Market Overview

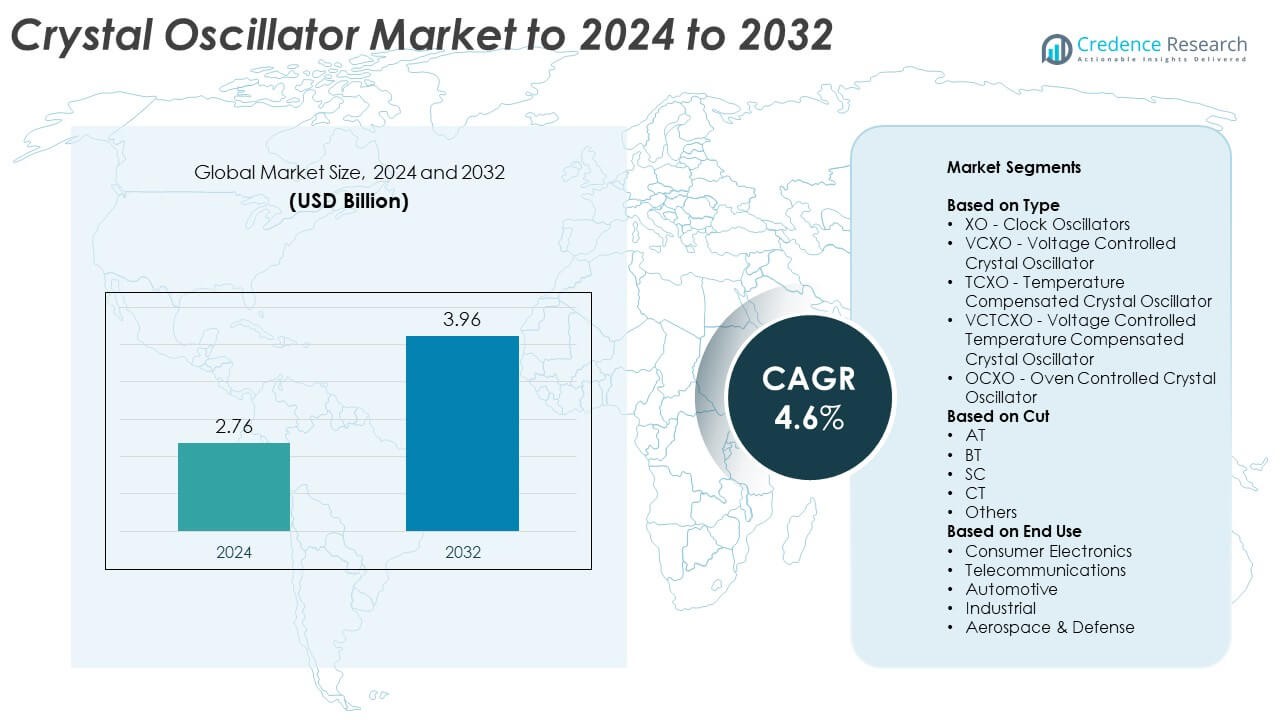

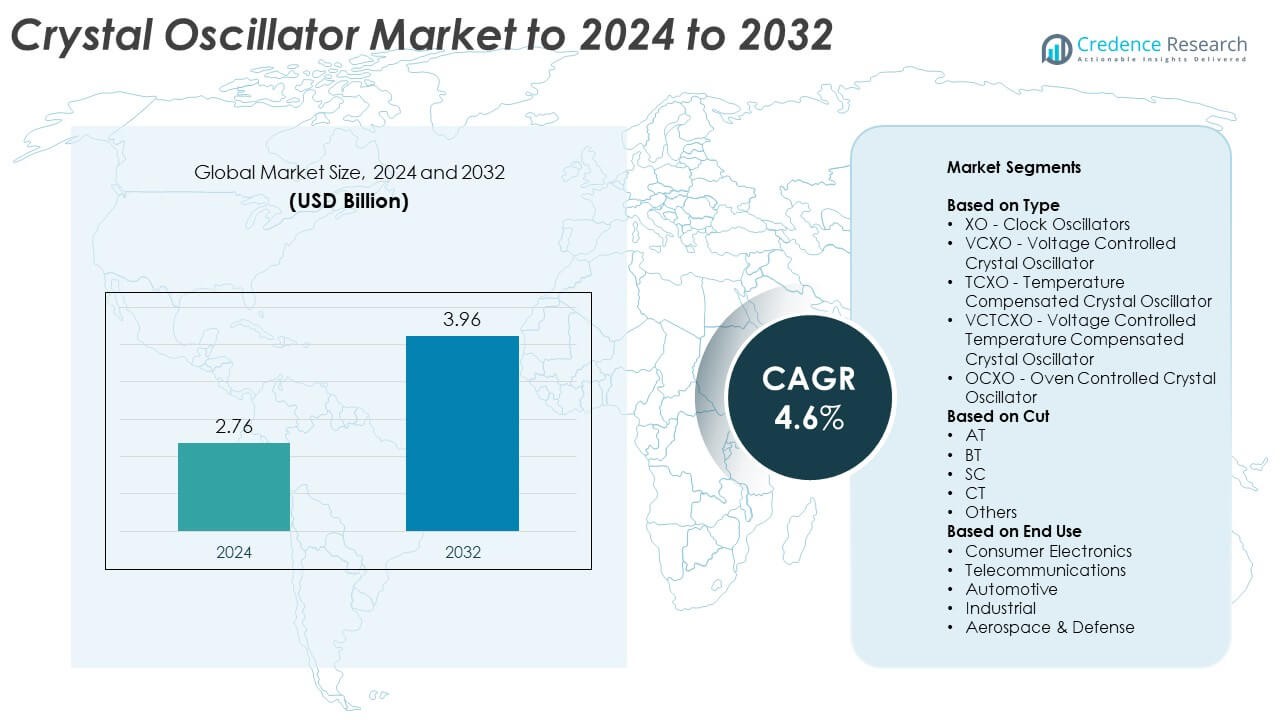

The Crystal Oscillator Market size was valued at USD 2.76 billion in 2024 and is anticipated to reach USD 3.96 billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crystal Oscillator Market Size 2024 |

USD 2.76 Billion |

| Crystal Oscillator Market, CAGR |

4.6% |

| Crystal Oscillator Market Size 2032 |

USD 3.96 Billion |

The crystal oscillator market is highly competitive, with key players such as Seiko Epson Corporation, Murata Manufacturing Co. Ltd, Microchip Technology Inc., Nihon Dempa Kogyo (NDK) Co. Ltd, Daishinku Corp., TXC Corporation, Kyocera Corporation, Abracon, and SiTime driving technological innovation. These companies focus on developing compact, temperature-stable, and energy-efficient oscillators to meet rising demand across telecommunications, automotive, and consumer electronics industries. Asia Pacific emerged as the leading region in 2024, accounting for 34% of the global market share. The region’s dominance is supported by strong electronics manufacturing capabilities, rapid 5G deployment, and continuous investments in semiconductor production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The crystal oscillator market was valued at USD 2.76 billion in 2024 and is projected to reach USD 3.96 billion by 2032, growing at a CAGR of 4.6%.

- Rising demand for precision timing components in 5G networks, IoT devices, and automotive systems is driving market expansion.

- Miniaturization and adoption of temperature-compensated oscillators are key trends enhancing performance in compact and high-frequency applications.

- The market is moderately consolidated, with leading players focusing on product innovation, energy efficiency, and global manufacturing expansion.

- Asia Pacific led the market with a 34% share in 2024, followed by North America at 29% and Europe at 25%, while the XO segment accounted for 42% of total market share.

Market Segmentation Analysis:

By Type

The XO (Clock Oscillators) segment dominated the crystal oscillator market in 2024 with a 42% share. These oscillators are widely used in smartphones, routers, and IoT devices due to their cost efficiency and stable frequency output. Growing adoption of compact and low-power XO units in wearable electronics and data communication equipment further supports segment growth. Expanding 5G infrastructure and advancements in timing accuracy continue to drive demand, as manufacturers prioritize high-performance clock oscillators for network synchronization and signal processing applications.

- For instance, the Kyocera AVX KC2016K is a standard clock oscillator series with dimensions of 2.0 × 1.6 mm, a frequency range of 1.5 MHz to 80 MHz, and a frequency stability of ±50 ppm, which is used for applications like consumer, industrial, and wireless communication equipment.

By Cut

The AT-cut crystal segment led the market in 2024, accounting for 47% of the total share. AT-cut crystals are preferred for their excellent frequency stability across temperature ranges, making them ideal for telecom and industrial systems. Their high precision and lower production cost contribute to their wide use in oscillators for wireless devices and timing systems. Increasing deployment of AT-cut crystals in automotive electronics and GPS modules enhances their market dominance, supported by continued demand for stable frequency sources in high-reliability environments.

- For instance, Murata automotive crystals reach overall accuracy of ±40 ppm from −40 °C to +125 °C.

By End Use

The telecommunications segment held the largest market share of 38% in 2024. Telecom infrastructure, including 5G base stations and optical networks, relies heavily on crystal oscillators for precise timing control. Growing data traffic and the need for stable synchronization in communication equipment continue to propel segment expansion. Manufacturers focus on developing high-frequency oscillators with superior temperature compensation to support modern network standards, while the rollout of fiber-optic and satellite communication systems further strengthens the demand for reliable crystal oscillator components.

Key Growth Drivers

Rising Demand from Telecommunications Sector

The growing deployment of 5G networks is a key growth driver for the crystal oscillator market. Telecom base stations and network infrastructure require highly stable frequency components for synchronization and signal integrity. Increasing data transmission volumes and expanding fiber-optic networks have boosted demand for advanced oscillators with low phase noise and high precision. The push toward digital connectivity and network automation continues to strengthen the adoption of crystal oscillators across global telecommunication systems.

- For instance, SiTime offers different Super-TCXO families, each optimized for specific performance criteria. The company’s ruggedized Endura family, including the SiT5543, features a maximum acceleration sensitivity as low as 0.01 ppb/g. Additionally, some of SiTime’s low-noise Super-TCXOs can achieve a phase noise of -159 dBc/Hz at a 10 kHz offset for a 19.2 MHz carrier frequency

Expansion of Consumer Electronics Industry

The surge in production of smartphones, wearables, and IoT devices drives market growth. Crystal oscillators play a vital role in providing timing control and frequency stability in compact electronic systems. Manufacturers are developing smaller, energy-efficient oscillators to meet design needs for portable and connected devices. The rise in smart home devices and digital ecosystems is further accelerating oscillator demand, particularly in high-frequency and miniaturized configurations for next-generation electronics.

- For instance, NDK introduced 0.8×0.6 mm NX0806AA crystal units with low ESR for compact designs.

Increasing Automotive Electronics Integration

Automotive electronics have become a major application area for crystal oscillators. Modern vehicles depend on precision timing for safety systems, GPS navigation, and engine control modules. The expansion of electric and autonomous vehicles has amplified the need for durable, vibration-resistant oscillators. Continuous development of in-vehicle communication systems and advanced driver assistance features enhances market penetration, with manufacturers focusing on producing automotive-grade oscillators that can operate reliably under extreme environmental conditions.

Key Trends & Opportunities

Miniaturization and Low-Power Designs

One of the key trends shaping the market is miniaturization. Electronic devices are becoming smaller and more power-efficient, pushing manufacturers to develop miniature crystal oscillators that maintain high performance. Compact oscillators are gaining popularity in wearables, drones, and portable medical devices. The trend toward smaller form factors without compromising frequency stability offers opportunities for technological innovation and design optimization.

- For instance, Abracon TCXO lineup spans 5 ppm to 50 ppb stability with −40 °C to +105 °C options.

Adoption of Smart Manufacturing and IoT

Growing adoption of IoT-based production systems in industrial settings creates new opportunities. Smart factories rely on precise timing control for automation, sensors, and robotics. Crystal oscillators ensure synchronization in these connected systems. As industries adopt predictive maintenance and machine-to-machine communication, demand for oscillators supporting reliable data transfer and low-latency performance continues to rise. This trend is expected to drive innovation in industrial-grade oscillator technologies.

- For instance, TXC offers TCXOs with \(\pm 0.5\) ppm frequency stability in packages such as the 2.5×2.0 mm (7L Series) and the larger 5.0×3.2 mm (7P Series), which have a frequency range of 10–52 MHz, to support applications requiring high precision over temperature variations.

Advancements in Temperature-Compensated Oscillators

Temperature-compensated crystal oscillators (TCXO) are witnessing strong growth due to their stability in varying environmental conditions. These devices are crucial for outdoor telecom and defense applications. Innovations in temperature compensation methods and packaging materials have enhanced their precision. The development of ultra-low drift and low phase-noise TCXO models presents new opportunities for manufacturers to serve high-performance applications such as satellite communication and GPS modules.

Key Challenges

Rising Raw Material Costs

The fluctuation in prices of quartz and other raw materials used in oscillator manufacturing poses a major challenge. Higher material and processing costs increase production expenses, impacting overall profitability. Supply chain disruptions and geopolitical tensions have also added instability to sourcing. Manufacturers face pressure to balance cost control with maintaining quality and reliability standards, which can slow innovation and expansion in emerging markets.

Technological Substitution Risk

Emerging alternative technologies such as MEMS oscillators are creating competition for traditional crystal oscillators. MEMS-based solutions offer smaller size, lower power use, and improved resistance to mechanical shock. As electronics manufacturers explore these new options, crystal oscillator producers must invest in innovation to maintain market relevance. Continuous differentiation through improved frequency stability, temperature tolerance, and design flexibility is essential to address this ongoing challenge.

Regional Analysis

North America

North America held a 29% share of the crystal oscillator market in 2024, driven by strong demand across telecommunications, aerospace, and defense sectors. The region’s established electronics industry and growing adoption of 5G networks support market expansion. The United States leads production and innovation, with several key manufacturers focusing on high-stability oscillators for data centers and communication systems. Increasing investments in satellite communication and industrial automation further enhance market growth, while advancements in low-phase noise oscillator technologies continue to strengthen the region’s position in precision frequency applications.

Europe

Europe accounted for 25% of the global crystal oscillator market share in 2024. The region’s growth is supported by expanding automotive electronics and industrial automation sectors, particularly in Germany, France, and the United Kingdom. Demand for high-performance oscillators in defense communication and aerospace navigation systems remains strong. European manufacturers are increasingly investing in miniaturized and energy-efficient crystal oscillators to meet environmental and regulatory standards. The rising integration of advanced driver assistance systems and connected vehicle technologies also drives adoption across the region’s evolving automotive supply chain.

Asia Pacific

Asia Pacific dominated the crystal oscillator market with a 34% share in 2024, making it the largest regional segment. The region’s leadership is attributed to the presence of major electronics manufacturing hubs in China, Japan, South Korea, and Taiwan. Rapid expansion in consumer electronics, smartphones, and telecommunications infrastructure continues to fuel demand. Rising adoption of automation and digitalization across industries also supports market growth. In addition, strong government initiatives promoting semiconductor production and export-oriented manufacturing are enhancing Asia Pacific’s role as a key supplier of crystal oscillator components globally.

Latin America

Latin America represented a 7% share of the crystal oscillator market in 2024, supported by increasing investment in telecommunication networks and consumer electronics production. Countries like Brazil and Mexico are witnessing growing adoption of oscillators in automotive electronics and industrial monitoring systems. The region’s push toward digital transformation and IoT-based solutions in manufacturing is fostering moderate growth. Despite limited local manufacturing, imports from Asian suppliers continue to meet regional demand, while partnerships and technological upgrades in electronic component distribution strengthen market penetration.

Middle East & Africa

The Middle East & Africa region accounted for 5% of the global market share in 2024. Growth is driven by expanding defense modernization programs, aerospace projects, and industrial automation across the Gulf nations. Increasing investments in telecommunications and smart infrastructure development, particularly in the United Arab Emirates and Saudi Arabia, are supporting oscillator demand. The region’s focus on diversifying its manufacturing base beyond oil is encouraging adoption of advanced electronic components, including precision oscillators, for defense, industrial, and communication systems applications.

Market Segmentations:

By Type

- XO – Clock Oscillators

- VCXO – Voltage Controlled Crystal Oscillator

- TCXO – Temperature Compensated Crystal Oscillator

- VCTCXO – Voltage Controlled Temperature Compensated Crystal Oscillator

- OCXO – Oven Controlled Crystal Oscillator

By Cut

By End Use

- Consumer Electronics

- Telecommunications

- Automotive

- Industrial

- Aerospace & Defense

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The crystal oscillator market features strong competition among major players such as Seiko Epson Corporation, Murata Manufacturing Co. Ltd, Microchip Technology Inc., Nihon Dempa Kogyo (NDK) Co. Ltd, Daishinku Corp., TXC Corporation, Kyocera Corporation, Abracon, and SiTime. The competitive environment is driven by rapid technological innovation, with manufacturers focusing on improving frequency stability, miniaturization, and temperature tolerance. Companies are investing in advanced manufacturing techniques to support the growing demand for compact and energy-efficient oscillators across consumer electronics and automotive sectors. Strategic collaborations, product portfoio diversification, and expansion into emerging markets are key strategies shaping competition. The emphasis on low-phase noise oscillators for high-speed communication and precision applications continues to define the competitive differentiation among industry participants, while R&D efforts in MEMS-based and hybrid oscillator technologies are expected to strengthen long-term market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, NDK launched a differential-output crystal oscillator series (NP2016SBE/NP2520SBE) for data centers and high-speed optical transceivers.

- In 2023, SiTime introduced its Epoch Platform, a MEMS-based oven-controlled oscillator (OCXO), to disrupt the quartz-based timing market.

- In 2023, SiTime acquired clock products and intellectual property (IP) from Aura Semiconductor, adding 20 new high-quality clocks to its portfolio.

- In 2023, Abracon launched the AS3115 Series, ultra-miniature crystal oscillators with a package footprint of just 1.6 mm x 0.8 mm.

Report Coverage

The research report offers an in-depth analysis based on Type, Cut, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising adoption of 5G and next-generation communication systems will boost demand for high-frequency oscillators.

- Miniaturized and low-power oscillators will gain prominence in wearable and IoT devices.

- Automotive-grade oscillators will see growth with increasing electric and autonomous vehicle production.

- Advancements in temperature-compensated oscillators will enhance performance in harsh environments.

- Integration of crystal oscillators in aerospace and satellite communication will continue expanding.

- Development of smart factories and industrial IoT will drive industrial-grade oscillator demand.

- MEMS-based technologies may influence design innovation and competition within oscillator manufacturing.

- Asia Pacific will maintain its dominance due to large-scale electronics manufacturing capacity.

- Focus on energy-efficient and eco-friendly oscillator designs will increase among manufacturers.

- Strategic partnerships and R&D investments will shape future market competitiveness and product innovation.