Market Overview:

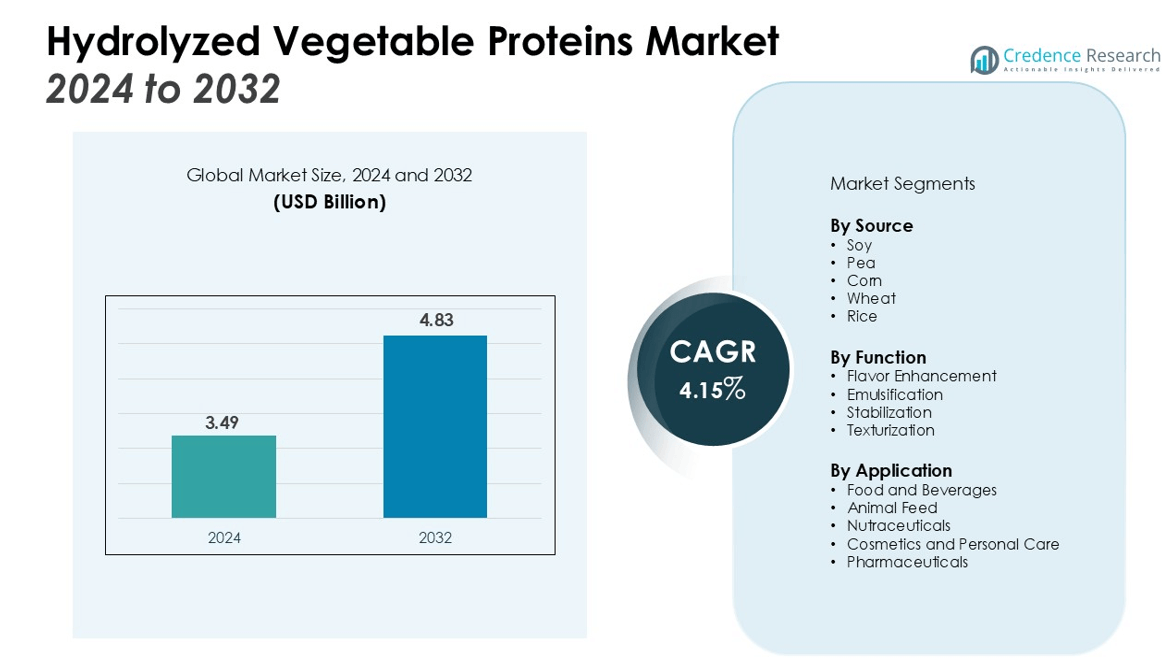

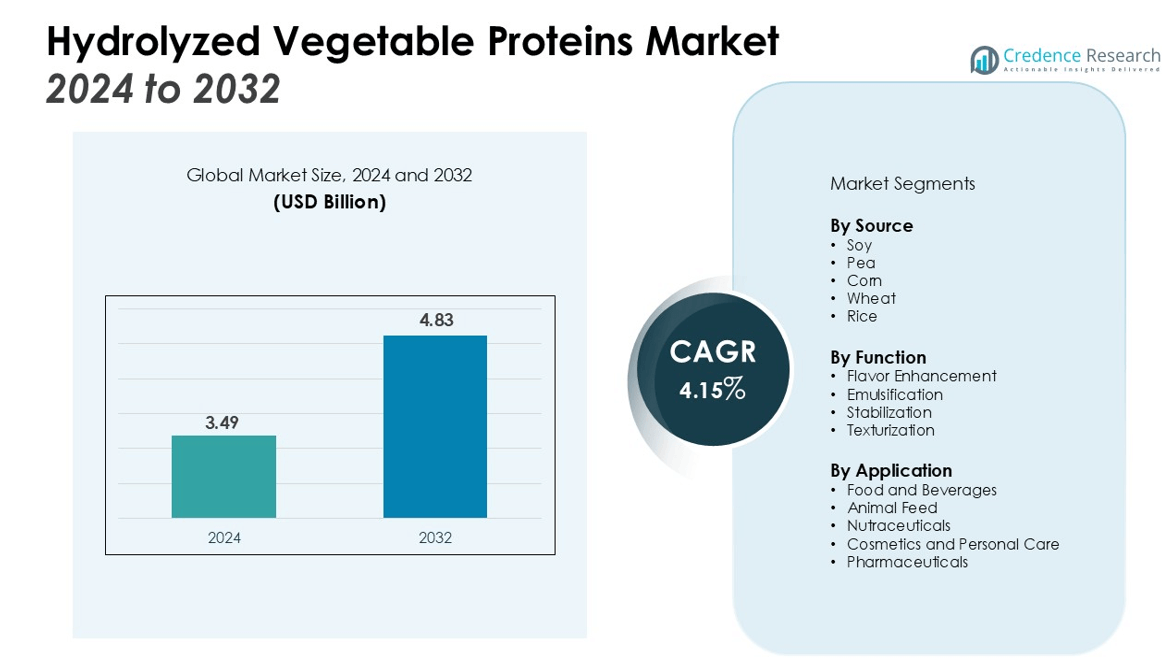

The Hydrolyzed Vegetable Proteins Market size was valued at USD 3.49 billion in 2024 and is anticipated to reach USD 4.83 billion by 2032, at a CAGR of 4.15% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hydrolyzed Vegetable Proteins Market Size 2024 |

USD 3.49 billion |

| Hydrolyzed Vegetable Proteins Market, CAGR |

4.15% |

| Hydrolyzed Vegetable Proteins Market Size 2032 |

USD 4.83 billion |

Key drivers for the HVP market include the growing trend toward vegan and vegetarian diets, coupled with the rising preference for clean-label and natural ingredients in food products. Additionally, the surge in demand for protein-rich foods, driven by health-conscious consumers and the functional benefits of HVP, is further propelling market growth. The food industry’s use of HVP for flavor enhancement and as an emulsifier, alongside its growing role in functional foods and supplements, is contributing to the market’s expansion. Furthermore, increasing awareness of the health benefits of plant-based proteins is fueling demand across multiple industries.

Regionally, North America and Europe dominate the Hydrolyzed Vegetable Proteins market due to high consumption rates of plant-based products and stringent food safety regulations. However, the Asia-Pacific region is expected to exhibit the highest growth during the forecast period, driven by increasing urbanization, changing dietary patterns, and the rising popularity of plant-based protein alternatives in emerging economies like China and India. The growing adoption of HVP in the region’s rapidly expanding food and beverage industry will further support this trend.

Market Insights:

- The shift towards vegan and vegetarian diets is boosting the demand for Hydrolyzed Vegetable Proteins (HVP) in plant-based food products.

- The growing preference for clean-label products is driving HVP adoption as a natural alternative to artificial additives.

- HVP’s nutritional benefits, including amino acids, are increasing its use in functional foods and dietary supplements.

- HVP is widely used in the food and beverage industry for flavor enhancement, emulsifying, and stabilizing products.

- The growing demand for plant-based proteins is stressing the agricultural sector, causing potential supply disruptions due to climate factors.

- Regulatory variations and quality control challenges pose hurdles for manufacturers, impacting product consistency and compliance.

- North America (35%), Europe (30%), and Asia-Pacific (25%) are the leading regions, with Asia-Pacific showing the highest growth potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Plant-Based Protein Alternatives

The increasing adoption of plant-based diets, particularly vegan and vegetarian, significantly drives the Hydrolyzed Vegetable Proteins (HVP) market. Consumers are becoming more health-conscious and are seeking alternatives to animal-based proteins, which has led to a surge in demand for plant-based protein sources. HVP offers an attractive option due to its high protein content and versatility in various food applications, making it a preferred ingredient in many plant-based food products, including meat alternatives, snacks, and beverages.

- For instance, a major supplier like Kerry Group plc offers HVP derived from at least 3 different plant sources—soy, wheat, and corn—to formulate specific savory notes required for plant-based meat alternatives.

Growing Consumer Preference for Clean-Label and Natural Ingredients

The growing consumer preference for clean-label products is another key factor fueling the market’s growth. Shoppers are increasingly avoiding artificial additives, preservatives, and chemicals in their food choices. Hydrolyzed Vegetable Proteins, which are natural and minimally processed, align with this trend. The clean-label movement has led manufacturers to explore HVP as a healthier, more natural alternative to artificial flavor enhancers and preservatives in food processing, boosting its demand in the food industry.

Health Benefits of Hydrolyzed Vegetable Proteins

Consumers are becoming more aware of the nutritional and functional benefits of HVP, such as its ability to improve digestion and support muscle repair. This growing awareness supports its use not only in food products but also in functional foods and dietary supplements. HVP is rich in amino acids and provides a range of health benefits that contribute to muscle growth, immune function, and overall wellness. The market is expected to grow as consumers increasingly incorporate HVP into their daily diets to support a healthy lifestyle.

- For instance, research conducted by Ajinomoto Co. found that a supplement containing just 3.6 grams of essential amino acids with a high leucine content effectively stimulates muscle protein synthesis after exercise, aiding recovery.

Expanding Applications in the Food and Beverage Industry

The widespread use of Hydrolyzed Vegetable Proteins in the food and beverage industry also drives market growth. HVP is utilized for flavor enhancement, improving the taste and texture of processed foods. Its ability to function as a natural emulsifier and stabilizer in products like sauces, soups, and dressings has made it a staple in the food processing sector. The growing demand for innovative food products, including plant-based protein-rich items, further supports the market’s expansion.

- For instance, Kerry Group plc offers a diverse portfolio of HVP products derived from at least 4 different plant sources—soy, corn, wheat, and pea—to improve flavor and functionality across various food applications.

Market Trends:

Increasing Demand for Plant-Based Protein Products

The Hydrolyzed Vegetable Proteins (HVP) market is witnessing a notable shift toward plant-based protein products, driven by changing consumer preferences. With a growing focus on vegan, vegetarian, and flexitarian diets, consumers are increasingly seeking alternatives to animal-derived protein sources. HVP, being a versatile and highly functional ingredient, is emerging as a key component in plant-based food formulations. This trend is further fueled by the rising awareness of the environmental benefits of plant-based diets, including reduced greenhouse gas emissions and lower resource consumption. As more consumers adopt plant-based lifestyles, the demand for HVP in meat substitutes, dairy alternatives, and plant-based beverages continues to rise, driving innovation within the food industry.

- For instance, Ingredion developed its VITESSENCE® Pulse 1803 pea protein isolate to help manufacturers create high-protein products, this ingredient is designed to enable formulators to achieve the 10 grams of protein per serving required for an “excellent source of protein” claim on product packaging.

Shift Toward Clean-Label and Natural Ingredients

The Hydrolyzed Vegetable Proteins market is benefiting from a growing shift toward clean-label and natural ingredients in food and beverage products. Consumers are increasingly prioritizing transparency in product labeling and are more inclined to choose foods that contain fewer additives and preservatives. HVP, with its natural composition and ability to function as a clean-label flavor enhancer and emulsifier, is gaining significant traction. As a result, many food manufacturers are incorporating HVP into their products to meet the demand for healthier, more natural options. This trend is evident across various food categories, including soups, sauces, snacks, and ready-to-eat meals, where the use of HVP as a key ingredient enhances both flavor and nutritional profile.

- For instance, Kerry Group has expanded its portfolio of clean-label food protection solutions to address this demand, the company’s range is now built on 5 core technological pillars, including fermentation metabolites, vinegar-based solutions, and functional plant extracts, to replace synthetic additives.

Market Challenges Analysis:

Supply Chain Disruptions and Raw Material Availability

The Hydrolyzed Vegetable Proteins (HVP) market faces challenges related to the availability and supply of raw materials. The increasing demand for plant-based proteins has put pressure on the agricultural sector to meet production needs. Factors such as climate change, crop failures, and fluctuations in crop yields can disrupt the supply of key raw materials, including soybeans and peas. This can lead to price volatility and supply shortages, which in turn may affect the cost and availability of HVP. Manufacturers must find ways to mitigate these challenges, either by diversifying their supply sources or adopting more sustainable practices to ensure a steady and reliable raw material supply.

Regulatory and Quality Control Issues

The regulatory environment surrounding the use of Hydrolyzed Vegetable Proteins presents another challenge for the market. Different regions have varying food safety and labeling regulations, which can complicate the approval process for HVP-based products. Manufacturers must ensure compliance with these regulations, which can lead to delays in product development and increased operational costs. Additionally, maintaining consistent quality across different batches of HVP is critical for ensuring consumer trust. Variability in production processes and sourcing can lead to inconsistencies in quality, which may affect product performance and customer satisfaction. These regulatory and quality control hurdles present ongoing challenges for market participants.

Market Opportunities:

Expansion of the Plant-Based Food Segment

The growing global shift toward plant-based diets presents significant opportunities for the Hydrolyzed Vegetable Proteins (HVP) market. As consumer preferences for vegan and vegetarian products continue to rise, the demand for plant-based protein sources like HVP is expected to increase. This trend is especially prominent in the food and beverage industry, where HVP is being used as a key ingredient in plant-based meat substitutes, dairy alternatives, and protein-rich snacks. With the expansion of the plant-based food segment, manufacturers can explore new product categories and innovate with HVP to meet the evolving needs of health-conscious consumers. This growing demand for plant-based products creates an expanding market for HVP as a core ingredient.

Technological Advancements in Protein Processing

Ongoing advancements in protein processing technology offer significant opportunities for the Hydrolyzed Vegetable Proteins market. Innovations that improve the efficiency, yield, and functionality of HVP production processes can help manufacturers meet the rising demand for high-quality, cost-effective products. Enhanced technologies also enable the development of specialized HVP variants with unique functional properties, such as improved solubility or better emulsifying capabilities. These innovations can open up new applications for HVP in diverse sectors, including nutraceuticals, personal care, and pet food. Manufacturers that invest in these technological advancements can gain a competitive edge and tap into growing markets with specialized product offerings.

Market Segmentation Analysis:

By Source

The Hydrolyzed Vegetable Proteins (HVP) market is primarily segmented by source, with soy, corn, and peas being the dominant plant-based sources. Soy holds the largest market share due to its high protein content and wide availability. Pea protein is also gaining traction, driven by its allergen-free nature and its growing use in plant-based food products. Corn-based HVP is used for specific applications, particularly in the food and beverage industry, where its mild flavor and functional properties are valued.

- For instance, Roquette has developed a patented process for its NUTRALYS® pea protein isolate that achieves an amino acid score of 93 for adults.

By Function

The HVP market is segmented by function into flavor enhancement, emulsification, and stabilization. Flavor enhancement is the leading functional segment, as HVP is widely used to improve taste and aroma in food products. Its role as an emulsifier and stabilizer is also significant, particularly in processed foods, sauces, and dressings. These functionalities make it a valuable ingredient in maintaining product consistency, texture, and overall quality.

- For instance, in a consumer study involving 120 participants, enzyme-hydrolyzed vegetable protein (eHVP) was successfully used as a flavor enhancer in soup, with the results indicating that consumers preferred certain eHVP-added samples over those with MSG.

By Application

The Hydrolyzed Vegetable Proteins market finds applications in various sectors, including food and beverages, animal feed, and nutraceuticals. In the food and beverage sector, it is used extensively in plant-based meat substitutes, snacks, and beverages due to its protein content and flavor-enhancing properties. The use of HVP in animal feed is growing due to its nutritional benefits, while in nutraceuticals, it is incorporated for its health-promoting properties, particularly in protein supplements and functional foods. These diverse applications ensure broad market potential for HVP.

Segmentations:

By Source

By Function

- Flavor Enhancement

- Emulsification

- Stabilization

- Texturization

By Application

- Food and Beverages

- Animal Feed

- Nutraceuticals

- Cosmetics and Personal Care

- Pharmaceuticals

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America: Strong Demand for Plant-Based Products and Food Safety Regulations

North America accounts for 35% of the Hydrolyzed Vegetable Proteins (HVP) market, driven by a robust demand for plant-based foods and stringent food safety regulations. The region leads in plant-based product innovations, with HVP being a key ingredient in meat substitutes and dairy alternatives. Rising health consciousness and consumer preference for clean-label products further fuel the market’s expansion. Food manufacturers are increasingly incorporating HVP to meet the growing demand for sustainable, protein-rich foods, and North American regulations support its widespread use across the industry.

Europe: Clean-Label Demand and Plant-Based Innovations Fuel Market Growth

Europe holds a 30% share in the Hydrolyzed Vegetable Proteins market, with significant demand for clean-label ingredients and plant-based products. The rise in vegan and vegetarian diets, along with consumer preference for natural, additive-free ingredients, propels the growth of HVP. Stringent food safety regulations in the region also support the use of HVP in food and beverages. The growing focus on functional foods, where HVP provides flavor enhancement and nutritional benefits, contributes to Europe’s strong position in the market.

Asia-Pacific: Rapid Growth Driven by Urbanization and Plant-Based Diet Adoption

The Asia-Pacific region represents 25% of the Hydrolyzed Vegetable Proteins market and is expected to witness the highest growth during the forecast period. Factors such as rapid urbanization, evolving dietary habits, and an increasing shift toward plant-based diets in countries like China and India are driving market expansion. HVP’s use in food and beverage applications, especially in plant-based proteins and supplements, is gaining popularity. Furthermore, the expanding pet food industry in the region supports increased adoption of HVP for nutritional enhancement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Hydrolyzed Vegetable Proteins (HVP) market is led by major players such as Ajinomoto Co., Inc., Cargill, Archer Daniels Midland Company (ADM), Kerry Group plc, and Givaudan, collectively holding a significant share. These companies leverage their established networks, broad product portfolios, and strong customer relationships to maintain dominance. Regional leaders like Roquette Frères and Angel Yeast focus on specific markets, while emerging players such as Symega and PT Indesso Aroma cater to niche segments with clean-label, allergen-free offerings. The competitive landscape is marked by continuous innovation, with firms investing in new product development and strategic partnerships to enhance their capabilities and market reach. This dynamic environment reflects the increasing demand for plant-based and clean-label ingredients across industries.

Recent Developments:

- In August 2025, Ajinomoto announced an investment in v2food Pty Ltd and also revealed plans for the construction of a new factory at Ajinomoto Philippines Corporation.

- In February 2025, Kerry launched its 2025 Supplement Taste Charts, offering guidance on emerging flavor trends within the wellness and nutraceutical markets, including tropical, botanical, and nostalgic tastes.

- In April 2025, Ajinomoto announced the agreement to sell its entire equity stake in in Ajinomoto Althea, Inc.

Report Coverage:

The research report offers an in-depth analysis based on Source, Function, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for Hydrolyzed Vegetable Proteins (HVP) is expected to rise as more consumers adopt plant-based diets.

- Increasing awareness of the health benefits of plant-based proteins will continue to drive HVP adoption in functional foods.

- As clean-label and natural ingredient preferences grow, HVP’s role as a natural flavor enhancer and emulsifier will expand in the food industry.

- The food and beverage industry will increasingly incorporate HVP in plant-based meat alternatives and dairy substitutes.

- The rise in health-conscious consumers will lead to greater use of HVP in dietary supplements and sports nutrition products.

- HVP’s application in the pet food industry will continue to increase, driven by the demand for high-protein formulations.

- Technological advancements in production methods will improve HVP’s cost-effectiveness and quality, supporting broader market penetration.

- Manufacturers will focus on sustainable sourcing of raw materials to meet the growing demand while addressing environmental concerns.

- The Asia-Pacific region is set to experience the highest growth, driven by urbanization and dietary shifts in emerging economies.

- Increased regulatory focus on food safety will ensure consistent product quality, enhancing consumer trust and expanding market opportunities.