Market Overview

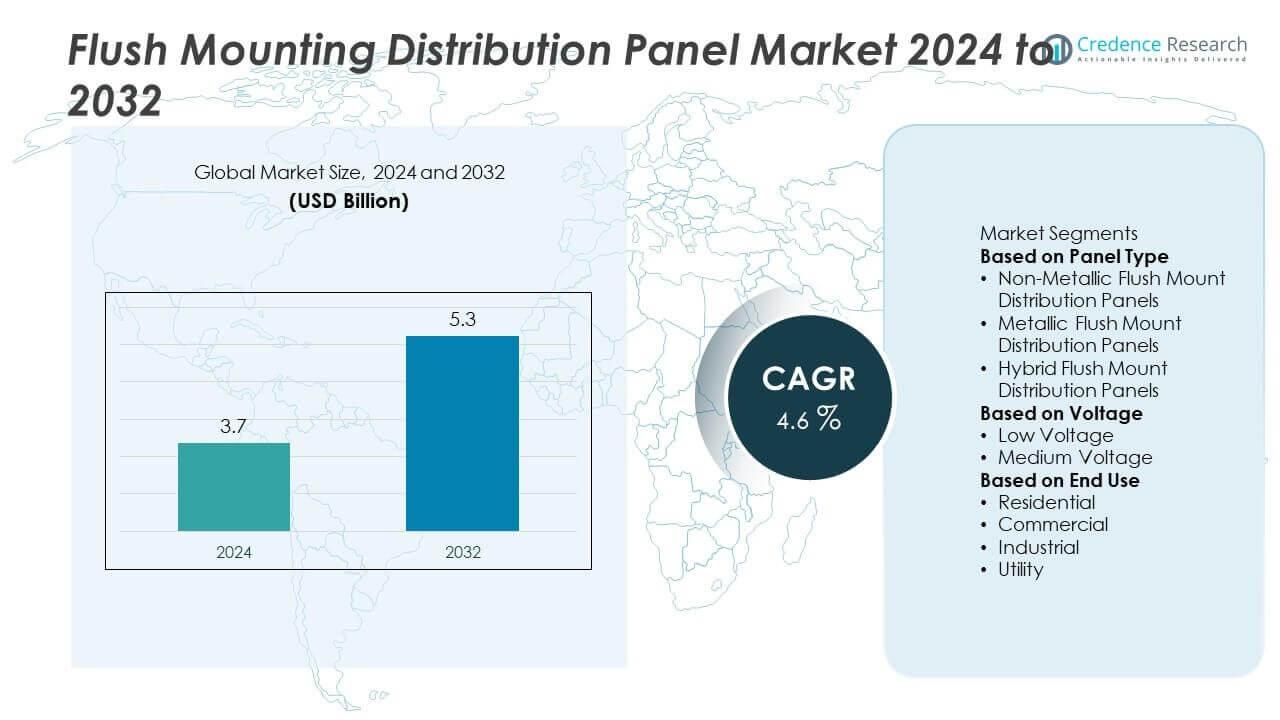

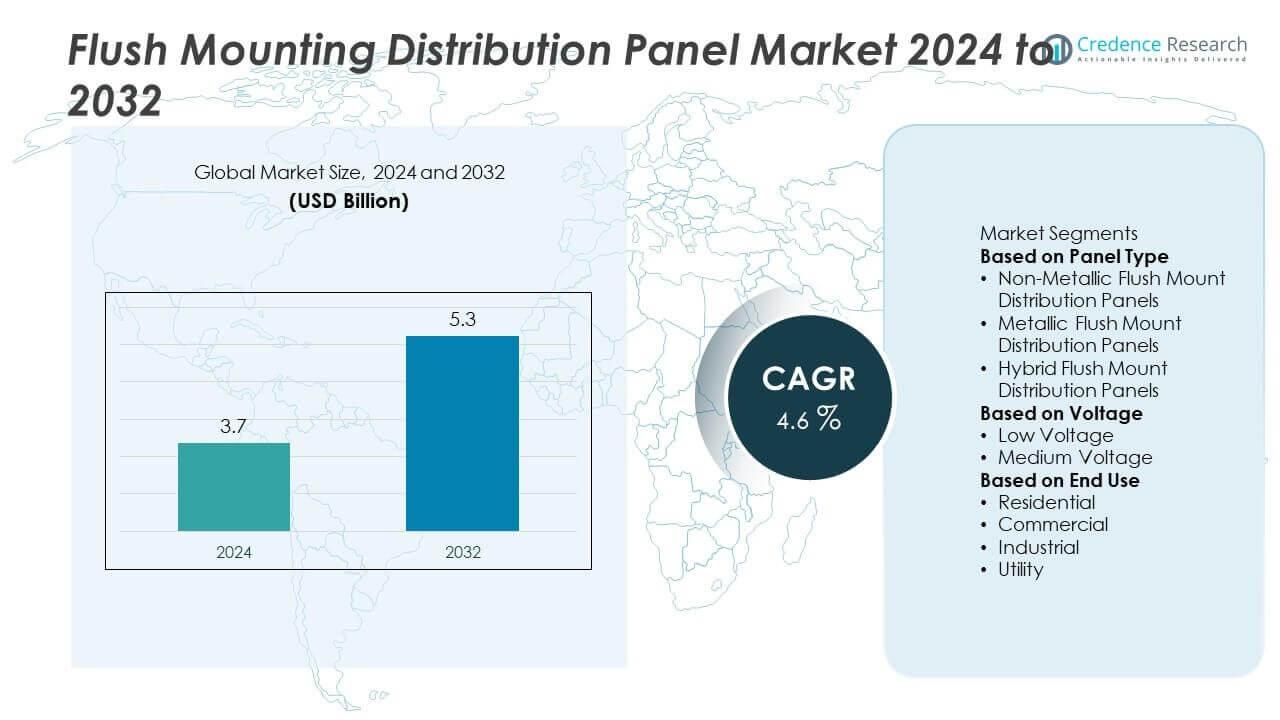

Flush Mounting Distribution Panel Market size was valued at USD 3.7 billion in 2024 and is projected to reach USD 5.3 billion by 2032, growing at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flush Mounting Distribution Panel Market Size 2024 |

USD 3.7 Billion |

| Flush Mounting Distribution Panel Market, CAGR |

4.6% |

| Flush Mounting Distribution Panel Market Size 2032 |

USD 5.3 Billion |

The Flush Mounting Distribution Panel Market grows through rising demand for reliable power distribution in residential, commercial, and industrial spaces, supported by urbanization and modern construction trends. It benefits from stricter safety regulations and the need for compact, aesthetically integrated systems that ensure both functionality and design appeal.

The Flush Mounting Distribution Panel Market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each region contributing through distinct growth factors. North America benefits from advanced building codes, retrofitting projects, and high adoption of smart panels in residential and commercial spaces. Europe emphasizes sustainable construction practices and strict energy efficiency standards, with Germany, France, and the United Kingdom driving large-scale adoption. Asia-Pacific records rapid expansion supported by urbanization, smart city initiatives, and rising housing demand across China, India, and Southeast Asia. Latin America and the Middle East & Africa are gradually adopting flush mounting solutions, driven by growing real estate projects and modern infrastructure investments. Key players influencing the market include Siemens, Schneider Electric, ABB, Eaton, and Legrand, all of which focus on advanced panel designs, IoT-enabled features, and global expansion strategies to strengthen competitiveness across diverse applications.

Market Insights

- The Flush Mounting Distribution Panel Market was valued at USD 3.7 billion in 2024 and is projected to reach USD 5.3 billion by 2032, at a CAGR of 4.6%.

- Rising demand for reliable power distribution in residential, commercial, and industrial applications drives adoption, supported by urbanization and growing focus on electrical safety.

- Key trends include integration of IoT-enabled monitoring features, compact and aesthetic panel designs, and increasing use of sustainable materials aligned with green building standards.

- Competitive dynamics feature leading players such as Siemens, Schneider Electric, ABB, Eaton, and Legrand, which focus on innovation, smart technologies, and expanding presence in emerging markets.

- Market restraints include high installation costs, limited retrofit options for older buildings, and competition from surface-mounted alternatives that are easier to install and maintain.

- Regional outlook highlights North America and Europe as strong markets due to advanced construction practices and safety regulations, while Asia-Pacific records rapid expansion driven by smart city projects and large-scale housing demand.

- Overall, the Flush Mounting Distribution Panel Market demonstrates resilience by aligning with energy efficiency goals, responding to regulatory pressures, and leveraging smart technologies, ensuring continued relevance in modern infrastructure development worldwide.

Market Drivers

Rising Demand for Reliable Power Distribution in Urban Infrastructure

The Flush Mounting Distribution Panel Market grows through increasing urbanization and expansion of residential and commercial infrastructure. Rising demand for reliable electricity in apartments, offices, and retail complexes fuels adoption. It ensures safe and efficient power distribution across multiple circuits in compact spaces. Builders prefer flush mounting designs for modern interiors, where aesthetics and safety play equal roles. Growing reliance on uninterrupted power supports integration of advanced panels in new projects. The expansion of real estate sectors strengthens market demand globally.

- For instance, ABB launched its MISTRAL41F series flush-mounted distribution boards, available in models supporting up to 72 modules, which are widely deployed in residential complexes across Europe.

Growth in Industrial and Commercial Applications

Industrial facilities and commercial establishments require efficient distribution panels to manage high power loads. The Flush Mounting Distribution Panel Market addresses this demand by offering compact yet durable solutions for diverse applications. It provides protection against overloads, short circuits, and electrical faults, ensuring operational safety. The commercial sector, including malls, hospitals, and educational institutions, increasingly integrates flush mounting systems to optimize space. Strong industrial expansion in emerging economies further accelerates demand. The growing focus on energy efficiency in industrial operations reinforces adoption of these systems.

- For instance, Siemens’ SIVACON S4 distribution panels, available in flush-mount configurations, support rated currents up to 4,000 A with short-circuit withstand capacity of 100 kA for 1 second, ensuring reliable power supply in industrial plants, hospitals, and large commercial complexes.

Rising Adoption of Smart Electrical Infrastructure

The shift toward smart grids and intelligent buildings supports strong growth in the market. The Flush Mounting Distribution Panel Market benefits from integration of IoT-enabled monitoring and digital control systems. It enables real-time diagnostics, predictive maintenance, and energy optimization in modern buildings. Utilities and facility managers adopt smart panels to reduce downtime and improve energy efficiency. Growing investments in digital infrastructure encourage upgrades to advanced distribution systems. The trend aligns with global energy transition and sustainability initiatives.

Supportive Regulations and Safety Standards

Strict government regulations regarding electrical safety drive adoption of flush mounting panels worldwide. The Flush Mounting Distribution Panel Market aligns with mandatory compliance requirements in residential, commercial, and industrial spaces. It ensures adherence to fire safety norms and electrical protection standards. Governments encourage builders to adopt reliable panels that minimize risks of electrical hazards. Rising consumer awareness about electrical safety strengthens preference for certified systems. This regulatory support creates long-term opportunities for market expansion across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Trends

Integration of Smart Monitoring and IoT Features

The Flush Mounting Distribution Panel Market reflects a clear trend toward intelligent monitoring solutions. Manufacturers introduce panels with IoT connectivity to support energy tracking and predictive maintenance. It enables facility managers to monitor performance remotely and reduce downtime. Smart sensors integrated into panels provide real-time alerts on overloads or faults. Growing adoption of building automation systems strengthens demand for such advanced solutions. The trend highlights the shift from traditional panels to digitally enabled infrastructure.

- For instance, Siemens launched its SENTRON 3VA molded case circuit breaker integrated with IoT-enabled monitoring modules, which can track load status across up to 24 circuits in real time, supporting smart facility management.

Focus on Compact and Aesthetic Designs

Modern construction emphasizes space optimization and clean interior designs. The Flush Mounting Distribution Panel Market responds with compact panels that blend seamlessly with walls and interior layouts. It supports installation in residential and commercial spaces without compromising aesthetics. Architects and builders prefer panels with sleek finishes and user-friendly access. The demand for minimalistic designs aligns with rising smart home and office developments. This trend ensures steady growth in both high-end and mid-segment housing projects.

- For instance, Legrand offers various XL³ flush-mounted distribution boards, which are highly modular and available in a wide range of dimensions to meet different requirements, including compact ones.

Sustainability and Energy Efficiency in Panel Designs

Global emphasis on sustainable infrastructure influences the design of modern distribution panels. The Flush Mounting Distribution Panel Market advances with energy-efficient materials and eco-friendly manufacturing processes. It reduces carbon footprint while improving system reliability. Manufacturers adopt recyclable materials and low-energy components to align with green building standards. Compliance with LEED and similar certifications strengthens the adoption of sustainable panels. This trend aligns with broader industry goals of energy transition and environmental responsibility.

Adoption Across Emerging Economies and Infrastructure Projects

Expanding infrastructure development in emerging markets creates strong opportunities for growth. The Flush Mounting Distribution Panel Market benefits from large-scale urban housing, smart city projects, and industrialization. It provides reliable and space-saving solutions for rapidly growing power needs. Governments in Asia-Pacific, Latin America, and Africa promote modernization of electrical networks. Increasing investments in residential and commercial projects drive steady demand. This trend reinforces the role of flush mounting distribution panels as a critical element of modern power systems.

Market Challenges Analysis

High Installation Costs and Limited Retrofit Options

The Flush Mounting Distribution Panel Market faces challenges due to high installation costs and limited flexibility in retrofitting older buildings. Installation often requires modifications to walls and existing wiring, which increases overall project expenses. It restricts adoption in cost-sensitive markets where budget-friendly alternatives are preferred. Small contractors and developers hesitate to adopt flush mounting solutions due to added labor and material costs. Retrofitting older infrastructures poses additional difficulties, reducing demand in regions with aging building stock. These factors slow market penetration, particularly in developing economies.

Competition from Surface-Mounted Alternatives and Safety Concerns

Surface-mounted panels continue to dominate in industrial and rural applications where cost and accessibility are priorities. The Flush Mounting Distribution Panel Market struggles to compete in such environments, as surface-mounted systems offer easier installation and maintenance. It also faces safety concerns in poorly executed installations where improper sealing may lead to overheating or electrical hazards. Limited awareness among consumers and builders about the long-term advantages of flush-mounted systems further hinders adoption. The challenge compels manufacturers to invest in education, innovation, and safety certifications to strengthen trust and expand market share.

Market Opportunities

Expansion of Smart Homes and Connected Buildings

The Flush Mounting Distribution Panel Market presents strong opportunities with the rise of smart homes and connected buildings. Consumers increasingly demand integrated electrical systems that combine safety, aesthetics, and digital monitoring. It enables seamless connection with IoT devices, supporting real-time diagnostics and energy optimization. Builders incorporate these panels into residential and commercial projects to enhance property value. The trend toward home automation creates consistent demand across both developed and developing markets. Growing consumer preference for compact and intelligent designs strengthens long-term growth potential.

Rising Infrastructure Development in Emerging Economies

Rapid urbanization and government investments in infrastructure create favorable conditions for adoption. The Flush Mounting Distribution Panel Market gains momentum from smart city projects, industrial facilities, and commercial complexes. It delivers reliable power distribution in high-density urban spaces where efficient use of space is critical. Expanding housing projects in Asia-Pacific, Latin America, and Africa fuel strong opportunities. Developers adopt flush-mounted systems to align with modern design and safety standards. These conditions position the market for steady growth across diverse construction sectors worldwide.

Market Segmentation Analysis:

By Panel Type

The Flush Mounting Distribution Panel Market segments by panel type into single-door and double-door designs. Single-door panels dominate in residential applications due to their compact size and suitability for small circuits. It offers a cost-effective solution that supports simple wiring needs in apartments and housing projects. Double-door panels hold strong demand in commercial and industrial facilities where higher circuit capacity and durability are required. These panels provide enhanced safety and convenient access for maintenance. The increasing use of modular panel types further supports flexibility in modern construction projects.

- For instance, ABB’s MISTRAL65 range offers single- and double-door enclosures covering from 4 up to 72 DIN-rail modules, with depths allowing adjustable DIN-rail spaces from 125 mm to 150 mm

By Voltage

Segmentation by voltage highlights low voltage and medium voltage categories. Low voltage panels lead adoption in residential and commercial buildings, where they ensure efficient power distribution for lighting, appliances, and HVAC systems. It is preferred for its affordability and ease of integration with existing wiring systems. Medium voltage panels record steady growth in industrial and infrastructure projects where higher loads are managed. The demand for reliable panels in factories, data centers, and healthcare facilities strengthens this category. Both voltage ranges contribute to broader adoption across diverse applications.

- For instance, Schneider Electric’s PrismaSeT Active low-voltage panels, with a rated capacity of up to 4,000 A, are used in data centers and commercial buildings to optimize reliable power distribution.

By End Use

The market segments by end use into residential, commercial, and industrial sectors. The residential sector dominates due to increasing construction of urban housing and smart homes that require compact and aesthetic solutions. It supports safe and efficient distribution while blending with interior designs. Commercial establishments such as offices, malls, and hospitals adopt flush mounting panels to save space and meet regulatory standards. Industrial facilities also use these panels, particularly in control rooms and equipment-heavy environments, to enhance safety and performance. Rising investments in modern infrastructure ensure that all three end-use categories continue to expand.

Segments:

Based on Panel Type

- Non-Metallic Flush Mount Distribution Panels

- Metallic Flush Mount Distribution Panels

- Hybrid Flush Mount Distribution Panels

Based on Voltage

- Low Voltage

- Medium Voltage

Based on End Use

- Residential

- Commercial

- Industrial

- Utility

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant position in the Flush Mounting Distribution Panel Market with a 34% market share in 2024. The region benefits from advanced construction practices, high adoption of smart building solutions, and strong demand for energy-efficient electrical systems. The United States drives growth through its robust residential and commercial construction sectors, where safety standards and modern designs favor flush mounting systems. It also gains momentum from ongoing retrofitting projects in older buildings that integrate updated electrical infrastructure. Canada and Mexico contribute steadily with rising investments in urban housing and commercial projects. The region’s emphasis on electrical safety regulations and digital integration ensures continuous adoption of advanced distribution panels.

Europe

Europe represents a 29% market share in 2024, supported by stringent energy efficiency policies and growing adoption of sustainable construction practices. Countries such as Germany, France, and the United Kingdom lead demand with widespread integration of flush mounting distribution panels in residential and commercial complexes. It aligns with the region’s focus on modern interior aesthetics and compact electrical systems. The European Union’s directives on building safety and energy conservation further encourage widespread use of high-quality panels. Eastern Europe records growing demand as new infrastructure projects expand across Poland, Hungary, and Romania. Europe’s leadership in smart home adoption and sustainability positions the region as a critical market driver.

Asia-Pacific

Asia-Pacific accounts for 24% of the global market share in 2024, reflecting rapid urbanization and strong construction activity. China leads regional adoption, driven by large-scale residential complexes, commercial buildings, and industrial facilities requiring compact electrical distribution solutions. It also gains traction in India, Japan, and South Korea, where smart city projects and rising disposable incomes fuel demand for modern infrastructure. Southeast Asian countries, including Indonesia, Vietnam, and Thailand, contribute with growing urban housing demand. The availability of cost-effective solutions and government investments in infrastructure projects drive steady adoption. Asia-Pacific is expected to be the fastest-growing region due to its scale of urban development and expanding middle-class consumer base.

Latin America

Latin America secures an 8% market share in 2024, driven primarily by Brazil and Mexico. Expanding urban housing and modernization of commercial spaces fuel demand for flush mounting distribution panels. It gains additional traction from rising adoption in retail, healthcare, and hospitality projects. However, cost constraints and limited awareness in rural areas hinder large-scale adoption. Governments are introducing energy efficiency initiatives that support integration of modern distribution systems. Despite economic challenges, the region demonstrates steady growth as developers prioritize safe and space-saving power distribution systems.

Middle East & Africa

The Middle East & Africa account for a 5% market share in 2024, reflecting emerging opportunities. Gulf countries, including Saudi Arabia and the United Arab Emirates, drive demand through large-scale infrastructure and smart city projects. It also records adoption in South Africa, supported by modernization of residential and commercial buildings. Limited awareness and high upfront costs restrict growth in several African nations. However, investments in sustainable infrastructure and government diversification strategies create new opportunities for adoption. The region gradually evolves into a promising market, supported by luxury housing demand and growing urban development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens

- Larsen & Toubro Limited

- ESL POWER SYSTEMS, INC.

- Eaton

- General Electric

- ABB

- ΩΤΚΑ

- Legrand

- NHP

- Schneider Electric

Competitive Analysis

The competitive landscape of the Flush Mounting Distribution Panel Market features leading players such as Siemens, Schneider Electric, ABB, Eaton, Legrand, General Electric, Larsen & Toubro Limited, NHP, ΩΤΚΑ, and ESL Power Systems, Inc.. These companies focus on delivering advanced distribution panels that combine safety, reliability, and modern design to meet the needs of residential, commercial, and industrial users. They invest heavily in research and development to integrate IoT-enabled monitoring, energy efficiency features, and smart connectivity into panel designs. Strategic expansions into emerging markets and infrastructure projects strengthen their global footprint, while partnerships with contractors and developers improve distribution networks. Many prioritize compliance with strict international safety and energy standards, ensuring product reliability and market trust. Competition remains strong as players differentiate through product innovation, sustainable materials, and customized solutions tailored to local regulatory requirements. Together, these strategies reinforce their market leadership and ensure long-term growth across diverse applications worldwide.

Recent Developments

- In January 2024, ABB announced integration of Azure IoT services into its digital distribution systems, enhancing remote monitoring and predictive maintenance for flush-mount panels.

- In November 2023, ABB launched its Protecta Power Panel Board, designed for flush mounting and boasting modular housings with advanced safety features and arc-fault detection in compact commercial and industrial settings.

- In May 2023, Schneider Electric introduced FlexSet, a customizable flush-mount switchboard for Canadian markets, offering flexible configuration in low-voltage applications.

- In April 2023, Hager Group partnered with E.ON to deliver smart energy distribution solutions for residential buildings featuring flush-mount capability and intelligent power management.

Report Coverage

The research report offers an in-depth analysis based on Panel Type, Voltage, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with rising demand for compact and space-efficient power distribution solutions.

- Smart panels with IoT-enabled monitoring will gain wider adoption in residential and commercial projects.

- Energy-efficient and sustainable materials will become central to new product designs.

- Integration with smart city projects will drive large-scale deployment in urban infrastructure.

- Advanced safety standards will encourage adoption of certified and compliant distribution panels.

- Retrofitting opportunities will expand as older buildings modernize electrical systems.

- Asia-Pacific and Latin America will record faster growth due to urbanization and housing expansion.

- Partnerships between manufacturers and real estate developers will strengthen market penetration.

- Cost optimization and modular panel designs will make solutions more accessible to mid-range projects.

- Continuous innovation in digital control and predictive maintenance will enhance long-term adoption.