Market Overview

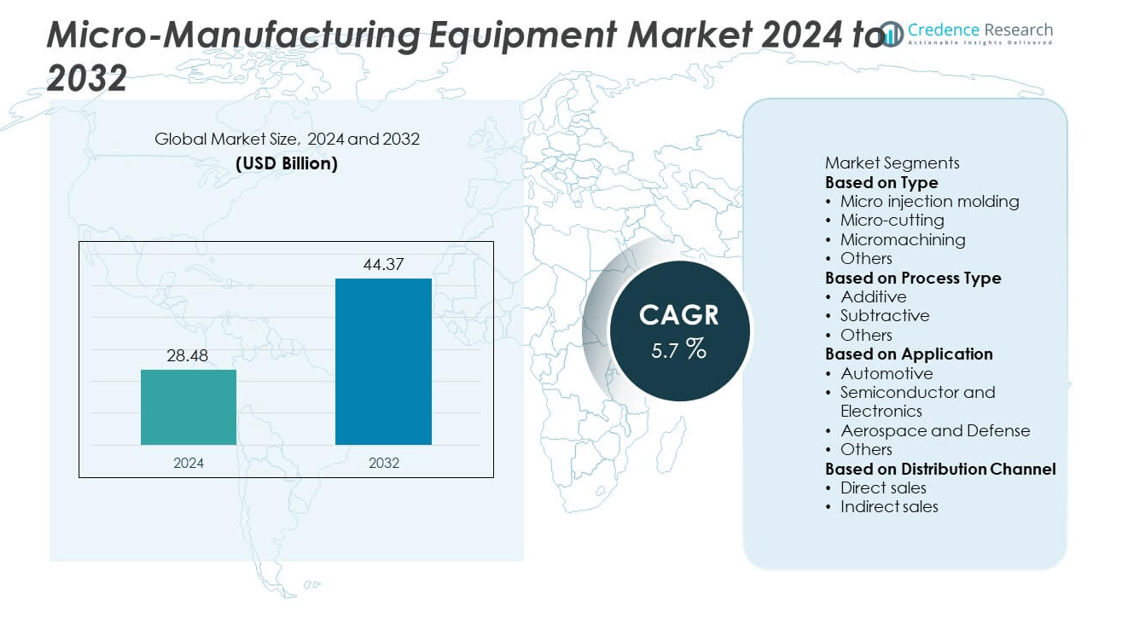

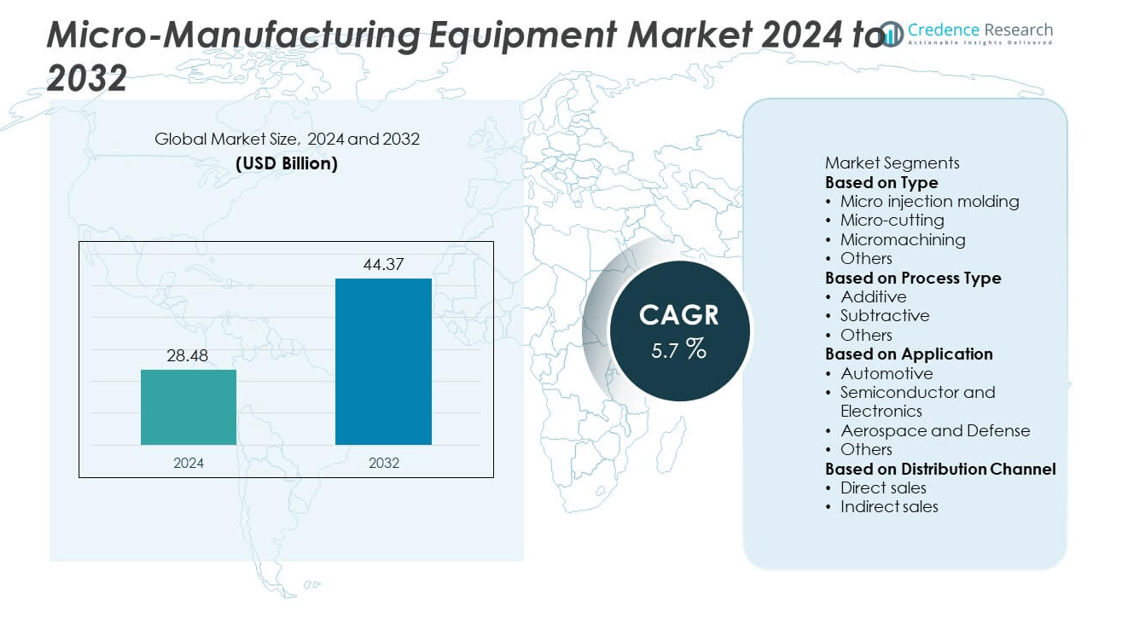

Micro-Manufacturing Equipment Market was valued at USD 28.48 billion in 2024 and is expected to reach USD 44.37 billion by 2032, growing at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Micro-Manufacturing Equipment Market Size 2024 |

USD 28.48 billion |

| Micro-Manufacturing Equipment Market, CAGR |

5.7% |

| Micro-Manufacturing Equipment Market Size 2032 |

USD 44.37 billion |

The Micro-Manufacturing Equipment Market grows with rising demand from medical devices, electronics, automotive, and aerospace industries that require high-precision components. Increasing miniaturization in consumer electronics and IoT devices fuels adoption of advanced micro-production systems.

The Micro-Manufacturing Equipment Market demonstrates strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads with robust adoption in aerospace, healthcare, and semiconductor industries supported by advanced R&D infrastructure. Europe shows significant growth with demand from automotive and precision engineering sectors, while Asia-Pacific emerges as the fastest-growing region driven by electronics, IoT, and large-scale industrialization in China, Japan, and South Korea. Latin America and the Middle East & Africa show gradual expansion, supported by healthcare modernization and industrial diversification programs. Key players influencing the market include Applied Materials, recognized for its advanced semiconductor equipment, ASML, a leader in photolithography systems, FANUC, specializing in robotics and automation for precision production, and Nanoscribe GmbH, known for its micro 3D printing technologies. These companies drive innovation through technological advancements, strategic collaborations, and global expansion across high-growth industries.

Market Insights

- The Micro-Manufacturing Equipment Market was valued at USD 28.48 billion in 2024 and is expected to reach USD 44.37 billion by 2032, growing at a CAGR of 5.7%.

- Rising demand from medical devices, electronics, and aerospace industries drives adoption of micro-manufacturing systems to ensure high precision and regulatory compliance.

- Market trends focus on automation, AI integration, and additive manufacturing at the micro scale, enabling faster prototyping, improved accuracy, and reduced operational costs.

- Leading players such as Applied Materials, ASML, FANUC, KUKA AG, and Nanoscribe GmbH shape competition by expanding product portfolios and investing in advanced technologies.

- High capital investment requirements, complex technical processes, and shortages of skilled workforce act as restraints, limiting adoption among smaller enterprises.

- North America leads with strong adoption across aerospace and healthcare, Europe expands with advanced automotive and engineering sectors, and Asia-Pacific records the fastest growth supported by electronics and semiconductor industries.

- The overall outlook remains positive as industries prioritize miniaturization, sustainability, and smart manufacturing solutions, while emerging economies create new opportunities for growth and innovation in precision manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Medical Device and Healthcare Industry

The Micro-Manufacturing Equipment Market grows with increasing adoption in medical devices and healthcare applications. Miniaturized components are essential for implants, surgical tools, and diagnostic instruments. It supports precision manufacturing that ensures accuracy, safety, and regulatory compliance. Rising demand for minimally invasive procedures drives investments in micro-scale production technologies. Manufacturers adopt these systems to meet strict quality standards in life sciences. Growth in global healthcare spending further strengthens adoption across medical sectors.

- For instance, Nanoscribe GmbH uses its IP‑S resin to print microlens arrays with shape accuracy better than 1 µm and surface roughness under 10 nm Ra for biomedical optics.

Expanding Applications in Electronics and Semiconductor Industry

The electronics and semiconductor sectors remain major drivers of demand for micro-manufacturing solutions. The Micro-Manufacturing Equipment Market benefits from the push for smaller, lighter, and more powerful devices. It enables production of microchips, sensors, and connectors with high precision. Rapid growth in consumer electronics, 5G networks, and IoT devices increases equipment utilization. Semiconductor manufacturers invest in advanced tools to meet global supply chain requirements. This demand sustains long-term growth for micro-manufacturing technologies.

- For instance, ASML and SK hynix assembled the first commercial High-NA EUV system, the Twinscan EXE:5200B, achieving 8 nm resolution using 0.55 numerical aperture optics.

Growing Adoption in Automotive and Aerospace Sectors

The automotive and aerospace industries rely on micro-manufacturing for lightweight and efficient components. The Micro-Manufacturing Equipment Market supports production of fuel-efficient parts, micro-sensors, and safety systems. It helps manufacturers meet performance and regulatory standards for modern vehicles and aircraft. Growing emphasis on electric mobility expands demand for micro-scale battery and sensor technologies. Aerospace applications require extreme precision in turbine engines and avionics systems. These industries drive steady growth through consistent adoption of advanced equipment.

Technological Advancements Driving Precision and Efficiency

Ongoing innovation in automation, robotics, and additive manufacturing fuels demand for advanced solutions. The Micro-Manufacturing Equipment Market benefits from integration of AI and machine learning in production systems. It allows manufacturers to achieve higher throughput and reduced error margins. 3D printing technologies enable customized production at the micro scale. Precision-driven industries adopt hybrid solutions combining laser machining and micro-milling. These advancements expand applications across multiple sectors, ensuring strong long-term adoption.

Market Trends

Integration of Automation and Smart Manufacturing

The Micro-Manufacturing Equipment Market is moving toward automation and smart factory models. Manufacturers integrate robotics, AI, and IoT to improve precision and reduce human error. It enables real-time monitoring of micro-scale processes with higher efficiency. Automated systems support mass production of complex parts while maintaining consistency. Demand for connected equipment grows as industries adopt Industry 4.0 strategies. This trend enhances productivity and lowers operational costs in micro-manufacturing environments.

- For instance, Nanoscribe’s Quantum X systems enable automated wafer‑scale microfabrication on an 8‑inch wafer, handling volumes up to 30 cubic centimeters per print run with sub‑micron feature accuracy down to 100 nm and surface roughness as low as 5 nm Ra, enabling precise, high‑throughput production

Adoption of Advanced Materials in Micro-Production

Growing use of advanced materials influences equipment design and process innovation. The Micro-Manufacturing Equipment Market incorporates systems capable of working with composites, ceramics, and bio-compatible materials. It allows manufacturers to meet requirements in healthcare, aerospace, and electronics. Demand for lightweight, durable, and high-performance components drives this adoption. Equipment that can handle diverse materials provides greater flexibility for end-use industries. This trend reinforces the need for multi-functional and adaptable systems.

- For instance, Nanoscribe’s GP‑Silica material enables printing of silica nanocomposite microstructures via two‑photon polymerization, achieving optical‑grade surface quality with feature size control down to 100 nm, and compatibility with glass‑like ceramic properties

Expansion of Additive Manufacturing at Micro Scale

Additive manufacturing is gaining traction in micro-production across multiple sectors. The Micro-Manufacturing Equipment Market benefits from demand for 3D printing of miniature parts and prototypes. It supports custom designs in medical implants, microfluidics, and electronics. Faster prototyping reduces development timelines and costs for manufacturers. Additive processes also reduce material waste, aligning with sustainability goals. Growing acceptance of 3D micro-printing highlights its role in future manufacturing strategies.

Focus on Miniaturization in Consumer and Industrial Devices

The global push for smaller, smarter, and more efficient products drives this trend. The Micro-Manufacturing Equipment Market supports production of compact sensors, actuators, and microchips. It caters to industries developing wearables, IoT devices, and automotive electronics. Miniaturization improves performance while reducing space and material use. Demand for precision in high-density electronics strengthens equipment innovation. This focus on smaller yet more capable devices ensures continuous growth in the market.

Market Challenges Analysis

High Capital Investment and Maintenance Costs

The Micro-Manufacturing Equipment Market faces challenges due to high capital requirements for advanced machinery. Businesses must invest heavily in precision tools, automation, and specialized systems. It limits adoption among small and mid-sized enterprises with constrained budgets. Maintenance costs are also significant, as equipment requires frequent calibration and technical expertise. Downtime during servicing impacts productivity and increases operational expenses. These financial barriers slow widespread penetration, especially in developing markets.

Technical Complexity and Skilled Workforce Shortages

Operating micro-manufacturing systems demands advanced technical knowledge and skilled labor. The Micro-Manufacturing Equipment Market struggles with a shortage of trained professionals capable of handling intricate processes. It creates risks of errors, inefficiency, and reduced product quality. Industries often need to invest in extensive training programs, adding to costs. Rapid technological advancements also require continuous workforce upskilling. This shortage of expertise slows adoption and complicates scaling across industries.

Market Opportunities

Expanding Role in Medical Devices and Healthcare Applications

The Micro-Manufacturing Equipment Market holds strong opportunities in the medical sector with rising demand for miniaturized devices. Implants, stents, surgical tools, and diagnostic systems require precision manufacturing at the micro level. It enables healthcare companies to meet strict regulatory standards while ensuring patient safety. Growth in minimally invasive procedures further boosts demand for micro-scale production. Emerging technologies in microfluidics and lab-on-chip systems create new application areas. This expansion positions micro-manufacturing as a critical enabler in modern healthcare solutions.

Rising Demand from Emerging Economies and New Industries

Developing regions present growth opportunities driven by industrialization and investments in advanced manufacturing. The Micro-Manufacturing Equipment Market benefits from adoption across electronics, aerospace, and automotive industries in Asia-Pacific and Latin America. It supports production of sensors, batteries, and precision components required for electric mobility and renewable energy systems. Governments encourage local manufacturing through supportive policies and incentives, creating a favorable environment. Vendors introducing cost-efficient, modular systems can capture demand in these regions. Expanding into new industries and emerging economies opens long-term revenue streams for equipment providers.

Market Segmentation Analysis:

By Type

The Micro-Manufacturing Equipment Market is segmented into micro-cutting, micro-molding, micro-forming, and micro 3D printing systems. Micro-cutting dominates due to its widespread use in producing precise components for medical devices, semiconductors, and aerospace applications. It ensures accuracy in materials such as metals, ceramics, and polymers. Micro-molding records strong demand in healthcare and electronics, supporting production of micro-sized parts with high repeatability. Micro-forming is gaining traction in automotive and aerospace sectors where lightweight and durable materials are critical. Micro 3D printing grows steadily as industries adopt additive methods for prototyping and complex designs. Each type plays a vital role in serving different precision manufacturing needs.

- For instance, Nanoscribe’s Photonic Professional GT+ system can print a cube microstructure whose base is 150 µm × 150 µm and height 15 µm, with line features narrower than 500 nm

By Process Type

Process types include photolithography, micro-milling, micro-turning, laser machining, and electroforming. The Micro-Manufacturing Equipment Market benefits from photolithography’s dominance in semiconductor production, enabling creation of ultra-fine circuits. Micro-milling and micro-turning are widely adopted for producing intricate mechanical parts across automotive and industrial applications. Laser machining is expanding due to its ability to deliver clean cuts and high accuracy in medical and aerospace components. Electroforming is valued for creating complex structures with precise dimensions, particularly in electronics. It reflects a diverse range of processes that support multiple industries requiring high-precision outputs.

- For instance, femtosecond laser micromachining of stainless steel, using 400 fs pulses at 25 kHz, achieved grooves with optimal ablation parameters spanning a fluence range from 0.15 to 133 J/cm²

By Application

Applications span across medical devices, electronics, aerospace, automotive, and industrial sectors. The Micro-Manufacturing Equipment Market records strong growth in medical devices due to rising demand for implants, surgical tools, and diagnostic equipment. Electronics lead adoption with applications in sensors, microchips, and semiconductor packaging. Aerospace integrates micro-manufacturing for turbines, avionics, and lightweight components requiring extreme accuracy. Automotive applications grow with rising demand for micro-sensors, EV batteries, and safety systems. Broader industrial use includes precision parts for energy and communication equipment. It highlights the versatility of micro-manufacturing equipment in serving multiple critical sectors worldwide.

Segments:

Based on Type

- Micro injection molding

- Micro-cutting

- Micromachining

- Others

Based on Process Type

- Additive

- Subtractive

- Others

Based on Application

- Automotive

- Semiconductor and Electronics

- Aerospace and Defense

- Others

Based on Distribution Channel

- Direct sales

- Indirect sales

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 33% of the Micro-Manufacturing Equipment Market in 2024, making it the leading regional market. The region benefits from strong demand in the medical device, aerospace, and semiconductor industries. It leverages advanced R&D capabilities and high adoption of automation technologies to support precision manufacturing. The presence of major aerospace hubs and leading medical technology companies accelerates deployment of micro-manufacturing systems. Government support for innovation and investment in smart manufacturing further strengthens regional growth. Companies in the U.S. and Canada focus on integrating AI and robotics to maintain leadership in global micro-production.

Europe

Europe represents 28% of the Micro-Manufacturing Equipment Market in 2024, supported by advanced automotive and aerospace industries. Germany, France, and the UK drive adoption with high investments in precision engineering and sustainable manufacturing practices. The region emphasizes innovation in micro-molding and laser machining technologies. It also benefits from the presence of strong medical device and healthcare infrastructure that requires high-precision components. Regulatory focus on quality standards pushes manufacturers to invest in advanced equipment. Europe’s strong base of industrial expertise ensures steady market expansion across key sectors.

Asia-Pacific

Asia-Pacific holds 26% of the Micro-Manufacturing Equipment Market in 2024 and records the fastest growth rate. The region is driven by rapid industrialization, urbanization, and expansion of the electronics and semiconductor sectors. China, Japan, South Korea, and India are key contributors, with significant investments in miniaturized components for consumer electronics and IoT devices. It also benefits from growing demand in automotive and renewable energy applications. Governments across the region support manufacturing initiatives with favorable policies and infrastructure development. Asia-Pacific continues to expand its role as a global hub for micro-manufacturing, supported by cost advantages and large-scale production capacity.

Latin America

Latin America accounts for 7% of the Micro-Manufacturing Equipment Market in 2024, with Brazil and Mexico leading adoption. Growth is supported by rising demand for precision manufacturing in automotive, healthcare, and electronics. It benefits from growing foreign investments and regional expansion of multinational companies. Limited local manufacturing capabilities create opportunities for international vendors to strengthen presence. Infrastructure challenges and economic volatility restrain faster adoption, but modernization efforts are improving the outlook. Latin America’s increasing focus on advanced manufacturing drives gradual but steady market development.

Middle East & Africa

The Middle East & Africa represents 6% of the Micro-Manufacturing Equipment Market in 2024, showing gradual adoption across emerging industries. Gulf countries, including the UAE and Saudi Arabia, invest in advanced manufacturing as part of economic diversification strategies. It supports adoption in healthcare and aerospace sectors that demand high-precision solutions. Africa shows early adoption in South Africa and Egypt, where healthcare and industrial modernization drive growth. Limited technical expertise and capital investment remain challenges but ongoing government initiatives encourage expansion. Rising demand for medical devices and industrial equipment positions the region for steady future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nanoscribe GmbH

- Hitachi High-Tech Corporation

- KUKA AG

- FANUC

- ARBURG GmbH + Co KG

- Matsuura Machinery

- Coherent Corp

- Hikari Kikai Seisakusho Co Ltd

- ASML

- Applied Materials

Competitive Analysis

The competitive landscape of the Micro-Manufacturing Equipment Market is shaped by leading players such as Applied Materials, ARBURG GmbH + Co KG, ASML, Coherent Corp, FANUC, Hikari Kikai Seisakusho Co Ltd, Hitachi High-Tech Corporation, KUKA AG, Matsuura Machinery, and Nanoscribe GmbH. These companies focus on delivering advanced equipment tailored for precision manufacturing in medical devices, electronics, aerospace, and automotive industries. They emphasize innovation in automation, robotics, photolithography, and micro 3D printing to address the rising demand for miniaturized components. Strategic investments in R&D help enhance equipment accuracy, throughput, and adaptability to advanced materials such as composites and biocompatibles. Many players expand their presence in Asia-Pacific, capitalizing on the booming electronics and semiconductor industries, while maintaining strong bases in North America and Europe. Partnerships with research institutions and large-scale manufacturers enable them to strengthen technological capabilities. Competitive intensity remains high as companies balance cost efficiency with advanced features, pushing continuous innovation and global expansion to secure market leadership in the evolving precision manufacturing landscape.

Recent Developments

- In March 2025, Hitachi High‑Tech Corporation completed and began operation at a new semiconductor equipment production facility for etch systems. The facility, located in Kasado, Yamaguchi Prefecture, had been under construction since December 2023.

- In 2025, The ALLROUNDER 475 V will have its world premiere at the K 2025 trade fair. It boasts high energy efficiency, a small installation area and an attractive price/performance ratio.

- In August 2023, Shanghai Micro Electronics Equipment Group announced the launch of 28 nm immersion lithography machine and the first domestically produced SSA/800-10W lithography machin

Report Coverage

The research report offers an in-depth analysis based on Type, Process Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for miniaturized components across industries.

- Medical devices and healthcare will remain a primary driver of advanced equipment adoption.

- Electronics and semiconductor sectors will accelerate demand for micro-scale precision tools.

- Automation, robotics, and AI integration will enhance efficiency and reduce errors.

- Additive manufacturing at the micro scale will gain prominence for prototyping and production.

- Emerging economies will create new opportunities through industrialization and government support.

- Aerospace and automotive sectors will adopt equipment for lightweight and efficient components.

- High investment in R&D will drive innovations in materials and manufacturing processes.

- Skilled workforce development will be critical to manage complex systems effectively.

- Global players will strengthen market positions through collaborations, acquisitions, and regional expansion.