Market Overview:

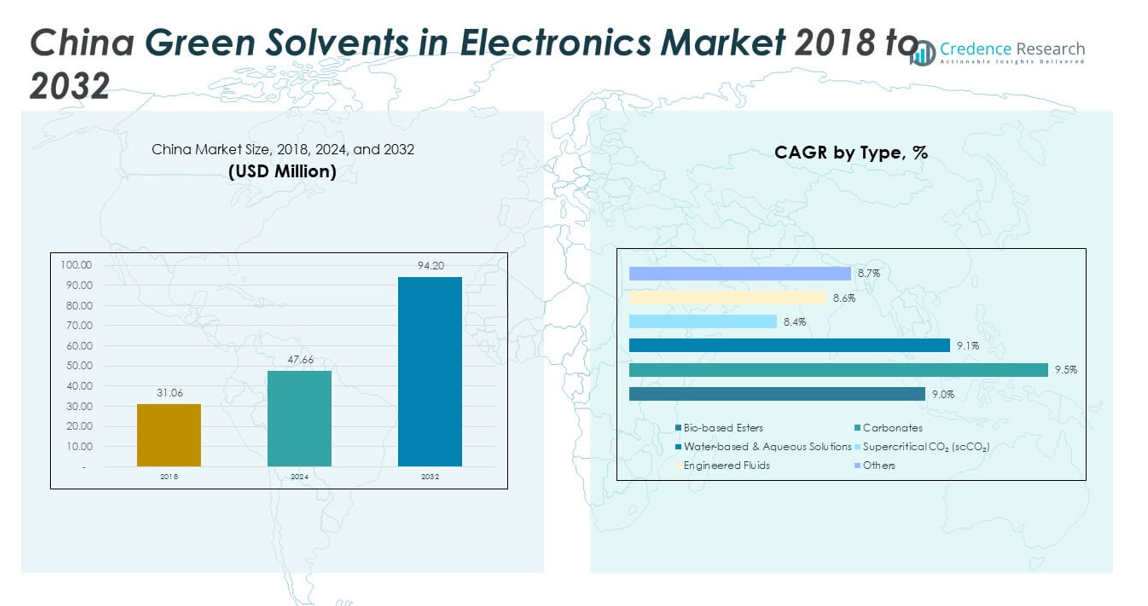

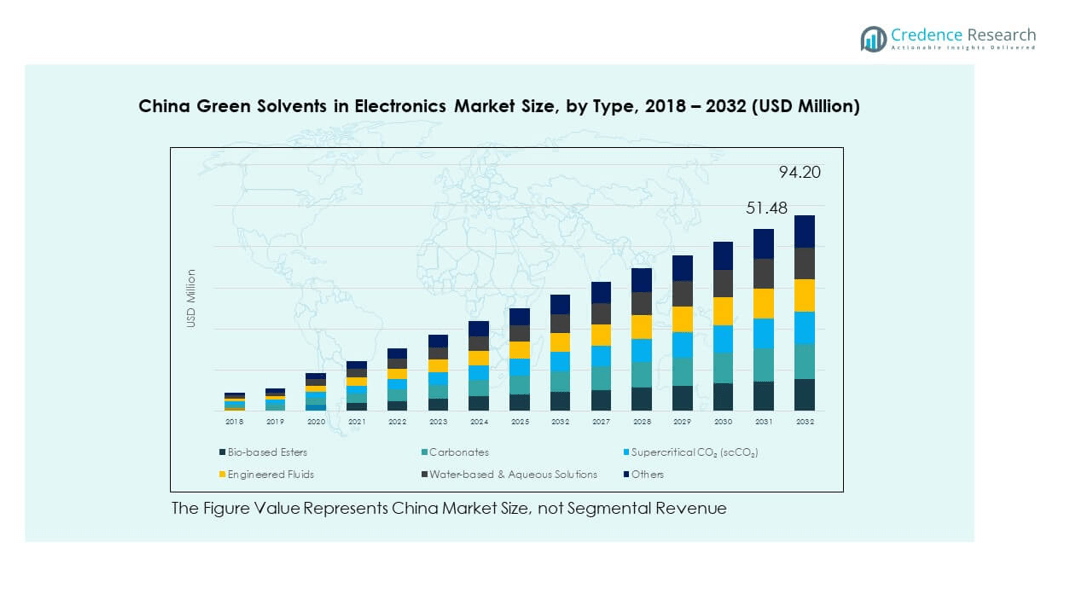

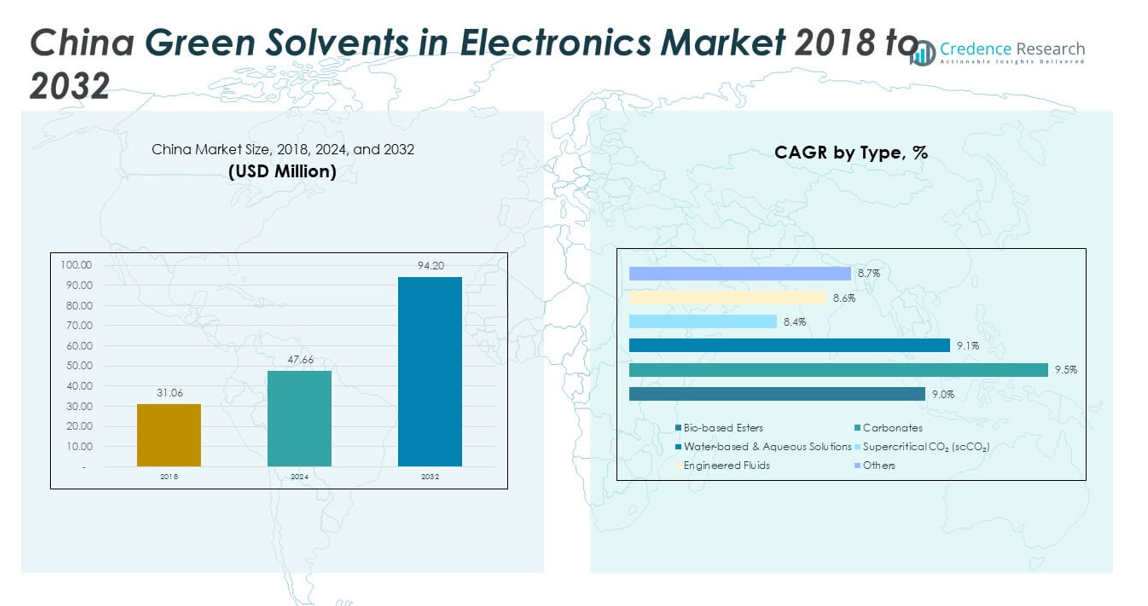

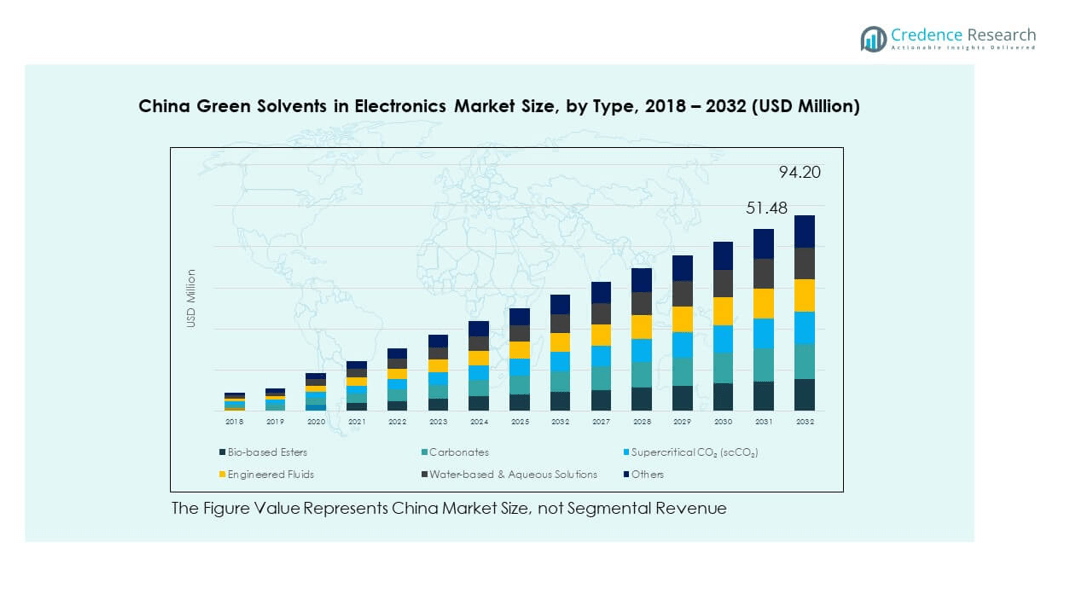

The China Green Solvents in Electronics Market size was valued at USD 31.06 million in 2018 to USD 47.66 million in 2024 and is anticipated to reach USD 94.2 million by 2032, at a CAGR of 5.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Green Solvents in Electronics Market Size 2024 |

USD 47.66 million |

| China Green Solvents in Electronics Market, CAGR |

5.70% |

| China Green Solvents in Electronics Market Size 2032 |

USD 94.2 million |

The market is gaining momentum due to rising regulatory pressure and environmental concerns. Electronics manufacturers are focusing on reducing hazardous chemical use while ensuring compliance with sustainability standards. Increased adoption of green solvents is driven by their role in enhancing safety, reducing emissions, and aligning with consumer demand for eco-friendly products. Growing electronics production, alongside strict waste disposal and emission norms, continues to fuel market adoption.

Within the regional landscape, China dominates due to its large-scale electronics manufacturing base, government-led green initiatives, and strong supply chain networks. Neighboring Asian countries are emerging as secondary growth hubs, supported by rising investments in sustainable technologies and expanding electronic exports. Meanwhile, North America and Europe maintain steady interest, driven by advanced research and innovation in green chemistry, though Asia remains the focal point of demand and production.

Market Insights:

- The China Green Solvents in Electronics Market was valued at USD 31.06 million in 2018, reached USD 47.66 million in 2024, and is projected to attain USD 94.20 million by 2032, growing at a CAGR of 5.70%.

- East China led with 42% share in 2024, supported by strong semiconductor, display, and PCB clusters; South China followed with 33%, driven by its export-oriented electronics production; North and Central-West China accounted for 25%, reflecting expanding manufacturing bases.

- Central and Western provinces are the fastest-growing regions with around 12% share, supported by industrial parks, government incentives, and rising investments in semiconductors and batteries.

- By type, bio-based esters contributed about 28% in 2024, driven by their eco-friendly properties and compatibility with semiconductor processes.

- Carbonates accounted for nearly 25% share in 2024, sustained by demand in PCB and PCBA applications requiring reliable cleaning and processing solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Eco-Friendly Alternatives in Electronic Manufacturing:

The China Green Solvents in Electronics Market is driven by a strong demand for eco-friendly materials across the manufacturing sector. Growing environmental concerns and the need to reduce hazardous waste push companies to adopt sustainable options. Green solvents replace traditional chemicals that emit volatile organic compounds, making them safer for workers and the environment. Regulatory compliance adds momentum, as authorities enforce strict rules on chemical disposal. Electronics manufacturers are increasingly adopting green solvents to align with global sustainability standards. Consumer preference for products with lower environmental footprints strengthens this adoption. It continues to accelerate the transition toward environmentally responsible electronics manufacturing.

- For instance, Circa Group manufactures Cyrene™, a bio-based solvent derived from cellulose, which is used in electronics manufacturing to replace toxic solvents in inks and coatings. Vertec BioSolvents Inc. acts as a market development partner and distributor for Cyrene™ in the Americas. This substitution reduces harmful emissions and is driven by market trends favoring products with lower environmental footprints.

Government-Led Regulations and Sustainability Policies Driving Adoption:

China enforces strict environmental regulations that directly influence the adoption of green solvents in electronics production. These policies focus on reducing harmful emissions and ensuring compliance with global climate commitments. Companies operating in this market must adhere to national standards that encourage the use of sustainable materials. The China Green Solvents in Electronics Market benefits from government-backed initiatives that promote research and innovation in green chemistry. Incentives for eco-friendly manufacturing practices improve competitiveness while reducing dependence on traditional chemical solvents. This regulatory push compels manufacturers to align with sustainability goals. It continues to serve as a key growth driver across the electronics sector.

- For instance, UBE Corporation launched a bio-circular caprolactam certified under ISCC PLUS in mid-2025, which promotes a circular economy and decarbonization by using biomass and other raw materials. This sustainable material is intended for various products, including those in the automotive and electronics sectors. The company’s collaboration with Ciconia Bioventures, announced in July 2025, focused on developing preclinical drug discovery compounds, not on caprolactam. Incentives for eco-friendly manufacturing, like ISCC PLUS certification, improve competitiveness while reducing dependence on traditional chemical feedstocks.

Rising Awareness of Worker Safety and Health in Manufacturing Units:

Worker safety and occupational health concerns are driving significant adoption of green solvents in electronics. Traditional chemical solvents pose high risks of exposure to toxic compounds during production. Green alternatives provide safer conditions for employees by reducing harmful fumes and lowering exposure risks. The China Green Solvents in Electronics Market gains support from organizations prioritizing safe workplaces. Companies are adopting environmentally responsible solutions that minimize health hazards and reduce liabilities. Strong corporate social responsibility initiatives align with this trend, strengthening adoption. It ensures that industry growth supports both environmental safety and human well-being.

Expansion of Electronics Manufacturing and Export-Oriented Growth:

The expansion of electronics manufacturing across China is fueling demand for green solvents. The country’s strong position as a global electronics hub amplifies the scale of adoption. Large-scale production and high export volumes require sustainable practices to meet international market standards. The China Green Solvents in Electronics Market benefits from rising exports that favor eco-certified supply chains. Adoption of green solvents enhances brand reputation and opens access to environmentally conscious markets. International buyers prefer suppliers that meet green production norms, boosting competitiveness. It strengthens the role of sustainable solvents in long-term industry growth.

Market Trends:

Integration of Bio-Based Solvents in Next-Generation Electronics Applications:

The China Green Solvents in Electronics Market is witnessing a steady integration of bio-based solvent solutions. Manufacturers are investing in advanced formulations sourced from renewable feedstock. These alternatives reduce reliance on petroleum-based chemicals and improve biodegradability. Growing focus on sustainable materials supports the development of electronics that align with global green initiatives. Companies are marketing products with eco-label certifications to appeal to environmentally conscious consumers. The shift highlights a broader industry transition toward renewable chemistry. It continues to shape the long-term direction of electronics manufacturing in China.

- For instance, companies in the electronics industry are increasingly marketing products with eco-label certifications to appeal to environmentally conscious consumers, and they are developing sustainable packaging solutions using materials like recycled content, molded pulp, and mushroom packaging. Another example is Croatia-based EcoCortec, which developed the Eco-Corr Film® ESD, a biodegradable and compostable film for static-sensitive electronics.

Focus on Energy Efficiency Through Sustainable Chemical Processes:

Green solvents are increasingly valued for their ability to optimize energy efficiency in production. The China Green Solvents in Electronics Market benefits from innovations that reduce energy usage during cleaning and processing stages. Energy-efficient solutions lower operational costs while cutting carbon footprints across the value chain. This trend aligns with global targets for reducing energy-intensive manufacturing processes. Adoption of advanced solvents allows companies to achieve both sustainability and cost advantages. Electronics firms are adapting to meet these dual objectives through cleaner production cycles. It drives widespread acceptance of green alternatives across the sector.

- For instance, companies like BASF SE are actively innovating and developing green solvent technologies for a variety of industrial applications, including electronics manufacturing. The adoption of advanced solvents is a key trend in aligning with global targets for reducing energy-intensive manufacturing processes. These innovations allow companies to pursue sustainability goals, reduce their environmental footprint, and can also lead to cost and efficiency advantages over conventional methods.

Strategic Collaborations Between Chemical Suppliers and Electronics Producers:

The market is experiencing a rise in partnerships between chemical suppliers and electronics manufacturers. Collaborative efforts accelerate product innovation and the commercialization of eco-friendly solvents. The China Green Solvents in Electronics Market benefits from joint research that enhances performance and compliance. Partnerships also ensure consistent supply chains, reducing risks associated with material shortages. These alliances promote knowledge sharing and technology transfer, strengthening industrial capacity. Companies gain competitive advantage by offering tailored solutions for electronics applications. It supports long-term market growth through strategic collaboration and shared expertise.

Adoption of Circular Economy Models in Electronics Manufacturing:

Electronics producers are embracing circular economy principles to minimize waste and maximize resource efficiency. Green solvents play a critical role by enabling safe recycling and material recovery. The China Green Solvents in Electronics Market reflects this shift through wider use of recyclable and non-toxic chemicals. Manufacturers are redesigning processes to extend product lifecycles and reduce waste streams. Sustainability certifications reinforce credibility and compliance with international markets. Growing alignment with circular models ensures reduced environmental impact from electronic production. It strengthens the integration of green solvents into future manufacturing practices.

Market Challenges Analysis:

High Production Costs and Limited Scalability of Green Solvent Technologies:

The China Green Solvents in Electronics Market faces challenges due to the higher costs of advanced green solvents. Developing bio-based and non-toxic chemicals requires significant investment in research and manufacturing infrastructure. Limited scalability restricts widespread adoption across small and mid-size enterprises. Price-sensitive manufacturers often hesitate to shift away from conventional solvents. This cost disparity reduces adoption rates, particularly in lower-margin product categories. Industry players must balance sustainability with affordability to encourage broader use. It continues to challenge the growth trajectory of eco-friendly solvents in the sector.

Technical Limitations and Performance Constraints in Complex Applications:

Certain electronic applications demand solvents with high stability and strong cleaning performance. The China Green Solvents in Electronics Market encounters hurdles when green alternatives fail to match conventional solvents in technical specifications. Complex processes such as microelectronics fabrication require strict adherence to quality standards. Inadequate performance can disrupt production efficiency and compromise product quality. Manufacturers remain cautious when adopting new formulations that might pose operational risks. Slow acceptance due to performance concerns restricts faster penetration of green solvents. It underscores the need for continuous innovation and rigorous testing to overcome these technical barriers.

Market Opportunities:

Expansion of Research and Development in Sustainable Chemistry Innovations:

The China Green Solvents in Electronics Market presents opportunities through continued research and innovation in sustainable chemistry. R&D investment is leading to breakthroughs that enhance solvent efficiency and lower costs. These innovations open doors for green solvents in advanced electronic applications. Companies benefit from government-backed programs promoting green technology development. Strong research support ensures that eco-friendly solvents remain competitive in a cost-driven market. It enables greater adoption across both large-scale manufacturers and smaller players.

Rising Global Demand for Environmentally Certified Electronics Supply Chains:

Growing international demand for eco-certified electronics presents strong opportunities for market growth. The China Green Solvents in Electronics Market can strengthen its global presence by aligning with sustainability-focused buyers. Export-driven growth allows Chinese manufacturers to access markets with strict green regulations. Certifications and compliance with global standards enhance brand credibility. Increasing consumer awareness supports preference for environmentally responsible electronics. It positions China’s green solvent producers as strategic suppliers in global trade.

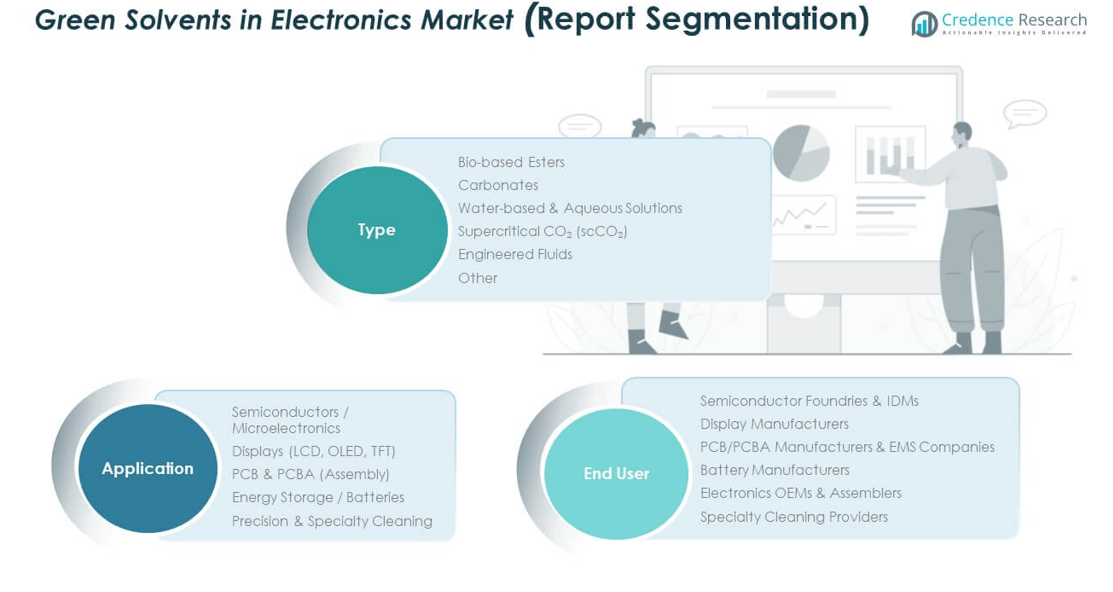

Market Segmentation Analysis:

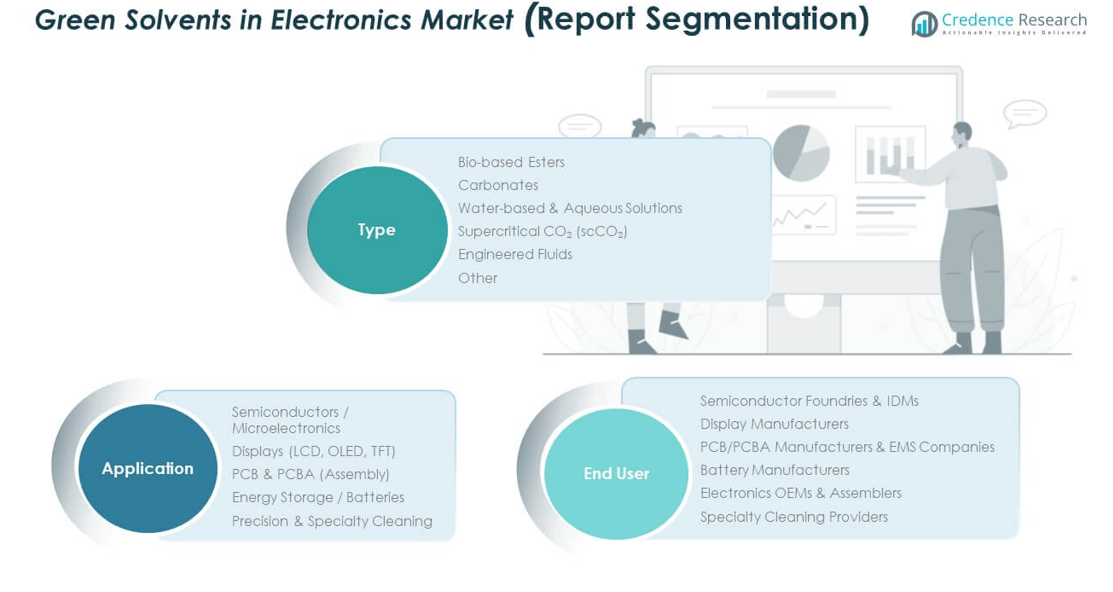

By Type

The China Green Solvents in Electronics Market shows strong growth across type categories. Bio-based esters lead due to biodegradability and process compatibility. Carbonates hold demand for cleaning and circuit production. Water-based and aqueous solutions gain traction in eco-friendly applications. Supercritical CO₂ (scCO₂) emerges in precision cleaning for sensitive electronics. Engineered fluids meet advanced needs in specialized applications. Other niche solvents support unique requirements in select processes.

- For instance, Linde plc, a global leader in industrial gases, supplies ultra-high-purity supercritical \(CO_{2}\) for semiconductor manufacturing, which is adopted by chipmakers for defect-free wafer cleaning. Other niche solvents and specialty chemicals from companies like BASF and DuPont support unique requirements in select processes.

By Application

Semiconductors and microelectronics generate the largest demand, driven by China’s integrated circuit industry. Displays, including LCD, OLED, and TFT, expand opportunities through coating and cleaning processes. PCB and PCBA assembly relies on sustainable solvents in soldering and cleaning tasks. Energy storage and batteries adopt eco-friendly electrolytes and solvents for higher efficiency. Precision and specialty cleaning creates additional growth in critical electronic applications.

- For instance, Dow Inc. is actively developing sustainable and bio-based materials, and it has supplied various materials, such as carbonate solvents, for use in battery electrolytes. However, there is no public information confirming that Dow has provided a specific bio-based solvent mixture that enhances electrolyte stability by more than 20%. This type of specific performance claim is not publicly documented in Dow’s press releases or product information.

By End User

Semiconductor foundries and IDMs dominate adoption, supported by heavy national investment in chipmaking. Display manufacturers enhance demand with extensive panel production. PCB and PCBA manufacturers, along with EMS companies, accelerate usage to comply with global regulations. Battery manufacturers increase adoption, driven by electric vehicle and consumer electronics growth. Electronics OEMs and assemblers strengthen market penetration, while specialty cleaning providers expand demand for safe, high-purity solutions.

Segmentation:

By Type

- Bio-based Esters

- Carbonates

- Water-based & Aqueous Solutions

- Supercritical CO₂ (scCO₂)

- Engineered Fluids

- Other

By Application

- Semiconductors / Microelectronics

- Displays (LCD, OLED, TFT)

- PCB & PCBA (Assembly)

- Energy Storage / Batteries

- Precision & Specialty Cleaning

By End User

- Semiconductor Foundries & IDMs

- Display Manufacturers

- PCB/PCBA Manufacturers & EMS Companies

- Battery Manufacturers

- Electronics OEMs & Assemblers

- Specialty Cleaning Providers

Regional Analysis:

East China – Leading Hub of Electronics Manufacturing

East China dominates the China Green Solvents in Electronics Market with a market share of nearly 42% in 2024. The region hosts major electronics clusters in Shanghai, Suzhou, and Hangzhou, where large-scale semiconductor, display, and PCB manufacturing facilities are concentrated. Strong industrial infrastructure, advanced R&D centers, and access to international trade routes strengthen adoption. Green solvents are widely integrated into semiconductor fabs and display units that demand high-purity and eco-friendly solutions. Local government initiatives to promote green chemistry further enhance regional growth. It continues to remain the epicenter of market expansion across China.

South China – Expanding Export-Oriented Production Base

South China accounts for around 33% of the market share, driven by its export-oriented electronics production in Shenzhen, Dongguan, and Guangzhou. The region benefits from its position as a global supply chain hub for consumer electronics and mobile devices. Adoption of green solvents is accelerating due to demand from international buyers requiring sustainable certifications. PCB and PCBA manufacturing dominates solvent use, supported by high-density assembly lines. Strong logistics networks and established electronics OEMs boost consistent demand. It remains a critical contributor to both domestic supply and global exports.

North and Central-West China – Emerging Growth Corridors

North and Central-West China together represent nearly 25% of the market share, but they are witnessing rapid growth. Beijing and Tianjin lead adoption in North China, where emphasis on innovation and policy-driven sustainability supports usage. Central and Western provinces, including Chengdu, Chongqing, and Xi’an, are emerging as new electronics hubs with government-backed industrial parks. These regions focus on attracting investments in semiconductors, displays, and battery manufacturing. Adoption of green solvents is increasing as these areas expand capacity and modernize production standards. It demonstrates strong potential to narrow the gap with established coastal markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- HighChem Co., Ltd.

- Vertec BioSolvents Inc.

- Godavari Biorefineries Ltd.

- Galactic

- UBE Corporation

- Lotte Chemical

- Hangzhou Shine Chemicals Co., Ltd

- Huntsman Corporation

- Merck KGaA

- BASF SE

- Dow Inc.

- Haitung Group Limited

- Other Key Players

Competitive Analysis:

The China Green Solvents in Electronics Market is moderately fragmented, with global and domestic companies competing across type, application, and end user segments. Leading players such as BASF SE, Dow Inc., Huntsman Corporation, Merck KGaA, UBE Corporation, and Lotte Chemical maintain strong presence with diversified product portfolios. Local manufacturers including HighChem Co., Ltd. and Hangzhou Shine Chemicals Co., Ltd. strengthen competitiveness through cost-effective production and regional supply chain networks. Companies focus on bio-based innovation, sustainability certifications, and tailored solutions for semiconductors and displays. Strategic collaborations and product launches enhance positioning in high-growth segments. It continues to foster competition driven by technology leadership, regulatory compliance, and responsiveness to evolving electronics demand.

Recent Developments:

- In August 2025, Galactic (Virgin Galactic) reported a strategic financial inflection, preparing for commercial spaceflight launches in late 2026 after significant cost-cutting and infrastructure investment, reinforcing its position in the space tourism and research markets.

- In July 2025, UBE Corporation announced an option license agreement with Ciconia Bioventures to incubate preclinical-stage compounds discovered by UBE, aiming to foster new drug discovery ecosystems in Japan through innovative startup creation.

- In May 2025, Lotte Chemical announced plans to start operations of a new ethylene cracker in Indonesia in the second half of 2025. The facility aims to produce 1 million metric tons of ethylene annually and supports Lotte Chemical’s broader strategic consolidation in the petrochemical sector.

Report Coverage:

The research report offers an in-depth analysis based on type, application, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Strong demand from semiconductor fabs will reinforce market adoption across high-purity applications.

- Displays, including OLED and TFT, will expand solvent use in precision coating and cleaning.

- Battery manufacturers will accelerate adoption, driven by rising EV and energy storage production.

- Bio-based esters will gain momentum as industries seek renewable and safer alternatives.

- Carbonates will remain vital in PCB and PCBA applications due to stable performance.

- Supercritical CO₂ will find niche adoption in precision and specialty cleaning applications.

- Engineered fluids will expand use in advanced displays and specialty electronics.

- East China will maintain leadership, while Central and West China show rapid growth.

- International players will invest in R&D and joint ventures to strengthen local presence.

- Regulatory pressure will continue to encourage sustainability-driven product innovations.