Market Overview

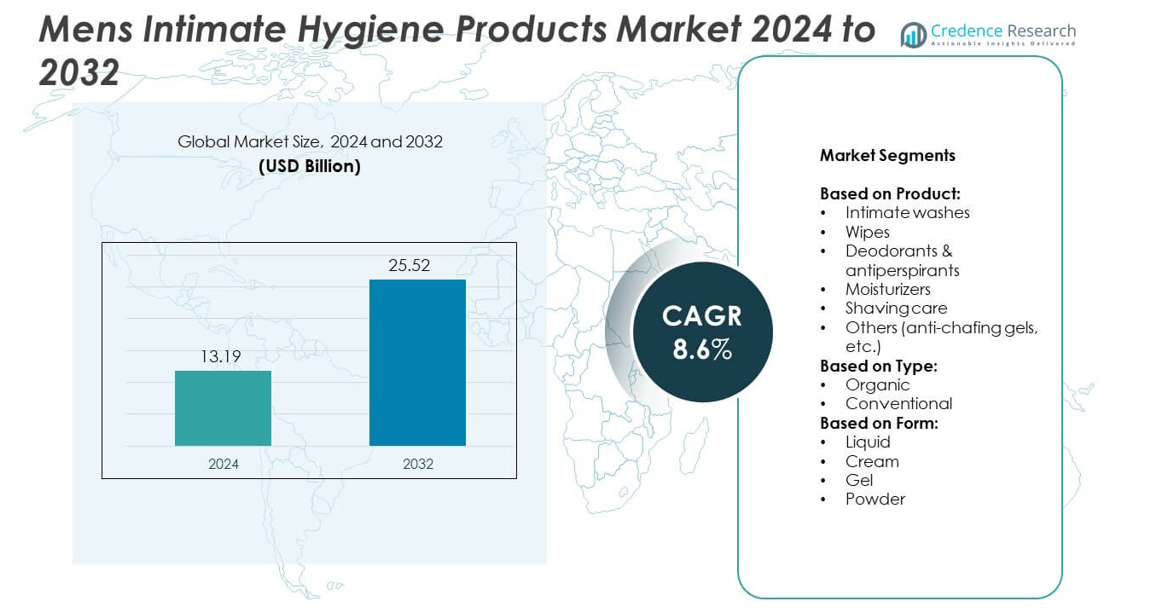

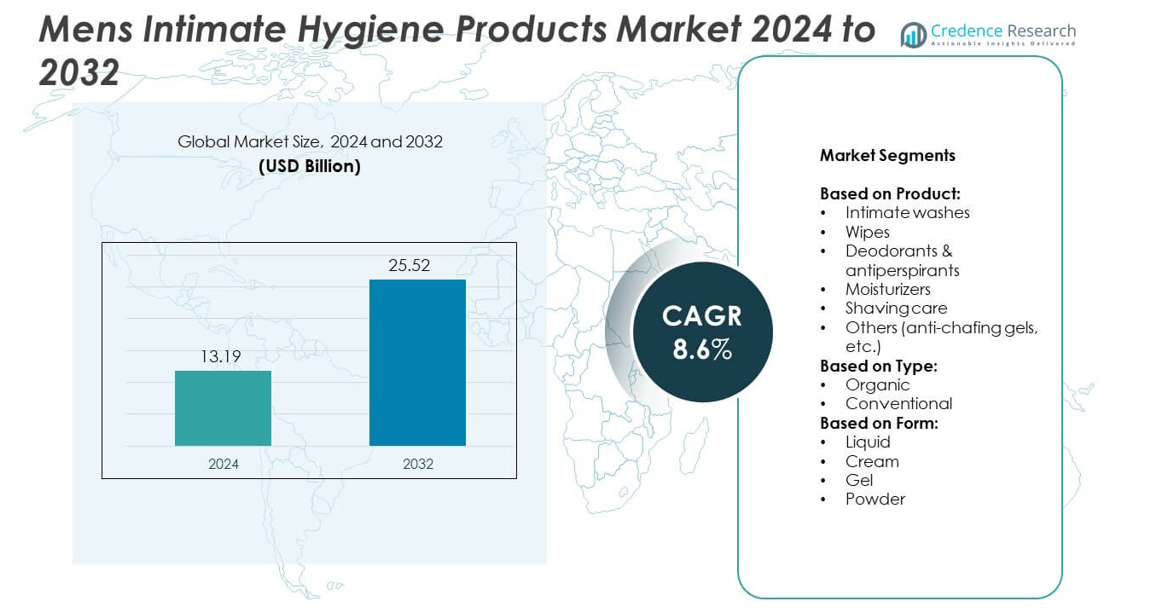

Mens Intimate Hygiene Products Market size was valued at USD 13.19 billion in 2024 and is anticipated to reach USD 25.52 billion by 2032, at a CAGR of 8.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Men’s Intimate Hygiene Products Market Size 2024 |

USD 13.19 billion |

| Men’s Intimate Hygiene Products Market, CAGR |

8.6% |

| Men’s Intimate Hygiene Products Market Size 2032 |

USD 25.52 billion |

The Mens Intimate Hygiene Products market grows due to rising awareness of male grooming and personal care. Increasing demand for natural and organic formulations drives product innovation, while urbanization and busy lifestyles boost adoption of convenient wipes, washes, and travel kits. E-commerce platforms expand accessibility, and digital campaigns strengthen brand visibility. Premium and multifunctional products attract health-conscious consumers, while subscription models enhance loyalty. Growing interest in sensitive skin care and odor control further fuels market expansion.

North America leads the Mens Intimate Hygiene Products market with strong adoption of premium and multifunctional products, supported by advanced retail infrastructure and high consumer awareness. Europe follows with growing demand for natural and organic formulations, driven by lifestyle and wellness trends. Asia-Pacific shows rapid expansion due to rising urbanization and increasing male grooming awareness. Key players shaping the market include Beiersdorf, Procter & Gamble, Unilever PLC, and L’Oreal, focusing on product innovation, digital marketing, and expanded e-commerce presence to capture diverse consumer segments.

Market Insights

- The Mens Intimate Hygiene Products market was valued at USD 13.19 billion in 2024 and is projected to reach USD 25.52 billion by 2032, at a CAGR of 8.6%.

- Rising awareness of male grooming and hygiene drives adoption of washes, wipes, deodorants, and moisturizers.

- Growing preference for natural, organic, and multifunctional products shapes product innovation and portfolio expansion.

- Key players such as Beiersdorf, Procter & Gamble, Unilever PLC, and L’Oreal focus on digital campaigns, e-commerce channels, and subscription models to strengthen market presence.

- Market growth faces challenges from high product costs and low awareness in semi-urban and rural regions.

- North America leads with advanced retail and high consumer awareness, Europe follows with demand for organic products, while Asia-Pacific shows rapid growth due to urbanization and rising grooming awareness.

- E-commerce expansion and digital marketing strategies are critical in reaching new consumers and driving brand loyalty across global regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Awareness of Personal Hygiene and Health Consciousness Among Men

Growing awareness of personal hygiene and male health drives the Mens Intimate Hygiene Products market. Consumers increasingly recognize the link between intimate care and overall wellness. It encourages adoption of specialized washes, wipes, and grooming products tailored for male anatomy. Social media campaigns and educational initiatives from brands highlight proper hygiene practices. Health-conscious men seek products with natural ingredients that minimize irritation and infections. This trend supports consistent product usage and repeat purchases, reinforcing market growth. Brands respond by offering formulations that combine cleansing with antibacterial or soothing benefits.

- For instance, Beiersdorf (Nivea Men) offers a range of dermatologically tested and pH-balanced shower gels, such as the NIVEA MEN Active Clean Shower Gel, available in 250 ml and 500 ml bottles.

Expanding Product Portfolio with Advanced Formulations and Functional Benefits

Innovation in product development fuels market expansion. Companies introduce products that target odor control, pH balance, and skin sensitivity. It appeals to men who demand multifunctional solutions in a single product. R&D investment focuses on natural extracts, probiotics, and dermatologically tested ingredients. Premium and mid-tier segments benefit from these value-added offerings. Product differentiation enables brands to capture a wider consumer base. It also strengthens brand loyalty through perceived efficacy and safety.

- For instance, Dove Men+Care products, such as their face moisturizers, contain various moisturizing ingredients, including Glycerin, Stearic Acid, and Vitamin B3, and are offered in various sizes, such as a 100g Hydration Boost Face Moisturizer

Influence of Urbanization and Lifestyle Changes on Male Grooming Habits

Urbanization and evolving lifestyles significantly impact the Mens Intimate Hygiene Products market. Busy schedules and active lifestyles increase the need for convenient, on-the-go products. It drives demand for wipes, sprays, and compact formulations suitable for travel and gym use. Exposure to diverse cultures and grooming trends encourages adoption among younger demographics. It also fuels awareness campaigns emphasizing discreet and hygienic personal care routines. Brands leverage retail expansion and e-commerce channels to reach urban male consumers efficiently.

Rising Digital Engagement and E-Commerce Penetration Boosting Accessibility

Digital platforms and e-commerce accelerate market accessibility and visibility. Online reviews, tutorials, and influencer promotions shape male grooming preferences. It enables consumers to explore new products with confidence before purchase. Direct-to-consumer channels allow brands to offer subscription models and personalized bundles. Targeted advertising improves awareness and educates users about intimate hygiene benefits. E-commerce also bridges regional gaps, reaching both metropolitan and semi-urban buyers. It supports faster adoption and sustained revenue growth across product categories.

Market Trends

Rising Preference for Natural and Organic Ingredients in Male Intimate Care

The Mens Intimate Hygiene Products market witnesses a shift toward natural and organic formulations. Consumers increasingly demand products free from harsh chemicals, sulfates, and parabens. It encourages brands to incorporate botanical extracts, aloe vera, and tea tree oil in washes and wipes. Eco-conscious buyers also prefer biodegradable and sustainable packaging. This trend drives innovation in premium and mid-tier product lines. It enhances brand reputation and strengthens consumer trust in product safety. Companies respond by marketing products highlighting gentle yet effective hygiene benefits.

- For instance, Himalaya Wellness offers an Intima Feminine Hygiene Wash, which is clinically tested and helps maintain a pH level of 3.5–4.5.

Integration of Multifunctional Benefits and Enhanced User Experience

Product differentiation through multifunctional benefits shapes market trends. The Mens Intimate Hygiene Products market focuses on odor control, moisturizing, and antibacterial properties. It caters to men seeking convenience in single-use products that deliver multiple benefits. Formulations often combine pH balance, soothing agents, and refreshing fragrances. Consumer feedback drives improvements in texture, fragrance, and application methods. It supports consistent use while building loyalty toward brands offering effective solutions. Companies increasingly emphasize sensory experience alongside hygiene performance.

- For instance, for male hygiene, Nivea Men offers deodorants like the Silver Protect line, which provides antibacterial protection. Competitors such as Pee Safe offer intimate wipes for men, with a 40-wipe pack available

Growth of Male Grooming and Lifestyle-Driven Consumption Patterns

Evolving male grooming habits influence product adoption and market dynamics. Urban men integrate intimate hygiene into daily grooming routines. It boosts demand for wipes, sprays, and compact products suitable for gym and travel use. Young professionals and millennials actively explore specialized hygiene options. Marketing campaigns highlight discreet usage, confidence, and personal care empowerment. It reinforces the perception of hygiene as a critical part of modern lifestyle. Retailers leverage lifestyle trends to curate targeted offerings and promotions.

E-Commerce Expansion and Digital Marketing Driving Consumer Engagement

Digital channels transform access to Mens Intimate Hygiene Products. E-commerce platforms allow exploration of new products and brands with detailed descriptions and reviews. It enables targeted promotions, subscription models, and personalized bundles. Influencers and social media campaigns educate consumers on intimate hygiene practices. Online availability enhances convenience for urban and semi-urban buyers alike. It supports faster adoption and repeat purchases through easy delivery and competitive pricing. Brands capitalize on digital engagement to strengthen visibility and credibility.

Market Challenges Analysi

Cultural Taboos and Limited Awareness Hindering Adoption of Male Intimate Care Products

The Mens Intimate Hygiene Products market faces challenges due to cultural sensitivities around male intimate care. In many regions, discussions on personal hygiene remain taboo, limiting consumer education and awareness. It slows adoption among conservative demographics despite increasing health consciousness. Social stigma often prevents men from openly purchasing or trying new products. Brands encounter difficulties in designing campaigns that communicate benefits without offending cultural norms. It requires careful marketing strategies to normalize intimate hygiene practices. Retailers also face hurdles in placing products in mainstream channels without discomfort to consumers.

High Competition and Pricing Pressure Impacting Market Penetration and Profitability

Intense competition among global and local players challenges the Mens Intimate Hygiene Products market. It pressures brands to differentiate products through unique formulations, packaging, or marketing campaigns. Price-sensitive consumers in emerging markets restrict premium product adoption. Limited consumer loyalty leads to frequent switching between brands, affecting revenue consistency. It compels companies to invest in cost-efficient production and promotional activities. Regulatory compliance for ingredient safety and labeling adds complexity to product launches. This combination of factors constrains profitability and slows market expansion in certain regions.

Market Opportunities

Expansion into Emerging Markets with Growing Male Grooming Awareness

The Mens Intimate Hygiene Products market presents opportunities in emerging regions with rising male grooming awareness. Urbanization and higher disposable incomes encourage men to invest in personal care products. It allows brands to introduce affordable and mid-tier options tailored to local preferences. Educational campaigns and influencer partnerships can increase acceptance and normalize intimate hygiene practices. Retail expansion into modern trade and e-commerce platforms enhances accessibility. It supports rapid market penetration and sustained revenue growth. Targeted marketing strategies help brands capture untapped consumer segments efficiently.

Innovation in Product Development and Personalized Male Hygiene Solutions

Product innovation offers significant growth potential for the Mens Intimate Hygiene Products market. Companies can develop specialized formulations for sensitive skin, odor control, and multifunctional benefits. It encourages adoption among men seeking tailored solutions that match lifestyle and health needs. Personalized bundles, subscription models, and direct-to-consumer offerings increase engagement and brand loyalty. Collaboration with dermatologists or health experts strengthens product credibility. It also enables differentiation in a competitive landscape while addressing unmet consumer demands. Continuous innovation can position brands as leaders in male intimate care solutions.

Market Segmentation Analysis:

By Product:

The Mens Intimate Hygiene Products market includes intimate washes, wipes, deodorants & antiperspirants, moisturizers, shaving care, and others such as anti-chafing gels. Intimate washes lead demand due to daily hygiene requirements and easy integration into routines. It provides cleansing while maintaining pH balance and preventing irritation. Wipes show growth from convenience and on-the-go usage in gyms and travel. Deodorants and antiperspirants appeal to men seeking odor control and freshness. Moisturizers gain traction among health-conscious consumers aiming to maintain skin hydration. Shaving care and specialized products expand the market by addressing grooming and comfort needs.

- For instance, Unilever’s Dove Men+Care offers a range of body and face washes, such as the Clean Comfort and Extra Fresh variants, that contain moisturizers like glycerin to help hydrate the skin. These washes are typically available in 250 ml and 500 ml sizes, and some products, such as their face moisturizers, contain various moisturizing ingredients, including Vitamin B3 and Stearic Acid

By Type:

Segmentation by type differentiates between organic and conventional products. Organic variants grow rapidly due to rising awareness of chemical-free personal care. It appeals to consumers with sensitive skin and environmentally conscious preferences. Conventional products maintain a large user base because of affordability and easy availability. It allows brands to balance product innovation with mass-market reach. This dual-type approach supports revenue growth across premium and mid-tier segments.

- For instance, Reckitt’s brand Dettol, however, offers multipurpose germ protection wet wipes that are safe for use on both skin and surfaces, available in packs of 40 or 80 wipes in some markets.

By Form:

Product form includes liquid, cream, gel, and powder formats. Liquid washes dominate due to traditional usage patterns and ease of application. It offers effective cleansing with minimal residue. Creams and gels attract consumers seeking multifunctional benefits like moisturizing and soothing. Powders gain niche demand for odor control and dryness, particularly in sports and active lifestyles. Form-based segmentation allows brands to cater to diverse consumer preferences and enhance user experience. It also facilitates product positioning across daily, travel, and premium segments.

Segments:

Based on Product:

- Intimate washes

- Wipes

- Deodorants & antiperspirants

- Moisturizers

- Shaving care

- Others (anti-chafing gels, etc.)

Based on Type:

Based on Form:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 32% share of the Mens Intimate Hygiene Products market, driven by strong awareness of personal hygiene and high disposable incomes. Consumers in the region increasingly adopt specialized washes, wipes, and deodorants that address odor control, pH balance, and skin sensitivity. It benefits from widespread retail penetration, e-commerce accessibility, and active marketing campaigns promoting male grooming. Urban male consumers show growing preference for organic and multifunctional products. It also experiences high adoption of shaving care and moisturizers due to lifestyle and grooming trends. Brand loyalty remains strong, with premium and mid-tier segments capturing significant attention. Companies invest in product innovation, digital engagement, and influencer partnerships to reinforce market presence.

Europe

Europe accounts for a 28% share of the market, supported by cultural acceptance of male grooming and strict regulatory standards for personal care products. Consumers prefer products with natural ingredients, dermatological testing, and environmentally friendly packaging. It experiences steady demand for intimate washes, wipes, and deodorants targeting odor control and skin health. Awareness campaigns highlighting proper hygiene and intimate care influence consumer behavior. Urbanization, active lifestyles, and high retail density accelerate product adoption. It also benefits from established distribution networks across supermarkets, pharmacies, and e-commerce platforms. European brands focus on product differentiation and quality certifications to maintain market leadership.

Asia-Pacific

Asia-Pacific commands a 25% share of the Mens Intimate Hygiene Products market, fueled by rapid urbanization, increasing disposable income, and growing awareness of personal hygiene among men. Rising exposure to global grooming trends and social media campaigns drives adoption. It supports demand for travel-friendly wipes, deodorants, and liquid washes suitable for busy and active lifestyles. Emerging middle-class populations in India, China, and Southeast Asia show interest in organic and multifunctional products. E-commerce expansion allows brands to reach semi-urban and rural consumers efficiently. It also enables faster product launches and consumer education through digital marketing. Companies leverage influencer engagement and targeted campaigns to increase brand visibility.

Latin America

Latin America holds a 9% share of the market, driven by growing male grooming awareness and rising urbanization. Consumers increasingly purchase deodorants, intimate washes, and moisturizing products. It faces challenges from price-sensitive buyers, but affordable product lines help expand adoption. Awareness campaigns and retail availability encourage consistent use among younger demographics. E-commerce penetration supports regional outreach and subscription models. It also benefits from local brands offering culturally relevant formulations. Companies emphasize promotions, sampling, and influencer campaigns to strengthen brand acceptance.

Middle East & Africa

Middle East & Africa represent a 6% share of the Mens Intimate Hygiene Products market, influenced by increasing awareness of personal grooming and hygiene among urban male populations. It shows growing demand for wipes, deodorants, and specialized washes suitable for hot and humid climates. Cultural norms and religious considerations influence product selection and marketing strategies. E-commerce channels support product accessibility across diverse geographic locations. It allows brands to introduce premium, organic, and multifunctional products to targeted urban consumers. Companies focus on educational campaigns and influencer marketing to normalize intimate hygiene practices and expand adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kimberly-Clark

- Manscaped

- Burt’s Bees

- L’Oreal

- Edgewell Personal Care

- The Man Company

- Procter & Gamble

- Coty Inc.

- Beiersdorf

- Hawkins & Brimble

- Reckitt and Benckiser

- Colgate Palmolive

- Unilever PLC

- Church & Dwight

- Cremo Company

Competitive Analysis

Key players operating in the Mens Intimate Hygiene Products market include Beiersdorf, Burt’s Bees, Church & Dwight, Colgate Palmolive, Coty Inc., Cremo Company, Edgewell Personal Care, Hawkins & Brimble, Kimberly-Clark, L’Oreal, Manscaped, Procter & Gamble, Reckitt and Benckiser, The Man Company, and Unilever PLC. These companies focus on expanding product portfolios through innovation in formulations, packaging, and multifunctional benefits. It allows them to cater to diverse consumer preferences across hygiene, moisturizing, and odor control segments. Strong marketing strategies, including influencer partnerships and digital campaigns, reinforce brand visibility and consumer engagement. It also enables premium and mid-tier brands to differentiate from competitors while addressing sensitive skin and organic product demand. Retail expansion and e-commerce penetration play a crucial role in reaching urban and semi-urban buyers efficiently. It helps companies capture new consumer segments while maintaining loyalty among existing users. Strategic collaborations and partnerships with dermatologists or health experts strengthen credibility and product appeal. It also supports entry into emerging markets with growing awareness of male grooming. Continuous investment in R&D ensures development of advanced formulations and sustainable packaging solutions. It positions leading players to respond effectively to evolving trends and maintain competitive advantage.

Recent Developments

- In July 2025, Beiersdorf implemented the EcoBeautyScore for its NIVEA and Eucerin brands

- In February 2024, Coty announced the launch of this ultra-premium fragrance brand, anchored in patented technology and sustainable practices.

- In 2024, Haleon announced the U.S. launch of Eroxon, with online pre-orders beginning then and availability in major retailers starting in October 2024

Report Coverage

The research report offers an in-depth analysis based on Product, Type, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Mens Intimate Hygiene Products market will expand with rising male grooming awareness.

- Demand for natural and organic formulations will continue to grow steadily.

- E-commerce channels will play a key role in product accessibility and adoption.

- Premium and multifunctional products will attract health-conscious urban consumers.

- Subscription models and personalized bundles will strengthen brand loyalty.

- Young professionals and millennials will drive adoption of travel-friendly and on-the-go products.

- Digital marketing and influencer campaigns will increase consumer education and engagement.

- Product innovation will focus on sensitive skin, odor control, and moisturizing benefits.

- Emerging markets will offer significant growth opportunities for mid-tier and affordable offerings.

- Regulatory compliance and safety standards will guide new product development and brand credibility.