloys, and a growing focus on recyclable and eco-friendly materials to support sustainability.

- The competitive landscape is led by Kormax, Toray Industries, DuPont de Nemours, TCL, Anderson Group, Exxon Mobil Corporation, Mitsubishi Chemical Corporation, ArcelorMittal, and Romar Engineering, with players investing in R&D, partnerships, and capacity expansion.

- Regionally, New South Wales holds 28% market share, Victoria 22%, Queensland 18%, Western Australia 15%, South Australia 10%, and other regions 7%, with metals being the dominant material segment at 42%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

The metals segment dominates the Australia Advanced Automotive Materials Market, accounting for approximately 42% of the total market share in 2024. Metals, particularly high-strength steel and aluminum alloys, are preferred due to their superior strength-to-weight ratio and recyclability, which supports fuel efficiency and emission reduction goals. Plastics follow closely, driven by their versatility and cost-effectiveness, capturing around 28% share. Composites and ceramics collectively hold the remaining 30%, with composites favored for lightweight structural components and ceramics for high-performance applications. The growing demand for lightweight vehicles and stringent environmental regulations are the primary drivers for metals and composites adoption.

- For instance, Alcoa Corporation has developed advanced high-strength aluminum alloys, such as C611 EZCast, with applications for electric vehicles to enable lightweight designs and improve vehicle efficiency.

By Application

Structural components lead the application segment with a market share of 38% in 2024, owing to their critical role in vehicle safety, performance, and crashworthiness. Body panels account for 27% of the share, supported by the use of lightweight metals and composites to enhance fuel efficiency. Interior components capture 20% and are increasingly using plastics and composites for design flexibility and cost savings. Electrical components, comprising 15%, are witnessing growth driven by the rise of electric vehicles and electronic systems integration. Overall, the push for lightweight, durable, and energy-efficient vehicles is the key driver across all applications.

- For instance, Sika supplies high-performance SikaForce® adhesives used in Body-in-White (BIW) applications to bond mixed materials like high-strength steel and aluminum in modern vehicle frames, enhancing structural rigidity and crash energy absorption without adding weight.

By End-Use Vehicle

Passenger cars dominate the end-use vehicle segment with a market share of 55% in 2024, reflecting high adoption of advanced materials for lightweighting, safety, and fuel efficiency. Commercial vehicles account for 30%, driven by the need for durable and high-strength materials to withstand heavy loads and harsh operating conditions. Two-wheelers hold 15%, with increasing use of plastics and composites for performance and cost efficiency. The growth in passenger car production, coupled with government incentives for low-emission vehicles and technological advancements in material engineering, are key factors driving material adoption across vehicle types.

Key Growth Drivers

Increasing Demand for Lightweight Vehicles

The rising emphasis on fuel efficiency and emission reduction is propelling the adoption of advanced automotive materials in Australia. Lightweight metals, composites, and plastics are increasingly replacing conventional materials to reduce vehicle weight without compromising structural integrity. This trend is particularly prominent in passenger cars and commercial vehicles, where manufacturers seek to meet stricter environmental regulations and consumer demand for energy-efficient mobility. Government policies supporting low-emission vehicles further drive investments in lightweight material technologies, boosting overall market growth.

- For instance, Toyota Australia supports multi-pathway approaches including low-carbon liquid fuels and the use of recyclable and bio-based materials, aiming to reduce vehicle emissions by more than 50% by 2035 compared to 2019 levels.

Technological Advancements in Material Engineering

Innovations in high-strength alloys, polymer composites, and ceramics are transforming automotive manufacturing processes in Australia. Advanced materials offer enhanced durability, corrosion resistance, and crashworthiness, enabling the production of safer and longer-lasting vehicles. Continuous research and development by market leaders, combined with collaborations between material suppliers and automotive OEMs, are accelerating the introduction of new material solutions. These advancements improve vehicle performance and reduce maintenance costs, creating a strong market incentive for manufacturers to integrate advanced materials across structural, body, and interior components.

- For instance, Hydro’s High Strength 400 aluminium alloy offers yield strengths above 370 MPa and ultimate tensile strengths over 400 MPa, providing lighter and more durable components for next-generation vehicles.

Expansion of Electric Vehicle Production

The rapid growth of electric vehicles (EVs) in Australia is driving demand for advanced automotive materials that support lightweighting, battery protection, and thermal management. Metals, composites, and specialized plastics optimize EV performance, extend battery life, and improve energy efficiency. Government incentives and rising consumer adoption of EVs further stimulate material innovation and supply chain development. As the EV segment expands, automotive manufacturers are investing heavily in advanced material solutions to meet the unique requirements of electric drivetrains, enhancing overall market growth.

Key Trends & Opportunities

Integration of Smart Materials

The adoption of smart materials, including shape-memory alloys and self-healing composites, is creating new opportunities in the Australian automotive market. These materials enhance vehicle safety, reduce maintenance costs, and improve performance under varying operational conditions. OEMs are increasingly exploring these innovations for structural components and interiors to differentiate products and meet evolving consumer expectations. The integration of smart materials also supports sustainability goals by extending component life cycles, presenting manufacturers with an opportunity to offer high-value, technologically advanced vehicles.

- For instance, self-healing composites are being developed to automatically repair minor damages like scratches or cracks, significantly reducing maintenance expenses and extending the lifespan of vehicle components, thus offering cost savings to car owners.

Rising Focus on Recycling and Sustainability

Sustainability initiatives are encouraging the use of recyclable and eco-friendly materials in automotive manufacturing. Metals like aluminum and high-strength steel, as well as recyclable plastics and composites, are gaining traction due to their reduced environmental impact. Automotive manufacturers are investing in closed-loop recycling systems and sustainable supply chains to comply with regulations and meet consumer expectations. This trend not only minimizes waste but also lowers production costs over time. Companies prioritizing sustainability gain competitive advantages and attract environmentally conscious customers.

- For instance, Nissan has developed a closed-loop recycling system for aluminum road wheels recovered from end-of-life vehicles, which are reused in high-quality suspension parts, minimizing virgin material use and environmental impact.

Key Challenges

High Cost of Advanced Materials

Despite their performance benefits, advanced automotive materials such as composites and high-performance alloys remain costlier than conventional alternatives. The higher production and processing costs can limit adoption, particularly among small and mid-sized vehicle manufacturers. Cost-sensitive end users may prefer traditional materials, slowing market penetration. Integrating advanced materials often requires specialized equipment and training, further increasing initial investment. Managing these costs while maintaining performance and regulatory compliance remains a significant challenge for manufacturers seeking to scale advanced material usage.

Limited Infrastructure and Supply Chain Constraints

The availability of high-quality raw materials and specialized processing facilities in Australia is limited, posing a challenge for widespread adoption of advanced automotive materials. Dependence on imports increases lead times and costs, while logistical constraints may affect production schedules. Supply chain disruptions, particularly for composites and specialized metals, can hinder consistent manufacturing and vehicle deliveries. Developing robust domestic supply chains and establishing partnerships with reliable material suppliers are essential to overcome infrastructure constraints and ensure the market can meet growing demand efficiently.

Regional Analysis

New South Wales

New South Wales holds a dominant position in the Australia Advanced Automotive Materials Market, capturing 28% of the total market share in 2024. The state benefits from a robust automotive manufacturing base, advanced research facilities, and proximity to key raw material suppliers. High demand for lightweight and durable materials in passenger cars and commercial vehicles drives market growth. Investments in EV production and sustainable automotive initiatives further strengthen adoption. Manufacturers are increasingly focusing on metals, composites, and plastics to enhance fuel efficiency and meet stringent emission regulations, positioning New South Wales as a key hub for advanced automotive material deployment.

Victoria

Victoria accounts for 22% of the market share, driven by its strong automotive component manufacturing sector and focus on innovation. The adoption of advanced materials in body panels, structural components, and interior parts is high, particularly in passenger vehicles. Government incentives for low-emission vehicles and research collaborations with universities and material suppliers promote advanced material integration. Growth in electric vehicle production, combined with increasing demand for lightweight, durable, and sustainable materials, positions Victoria as a significant contributor to market expansion. Strategic partnerships and investments in R&D are further strengthening its role in shaping the advanced automotive materials market.

Queensland

Queensland contributes 18% of the market share in 2024, supported by increasing vehicle production and the growing adoption of EVs. Advanced metals, plastics, and composites are widely used across structural and interior components to improve performance and reduce vehicle weight. The state’s focus on sustainability initiatives, including recyclable material usage and low-emission technologies, is driving demand. Additionally, Queensland’s well-established industrial base and expanding automotive supply chain network enable efficient distribution of advanced materials. Investments in research, coupled with favorable government policies, are further accelerating market growth, particularly in the passenger car and commercial vehicle segments.

Western Australia

Western Australia holds 15% of the market share, driven by its access to raw materials and increasing automotive manufacturing activities. The adoption of metals and composites in structural and body applications supports lightweighting and improved vehicle performance. Growth in commercial vehicles and mining-related automotive demand further fuels the use of advanced materials. Government initiatives promoting sustainable production practices and energy-efficient vehicles enhance market penetration. Manufacturers in Western Australia are investing in material processing technologies and supply chain efficiency to meet rising demand. The combination of raw material availability and industrial support positions the region as a key contributor to market growth.

South Australia

South Australia captures 10% of the market share, supported by its automotive component manufacturing expertise and growing interest in electric and hybrid vehicles. Advanced materials, including high-strength steel, aluminum, and plastics, are increasingly integrated into vehicle structural, body, and interior components. State policies encouraging low-emission vehicles and sustainability initiatives promote adoption of recyclable and lightweight materials. Investment in R&D and partnerships with material suppliers drive innovation in composites and ceramics. With a focus on sustainable automotive production and lightweight vehicle technologies, South Australia is positioned to steadily grow its contribution to the Australia Advanced Automotive Materials Market.

Other Regions

Other regions, including Tasmania, Northern Territory, and Australian Capital Territory, collectively hold 7% of the market share in 2024. These regions are experiencing steady growth in the adoption of advanced materials due to increasing demand for passenger vehicles and government initiatives supporting low-emission and energy-efficient vehicles. Metals, plastics, and composites are being increasingly used in structural, body, and interior components. Investment in local supply chains, material processing infrastructure, and research collaborations are supporting market penetration. Despite smaller production volumes compared to major states, these regions are contributing to overall market growth and represent emerging opportunities for manufacturers.

Market Segmentations:

By Material

- Metals

- Plastics

- Composites

- Ceramics

By Application

- Structural Components

- Body Panels

- Interior Components

- Electrical Components

By End-Use Vehicle

- Passenger Cars

- Commercial Vehicles

- Two-wheelers

By Region

- New Southwales

- Victoria

- Queensland

- Western Australia

- South Australia

- Other Regions

Competitive Landscape

Competitive landscape in the Australia Advanced Automotive Materials Market is dominated by key players including Kormax, Toray Industries, DuPont de Nemours, TCL, Anderson Group, Exxon Mobil Corporation, Mitsubishi Chemical Corporation, ArcelorMittal, and Romar Engineering. These companies are leveraging advanced material technologies, strategic partnerships, and extensive R&D investments to strengthen their market position. Intense competition is driving innovation in high-strength metals, composites, plastics, and ceramics, particularly for lightweighting, EV components, and sustainable applications. Players are focusing on expanding production capacities, optimizing supply chains, and developing cost-effective, durable solutions to meet evolving automotive industry requirements. Additionally, mergers, acquisitions, and collaborations are common strategies to enhance regional presence and product portfolios. The competitive environment fosters rapid technological advancements, while smaller and emerging players are increasingly entering the market with niche solutions, intensifying competition and accelerating overall market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kormax

- Toray Industries, Inc.

- DuPont de Nemours, Inc.

- TCL

- Anderson Group

- Exxon Mobil Corporation

- Mitsubishi Chemical Corporation

- ArcelorMittal

- Romar Engineering

- Other Key Players

Recent Developments

- In June 2025, ArcelorMittal completed the acquisition of Nippon Steel’s 50% stake in AM/NS Calvert, gaining full ownership of the facility now renamed ArcelorMittal Calvert.

- In July 2025, Toray Industries partnered with Honda and other stakeholders to expand the use of recycled materials in automotive applications, promoting a circular economy.

- In September 2025, Brenntag signed a supply agreement with Sudarshan Chemical Industries to distribute anticorrosive pigments for automotive applications in Australia.

Report Coverage

The research report offers an in-depth analysis based on Material, Application, End Use Vehicle and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising demand for lightweight vehicles.

- Increasing adoption of electric vehicles will drive the use of advanced materials.

- Continuous technological innovations in metals, plastics, and composites will enhance vehicle performance.

- Sustainability initiatives will promote the use of recyclable and eco-friendly materials.

- Expansion of passenger car and commercial vehicle production will boost material demand.

- Manufacturers will increasingly invest in R&D to develop high-performance and cost-effective solutions.

- Integration of smart materials will create new opportunities in safety and efficiency.

- Collaborations and partnerships between OEMs and material suppliers will strengthen market growth.

- Government policies and incentives for low-emission vehicles will support material adoption.

- The market will witness increased competition, driving innovation and technological advancements.