Market Overview

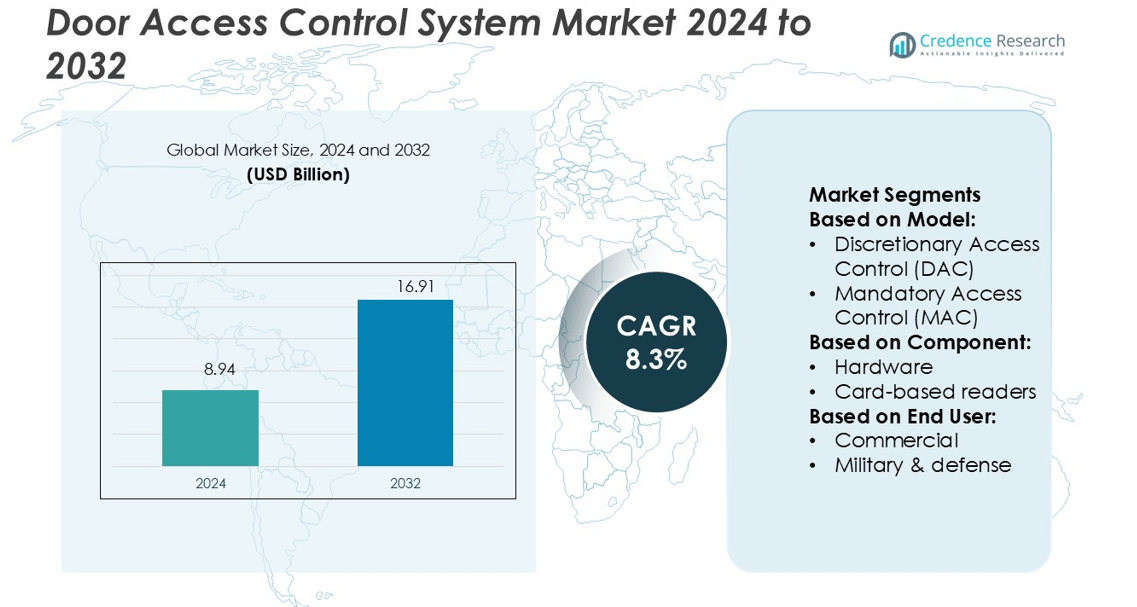

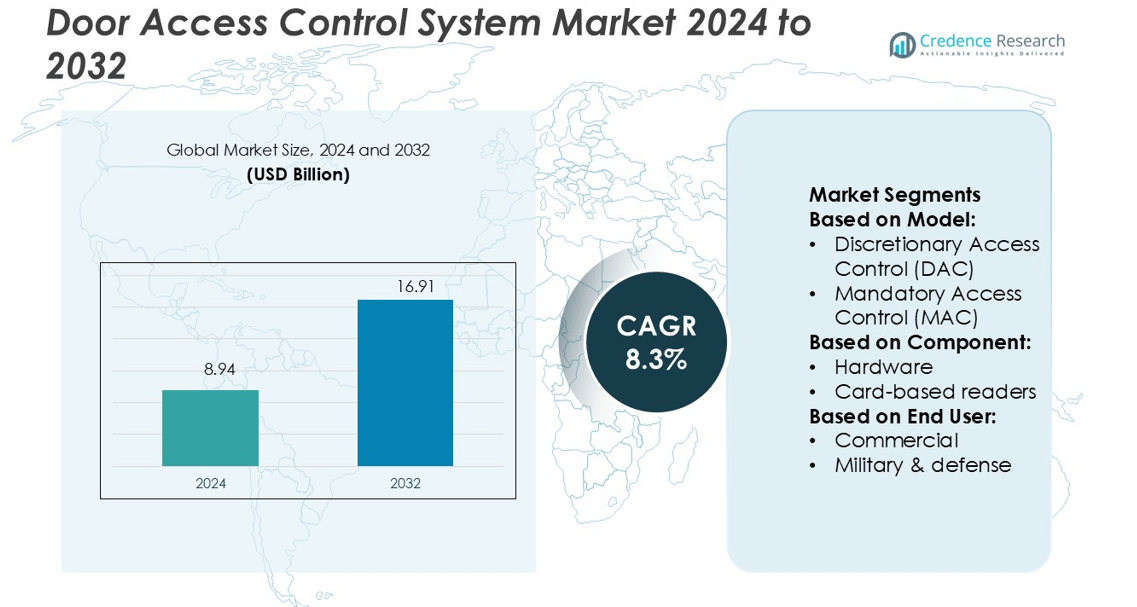

Door Access Control System Market size was valued USD 8.94 billion in 2024 and is anticipated to reach USD 16.91 billion by 2032, at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DDoor Access Control System Market Size 2024 |

USD 8.94 billion |

| Door Access Control System Market, CAGR |

8.3% |

| Door Access Control System Market Size 2032 |

USD 16.91 billion |

The Door Access Control System Market is led by major players including Johnson Controls Inc., Suprema Inc., IDEMIA, Matrix Systems, 3M Cogent, Inc., UNIONCOMMUNITY Co., Ltd, BOSCH Security, HID Global Corporation, NEC Corporation, and Hitachi, Ltd. These companies drive market growth through advanced biometric solutions, AI-enabled authentication, and cloud-based security platforms. They focus on innovation, strategic collaborations, and global expansion to strengthen their competitive edge. North America dominates the market with a 36% share, supported by strong security regulations, high technology adoption, and the presence of leading manufacturers. Continuous investment in infrastructure modernization and smart building projects further reinforces the region’s leadership position.

Market Insights

- The Door Access Control System Market was valued at USD 8.94 billion in 2024 and is projected to reach USD 16.91 billion by 2032, growing at a CAGR of 8.3%.

- Rising demand for advanced security solutions and smart building technologies is driving market growth across commercial, government, and residential sectors.

- Growing adoption of AI-enabled biometric authentication and cloud-based access platforms is shaping key market trends.

- North America leads with a 36% share, supported by strong regulatory standards, while Europe and Asia Pacific follow with expanding infrastructure investments.

- Hardware components hold a dominant segment share due to high adoption of biometric readers and access controllers in critical infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Model

Role-Based Access Control (RBAC) dominates the market with a 37% share. RBAC enables organizations to assign permissions based on user roles, reducing manual configuration and enhancing security. Its structured authorization model is widely adopted in commercial buildings, airports, and government facilities. The demand is increasing as enterprises seek centralized control, compliance with security standards, and scalable access management solutions. Discretionary Access Control (DAC) is also growing in small businesses due to its ease of use, while Attribute-Based Access Control (ABAC) gains traction in sectors requiring dynamic, context-aware security.

- For instance, CoreStation can handle up to 500,000 users and 1,000,000 fingerprint templates and operate within larger, scalable network topologies.CoreStation can store up to 1 million fingerprint templates.

By Component

Hardware holds the largest market share at 52%, driven by widespread deployment of card-based and biometric readers. Biometric readers lead within hardware, offering advanced security through fingerprint and facial recognition technology. Enterprises favor biometric and multi-technology readers to prevent credential theft and support multi-factor authentication. Software solutions support real-time monitoring and reporting, while service offerings focus on installation and maintenance. The rise of cloud-based platforms also strengthens software integration for centralized access control management across multi-site facilities.

- For instance, Matrix Systems’ COSEC PATH RDFE V2 reader supports storage of 9,600 fingerprint templates with a 500 dpi optical sensor, and communicates via RS-232 and RS-485 in an IP65 enclosure.

By End-User

The commercial segment leads the market with a 31% share, fueled by rapid adoption in office buildings, retail centers, and co-working spaces. Businesses prioritize physical security, visitor tracking, and compliance with data protection regulations. Military and government facilities also drive growth through high-security systems with multi-layer authentication. Healthcare and education sectors increasingly invest in access control to protect sensitive data and ensure safety. Residential demand grows steadily, supported by the rise of smart home solutions with integrated mobile app access and remote monitoring.

Key Growth Drivers

Rising Need for Advanced Security Solutions

The increasing demand for high-level security across commercial, residential, and government facilities is driving market growth. Door access control systems offer real-time monitoring, entry restrictions, and multi-layer authentication, which help reduce security breaches. Biometric readers and smart card systems are widely used for controlled access in corporate buildings. Their adoption improves safety while reducing manual monitoring costs. The growing number of commercial buildings, airports, and smart infrastructure projects further accelerates the deployment of advanced access control technologies.

- For instance, 3M Cogent’s MiY biometric access control reader processes authentication in 2.5 seconds per transaction (versus TWIC’s 3-second benchmark).

Integration with Smart Building Infrastructure

The adoption of smart building solutions is boosting demand for integrated access control systems. These systems connect with HVAC, lighting, and surveillance networks to improve operational efficiency. For instance, AI-powered access platforms enable remote entry control and real-time occupancy tracking. IoT integration allows facility managers to manage multiple access points from a single dashboard. This enhances user convenience and energy efficiency, making integrated systems a preferred choice in modern office complexes, hotels, and industrial facilities.

- For instance, Bosch’s Building Integration System (BIS) underpins its access control and security offerings, with over 3,000 installations globally managing 10 million detectors across diverse facilities.

Rising Regulatory and Compliance Standards

Strict safety and security regulations in commercial and industrial sectors are supporting market expansion. Government standards require advanced access control systems for critical infrastructure, financial institutions, and healthcare facilities. Many companies are upgrading legacy systems to meet compliance requirements for cybersecurity and physical security. Regulations such as GDPR and data protection laws are encouraging the adoption of secure access technologies. This trend pushes organizations to invest in certified and scalable door access control systems to avoid penalties and strengthen security.

Key Trends & Opportunities

Growing Adoption of Biometric and Multi-Factor Authentication

Biometric technologies such as facial recognition, fingerprint scanning, and iris recognition are gaining traction in access control systems. These solutions improve accuracy, reduce the risk of unauthorized access, and support contactless authentication. Multi-factor authentication, which combines biometrics with smart cards or mobile credentials, is becoming standard in sensitive facilities. This trend creates opportunities for vendors offering advanced, AI-enabled biometric systems. The growing need for hygienic and efficient authentication methods is also driving demand in healthcare, banking, and transportation sectors.

- For instance, Hitachi’s C-1 finger vein authentication unit verifies users by scanning three fingers from a contactless distance of approximately 20 mm. The authentication process, which occurs in seconds, enables fully contactless entry.

Expansion of Cloud-Based Access Control Systems

Cloud-based access control solutions offer remote management, faster installation, and lower upfront costs. They provide scalability, making them ideal for multi-site organizations. Facility managers can easily update permissions and monitor access activities from centralized platforms. This trend is enabling small and medium enterprises to adopt secure, flexible solutions without heavy infrastructure investments. The growing integration of cloud with IoT, AI, and mobile platforms is creating new opportunities for vendors to offer subscription-based, software-as-a-service models.

- For instance, NEC’s Identity Cloud Service (ICS) enables deployment in hours via Azure, rather than weeks for on-premise systems. The service supports 1:1 face verification, 1:N face search, and liveness detection/PAD for anti-spoofing.

Demand for Mobile and Contactless Credentials

The shift toward mobile-based access is a major trend in this market. Mobile credentials allow users to unlock doors using smartphones or wearables, eliminating the need for physical keys or cards. NFC, Bluetooth, and QR code technologies support contactless entry, improving user convenience and hygiene. Enterprises are adopting mobile solutions to reduce administrative overhead and strengthen security. This trend opens opportunities for tech providers to offer advanced mobile authentication platforms with enhanced encryption and real-time access control.

Key Challenges

High Initial Investment and Integration Complexity

Implementing advanced door access control systems involves significant costs, including hardware, software, and installation. Integrating new solutions with existing building management systems can be technically challenging and time-consuming. Many organizations delay adoption due to the need for skilled professionals and additional infrastructure upgrades. This challenge is more prominent for small and medium businesses with limited security budgets. Overcoming this barrier requires flexible financing models, simplified deployment, and modular solutions.

Cybersecurity Risks and Data Privacy Concerns

As access control systems become more connected through IoT and cloud platforms, cybersecurity risks are increasing. Data breaches, hacking attempts, and system manipulation can compromise facility security. Biometric data storage raises privacy concerns and regulatory challenges. Companies must invest in encryption, multi-layer security protocols, and regular updates to address these risks. Vendors face the ongoing challenge of maintaining data protection and compliance while offering user-friendly and connected security solutions.

Regional Analysis

North America

North America leads the Door Access Control System Market with a 36% market share. Growth is driven by strong security regulations, smart building projects, and widespread adoption of advanced access technologies. High integration of biometric and mobile-based access solutions in commercial and government facilities supports this dominance. Leading companies invest heavily in R&D and cloud-based platforms to enhance system performance. The U.S. remains the core market, driven by rising demand in corporate offices, educational institutions, and critical infrastructure sectors. Canada also shows growing adoption due to its increasing investments in smart infrastructure and digital security transformation initiatives.

Europe

Europe holds a 29% market share in the Door Access Control System Market. The region benefits from strict data protection regulations, advanced infrastructure, and the rapid deployment of access systems in public and private buildings. The increasing shift toward mobile credentials and touchless entry solutions supports this growth. Countries such as Germany, the U.K., and France lead adoption through modernization of commercial buildings and government facilities. Manufacturers emphasize sustainability, aligning with the EU’s green building standards. Strategic collaborations between security vendors and system integrators further strengthen Europe’s competitive position in the global market.

Asia Pacific

Asia Pacific accounts for a 24% market share, driven by rapid urbanization, rising construction activity, and smart city initiatives. Countries such as China, Japan, and India are investing heavily in commercial, industrial, and residential infrastructure. The adoption of biometric and cloud-based access control systems is increasing in large facilities, including offices, airports, and transportation hubs. Local manufacturers and global players are expanding partnerships to meet demand for scalable and cost-effective solutions. Government-led digital transformation programs and security modernization projects further enhance the region’s growth outlook, positioning Asia Pacific as a key future growth hub.

Latin America

Latin America captures a 6% market share in the Door Access Control System Market. The region is witnessing steady growth driven by urban infrastructure expansion, smart building projects, and rising security concerns. Brazil and Mexico are the leading markets due to strong commercial construction activity and increased investment in modern security systems. Biometric access and card-based solutions are gaining traction in corporate and residential sectors. While the market is still developing, strategic entry by global security firms and local partnerships are expected to accelerate adoption, improving regional security infrastructure and driving steady revenue growth.

Middle East & Africa

The Middle East & Africa region holds a 5% market share in the Door Access Control System Market. Growth is fueled by infrastructure investments, rapid development of smart cities, and modernization of security systems in commercial and public buildings. The UAE, Saudi Arabia, and South Africa lead adoption with strong investments in advanced access technologies. High demand comes from airports, government facilities, and hospitality sectors. International players are expanding their presence through joint ventures and technology collaborations, supporting long-term regional growth. Rising security regulations and digital transformation initiatives are expected to boost adoption further.

Market Segmentations:

By Model:

- Discretionary Access Control (DAC)

- Mandatory Access Control (MAC)

By Component:

- Hardware

- Card-based readers

By End User:

- Commercial

- Military & defense

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Door Access Control System Market is driven by key players such as Johnson Controls Inc., Suprema Inc., IDEMIA, Matrix Systems, 3M Cogent, Inc, UNIONCOMMUNITY Co., Ltd, BOSCH Security, HID Global Corporation, NEC Corporation, and Hitachi, Ltd. The competitive landscape of the Door Access Control System Market is defined by strong innovation, strategic partnerships, and expanding global reach. Companies focus on developing advanced biometric, RFID, and mobile credential technologies to address rising security demands. Many are investing in AI-powered authentication, cloud-based platforms, and multi-factor access solutions to enhance system efficiency. Mergers and acquisitions strengthen market presence and accelerate product development. Vendors also emphasize compliance with global security standards to increase adoption across industries. The growing preference for contactless, scalable, and energy-efficient solutions continues to drive innovation, creating intense competition and shaping future market strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Smart Bolt Elite, a cutting-edge smart lock tailored for the rental housing sector. This device integrates Rently’s expertise in leasing automation and smart home technology with ASSA ABLOY’s advanced SmartKey Security re-keying solution.

- In March 2025, Johnson Controls, a provider of smart, healthy, and sustainable building solutions, unveiled a series of enhancements to its Access Control And Video Surveillance (ACVS) offerings. These upgrades are designed to integrate with existing security systems, thereby improving the management of critical security operations and providing comprehensive protection for people, buildings, and assets.

- In January 2025, dormakaba Group, announced the expansion of its partnership with technology company Rohde & Schwarz from the airport sector to the critical infrastructure domain. The two companies have developed an innovative automated personnel screening solution designed to enhance security checks while increasing capacity and efficiency.

- In June 2024, Control iD, an access control system provider, partnered with Paravision, an AI software provider, and launched its new product, the iDFace Max, using facial identification technology. Key features of iDFace Max include advanced facial identification, design and connectivity, and embedded web software.

Report Coverage

The research report offers an in-depth analysis based on Model, Component, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider adoption of biometric and mobile-based access solutions.

- Cloud-based platforms will dominate new deployments in commercial and public spaces.

- AI-driven authentication systems will enhance real-time security and monitoring.

- Integration with smart building technologies will become more common.

- Touchless access solutions will grow rapidly in healthcare, education, and offices.

- Vendors will focus on energy-efficient and sustainable security solutions.

- Strategic collaborations will expand market presence and accelerate innovation.

- Government regulations will push the adoption of advanced access control systems.

- Cybersecurity integration will play a critical role in future product designs.

- The demand for scalable and flexible access solutions will increase across industries.