Market Overview

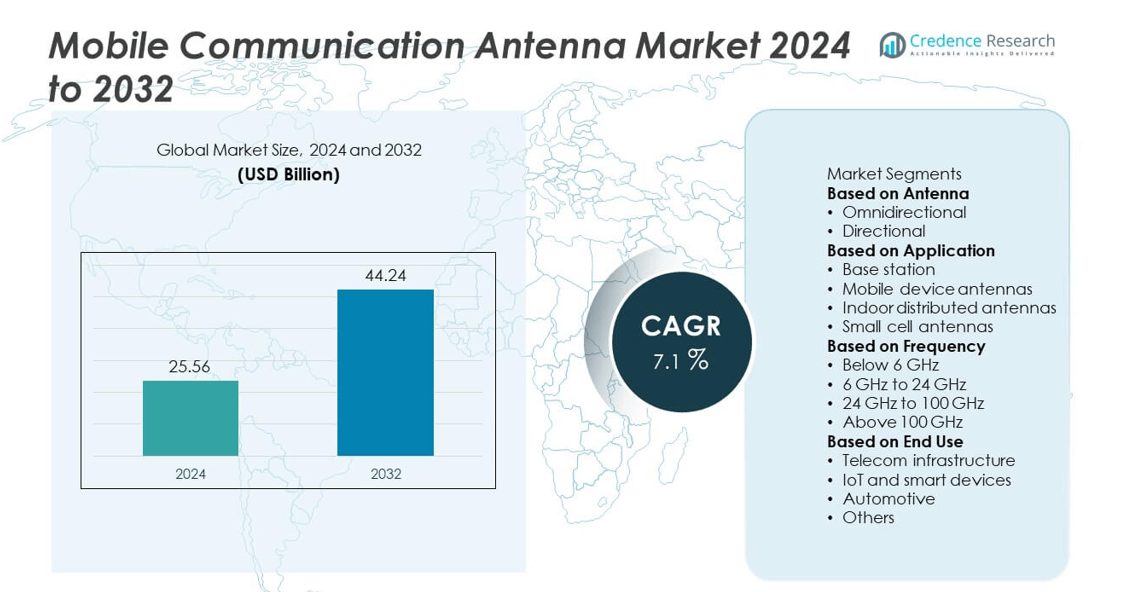

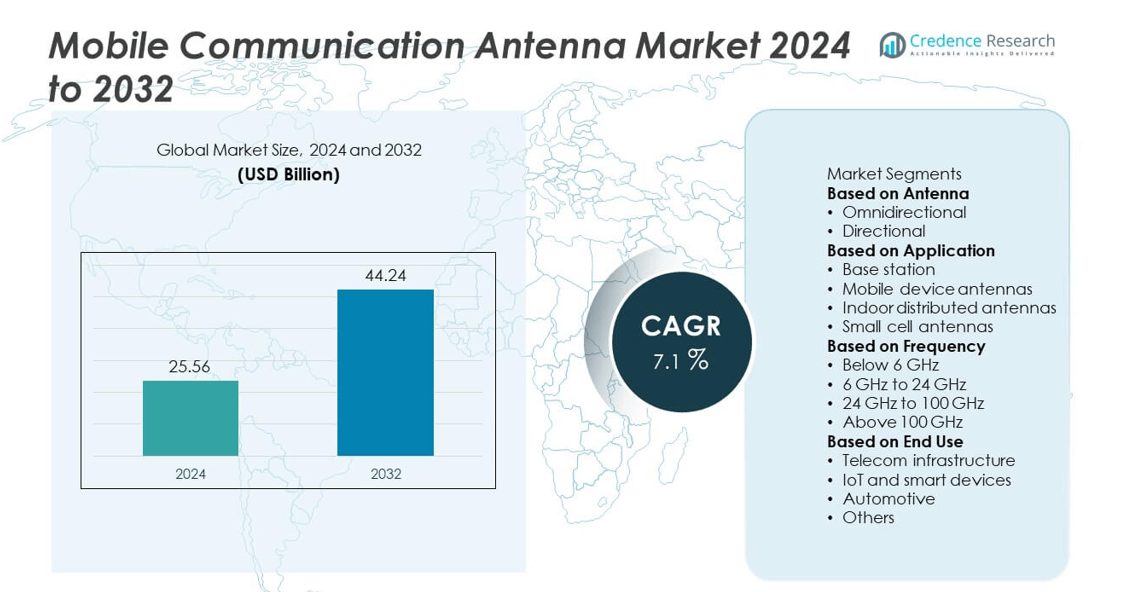

Mobile Communication Antenna Market size was valued at USD 25.56 billion in 2024 and is projected to reach USD 44.24 billion by 2032, growing at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mobile Communication Antenna Market Size 2024 |

USD 25.56 billion |

| Mobile Communication Antenna Market, CAGR |

7.1% |

| Mobile Communication Antenna Market Size 2032 |

USD 44.24 billion |

The Mobile Communication Antenna Market grows through rising demand for high-speed connectivity, rapid 5G deployment, and expanding IoT applications. Telecom operators invest in advanced antenna technologies such as massive MIMO, beamforming, and small cells to manage increasing data traffic.

The Mobile Communication Antenna Market demonstrates strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads through advanced telecom infrastructure, widespread 5G adoption, and robust R&D capabilities. Europe shows steady growth driven by smart city initiatives, sustainable network deployment, and stringent regulatory standards. Asia-Pacific experiences rapid expansion due to high population density, urbanization, and massive investments in 5G networks across China, India, and Japan. Latin America and the Middle East & Africa witness gradual adoption, supported by infrastructure modernization and increasing mobile connectivity demand. Key players shaping the market include Ericsson, Huawei, Nokia, and CommScope, which invest heavily in innovative antenna solutions, multi-band technologies, and energy-efficient designs. Their global deployment strategies and technological advancements strengthen network coverage, optimize data transmission, and enhance overall communication reliability, positioning them as leaders in next-generation mobile communication infrastructure.

Market Insights

- The Mobile Communication Antenna Market was valued at USD 25.56 billion in 2024 and is projected to reach USD 44.24 billion by 2032, growing at a CAGR of 7.1%.

- Rising demand for reliable and high-speed mobile connectivity drives the market. Telecom operators invest in advanced antenna solutions to support 5G rollout and network expansion.

- Adoption of multi-band, smart, and compact antennas trends strongly. It supports urban and rural network coverage, reduces power consumption, and enhances data transmission efficiency.

- Companies like Ericsson, Huawei, Nokia, and CommScope dominate the market. They focus on innovation, global deployment strategies, and energy-efficient antenna technologies.

- High installation costs, complex regulatory approvals, and spectrum allocation challenges restrain growth. It limits rapid deployment in developing regions and delays large-scale projects.

- North America leads due to advanced telecom infrastructure and 5G adoption. Europe grows steadily with smart city projects, while Asia-Pacific shows rapid expansion from urbanization and large-scale network investments.

- Opportunities exist in emerging markets, IoT integration, and network densification. Mobile Communication Antenna Market benefits from increasing mobile subscriptions, digital transformation initiatives, and demand for energy-efficient network solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for High-Speed Connectivity and Data Traffic Management

The Mobile Communication Antenna Market expands with the rising need for high-speed connectivity. Increasing mobile data traffic from video streaming, social media, and cloud services drives adoption. Telecom operators deploy advanced antennas to manage higher network loads effectively. Antennas support seamless coverage and reduce latency in high-density areas. Consumers demand uninterrupted connectivity across urban and rural regions, reinforcing upgrades in infrastructure. It ensures antennas remain critical for sustaining modern communication demands.

- For instance, In March 2025, Ericsson, Qualcomm, and NBN Co successfully completed a live field trial in Australia, achieving 5G mmWave coverage over a distance of 14 km. The trial delivered download speeds exceeding 1 Gbps across that range using commercial software and hardware, including Ericsson’s mmWave integrated radio and a Qualcomm Fixed Wireless Access test device.

Rapid Deployment of 5G Infrastructure and Network Modernization

The Mobile Communication Antenna Market grows through accelerated 5G deployment worldwide. Governments and operators invest in new-generation networks to support faster speeds and massive device connections. Advanced antenna technologies such as MIMO and beamforming improve network efficiency. Operators modernize legacy infrastructure to align with evolving customer expectations. Expansion into smart cities and industrial IoT applications further strengthens antenna demand. It places antennas at the core of next-generation communication systems.

- For instance, in February 2025, Huawei deployed its FDD tri-band Massive MIMO antenna across Europe, integrating 1.8 GHz, 2.1 GHz, and 2.6 GHz bands in a single unit. The system delivers 64T64R support and peak throughput exceeding 4.2 Gbps, accelerating urban 5G rollout and backward compatibility with LTE.

Expansion of IoT Devices and Smart Applications

The Mobile Communication Antenna Market benefits from the rapid increase of IoT-enabled devices. Smart homes, connected vehicles, and industrial automation require reliable antenna integration. Rising adoption of wearables and smart sensors intensifies network demand. Antennas ensure stable connectivity for billions of devices across varied applications. Enterprises deploy antennas in private networks to enhance performance and security. It highlights antennas as enablers of seamless IoT ecosystems.

Growing Investments in Rural Coverage and Emerging Markets

The Mobile Communication Antenna Market advances with strong investments in rural and underserved regions. Operators expand infrastructure to close the digital divide and increase mobile penetration. Governments support initiatives to extend broadband connectivity in remote areas. Antenna manufacturers develop cost-efficient designs for wide-area coverage. Growing smartphone adoption in emerging economies accelerates demand for robust networks. It supports long-term opportunities by ensuring inclusive access to mobile communication services.

Market Trends

Adoption of Advanced Antenna Technologies for 5G Networks

The Mobile Communication Antenna Market shows a strong trend toward advanced technologies. Massive MIMO, beamforming, and small-cell antennas support higher speeds and reduced latency. Telecom operators adopt these solutions to handle rising data consumption and connected devices. These technologies enhance spectrum efficiency and improve user experience in dense urban areas. Vendors focus on designing compact, high-performance models to suit diverse environments. It ensures antennas remain vital to achieving 5G’s full potential.

- For instance, in 2025, Huawei commercially launched its FDD tri-band Massive MIMO solution, enabling the integrated deployment of the 1.8 GHz, 2.1 GHz, and 2.6 GHz frequency bands.

Growing Integration of Antennas in Smart Devices and Applications

The Mobile Communication Antenna Market evolves with expanding use in consumer and industrial devices. Smartphones, wearables, and connected vehicles require sophisticated antenna designs for seamless performance. Industrial automation and healthcare IoT solutions also strengthen this demand. Manufacturers develop multi-band and miniaturized antennas to meet diverse application needs. Growth in AR, VR, and smart appliances further reinforces innovation in antenna technology. It highlights the role of antennas in enabling connected ecosystems.

- For instance, In 2025, Qualcomm announced its X85 5G Modem-RF system at Mobile World Congress (MWC), integrating AI-based antenna tuning and supporting up to 6 embedded antennas for smartphones. It features a peak download speed of 12.5 Gbps and a peak uplink speed of 3.7 Gbps. The X85 modem also powers the Dragonwing Fixed Wireless Access (FWA) platform.

Expansion of Small Cell Infrastructure for Network Densification

The Mobile Communication Antenna Market benefits from investments in small cell networks. Operators deploy these solutions to improve coverage and capacity in high-traffic zones. Small cells address gaps in urban connectivity where traditional towers are less effective. They support improved service quality for mobile broadband and 5G applications. Antenna vendors design solutions that combine compact size with high efficiency. It accelerates the rollout of dense, high-capacity networks worldwide.

Focus on Energy Efficiency and Sustainable Antenna Designs

The Mobile Communication Antenna Market advances with rising emphasis on energy-efficient designs. Operators and manufacturers target reduced power consumption to lower operational costs. Sustainable materials and eco-friendly production methods gain importance in antenna development. Innovations focus on reducing carbon impact while maintaining performance standards. Integration of renewable energy support in network sites further enhances sustainability. It positions antennas as essential components of greener telecommunication infrastructure.

Market Challenges Analysis

High Infrastructure Costs and Complex Deployment Requirements

he Mobile Communication Antenna Market faces challenges linked to high infrastructure investment and deployment complexity. Operators must allocate significant capital to upgrade or expand antenna networks, particularly for 5G and small-cell installations. Dense urban environments require customized solutions that increase costs and lengthen deployment timelines. Rural and remote areas demand broader coverage, yet low population density limits profitability. Regulatory approvals and zoning restrictions further slow installation. It creates financial and operational barriers for both established operators and new entrants.

Performance Limitations and Technical Barriers in Advanced Networks

The Mobile Communication Antenna Market encounters difficulties with performance optimization and technical constraints. Advanced technologies such as massive MIMO and beamforming demand precise calibration to function effectively. Interference issues and spectrum limitations often reduce efficiency in real-world environments. Miniaturization to fit modern devices introduces trade-offs in signal strength and coverage. Manufacturers struggle to balance performance, size, and cost without compromising reliability. It highlights the need for continuous innovation to overcome adoption challenges in high-performance networks.

Market Opportunities

Expansion Through 5G Rollouts and Emerging Technologies

The Mobile Communication Antenna Market presents strong opportunities through global 5G rollouts and adoption of emerging technologies. Telecom operators invest heavily in infrastructure to support faster speeds and ultra-low latency. Advanced antennas designed for massive MIMO and beamforming provide scalable solutions to meet growing demand. Integration with smart city projects, autonomous vehicles, and industrial IoT expands new use cases. Vendors that focus on compact, high-performance antennas can capture a significant share of these deployments. It positions antennas as central to the digital transformation of multiple industries.

Growth Potential in Underserved and Rural Regions

The Mobile Communication Antenna Market also benefits from untapped potential in rural and underserved areas. Governments and private players invest in connectivity projects to close the digital divide. Antenna manufacturers are developing cost-effective solutions that ensure wide-area coverage in challenging terrains. Expanding smartphone penetration and demand for reliable broadband accelerate rural adoption. Opportunities also arise from initiatives promoting universal internet access in emerging economies. It supports long-term revenue growth while enhancing global connectivity.

Market Segmentation Analysis:

By Antenna

The Mobile Communication Antenna Market divides into microstrip antennas, loop antennas, array antennas, and others. Microstrip antennas dominate due to their compact size, low cost, and suitability for mobile devices. Loop antennas gain steady use in portable applications where space constraints exist. Array antennas hold significant importance in advanced communication networks, supporting massive MIMO and beamforming for 5G systems. These antennas enable high capacity and low latency across urban and dense environments. Other antenna types cater to specialized applications, ensuring wide flexibility across industries. It reinforces the importance of diversified antenna designs in meeting dynamic connectivity demands.

- For instance, in August 2025, ZTE deployed its HP 8T8R UBR array antenna, supporting 8 × 120W RF chains across dual FDD bands (1800 MHz and 2100 MHz), enabling full-band load balancing and 5G+LTE co-coverage with sector peak throughput exceeding 3.9 Gbps.

By Application

The Mobile Communication Antenna Market demonstrates wide applications across smartphones, laptops, tablets, IoT devices, and automotive systems. Smartphones remain the leading category, driving consistent demand for compact and high-performance antennas. Rising adoption of connected vehicles enhances the role of antennas in automotive communication systems. IoT devices in healthcare, industrial automation, and smart homes require reliable integration, expanding opportunities. Laptops and tablets adopt advanced antennas to ensure seamless wireless connectivity. It highlights the critical role of antennas in enabling continuous digital interaction across consumer and industrial ecosystems.

- For instance, CommScope’s ERA® Digital DAS, designed for large venues, supports wireless coverage across a range from 30,000 up to several million square feet using fully digital nodes and IT-standard cabling. It handles multi-operator 4G and 5G connectivity with flexible scalability

By Frequency

The Mobile Communication Antenna Market operates across low-frequency, medium-frequency, and high-frequency ranges. Low-frequency antennas ensure wide coverage and strong penetration in rural and suburban regions. Medium-frequency bands balance speed and coverage, making them essential for nationwide 4G and 5G deployments. High-frequency antennas, including millimeter-wave, support ultra-fast data transfer in dense urban areas. These frequencies enable advanced use cases such as AR, VR, and autonomous driving. Vendors design antennas capable of multi-band support to provide flexibility and reduce infrastructure complexity. It ensures antennas remain adaptive to evolving spectrum strategies and technology upgrades.

Segments:

Based on Antenna

- Omnidirectional

- Directional

Based on Application

- Base station

- Mobile device antennas

- Indoor distributed antennas

- Small cell antennas

Based on Frequency

- Below 6 GHz

- 6 GHz to 24 GHz

- 24 GHz to 100 GHz

- Above 100 GHz

Based on End Use

- Telecom infrastructure

- IoT and smart devices

- Automotive

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Mobile Communication Antenna Market, accounting for 33% in 2024. The region benefits from advanced telecommunication infrastructure and rapid adoption of 5G networks. The United States leads with strong investments from major telecom operators expanding coverage across urban and rural areas. Canada follows with steady demand driven by increasing smartphone penetration and government-backed digital connectivity initiatives. High usage of smart devices, IoT platforms, and connected vehicles further drives antenna deployment. The presence of leading technology providers and research hubs supports innovation in antenna design and performance. It secures North America’s role as a global leader in next-generation antenna technologies.

Europe

Europe represents the second-largest region in the Mobile Communication Antenna Market, with a 29% share in 2024. Countries such as Germany, the United Kingdom, and France lead adoption with heavy investments in 5G infrastructure. The European Union emphasizes spectrum efficiency, network security, and sustainable infrastructure, shaping antenna deployment strategies. Rising use of smart city technologies, connected healthcare systems, and industrial IoT expands demand across the region. Strong focus on green energy and sustainable telecom operations encourages manufacturers to design energy-efficient antenna solutions. Eastern Europe shows steady growth as operators modernize legacy infrastructure to support faster connectivity. It reinforces Europe’s competitive position in mobile communication technology adoption.

Asia-Pacific

Asia-Pacific accounts for 26% of the Mobile Communication Antenna Market in 2024 and emerges as the fastest-growing region. China, Japan, South Korea, and India are key contributors with large-scale investments in 5G rollouts and IoT adoption. Rising smartphone penetration and urbanization create a strong need for high-capacity antenna networks. Local manufacturers develop cost-effective antenna solutions, improving affordability and accessibility. Government initiatives promoting digital infrastructure and smart industries fuel rapid market expansion. Strong adoption of connected vehicles, industrial automation, and digital healthcare adds further momentum. It positions Asia-Pacific as a critical hub for production, deployment, and innovation in mobile communication antennas.

Latin America

Latin America contributes 7% share to the Mobile Communication Antenna Market in 2024. Brazil and Mexico dominate with increasing demand for improved mobile coverage and internet access. Government programs supporting digital inclusion initiatives drive investments in telecom infrastructure. Expansion of e-commerce, digital banking, and mobile entertainment strengthens antenna adoption. Local challenges such as uneven infrastructure and economic constraints limit growth in some countries. Operators address these challenges through partnerships with global vendors and cost-effective antenna deployments. It creates a favorable outlook for steady expansion across urban and semi-urban markets.

Middle East & Africa

The Middle East & Africa region holds 5% of the Mobile Communication Antenna Market in 2024. Gulf countries such as the UAE and Saudi Arabia lead with strong investments in 5G and smart city projects. Africa shows gradual adoption supported by mobile-first economies and rising smartphone penetration. Governments invest in digital infrastructure to expand broadband connectivity across underserved regions. Demand for antennas grows in healthcare, education, and financial services enabled through mobile platforms. Limited local manufacturing capabilities create dependency on imports, but rising investments offer growth opportunities. It positions the region as an emerging market with strong potential for long-term development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Qualcomm

- Huawei

- Alpha Wireless

- Ericsson

- PCTEL

- ZTE

- Nokia

- Amphenol

- CommScope

- Kathrein Mobile Communication

Competitive Analysis

Competitive landscape of the Mobile Communication Antenna Market is led by Alpha Wireless, Ericsson, Huawei, Nokia, CommScope, Amphenol, PCTEL, Qualcomm, ZTE, and Samsung. These players focus on technological innovation, strategic partnerships, and global deployment to strengthen their market positions. Companies invest in advanced antenna solutions such as multi-band, smart, and compact antennas to support 5G networks, improve coverage, and enhance data transmission efficiency. It drives differentiation through energy-efficient designs, lightweight materials, and enhanced durability. Strategic collaborations with telecom operators and governments enable faster network expansion and penetration in urban and rural areas. Leading players also adopt aggressive R&D programs to introduce next-generation antennas for IoT, MIMO, and small-cell applications. The market experiences high competition due to rapid technological evolution and increasing demand for reliable mobile connectivity. Companies prioritize cost optimization, network integration services, and localized manufacturing to maintain competitiveness. Emerging markets and large-scale infrastructure projects further intensify competition, encouraging continuous innovation and customized solutions. The focus on scalability, interoperability, and compliance with global standards remains central to sustaining leadership in the Mobile Communication Antenna Market.

Recent Developments

- In February 2025, KT and Nokia successfully validated ultra-high-density antenna technology for 6G at 7 GHz in Finland. This next-gen antenna uses more elements than 5G, enabling higher transmission speeds through beamforming and multiplexing multiple data streams.

- In June 2024, Vodafone and Ericsson introduced compact antenna technology to enhance Germany’s 5G network, tackling the challenge of limited rooftop space for new installations. The rollout began in Dusseldorf, with plans to deploy 500 antennas by the end of 2026.

- In May 2024, Verizon announced a strategic partnership with AST SpaceMobile, to target 100% coverage of the continental US on premium 850 MHz spectrum, with two major US mobile operators to provide direct-to-cellular connectivity

Report Coverage

The research report offers an in-depth analysis based on Antenna, Application, Frequency, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced antennas will grow with global 5G expansion and network densification.

- Massive MIMO and beamforming technologies will become standard in next-generation deployments.

- Energy-efficient and sustainable antenna designs will gain higher priority among operators.

- Integration of antennas in IoT, smart devices, and connected vehicles will accelerate.

- Small cell infrastructure will expand to improve coverage in dense urban environments.

- Asia-Pacific will remain the fastest-growing region due to rapid digitalization and urbanization.

- Strategic alliances between telecom operators and antenna manufacturers will drive innovation pipelines.

- High-frequency antennas will see greater adoption for AR, VR, and autonomous systems.

- Rural and underserved regions will create growth opportunities through government connectivity programs.

- Continuous R&D investment will focus on compact, multi-band solutions for diverse applications.