Market Overview

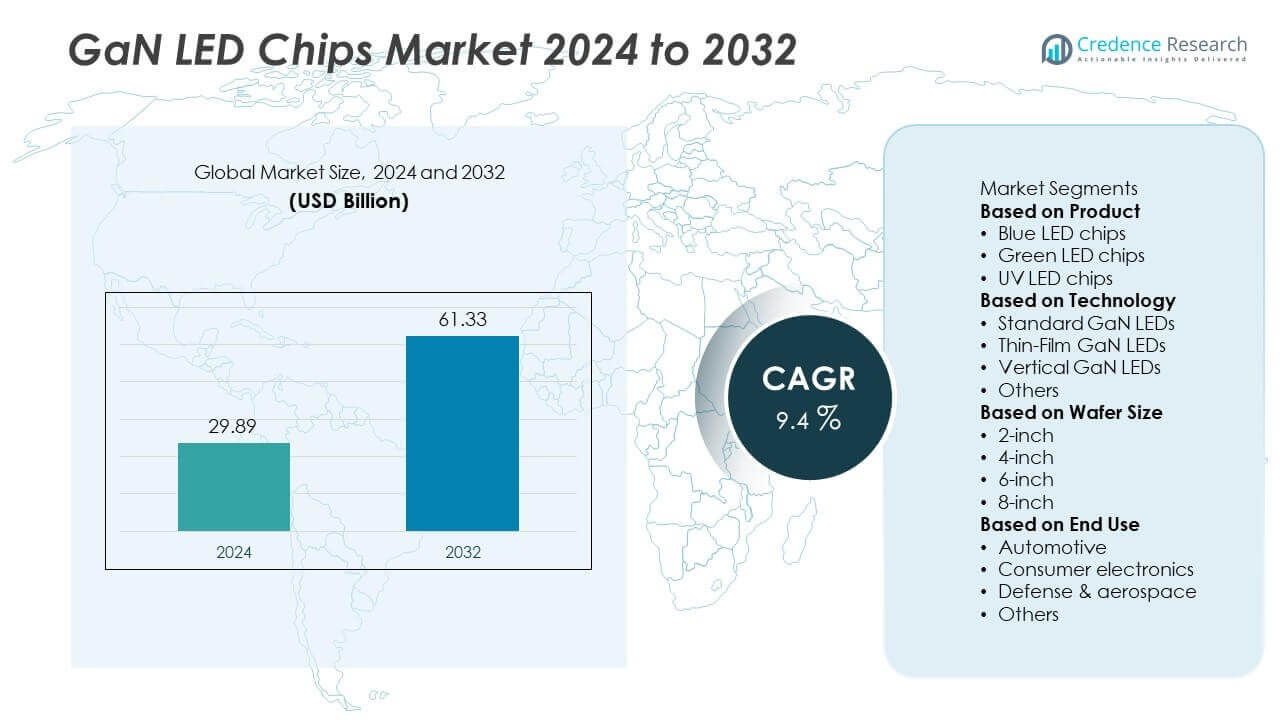

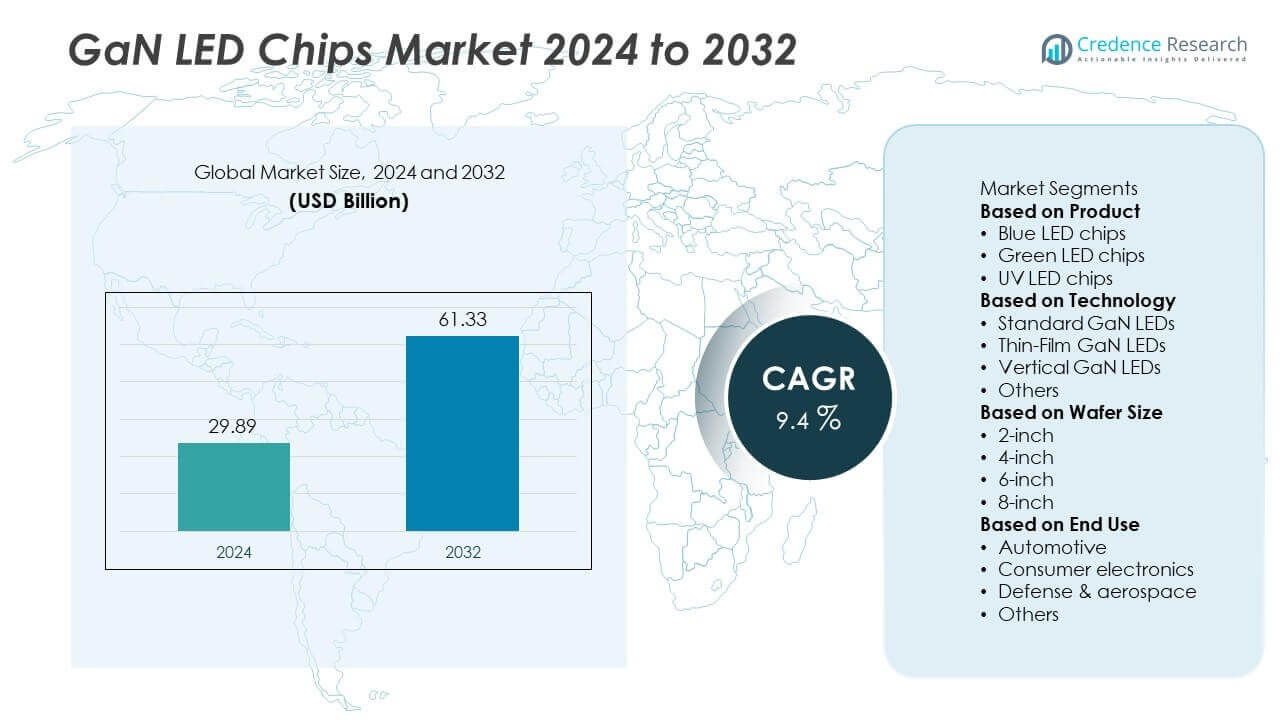

The GaN LED Chips Market was valued at USD 29.89 billion in 2024 and is projected to reach USD 61.33 billion by 2032, growing at a CAGR of 9.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| GaN LED Chips Market Size 2024 |

USD 29.89 Billion |

| GaN LED Chips Market, CAGR |

9.4% |

| GaN LED Chips Market Size 2032 |

USD 61.33 Billion |

The GaN LED Chips Market grows steadily with rising demand for energy-efficient lighting, advanced displays, and automotive applications. Strong drivers include global adoption of Industry 4.0, sustainability initiatives, and regulatory pressure to replace traditional lighting with eco-friendly alternatives.

The GaN LED Chips Market demonstrates strong regional growth across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each supported by distinct industry dynamics. North America leads in adoption for consumer electronics, defense, and healthcare, while Europe emphasizes automotive lighting, smart infrastructure, and regulatory compliance for energy efficiency. Asia-Pacific shows the fastest expansion with large-scale manufacturing in China, advanced display innovation in Japan and South Korea, and rising adoption in India’s lighting and infrastructure projects. Latin America and the Middle East & Africa contribute with growing investments in energy-efficient technologies and smart city programs. Key players shaping the competitive landscape include Nichia Corporation, Cree, Epistar, and Lumileds Holding, who focus on product innovation, manufacturing capacity expansion, and integration of GaN chips in new applications such as micro-LED displays and UV sterilization.

Market Insights

- The GaN LED Chips Market was valued at USD 29.89 billion in 2024 and is projected to reach USD 61.33 billion by 2032, at a CAGR of 9.4%.

- Key drivers include rising global demand for energy-efficient lighting, adoption of GaN LEDs in displays, and increasing use in automotive lighting systems to enhance safety and performance.

- Market trends highlight the rapid growth of micro-LED and mini-LED displays, strong adoption of UV LEDs in healthcare and sanitation, and expanding integration into smart city lighting and infrastructure projects.

- Competitive analysis shows major players such as Nichia Corporation, Cree, Epistar, Lumileds Holding, and Osram Opto Semiconductors focusing on innovation, wafer technology improvements, and large-scale manufacturing to maintain leadership.

- Market restraints include high manufacturing costs, reliance on expensive substrates like sapphire and silicon carbide, and complex production processes that limit scalability in price-sensitive regions.

- Regional analysis reveals North America as a leader in advanced adoption across defense, healthcare, and consumer electronics, while Europe emphasizes automotive applications and regulatory-driven energy efficiency. Asia-Pacific remains the fastest-growing region with strong contributions from China, Japan, South Korea, and India, supported by large-scale electronics production and government incentives. Latin America and the Middle East & Africa show steady growth through infrastructure projects, energy-efficient programs, and sanitation initiatives.

- The long-term outlook remains positive as manufacturers invest in cost optimization, larger wafer technologies, and R&D to expand applications, ensuring that GaN LED chips continue to play a central role in both consumer and industrial markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Energy-Efficient Lighting Solutions

The GaN LED Chips Market benefits from rising global demand for energy-efficient lighting technologies. Governments and industries focus on reducing power consumption and carbon emissions, creating strong adoption opportunities. It provides higher luminous efficiency, longer lifespan, and lower operational costs compared to traditional lighting sources. Consumers and businesses alike embrace LEDs in residential, commercial, and industrial settings. Urbanization and infrastructure development fuel deployment in streetlights, office complexes, and public facilities. This strong push toward efficiency continues to expand demand across multiple end-use sectors.

- For instance, Nichia’s 757G mid-power GaN LED produces 37.5 lumens at 65 mA with luminous efficacy reaching 210 lm/W, enabling large-scale use in office and street lighting applications.

Rising Adoption in Consumer Electronics and Display Technologies

Increasing use of advanced displays in smartphones, televisions, and wearable devices drives steady growth. The GaN LED Chips Market supports high brightness, superior contrast, and slim designs for consumer electronics. It enhances visual performance while ensuring lower power use, aligning with consumer expectations for longer battery life. The growing popularity of OLED and micro-LED displays relies on these chips for improved performance. Large-scale demand from electronics manufacturers accelerates production and investment in chip development. This adoption trend reinforces the role of GaN LEDs in shaping next-generation display technologies.

- For instance, Samsung’s 110-inch micro-LED TV, first revealed to consumers in late 2020 and globally released in 2021, utilizes micrometer-sized inorganic LEDs, likely made with Gallium Nitride (GaN) compounds. The display’s inorganic materials allow for a long lifespan, which Samsung has cited as being up to 100,000 hours.

Expansion of Automotive Lighting and Smart Vehicle Applications

The automotive industry creates significant growth opportunities with its shift toward LED-based lighting systems. The GaN LED Chips Market supports applications in headlights, interior lighting, and advanced driver-assistance systems. It provides brighter illumination, compact design, and higher reliability under extreme conditions. Automakers integrate LEDs to improve safety and design flexibility, while electric vehicle adoption further boosts demand. Smart vehicle platforms also rely on LEDs for efficient communication and display systems. This growing integration strengthens the automotive sector’s role as a key demand driver.

Government Regulations and Sustainability Initiatives Encouraging LED Transition

Global regulatory bodies continue to phase out inefficient lighting technologies in favor of LEDs. The GaN LED Chips Market benefits from policies supporting eco-friendly lighting and reduced greenhouse gas emissions. It aligns with international energy efficiency standards such as ENERGY STAR and EU directives. Governments offer subsidies, incentives, and public projects that prioritize LED-based solutions. The rise of green building certifications also pushes developers to adopt advanced lighting systems. Strong regulatory frameworks secure long-term opportunities for GaN LEDs in both developed and emerging economies.

Market Trends

Growing Penetration of Micro-LED and Mini-LED Displays

The GaN LED Chips Market is influenced by rising demand for micro-LED and mini-LED technologies in consumer electronics. It supports higher resolution, improved brightness, and longer durability compared to conventional displays. Smartphone and television manufacturers adopt these solutions to deliver enhanced visual experiences. The shift from traditional LCD to next-generation LED displays strengthens the role of GaN chips. Companies invest in advanced fabrication techniques to achieve cost-efficient production. This trend positions GaN LEDs as the backbone of future display innovation.

- For instance, LG Display unveiled a 12-inch stretchable micro-LED display in November 2024 using micro-LED light sources measuring up to 40 µm, which it demonstrated as a concept for potential automotive applications.

Rising Role of Smart Lighting in Connected Infrastructure

Smart city initiatives and IoT-enabled platforms expand opportunities for advanced lighting systems. The GaN LED Chips Market supports adaptive lighting, automated control, and integration with energy management platforms. It enables real-time adjustment of brightness, color, and efficiency based on environmental conditions. Demand grows across smart homes, commercial complexes, and public infrastructure projects. Connectivity with wireless systems such as Zigbee and Wi-Fi accelerates adoption. This trend highlights how GaN LEDs contribute to digital and energy-efficient infrastructure development.

- For instance, ams OSRAM supplied some components, like their high-efficiency GaN-based LEDs (such as those from the Oslon Square line), for smart lighting projects that occurred in or near Berlin.

Integration of GaN LEDs in UV and Specialty Applications

The market shows increasing use of GaN LEDs in ultraviolet lighting for sterilization, medical devices, and water purification. The GaN LED Chips Market supports compact and high-output UV solutions that outperform traditional mercury lamps. It enables safe and eco-friendly disinfection practices in healthcare and municipal services. Rising awareness of hygiene and clean water access boosts demand for these applications. Industrial sectors also deploy UV LEDs for curing, printing, and surface treatments. Expanding specialty uses diversify the market’s scope beyond traditional lighting.

Advances in Manufacturing Technologies and Cost Optimization

Continuous improvements in epitaxy, wafer production, and packaging enhance performance and reduce costs. The GaN LED Chips Market benefits from innovations in chip design that increase efficiency and reliability. It enables manufacturers to scale production for mass-market applications in displays, lighting, and automotive systems. Larger wafer sizes and automation in fabrication processes reduce unit costs significantly. Industry players also focus on recycling and material optimization to improve sustainability. This trend ensures that GaN LED adoption becomes more accessible across diverse industries.

Market Challenges Analysis

High Manufacturing Costs and Complex Production Processes

The GaN LED Chips Market faces challenges from high production costs and technical complexities in fabrication. It requires advanced epitaxial growth methods, expensive substrates, and precision equipment. These factors limit cost efficiency and create barriers for new entrants and smaller manufacturers. The reliance on sapphire and silicon carbide substrates further increases expenses in large-scale production. Companies must invest heavily in research and facilities to achieve yield improvements and consistency. The high cost structure delays wider adoption in price-sensitive markets.

Intense Competition and Supply Chain Vulnerabilities

Global competition and supply chain limitations create additional obstacles for the GaN LED Chips Market. It faces pressure from alternative technologies such as OLEDs and traditional LEDs in some applications. Supply disruptions of raw materials and wafers can impact production schedules and raise costs. Fluctuations in demand for consumer electronics and automotive lighting also create uncertainty for manufacturers. Intellectual property disputes between global players often slow innovation and market penetration. These challenges highlight the need for strong partnerships and resilient supply strategies.

Market Opportunities

Expanding Role in Next-Generation Display and Consumer Electronics

The GaN LED Chips Market holds strong opportunities in advanced display technologies for smartphones, televisions, and wearables. It enables higher brightness, energy savings, and longer device lifespans, making it ideal for micro-LED and mini-LED displays. Consumer demand for premium viewing experiences creates consistent growth potential. Companies invest in scaling production and cost optimization to make these chips viable for mass adoption. It also supports flexible designs for compact devices and foldable displays. The shift toward immersive electronics expands opportunities for manufacturers across global markets.

Growing Applications in Healthcare, UV Lighting, and Automotive Systems

The GaN LED Chips Market benefits from rising demand in healthcare, sanitation, and automotive sectors. It supports UV LEDs for water purification, air sterilization, and medical disinfection, aligning with global health priorities. Automotive adoption accelerates through use in headlights, interior lighting, and vehicle displays, driven by electric and smart vehicle growth. Governments worldwide encourage sustainable lighting solutions, creating demand in both public and industrial sectors. Expanding applications beyond traditional lighting strengthen long-term growth prospects. This diversification of end uses ensures stable opportunities across industries.

Market Segmentation Analysis:

By Product

The GaN LED Chips Market is segmented into blue LED chips, green LED chips, and others including UV and white LED chips. Blue LED chips dominate demand due to their widespread use in displays, lighting systems, and backlight units. It delivers high brightness and efficiency, making it suitable for large-scale consumer electronics applications. Green LED chips are increasingly important for display technologies requiring color precision and higher visibility. UV and white chips gain adoption in specialty areas such as medical devices, sterilization systems, and water purification units. The diversity of product offerings allows manufacturers to serve multiple industries and expand their market presence.

- For instance, a specific Seoul Viosys UV-C LED (model CUD7GF1B) is capable of emitting at a peak wavelength of 275 nm, and typically has an optical output of 16 mW when operated at its specified test current.

By Technology

Segmentation by technology includes traditional LED, micro-LED, and mini-LED platforms. Traditional LEDs maintain strong demand in general lighting and automotive uses due to cost efficiency and established infrastructure. It continues to support mass-market applications while evolving with improved efficiency. Micro-LED technology shows the fastest growth, with applications in next-generation displays offering high resolution, durability, and low power use. Mini-LEDs bridge the gap between conventional LEDs and micro-LEDs, with strong adoption in televisions, laptops, and tablets. These advancements demonstrate how GaN-based platforms adapt to both mainstream and premium applications.

- For instance, VueReal demonstrated microdisplays with 5.2 µm pixel pitch achieving peak brightness above 1,000,000 nits for green color in AR-type displays.

By Wafer Size

The GaN LED Chips Market is categorized by wafer size into 2-inch, 4-inch, 6-inch, and 8-inch segments. Smaller wafer sizes remain widely used in established production lines, though they face challenges in scalability. It is the larger wafer formats, such as 6-inch and 8-inch, that gain momentum due to cost efficiency and higher yields. These larger wafers enable mass production to meet growing demand from electronics and automotive sectors. Manufacturers prioritize expansion of fabrication facilities to adopt larger wafer technologies for economies of scale. This shift toward advanced wafer sizes reflects the industry’s focus on efficiency, scalability, and performance enhancement.

Segments:

Based on Product

- Blue LED chips

- Green LED chips

- UV LED chips

Based on Technology

- Standard GaN LEDs

- Thin-Film GaN LEDs

- Vertical GaN LEDs

- Others

Based on Wafer Size

- 2-inch

- 4-inch

- 6-inch

- 8-inch

Based on End Use

- Automotive

- Consumer electronics

- Defense & aerospace

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for around 33% of the GaN LED Chips Market share in 2024, making it one of the leading regions. The strong base of consumer electronics, automotive, and defense industries drives consistent adoption. It benefits from advanced research infrastructure, high investment in R&D, and strong semiconductor manufacturing capabilities. The United States leads with extensive use of GaN LEDs in displays, automotive lighting, and defense applications such as radar and communication systems. Canada contributes through growing healthcare and UV sterilization adoption, while Mexico supports demand with its rising automotive manufacturing base. Favorable government policies toward energy-efficient technologies continue to strengthen the market’s presence in the region.

Europe

Europe holds nearly 27% of the GaN LED Chips Market share in 2024. The region is shaped by strong environmental regulations, sustainability goals, and emphasis on eco-friendly lighting systems. It demonstrates widespread adoption in automotive lighting, given Europe’s position as a global hub for vehicle production. Germany, France, and the United Kingdom dominate the regional demand with extensive use in advanced displays, industrial applications, and renewable energy systems. It also benefits from investment in smart city projects and EU-backed initiatives for energy-efficient infrastructure. Growing focus on micro-LED technologies in European electronics further enhances regional demand.

Asia-Pacific

Asia-Pacific captures about 30% of the GaN LED Chips Market share in 2024, and it is the fastest-growing regional market. China leads the demand with its massive production of consumer electronics, extensive display manufacturing, and government-backed semiconductor programs. Japan and South Korea contribute through innovation in micro-LED and mini-LED displays, alongside strong integration in automotive and robotics. India emerges as a high-potential market, with rising adoption of GaN-based solutions in lighting and infrastructure development. It benefits from large-scale manufacturing hubs, cost-effective labor, and government incentives for advanced technology adoption. Growing deployment of 5G and IoT platforms across the region further strengthens the demand outlook.

Latin America

Latin America represents close to 6% of the GaN LED Chips Market share in 2024. The region is at an early adoption stage but shows steady progress due to expansion in consumer electronics and automotive sectors. Brazil drives most of the demand through its large manufacturing base and increasing focus on energy-efficient technologies. Mexico follows with growing use of GaN LEDs in displays and vehicle lighting. It benefits from expanding infrastructure projects and government programs aimed at promoting energy-efficient lighting systems. Challenges remain in terms of high costs and limited local semiconductor production, but regional growth potential continues to improve.

Middle East and Africa

The Middle East and Africa together account for about 4% of the GaN LED Chips Market share in 2024. The region demonstrates growing interest in energy-efficient lighting, water purification using UV LEDs, and infrastructure digitization. The United Arab Emirates and Saudi Arabia lead demand with large-scale smart city initiatives and investments in advanced lighting technologies. South Africa and Egypt represent key African markets with applications in healthcare and sanitation projects. It faces limitations due to higher costs and limited semiconductor infrastructure, but government-backed sustainability programs strengthen adoption prospects. The region’s growing alignment with clean energy and smart infrastructure creates long-term opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the GaN LED Chips Market is defined by leading players such as Nichia Corporation, Cree, Epistar, Lumileds Holding, Osram Opto Semiconductors, Bridgelux, SemiLEDs, Seoul Semiconductor, Epileds Technologies, and Efficient Power Conversion Corporation. These companies compete through product innovation, advanced manufacturing capabilities, and expansion into new applications such as micro-LED displays, automotive lighting, and UV sterilization systems. They focus heavily on research and development to enhance chip efficiency, brightness, and durability while addressing cost reduction challenges through larger wafer sizes and optimized fabrication processes. Strategic partnerships, mergers, and collaborations are actively pursued to strengthen supply chains and global market reach. Each player leverages its core expertise, whether in large-scale production, specialty UV applications, or display integration, to differentiate its offerings in a highly competitive environment. With growing demand from electronics, automotive, and healthcare industries, these leaders continue to shape the market through technology advancements and global expansion strategies.

Recent Developments

- In August 2025, EPC announced the EPC9196, a 3-phase BLDC motor drive inverter reference design optimized for 96 V–150 V battery systems, using the EPC2304 eGaN FET, rated 200 V, with typical on-resistance of 3.5 mΩ, delivering up to 25 ARMS (35 Apk) at switching frequencies up to 100 kHz.

- In May 2025, Nichia Corporation, Nichia’s Cube Direct Mountable Chip won a LightFair Innovation Award in LED Chips & Modules category.

- In May 2025, Seoul Semiconductor Began supplying WICOP-based Mini LED chips for automotive displays starting in May 2025. The WICOP (No-wire, No-lens, No-package) tech reaches up to 1,200 nits, offers better brightness/color than OLED, and cuts cost by up to 25%.

- In 2025, ams OSRAM & Nichia, Developed micro-LED solutions enabling more than 100× increase in resolution vs traditional matrix LEDs (for automotive Adaptive Driving Beam applications).

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Wafer Size, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for energy-efficient lighting across residential and industrial sectors.

- Adoption of GaN LED chips in micro-LED and mini-LED displays will grow steadily.

- Automotive applications will increase as electric and smart vehicles integrate advanced lighting systems.

- Healthcare and sanitation sectors will drive demand for UV GaN LEDs in sterilization.

- Smart city projects will accelerate adoption of GaN-based lighting for infrastructure.

- Larger wafer technologies will reduce production costs and improve scalability for mass applications.

- Asia-Pacific will lead growth with strong manufacturing bases and government-backed incentives.

- Europe will strengthen demand through strict energy efficiency regulations and automotive innovation.

- North America will maintain adoption in defense, healthcare, and advanced consumer electronics.

- Continuous R&D investments will drive breakthroughs in efficiency, performance, and specialty applications.