Market Overview

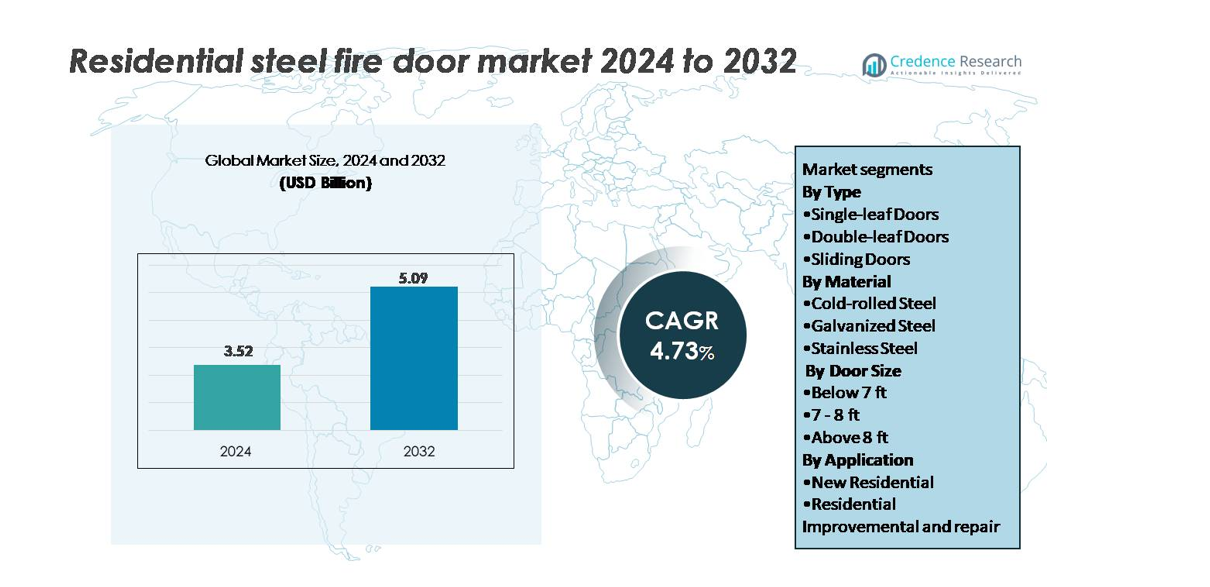

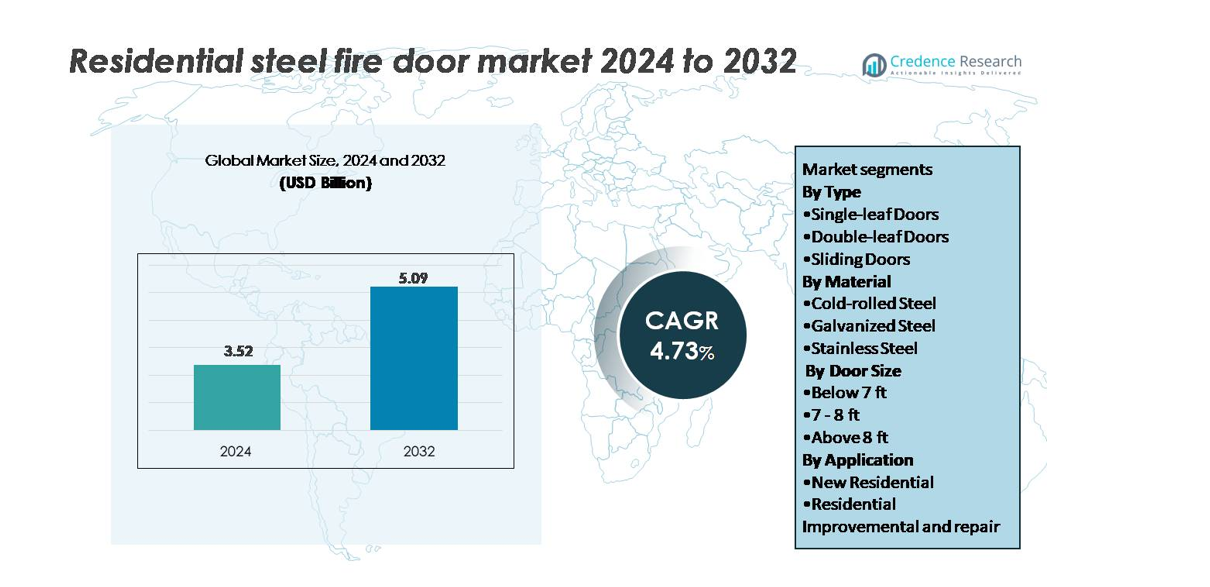

The Residential Steel Fire Door Market size was valued at USD 3.52 billion in 2024 and is projected to reach USD 5.09 billion by 2032, growing at a CAGR of 4.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Steel Fire Door Market Size 2024 |

USD 3.52 billion |

| Residential Steel Fire Door Market, CAGR |

4.73% |

| Residential Steel Fire Door Market Size 2032 |

USD 5.09 billion |

The residential steel fire door market is led by major players including Masonite International Corporation, ASSA ABLOY, Hormann LLC, Allegion PLC, Kingspan Group Plc., JELD-WEN Holdings Inc., Apex Industries, Therma-Tru Corp, De La Fontaine Industries, and Deansteel Manufacturing Co., Inc. These companies emphasize certified fire protection, design innovation, and material durability to strengthen their competitive position. Strategic expansions and technological advancements, such as smart-closing mechanisms and energy-efficient steel doors, drive their market leadership. North America dominates the market with a 37.6% share, driven by large-scale housing developments, rising safety awareness, and stricter building codes in China, Japan, and India.

Market Insights

- The Residential Steel Fire Door Market size was valued at USD 3.52 billion in 2024 and is projected to reach USD 5.09 billion by 2032, growing at a CAGR of 4.73% during the forecast period.

- Demand is driven by stringent fire safety regulations and growing adoption of durable, low-maintenance materials in modern residential buildings.

- The market is witnessing trends toward smart, automated fire door systems and eco-friendly manufacturing using recycled steel and low-VOC coatings.

- Leading players such as Masonite International Corporation, ASSA ABLOY, Hormann LLC, Allegion PLC, and Kingspan Group Plc. focus on expanding product portfolios through certified and energy-efficient solutions.

- North America leads with a 37.6% regional share, while the single-leaf door segment dominates with 54.2% share, supported by widespread use in compact residential spaces and growing high-rise housing construction across China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The single-leaf door segment held the dominant market share of 54.2% in 2024. Its popularity stems from cost-effectiveness, easy installation, and suitability for standard residential entrances. These doors offer reliable fire resistance while maintaining aesthetic flexibility. Demand continues to grow in urban housing projects emphasizing compact layouts and efficient safety solutions.

- For instance, ASSA ABLOY introduced a single-leaf fire door series featuring 90-minute fire resistance and enhanced smoke control seals, ensuring compliance with EN 1634-1 standards for multi-family residences.

By Material

Galvanized steel accounted for the largest share of 48.9% in 2024 due to its superior corrosion resistance and durability. It is widely adopted for exterior applications where exposure to moisture is common. The segment benefits from low maintenance and longer lifespan compared to cold-rolled or stainless steel variants. For instance, Hormann launched galvanized fire-rated doors using zinc-coated sheets of 1.5 mm thickness, offering protection against rust and ensuring over 240 minutes of fire endurance under BS 476 Part 22 certification.

- For instance, Tata Steel introduced its Galvano range of zero-spangle galvanized sheets with coating thickness up to 275 g/m² and tensile strength reaching 550 MPa, providing enhanced corrosion resistance for industrial enclosures and roofing systems.

By Application, Door Size, and End Use

In terms of application, new residential construction dominated with a 57.4% market share, supported by stricter building codes requiring certified fire doors in new projects. Doors between 7–8 ft led the size segment due to their compatibility with modern architectural designs and ease of installation. Exterior use also held a notable share, driven by demand for weather-resistant models in high-rise and independent homes. For instance, Saint-Gobain Sejin developed an exterior fire door with a dual-layer steel core rated for 120 minutes fire integrity and tested at 1,000°C, meeting urban residential safety standards.

Key Growth Drivers

Stricter Fire Safety Regulations

Governments across major markets are mandating certified fire‐rated doors in residential buildings. The rising number of fire‐related incidents and enhanced public safety norms compel construction and renovation projects to install steel fire doors that meet international standards. Manufacturers of the residential steel fire door segment benefit from these regulatory changes, which drive demand and increase adoption across new builds and retrofit applications.

- For instance, JELD-WEN’s FD60 doorset is CERTIFIRE CF179 and rated 60 minutes. Hörmann’s BS-standard steel doors use hinges durability tested for 200,000 cycles.

Urbanisation & Residential Construction Growth

Rapid urbanisation, especially in Asia‐Pacific and the Middle East, fuels demand for multi‐storey residential projects and gated communities. These developments require robust fire protection elements, including steel fire doors, to comply with building safety codes. As developers scale residential projects and upgrade older housing stock, the market for residential steel fire doors expands accordingly, benefiting material suppliers and fabricators.

- For instance, Hormann Middle East (or its group company Shakti Hormann) supplies fire-rated steel doors that are engineered for 240 minutes of fire resistance and tested under the BS 476 Parts 20 & 22 standards.

Preference for Durable, Low‐Maintenance Materials

Homeowners and developers increasingly favour steel fire doors over timber variants due to better durability, lower maintenance and resistance to fire, moisture and termites. Steel fire doors provide longer lifespan and stronger structural integrity, which aligns with a trend toward long‐term quality investments in housing. This material shift advantages manufacturers offering cold‐rolled, galvanized or stainless steel fire door solutions and supports premiumisation in the segment.

Key Trends & Opportunities

Smart & Automated Fire Door Technologies

Manufacturers are integrating sensors, IoT connectivity and automatic closing systems into residential steel fire doors, enabling real‐time monitoring and enhanced safety. These smart doors can trigger notifications or integration with home automation platforms. As smart homes become mainstream, this presents an opportunity to differentiate products and capture premium segments in residencies seeking both aesthetics and functional safety.

- For instance, ASSA ABLOY’s SMARTair system integrates RFID and BLE-enabled sensors for access tracking and automatic locking during emergency alerts, operating on a 56 MHz frequency with <1 s activation latency.

Sustainable Materials & Eco-Friendly Manufacturing

Environmental concerns and circular economy mandates are pushing production toward recycled steel, eco‐coatings and low-VOC materials in fire door manufacturing. Sustainable product attributes appeal to environmentally conscious homeowners and developers and can satisfy green building certifications. Producers that offer steel fire doors made from high recycled‐content steel or use low-emission processes can tap into a growing sustainability‐driven market segment.

- For instance, ASSA ABLOY uses over 90% recycled steel content in its EcoDoor series, achieving an Environmental Product Declaration (EPD) verified under ISO 14025 and reducing embodied carbon by up to 2.1 kg CO₂ per door compared to conventional steel units.

Key Challenges

High Initial Cost and Installation Complexity

Steel fire doors require higher upfront costs than standard doors and need installation by skilled labour to meet certification standards. In cost-sensitive residential markets and lower-income segments, this cost barrier limits adoption. Developers and homeowners may delay or avoid specifying certified steel fire doors due to budget constraints, impacting market penetration.

Fragmented Standards & Competition from Non-Certified Products

The market faces inconsistencies in fire door certification across regions and a proliferation of non-compliant or counterfeit products. This undermines trust and complicates specification by architects or builders. Manufacturers adhering to high certification standards face price pressure from cheaper alternatives, which can erode margins and challenge the value proposition of genuine certified steel fire doors.

Regional Analysis

North America

North America dominated the residential steel fire door market in 2024 with a 37.6% share. The region’s growth stems from stringent fire safety regulations and widespread adoption of energy-efficient building materials. The U.S. leads the market due to strong construction activity and retrofit demand in urban housing. Canada is also witnessing growth through government-backed fire safety upgrades and green building initiatives. Leading manufacturers such as ASSA ABLOY and Allegion continue expanding their fire-rated door portfolios, focusing on smart and sustainable steel solutions tailored for modern residential architecture.

Europe

Europe accounted for a 29.4% share of the residential steel fire door market in 2024. The market benefits from well-established safety codes and increasing adoption of EN 1634-1 certified doors in residential complexes. The U.K., Germany, and France represent the largest consumers, driven by rising multi-family construction and refurbishment projects. Ongoing energy-efficiency standards and fire safety modernization further support market expansion. European players like Hörmann and Teckentrup emphasize R&D for corrosion-resistant and acoustic-rated steel fire doors to enhance performance and sustainability.

Asia-Pacific

Asia-Pacific held a 23.8% share in 2024 and is projected to be the fastest-growing region. Rapid urbanization, infrastructure expansion, and tightening building codes in China, India, and Japan drive demand. Governments in these countries are enforcing mandatory fire safety standards in high-rise and smart residential projects. Rising middle-class housing demand and increased awareness of fire-resistant construction also contribute to growth. Regional manufacturers, including Sanwa Holdings and dormakaba, are introducing lightweight, thermally insulated steel fire door models for large-scale residential developments.

Latin America

Latin America captured a 5.7% share in the residential steel fire door market in 2024. Brazil and Mexico dominate due to steady growth in urban residential construction and greater emphasis on occupant safety. Government-led programs encouraging safer housing designs are improving adoption rates. Economic recovery and construction modernization projects are also supporting market expansion. Local manufacturers focus on cost-effective steel door solutions with enhanced durability to meet diverse building needs in middle-income residential segments.

Middle East & Africa

The Middle East & Africa region accounted for a 3.5% share in 2024. Increasing investment in residential complexes and smart city projects is driving steady demand for fire-rated steel doors. The United Arab Emirates and Saudi Arabia are key markets due to strong adherence to building safety codes. Africa’s emerging urban centers, including South Africa and Kenya, are witnessing rising awareness of fire protection standards. The region’s market growth is further supported by international manufacturers expanding partnerships with local distributors to meet rising construction demands.

Market Segmentations:

By Type

- Single-leaf Doors

- Double-leaf Doors

- Sliding Doors

By Material

- Cold-rolled Steel

- Galvanized Steel

- Stainless Steel

By Door Size

- Below 7 ft

- 7 – 8 ft

- Above 8 ft

By Application

- New Residential

- Residential Improvement & Repair

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player analysis

- Masonite International Corporation

- HMX, LLC

- Cambridge Doors and Windows

- Kingspan Group Plc.

- Apex Industries

- Therma-Tru Corp

- MPI Custom Steel Doors and Frames

- Hormann LLC

- TruDoor, LLC

- ASSA ABLOY

- Allegion PLC

- De La Fontaine Industries

- Titan Metal Products

- Deansteel Manufacturing Co., Inc.

- Safex Fire Services Ltd.

- JELD-WEN Holdings Inc.

Competitive Landscape

The residential steel fire door market features a competitive landscape dominated by leading manufacturers such as Masonite International Corporation, HMX, LLC, Cambridge Doors and Windows, Kingspan Group Plc., Apex Industries, Therma-Tru Corp, MPI Custom Steel Doors and Frames, Hormann LLC, TruDoor, LLC, ASSA ABLOY, Allegion PLC, De La Fontaine Industries, Titan Metal Products, Deansteel Manufacturing Co., Inc., Safex Fire Services Ltd., and JELD-WEN Holdings Inc. These companies compete through innovation in design, fire-resistance certification, and energy efficiency. Firms are investing in automated production lines, corrosion-resistant coatings, and smart locking systems to enhance performance and safety standards. For instance, ASSA ABLOY launched a residential-grade fire door series featuring smart close technology and integrated thermal seals, improving both safety and insulation efficiency. Partnerships with construction firms and expansion into emerging residential markets further strengthen their global presence and market share leadership.

Recent Developments

- In October 2023, ASSA ABLOY launched the OH1142P Dual Drive doors. The Dual Drive, embedded within the door, relies on two motors. These motors, working on either side of the door, smoothly lift and lower it using a fixed chain. It also offers smart connectivity for ongoing optimization.

- In January 2023, Therma-Tru launched its fiberglass and steel product lineup for 2023, which included an innovative, integrated storm & entry door system, decorative glass designs, paint & stain color options, additional sizes for popular styles, and more.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Door size, Application, End use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for certified steel fire doors will continue to rise due to stricter residential safety regulations.

- Manufacturers will invest in automation and digital monitoring technologies to enhance product quality.

- Smart fire doors with IoT sensors and self-closing mechanisms will gain strong adoption in modern homes.

- Sustainable and recyclable steel materials will become standard in future product lines.

- Prefabricated housing and modular construction projects will increase the need for ready-to-install fire doors.

- Asia-Pacific will remain the key growth region supported by rapid urbanization and housing expansion.

- Companies will expand partnerships with real estate developers to secure long-term installation contracts.

- Innovation in lightweight, thermally insulated steel doors will improve energy efficiency in homes.

- Growing home renovation and retrofit activities will sustain aftermarket demand.

- Enhanced certification standards and testing protocols will improve consumer trust and product reliability globally.