Market Overview

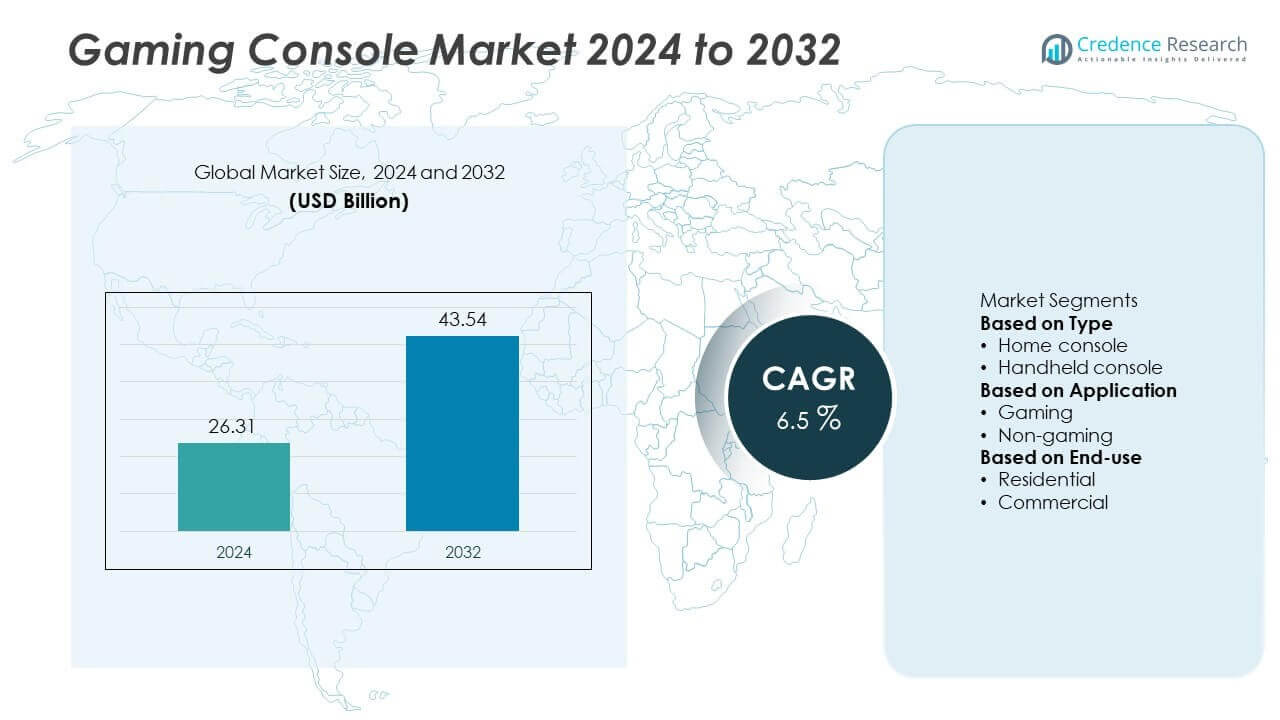

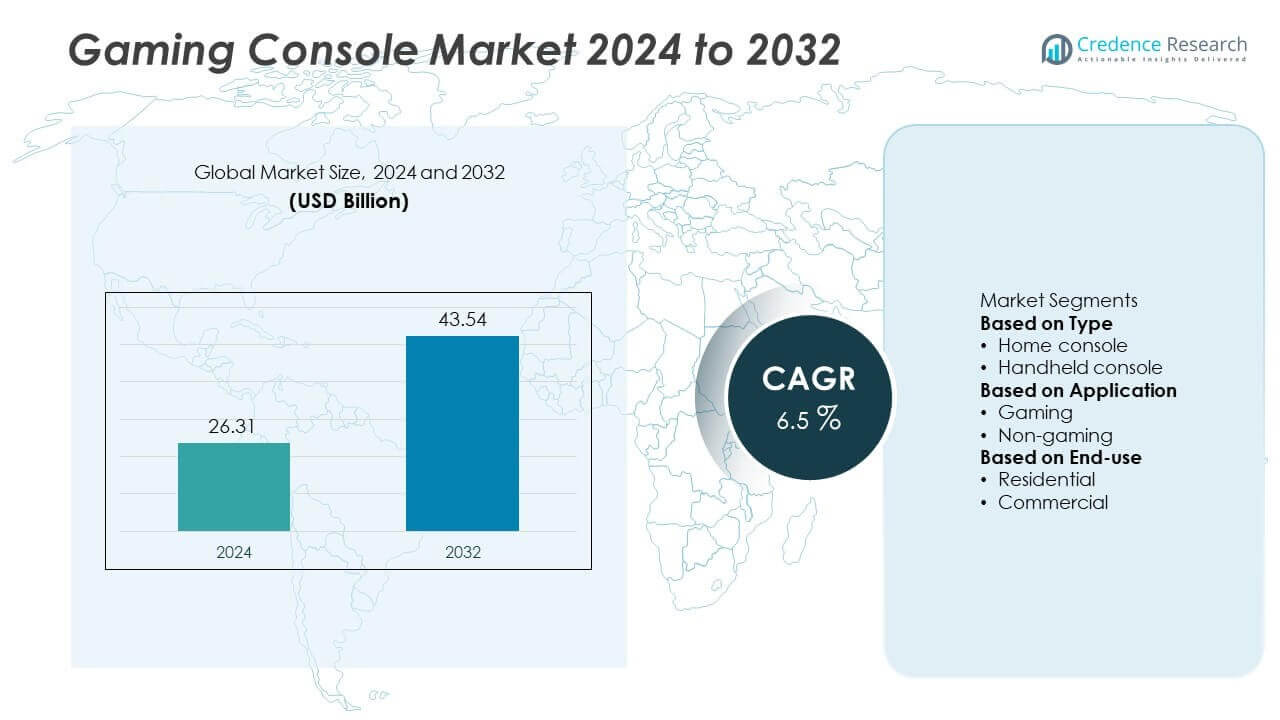

The Gaming Console Market was valued at USD 26.31 billion in 2024 and is projected to reach USD 43.54 billion by 2032, growing at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gaming Console Market Size 2024 |

USD 26.31 Billion |

| Gaming Console Market, CAGR |

6.5% |

| Gaming Console Market Size 2032 |

USD 43.54 Billion |

The Gaming Console Market is driven by rising demand for immersive gaming experiences, growth of esports, and expansion of subscription-based services. Advanced hardware with high-performance GPUs, 4K resolution, and faster load times enhances user engagement.

The Gaming Console Market demonstrates strong global presence with growth shaped by regional dynamics and technological adoption. North America leads with advanced infrastructure, high consumer spending, and widespread adoption of online subscription platforms. Europe follows with strong demand for immersive gaming and expanding esports culture supported by localized content and regulatory focus on sustainability. Asia-Pacific emerges as the fastest-growing region, driven by large youth populations, rapid digitalization, and government-backed initiatives in gaming and digital entertainment. Latin America and the Middle East & Africa show steady adoption supported by improving internet access, growing disposable incomes, and rising popularity of multiplayer gaming. Key players such as Microsoft Corporation, Nintendo, and Sony Corporation drive innovation through advanced hardware, cloud gaming platforms, and exclusive content strategies. NVIDIA Corporation also contributes by delivering GPU technologies that support immersive console experiences. These companies focus on continuous R&D, strategic partnerships, and product diversification to maintain leadership in the competitive landscape.

Market Insights

- The Gaming Console Market was valued at USD 26.31 billion in 2024 and is projected to reach USD 43.54 billion by 2032, growing at a CAGR of 6.5%.

- Rising demand for immersive gaming experiences powered by high-performance GPUs, 4K resolution, and faster processing speeds is a major driver for market expansion.

- Key market trends include the shift toward digital distribution, cloud-based gaming services, cross-platform play, and the integration of VR and AR technologies for enhanced experiences.

- Competitive landscape features major players such as Microsoft Corporation, Nintendo, Sony Corporation, NVIDIA Corporation, and Logitech, who focus on innovation, exclusive titles, and subscription platforms to strengthen their market position.

- Market restraints include high development and manufacturing costs, price sensitivity among consumers, semiconductor shortages, and rapid technology cycles that shorten console lifespans.

- North America leads adoption with advanced infrastructure and strong demand for premium consoles, Europe emphasizes sustainability and localized gaming content, while Asia-Pacific shows fastest growth driven by digitalization, esports, and youth demographics.

- Emerging opportunities lie in expanding subscription ecosystems, integration of cloud gaming services, and growing demand in Latin America, the Middle East, and Africa, where rising internet connectivity and affordable financing options encourage broader adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Immersive Gaming Experiences through Advanced Hardware

The Gaming Console Market benefits from growing consumer preference for immersive entertainment. Advanced consoles now feature high-performance GPUs, ultra-HD graphics, and adaptive frame rates to enhance visual quality. Integration of ray tracing and high-speed SSDs ensures faster loading and smoother gameplay. These advancements improve the realism of gaming, appealing to both casual and professional players. Rising popularity of open-world and story-driven titles further fuels demand. Hardware innovation remains a critical driver in sustaining market expansion.

- For instance, the Xbox Series X delivers 12.155 teraflops of GPU performance with 52 compute units running at 1.825 GHz. It includes a custom 1 TB NVMe SSD with 2.4 GB/s raw input/output throughput, which increases to 4.8 GB/s for compressed data, enabled by the Xbox Velocity Architecture.

Expansion of Online Gaming and Subscription-Based Services

The Gaming Console Market is strongly supported by online gaming ecosystems and subscription platforms. Services like Xbox Game Pass and PlayStation Plus increase accessibility to vast game libraries at affordable prices. Cross-platform compatibility encourages multiplayer engagement, strengthening community growth. Cloud-based services allow users to play without large upfront purchases. This trend aligns with shifting consumer behavior toward digital content consumption. The availability of subscription bundles continues to boost console demand worldwide.

- For instance, PlayStation 5 includes a custom AMD RDNA 2 GPU with 36 compute units at up to 2.23 GHz, delivering 10.28 teraflops of performance, paired with an 825 GB SSD capable of 5.5 GB/s data transfer to reduce loading times.

Growth of Esports and Competitive Gaming Culture

The Gaming Console Market gains momentum from the rapid growth of esports and competitive gaming. Professional tournaments attract millions of viewers globally, driving interest in high-performance consoles. Publishers and console makers sponsor events, reinforcing brand visibility and consumer engagement. It supports rising demand for advanced features like low-latency performance and high refresh rates. Younger demographics view competitive gaming as both entertainment and career opportunities. The strong influence of esports ensures ongoing demand for console-based experiences.

Technological Integration with VR, AR, and Cloud Platforms

The Gaming Console Market is shaped by integration with new-age technologies like virtual reality, augmented reality, and cloud connectivity. VR headsets paired with consoles enhance interactive experiences in both gaming and fitness applications. Cloud connectivity enables seamless downloads, updates, and multiplayer interactions. AR integration creates new forms of hybrid entertainment, bridging digital and physical environments. It increases the value proposition of consoles beyond traditional gameplay. These innovations support continuous adoption and long-term growth across global markets.

Market Trends

Shift toward Digital Distribution and Cloud-Based Gaming Platforms

The Gaming Console Market is experiencing a strong transition from physical discs to digital formats. Players prefer convenient downloads and instant access to extensive libraries. Cloud platforms reduce the dependency on storage limits, offering flexibility across devices. It allows publishers to release updates, expansions, and new titles directly to users. Subscription services combine with digital distribution to strengthen engagement. This trend reduces retail dependence and increases direct revenue streams for console manufacturers.

- For instance, Sony reported that in fiscal year 2024, full-game software on PlayStation 4/PlayStation 5 achieved a digital download ratio of 76% of software units, up from 70% in the prior fiscal year.

Integration of Cross-Platform Play and Social Connectivity

The Gaming Console Market benefits from rising demand for cross-platform functionality. Gamers expect seamless play with peers regardless of hardware choice. Social features such as integrated chat, content sharing, and community hubs create a more connected ecosystem. It enhances player engagement and drives loyalty across platforms. Competitive titles and multiplayer genres rely heavily on cross-play features. Console makers continue to invest in partnerships that strengthen interoperability between networks.

- For instance, Steam set a new record on March 2 or 3, 2025, reaching a peak of approximately 40.27 million concurrent online users, including a new record of around 12.8 million actively in-game. This highlights the growing scale of PC gaming and cross-platform connected play, as the peak coincided with the release of the cross-platform title Monster Hunter Wilds.

Rising Adoption of Virtual Reality and Augmented Reality Experiences

The Gaming Console Market is being shaped by the adoption of VR and AR technologies. VR headsets linked with consoles expand immersive storytelling and interactive play. AR capabilities introduce new hybrid applications, blending digital experiences with real-world environments. It increases the appeal of consoles beyond entertainment to education and fitness sectors. Hardware upgrades align with these technologies to deliver responsive performance. The growth of VR and AR ecosystems signals a major trend in console innovation.

Focus on Sustainability and Energy-Efficient Console Designs

The Gaming Console Market reflects a growing emphasis on sustainability and energy efficiency. Manufacturers design consoles with improved cooling systems, lower energy consumption, and recyclable materials. Regulations in key markets encourage environmentally responsible product development. It supports consumer expectations for eco-friendly choices without compromising performance. Energy-efficient designs extend device lifespan and reduce operational costs. This sustainability focus strengthens brand reputation and aligns the industry with global environmental goals.

Market Challenges Analysis

High Development Costs and Price Sensitivity among Consumers

The Gaming Console Market faces significant challenges from high production costs and consumer price sensitivity. Manufacturers invest heavily in advanced processors, GPUs, and storage systems to meet performance expectations. Rising material and component costs increase overall console prices, limiting affordability in price-sensitive regions. It also creates difficulties in balancing premium features with mass-market accessibility. Some consumers turn to mobile or PC gaming as lower-cost alternatives, reducing console adoption. Managing affordability while maintaining innovation remains a critical challenge for industry players.

Supply Chain Disruptions and Rapid Technology Obsolescence

The Gaming Console Market encounters obstacles from global supply chain disruptions and fast technology cycles. Shortages of semiconductors and critical components delay production and constrain availability. It limits manufacturers’ ability to meet rising demand during peak seasons. Rapid technological advancements also shorten product lifecycles, making older consoles less attractive within a few years. Consumers may hesitate to invest in consoles due to concerns about quick obsolescence. Addressing these disruptions and improving long-term value is essential for sustainable market growth.

Market Opportunities

Expansion of Cloud Gaming and Subscription Ecosystems

The Gaming Console Market holds strong opportunities through the rise of cloud-based platforms and subscription models. Cloud gaming reduces reliance on hardware specifications, expanding accessibility for a wider consumer base. Subscription ecosystems provide recurring revenue and enhance engagement with extensive libraries of popular titles. It also encourages long-term loyalty by offering bundled services such as online multiplayer and exclusive content. Partnerships with telecom providers and streaming companies can further accelerate adoption. This model opens new growth avenues by diversifying revenue streams beyond traditional console sales.

Integration of Emerging Technologies and New Demographics

The Gaming Console Market benefits from opportunities created by VR, AR, and AI integration. These technologies enhance immersive experiences and attract interest from both core and casual gamers. It expands use cases into areas like education, training, and fitness, strengthening console adoption. Growing female gamer participation and rising engagement among older demographics broaden the consumer base. Opportunities also emerge in emerging markets where rising disposable incomes drive entertainment demand. Combining innovation with inclusivity positions the industry for strong long-term growth.

Market Segmentation Analysis:

By Type

The Gaming Console Market is segmented by type into home consoles, handheld consoles, and hybrid consoles. Home consoles dominate due to strong performance capabilities, advanced graphics, and wide support for online ecosystems. Leading manufacturers focus on continuous hardware upgrades, exclusive titles, and immersive user experiences to maintain dominance. Handheld consoles retain demand in markets favoring portability and affordability, appealing to younger demographics and casual players. Hybrid consoles gain popularity for combining portability with traditional console features, offering flexibility across gaming environments. It supports diverse consumer preferences by catering to both immersive and mobile experiences.

- For instance, Nintendo reported cumulative global sales of over 152.12 million Switch hybrid consoles as of March 2025, making it one of the best-selling consoles in history.

By Application

The Gaming Console Market, by application, includes gaming, multimedia, and non-entertainment uses. Gaming remains the primary application, with rising demand for interactive titles, multiplayer functionality, and immersive experiences. Multimedia applications, such as video streaming, music playback, and online browsing, enhance the role of consoles as entertainment hubs. It enables consumers to consolidate gaming and digital media consumption into a single device. Non-entertainment applications are emerging in education, training simulations, and fitness, supported by VR and AR integration. This diversification broadens console adoption and strengthens long-term market appeal.

- For instance, Sony revealed that total annual gameplay hours across all PlayStation platforms reached 51 billion, with high engagement on the PlayStation 5. In May 2024, the company noted that the PS5 had a similar number of monthly active users as the PS4, both around 49 million, with PS5 players logging more hours.

By End-use

The Gaming Console Market, by end-use, is classified into residential and commercial segments. Residential users represent the largest share, driven by household entertainment demand and family-oriented gaming. Strong internet connectivity, online subscription models, and access to extensive game libraries sustain residential adoption. Commercial applications grow through esports arenas, gaming cafes, and entertainment centers that rely on high-performance consoles. It strengthens industry revenues by reaching both private and public user bases. The dual role of consoles in home entertainment and commercial ventures underlines their adaptability in a competitive digital ecosystem.

Segments:

Based on Type

- Home console

- Handheld console

Based on Application

Based on End-use

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Gaming Console Market, accounting for nearly 40% in 2024. The region benefits from strong consumer purchasing power, high penetration of online gaming services, and the presence of leading console manufacturers. The United States leads adoption with demand for high-performance home consoles and subscription-based gaming ecosystems. Canada contributes with steady growth in digital distribution and esports engagement, while Mexico shows rising interest due to improving internet infrastructure and expanding middle-class income. It reflects a mature yet innovative market environment supported by widespread broadband access and active developer communities. Continued investment in cloud gaming, VR experiences, and digital platforms reinforces North America’s leading position in the global market.

Europe

Europe represents around 28% of the Gaming Console Market share in 2024. Countries such as the United Kingdom, Germany, and France dominate regional adoption, driven by strong demand for immersive gaming, esports tournaments, and digital content. The region benefits from a balance of premium console adoption and growing handheld device usage, appealing to a diverse consumer base. Eastern and Southern European markets are expanding with improved digital infrastructure and rising disposable incomes. It is also shaped by strict regulatory frameworks, sustainability goals, and energy-efficient console designs. Growing participation in online multiplayer gaming and expansion of localized content further strengthen Europe’s share. Investment in innovative subscription services supports steady growth across both established and emerging European markets.

Asia-Pacific

Asia-Pacific accounts for about 22% of the Gaming Console Market share in 2024 and stands as the fastest-growing region. China leads with a large consumer base and government support for digital entertainment, while Japan and South Korea continue to drive innovation in handheld and hybrid consoles. India is emerging as a key market due to improving internet connectivity, expanding youth demographics, and rising household incomes. It benefits from the popularity of esports, increasing smartphone penetration that introduces consumers to gaming, and growing partnerships between global console makers and local distributors. The region demonstrates strong opportunities for subscription platforms and cloud gaming services, supported by advanced 5G networks. Asia-Pacific’s rapid pace of adoption positions it as a critical growth engine for the global market over the forecast period.

Latin America

Latin America holds nearly 6% of the Gaming Console Market share in 2024. Brazil leads with widespread interest in gaming culture and expanding esports tournaments, while Mexico shows consistent growth supported by digital content consumption. Argentina, Chile, and Colombia contribute through rising console affordability and improved access to broadband services. It faces challenges from price sensitivity and fluctuating economic conditions, yet increasing consumer demand for interactive entertainment supports market expansion. Local gaming communities and the popularity of multiplayer titles create opportunities for console makers to expand their presence. Subscription-based gaming services and affordable financing options are expected to improve adoption rates across the region.

Middle East and Africa

The Middle East and Africa together represent approximately 4% of the Gaming Console Market share in 2024. The United Arab Emirates and Saudi Arabia dominate regional adoption, supported by strong investments in entertainment infrastructure, digital transformation strategies, and growing interest in esports. Africa shows gradual adoption led by South Africa, Nigeria, and Egypt, where rising internet access and youthful demographics drive console purchases. It faces constraints such as limited affordability and infrastructure challenges, yet government-backed initiatives in digital economy development create opportunities for growth. The increasing popularity of cloud gaming and mobile integration further supports gradual expansion in this region. Strategic partnerships with local distributors and emphasis on affordability are expected to accelerate adoption across both the Middle East and Africa during the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Razer Inc.

- Microsoft Corporation

- Logitech

- Samsung Electronics Corporation

- Mad Catz Global Limited

- Nintendo

- Corsair Components Inc.

- Panasonic Corporation

- NVIDIA Corporation

- NEC Corporation

Competitive Analysis

The competitive landscape of the Gaming Console Market is shaped by key players including Microsoft Corporation, Sony Corporation, Nintendo, NVIDIA Corporation, Logitech, Razer Inc., Samsung Electronics Corporation, Corsair Components Inc., Mad Catz Global Limited, and Panasonic Corporation. These companies drive competition through continuous innovation in hardware, software ecosystems, and digital platforms, ensuring strong consumer engagement across global markets. Their strategies focus on delivering advanced performance, exclusive game libraries, and integration with emerging technologies such as VR, AR, and cloud gaming. Subscription-based services and digital distribution models further strengthen their ability to retain users and expand recurring revenue streams. Accessory manufacturers enhance the ecosystem with high-quality peripherals, while technology providers support console performance through GPU, display, and connectivity advancements. The market remains highly dynamic, with heavy investment in R&D, strategic partnerships, and esports sponsorships. Competitive intensity ensures that players constantly refine their offerings to capture evolving consumer preferences and sustain long-term growth.

Recent Developments

- In August 2025, Samsung expanded its Gaming Hub with new social game partners (Volley, PHȲND, GameLoop) for TV-based multiplayer experiences.

- In June 2025, Microsoft confirmed a next-generation Xbox console built on advanced AMD silicon and supporting multi-store functionality.

- In March 2025, Samsung showcased a Flex Gaming prototype with a 7.2-inch foldable OLED display at MWC 2025.

- In 2025, Razer unveiled a new AI developer tool, aiming to reduce lead times and bugs during game development.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for next-generation consoles will rise with advanced graphics and faster processing speeds.

- Cloud gaming platforms will expand access and reduce dependence on physical hardware.

- Subscription services will grow further, offering bundled game libraries and online features.

- Integration of VR and AR will enhance immersive gameplay and attract wider audiences.

- Cross-platform play will become standard, strengthening global multiplayer communities.

- Esports growth will drive demand for performance-focused consoles and accessories.

- Sustainability goals will push manufacturers to design energy-efficient and recyclable consoles.

- Emerging markets will adopt consoles rapidly due to rising internet access and disposable incomes.

- Hybrid consoles will gain traction by offering flexibility between handheld and home use.

- Strategic collaborations between console makers, telecoms, and content providers will shape future growth.