Market Overview:

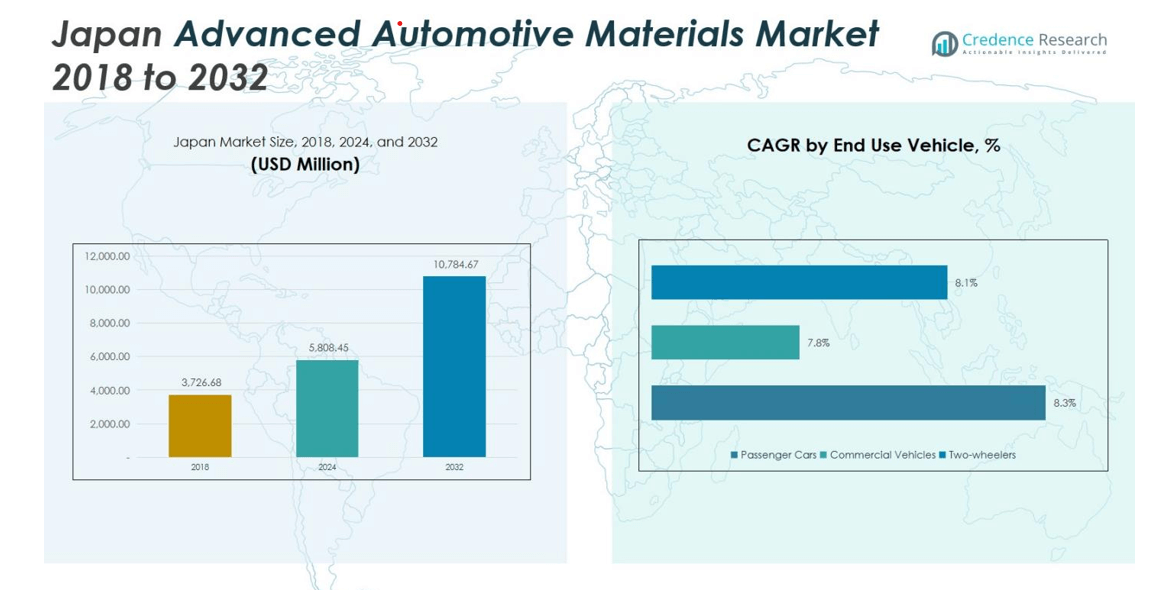

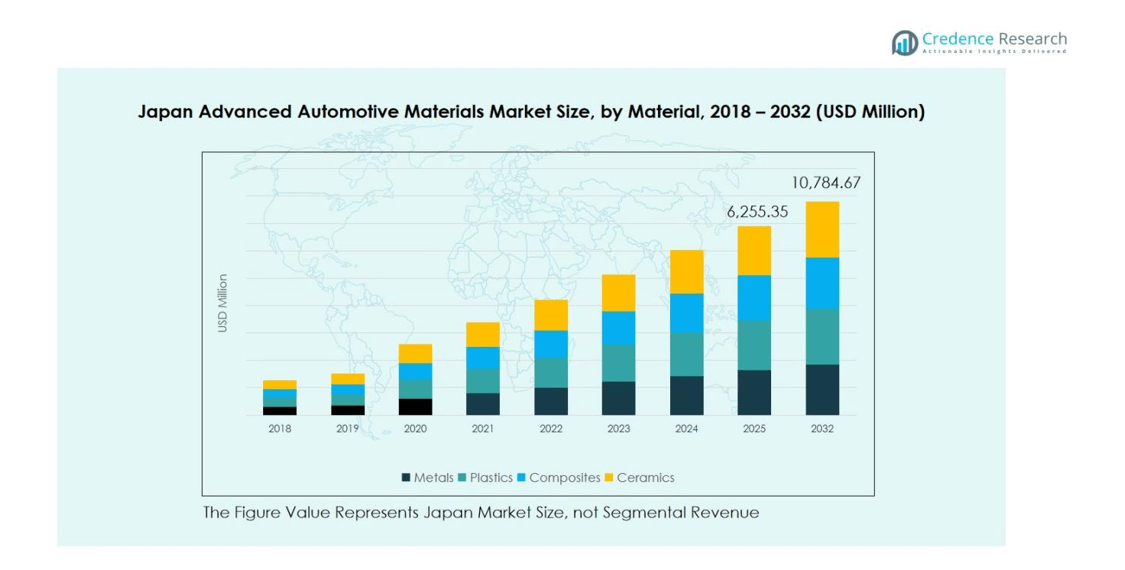

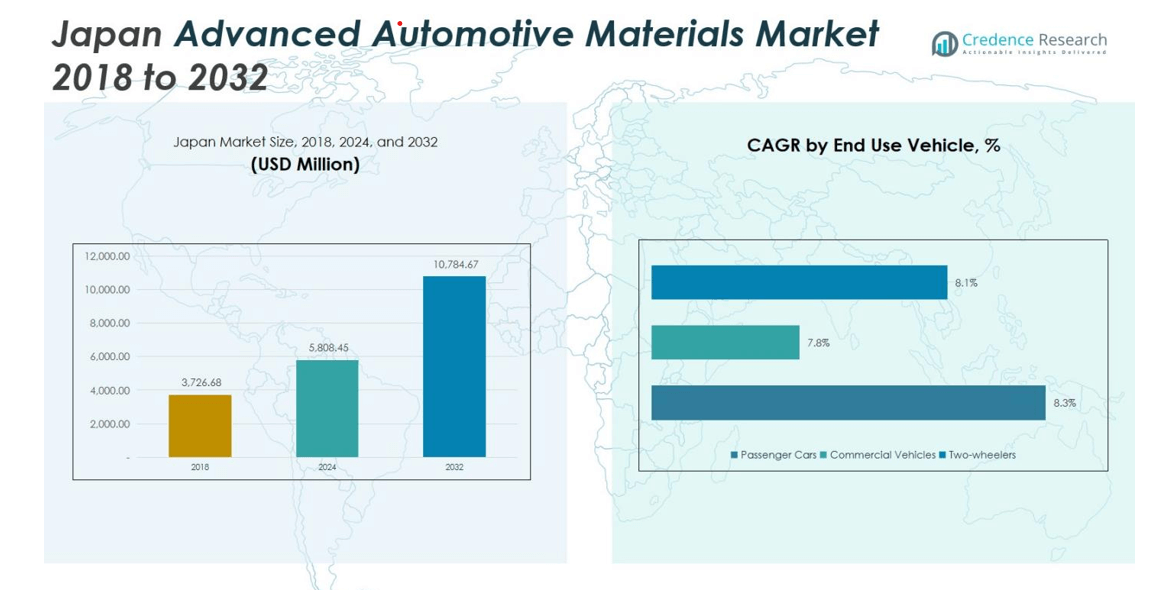

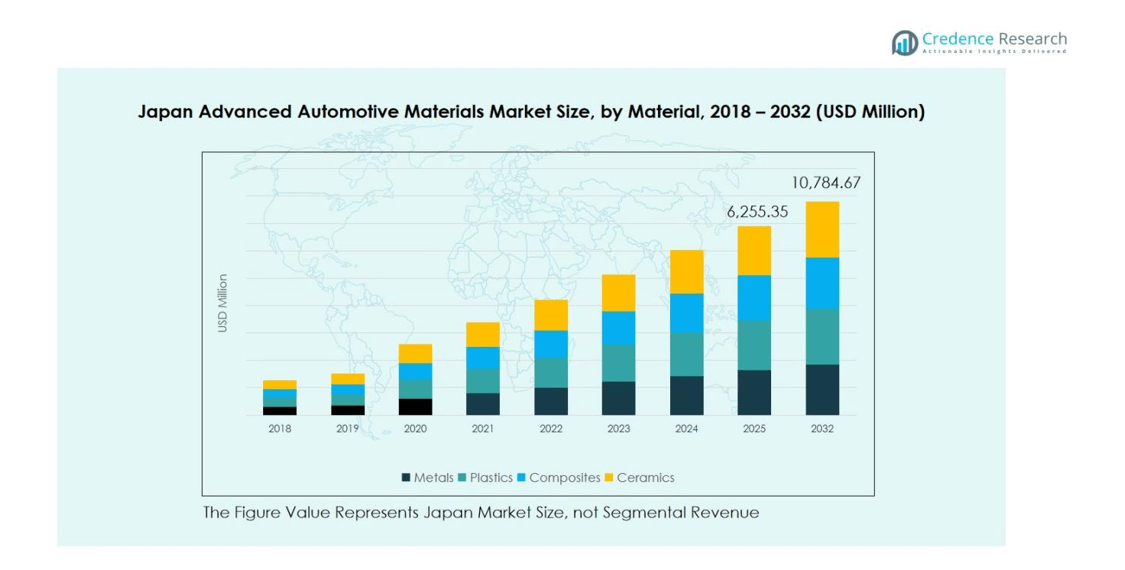

Japan Advanced Automotive Materials Market size was valued at USD 3,726.68 Million in 2018 and is projected to reach USD 5,808.45 Million in 2024, ultimately reaching USD 10,784.67 Million by 2032, growing at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Advanced Automotive Materials Market Size 2024 |

USD 5,808.45 Million |

| Japan Advanced Automotive Materials Market, CAGR |

7.8% |

| Japan Advanced Automotive Materials Market Size 2032 |

USD 10,784.67 Million |

The Japan Advanced Automotive Materials Market is dominated by key players such as Iwatani, Toray Industries, UACJ Corporation, Advanced Material Japan Corporation, Kureha, Kobe Steel Ltd, Mitsubishi Chemical Corporation, ArcelorMittal, and Sankyo Tateyama, Inc. These companies are driving market growth through continuous innovation in high-strength metals, lightweight composites, and advanced plastics, catering to increasing demand for fuel-efficient and safer vehicles. Strategic collaborations with automakers, investments in R&D, and expansion of production capacities have strengthened their market positions. Regionally, the Kanto region leads with a 32% market share, followed by Kansai at 21%, Chubu at 19%, Kyushu at 16%, and Tohoku at 12%, reflecting the concentration of automotive manufacturing hubs and advanced research facilities. Strong technological expertise and proactive growth strategies enable these companies to maintain competitiveness while supporting the adoption of advanced automotive materials across passenger cars, commercial vehicles, and two-wheelers.

Market Insights

- The Japan Advanced Automotive Materials Market size was valued at USD 5,808.45 Million in 2024 and is projected to reach USD 10,784.67 Million by 2032, growing at a CAGR of 7.8%.

- Growth is driven by rising demand for lightweight vehicles, adoption of electric and hybrid vehicles, and stringent safety and emission regulations encouraging the use of high-strength metals, composites, and advanced plastics.

- Market trends include increased integration of smart and multifunctional materials, adoption of high-performance polymers, and expansion of EV infrastructure, creating opportunities for innovative solutions in body panels, structural, and electrical components.

- The competitive landscape features key players such as Iwatani, Toray Industries, UACJ Corporation, Advanced Material Japan Corporation, Kureha, and Kobe Steel Ltd, leveraging R&D investments, partnerships, and capacity expansion to strengthen market presence.

- Regionally, Kanto leads with 32% market share, followed by Kansai (21%), Chubu (19%), Kyushu (16%), and Tohoku (12%), while metals dominate the material segment with a 38% share, and structural components hold 42% of the application segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material:

Metals dominate the Japan Advanced Automotive Materials Market, accounting for =38% of the market share. The segment’s growth is driven by the rising demand for lightweight yet high-strength automotive components, enabling improved fuel efficiency and compliance with stringent emission regulations. Aluminum and high-strength steel alloys are particularly popular due to their superior mechanical properties and cost-effectiveness. Plastics, composites, and ceramics are gaining traction, but metals remain essential for structural and safety-critical components, sustaining steady adoption across passenger cars and commercial vehicles.

- For instance, Kobe Steel’s aluminum forging products for automotive suspensions achieve over 40% weight reduction compared to conventional steel parts, contributing to improved ride quality and fuel economy in passenger vehicles.

By Application:

Structural components lead the application segment with around 42% share, fueled by the automotive industry’s focus on reducing vehicle weight while maintaining rigidity and safety. Advanced metals and composites are increasingly used in chassis, subframes, and suspension components to enhance performance and fuel efficiency. Body panels and interior components follow, supported by lightweight plastics and composites that improve aesthetic appeal and functionality. Electrical components are growing steadily due to the expansion of electric vehicles (EVs) and hybrid vehicles, which require advanced materials for insulation, thermal management, and lightweight construction.

- For instance, Lamborghini’s composite engine subframe option reduces component weight by 60% compared to standard steel subframes, improving torsional rigidity while cutting mass by 9 kg.

By End-Use Vehicles:

Passenger cars hold the largest share in the Japan Advanced Automotive Materials Market, representing 55% of the segment. The growth is driven by increasing consumer demand for fuel-efficient, lightweight, and safer vehicles, which require metals, composites, and advanced plastics in structural and aesthetic components. Commercial vehicles and two-wheelers are also contributing to market growth, with commercial vehicles adopting high-strength metals and composites for durability, while two-wheelers focus on lightweight plastics and composites to improve performance and handling. EV adoption further boosts material demand across all vehicle types.

Growth Drivers

Increasing Demand for Lightweight Vehicles

The growing focus on fuel efficiency and stringent emission regulations is driving the adoption of lightweight materials in Japan’s automotive sector. Automakers are increasingly integrating advanced metals, composites, and plastics to reduce vehicle weight without compromising structural integrity or safety. This trend is particularly strong in passenger cars and electric vehicles, where weight reduction directly enhances energy efficiency and battery performance. The emphasis on lightweight solutions is boosting demand for high-strength steel, aluminum alloys, and engineered composites, sustaining robust growth across the market.

- For instance, Nissan is transitioning to low CO₂ emission aluminum parts made from green or recycled aluminum in models from 2024 onward, aiming to lower vehicle weight and carbon footprint while supporting electrification efforts.

Rising Adoption of Electric and Hybrid Vehicles

The shift toward electric and hybrid vehicles (EVs/HEVs) is accelerating the need for advanced automotive materials in Japan. Lightweight metals, plastics, and composites are critical for improving vehicle range, battery efficiency, and overall performance. Additionally, electrical components require high-performance insulating materials and thermally stable composites. The rapid expansion of the EV market, supported by government incentives and consumer awareness, is driving substantial growth for materials that enhance safety, energy efficiency, and durability.

- For instance, Sumitomo Riko developed a high-performance thermal insulator based on silica aerogel, which significantly improves electricity use efficiency in EVs by effectively managing heat.

Stringent Safety and Performance Regulations

Regulatory requirements in Japan are pushing automakers to adopt materials that enhance vehicle safety, durability, and performance. Advanced metals and composites are increasingly used in structural components, crash zones, and reinforcement areas to meet crashworthiness standards. This regulatory emphasis encourages innovation in high-strength steel, aluminum, and hybrid composites, driving investments in research and development. Manufacturers are focusing on materials that simultaneously reduce weight, improve mechanical properties, and ensure compliance with environmental and safety norms, fueling sustained market growth.

Key Trends & Opportunities

Integration of Smart and Functional Materials

Automakers are increasingly incorporating smart and functional materials, such as self-healing composites and high-performance polymers, to improve vehicle durability and functionality. These materials enhance corrosion resistance, thermal management, and impact resistance, creating opportunities for innovation in high-end passenger vehicles and EVs. The integration of advanced coatings, lightweight composites, and multifunctional materials supports superior performance, aesthetic appeal, and energy efficiency. Growing R&D investments and partnerships are further expanding market potential.

- For instance, companies like BASF have developed specialized coating systems that better adhere to lightweight materials like aluminum alloys and composites, supporting corrosion resistance and energy efficiency in next-generation vehicles.

Expansion of Electric Vehicle Infrastructure

The rapid expansion of EV infrastructure in Japan is creating significant opportunities for advanced automotive materials. As automakers focus on producing electric and hybrid vehicles at scale, demand for lightweight metals, composites, and high-performance plastics increases. Advanced materials are required for battery enclosures, thermal management systems, and structural components to ensure safety, durability, and efficiency. The ongoing transition to sustainable mobility, supported by government policies and incentives, is fostering innovation and adoption.

- For instance, companies such as Hitachi are developing smaller, lighter charging stations, which facilitate larger deployment and reduce infrastructure costs, illustrating how technological advancements in materials and design are underpinning Japan’s strategic push for sustainable mobility.

Key Challenges

High Production Costs of Advanced Materials

The adoption of advanced automotive materials is often constrained by high production and processing costs. Metals such as aluminum alloys and high-strength steels, as well as engineered composites, require specialized manufacturing processes and precision handling, which increase expenses. Small and mid-sized manufacturers may face budgetary constraints, limiting large-scale adoption. Cost pressures can also affect vehicle pricing and consumer demand. Managing production efficiency while maintaining quality and performance remains a critical challenge.

Technical Complexity and Integration Issues

Integrating advanced materials into automotive designs involves significant technical complexity. Differences in material properties, thermal expansion, and mechanical behavior can lead to challenges in joining metals, plastics, and composites. Additionally, design adjustments and specialized tooling are often required, increasing development time and costs. Ensuring consistent quality, performance, and safety across diverse vehicle models adds further complexity, requiring manufacturers to invest in skilled workforce, R&D, and process optimization.

Regional Analysis

Kanto

The Kanto region dominates the Japan Advanced Automotive Materials Market, holding a market share of 32%. The region benefits from a dense concentration of automotive manufacturing hubs, advanced research facilities, and established supply chains. Demand for lightweight metals, composites, and high-performance plastics is strong, driven by passenger car production and electric vehicle adoption. Automotive manufacturers in Kanto are investing heavily in advanced materials to meet fuel efficiency standards and safety regulations. The region’s infrastructure, skilled workforce, and focus on technological innovation make it a key driver for growth in the advanced automotive materials sector.

Kansai

The Kansai region holds a market share of 21%, supported by its established industrial base and presence of major automotive suppliers. The growth of advanced automotive materials in Kansai is fueled by increasing demand for high-strength metals and lightweight composites in both passenger cars and commercial vehicles. Local manufacturers are emphasizing material innovation to enhance vehicle performance and reduce environmental impact. The region’s focus on research and development, coupled with government incentives for sustainable mobility, is encouraging the adoption of advanced plastics and ceramics, making Kansai a significant contributor to Japan’s overall market growth.

Chubu

The Chubu region contributes a market share of 19%, driven by its strategic position as a manufacturing hub for automotive components. The region has a high concentration of automotive component producers, creating strong demand for metals, composites, and advanced plastics. Manufacturers are adopting lightweight and durable materials to improve vehicle fuel efficiency, safety, and performance. The growth of electric and hybrid vehicles in the region further accelerates material adoption. Chubu’s focus on industrial automation, advanced manufacturing techniques, and collaboration with research institutions positions it as a critical region for the expansion of the advanced automotive materials market.

Tohoku

The Tohoku region accounts for a market share of 12%, with growth driven by increasing investments in automotive component manufacturing and material innovation. The region focuses on producing lightweight metals, composites, and high-performance plastics for structural and interior applications. The presence of specialized suppliers and research centers supports the development of advanced materials for both passenger and commercial vehicles. Government initiatives promoting sustainable mobility and energy efficiency are further boosting material adoption. Tohoku’s relatively lower operational costs compared to other regions make it an attractive location for manufacturers seeking efficiency while contributing to the nationwide growth of the advanced automotive materials market.

Kyushu

The Kyushu region holds a market share of 16%, supported by its growing automotive industry and strong infrastructure for advanced material production. Demand in Kyushu is primarily driven by lightweight metals, composites, and plastics used in passenger cars and commercial vehicles. The region’s manufacturers are focusing on reducing vehicle weight, improving fuel efficiency, and complying with environmental regulations. Investments in R&D and partnerships with technology providers are enhancing the adoption of innovative materials. Kyushu’s strategic location and skilled workforce position it as a vital region contributing to the overall growth of Japan’s advanced automotive materials market.

Market Segmentations:

By Material

- Metals

- Plastics

- Composites

- Ceramics

By Application

- Structural Components

- Body Panels

- Interior Components

- Electrical Components

By End-Use Vehicles

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

By Region

- Kanto

- Kansai

- Chubbu

- Kyushu

- Tohoku

Competitive Landscape

The competitive landscape of the Japan Advanced Automotive Materials Market features key players such as Iwatani, Toray Industries, UACJ Corporation, Advanced Material Japan Corporation, Kureha, Kobe Steel Ltd, Mitsubishi Chemical Corporation, ArcelorMittal, and Sankyo Tateyama, Inc. These companies are driving market growth through strategic initiatives, including product innovation, partnerships, and capacity expansion. They are focusing on developing lightweight metals, high-performance composites, and advanced plastics to meet the increasing demand for fuel-efficient and safer vehicles. Continuous investment in R&D allows these players to introduce technologically superior materials for structural, body, and electrical components. Additionally, collaborations with automakers and suppliers help streamline the adoption of advanced materials across passenger cars, commercial vehicles, and two-wheelers. Strong brand presence, technological expertise, and proactive growth strategies are enabling these companies to maintain a competitive edge while addressing evolving industry trends and regulatory requirements in Japan.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Iwatani

- Toray Industries, Inc.

- UACJ Corporation

- Advanced Material Japan Corporation

- Kureha

- Kobe Steel Ltd

- Mitsubishi Chemical Corporation

- ArcelorMittal

- Sankyo Tateyama, Inc

- Other Key Players

Recent Developments

- In October 8, 2025, Toyota Motor Corporation partnered with Sumitomo Metal Mining Co., Ltd. to jointly develop and produce cathode materials for all-solid-state batteries (SSBs) for electric vehicles.

- In October 24, 2025, Mazda Motor Corporation and Nippon Steel Corporation expanded their partnership to develop a lighter, stronger body structure for the All-New MAZDA CX-5.

- In September 24, 2025, Resonac Corporation transferred its automotive molded parts business in Japan and Thailand through an absorption-type company split and share transfer.

- In February 3, 2025, Dai Nippon Printing Co., Ltd. (DNP) acquired all shares of HK Holding Co., Ltd., which operates HIKARI METAL INDUSTRY CO., LTD. This acquisition enhances DNP’s capabilities in producing decorative molded parts for automobiles and industrial equipment, supporting the industry’s shift toward lightweight and sustainable materials.

Report Coverage

The research report offers an in-depth analysis based on Material, Application, End Use Vehicle and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily driven by increasing demand for lightweight and fuel-efficient vehicles.

- Adoption of electric and hybrid vehicles will accelerate the need for advanced metals, plastics, and composites.

- High-strength steel and aluminum alloys will remain dominant in structural and safety-critical components.

- Composites and high-performance plastics will see increased use in body panels and interior applications.

- Integration of smart and multifunctional materials will create new opportunities for innovation.

- Expansion of EV infrastructure will boost demand for materials used in battery enclosures and thermal management.

- Government regulations on emissions and safety will continue to influence material selection and adoption.

- Collaboration between automakers and material suppliers will drive R&D and faster market adoption.

- Lightweight solutions will be prioritized to improve vehicle performance and energy efficiency.

- Continuous technological advancements will enhance material performance, durability, and cost-effectiveness.