Market Overview:

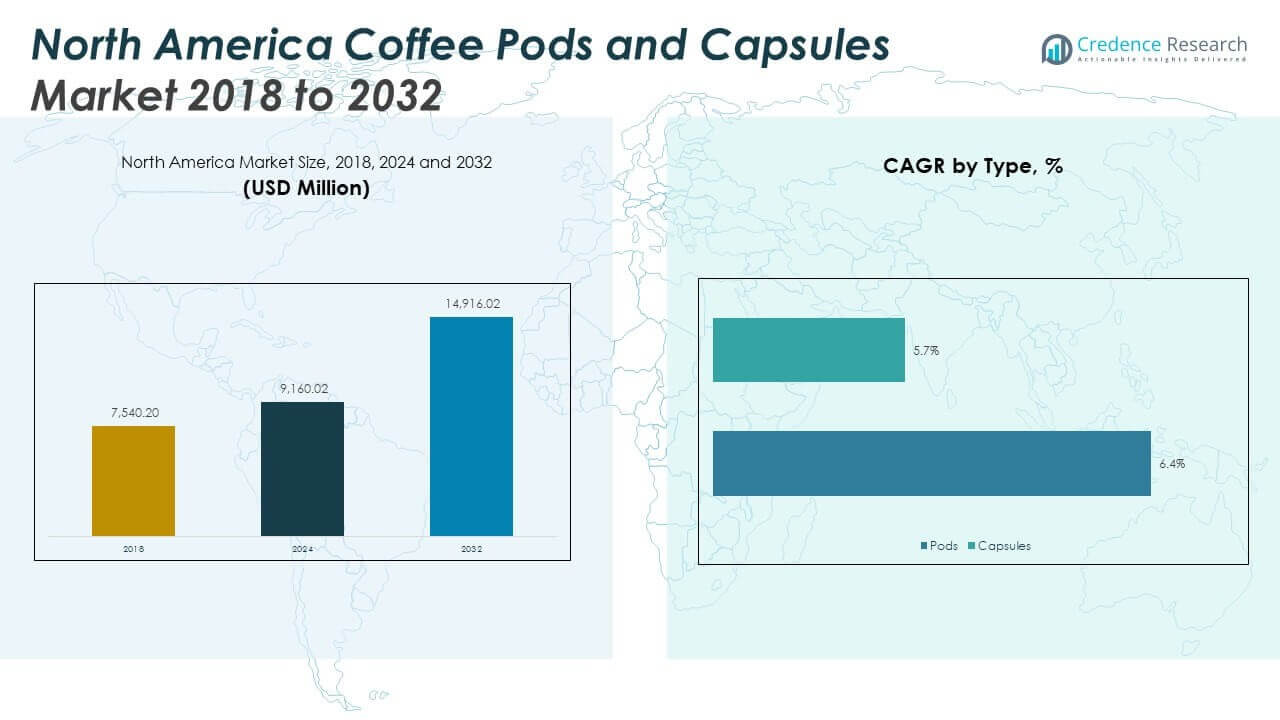

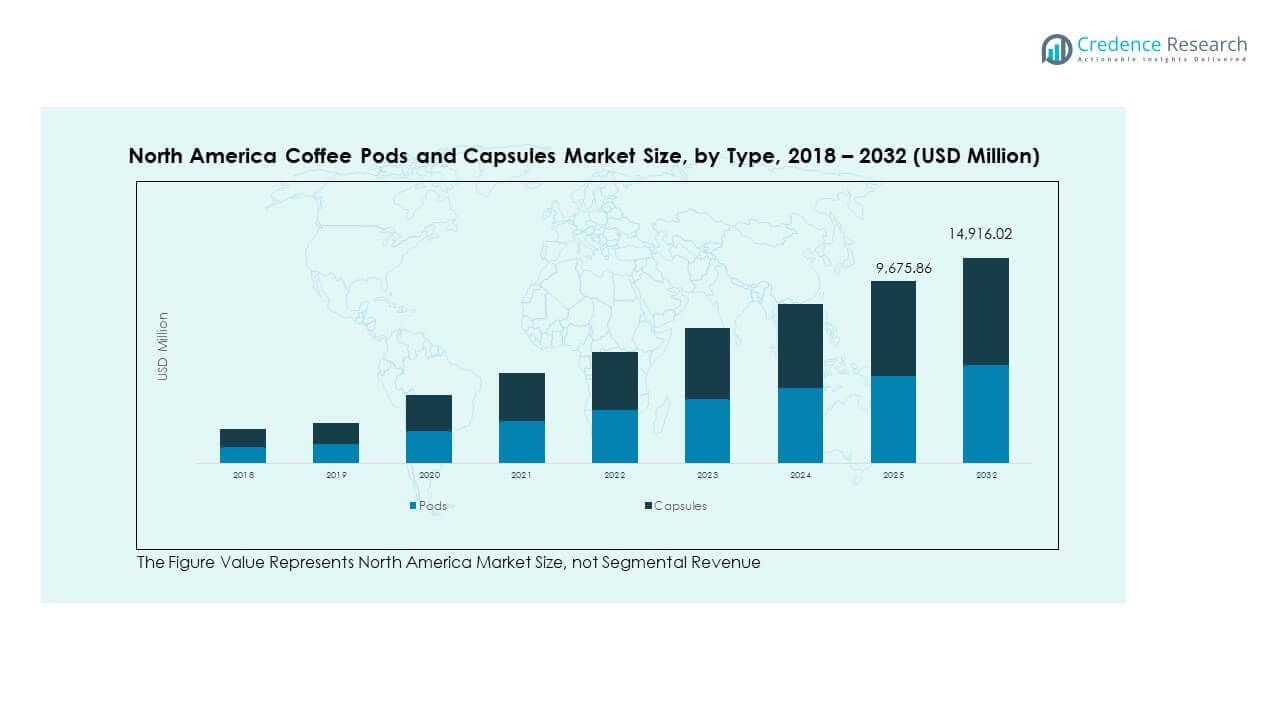

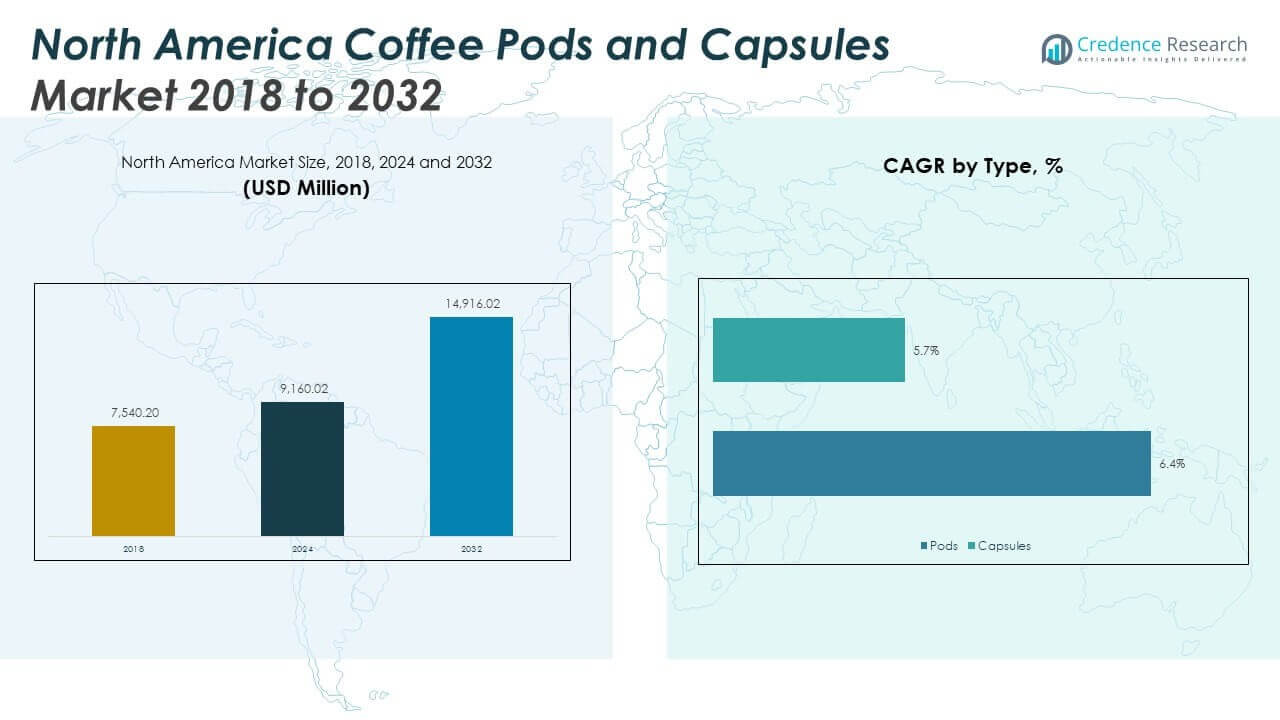

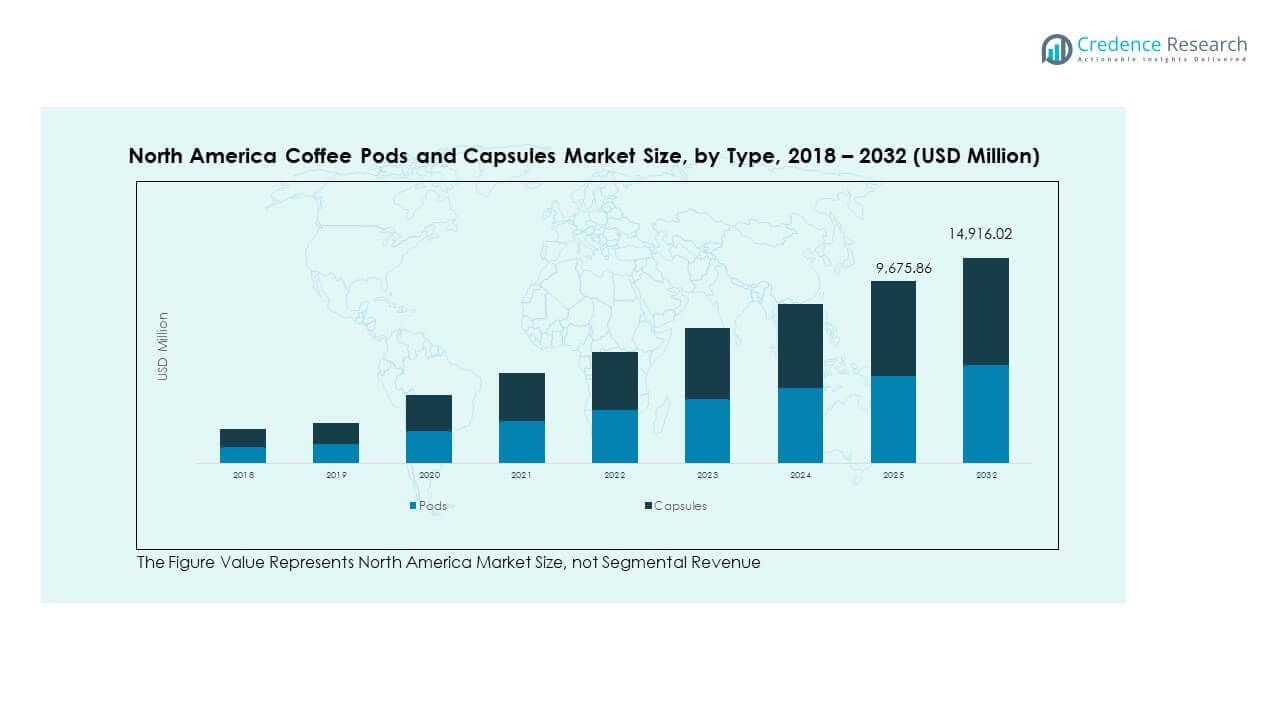

The North America Coffee Pods Capsules Market size was valued at USD 7,540.20 million in 2018 to USD 9,160.02 million in 2024 and is anticipated to reach USD 14,916.02 million by 2032, at a CAGR of 6.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Coffee Pods Capsules Market Size 2024 |

USD 9,160.02 Million |

| North America Coffee Pods Capsules Market, CAGR |

6.28% |

| North America Coffee Pods Capsules Market Size 2032 |

USD 14,916.02 Million |

Growth in the market is driven by consumer preference for convenience, premium quality, and single-serve brewing systems. Increasing adoption of smart coffee machines in households, rising café culture, and demand for variety in coffee flavors are influencing sales. Strong marketing strategies by global coffee brands and sustainability efforts, such as recyclable and compostable pods, further strengthen the adoption of coffee pods and capsules across urban and semi-urban regions.

Geographically, the U.S. leads the market due to high coffee consumption, advanced retail infrastructure, and strong penetration of premium coffee brands. Canada shows growing demand, supported by rising urbanization and expanding café culture. Mexico represents an emerging segment where affordability, growing middle-class purchasing power, and expansion of retail channels are creating opportunities for future growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Coffee Pods Capsules Market was valued at USD 7,540.20 million in 2018, reached USD 9,160.02 million in 2024, and is projected to attain USD 14,916.02 million by 2032, expanding at a CAGR of 6.28%.

- The United States leads with nearly 70% share in 2024, supported by strong coffee culture, retail infrastructure, and premium brand presence, while Canada holds about 20% share due to steady adoption of premium flavors.

- Mexico contributes around 10% share in 2024 and is the fastest-growing regional market, driven by rising middle-class income, lifestyle shifts, and expansion of retail and online channels.

- Pods captured the larger segment share, accounting for nearly 58% in 2024, driven by affordability and wider machine compatibility.

- Capsules represented about 42% share in 2024, gaining traction in premium households due to freshness, convenience, and variety of specialty blends.

Market Drivers:

Market Drivers:

Rising Consumer Preference for Convenience and Single-Serve Coffee Solutions:

The North America Coffee Pods Capsules Market benefits from strong consumer demand for convenience-driven solutions. Single-serve pods and capsules save time, making them popular among busy professionals and urban households. Growing adoption of compact brewing systems at home and in offices fuels higher consumption. Many consumers prefer the ease of brewing consistent coffee without waste. Premiumization within the single-serve category supports this momentum. Coffee capsules also offer variety in flavors and strengths, appealing to diverse preferences. It continues to attract new buyers by aligning convenience with consistent quality.

- For instance, Keurig has seeded more than 40 million active brewers in US homes, capturing nearly one-third of households and driving consistent pod consumption with over 516 million cups brewed daily in the US alone. Growing adoption of compact brewing systems at home and in offices fuels higher consumption. Many consumers prefer the ease of brewing consistent coffee without waste. Premiumization within the single-serve category supports this momentum.

Expansion of Café Culture and At-Home Coffee Experience:

The rise of café culture in urban areas plays a major role in boosting capsule sales. Consumers seek premium café-like experiences within their homes, driving higher adoption of coffee machines. Brands replicate café-quality flavors through pods, meeting expectations of taste and aroma. Younger demographics embrace this trend due to lifestyle changes and social influence. This shift expands the overall consumption base in the region. Rising awareness of international coffee varieties also supports capsule demand. The North America Coffee Pods Capsules Market grows further by bridging café experiences with at-home brewing.

- For instance, Lavazza’s influence on coffee culture blends traditional espresso excellence with specialty capsules sourced from over 25 countries, enhancing at-home coffee experiences globally. Younger demographics embrace this trend due to lifestyle changes and social influence. This shift expands the overall consumption base in the region. Rising awareness of international coffee varieties also supports capsule demand.

Innovation in Coffee Machine Technology and Pod Compatibility:

Advancements in coffee machine technology continue to accelerate capsule consumption. Companies focus on user-friendly designs, smart features, and multi-brand compatibility. Enhanced pod-machine compatibility expands consumer choices, supporting loyalty to capsules. Energy-efficient models further strengthen appeal among environmentally aware buyers. Many brands develop machines tailored for specific pod ranges, ensuring better brewing results. Increasing partnerships between machine and pod manufacturers create robust ecosystems. It leverages these innovations to enhance both consumer satisfaction and market penetration.

Sustainability Efforts and Eco-Friendly Packaging Solutions:

Growing environmental concerns drive a shift toward recyclable and biodegradable coffee pods. Brands invest in sustainable packaging materials to reduce plastic waste. Eco-conscious consumers respond positively to these initiatives, boosting capsule acceptance. Governments and regulations emphasize waste reduction, encouraging companies to adopt greener strategies. Compostable pods and recyclable aluminium capsules gain traction in premium categories. This strengthens the brand image of companies leading sustainability efforts. The North America Coffee Pods Capsules Market aligns with environmental awareness while maintaining strong product appeal.

Market Trends:

Market Trends:

Premiumization and Introduction of Specialty Coffee Varieties in Capsules:

The North America Coffee Pods Capsules Market experiences rising demand for premium blends. Specialty coffee flavors, sourced from single-origin beans, appeal to discerning buyers. Brands introduce gourmet and artisanal variants to capture high-income groups. Limited edition seasonal capsules attract repeat purchases and customer loyalty. Younger consumers often prefer unique coffee experiences, strengthening this trend. Partnerships with coffeehouses expand access to luxury blends at home. It continues to evolve by offering high-value, differentiated capsules to diverse consumer segments.

- For instance, Starbucks has expanded its capsule offerings to include single-origin and artisanal blends, targeting premium consumers seeking unique coffee experiences. Brands introduce gourmet and artisanal variants to capture high-income groups. Limited edition seasonal capsules attract repeat purchases and customer loyalty. Younger consumers often prefer unique coffee experiences, strengthening this trend. Partnerships with coffeehouses expand access to luxury blends at home.

Adoption of Smart and Connected Coffee Machines in Homes and Offices:

Smart coffee machines integrated with app controls are gaining adoption across North America. Consumers value personalized brewing through mobile and voice-enabled systems. Machine connectivity ensures precise customization of strength, size, and temperature. Such innovations increase capsule use due to higher machine engagement. Offices and co-working spaces prefer these solutions for efficiency and consistency. Smart appliances often promote subscription-based capsule models. The North America Coffee Pods Capsules Market grows further as connected ecosystems encourage repeat capsule purchases.

- For instance, Keurig’s Q4 2024 brewer shipments rose 7.3% year over year, reflecting strong adoption of connected machines that promote subscription-based capsule models. Offices and co-working spaces prefer these solutions for efficiency and consistency. Smart appliances often promote subscription-based capsule models.

Evolving Distribution Channels and Strengthening of E-Commerce Sales:

E-commerce platforms and direct-to-consumer channels expand the reach of coffee capsules. Online retailers offer subscription models that ensure consistent supply. Specialty websites promote unique capsule varieties and machine bundles. Traditional supermarkets and hypermarkets still remain strong but complement digital sales. Consumers appreciate the convenience of doorstep delivery of premium capsules. Digital platforms also enable greater brand visibility and consumer engagement. It gains momentum as e-commerce supports wider accessibility and loyalty in the competitive landscape.

Shift Toward Personalized Coffee Experiences and Customization Options:

Consumers increasingly seek tailored coffee experiences through capsules. Customizable pod options allow users to adjust flavor intensity and brewing style. Machine manufacturers collaborate with brands to offer capsule assortments meeting diverse tastes. Personalization attracts younger buyers who prioritize unique experiences over standard options. Consumers explore global coffee origins through curated capsule selections. This trend enhances customer satisfaction while boosting premium sales. The North America Coffee Pods Capsules Market evolves by focusing on individualized experiences and versatile solutions.

Market Challenges Analysis:

Market Challenges Analysis:

High Environmental Impact of Single-Use Pods and Sustainability Pressure:

The North America Coffee Pods Capsules Market faces challenges linked to environmental impact. Single-use pods contribute significantly to plastic and aluminum waste streams. Many consumers criticize the lack of widespread recycling options. Companies face pressure from regulators to reduce waste and carbon footprints. Developing compostable or recyclable alternatives increases costs for manufacturers. Eco-conscious buyers sometimes avoid capsules, preferring traditional brewing methods. This creates tension between convenience and sustainability. It must address these issues to maintain long-term growth potential.

Intense Competition and Pricing Pressures from Global and Local Brands:

The market experiences heavy competition among established global players and emerging local brands. Price-sensitive customers often compare capsules with traditional ground coffee. Premiumization strategies sometimes fail to attract middle-income households. Market entry barriers are lower, encouraging smaller players to launch capsule offerings. This fragmentation impacts brand loyalty and pricing power. Companies need continuous innovation to stay ahead in a saturated market. The North America Coffee Pods Capsules Market adapts by balancing premium positioning with affordability.

Market Opportunities:

Expansion into Emerging Demographics and Untapped Regional Segments:

The North America Coffee Pods Capsules Market presents strong opportunities in untapped demographics. Younger consumers show interest in convenient, premium, and eco-friendly options. Growth in Mexico highlights untapped potential as middle-class income rises. Expanding retail penetration and online channels broaden market reach. Companies can capture new audiences through affordable capsule ranges. Emerging segments reflect rising aspirations for modern and stylish brewing. It leverages this shift to expand adoption across varied household types.

Growth Potential Through Sustainability and Product Differentiation Strategies:

Sustainability-focused innovations create opportunities to capture eco-conscious buyers. Compostable, plant-based, and recyclable pods differentiate brands in a competitive market. Product differentiation through unique flavors and specialty offerings attracts premium buyers. Collaborations with popular cafés and roasters add further appeal. Digital marketing strategies enhance direct engagement with target audiences. It benefits from combining sustainability with innovation to build stronger customer loyalty. Companies that lead in this area position themselves for long-term growth success.

Market Segmentation Analysis:

By Type

Pods dominate the North America Coffee Pods Capsules Market due to their affordability and compatibility with a wide range of brewing machines. They appeal to households seeking convenience and cost-effective options. Capsules, on the other hand, gain strong traction among premium consumers. Their airtight design ensures freshness, delivering café-quality coffee at home. It balances both segments by serving budget-conscious users and those seeking a luxury coffee experience.

By Packaging Material

Conventional plastic remains widely used because of its availability and low cost. However, rising environmental concerns drive demand for bioplastics and fabric-based pods. Bioplastics are gaining momentum as brands invest in eco-friendly alternatives. Fabric options appeal to niche consumers focused on sustainability. Others, such as aluminum and hybrid blends, create opportunities for differentiation. It reflects a clear transition toward sustainable packaging while retaining price-sensitive buyers.

- For instance, an Italian company producing polylactic acid (PLA) compostable coffee capsules achieves a 100% material circularity indicator when composted industrially, outperforming aluminum and plastic capsules in sustainability metrics. Fabric options appeal to niche consumers focused on sustainability. Others, such as aluminum and hybrid blends, create opportunities for differentiation. It reflects a clear transition toward sustainable packaging while retaining price-sensitive buyers.

By Coffee Type

Traditional coffee leads consumption, driven by its strong cultural acceptance and preference for classic flavors. Decaf caters to health-conscious consumers and expands steadily in urban markets. The balance between tradition and lifestyle choices sustains growth across both categories. It highlights how diverse consumer needs shape overall adoption.

By Distribution Channel

Store-based channels, including supermarkets and hypermarkets, continue to dominate sales because of visibility and accessibility. Non-store-based channels, especially e-commerce platforms, are expanding quickly. Online platforms attract younger demographics through subscription models and direct-to-home delivery. It strengthens overall market accessibility by integrating physical and digital sales strategies.

Segmentation:

By Type

By Packaging Material

- Conventional Plastic

- Bioplastics

- Fabric

- Others

By Coffee Type

By Distribution Channel

- Store Based

- Non-Store Based

By Country

Regional Analysis:

United States

The United States holds the dominant share of the North America Coffee Pods Capsules Market, accounting for nearly 70% of the regional revenue in 2024. Strong coffee culture, advanced retail infrastructure, and widespread adoption of premium coffee machines support its leadership. High consumer spending on specialty beverages and demand for single-serve convenience further accelerate market expansion. Global brands prioritize the U.S. for product launches and subscription models. Sustainability-focused capsules gain traction in metropolitan cities where eco-conscious buyers influence trends. It sustains leadership through innovation, wide availability, and consumer loyalty to premium brands.

Canada

Canada represents around 20% of the North America Coffee Pods Capsules Market share, driven by rising urbanization and evolving consumer lifestyles. Coffee consumption remains deeply embedded in Canadian culture, fueling consistent demand for pods and capsules. Growth is further supported by expanding café chains and an increasing preference for premium flavors at home. Consumers actively explore sustainable packaging options, reflecting environmental priorities. E-commerce platforms strengthen accessibility for both domestic and international brands. It continues to grow steadily by aligning with premiumization and eco-friendly product preferences.

Mexico

Mexico contributes nearly 10% of the regional share, representing an emerging opportunity within the North America Coffee Pods Capsules Market. Rising middle-class income levels and increasing retail penetration support steady growth. Consumers embrace affordable pods as brewing machines become more accessible in households. International players invest in localized flavors to appeal to traditional taste preferences. Digital sales channels introduce subscription services, expanding reach among younger demographics. It shows strong potential as affordability, lifestyle changes, and urban demand shape long-term market development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Keurig Dr Pepper Inc. (United States)

- Starbucks Corporation (United States)

- The Kraft Heinz Company (United States)

- The J.M. Smucker Company (United States)

- Bestpresso Inc. (United States)

- Gourmesso (Coffee Capsules Inc.) (United States)

- Mother Parkers Tea & Coffee Inc. (Canada)

Competitive Analysis:

The North America Coffee Pods Capsules Market is highly competitive, with global leaders and regional brands actively expanding their portfolios. Keurig Dr Pepper, Starbucks Corporation, The Kraft Heinz Company, and The J.M. Smucker Company dominate through strong brand equity, wide distribution, and premium offerings. Smaller players such as Bestpresso, Gourmesso, and Mother Parkers Tea & Coffee add pressure by targeting niche segments with affordable and eco-friendly products. Innovation in flavor diversity, machine compatibility, and sustainable packaging drives competitive positioning. Companies strengthen their presence through partnerships, subscription services, and product differentiation. It remains defined by innovation, brand loyalty, and consistent efforts to align with evolving consumer expectations.

Recent Developments:

- In February 2025, Keurig Dr Pepper Inc. launched a bold new flavor lineup for the U.S. market, which includes Dr Pepper Blackberry in both regular and zero sugar options, 7UP Tropical with mango and peach flavors, Snapple Peach Tea & Lemonade, and two new Bai varieties featuring strawberry. Additionally, the company introduced RC Cola Zero Sugar nationally and various retailer-exclusive and regional offerings throughout the year. Furthermore, in July 2025, Keurig Dr Pepper acquired full ownership of Dyla Brands, a major player in powdered drink mix and liquid water enhancers, to capitalize on growing consumer demand for functional and trend-forward beverage enhancers.

- The J.M. Smucker Company completed the acquisition of Hostess Brands Inc. in November 2023, significantly expanding its portfolio in the sweet baked snacks market. In early 2025, Smucker also divested certain value brands, including Cloverhill and Big Texas, to JTM Foods LLC to prioritize resources and advance growth within the Hostess brand.

- Mother Parkers Tea & Coffee Inc. announced in February 2023 the construction of a $33.4 million cold coffee and tea extract manufacturing facility in Mississauga to expand product offerings. The company remains focused on sustainability and innovation, supported by investments from the Ontario government.

Report Coverage:

The research report offers an in-depth analysis based on Type, Packaging Material, Coffee Type, and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of eco-friendly and recyclable capsules will reshape product development strategies.

- Expansion of subscription-based models will increase consumer loyalty and repeat purchases.

- E-commerce growth will strengthen non-store-based sales channels across the region.

- Premiumization and specialty coffee capsules will appeal to affluent urban buyers.

- Innovation in smart coffee machines will boost capsule usage in households and offices.

- Seasonal and limited-edition flavors will enhance consumer engagement and brand recall.

- Collaborations between machine makers and coffee brands will improve compatibility and reach.

- Sustainability regulations will drive higher investments in biodegradable packaging solutions.

- Emerging demand in Mexico will create new growth avenues for regional players.

- Competitive intensity will increase, pushing companies to focus on innovation and differentiation.

Market Drivers:

Market Drivers: Market Trends:

Market Trends: Market Challenges Analysis:

Market Challenges Analysis: