Market Overview

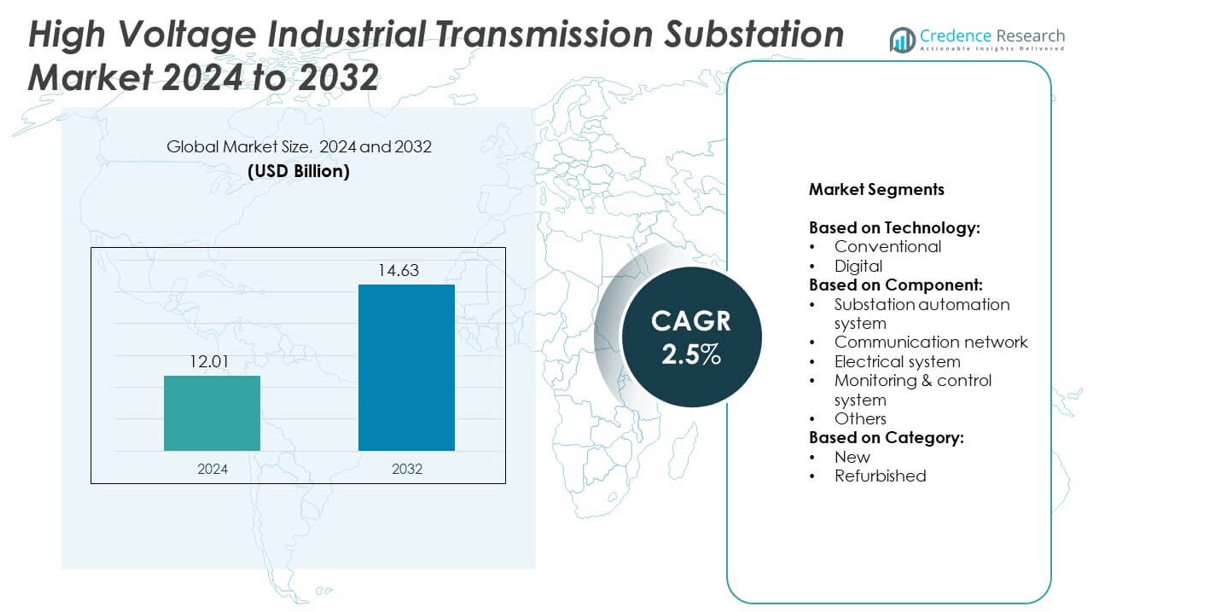

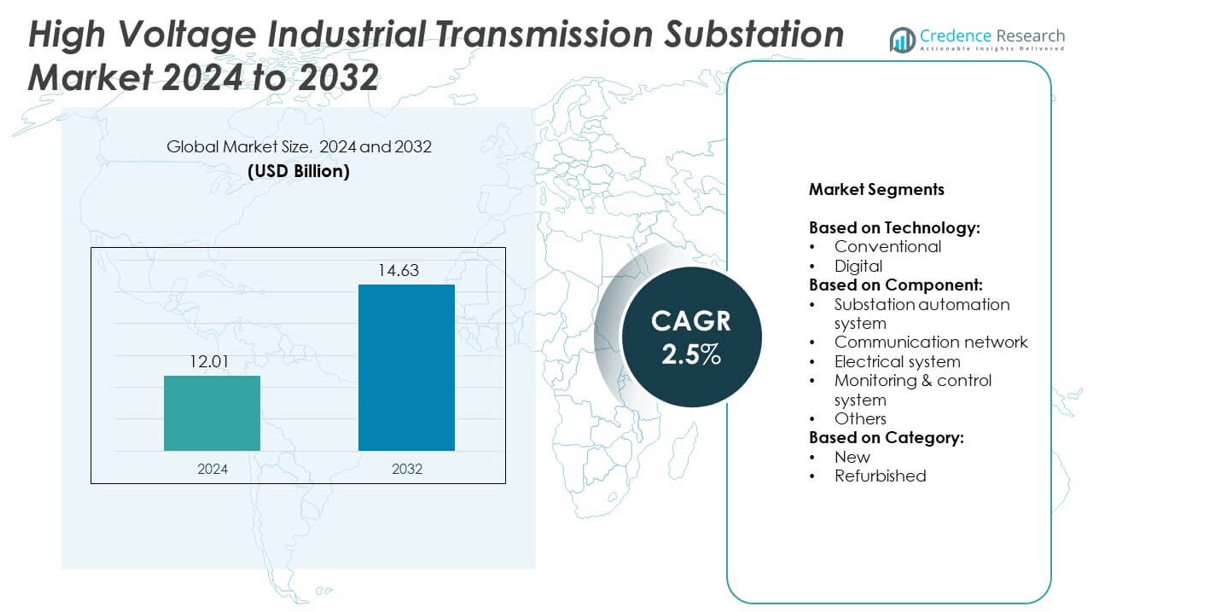

The High Voltage Industrial Transmission Substation Market size was valued at USD 12.01 billion in 2024 and is anticipated to reach USD 14.63 billion by 2032, growing at a CAGR of 2.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Voltage Industrial Transmission Substation Market Size 2024 |

USD 12.01 billion |

| High Voltage Industrial Transmission Substation Market, CAGR |

2.5% |

| High Voltage Industrial Transmission Substation Market Size 2032 |

USD 14.63 billion |

The High Voltage Industrial Transmission Substation market grows with rising electricity demand, grid modernization, and renewable integration. Utilities upgrade aging infrastructure and deploy digital substations for better control, safety, and efficiency. Governments support expansion through policy incentives and funding for smart grid projects. Space-constrained regions adopt gas-insulated substations to meet land and reliability challenges. The shift toward remote monitoring and predictive maintenance strengthens investment in automation. These trends collectively drive sustained adoption across industrial and utility-scale transmission networks.

Asia Pacific leads the High Voltage Industrial Transmission Substation market due to rapid infrastructure growth and renewable energy expansion. North America and Europe follow with strong investments in grid modernization and replacement of aging assets. Latin America and the Middle East focus on expanding access and supporting industrial demand through new installations. Key players driving regional developments include Siemens, Hitachi Energy, Schneider Electric, and General Electric, who actively support large-scale projects and grid automation across these high-growth markets.

Market Insights

- The High Voltage Industrial Transmission Substation market was valued at USD 12.01 billion in 2024 and is projected to reach USD 14.63 billion by 2032, growing at a CAGR of 2.5%.

- Rising electricity demand, renewable energy expansion, and grid reliability needs are driving new substation installations.

- Utilities shift toward digital substations with automation, real-time monitoring, and advanced protection systems.

- Leading players such as Siemens, ABB, Hitachi Energy, and Schneider Electric compete on innovation, project scale, and system integration capabilities.

- High upfront costs, lengthy regulatory processes, and skilled labor shortages challenge market growth and timely project execution.

- Asia Pacific leads in deployments, followed by North America and Europe, while Latin America and the Middle East show steady expansion.

- Compact gas-insulated systems, modular substation designs, and cybersecurity features continue to shape investment trends across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Expansion of Power Infrastructure to Meet Rising Global Electricity Demand

Growing electricity demand across residential, commercial, and industrial sectors is driving investments in power infrastructure. Governments and utilities are upgrading existing substations and building new ones to support stable transmission. The High Voltage Industrial Transmission Substation market benefits directly from this push for reliable and high-capacity grids. Many countries expand their networks to accommodate urban growth and support rural electrification. These projects require advanced substations to manage increased loads and reduce transmission losses. It supports the deployment of efficient grid components like switchgear, circuit breakers, and monitoring systems.

- For instance, In May 2023, Siemens Energy, in partnership with Giza Systems, delivered and commissioned four mobile substations for the Egyptian Electricity Transmission Company (EETC) to improve power connectivity and resilience. These substations, which included two 220 kV and two 66 kV units, provided a combined capacity of 200 MVA to ensure power stability for remote projects.

Integration of Renewable Energy Sources into Centralized Transmission Grids

Countries continue to integrate solar, wind, and hydroelectric sources into national grids. The fluctuating output from renewables demands grid stability, prompting upgrades in substation capabilities. The High Voltage Industrial Transmission Substation market sees demand for reactive power management, voltage control, and flexible grid support systems. Substations play a key role in handling the intermittency of renewables and balancing regional power loads. Utilities rely on grid-scale substations to connect remote generation sites to load centers. It enhances grid resilience and supports national energy transition goals.

- For instance, ABB has been a long-term partner in Brazil’s energy sector, providing infrastructure for various projects. While not specific to 2024, ABB delivered a 500 kV digital substation in Brazil in 2020 to integrate power from a 475 MW solar park.

Modernization of Aging Infrastructure Across Developed Economies

Many substations in North America and Europe were installed decades ago and lack digital control features. Aging assets increase outage risks and operational costs, prompting replacement initiatives. The High Voltage Industrial Transmission Substation market benefits from programs targeting smart upgrades and improved reliability. Governments allocate funding toward grid modernization under decarbonization and reliability mandates. Utilities seek compact, automated substations with minimal maintenance and improved diagnostics. It accelerates demand for digital substations with embedded intelligence and real-time monitoring.

Strong Policy Support for Grid Resilience and Interconnection Projects

Policymakers across regions introduce frameworks supporting investment in grid hardening and expansion. These policies focus on reducing blackout risks, improving interregional transfer capacity, and supporting clean energy targets. The High Voltage Industrial Transmission Substation market aligns with national priorities on energy security and climate adaptation. Transmission developers receive incentives to build resilient substation networks and reduce bottlenecks. Interconnection projects across borders also require high voltage substations with flexible load handling. It positions substations as essential infrastructure for regional power coordination.

Market Trends

Adoption of Digital Substations with Intelligent Monitoring and Automation

Utilities increasingly deploy digital substations to improve control, safety, and asset efficiency. These substations replace hardwired connections with fiber-optic systems and intelligent electronic devices. The High Voltage Industrial Transmission Substation market embraces this shift toward real-time data acquisition and predictive diagnostics. Digital technologies reduce downtime, lower maintenance costs, and enable fast response to faults. Advanced analytics also help optimize load balancing and asset utilization. It ensures better performance visibility and enables remote control from centralized facilities.

- For instance, In June 2023 ISO New England presentation mentioned GE-manufactured relay equipment at the Deerfield 345/115 kV substation in New Hampshire, which is part of the New England transmission system. Additionally, Eversource’s Woburn to Wakefield 345 kV transmission line project, which involved substation upgrades, was underway in Massachusetts during 2023 and completed in early 2024.

Rising Use of Gas-Insulated Substations for Space-Constrained Installations

Urban areas and offshore projects require compact and low-maintenance substation solutions. Gas-insulated substations (GIS) meet these needs by offering enclosed systems with smaller footprints. The High Voltage Industrial Transmission Substation market incorporates GIS technology to meet spatial and environmental constraints. GIS units reduce electromagnetic interference and resist harsh weather conditions. Developers prefer them for metro zones, renewable energy plants, and industrial facilities. It provides high reliability with minimal land usage and lower operational risk.

- For instance, In June 2025, Hitachi Energy India announced a separate order from the Power Grid Corporation of India to supply 30 units of 765 kV transformers for grid expansion projects, which will be manufactured at its Vadodara facility. India’s interregional power transfer capacity stood at 118,740 MW as of March 31, 2024, and is planned to increase to 142,940 MW by March 31, 2027, through various projects.

Increased Integration of Cybersecurity Solutions in Substation Infrastructure

The growing digitization of substations introduces new cybersecurity vulnerabilities. Utilities now embed security layers to protect operational technology and prevent grid disruptions. The High Voltage Industrial Transmission Substation market responds by including encryption, authentication protocols, and intrusion detection systems. Cybersecure designs are essential for meeting regulatory compliance and protecting grid assets. Operators invest in continuous monitoring and security audits to mitigate risks. It builds resilience against evolving threats and ensures uninterrupted grid operations.

Deployment of Modular Substation Units for Fast-Track Grid Expansion

Developers seek faster deployment options to support urgent power demands and infrastructure projects. Modular substations offer pre-engineered, factory-assembled units that speed up installation timelines. The High Voltage Industrial Transmission Substation market adopts modular systems to streamline construction and reduce onsite work. These units simplify logistics, improve quality control, and lower project costs. They are ideal for temporary grids, remote sites, and emergency response applications. It helps utilities meet short lead times without compromising performance.

Market Challenges Analysis

High Capital Costs and Lengthy Regulatory Approval Processes Delay Project Execution

Substation projects require high upfront capital for equipment, land, engineering, and installation. Long timelines for design, procurement, and grid integration extend project cycles further. The High Voltage Industrial Transmission Substation market faces delays due to environmental clearances, land acquisition, and local opposition. Navigating national and regional regulations often slows execution and increases costs. Smaller utilities and developers may struggle to secure funding or absorb overruns. It creates a barrier for timely capacity additions in fast-growing regions.

Complex Integration of Advanced Technologies Increases Design and Operational Risks

Modern substations demand integration of digital controls, automation systems, and cybersecurity measures. These features require skilled labor, advanced planning, and coordination with legacy infrastructure. The High Voltage Industrial Transmission Substation market encounters difficulties aligning older grid assets with new substation components. Incompatibility between software, protocols, and hardware can disrupt system performance. Skilled workforce shortages also hinder smooth commissioning and operation. It raises reliability concerns and limits the pace of modernization.

Market Opportunities

Rising Renewable Energy Projects and Interconnection Demands Create Long-Term Growth Scope

Global investment in solar, wind, and hydroelectric power continues to expand across regions. These projects often require large-scale substations to connect remote generation sources to urban load centers. The High Voltage Industrial Transmission Substation market benefits from this shift toward decentralized and variable energy input. Developers seek grid solutions that stabilize output and handle real-time load fluctuations. Interconnection upgrades across countries and regions drive demand for robust high-voltage infrastructure. It supports cross-border energy trade and strengthens energy security strategies.

Government-Led Infrastructure Modernization and Grid Digitization Programs Drive Adoption

Several national governments fund smart grid programs and digital infrastructure upgrades. These initiatives support replacement of outdated assets and encourage digital substation deployment. The High Voltage Industrial Transmission Substation market aligns with long-term policy goals focused on climate resilience and energy efficiency. Public-private partnerships help accelerate deployment of modern grid nodes with advanced communication systems. It creates business opportunities for equipment suppliers, integrators, and service providers. Growing smart city projects also require substations with automated, real-time control systems.

Market Segmentation Analysis:

By Technology:

The High Voltage Industrial Transmission Substation market is divided into conventional and digital segments. Conventional substations still hold a strong presence due to legacy infrastructure in several regions. However, digital substations are gaining ground quickly with utilities focusing on real-time control and automation. These systems offer benefits like reduced wiring, improved safety, and faster fault detection. Utilities investing in smart grids and remote operations favor digital solutions. It marks a shift in industry preference toward high-efficiency and data-driven operations.

- For instance, In November 2023, Schneider Electric also participated in the Enlit Europe 2023 event in Paris, where its experts discussed solutions for grid modernization through increased network automation on smart grids. Market research reports published in early to mid-2025 confirm that the global digital substation market is growing and is projected to reach over $13 billion by the early 2030s

By Component:

The market includes substation automation systems, communication networks, electrical systems, monitoring and control systems, and others. Electrical systems remain a dominant segment due to their critical role in power transformation and protection. Monitoring and control systems are growing with demand for real-time diagnostics and predictive maintenance. Communication networks support remote operations and cybersecurity protocols, essential in modern grid architecture. Substation automation systems enable improved reliability and reduce manual intervention. It creates integrated platforms for coordinated asset performance.

- For instance, Toshiba Energy Systems & Solutions is a major manufacturer of Gas-Insulated Switchgear (GIS), which is used to construct compact substations suitable for crowded urban environments like Tokyo. Compared to conventional air-insulated switchgear (AIS) substations, GIS can reduce the required installation space significantly, some industry sources suggest GIS can be up to 10 times smaller, but the exact reduction percentage is specific to each project

By Category:

The market splits into new and refurbished substations. New installations lead the market, supported by infrastructure expansion and renewable energy integration. Refurbished substations offer cost savings and are popular in regions with budget constraints or aging infrastructure. Many utilities refurbish existing assets to add digital components without full system replacement. It allows for phased modernization while extending asset life and improving performance. This segment remains vital in developed markets undergoing grid upgrades.

Segments:

Based on Technology:

Based on Component:

- Substation automation system

- Communication network

- Electrical system

- Monitoring & control system

- Others

Based on Category:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America held a 28.4% share of the High Voltage Industrial Transmission Substation market in 2024. The region shows strong activity due to aging grid infrastructure and large-scale renewable energy integration across the United States and Canada. Federal and state-level investments support substation upgrades, especially to accommodate offshore wind and solar power sources. Utilities invest in digital substations with advanced monitoring and cybersecurity functions to ensure system reliability. In the U.S., projects under the Grid Resilience and Innovation Partnership (GRIP) Program stimulate adoption of modern substation technologies. Canada also expands transmission capacity in remote and northern regions where demand continues to rise. It creates sustained opportunities for equipment manufacturers and EPC firms across the region.

Europe

Europe accounted for 24.7% of the global market in 2024, supported by ambitious energy transition goals and strong interconnection frameworks. EU nations deploy high voltage substations to facilitate cross-border energy trade and integrate offshore renewable capacity. Germany, France, and the UK lead in replacing conventional substations with digital variants under national grid modernization programs. The region enforces strict emission rules and emphasizes energy efficiency, encouraging automation and smart monitoring features. Countries like Norway and Denmark also invest in HVDC substations to link wind energy projects with mainland grids. Eastern Europe witnesses growth through EU funding for cross-regional transmission upgrades. It drives adoption of high-capacity and low-loss substation systems across key corridors.

Asia Pacific

Asia Pacific represented 31.2%, holding the largest share of the High Voltage Industrial Transmission Substation market in 2024. Rapid urbanization, industrialization, and infrastructure expansion drive substantial demand for transmission infrastructure across China, India, Japan, and Southeast Asia. China leads in deploying ultra-high-voltage AC and DC substations for long-distance power transmission. India’s growing renewable capacity, especially in solar parks, requires new substations to manage fluctuating loads and improve access in rural areas. Japan focuses on upgrading substations with earthquake-resistant and space-saving designs. Southeast Asian nations invest in grid modernization to reduce losses and expand access in under-electrified zones. It makes Asia Pacific the fastest-transforming market with strong focus on digital substation deployment.

Latin America

Latin America held 7.6% of the global share in 2024, with demand primarily driven by grid expansions in Brazil, Mexico, and Chile. These countries focus on integrating hydroelectric, solar, and wind sources into national grids. Substation development supports electrification of remote areas and improves regional transmission reliability. Governments introduce policy support to attract public-private partnerships for modern grid infrastructure. Brazil invests in interconnecting northern and central regions through high voltage lines supported by new substations. Mexico upgrades aging infrastructure with modular and prefabricated systems to shorten deployment time. It positions Latin America as a steadily growing market with regional development priorities.

Middle East and Africa

The Middle East and Africa region captured 8.1% of the High Voltage Industrial Transmission Substation market in 2024. Investments in energy parks, smart cities, and cross-border transmission systems support market expansion. Gulf countries such as Saudi Arabia and the UAE integrate substations into mega infrastructure and utility-scale solar projects. Africa sees growth from World Bank-funded grid expansion efforts focused on rural electrification and interconnection across sub-Saharan regions. North African nations, including Egypt and Morocco, deploy new substations to support renewable energy exports to Europe. Grid reliability and access remain major focus areas, creating long-term infrastructure opportunities. It makes this region essential for closing power access gaps and increasing transmission stability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Open System International

- L&T Electrical and Automation

- Schneider Electric

- Tesco Automation

- Texas Instruments

- Locamation

- Eaton

- CG Power

- Hitachi Energy

- Rockwell Automation

- ABB

- Efacec

- Siemens

- General Electric

Competitive Analysis

The competitive landscape of the High Voltage Industrial Transmission Substation market includes key players such as Siemens, ABB, Hitachi Energy, Schneider Electric, General Electric, Eaton, CG Power, Rockwell Automation, Texas Instruments, and L&T Electrical and Automation. These companies compete based on innovation, product reliability, global presence, and integration capabilities. Market leaders offer advanced substation automation, digital monitoring, and compact gas-insulated solutions to meet diverse grid demands. They invest in research and development to improve grid performance, reduce downtime, and meet evolving cybersecurity requirements. Several players focus on turnkey substation projects, combining engineering, procurement, and construction services. Others strengthen their position by forming partnerships with utilities and transmission operators. Regional players address cost-sensitive markets through refurbished systems and modular products. The growing demand for digital substations and predictive maintenance tools drives competition in software-enabled solutions. Players differentiate themselves by offering end-to-end platforms and lifecycle services that reduce operational complexity for grid operators.

Recent Developments

- In January 2025, Hitachi Energy was selected to supply 500 kV high-voltage circuit breakers for Transgrid’s HumeLink project in New South Wales, Australia. This equipment supports renewable power transmission across a 365 km network connecting Wagga Wagga, Bannaby, and Maragle

- In 2025, GE Vernova was selected by Sterlite Grid 32 to supply 765 kV power transformers for the Khavda Phase-IV project.

- In 2024, ABB unveiled new digital transformer monitoring tools enhancing substation efficiency

Report Coverage

The research report offers an in-depth analysis based on Technology, Component, Category and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Utilities will invest more in digital substations with remote monitoring and automation capabilities.

- Renewable energy expansion will drive the need for flexible high-voltage transmission systems.

- Governments will continue funding grid modernization to improve energy security and efficiency.

- Compact and gas-insulated substations will see higher demand in space-constrained environments.

- Cybersecurity integration will become a standard requirement for all new substation installations.

- Emerging markets will prioritize new substation projects to support rural electrification goals.

- Modular substations will gain popularity for faster deployment and lower on-site work.

- Aging infrastructure in developed regions will push refurbishment and upgrade projects.

- Cross-border energy transmission projects will create demand for large-scale substations.

- Real-time data and predictive maintenance tools will drive operational efficiency across substations.