Market Overview

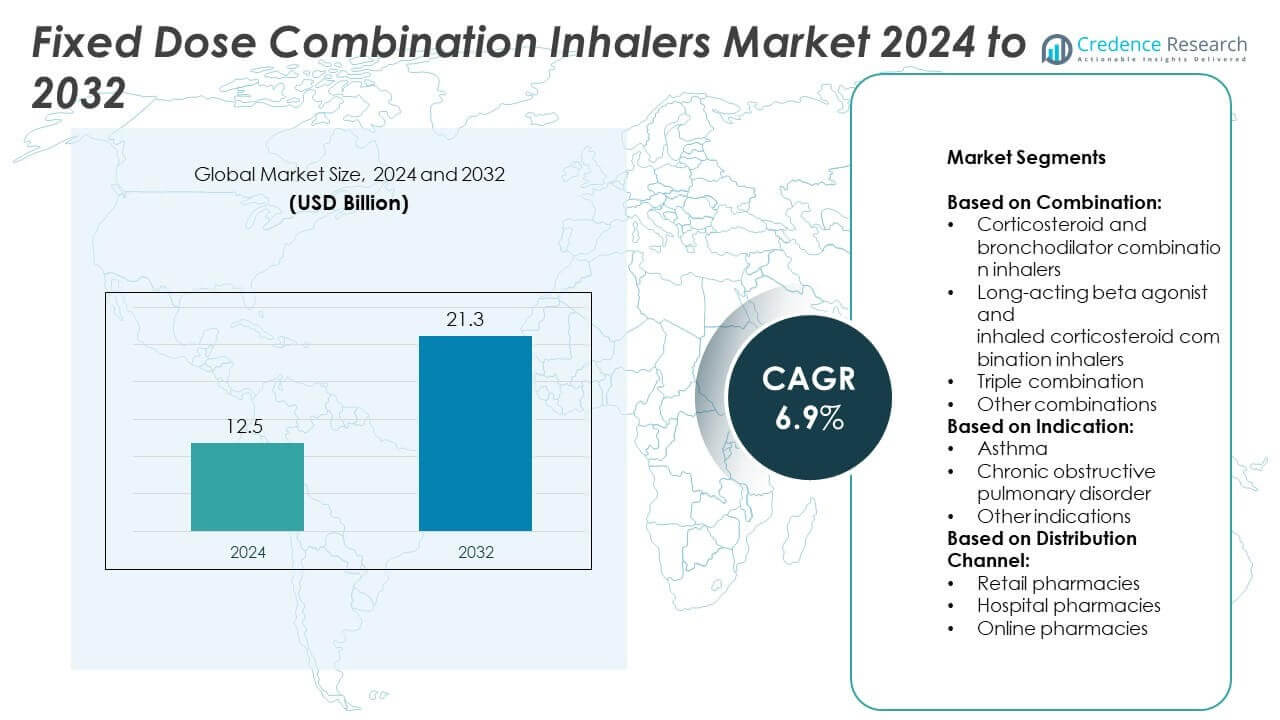

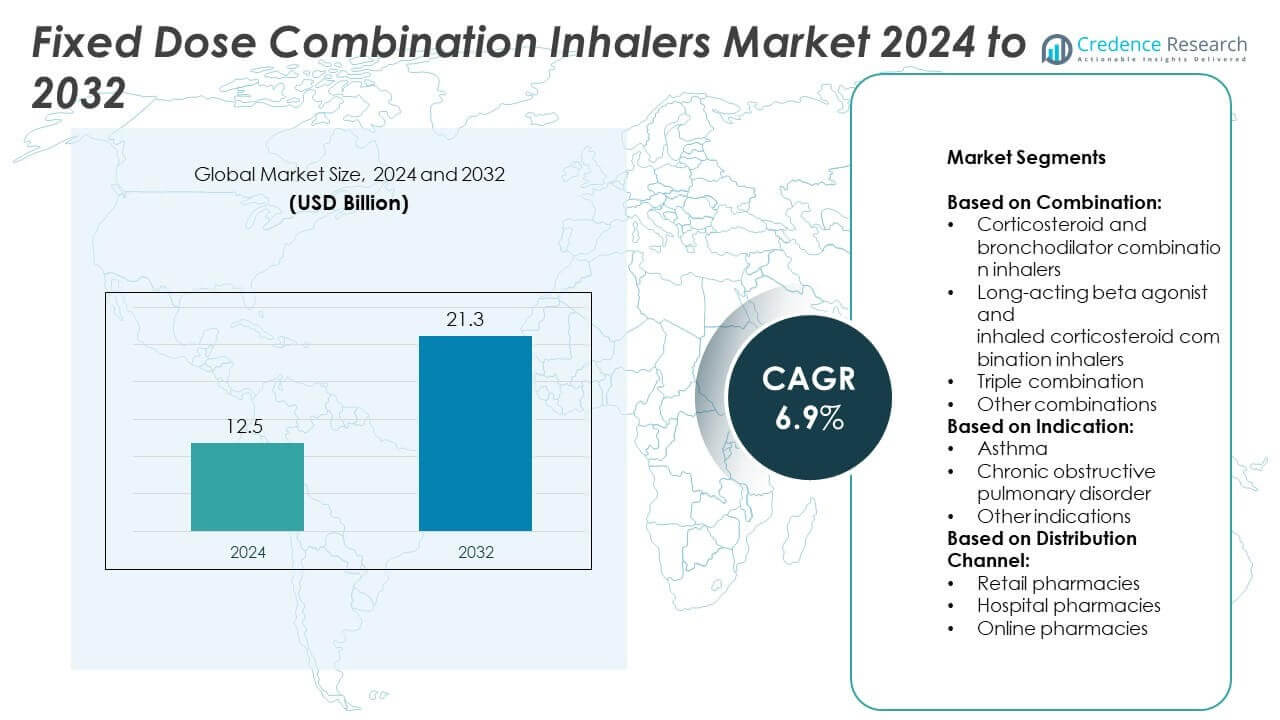

Fixed Dose Combination Inhalers Market size was valued at USD 12.5 billion in 2024 and is anticipated to reach USD 21.3 billion by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fixed Dose Combination Inhalers Market Size 2024 |

USD 12.5 Billion |

| Fixed Dose Combination Inhalers Market, CAGR |

6.9% |

| Fixed Dose Combination Inhalers Market Size 2032 |

USD 21.3 Billion |

The Fixed Dose Combination Inhalers market grows with rising asthma and COPD cases, increasing demand for simplified therapies, and the shift toward home-based chronic care. Triple drug combinations and smart inhalers enhance treatment outcomes and adherence. Regulatory support and clinical guidelines promote fixed dose use across moderate to severe cases. Sustainability trends influence inhaler design, driving low-emission propellant adoption. Generic availability in emerging markets expands access and affordability, reinforcing the market’s role in long-term respiratory disease management.

North America leads the Fixed Dose Combination Inhalers market due to high diagnosis rates and advanced healthcare systems. Europe follows with strong clinical adoption and regulatory backing for fixed dose therapies. Asia-Pacific shows fast growth driven by increasing respiratory disease awareness and expanding access to generics. Latin America and the Middle East & Africa show steady demand through public health initiatives. Key players active across these regions include AstraZeneca, Cipla, GSK, and Chiesi Farmaceutici.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fixed Dose Combination Inhalers market was valued at USD 12.5 billion in 2024 and is projected to reach USD 21.3 billion by 2032, growing at a CAGR of 6.9%.

- Rising asthma and COPD cases, along with aging populations, drive consistent demand for long-term combination therapies.

- Triple combination inhalers and digital smart devices are emerging trends enhancing treatment outcomes and adherence.

- Key players like AstraZeneca, Cipla, GSK, Chiesi Farmaceutici, and Teva maintain strong positions through product innovation and global outreach.

- High development costs, complex regulatory processes, and device misuse remain challenges limiting product accessibility and treatment efficacy.

- North America leads the market with strong clinical infrastructure, while Asia-Pacific shows the fastest growth driven by generics and healthcare access.

- Sustainability in inhaler design, expansion into rural areas, and growing public health investments offer long-term growth opportunities.

Market Drivers

Rising Prevalence of Chronic Respiratory Diseases Across Aging and Urban Populations

Fixed Dose Combination Inhalers market benefits from increasing cases of asthma and COPD worldwide. The aging global population faces higher respiratory disease risk, requiring long-term inhalation therapies. Urban air pollution, indoor allergens, and industrial exposure worsen lung function, boosting inhaler prescriptions. Healthcare systems support early detection and long-term disease control, promoting combination therapy use. These inhalers simplify daily regimens and improve adherence, making them suitable for elderly and high-risk patients. It aligns with the shift toward preventive care and chronic condition management. Physicians increasingly adopt fixed dose combinations to reduce exacerbation frequency and hospital visits.

- For instance, GSK’s reported turnover for the full year 2020 was £34.1 billion. Following the spin-off of its Consumer Healthcare business (Haleon) in July 2022, GSK’s reported turnover for 2023 was £30.3 billion. Breo Ellipta (fluticasone furoate/vilanterol) is approved for the long-term maintenance treatment of chronic obstructive pulmonary disease (COPD) and for the treatment of asthma in adults aged 18 years and older. It is not indicated for the relief of acute bronchospasm.

Therapeutic Convenience and Adherence Boost Through Multi-Drug Single-Device Delivery

The market grows with rising demand for therapeutic convenience and simplified treatment. Fixed dose combination inhalers integrate two or three active drugs into one device, reducing patient error. Treatment compliance improves due to fewer doses and reduced confusion in multi-step regimens. It becomes vital for COPD and asthma patients managing multiple comorbidities. Healthcare providers favor these inhalers to improve outcomes and reduce healthcare burden. Guidelines from medical associations also support use in moderate to severe cases. Market adoption strengthens due to rising awareness among physicians and pharmacists.

- For instance, globally in 2021, AstraZeneca reported total revenue of $37.4 billion, which included significant sales from its Respiratory & Immunology portfolio (featuring Symbicort), Rare Disease products following the Alexion acquisition in July 2021, and its COVID-19 vaccine.

Favorable Regulatory Support and Clinical Guidelines Promote Fixed Combination Use

The Fixed Dose Combination Inhalers market gains traction from supportive regulatory and clinical frameworks. Global health bodies, including GOLD and GINA, recommend combination therapies for advanced-stage patients. Many fixed dose formulations receive fast-track approvals due to their role in improving population health. It allows pharmaceutical firms to launch new combinations quickly across regions. Insurance reimbursement also favors these combinations in chronic respiratory treatment plans. Countries with universal healthcare systems incorporate such therapies in public formularies. Policymaker support continues to drive sustained product uptake.

Inhalation Device Innovations Enhance Efficacy and Expand Patient Access Globally

Technology advancements in inhalation devices expand market potential and user confidence. Smart inhalers, breath-actuated mechanisms, and dose counters improve drug delivery accuracy. It ensures correct dose administration and improves patient engagement. Digital tracking features support remote monitoring and adherence tracking in chronic care models. These innovations lower error rates and allow data-based therapy adjustments. Manufacturers invest in developing cost-effective and portable devices for emerging markets. Device reliability and ease-of-use remain central to expanding combination therapy use.

Market Trends

Rising Shift Toward Triple Combination Therapies in Moderate to Severe COPD Cases

Fixed Dose Combination Inhalers market experiences a growing shift toward triple therapy inhalers. These formulations combine corticosteroids, long-acting beta agonists, and muscarinic antagonists. It supports more effective disease control in patients unresponsive to dual therapy. Clinical evidence shows reduced exacerbations and improved lung function with triple drug regimens. Pharmaceutical firms focus on expanding triple therapy product lines for broader COPD segments. Guidelines from GOLD further accelerate their adoption across hospital and retail channels. This trend reflects increasing personalization in respiratory care.

- For instance, In Europe, Trimbow was approved for COPD in 2017 and for asthma in 2021. Chiesi reported a total group turnover of €2.42 billion in 2021, driven by strong growth in its respiratory portfolio.

Digital Health Integration with Inhalers to Improve Monitoring and Treatment Outcomes

Smart inhalers integrated with digital platforms emerge as a major trend. These devices feature dose counters, adherence trackers, and Bluetooth connectivity for real-time data sharing. It allows healthcare providers to monitor patient compliance remotely and adjust treatment plans. The trend aligns with telemedicine expansion and chronic care management models. Companies invest in partnerships with digital health firms to develop app-based tracking tools. Regulatory bodies recognize these tools as supportive elements for therapy optimization. The Fixed Dose Combination Inhalers market leverages this shift to improve disease control standards.

- For instance, Adherium supply devices for an AstraZeneca COPD adherence study, which aimed to enroll almost 400 patients in 2016. Adherium has developed its technology and collaborated with academic partners for over 15 years to demonstrate the effectiveness of its devices.

Growing Focus on Environmentally Friendly Propellants and Sustainable Inhaler Designs

Environmental concerns drive demand for greener inhaler solutions. Manufacturers redesign inhalers using low-global-warming-potential (GWP) propellants to meet emission norms. It supports compliance with climate commitments and future-proven respiratory therapies. Companies also explore dry powder inhaler formats that eliminate gas propellants. The shift responds to regulations targeting hydrofluoroalkane (HFA) propellants in metered dose inhalers. Consumer awareness of environmental impact influences purchasing decisions in developed markets. Sustainability becomes a competitive differentiator in new product development.

Expansion of Fixed Combination Inhalers in Emerging Healthcare Markets Through Generics

Generic versions of fixed combination inhalers expand access in cost-sensitive regions. Patent expiries allow local manufacturers to introduce affordable alternatives. It helps healthcare systems in Latin America, Asia-Pacific, and Africa address unmet needs. Governments support this trend through price caps and public health procurement. Global firms partner with regional producers to localize production and reach underserved populations. The Fixed Dose Combination Inhalers market grows steadily as generics improve availability and lower treatment costs. This supports wider use in public health programs.

Market Challenges Analysis

High Development Costs and Regulatory Complexity Delay New Product Approvals

Fixed Dose Combination Inhalers market faces challenges linked to stringent regulatory frameworks and high R&D expenses. Developing combination therapies requires extensive clinical trials to prove safety and efficacy of each drug in one device. It leads to longer approval timelines and higher upfront investment for pharmaceutical firms. Regulatory agencies often demand comparative studies with monotherapy and dual therapy options. Variability in approval standards across regions complicates global launches and market entry. Smaller firms struggle to compete due to limited financial resources and technical capabilities. These factors slow innovation and limit product diversity in competitive landscapes.

Device Handling Errors and Low Patient Awareness Limit Therapeutic Outcomes

User errors in inhaler handling remain a major barrier in achieving effective disease control. Many patients struggle with correct inhalation technique, especially with complex multi-dose devices. It impacts drug deposition in the lungs and reduces treatment success. Fixed Dose Combination Inhalers market addresses this challenge through patient training and simpler device formats. Low awareness in rural or underdeveloped regions further limits access and adherence. Healthcare systems must invest in education and outreach to improve usage accuracy. Without proper support, even advanced therapies may fail to deliver intended benefits.

Market Opportunities

Expansion of Home-Based Respiratory Care Models Creates Demand for Combination Inhalers

Growth in home-based healthcare opens strong opportunities for inhaler manufacturers. Patients with chronic respiratory diseases prefer treatments that reduce hospital visits and support independent care. Fixed Dose Combination Inhalers market aligns with this trend by offering simplified drug delivery in compact formats. It supports long-term management of COPD and asthma outside clinical settings. Telemedicine and remote patient monitoring enhance the value of these inhalers in decentralized care models. Companies developing user-friendly and digitally connected inhalers gain competitive advantage. This shift accelerates product demand across aging populations and rural settings.

Rising Healthcare Access in Emerging Economies Encourages Market Penetration

Healthcare expansion in Asia-Pacific, Latin America, and parts of Africa offers growth potential for fixed combination therapies. Governments invest in respiratory care infrastructure and widen access to essential medicines. Fixed Dose Combination Inhalers market can tap into these regions by offering low-cost or generic options. It meets rising demand for maintenance therapies driven by urban pollution and smoking-related illness. Strategic collaborations with local manufacturers support affordability and regulatory alignment. International players entering these markets gain first-mover benefits and build brand loyalty. Growing disease awareness and rising diagnosis rates further strengthen long-term demand.

Market Segmentation Analysis:

By Combination:

Corticosteroid and bronchodilator combination inhalers hold a major share due to their use in both asthma and COPD treatment. These formulations reduce airway inflammation and improve airflow, offering effective symptom control. Long-acting beta agonist and inhaled corticosteroid combination inhalers are preferred for patients requiring maintenance therapy with fewer daily doses. Triple combination inhalers gain momentum in moderate to severe COPD patients who do not respond well to dual therapy. It allows more comprehensive treatment by targeting multiple pathways. Other combinations, including newer experimental formulations, remain niche but present scope for clinical innovation. The Fixed Dose Combination Inhalers market grows steadily with increasing adoption of triple and dual combinations.

- For instance, Amazon Pharmacy, which launched in the U.S. in November 2020 after the acquisition of PillPack, continued to expand its services throughout 2021, providing customers with digital access to prescription drugs. Amazon did report overall financial figures for its full-year 2021, with net sales increasing 22% to $469.8 billion.

By Indication:

Asthma dominates the market due to its high global prevalence and the need for long-term control. These inhalers offer convenient daily maintenance therapy that improves adherence in adult and pediatric populations. Chronic obstructive pulmonary disorder follows closely, supported by the growing burden of smoking-related and age-associated respiratory decline. It creates strong demand for both dual and triple therapy options. Other indications such as bronchitis or allergic rhinitis contribute smaller shares but show localized growth. The Fixed Dose Combination Inhalers market supports evolving clinical strategies for chronic respiratory care.

- For instance, Novartis Breezhaler devices, used for managing respiratory diseases, require patients to master a correct inhalation technique to ensure optimal drug delivery. In a 2022 cross-over study involving 114 patients with asthma, 32% of participants required repeated instruction from a healthcare professional after initial guidance to achieve the correct inhalation technique with the Breezhaler.

By Distribution Channel:

Retail pharmacies lead the segment due to high prescription volume and easy product availability. These outlets serve as key access points for patients managing long-term respiratory conditions. Hospital pharmacies play a critical role for newly diagnosed or severe cases, often linked with specialist consultations and discharge planning. Online pharmacies grow rapidly, driven by e-commerce expansion, chronic therapy refill needs, and home delivery preferences. It supports patients seeking convenience and privacy in treatment management. Market participants optimize distribution strategies across all channels to expand reach and improve adherence outcomes.

Segments:

Based on Combination:

- Corticosteroid and bronchodilator combination inhalers

- Long-acting beta agonist and inhaled corticosteroid combination inhalers

- Triple combination

- Other combinations

Based on Indication:

- Asthma

- Chronic obstructive pulmonary disorder

- Other indications

Based on Distribution Channel:

- Retail pharmacies

- Hospital pharmacies

- Online pharmacies

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 38.2% share of the global Fixed Dose Combination Inhalers market in 2024. The region leads due to high awareness of chronic respiratory diseases and early adoption of advanced therapies. The United States drives most of the demand, supported by strong healthcare infrastructure and insurance coverage for long-term inhalation therapies. Physicians prefer combination inhalers to ensure compliance and reduce hospitalizations among aging populations. The market benefits from wide access to branded and generic formulations across both retail and hospital pharmacies. Canada also contributes to regional growth with public health initiatives targeting asthma and COPD management. Ongoing innovation in smart inhalers and triple therapies supports future market expansion.

Europe

Europe held a 27.5% share in the global Fixed Dose Combination Inhalers market in 2024. Countries like Germany, the United Kingdom, and France show strong demand for maintenance therapies in asthma and COPD. Government healthcare systems support use of combination inhalers through reimbursement and formulary inclusion. Medical guidelines from bodies like ERS and NICE encourage adoption of fixed dose therapies to improve patient outcomes. The region sees growing preference for sustainable and environmentally friendly inhaler formats, such as dry powder inhalers. Market participants invest in portfolio diversification to meet regulatory demands and patient preferences. Europe remains a key region for clinical trials and early product launches.

Asia-Pacific

Asia-Pacific captured 21.3% of the market share in 2024, showing the fastest growth across global regions. Rising diagnosis rates of respiratory conditions, air pollution, and smoking contribute to increasing demand. China and India lead regional sales due to population size and expanding healthcare access. Fixed Dose Combination Inhalers market in Asia-Pacific benefits from generics availability and public health campaigns focused on chronic disease management. Companies localize production to reduce cost and improve distribution across rural and semi-urban areas. Regional governments invest in strengthening primary healthcare systems, making maintenance therapies more accessible. Continued urbanization and rising health awareness drive long-term growth.

Latin America

Latin America accounted for 7.8% of the global market share in 2024. Brazil and Mexico represent the largest contributors, supported by national respiratory care programs. The region sees rising adoption of combination inhalers for asthma and COPD management in both private and public healthcare. Local manufacturers introduce generic versions to improve affordability and access. Import reliance decreases as regional production capacity expands. Urban centers witness stronger uptake, while rural areas face access limitations. Partnerships between global and domestic firms help bridge these gaps.

Middle East & Africa

Middle East & Africa held a 5.2% market share in 2024, representing the smallest regional share. The market shows gradual growth driven by rising awareness and improving healthcare infrastructure. South Africa and Gulf countries like Saudi Arabia and UAE contribute significantly due to better respiratory diagnostics and medication access. However, high treatment costs and uneven distribution hinder broader adoption. Government-led procurement and donor-funded programs support therapy access in select areas. Market players focus on training and education to drive patient adherence and physician acceptance. Growth remains steady but limited by economic and logistical barriers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Glenmark Pharmaceuticals

- Chiesi Farmaceutici

- Mylan (Viatris)

- AstraZeneca

- Lupin

- Orion

- Zydus Group

- Cipla

- Hikma Pharmaceuticals

- Vectura Group

- Novartis

- Teva Pharmaceuticals

- GlaxoSmithKline

- Sun Pharmaceutical Industries

- Boehringer Ingelheim

Competitive Analysis

Leading players in the Fixed Dose Combination Inhalers market include AstraZeneca, Chiesi Farmaceutici, Cipla, GSK, Teva Pharmaceuticals, Lupin, Novartis, Boehringer Ingelheim, Sun Pharmaceutical Industries, and Mylan (Viatris). These companies maintain strong positions through diverse product portfolios, regulatory approvals, and global distribution networks. They focus on dual and triple combination therapies targeting both asthma and COPD patients. Innovation in inhalation technology, such as breath-actuated devices and dose counters, enhances patient adherence and product differentiation. Large firms leverage clinical trial capabilities and partnerships to secure early access to emerging markets. Generics-focused companies compete by offering cost-effective alternatives post-patent expiry, especially in Asia-Pacific and Latin America. Brand loyalty and physician trust remain critical in mature markets, while pricing flexibility drives adoption in cost-sensitive regions. Environmental sustainability also influences competition, with several players shifting toward low-GWP propellants and dry powder inhalers. Strategic moves include co-marketing deals, in-house R&D investments, and expansion of online distribution channels. Competition remains intense, driven by product innovation, market expansion, and growing patient demand.

Recent Developments

- In 2025, AstraZeneca presented new clinical and real-world data for inhaled medicines AIRSUPRA (albuterol/budesonide) and BREZTRI (budesonide/glycopyrrolate/formoterol fumarate) at the American Thoracic Society International Conference.

- In November 2023, GSK announced its plan to begin final-stage (Phase III) clinical trials in 2024 to replace the propellant in its Ventolin inhaler with a next-generation version.

- In November 2023, Chiesi Farmaceutici and Haisco Pharmaceutical announced to sign a license agreement for the development, manufacture, and commercialization of HSK31858, a novel, reversible dipeptidyl peptidase 1 (DPP1) inhibitor for respiratory diseases.

Report Coverage

The research report offers an in-depth analysis based on Combination, Indication, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for maintenance therapies in asthma and COPD.

- Triple combination inhalers will gain broader acceptance in moderate to severe respiratory cases.

- Smart inhalers with digital features will improve adherence and treatment tracking.

- Generic fixed dose combinations will strengthen access in cost-sensitive markets.

- Regulatory approvals will speed up as clinical guidelines favor combination therapies.

- Eco-friendly inhaler designs will attract environmentally conscious healthcare systems.

- Home-based respiratory care models will increase demand for user-friendly inhalers.

- Manufacturers will invest in local partnerships to improve distribution in emerging regions.

- Innovation in drug formulations will support personalized treatment options.

- Public health programs will include fixed dose inhalers in chronic care strategies.