Market Overview

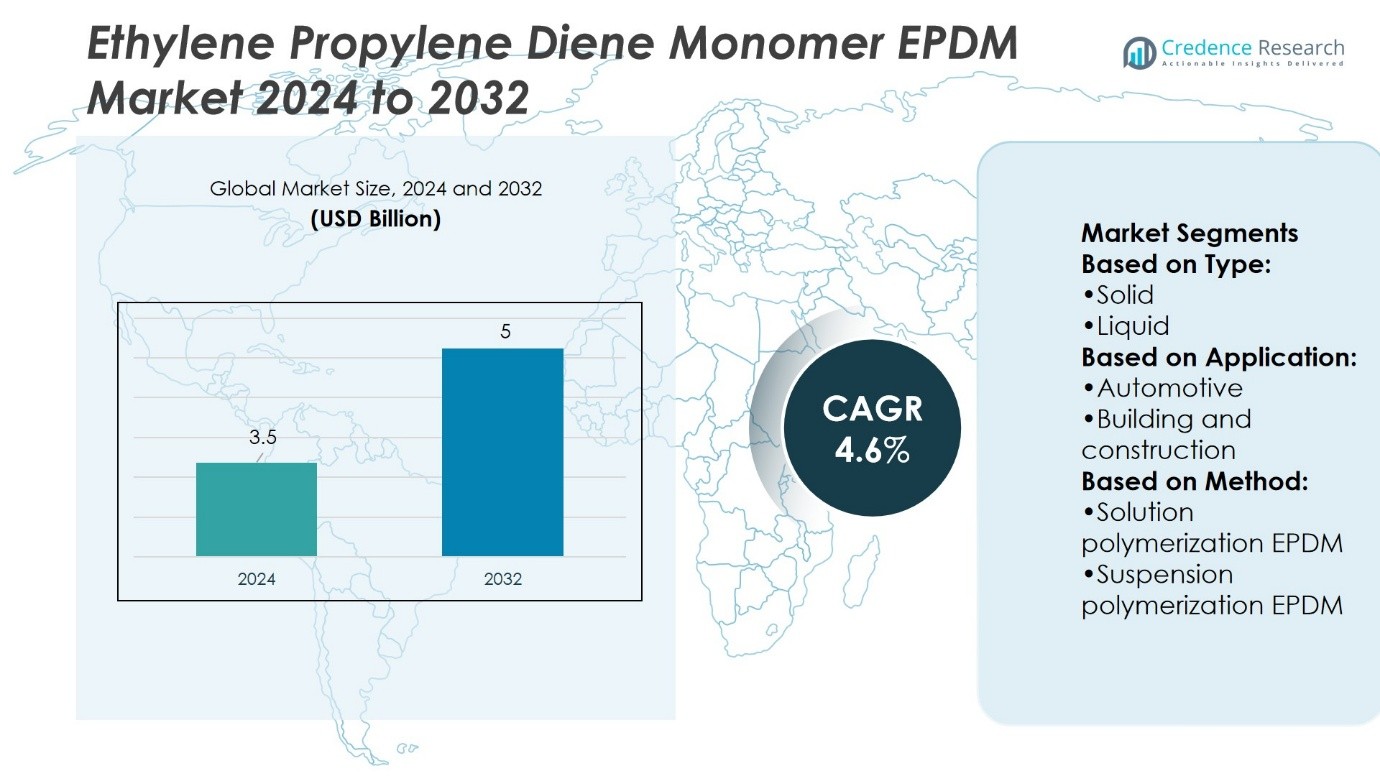

Ethylene Propylene Diene Monomer (EPDM) Market size was valued at USD 3.5 billion in 2024 and is anticipated to reach USD 5 billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ethylene Propylene Diene Monomer (EPDM) Market Size 2024 |

USD 3.5 Billion |

| Ethylene Propylene Diene Monomer (EPDM) Market , CAGR |

4.6% |

| Ethylene Propylene Diene Monomer (EPDM) Market Size 2032 |

USD 5 Billion |

The Ethylene Propylene Diene Monomer (EPDM) Market grows with strong demand from automotive, construction, and industrial sectors. It supports vehicle durability through heat- and ozone-resistant sealing systems and extends building lifespans with long-lasting roofing membranes. Rising investments in electric vehicles create opportunities for EPDM use in battery pack insulation and thermal management. Green construction initiatives strengthen adoption of recyclable and eco-friendly formulations. Innovation in polymerization methods enhances product consistency and performance. Industrial expansion in emerging economies fuels wider applications in hoses, gaskets, and molded goods. Sustainability and durability trends ensure continuous growth across global end-use industries.

North America holds a strong share of the Ethylene Propylene Diene Monomer EPDM Market driven by automotive and construction demand, while Europe advances with sustainability-focused applications in roofing and industrial systems. Asia-Pacific leads growth through rapid industrialization, infrastructure expansion, and rising EV production. Latin America and Middle East & Africa show steady adoption supported by construction and energy projects. Key players shaping the market include Exxon Mobil Corporation, ARLANXEO, Mitsui Chemicals, Lion Elastomers, and KUMHO POLYCHEM.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Ethylene Propylene Diene Monomer EPDM Market size was valued at USD 3.5 billion in 2024 and is expected to reach USD 5 billion by 2032, at a CAGR of 4.6%.

- Demand is driven by automotive, construction, and industrial sectors seeking durable sealing and insulation solutions.

- Market trends highlight adoption in electric vehicles, roofing membranes, and recyclable eco-friendly formulations.

- Competition remains strong with leading producers focusing on innovation, polymerization methods, and sustainability-driven product development.

- Restraints include raw material price volatility and growing substitution threats from thermoplastic elastomers.

- North America and Europe show steady demand, while Asia-Pacific leads growth supported by industrialization and EV expansion.

- Latin America and Middle East & Africa contribute with construction, energy, and infrastructure projects reinforcing market stability.

Market Drivers

Growing Demand in Automotive Sealing Systems and Components

The Ethylene Propylene Diene Monomer EPDM Market grows with rising demand for advanced automotive sealing systems. Automakers rely on EPDM for weatherstrips, hoses, and gaskets due to its superior resistance to heat, ozone, and weathering. It enhances vehicle durability while supporting weight reduction strategies in lightweight designs. Strong growth in electric vehicles further expands opportunities for EPDM applications in high-performance insulation and cooling systems. Its ability to withstand temperatures up to 150°C supports long service life. Stringent safety and efficiency standards reinforce demand across global automotive production.

- For instance, Lion Elastomers supplies Royaltherm® 1411A, a silicone-modified EPDM elastomer with a Shore A hardness of 30–40 after curing. Royaltherm is utilized in automotive applications, such as under-hood hose insulation, due to its enhanced resistance to heat and ozone compared to standard EPDM.

Expansion in Construction and Roofing Applications

Construction activities across commercial and residential sectors drive steady use of EPDM in roofing and waterproofing solutions. The material’s durability and low maintenance requirements make it an attractive choice for sustainable building projects. It delivers flexibility and maintains performance under extreme weather cycles, including freezing and high solar radiation. Adoption strengthens through energy-efficient roofing systems that extend lifespans beyond 30 years. Increasing investments in urban infrastructure projects further boost consumption. The emphasis on long-lasting and eco-friendly materials positions EPDM strongly within modern construction practices.

- For instance, Kumho Polychem boosted EPDM production to 310,000 MT per year with its 2024 plant expansion using ultralow‑temperature polymerization, enhancing its ability to supply roofing membranes with long lifespans.

Rising Adoption in Industrial and Mechanical Applications

The industrial sector demonstrates strong uptake of EPDM for hoses, conveyor belts, and seals. Its resistance to water, acids, and alkalis ensures reliable performance across diverse operating conditions. EPDM supports machinery efficiency and reduces downtime in demanding environments such as chemical plants and power generation. It withstands repeated compression without cracking, enhancing safety and longevity in sealing systems. Industrial expansion in emerging economies contributes to wider use of the material. Continuous replacement of outdated materials with EPDM reinforces its role in critical operations.

Increased Focus on Sustainability and Eco-Friendly Materials

Sustainability trends strengthen EPDM adoption in industries aiming to lower environmental impact. It is recyclable and compatible with eco-friendly manufacturing practices, aligning with stricter environmental regulations. Green building initiatives support wider use of EPDM membranes in energy-efficient designs. In the automotive sector, it reduces reliance on non-durable polymers by extending part lifespans. Research advances highlight bio-based formulations, further positioning EPDM as a future-ready solution. Rising awareness of eco-compliance reinforces its adoption in both developed and developing regions.

Market Trends

Increasing Use in Energy-Efficient Building and Roofing Solutions

The Ethylene Propylene Diene Monomer EPDM Market shows a clear trend toward energy-efficient building practices. EPDM membranes are widely adopted in cool roofing systems designed to reduce urban heat effects. It provides long-term weather resistance, making it ideal for large commercial structures and sustainable housing projects. Demand strengthens in regions implementing green building codes and energy efficiency mandates. Adoption of prefabricated EPDM sheets supports faster installation while minimizing labor costs. This focus on durability and efficiency enhances its importance in construction markets.

- For instance, ExxonMobil’s Vistalon™ 9301 EPDM, a rubber compound well-suited for sheeting goods like roofing membranes, features a Shore A hardness of 65 in a typical roofing formulation. Known for its weather resistance, it can be processed efficiently for high-speed extrusion.

Advancements in Automotive Lightweighting and Electrification

Automotive trends emphasize lighter materials and reliable thermal performance, boosting demand for EPDM components. It supports efficient sealing in battery systems and charging infrastructure within electric vehicles. EPDM’s flexibility at temperatures as low as -40°C secures consistent performance in harsh conditions. Automakers increasingly select EPDM for lightweight designs that extend driving range. Its durability reduces replacement frequency, aligning with cost and sustainability goals. Growth in global EV production reinforces long-term prospects for EPDM in transportation.

- For instance, ARLANXEO’s high‑Mooney EPDM grade Keltan 13951C DE features a Mooney viscosity of 92 MU (measured at 150 °C with ML (1+8)) and contains 44 wt % ethylene and 9 wt % ENB diene units, which are specifications used to determine processing.

Rising Demand in Renewable Energy and Industrial Expansion

EPDM demonstrates growing relevance in renewable energy applications, including sealing solutions for wind turbines and solar panels. It provides resistance against UV radiation and ozone, critical for outdoor equipment reliability. Industrial facilities adopt EPDM for hoses and gaskets exposed to aggressive chemicals. It supports operations in sectors requiring robust materials for high-stress environments. Emerging economies with expanding manufacturing bases contribute to wider adoption. This shift highlights EPDM’s adaptability across industrial and renewable energy domains.

Innovation in Bio-Based and Sustainable Formulations

Innovation trends show strong focus on bio-based EPDM to reduce dependence on petrochemicals. Research advances lead to formulations that maintain performance while lowering carbon impact. It strengthens adoption among manufacturers seeking compliance with international sustainability frameworks. Interest in closed-loop recycling initiatives is expanding within the polymer industry. Companies invest in new production technologies that improve efficiency and reduce emissions. These sustainability-driven innovations position EPDM as a material aligned with long-term environmental goals.

Market Challenges Analysis

Volatility in Raw Material Supply and Pricing Pressure

The Ethylene Propylene Diene Monomer EPDM Market faces challenges from fluctuations in raw material availability. EPDM production depends heavily on petroleum-based feedstocks, making it vulnerable to crude oil supply disruptions. It also contends with global trade uncertainties that impact the cost of ethylene, propylene, and diene. Price volatility often creates unpredictability for manufacturers and limits long-term planning. High energy costs in production further add to margin pressures. These conditions make supply chain management a critical concern for producers and end users.

Environmental Regulations and Substitution Threats

Stringent environmental regulations create barriers for EPDM manufacturers across global markets. Compliance with emission standards and disposal requirements often demands costly process upgrades. It faces growing competition from thermoplastic elastomers that provide recyclability and lower environmental impact. Shifts in customer preferences toward sustainable materials intensify this substitution risk. Limited awareness in developing markets also restricts the pace of adoption. Addressing regulatory compliance while competing with alternative materials remains a persistent challenge for the industry.

Market Opportunities

Expanding Role in Sustainable Construction and Green Infrastructure

The Ethylene Propylene Diene Monomer EPDM Market holds strong opportunities in sustainable building applications. EPDM membranes provide long-lasting waterproofing in energy-efficient roofing systems and green infrastructure projects. It supports reduced maintenance and extended service life, aligning with eco-friendly construction standards. Growing investment in smart cities creates demand for durable roofing and sealing materials. EPDM’s recyclability enhances its appeal in regions adopting circular economy principles. Rising focus on energy conservation reinforces its position as a preferred construction material.

Growing Use in Electric Vehicles and Renewable Energy Systems

Global electrification trends create new growth prospects for EPDM in automotive and energy sectors. It ensures performance in battery pack sealing, charging infrastructure, and thermal management systems. Its low-temperature flexibility and high heat resistance strengthen adoption in electric mobility solutions. Renewable energy projects also require EPDM for sealing wind turbines, solar panel frames, and protective cabling. Rising investments in EV production and clean energy expansion support wider use of EPDM. These opportunities highlight its relevance in next-generation transportation and power infrastructure.

Market Segmentation Analysis:

By Type

The Ethylene Propylene Diene Monomer EPDM Market is segmented into solid, liquid, and granules. Solid EPDM dominates use across sealing, roofing, and industrial components due to durability and flexibility. It supports large-scale applications requiring long service life under extreme weather. Liquid EPDM finds opportunities in coatings, adhesives, and waterproof membranes where direct application provides faster installation. Granules are increasingly adopted in flooring, playgrounds, and sports surfaces due to impact resistance and safety. The variation in types ensures tailored solutions across automotive, construction, and specialty industries.

- For instance, Elevate’s RubberGard EPDM single-ply membranes come in multiple thickness options: the internally‐reinforced MAX series is available in 45 mil (1.1 mm), 60 mil (1.5 mm), or 75 mil (1.9 mm) thicknesses.

By Application

EPDM serves critical roles in automotive, building and construction, molded goods, lubricant additives, and other industrial uses. Automotive applications lead with extensive demand for hoses, seals, and weatherstrips, where it provides ozone and heat resistance. Building and construction rely on EPDM membranes for roofing, window gaskets, and insulation that perform across decades of exposure. Molded goods such as gaskets, O-rings, and belts reinforce its importance in heavy machinery and consumer products. Lubricant additives use EPDM for viscosity improvement and stability in mechanical systems. It continues to expand in diverse industrial uses such as cable insulation and water systems.

- For instance, Sumitomo Chemical offers its Esprene 670F EPDM grade, which has a Mooney viscosity of 165 (ML 1+4 at 125 °C) and contains 66 wt% ethylene and 4.0 wt% diene. This high-viscosity grade is suitable for manufacturing high specific-gravity EPDM compositions used in various automotive and industrial molded products.

By Method

The market is also segmented by solution polymerization, suspension polymerization, and gas-phase polymerization EPDM. Solution polymerization remains widely adopted due to its ability to produce high-performance grades with uniform molecular distribution. It supports applications where precise properties are required, including automotive seals and roofing systems. Suspension polymerization offers cost-effective production and flexibility for multiple end uses. Gas-phase polymerization demonstrates efficiency in large-scale operations while reducing process complexity. It creates opportunities for tailored molecular structures that align with specialized applications. Advances in these methods ensure consistent quality and innovation across industries adopting EPDM.

Segments:

Based on Type:

Based on Application:

- Automotive

- Building and construction

Based on Method:

- Solution polymerization EPDM

- Suspension polymerization EPDM

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for around 29% share of the Ethylene Propylene Diene Monomer EPDM Market. The region benefits from a mature automotive industry, with significant EPDM use in sealing systems, hoses, and weatherstrips. It also holds strong demand from the construction sector, where EPDM roofing membranes dominate sustainable and energy-efficient building designs. Investments in electric vehicles and charging infrastructure further support wider adoption. The United States leads the regional market with high production capabilities and a strong presence of multinational manufacturers. Canada contributes with demand from infrastructure and industrial projects that emphasize long-term material performance. Regulatory support for energy-efficient construction secures steady opportunities for EPDM expansion.

Europe

Europe holds a 27% share of the Ethylene Propylene Diene Monomer EPDM Market. The region shows strong growth through construction projects, automotive production, and renewable energy expansion. EPDM is widely used in roofing systems across Germany, the UK, and France, where strict environmental codes demand durable and recyclable materials. Automotive producers in Germany and Italy drive consistent demand for high-performance sealing applications. Europe also supports research into bio-based EPDM, aligning with sustainability goals and carbon reduction policies. The presence of large-scale producers ensures local supply and innovation in specialty EPDM grades. Market adoption is reinforced by government policies promoting green infrastructure and recycling initiatives.

Asia-Pacific

Asia-Pacific contributes the largest share at 32% of the Ethylene Propylene Diene Monomer EPDM Market. The region is supported by rapid industrialization, infrastructure development, and automotive expansion. China and India lead with strong demand for EPDM membranes in roofing and water systems used in smart city projects. Japan and South Korea drive innovation in automotive EPDM applications, particularly in electric vehicles. Construction growth across Southeast Asia creates further opportunities for roofing and insulation products. Availability of cost-effective manufacturing strengthens the regional supply chain, making Asia-Pacific a hub for exports. Government initiatives focused on renewable energy also boost EPDM demand in turbine and solar equipment applications.

Latin America

Latin America holds about 7% share of the Ethylene Propylene Diene Monomer EPDM Market. The region demonstrates growing adoption in construction projects, particularly in commercial roofing and insulation systems. Brazil and Mexico lead demand with strong automotive production and industrial activities. EPDM is increasingly applied in sealing systems for oil and gas operations, where durability under harsh conditions is required. Urban development programs expand opportunities for waterproofing and roofing materials. The region also benefits from gradual adoption of energy-efficient building standards. Limited local production capacity creates reliance on imports, though demand remains steady across diverse end-use sectors.

Middle East & Africa

The Middle East & Africa represent a 5% share of the Ethylene Propylene Diene Monomer EPDM Market. Infrastructure expansion, oil and gas projects, and industrial investments shape regional consumption. EPDM materials are adopted for sealing systems in pipelines, refineries, and construction under extreme heat conditions. The UAE and Saudi Arabia drive demand through large-scale infrastructure and smart city projects. South Africa contributes with adoption in automotive components and commercial roofing. Growing awareness of sustainable building practices supports wider use of EPDM boards and membranes. Although the region remains smaller compared to others, long-term opportunities are tied to ongoing industrialization and energy diversification strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lion Elastomers

- KUMHO POLYCHEM

- Exxon Mobil Corporation

- PetroChina Company Limited

- ARLANXEO

- Mitsui Chemicals, Inc.

- Elevate (HOLCIM)

- Rubber Engineering & Development Company (REDCO)

- Sumitomo Chemical Co., Ltd.

- Johns Manville

Competitive Analysis

The Ethylene Propylene Diene Monomer EPDM Market include Lion Elastomers, KUMHO POLYCHEM, Exxon Mobil Corporation, PetroChina Company Limited, ARLANXEO, Mitsui Chemicals, Inc., Elevate (HOLCIM), Rubber Engineering & Development Company (REDCO), Sumitomo Chemical Co., Ltd., and Johns Manville. The Ethylene Propylene Diene Monomer EPDM Market is defined by strong competition across global and regional manufacturers. Companies focus on expanding production capacity and developing high-performance grades tailored to automotive, construction, and industrial applications. Innovation plays a central role, with research emphasizing improved resistance to heat, ozone, and environmental stressors. Producers invest in bio-based and recyclable formulations to align with sustainability goals and meet tightening environmental regulations. Roofing membranes, automotive seals, and molded components remain priority segments, driving specialized product development and differentiation. Competitive advantage often depends on the ability to maintain reliable supply chains, manage raw material volatility, and deliver cost-effective solutions without compromising quality. Many producers strengthen their positions through partnerships, licensing agreements, and localized production strategies that reduce logistical challenges. The market also sees rising interest in advanced polymerization methods, ensuring flexibility in molecular design and consistency in performance.

Recent Developments

- In August 2025, ARLANXEO launched ISCC PLUS-certified Keltan Eco-B and Eco-BC grades in India, offering bio-based EPDM alternatives with identical performance to conventional rubbers.

- In May 2024, KRAIBURG TPE launched newly developed EPDM adhesion compounds, primarily designed for automotive sealing applications. Equipped with a formulation suitable for exterior automotive parts, UV resistance capabilities, and other key features, this portfolio is expected to strengthen KRAIBURG TPE’s market position in the automotive sealing and adhesion sector.

- In February 2024, Emulco NV collaborated with Lion Elastomers, liquid-EPDM (L-EPDM) polymers, and Ethylene Propylene Diene Monomer (EPDM) rubber provider. Two have signed a supply contract linked with the use of Trilene 65 L-EPDM, a component for Emulco’s water-based EPDM dispersion product.

- In November 2023, Borealis AG closed a deal to acquire Rialti, a recycled polypropylene compound producer, to boost its portfolio of PP compounds based on mechanical recyclates by 50,000 tons annually.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Method and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for EPDM will expand with growth in electric vehicles and charging infrastructure.

- Roofing and waterproofing applications will remain central in sustainable construction projects.

- Bio-based EPDM grades will gain traction under stricter environmental regulations.

- Industrial growth in Asia-Pacific will drive higher adoption across multiple applications.

- Advanced polymerization methods will support production of consistent and high-performance grades.

- Recycling initiatives will shape product development and strengthen eco-friendly positioning.

- Renewable energy projects will increase use of EPDM in wind and solar equipment.

- Automotive lightweighting trends will boost demand for durable and flexible sealing systems.

- Regional players will focus on localized supply to reduce logistics and cost challenges.

- Research investments will create innovative formulations for niche industrial and aerospace uses.