Market Overview

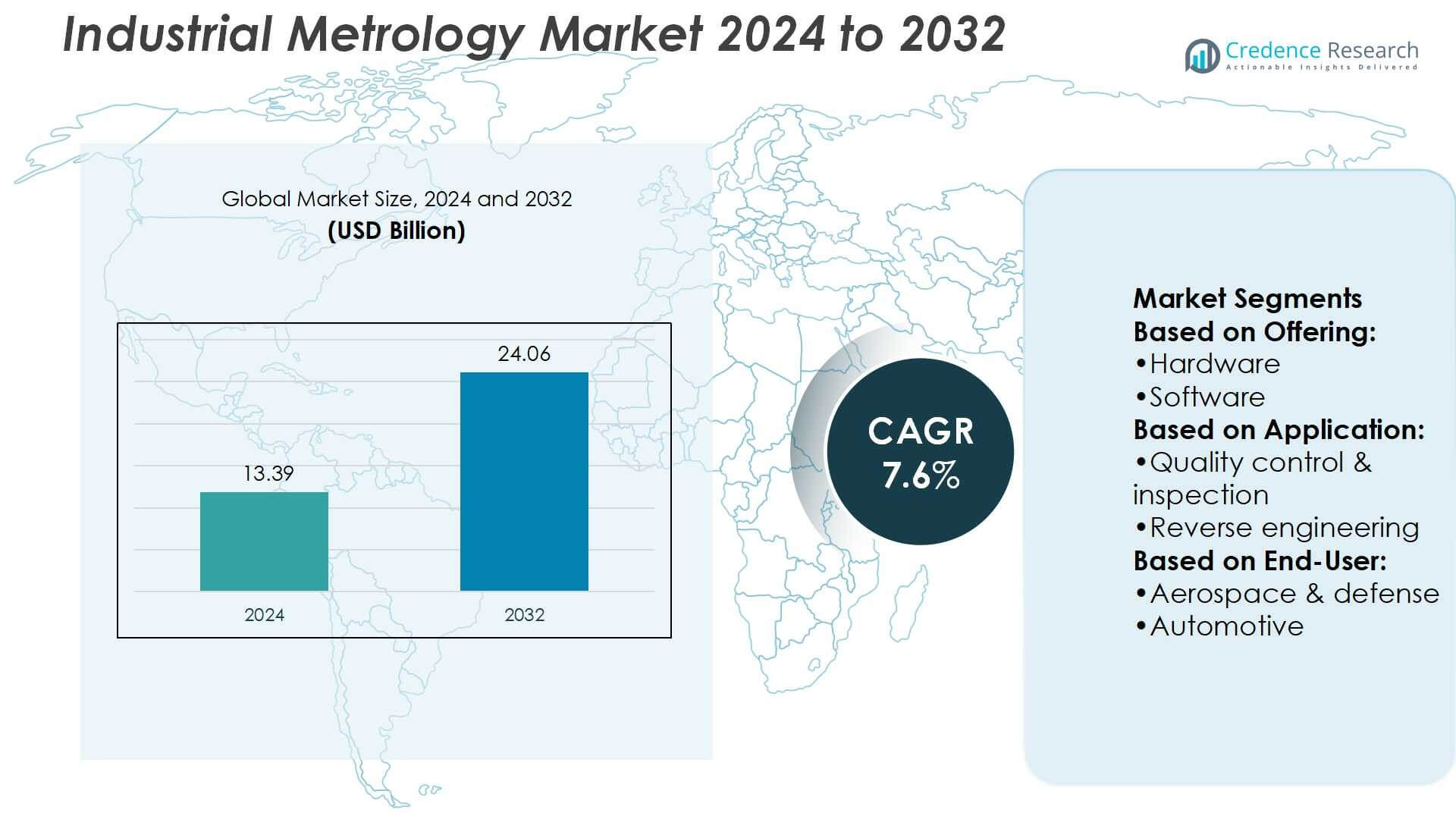

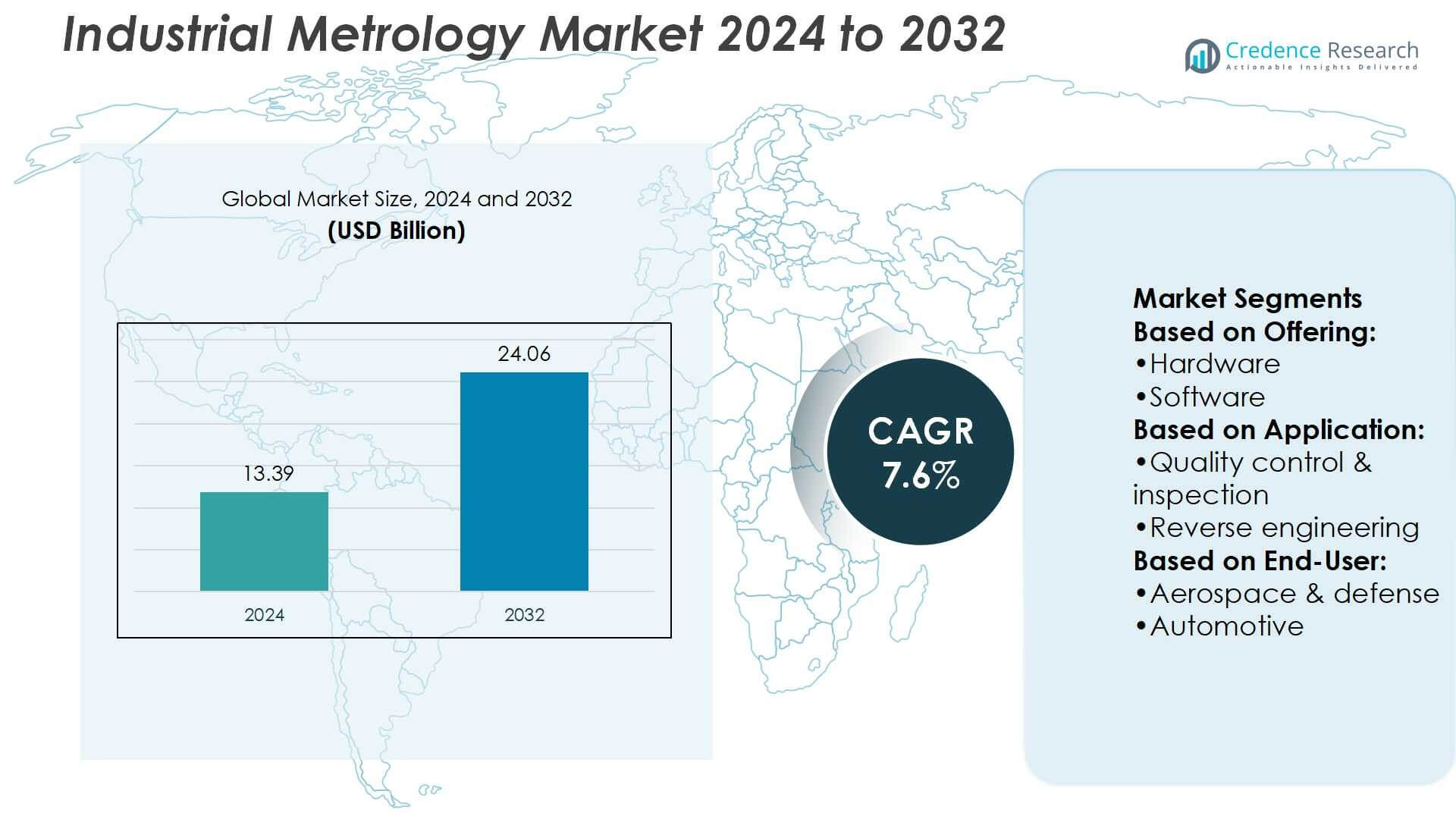

Industrial Metrology Market size was valued at USD 13.39 billion in 2024 and is anticipated to reach USD 24.06 billion by 2032, at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Metrology Market Size 2024 |

USD 13.39 Billion |

| Industrial Metrology Market, CAGR |

7.6% |

| Industrial Metrology Market Size 2032 |

USD 24.06 Billion |

The Industrial Metrology Market grows through strong drivers and evolving trends that emphasize precision, automation, and digital integration. Rising demand from aerospace, automotive, semiconductor, and manufacturing sectors fuels adoption of advanced measurement systems for quality assurance and compliance. It benefits from rapid advancements in 3D scanning, optical metrology, and coordinate measuring machines that improve speed and accuracy. Industry 4.0 and smart factory initiatives create momentum for connected, cloud-enabled, and AI-powered solutions. Increasing use of portable and in-line inspection tools highlights the trend toward real-time monitoring and predictive quality control, ensuring the market’s relevance across diverse industrial applications.

The Industrial Metrology Market shows strong regional diversity, with North America leading through advanced aerospace and automotive sectors, Europe maintaining steady growth with strict compliance standards, and Asia Pacific emerging as the fastest-growing region driven by expanding manufacturing and semiconductor industries. Latin America and the Middle East & Africa hold smaller but rising shares supported by industrial investments. Key players such as Carl Zeiss AG, Hexagon AB, Mitutoyo Corporation, KEYENCE CORPORATION, and Nikon Metrology strengthen global presence through innovation and strategic partnerships.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Industrial Metrology Market size was valued at USD 13.39 billion in 2024 and is anticipated to reach USD 24.06 billion by 2032, at a CAGR of 7.6%.

- Rising demand from aerospace, automotive, semiconductor, and manufacturing industries drives adoption of advanced metrology solutions.

- Increasing focus on automation, digital integration, and Industry 4.0 accelerates market expansion.

- Competitive landscape features innovation in 3D scanning, optical systems, and coordinate measuring machines.

- High implementation costs and shortage of skilled professionals act as key restraints.

- North America leads with aerospace and automotive dominance, while Europe benefits from strict compliance standards.

- Asia Pacific grows fastest due to manufacturing and semiconductor expansion, with Latin America and Middle East & Africa contributing smaller but rising shares.

Market Drivers

Rising Demand for Precision in Manufacturing and Quality Assurance

The Industrial Metrology Market grows on the back of rising demand for precision across industries. Automotive and aerospace manufacturers adopt advanced metrology systems to reduce defects and optimize production cycles. It ensures accurate validation of parts and assemblies, supporting higher efficiency in mass production. Electronics and semiconductor sectors also rely on advanced measurement solutions for miniaturized components. Manufacturers prioritize quality assurance to meet stringent regulatory and customer standards. The market expands as companies view accurate measurement as a driver of competitiveness.

- For instance, Mitutoyo’s MDH Digimatic High-Accuracy Micrometer delivers ±0.5 µm accuracy with 0.1 µm resolution in the 0-25 mm range.It ensures accurate validation of parts and assemblies, supporting higher efficiency in mass production.

Technological Advancements in Measurement Solutions and Automation Integration

The Industrial Metrology Market benefits from continuous innovations in automation and digital technologies. 3D scanning, coordinate measuring machines, and optical measurement tools deliver faster and more accurate results. It integrates with automated systems and robotic platforms to reduce human error. Cloud-based data analytics enhances measurement accuracy and provides real-time insights. Industry 4.0 adoption accelerates demand for connected and automated metrology systems. Manufacturers invest in smart solutions that improve throughput and enable predictive quality control.

- For instance, KEYENCE’s VL-770 3D Scanner CMM attains repeatability of 2 µm σ and measurement accuracy of ±10 µm over a measurement range of ø300 × H200 mm. It integrates with automated systems and robotic platforms to reduce human error.

Expanding Applications Across Diverse Industrial Sectors

The Industrial Metrology Market witnesses growing adoption in medical devices, energy, and heavy equipment manufacturing. These industries require precise tolerance measurement to maintain safety and reliability standards. It supports efficient resource utilization and reduces operational waste. Wind turbine manufacturers use metrology tools for large-scale component alignment. Oil and gas sectors apply advanced measurement systems in pipeline inspection and equipment calibration. Broader adoption across industries strengthens the market’s long-term growth outlook.

Strong Role of Regulatory Standards and Global Trade Requirements

The Industrial Metrology Market gains momentum from strict compliance and international trade requirements. Global standards in aviation, automotive safety, and medical device production emphasize reliable measurement practices. It enables manufacturers to meet certification norms and reduce the risk of recalls. Harmonized trade regulations push suppliers to invest in high-end measurement tools. Governments encourage adoption of advanced quality systems through industry-specific mandates. Growing emphasis on compliance enhances demand for accurate, traceable, and standardized measurement solutions.

Market Trends

Market Trends

Increasing Adoption of Non-Contact and Optical Measurement Technologies

The Industrial Metrology Market advances with strong demand for non-contact solutions. Optical metrology, 3D scanning, and laser-based systems deliver rapid and precise measurements without damaging components. It supports complex geometries in aerospace, automotive, and electronics manufacturing. Non-contact technologies also enhance efficiency by reducing inspection cycle times. The trend reflects a shift toward high-speed production environments. Industries invest in advanced sensors that improve accuracy while minimizing operator intervention.

- For instance, Creaform’s MetraSCAN 3D handheld optical CMM scanner can deliver an accuracy of up to 0.025 mm and, when combined with its C-Track optical tracker, a volumetric accuracy of 0.064 mm within a measurement volume of 9.1 m³.

Integration of Metrology with Smart Manufacturing and Industry 4.0

The Industrial Metrology Market evolves with integration into digital ecosystems. Metrology tools now connect with IoT platforms and digital twins to optimize production. It enables predictive maintenance, real-time monitoring, and data-driven decision-making. Manufacturers adopt machine learning and AI to enhance defect detection. Connectivity with automated systems ensures faster quality control across production lines. This trend accelerates the movement toward fully connected smart factories.

- For instance, Nikon’s NEXIV VMF-K Series offers height measurement repeatability of 0.2 µm (2σ) using a 45× objective lens, while maintaining field of view at 0.26×0.19 mm for the fine magnification mode.

Growing Focus on Portable and In-Line Metrology Solutions

The Industrial Metrology Market experiences rising demand for portable and in-line solutions. Manufacturers adopt mobile devices and handheld systems for flexibility across shop floors. It allows real-time measurement directly within production environments. In-line metrology tools reduce downtime by integrating inspection into the manufacturing process. Portable solutions also support remote operations and field applications. This trend increases adoption among industries seeking faster, more adaptive measurement systems.

Rising Importance of Sustainability and Energy-Efficient Metrology Practices

The Industrial Metrology Market reflects growing emphasis on sustainability. Manufacturers demand energy-efficient equipment and eco-friendly measurement solutions. It supports reduced material waste and resource efficiency in industrial operations. Lightweight systems with low power requirements gain traction among environmentally conscious firms. The trend aligns with global sustainability targets across manufacturing sectors. Integration of green practices strengthens the market’s role in building sustainable industrial ecosystems.

Market Challenges Analysis

High Implementation Costs and Complexity of Advanced Metrology Systems

The Industrial Metrology Market faces significant challenges due to high implementation costs. Advanced systems such as coordinate measuring machines and optical scanners require substantial capital investment. It becomes difficult for small and medium enterprises to adopt these technologies, limiting widespread penetration. The complexity of integrating advanced tools with existing production lines further adds to adoption barriers. Training requirements for skilled operators increase operational expenses. Market growth slows when manufacturers hesitate to invest in expensive equipment without clear short-term returns.

Shortage of Skilled Workforce and Technical Standardization Issues

The Industrial Metrology Market also struggles with a shortage of skilled professionals capable of operating and interpreting complex measurement systems. It creates reliance on extensive training, which raises both costs and adoption timelines. Variations in technical standards across regions complicate global trade and certification processes. Companies must comply with multiple regulatory frameworks, adding operational burden. Lack of workforce expertise combined with fragmented standards reduces the efficiency of advanced metrology deployment. These challenges limit the market’s ability to scale rapidly across diverse industrial sectors.

Market Opportunities

Expansion into Emerging Industries and High-Growth Applications

The Industrial Metrology Market presents strong opportunities in emerging sectors such as renewable energy, medical devices, and electric vehicles. These industries demand high precision for complex components and safety-critical applications. It creates prospects for suppliers offering advanced measurement solutions tailored to new requirements. Wind turbine blade alignment, EV battery inspection, and surgical instrument calibration highlight growth avenues. Expanding applications across healthcare and energy sectors drive long-term demand. Companies that develop industry-specific solutions can capture significant market share.

Rising Demand for Automation and Digital Transformation in Manufacturing

The Industrial Metrology Market benefits from rising investment in automation and digital transformation. Manufacturers seek integrated systems that support real-time monitoring and predictive quality control. It strengthens opportunities for providers of AI-powered, cloud-enabled, and IoT-connected metrology tools. Adoption of digital twins and smart factory models requires accurate measurement data, boosting demand. Portable and in-line systems also create new opportunities by enhancing flexibility in production environments. Vendors offering scalable, intelligent solutions position themselves well for sustained growth.

Market Segmentation Analysis:

By Offering

The Industrial Metrology Market divides into hardware, software, and services. Hardware dominates the segment due to widespread adoption of coordinate measuring machines, optical scanners, and laser trackers. It drives growth by providing accurate measurement tools essential for quality assurance. Software plays a vital role by enabling data analytics, visualization, and integration with digital manufacturing systems. Services such as calibration, consulting, and training gain traction as industries seek expertise for complex applications. The combination of these offerings supports the market’s shift toward end-to-end solutions.

- For instance, FARO Laser Tracker X & Xi achieves 3D single-point accuracy of 0.011 mm. The 3D single-point accuracy of 0.011 mm (0.0004”) is accurately stated in the product description.

By Application

The Industrial Metrology Market segments by application into quality control and inspection, reverse engineering, mapping and modeling, and others. Quality control and inspection hold the largest share, driven by demand for precision in automotive and aerospace production. It ensures compliance with safety and performance standards, making it a critical driver of adoption. Reverse engineering finds growing use in product redesign, legacy part reproduction, and aftermarket applications. Mapping and modeling support advanced simulation and design validation, expanding relevance in high-tech manufacturing. The diversity of applications strengthens metrology’s position across industries.

- For instance, KLA’s Kronos 1190 inspection system detects defects as small as 150 nm in processes such as through silicon vias and redistribution layers in advanced wafer-level packaging. It ensures compliance with safety and performance standards, making it a critical driver of adoption.

By End-User

The Industrial Metrology Market divides by end-user into aerospace and defense, automotive, semiconductor, and manufacturing. Aerospace and defense adopt metrology systems to ensure structural integrity, safety, and compliance with international standards. It supports the production of advanced aircraft components and defense equipment. Automotive remains a key contributor, using metrology tools for engine parts, body assembly, and electric vehicle components. Semiconductor manufacturers adopt precision tools for micro-scale measurement and defect detection. Broader manufacturing industries integrate metrology solutions to improve efficiency, reduce waste, and enhance product quality. Together, these end-user segments define the market’s wide industrial footprint.

Segments:

Based on Offering:

Based on Application:

- Quality control & inspection

- Reverse engineering

Based on End-User:

- Aerospace & defense

- Automotive

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 34.5% of the global Industrial Metrology Market in 2024. The United States dominated this share, supported by its large aerospace, automotive, and semiconductor industries. Canada and Mexico contributed smaller but steady growth through manufacturing modernization. It benefitted from advanced infrastructure, strict regulatory requirements, and widespread adoption of Industry 4.0 practices. High demand for precision systems in aerospace and defense boosted adoption of coordinate measuring machines and optical scanning devices. Growth remains strong as companies invest in smart factories and automated quality assurance. The region continues to set benchmarks for technological innovation and standardization in industrial measurement.

Europe

Europe held about 24.8% of the Industrial Metrology Market in 2024. Germany, the UK, and France were the leading countries, driven by their automotive and aerospace industries. It gained strength from strict EU regulations on product safety, certification, and traceability. The region also showed high adoption of advanced optical metrology and 3D scanning tools. Manufacturers integrated digital inspection into production lines to improve efficiency and compliance. Growth opportunities stemmed from the expansion of renewable energy and medical device sectors. Europe maintains a stable position with steady investments in sustainability-driven manufacturing.

Asia Pacific

Asia Pacific represented 28.2% of the Industrial Metrology Market in 2024. China led the region, followed by Japan, South Korea, and India, with strong manufacturing and semiconductor bases. It achieved the fastest growth rate, projected at over 10% CAGR from 2025 to 2032. Automotive component production, electronics miniaturization, and industrial automation supported rising demand. Governments across Asia encouraged precision engineering and smart manufacturing to improve global competitiveness. Portable and in-line metrology tools gained high traction for efficiency. Asia Pacific is positioned to increase its global share due to growing industrial investments and expanding exports.

Latin America

Latin America accounted for 6.5% of the Industrial Metrology Market in 2024. Brazil and Mexico were the largest contributors, driven by automotive and energy sectors. It faced challenges such as limited infrastructure, lower automation levels, and high equipment costs. Local adoption remained gradual but steady in quality control and calibration services. International firms expanded their service networks to meet rising demand in industrial hubs. Opportunities emerged from oil & gas, renewable energy projects, and regional automotive supply chains. Latin America remains a promising but underdeveloped segment of the global market.

Middle East & Africa

The Middle East & Africa held 6% of the Industrial Metrology Market in 2024. Oil & gas and energy industries were the main drivers of demand in the region. It invested in advanced inspection and calibration solutions to support infrastructure and industrial projects. Countries such as the UAE and Saudi Arabia led adoption due to strong government focus on industrial diversification. Africa showed slower uptake but benefitted from foreign investments in mining and energy. The region continues to grow steadily, supported by government initiatives and technology transfer. MEA remains a small but expanding part of the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mitutoyo Corporation

- KEYENCE CORPORATION

- Creaform

- Nikon Metrology

- FARO Technologies

- KLA Corporation

- Hexagon AB

- Nordson Corporation

- Jenoptik AG

- Carl Zeiss AG

Competitive Analysis

The Industrial Metrology Market players include Carl Zeiss AG, Creaform, FARO Technologies, Hexagon AB, Jenoptik AG, KEYENCE CORPORATION, KLA Corporation, Mitutoyo Corporation, Nikon Metrology, and Nordson Corporation. The Industrial Metrology Market remains highly competitive, characterized by rapid technological innovation and evolving customer demands. Companies focus on developing advanced solutions that integrate automation, artificial intelligence, and real-time data analytics to improve accuracy and efficiency. The market emphasizes portable systems, in-line inspection tools, and cloud-enabled platforms that support smart manufacturing and predictive quality control. Firms also expand service offerings such as calibration, consulting, and training to enhance customer value. Strong competition drives continuous investment in research and development, enabling the launch of faster, more precise, and cost-effective systems. Global expansion strategies, partnerships, and digital transformation initiatives further define the competitive landscape.

Recent Developments

- In May 2025, PVA TePla AG announced the acquisition of DIVE Imaging Systems GmbH, a spin-off from the Fraunhofer Institute for Material and Beam Technology. DIVE specializes in advanced optical material analysis technologies, including hyperspectral imaging combined with artificial intelligence, enabling precise, non-destructive inspection of materials and components.

- In September 2024, Sandvik announced the launch of ZeroTouch, a new business unit specializing in advanced automated industrial measurement solutions. As part of Sandvik Manufacturing Solutions’ strategic focus on software-driven automation, ZeroTouch introduces its “Metrology in Motion” platform—a high-speed, high-accuracy, non-contact solution providing real-time, actionable data for continuous process control.

- In May 2024, Hexagon’s Manufacturing Intelligence division launched its novel handheld 3D scanning technology. The technology complements its vast range of production inspection devices along with extreme capabilities for flexible measurements.

- In April 2024, the new PolyWorks 2024 was launched by InnovMetric, the independent software development company that empowers manufacturers of every size to digitally transform their 3D measurement processes.

Report Coverage

The research report offers an in-depth analysis based on Offering, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of smart factory technologies.

- Demand for portable and in-line metrology systems will continue to grow.

- Integration of AI and machine learning will enhance defect detection accuracy.

- Cloud-enabled platforms will strengthen real-time monitoring and predictive quality control.

- Semiconductor and electronics industries will drive demand for ultra-precision measurement tools.

- Aerospace and automotive sectors will invest more in automated inspection systems.

- Sustainability goals will increase focus on energy-efficient metrology solutions.

- Emerging economies will boost growth through expanding manufacturing infrastructure.

- Service-based models such as calibration and consulting will gain higher importance.

- Strategic partnerships and mergers will shape the competitive landscape globally.

Market Trends

Market Trends