Market Overview

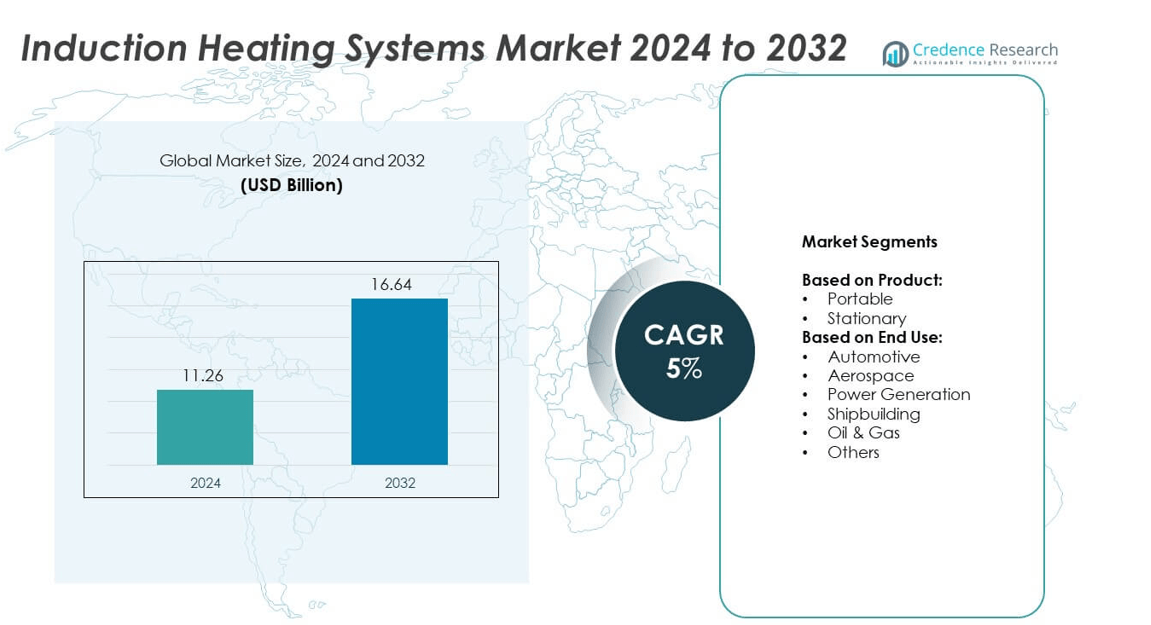

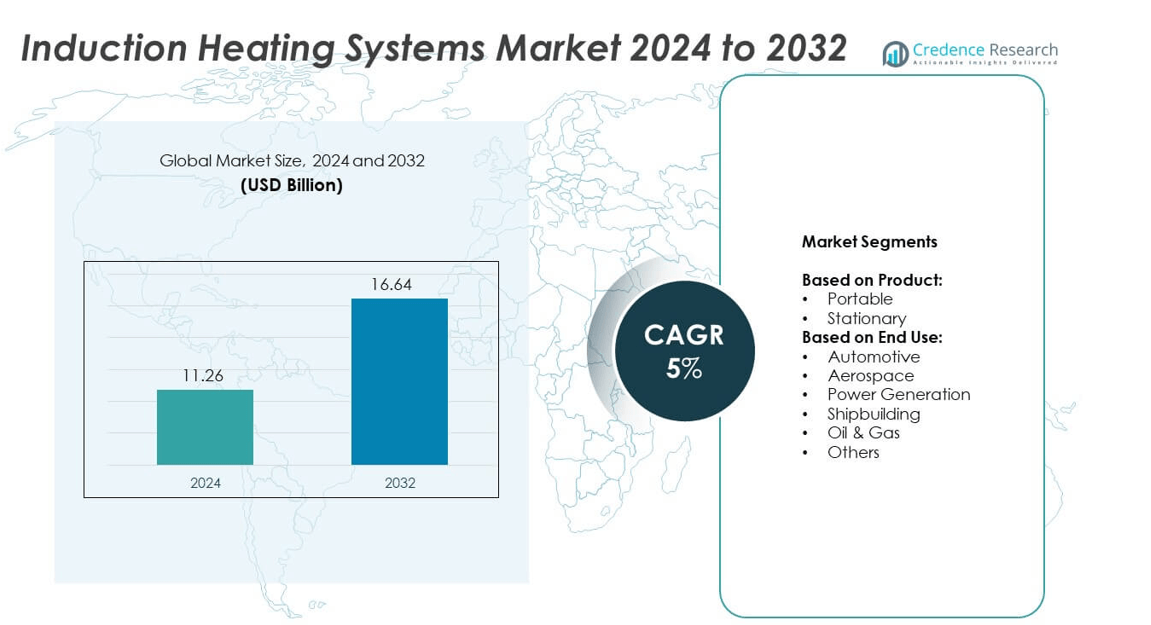

The Induction Heating Systems Market size was valued at USD 11.26 Billion in 2024 and is projected to reach USD 16.64 Billion by 2032, growing at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Induction Heating Systems Market Size 2024 |

USD 11.26 Billion |

| Induction Heating Systems Market, CAGR |

5.% |

| Induction Heating Systems Market Size 2032 |

USD 16.64 Billion |

The Induction Heating Systems market grows with rising demand for energy-efficient and precise heating solutions across industries. Automotive and aerospace sectors adopt these systems for welding, brazing, and component hardening to enhance productivity. Power generation and oil and gas facilities rely on them for turbine maintenance and pipeline construction. Increasing focus on sustainable manufacturing and regulatory push for low-emission technologies drive adoption. Integration with digital monitoring and automation further accelerates system deployment, supporting growth across diverse industrial applications.

The Induction Heating Systems market demonstrates strong regional diversity, with North America and Europe leading in advanced manufacturing adoption, while Asia Pacific drives growth through rapid industrialization and expanding automotive production. Latin America and the Middle East & Africa show steady progress with applications in oil, gas, and power projects. Key players such as Ambrell, Inductoheat, Ajax Tocco, and ABP Induction Systems strengthen their presence through innovation, regional partnerships, and integration of digital technologies into heating solutions.

Market Insights

- The Induction Heating Systems market was valued at USD 11.26 Billion in 2024 and is projected to reach USD 16.64 Billion by 2032, at a CAGR of 5%.

- Strong demand for energy-efficient and eco-friendly heating solutions drives adoption across automotive, aerospace, power, and oil and gas industries.

- Growing trend toward digital monitoring, IoT-enabled platforms, and smart control systems strengthens the role of induction heating in Industry 4.0 manufacturing.

- Competition is marked by innovation in high-frequency power electronics, modular systems, and global expansion strategies of leading companies.

- High initial investment and maintenance complexity restrain adoption among small and medium enterprises, limiting penetration in cost-sensitive markets.

- Asia Pacific shows rapid growth driven by industrial expansion in China, India, and South Korea, while North America and Europe lead in advanced technology adoption.

- Latin America and the Middle East & Africa gradually adopt induction systems in oil and gas, construction, and power generation, creating long-term opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Adoption of Energy-Efficient and Eco-Friendly Heating Technologies

The Induction Heating Systems market benefits from strong demand for energy-efficient solutions across industries. Governments and manufacturers focus on reducing emissions and improving energy use efficiency. Induction heating enables precise heat application, which reduces energy waste and enhances productivity. It supports eco-friendly operations by eliminating harmful combustion-related emissions common in conventional systems. Growing awareness about sustainable practices drives replacement of outdated equipment with modern induction systems. Rising regulatory push toward cleaner technologies further strengthens adoption across automotive, aerospace, and power sectors.

- For instance, ENRX (formerly EFD Induction) has installed over 30,000 induction heating systems worldwide, supporting emission reduction and sustainable manufacturing.

Expanding Use in Automotive and Aerospace Manufacturing Processes

The Induction Heating Systems market gains traction from widespread adoption in automotive and aerospace applications. Automakers employ induction heating for welding, brazing, and surface hardening due to its precision. It allows faster cycle times and higher-quality finishes compared to traditional methods. Aerospace manufacturers rely on induction heating for turbine blade hardening and composite material curing. The shift toward lightweight materials in vehicle production also creates demand for advanced heating solutions. Growth in electric vehicle manufacturing strengthens usage of induction heating in battery and motor component production.

- For instance, Bosch’s Bari plant reported heat-treating around 2 million automotive components and 1 million e-bike components in 2021, showcasing induction technology’s role in mobility manufacturing.

Rising Demand for Precision and Automation in Industrial Operations

The Induction Heating Systems market aligns with rising demand for precision and automation in manufacturing. Modern facilities require reliable, controlled heating systems that integrate with digital monitoring. It ensures consistent results while reducing downtime and production errors. Automated induction heating supports smart factory initiatives and enhances operational safety. Industries such as metallurgy, electronics, and shipbuilding use it for efficient, controlled heating in critical applications. This shift toward automation and digital integration accelerates replacement of legacy thermal technologies.

Increasing Applications in Power Generation and Oil & Gas Sectors

The Induction Heating Systems market sees growing deployment in power generation and oil and gas industries. It supports critical processes such as pipe welding, turbine component hardening, and preheating. The ability to deliver localized, rapid, and repeatable heating reduces operational risks in sensitive environments. Growing investments in nuclear, thermal, and renewable power plants encourage use of advanced heating systems. Oil and gas facilities adopt induction heating for safer and more efficient pipeline construction. Expanding infrastructure projects worldwide continue to create strong demand across these industrial sectors.

Market Trends

Integration of Digital Monitoring and Smart Control Systems

The Induction Heating Systems market reflects a strong trend toward digital monitoring and advanced control integration. Manufacturers adopt IoT-enabled solutions that provide real-time data on temperature, energy use, and performance. It enhances efficiency by reducing maintenance costs and enabling predictive analysis. Smart control systems allow remote operation, which improves safety in industrial environments. Industries prefer digital-enabled equipment for better process visibility and higher production reliability. The shift toward Industry 4.0 practices fuels continuous demand for connected induction heating solutions.

- For instance, In January 2016, Ajax TOCCO Magnethermic shipped a 1,900 kW induction heating dryer system to a steel strip galvanizing producer in China for drying various coatings. This high-powered system was designed to heat steel strip ranging from 0.40 mm to 2.50 mm thick and 800 mm to 1,676 mm wide at a rate of 220 meters per minute, or 116 metric tons per hour, proving the benefits of industrial-scale automation.

Shift Toward Portable and Modular Heating Equipment

The Induction Heating Systems market shows rising demand for portable and modular solutions. End users seek compact systems that can be deployed across multiple production sites. It supports faster installation, lower maintenance, and higher operational flexibility compared to fixed units. Modular systems allow scaling of heating capacity without heavy infrastructure investment. Automotive, construction, and repair industries benefit from the adaptability of portable induction heaters. The growing focus on cost-effective and mobile solutions accelerates this trend globally.

- For instance, ENRX provides advanced induction solutions used in over 80 countries, including projects in energy and heavy industry sectors.

Focus on High-Frequency and Advanced Power Electronics

The Induction Heating Systems market continues to advance with innovations in high-frequency technology and power electronics. New inverter designs and advanced semiconductors enable faster heating and improved thermal control. It ensures precision for applications requiring exact temperature ranges and reduced heat loss. Aerospace and electronics manufacturing increasingly demand such high-frequency systems for delicate components. Higher efficiency and compact system design also reduce overall energy requirements. The industry trend toward advanced electronics drives continuous technology development.

Expansion of Applications Across Emerging Industrial Sectors

The Induction Heating Systems market expands into new areas such as renewable energy and medical device manufacturing. It provides controlled heating for processes like solar panel production and medical instrument sterilization. Industries value the clean, contactless, and reliable nature of induction heating for sensitive operations. Growing investments in renewable technologies encourage broader use of advanced heating solutions. Medical, electronics, and defense sectors create new opportunities for system suppliers. This diversification of applications strengthens long-term market growth potential.

Market Challenges Analysis

High Initial Investment and Maintenance Complexity

The Induction Heating Systems market faces challenges from high upfront investment costs. Small and medium enterprises hesitate to adopt due to capital constraints. It requires specialized power supplies, advanced control systems, and skilled technicians, which raise expenses. Maintenance complexity also adds burden, as improper handling can damage sensitive components. Industries with limited budgets often prefer conventional heating technologies despite lower efficiency. This cost barrier slows adoption in price-sensitive markets and restricts growth potential in developing regions.

Limited Awareness and Technical Expertise Across End Users

The Induction Heating Systems market also encounters difficulties linked to limited awareness and technical expertise. Many industries lack knowledge about operational advantages and long-term savings from these systems. It demands skilled operators for setup, monitoring, and integration with automated production lines. Shortage of trained professionals increases reliance on external support, which delays operations. In some regions, industries hesitate to switch due to unfamiliarity with induction technology. Low awareness and skill gaps hinder widespread adoption despite proven efficiency benefits.

Market Opportunities

Expansion into Renewable Energy and Electric Vehicle Manufacturing

The Induction Heating Systems market holds strong opportunities in renewable energy and electric vehicle production. It supports processes such as turbine component hardening, solar panel assembly, and EV motor part manufacturing. Growing investment in clean energy and mobility solutions creates consistent demand for advanced heating technologies. Manufacturers of EV batteries and charging infrastructure also benefit from precise and efficient heating systems. Governments promote local manufacturing of clean energy equipment, which accelerates adoption. This expansion into high-growth sectors ensures long-term opportunities for technology providers.

Advancements in Automation and Emerging Industrial Applications

The Induction Heating Systems market gains opportunities from automation-driven industries and emerging applications. It integrates seamlessly with smart factory frameworks, offering controlled, consistent heating with reduced downtime. Growth in aerospace, electronics, and healthcare sectors opens new possibilities for advanced induction solutions. Medical device manufacturing uses it for sterilization, while electronics firms apply it for precision soldering. Adoption of modular and portable units increases flexibility for industrial and field operations. Expanding use in diverse sectors strengthens market presence and supports future scalability.

Market Segmentation Analysis:

By Product:

The Induction Heating Systems market is divided into portable and stationary systems. Portable systems are gaining strong preference due to their flexibility and ease of deployment in diverse industrial settings. It allows operators to perform heating tasks across multiple workstations without requiring large infrastructure changes. Portable units are especially useful in repair, maintenance, and field applications where mobility is critical. Stationary systems continue to dominate large-scale manufacturing facilities that demand consistent, high-capacity operations. Their ability to integrate with automated production lines makes them essential in sectors requiring precision and volume efficiency. This balance between mobility and fixed efficiency defines the product landscape.

- For instance, SECO/WARWICK delivered a single-chamber Vector vacuum furnace with working space of 900 × 900 × 1200 mm, enabling rapid cooling up to 6 bar absolute pressure for producing gas turbine components

By End use:

The Induction Heating Systems market covers automotive, aerospace, power generation, shipbuilding, oil and gas, and other industries. Automotive applications represent a major segment, with induction heating widely used for welding, brazing, and component hardening. It supports faster production cycles and improves the durability of vehicle parts, aligning with the growth in electric vehicle manufacturing. Aerospace companies rely on induction systems for turbine blade processing and composite curing, where precision and reliability are vital. Power generation employs these systems for turbine maintenance, pipe welding, and component hardening, ensuring operational safety and reduced downtime. Shipbuilding uses induction technology for large-scale welding and repair tasks that require efficiency in challenging environments. Oil and gas facilities adopt it for pipeline construction and maintenance, where rapid, localized heating reduces risks and improves efficiency. Other industries, including electronics and healthcare, are emerging users, applying induction heating in specialized processes such as soldering and sterilization. This broad end-use adoption highlights the technology’s versatility and growth potential across sectors.

- For instance, Siemens Energy designed the heat pump to provide a thermal capacity of up to 8 MW and supply flow temperatures between 85 °C and 120 °C.

Segments:

Based on Product:

Based on End Use:

- Automotive

- Aerospace

- Power Generation

- Shipbuilding

- Oil & Gas

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 32% share of the Induction Heating Systems market, supported by strong adoption across manufacturing, automotive, and aerospace sectors. The region benefits from advanced industrial infrastructure and significant investments in energy-efficient technologies. It sees rapid adoption of induction heating in electric vehicle manufacturing, where demand for precise, clean, and controlled processes continues to rise. The aerospace sector also drives growth, with induction systems used for turbine blade hardening, composite curing, and advanced welding processes. It further gains momentum from the U.S. and Canada’s focus on modernizing power generation plants and expanding renewable energy capacity. Increasing replacement of conventional heating with digitally integrated induction systems supports market expansion in this region.

Europe

Europe holds 28% share of the Induction Heating Systems market, driven by its advanced automotive and aerospace manufacturing base. Germany, France, and the UK lead in adopting induction systems for welding, brazing, and component hardening. It benefits from strong government support for energy-efficient and sustainable industrial operations under EU regulations. Automotive companies in the region use induction heating for electric vehicle components, while aerospace firms rely on it for precision processes. Europe’s focus on Industry 4.0 and integration of smart factory solutions accelerates adoption of digital-enabled heating technologies. Power generation and oil and gas sectors also contribute through modernization of plants and pipelines. This region continues to expand its footprint in portable and stationary induction systems.

Asia Pacific

Asia Pacific represents the largest share, standing at 34% of the Induction Heating Systems market. The region benefits from rapid industrialization and large-scale infrastructure development across China, India, Japan, and South Korea. It leads in automotive production, where induction heating plays a crucial role in component manufacturing and assembly. Aerospace and shipbuilding sectors in Japan and South Korea further strengthen adoption, with demand for high-precision systems growing steadily. It also benefits from strong investments in renewable energy projects and power generation infrastructure. Local manufacturers introduce cost-effective solutions, driving adoption in small and mid-scale industries. The region’s fast-growing electronics and healthcare sectors also create new opportunities for induction heating applications.

Latin America

Latin America accounts for 4% share of the Induction Heating Systems market, driven by gradual industrial development and adoption in oil and gas, mining, and automotive sectors. Brazil and Mexico remain the key contributors, with automotive production supporting steady demand for induction-based hardening and welding systems. It sees growing interest in renewable power generation projects, particularly wind and hydro, which require advanced turbine component maintenance. Oil and gas pipeline construction across the region also relies on efficient induction heating solutions. Limited awareness and higher upfront costs slow broader adoption, but rising investments in industrial modernization support steady progress. This region holds significant growth potential in portable induction systems.

Middle East and Africa

The Middle East and Africa hold 2% share of the Induction Heating Systems market, supported by oil and gas, construction, and power generation sectors. Countries such as Saudi Arabia, the UAE, and South Africa adopt induction heating for pipeline construction, heavy equipment maintenance, and industrial welding. It gains traction in large-scale infrastructure projects where safety, precision, and efficiency are critical. Renewable energy investments, including solar and wind, also create opportunities for broader deployment of heating systems. The market faces challenges due to limited local manufacturing and reliance on imports. However, government initiatives to diversify energy and industrial bases support gradual expansion in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ambrell

- Miller Electric

- LINTEC

- American Induction Heating Corporation

- CEC Induction

- SEFO

- TDK

- Ajax Tocco

- Inductoheat

- Riello Induction

- IHW

- HylecAPL

- Fives

- ellwood

- ABP Induction Systems

Competitive Analysis

The leading players in the Induction Heating Systems market include Ambrell, Miller Electric, LINTEC, American Induction Heating Corporation, CEC Induction, SEFO, TDK, Ajax Tocco, Inductoheat, Riello Induction, IHW, HylecAPL, Fives, ellwood, and ABP Induction Systems. These companies compete through technological innovation, product diversification, and strategic partnerships across major industries such as automotive, aerospace, power generation, and oil and gas. Their focus remains on delivering systems with higher efficiency, precision, and digital integration to meet evolving industrial demands. Competition in the market is shaped by the ability to provide tailored solutions across portable and stationary systems. Global leaders emphasize research in high-frequency power electronics, modular designs, and IoT-enabled platforms that enhance performance and reduce operational costs. Regional players target specific industrial applications, offering competitive pricing and localized support. Strategic mergers and acquisitions strengthen global presence, while partnerships with OEMs secure long-term supply contracts. The growing shift toward sustainable and automated manufacturing processes continues to influence competitive strategies. Companies that balance innovation with cost-efficiency are expected to maintain stronger positions in this competitive landscape.

Recent Developments

- In 2025, Miller introduced the New Venture™ 150 Battery Powered Welder, emphasizing manufacturing innovation, efficiency, and operator safety

- In 2025, Inductoheat continues to focus on advanced induction heating technologies with a strong emphasis on digital process monitoring, SPC software, independent frequency and power inverters, and environmentally friendly solutions, reflecting ongoing innovation and service excellence

- In 2023, Ambrell introduced the new EKOHEAT 2 family of induction heating products featuring advanced capabilities including improved efficiency and control.

Report Coverage

The research report offers an in-depth analysis based on Product, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Induction Heating Systems market will expand with growing demand for energy-efficient solutions.

- Adoption in electric vehicle manufacturing will continue to strengthen system deployment.

- Aerospace and defense sectors will drive demand for precision-based induction applications.

- Portable and modular systems will gain preference for flexible industrial operations.

- Integration with IoT and smart factory platforms will enhance system adoption.

- Emerging applications in medical device manufacturing will support broader market reach.

- Renewable energy projects will increase use of induction heating for component processing.

- Asia Pacific will maintain dominance due to strong industrial growth and manufacturing base.

- Europe and North America will advance with technology-driven modernization and sustainability goals.

- Ongoing innovations in high-frequency power electronics will shape the next generation of systems.