Market Overview:

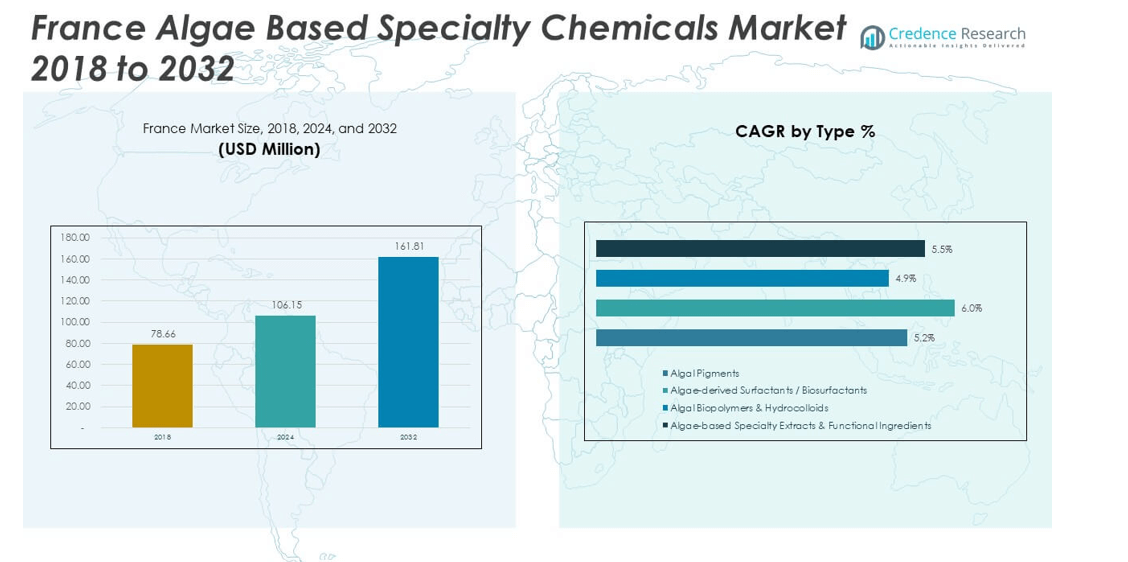

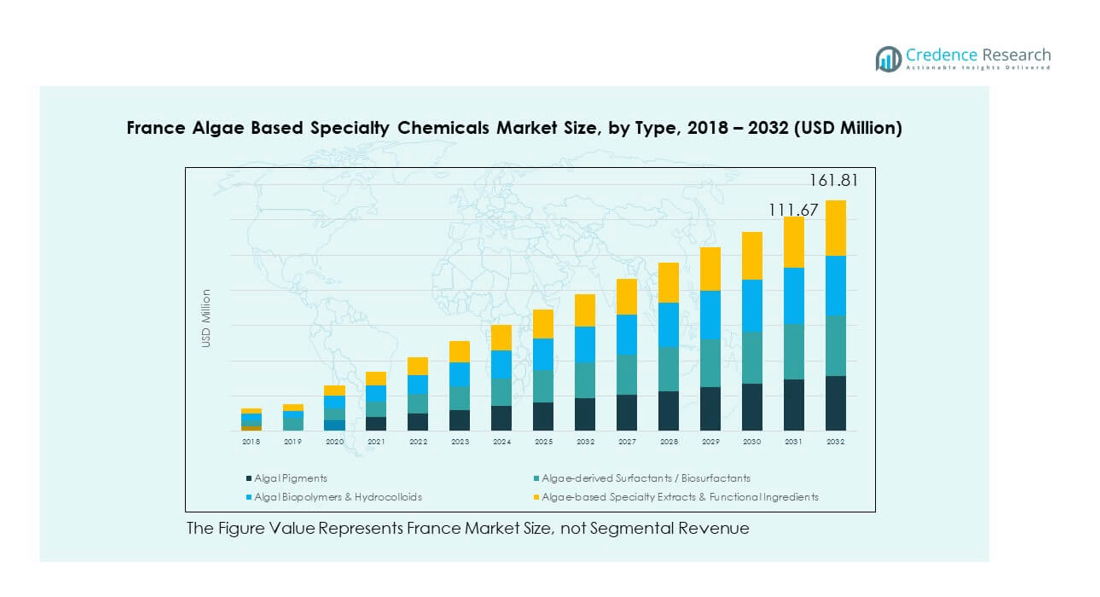

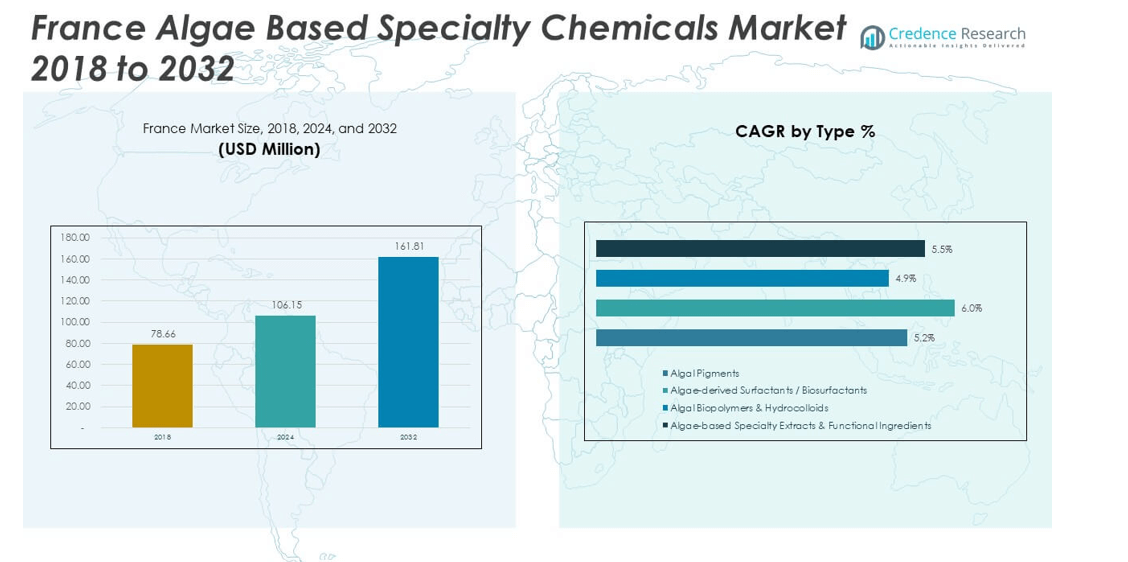

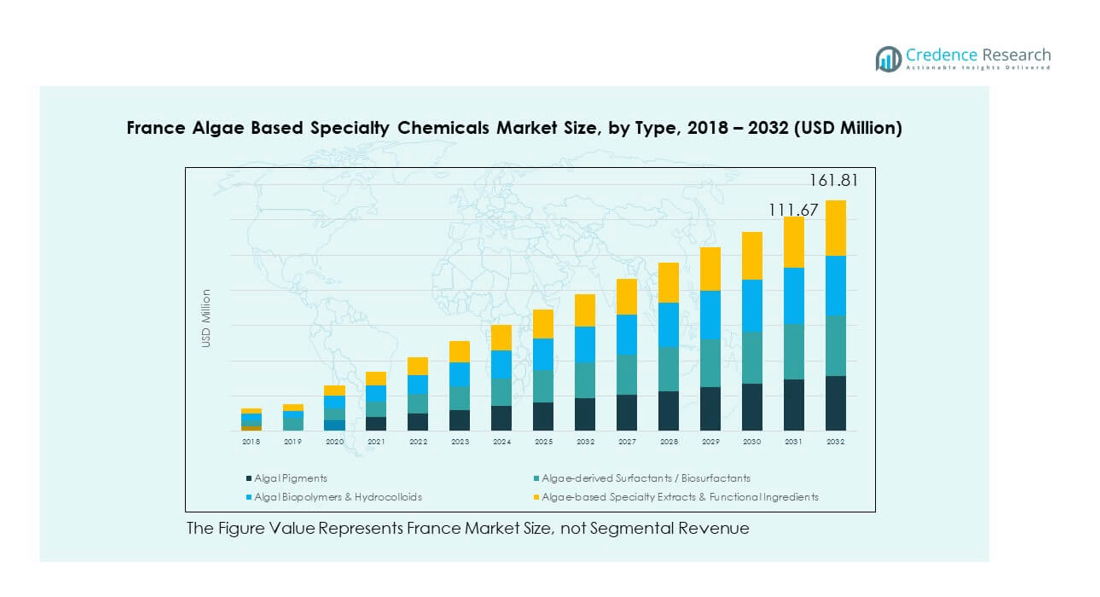

The France Algae Based Specialty Chemicals Market size was valued at USD 78.66 million in 2018 to USD 106.15 million in 2024 and is anticipated to reach USD 161.81 million by 2032, at a CAGR of 5.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Algae Based Specialty Chemicals Market Size 2024 |

USD 106.15 million |

| France Algae Based Specialty Chemicals Market , CAGR |

5.41% |

| France Algae Based Specialty Chemicals Market Size 2032 |

USD 161.81 million |

Market growth is driven by rising demand for sustainable, bio-based alternatives across consumer and industrial applications. Cosmetic and personal care producers are adopting algae-derived pigments and extracts for natural formulations. Food and nutraceutical companies are integrating algae-based bioactives into clean-label products. Pharmaceutical research is expanding algae use in functional ingredients and biomarkers. Regulatory frameworks in France support eco-friendly chemical adoption, creating favorable conditions. Continuous innovation in cultivation and extraction technologies further enhances scalability. It strengthens competitiveness against traditional petrochemical alternatives.

Regionally, Northern France leads with established biotech hubs and strong industrial infrastructure supporting algae research and production. Western France benefits from coastal access, aquaculture resources, and government programs promoting algae utilization. Southern and Central regions are gaining momentum through integration in cosmetics, pharmaceuticals, and agriculture. France also acts as a gateway for broader European markets, connecting producers with regional demand for sustainable ingredients. Emerging adoption in Eastern Europe adds new growth potential. It highlights France’s role as a core innovator while neighboring countries expand implementation across diverse applications.

Market Insights

- The France Algae Based Specialty Chemicals Market was valued at USD 78.66 million in 2018, reached USD 106.15 million in 2024, and is projected to hit USD 161.81 million by 2032, growing at a CAGR of 5.41%.

- Northern France holds 36% share, driven by industrial hubs and biotech clusters, while Western France accounts for 31% share due to strong coastal resources, and Southern & Central France together represent 33% share supported by cosmetics, pharma, and agriculture.

- Northern France emerges as the fastest-growing region with 36% share, benefiting from advanced R&D, industrial infrastructure, and strong partnerships supporting algae cultivation and specialty chemical production.

- Algal pigments lead the type segment with nearly 38% share, reflecting strong demand in cosmetics, food, and textile industries for natural and stable coloring agents.

- Algal biopolymers and hydrocolloids contribute close to 27% share, supported by applications in food, packaging, and pharmaceuticals, strengthening their role in functional and eco-friendly solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand For Sustainable Ingredients Across Industries

The France Algae Based Specialty Chemicals Market benefits from increasing demand for eco-friendly and sustainable solutions across multiple industries. Consumers are actively choosing products with natural and bio-based origins, driving manufacturers to replace synthetic ingredients. Personal care, cosmetics, and pharmaceuticals rely on algae-based extracts for their multifunctional properties such as hydration and antioxidant activity. Food and beverage producers are also adopting algae-derived ingredients for clean-label formulations. Regulatory bodies in France support green chemistry initiatives, accelerating market adoption. Continuous research into algae strains enhances efficiency and product diversity. It is positioning itself as a reliable source of natural raw materials.

- For instance, Microphyt, headquartered in Baillargues, France, inaugurated the world’s first industrial-scale microalgae biorefinery in July 2025, spanning 5,000 m² and designed to produce over 100 tons of natural ingredients each year for health, personal care, nutrition, and animal feed. The facility supplies ingredients for 11 commercialized products distributed in more than 15 countries, using proprietary photobioreactor technology for sustainable extraction.

Strong Role Of Regulatory Frameworks Supporting Green Chemistry

Government policies in France encourage the development of bio-based specialty chemicals by funding research and supporting commercial applications. Stricter rules against petrochemical use have opened space for algae-derived substitutes in consumer products. Companies are securing certifications to highlight the safety and sustainability of algae-based formulations. Public policies also focus on reducing carbon emissions, creating opportunities for bio-based industries. Investment incentives allow startups and established players to expand their algae processing capabilities. These efforts ensure stable demand for bio-derived compounds. It benefits from this structured regulatory ecosystem that promotes innovation and sustainability.

- For instance, the French technology center CEVA (Centre d’Etude et de Valorisation des Algues) employs 29 permanent staff, including 24 scientists, and operates both inshore and offshore research platforms for large-scale algae field experimentation. CEVA participates in major national and EU regulatory-driven consortia focused on the development and certification of new algal applications in bio-based specialties for nutrition, cosmetics, bioremediation, and agriculture, demonstrating robust support from France’s public policy ecosystem.

Technological Advancements In Algae Cultivation And Processing

Innovations in algae cultivation methods and extraction technologies are significantly improving production scalability. Companies are developing advanced bioreactors, photobioreactors, and controlled growth systems to maximize yield. Efficient harvesting and extraction technologies improve quality and reduce production costs. French biotech firms are actively investing in research collaborations with universities to enhance algae-derived applications. These innovations strengthen the competitiveness of algae specialty chemicals against traditional chemical sources. Improved productivity ensures consistency in supply for industries with rising demand. It demonstrates strong progress in overcoming scalability limitations and securing industrial viability.

Strategic Partnerships And Industry Collaborations

Collaborations between biotech firms, chemical companies, and consumer goods manufacturers are expanding the role of algae-based chemicals. Partnerships accelerate product development and enable faster integration into personal care, food, and industrial markets. Joint ventures also help firms share costs in research and large-scale production. French companies collaborate with European peers to build strong distribution networks and regulatory influence. Growing alliances with global firms increase international adoption of algae-based compounds. This collaborative approach supports the integration of algae-based solutions into high-demand industries. It creates new growth pathways by aligning innovation with market needs.

Market Trends

Expanding Use Of Algae-Derived Pigments And Colorants

The France Algae Based Specialty Chemicals Market is witnessing growing use of algae-derived pigments in cosmetics, textiles, and food industries. These natural pigments are preferred for their stability, biodegradability, and absence of harmful residues. Cosmetic manufacturers are adopting microalgae-based pigments to create natural formulations aligned with consumer expectations. In the food industry, algae-based pigments serve as healthier alternatives to synthetic dyes. Textile producers also explore algae-derived pigments to support sustainable fashion initiatives. Research into improving pigment stability under UV exposure and storage conditions is advancing rapidly. It is expanding product offerings for industries seeking natural coloring solutions.

Increased Focus On Functional Ingredients For Personal Care

Personal care and cosmetics producers in France are integrating algae-based specialty chemicals to enhance product performance. Algae extracts deliver anti-aging, moisturizing, and antioxidant effects that align with consumer preferences. Companies are formulating new skincare products using algae-derived polysaccharides, proteins, and oils. Demand for natural bioactives in anti-pollution and sun-protection cosmetics is growing rapidly. Research investments in France are targeting high-value applications to meet consumer expectations. This trend reinforces algae’s role as a premium raw material in cosmetics. It highlights the strong growth potential within the personal care segment.

- For instance, Solabia Group (France) commercializes HelioPure® Skin, a microalgae-derived ingredient sourced from Phaeodactylum tricornutum cultivated with its sustainable “Blue Technology.” Rich in fucoxanthin, it supports skin barrier function and offers photo-protection benefits for cosmetics and personal care applications.

Integration Into Sustainable Packaging Solutions

Algae-based specialty chemicals are being researched as sustainable materials for packaging in France. Startups are developing algae-derived bioplastics that can replace conventional petroleum-based plastics. Food companies are testing biodegradable films derived from algae for packaging solutions. Regulatory pressures on single-use plastics are encouraging the transition toward bio-based packaging alternatives. Consumer acceptance of algae packaging is strengthening adoption in food and cosmetics sectors. Pilot projects by packaging innovators in France demonstrate promising outcomes for algae-based biopolymers. It enhances the market outlook by linking specialty chemicals with sustainable packaging trends.

- For example, Notpla, a UK-based company, has replaced over 21.5 million single-use plastic items in Europe with its seaweed-based, home-compostable packaging. In 2023, its coating was officially recognized by the Dutch government as the first material to qualify as “plastic-free” under the EU Single-Use Plastics Directive.

Growing Research On Pharmaceutical Applications

Pharmaceutical companies in France are exploring algae-derived compounds for applications in drug delivery and medical formulations. Algae produce bioactive molecules such as polysaccharides, proteins, and fatty acids with therapeutic potential. Research centers are examining anti-inflammatory, antimicrobial, and immunomodulatory properties of algae-based chemicals. Clinical studies are being initiated to validate medical applications of algae-derived compounds. This focus on bio-pharmaceutical innovations strengthens algae’s presence in high-value industries. Companies are partnering with universities and biotech firms to accelerate development. It is positioning algae as a strategic source of bioactives for healthcare solutions.

Market Challenges Analysis

High Production Costs And Scalability Constraints

The France Algae Based Specialty Chemicals Market faces challenges related to high production costs and scalability issues. Cultivating algae under controlled environments requires significant capital investment. Photobioreactors and advanced harvesting technologies increase costs compared to traditional chemical production. Limited scalability creates supply constraints that impact industries seeking consistent raw materials. High energy and operational costs further restrict large-scale adoption. Price competition with synthetic alternatives limits algae-based solutions in cost-sensitive industries. It is working to reduce costs through technological advancements but challenges remain significant.

Complex Regulatory Approvals And Market Acceptance

Regulatory processes for algae-derived chemicals are complex, slowing down market entry for new applications. Companies must comply with strict safety, labeling, and testing requirements before commercialization. Delays in approval processes restrict faster adoption of innovative algae-based products. Market acceptance also depends on consumer awareness of algae-derived ingredients. Some industries remain cautious about replacing synthetic chemicals due to performance concerns. Companies face hurdles in building consumer trust for algae-based formulations. It encounters barriers in navigating regulatory frameworks and achieving wide-scale acceptance.

Market Opportunities

Expanding Potential In Clean-Label Consumer Products

The France Algae Based Specialty Chemicals Market presents strong opportunities in clean-label and natural product segments. Consumers increasingly demand transparency in personal care, food, and nutraceuticals. Algae-derived compounds provide unique bioactives that align with these preferences. Manufacturers are developing innovative formulations using algae-based polysaccharides, pigments, and proteins. Rising demand for anti-aging and wellness-oriented products strengthens the role of algae in consumer markets. Regulatory support for natural and eco-friendly solutions further enhances opportunities. It is expected to capture higher demand in the premium clean-label sector.

Export Growth And International Collaborations

French producers are well-positioned to expand into international markets through exports and partnerships. Global demand for algae-derived specialty chemicals is increasing across cosmetics, pharmaceuticals, and industrial applications. Collaborations with North American and Asian firms provide access to large consumer bases. Export opportunities are supported by France’s strong R&D capabilities and product quality standards. Growing partnerships with global biotechnology firms strengthen France’s position in international supply chains. Companies are building long-term strategies to integrate into global value chains. It highlights a promising pathway for growth through international market expansion.

Market Segmentation Analysis

By type, algal pigments dominate the France Algae Based Specialty Chemicals Market due to their high demand in cosmetics, food, and textiles for natural coloring and stability. Algae-derived surfactants and biosurfactants are gaining traction in cleaning and personal care products, driven by eco-friendly formulations. Algal biopolymers and hydrocolloids contribute significantly to packaging, food, and pharmaceutical industries due to their gelling and stabilizing properties. Algae-based specialty extracts and functional ingredients are expanding in nutraceuticals and health products, supported by consumer preference for natural bioactives. It shows strong potential in diversifying applications across high-value industries.

- For instance, in January 2025, Algaia S.A. (France) launched a new line of enhanced-stability algal pigments specifically for beverage applications, meeting clean-label and regulatory standards for natural coloring in European food and beverage production.

By end user, food and beverage companies represent a leading segment as they adopt algae-based ingredients for functional and clean-label products. Cosmetics and personal care companies are integrating algae extracts for moisturizing, anti-aging, and protective properties. Pharmaceutical and diagnostics firms utilize algae-derived pigments and biomarkers in therapeutic and diagnostic applications. Packaging and bioplastics manufacturers are testing algae-based solutions to replace petroleum-based plastics. Agriculture and aquaculture formulators are adopting algae as biofertilizers and sustainable feed additives. Industrial and household cleaning product makers are shifting to algae-derived biosurfactants for green formulations. It reflects wide adoption across consumer and industrial sectors, reinforcing growth momentum.

- For instance, in February 2024, the French start-up Eranova partnered with Somater to commercialize ALGX, a 100% bio-based polymer packaging material derived from green algae harvested in France’s Étang de Berre lagoon, providing an alternative to fossil-based polymers in food and personal care packaging applications.

Segmentation

By Type

- Algal Pigments

- Algae-derived Surfactants / Biosurfactants

- Algal Biopolymers & Hydrocolloids

- Algae-based Specialty Extracts & Functional Ingredients

By End User

- Food & Beverage and Nutraceutical Brands

- Cosmetics & Personal Care Companies

- Pharmaceutical & Diagnostics Firms (Pigments/Biomarkers)

- Packaging & Bioplastics Manufacturers

- Agriculture & Aquaculture Formulators

- Industrial & Household Cleaning Product Makers

Regional Analysis

Northern France

Northern France holds 36% share of the France Algae Based Specialty Chemicals Market, driven by strong industrial bases and established biotechnology clusters. The region benefits from proximity to research institutions and well-developed supply chains that support algae cultivation and processing. Local companies focus on producing pigments, surfactants, and specialty extracts for cosmetics and food industries. Rising consumer demand for eco-friendly and natural products also strengthens adoption in this subregion. Strategic collaborations between biotech startups and multinational firms enhance product innovation. It continues to expand through investments in R&D and sustainable manufacturing facilities.

Western France

Western France accounts for 31% share of the France Algae Based Specialty Chemicals Market, supported by its concentration of coastal resources and algae cultivation initiatives. The region has strong aquaculture and marine research activities, providing raw material access for specialty chemical production. Food and nutraceutical industries in Brittany and surrounding areas drive algae-based ingredient demand. The subregion benefits from government-backed sustainability programs promoting algae utilization. Startups and SMEs are leveraging pilot projects to develop bioplastics and specialty biopolymers. It is growing steadily due to favorable environmental policies and coastal resource availability.

Southern and Central France

Southern and Central France together represent 33% share of the France Algae Based Specialty Chemicals Market, with demand led by cosmetics, pharmaceuticals, and agriculture. The presence of major personal care companies in Provence and Rhône-Alpes fosters integration of algae-derived ingredients into skincare and wellness products. Pharmaceutical firms are adopting algae-based compounds for research in biomarkers and functional ingredients. Agricultural sectors also explore algae applications for fertilizers and aquafeed formulations. Universities and research hubs in Lyon and Marseille provide strong scientific support for algae innovations. It continues to progress as companies expand into value-added specialty chemical applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CABB Chemicals

- BASF SE

- I.D. Parry (Parry Nutraceuticals)

- Cyanotech Corporation

- Earthrise Nutritionals

- Algatechnologies (Algatech)

- CP Kelco

- Cargill

- DSM

- Other Key Players

Competitive Analysis

The France Algae Based Specialty Chemicals Market is defined by competition between global corporations and specialized biotech firms. BASF SE, DSM, and Cargill dominate with extensive product portfolios and strong R&D investments, ensuring consistent supply and global reach. Local firms such as Algatechnologies, E.I.D. Parry, and Earthrise Nutritionals add niche capabilities, focusing on high-value extracts and pigments. Startups are also playing a critical role by developing innovative applications in bioplastics, packaging, and natural cosmetics. Strategic collaborations and mergers strengthen the competitive landscape by combining technology expertise with distribution capacity. It demonstrates a balanced mix of global leaders and agile regional players, fostering innovation and market expansion.

Recent Developments

- In July 2025, Microphyt, together with a consortium of 11 European partners, officially inaugurated the world’s first industrial-scale microalgae biorefinery in Baillargues, southern France. The new facility is expected to produce 100 tons per year of natural active ingredients derived from algae for the health, nutrition, cosmetics, and animal feed sectors, positioning France as a leader in sustainable, algae-based specialty chemicals production. The project was completed after four years of collaboration and received €14.3 million in funding from the CBE JU program, with the objective to support large-scale biotechnological innovation for bio-based markets.

- In June 2025, CABB Chemicals entered a major strategic partnership with Origin by Ocean to establish a first-of-its-kind algae biorefinery at CABB’s production site in Kokkola, Finland. This facility will extract valuable chemicals, such as alginate and fucoidan, from sargassum using proprietary biorefinery technology, aiming for startup in 2028.

- In March 2025, Aker BioMarine announced the exclusive launch of Revervia®, a new algae ingredient with a high natural concentration of DHA omega-3 oil, in partnership with Ideactifs as the distributor for France and Benelux. This development aims to accelerate the availability of innovative, algae-derived health ingredients in the French specialty chemicals market and foster greater adoption of algae-based solutions in the region.

Report Coverage

The research report offers an in-depth analysis based on Type and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The France Algae Based Specialty Chemicals Market is expected to strengthen its role in clean-label consumer products.

- Rising demand for natural pigments and extracts will push adoption in cosmetics and personal care industries.

- Food and nutraceutical companies will increasingly rely on algae-derived bioactives for product differentiation.

- Pharmaceutical research will expand algae applications in functional ingredients, biomarkers, and drug delivery systems.

- The packaging industry will integrate algae-based bioplastics, enhancing sustainability and reducing plastic dependency.

- Agricultural and aquaculture sectors will scale algae-based solutions for feed and biofertilizer formulations.

- Strategic collaborations between biotech firms and multinationals will accelerate commercialization of innovative compounds.

- Regulatory frameworks in France will continue to encourage bio-based chemical production and adoption.

- Technological advancements in cultivation and extraction will improve scalability and lower production costs.

- Export potential will rise as French producers expand into global value chains and partnerships.