Market Overview

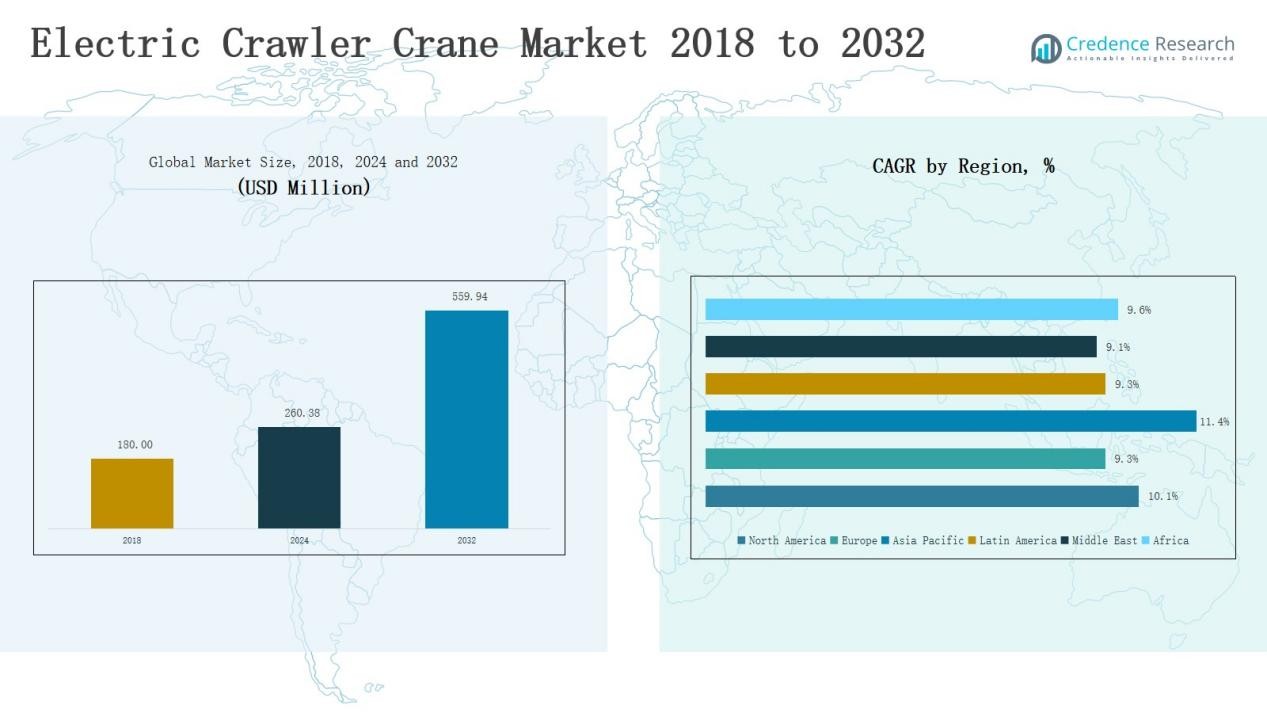

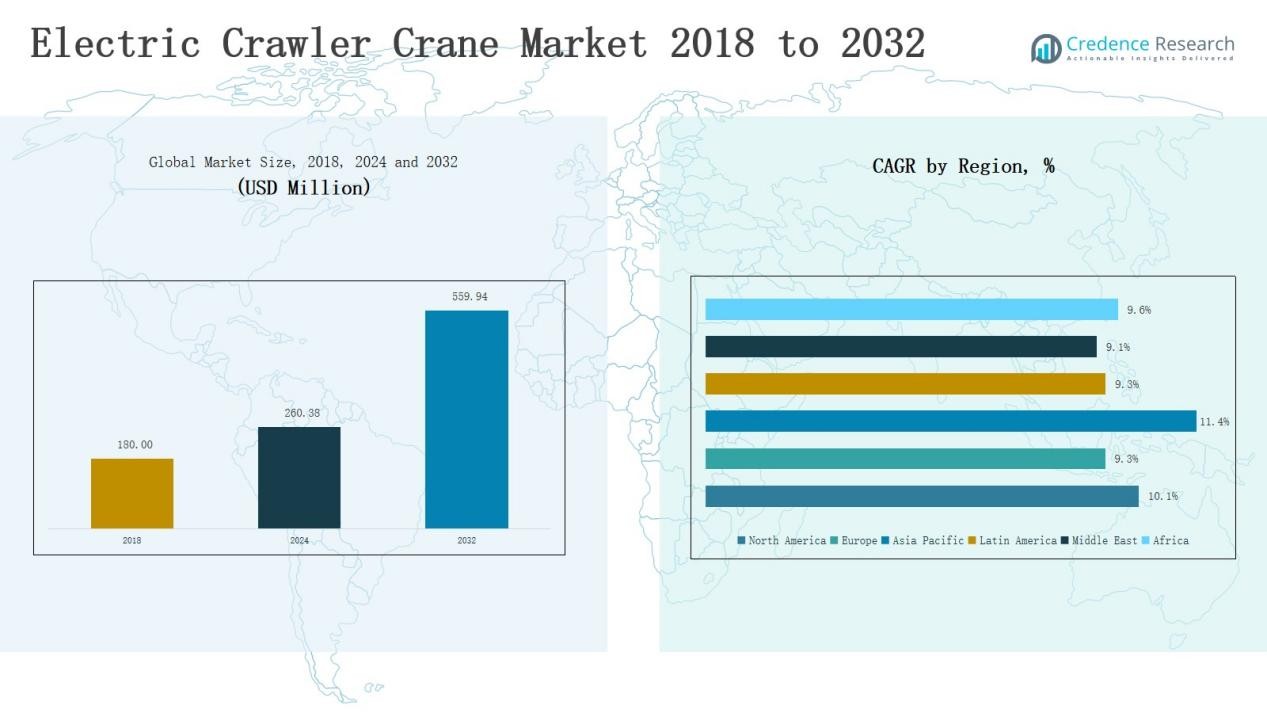

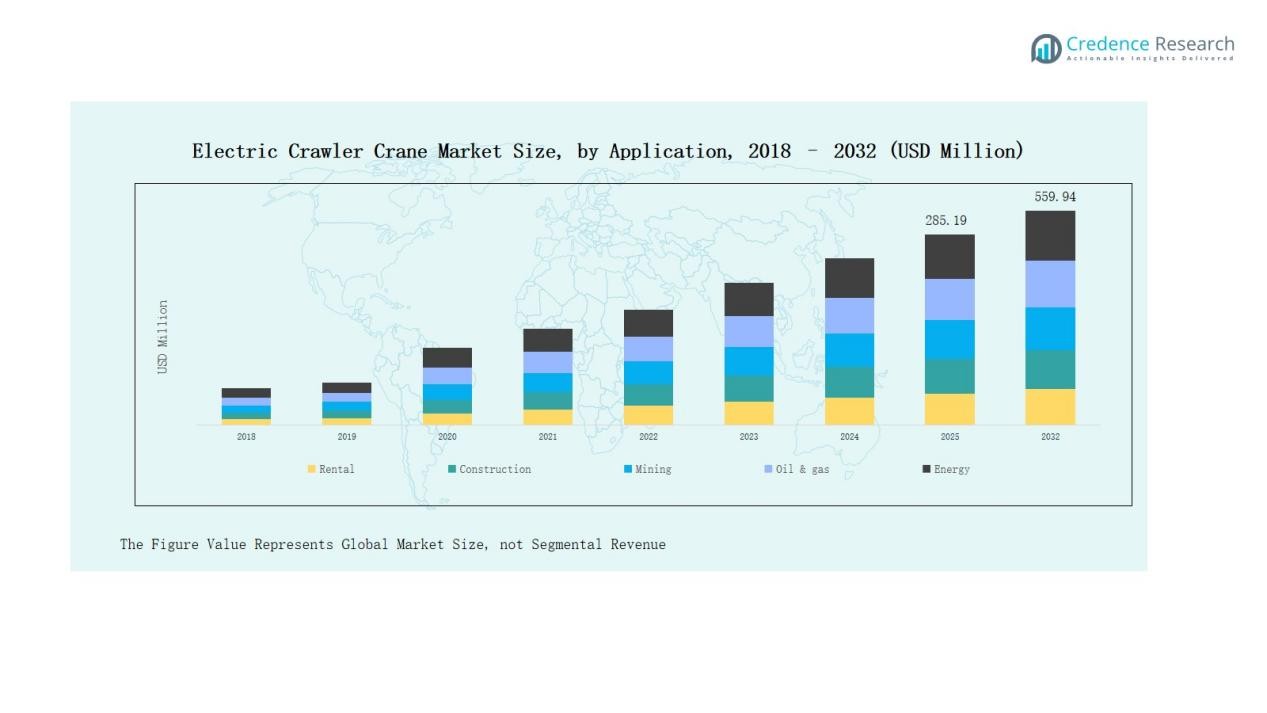

Electric Crawler Crane Market size was valued at USD 180.00 million in 2018 to USD 260.38 million in 2024 and is anticipated to reach USD 559.94 million by 2032, at a CAGR of 10.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Crawler Crane Market Size 2024 |

USD 260.38 Million |

| Electric Crawler Crane Market, CAGR |

10.12% |

| Electric Crawler Crane Market Size 2032 |

USD 559.94 Million |

The Electric Crawler Crane Market is shaped by leading players such as Liebherr-International AG, PV-E Cranes, SANY, Marchetti Autogru S.p.A., and MAEDA SEISAKUSHO CO., LTD, each competing through product innovation, rental fleet expansion, and technology integration. These companies focus on enhancing efficiency, sustainability, and versatility to meet diverse project requirements across infrastructure, energy, and industrial sectors. North America emerged as the leading region in 2024 with a 34% share, driven by large-scale infrastructure modernization, renewable energy projects, and strong adoption of rental services supported by well-established manufacturers and service networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Crawler Crane Market grew from USD 180.00 million in 2018 to USD 260.38 million in 2024 and is projected to reach USD 559.94 million by 2032, advancing at a CAGR of 10.12%.

- The 50 to 250 metric tons capacity segment led with a 42% share in 2024, while below 50 metric tons held 25%, 250 to 450 metric tons captured 20%, and 450 to 650 metric tons accounted for 13%.

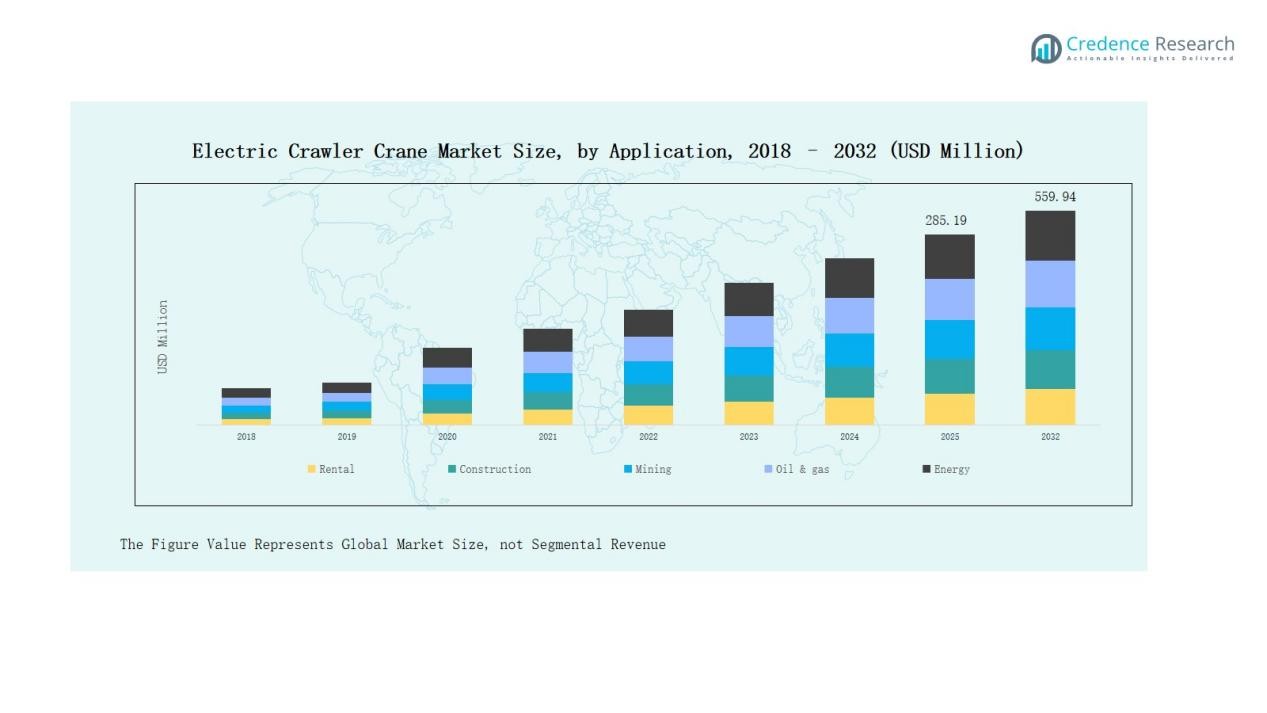

- By application, construction dominated with 38% share in 2024, followed by rental at 28%, energy projects at 15%, oil & gas at 12%, and mining at 7%.

- North America held the largest regional share at 34% in 2024, while Europe and Asia Pacific followed with 22% each, supported by infrastructure modernization and renewable energy projects.

- Key players include Liebherr-International AG, PV-E Cranes, SANY, Marchetti Autogru S.p.A., and MAEDA SEISAKUSHO CO., LTD, competing through innovation, rental fleet expansion, and sustainable technology integration.

Market Segment Insights

By Capacity

The 50 to 250 metric tons segment dominated with a 42% share in 2024, driven by extensive use in infrastructure and industrial projects due to its balance of lifting power, mobility, and cost efficiency. The below 50 metric tons segment followed with 25% share, favored for urban construction and rental fleets owing to its compact design. Higher-capacity categories showed niche but rising demand, with 250 to 450 metric tons at 20% share and 450 to 650 metric tons at 13%, supported by heavy lifting needs in mining, oil & gas, and large energy projects.

- For instance, Liebherr launched the LRT 1130‑2.1, a 130‑ton rough‑terrain crane designed for infrastructure projects requiring high lifting power with flexible mobility.

By Application

The construction segment led the market with 38% share in 2024, supported by rapid urbanization, infrastructure modernization, and smart city initiatives. The rental segment accounted for 28%, reflecting contractor preference for flexible, cost-effective access to equipment. Meanwhile, energy projects held 15% share, boosted by renewable power expansion, while oil & gas contributed 12% from offshore and refinery projects. The mining sector secured the remaining 7%, with demand tied to heavy-duty excavation and extraction operations.

- For instance, Petrobras awarded over $8 billion in contracts for offshore floating production systems related to its P-84 and P-85 FPSO units, underscoring sustained investment in offshore oil projects.

Key Growth Drivers

Rising Infrastructure Development

Global investment in infrastructure projects is a major driver for electric crawler crane adoption. Governments and private sectors are funding smart city projects, transportation networks, and commercial complexes. These initiatives require versatile lifting equipment, making mid-capacity cranes especially vital. The need for sustainable construction practices further boosts demand for electric models, offering reduced emissions and improved efficiency compared to traditional cranes. This trend positions electric crawler cranes as essential assets in meeting modern infrastructure requirements worldwide.

- For instance, Liebherr introduced the LR 1250.1 unplugged, a 250‑tonne battery-powered crawler crane designed for urban infrastructure projects, operating emission-free in unplugged mode for up to 8 hours.

Shift Toward Sustainable Energy

The accelerating shift to renewable energy sources significantly supports market growth. Wind farms, solar projects, and hydroelectric facilities require high-capacity lifting solutions for turbine installation, panel assembly, and heavy component placement. Electric crawler cranes align well with sustainability goals, offering lower operational emissions while maintaining strong lifting performance. Government initiatives promoting clean energy infrastructure provide steady opportunities, ensuring long-term demand from the renewable energy sector. This shift strengthens the crane market’s alignment with global decarbonization objectives.

- For instance, Emil Egger AG deployed Liebherr LR 11000 and LR 1700-1.0 crawler cranes to erect six wind turbines at Switzerland’s second largest wind farm in the Jura Mountains, completing lifts of over 70 tons at heights of 100 meters during an eight-week project.

Expansion of Rental Services

Rental services are expanding as construction companies and contractors prefer flexible equipment access over ownership. Electric crawler cranes are increasingly offered in rental fleets to meet short-term project requirements, reducing capital expenses for end-users. The growth of rental demand is supported by urban projects where smaller cranes are needed temporarily and large-scale projects requiring heavy-duty lifting on a project-specific basis. This expansion enhances accessibility, accelerates adoption across regions, and broadens the customer base for crane manufacturers.

Key Trends & Opportunities

Integration of Advanced Technologies

The integration of telematics, IoT-enabled monitoring, and automation is reshaping the electric crawler crane market. Smart technologies provide real-time insights into performance, predictive maintenance, and safety features, helping operators reduce downtime and improve efficiency. Manufacturers are investing in intelligent systems to meet the growing demand for precision and reliability. This trend represents a strong opportunity to differentiate offerings and cater to advanced infrastructure and industrial projects requiring high-tech equipment.

- For instance, Jekko launched the JCX80 telescopic crawler crane featuring smart automation and remote operation capabilities, designed for efficient use in confined construction sites.

Emerging Demand in Asia-Pacific

Asia-Pacific presents significant opportunities due to rapid urbanization, rising industrial projects, and renewable energy investments. Countries like China, India, and Southeast Asian nations are expanding infrastructure spending, creating a robust pipeline for crane deployment. Affordable financing options and government-backed energy projects further fuel regional demand. As local players expand their fleets and global manufacturers increase their presence, Asia-Pacific is projected to record the fastest growth, making it a pivotal region for market expansion.

- For instance, Tata Hitachi launched its NX30 Next Gen Mini Excavator in India to cater to urban construction.

Key Challenges

High Initial Investment Costs

Electric crawler cranes require substantial upfront investments compared to conventional diesel-powered cranes. The high purchase price limits adoption among small and medium-sized contractors, especially in developing regions. While rental models ease access, cost barriers still slow overall market penetration. Manufacturers face the challenge of balancing advanced technology integration with affordability to make electric cranes accessible across diverse project scales.

Limited Charging Infrastructure

The reliance on adequate charging and power infrastructure is a critical challenge for market expansion. Many construction and mining sites are located in remote areas with limited grid access, making charging logistics difficult. This limitation hampers large-scale adoption and reduces the practicality of electric cranes in certain projects. Without expanded charging networks and mobile charging solutions, the growth potential of electric crawler cranes will remain constrained in less developed regions.

Competition from Conventional Cranes

Despite environmental advantages, electric crawler cranes face strong competition from diesel-powered alternatives. Conventional cranes are widely available, less expensive, and supported by established service networks. Many contractors continue to rely on traditional models due to familiarity and proven reliability. Overcoming this challenge requires aggressive promotion of the long-term benefits of electric cranes, such as lower operating costs and compliance with environmental regulations, to shift market preferences toward cleaner alternatives.

Regional Analysis

North America

North America led the global electric crawler crane market in 2024 with a 34% share, supported by a market value of USD 94.67 million. The region is projected to reach USD 202.92 million by 2032, expanding at a CAGR of 10.1%. Growth is driven by large-scale infrastructure modernization, industrial automation, and energy projects, particularly in the U.S. The strong presence of leading manufacturers and advanced rental service networks further strengthens regional dominance, making North America the most mature market globally.

Europe

Europe accounted for a 22% market share in 2024, valued at USD 62.69 million, with growth expected to reach USD 126.97 million by 2032 at a CAGR of 9.3%. The region benefits from stringent emission regulations, which favor the adoption of electric over diesel-powered cranes. Demand is supported by smart city projects, renewable energy expansion, and industrial retrofitting, especially in Germany, France, and the UK. Rental adoption is also strong, helping contractors manage high ownership costs.

Asia Pacific

Asia Pacific held a 22% share in 2024, with revenues of USD 60.89 million, projected to reach USD 144.41 million by 2032 at the fastest CAGR of 11.4%. The region’s growth is fueled by rapid urbanization, infrastructure megaprojects, and renewable energy investments in China, India, and Southeast Asia. Local manufacturers are expanding fleets at competitive prices, while government-backed initiatives in sustainable construction and green energy accelerate adoption. Asia Pacific is expected to emerge as the most dynamic growth hub globally.

Latin America

Latin America represented a 7% share in 2024, valued at USD 20.39 million, and is forecasted to reach USD 41.31 million by 2032, growing at a CAGR of 9.3%. Brazil leads the region with strong investments in construction and mining, while Argentina and Mexico provide additional growth potential. Market expansion is supported by increasing rental penetration and gradual transition toward sustainable equipment, although economic fluctuations and infrastructure funding gaps remain constraints.

Middle East

The Middle East accounted for a 6% share in 2024, with a market size of USD 12.65 million, expected to double to USD 25.26 million by 2032 at a CAGR of 9.1%. Demand is driven by oil & gas exploration, large-scale energy projects, and smart infrastructure development across GCC nations. The region is investing in green construction initiatives, but reliance on conventional cranes remains a restraint. Saudi Arabia and the UAE dominate demand due to megaprojects under Vision 2030 and Expo-related developments.

Africa

Africa held the smallest share of 4% in 2024, valued at USD 9.09 million, projected to reach USD 19.08 million by 2032 at a CAGR of 9.6%. Growth is supported by urbanization, mining expansion, and renewable energy projects, particularly in South Africa, Egypt, and Nigeria. However, limited charging infrastructure and high upfront costs restrict adoption. Despite these challenges, increasing foreign investments in infrastructure and energy diversification provide long-term opportunities for electric crawler crane deployment.

Market Segmentations:

By Capacity

- Below 50 metric tons

- 50 to 250 metric tons

- 250 to 450 metric tons

- 450 to 650 metric tons

By Application

- Rental

- Construction

- Mining

- Oil & Gas

- Energy

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Crawler Crane Market is defined by a mix of global manufacturers and specialized regional players, each focusing on innovation and strategic expansion. Leading companies such as Liebherr-International AG, PV-E Cranes, SANY, Marchetti Autogru S.p.A., and MAEDA SEISAKUSHO CO., LTD dominate through strong product portfolios, advanced technology integration, and extensive service networks. These players invest heavily in research and development to introduce cranes with higher efficiency, improved safety, and reduced emissions, aligning with global sustainability targets. Rental fleet expansion remains a key strategy, enabling broader accessibility and cost-effective adoption across varied end users. Partnerships with contractors, infrastructure firms, and renewable energy developers further strengthen market presence. Regional players compete on pricing and customization, particularly in emerging markets such as Asia Pacific and Latin America. With rising demand from infrastructure, energy, and industrial projects, competition is expected to intensify, driving continuous innovation and strategic collaborations across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In March 2025, Manitowoc confirmed the launch of the Grove GHC200 telescopic crawler crane, a 160-ton unit developed from the Sennebogen 200-ton design to enhance lifting capabilities.

- In May 2025, Sany Group launched the SCC2000A-EV, a 200-ton pure electric crawler crane powered by a 422 kWh CATL battery and 234 kW motor.

- In May 2025, Jekko presented new electric and compact crawler crane models at Bauma 2025, including the SPX328 EVO+, JCX80 telescopic crawler, and SPX532.2.

- In January 2025, Tadano completed the acquisition of Manitex International, making it a wholly owned subsidiary to expand its global product portfolio and market presence.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with increasing infrastructure modernization across developed and emerging economies.

- Adoption will strengthen as governments push for sustainable and low-emission construction equipment.

- Rental services will expand further, making cranes more accessible to small contractors.

- Renewable energy projects will create significant opportunities for high-capacity crane deployment.

- Asia Pacific will continue to emerge as the fastest-growing regional hub for adoption.

- Integration of IoT, telematics, and automation will enhance operational efficiency and safety.

- Manufacturers will focus on developing modular and cost-efficient crane models.

- Mining and oil & gas projects will sustain demand for heavy-duty lifting solutions.

- Improved charging infrastructure will support wider acceptance of electric models.

- Competitive pressure will drive innovation and collaborations among global and regional players.