Market Overview:

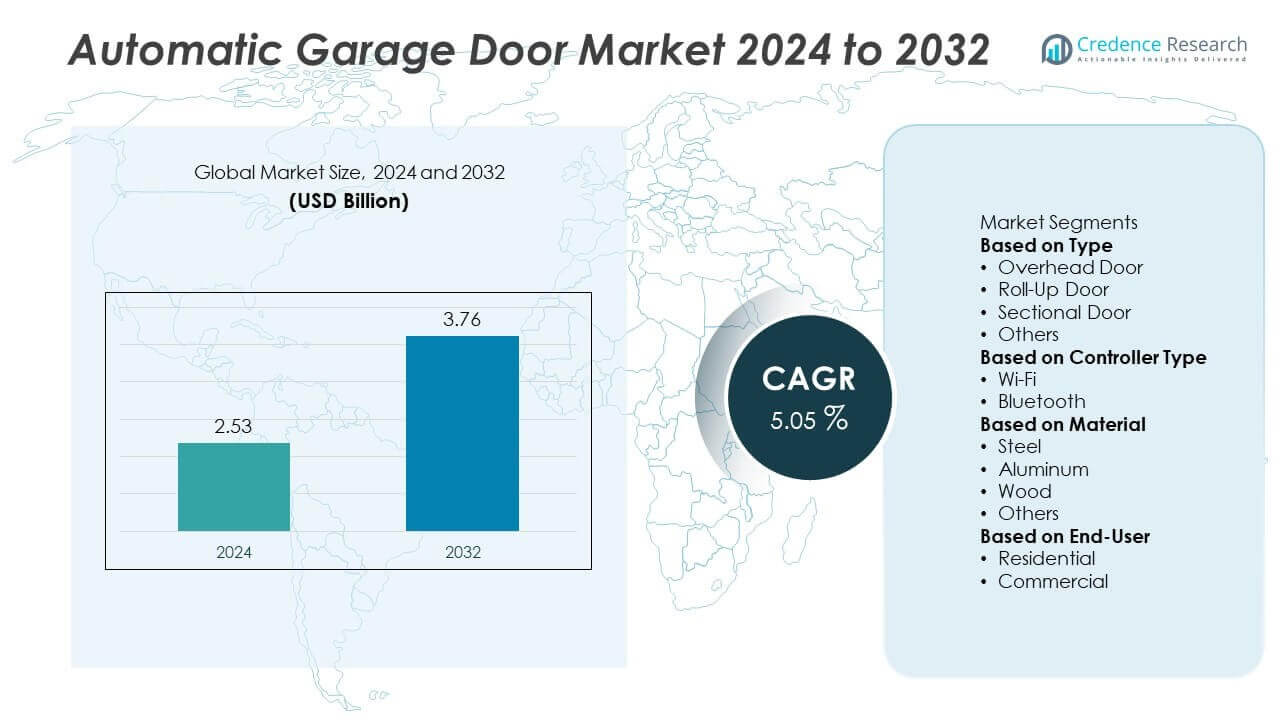

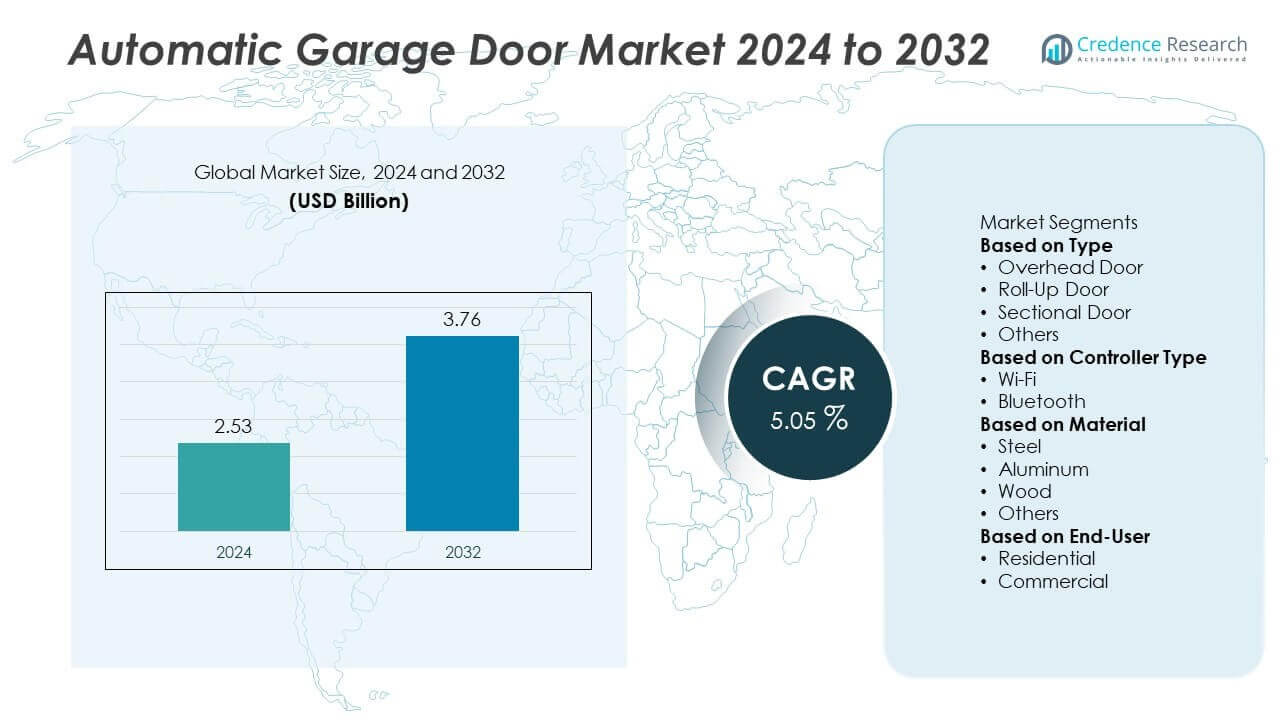

The Automatic Garage Door Market was valued at USD 2.53 billion in 2024 and is projected to reach USD 3.76 billion by 2032, growing at a CAGR of 5.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automatic Garage Door Market Size 2024 |

USD 2.53 Billion |

| Automatic Garage Door Market, CAGR |

5.05% |

| Automatic Garage Door Market Size 2032 |

USD 3.76 Billion |

The automatic garage door market is led by key players such as Chamberlain Group LLC, Overhead Door Corporation, Teckentrup GmbH & Co. KG, Assa Abloy AB, Raynor Garage Doors, Novoferm GmbH, Cardale Garage Doors Ltd., SKB Shutters Corporation Bhd, Yingkou Jinlian Machinery Co., Ltd., and Shenzhen Wangtong Locks Co., Ltd. These companies focus on smart connectivity, energy-efficient designs, and expanded service networks to strengthen their market presence. North America leads the market with 38% share in 2024, driven by high residential adoption and strong smart home integration. Europe follows with 27% share, supported by strict energy efficiency regulations and growing retrofit demand.

Market Insights

- The Automatic Garage Door market was valued at USD 2.53 billion in 2024 and will reach USD 3.76 billion by 2032 at a CAGR of 5.05%.

- Rising residential construction, renovation projects, and demand for smart home integration drive strong market growth across both developed and developing regions.

- Key trends include adoption of Wi-Fi-enabled controllers with 65% share and growing demand for insulated overhead doors holding 40% share in 2024.

- Leading players such as Chamberlain Group LLC, Overhead Door Corporation, and Assa Abloy AB invest in IoT features, safety sensors, and R&D to gain competitive advantage.

- North America leads with 38% share, followed by Europe at 27% and Asia-Pacific at 24%, while Rest of the World contributes 11%, supported by premium residential and commercial projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Overhead doors dominate the automatic garage door market, capturing nearly 40% share in 2024 due to their durability, smooth operation, and space-saving design. Their popularity in residential projects and small commercial facilities supports consistent demand. Roll-up doors hold a strong position in industrial and warehouse applications, favored for their security and minimal maintenance needs. Sectional doors gain traction in premium residential properties with enhanced insulation and aesthetics. The “others” category, including swing and slide doors, serves niche use cases but grows slowly compared to mainstream designs.

- For instance, Rytec High Performance Doors has delivered more than 150,000 doors over its nearly 40-year history, serving logistics centers and cold storage facilities. While the company is known for its high-performance doors.

By Controller Type

Wi-Fi controllers lead the market with approximately 65% share in 2024, driven by the rising adoption of smart home systems. Consumers prefer Wi-Fi-enabled doors for remote operation, smartphone integration, and compatibility with voice assistants like Alexa and Google Home. Bluetooth controllers follow with moderate growth, catering to users who prefer local control without internet dependency. Growing interest in IoT solutions, automation, and enhanced home security continues to push Wi-Fi-based solutions ahead, making them the preferred choice for residential upgrades and connected living environments.

- For instance, Chamberlain Group’s myQ platform announced that it crossed 10 million connected users in October 2023, enabling real-time garage access monitoring.

By Material

Steel doors hold the largest share, accounting for nearly 50% of the market in 2024, due to their strength, durability, and cost-effectiveness. They are widely used in residential and commercial installations requiring robust security. Aluminum doors gain traction with lightweight construction and corrosion resistance, making them ideal for coastal areas. Wood doors maintain a premium niche for homeowners seeking aesthetic appeal and customization. Other materials, including composites and glass, capture a small share but grow as demand for modern, energy-efficient, and design-oriented garage solutions increases.

Key Growth Drivers

Rising Residential Construction and Renovation

Rapid urbanization and increasing residential construction projects boost demand for automatic garage doors. Homeowners prefer modern, secure, and space-saving solutions to enhance property value. Renovation activities, particularly in North America and Europe, favor smart overhead and sectional doors with advanced features. Growing disposable income supports premium door purchases with improved insulation and noise reduction. Energy-efficient models that comply with green building standards gain traction. This driver strongly supports long-term demand across both new builds and retrofits, making residential installations the largest growth contributor.

- For instance, the Hörmann Group has produced and delivered over 20 million doors worldwide since its founding in 1935, and specializes in doors and operators for both residential and commercial properties.

Increasing Adoption of Smart Home Technologies

Integration of garage doors with smart home systems significantly drives market growth. Consumers prefer Wi-Fi-enabled doors that allow remote access, monitoring, and scheduling through smartphone apps. The popularity of voice-controlled assistants such as Alexa and Google Home enhances demand for connected garage solutions. Manufacturers invest in IoT features, including geofencing and security alerts, to improve user experience. This driver is particularly strong in developed markets where smart home penetration is high, creating opportunities for aftermarket upgrades and bundled home automation packages.

- For instance, Nice S.p.A. integrated its Yubii Home system with Google Assistant, enabling voice control for compatible devices, including garage doors. The integration of the Yubii platform and Google Assistant occurred earlier than January 2024, with compatibility mentioned in documentation as far back as October 2022.

Growing Commercial and Industrial Demand

Commercial facilities, warehouses, and logistics hubs increasingly adopt automated roll-up doors to improve operational efficiency. The rise in e-commerce and distribution centers requires secure, fast-operating doors to handle high traffic. Industrial users favor durable materials like steel and aluminum, which withstand heavy-duty usage. Automated access control and safety sensors enhance workplace safety and productivity. This driver ensures consistent demand from the non-residential sector, especially in regions investing in industrial expansion and smart logistics infrastructure.

Key Trends & Opportunities

Energy-Efficient and Insulated Doors

Manufacturers focus on offering energy-efficient doors with advanced insulation to reduce heat loss. Sectional doors with high R-value panels are gaining traction in cold climates. Demand for eco-friendly materials, low-maintenance coatings, and recyclable components is rising. Compliance with green building codes and energy efficiency standards creates opportunities for premium products. This trend aligns with global carbon reduction goals, allowing brands to position themselves as sustainable and future-ready.

- For instance, Garaga’s Standard+ garage doors, which are built for energy efficiency in the Canadian climate and feature an R-16 insulation value, can be equipped with components that meet the requirements for certain ENERGY STAR qualified products. Specific U-factor ratings, which measure the rate of heat transfer, can vary based on the exact door configuration and optional elements.

Rapid Shift Toward Smart and Connected Systems

The market sees growing demand for cloud-connected, AI-enabled garage door systems. Users prefer solutions that send real-time alerts, integrate with home security cameras, and offer remote diagnostics. Manufacturers explore subscription-based services for predictive maintenance and firmware updates. Partnerships between door manufacturers and smart home platform providers create new revenue opportunities. This trend drives innovation and differentiation, enabling competitive advantage in the premium market segment.

- For instance, Somfy rolled out OTA firmware updates to connected motors and controls in 2024, such as the June 2024 TaHoma update which improved battery monitoring and scheduling capabilities, consistent with the company’s continuous effort to improve product performance and reduce technical support needs.

Key Challenges

High Installation and Maintenance Costs

The initial investment for automatic garage doors remains relatively high, which can deter price-sensitive buyers. Installation involves skilled labor, wiring, and programming, increasing overall cost. Maintenance, including motor servicing and controller replacement, adds to long-term ownership expenses. This challenge particularly affects small businesses and homeowners in developing markets where manual doors remain more affordable.

Cybersecurity and Connectivity Risks

As garage doors integrate with Wi-Fi and IoT platforms, they become potential targets for hacking or unauthorized access. Security breaches can compromise household safety. Manufacturers must invest in strong encryption and secure firmware updates to prevent vulnerabilities. Consumer concerns about data privacy and network security may slow adoption of connected garage systems, especially in regions with low awareness of cybersecurity measures.

Regional Analysis

North America

North America holds the largest share of the automatic garage door market with 38% in 2024, supported by high residential ownership and strong demand for smart home integration. The U.S. leads the region, driven by renovation activities and replacement demand for modern, energy-efficient doors. Canada sees rising adoption in suburban housing projects, with emphasis on insulated sectional doors for harsh winters. Well-established players and strong distribution networks enhance market penetration. Technological innovations, such as Wi-Fi-enabled controllers and safety sensors, further drive growth, keeping North America a dominant revenue-generating region during the forecast period.

Europe

Europe accounts for 27% share of the market in 2024, with Germany, the U.K., and France leading adoption. Stringent energy efficiency regulations drive demand for insulated and automated sectional doors, particularly in residential retrofits. The growing popularity of smart home solutions fuels installation of Wi-Fi-connected garage doors. Urban renovation programs and government incentives for energy-efficient housing further strengthen market potential. Commercial demand grows steadily, especially for roll-up doors in logistics facilities. Local manufacturers emphasize sustainable materials and compliance with CE safety standards, enhancing competitiveness across key European markets and aligning with regional decarbonization targets.

Asia-Pacific

Asia-Pacific represents 24% market share in 2024 and is the fastest-growing region due to rapid urbanization and rising disposable incomes. China and India drive significant demand through expanding residential construction and infrastructure projects. Smart home penetration is increasing, supporting sales of Wi-Fi-enabled garage doors in urban areas. Japan and South Korea focus on premium doors with advanced automation and noise reduction features. Growth in e-commerce and warehousing also boosts roll-up door installations in industrial applications. Competitive pricing and local manufacturing capacity make the region highly attractive for global players aiming to expand their footprint.

Rest of the World (RoW)

The Rest of the World contributes 11% share of the automatic garage door market in 2024, led by the Middle East and Latin America. Rising urban development and increasing adoption of residential security solutions fuel steady growth. Gulf countries invest in premium residential and commercial projects, favoring modern overhead and sectional doors. Latin America sees rising demand in gated communities and small businesses seeking secure, durable solutions. Limited awareness of smart automation slightly restrains adoption, but falling technology costs and expanding distributor networks create opportunities for gradual market penetration in underdeveloped economies.

Market Segmentations:

By Type

- Overhead Door

- Roll-Up Door

- Sectional Door

- Others

By Controller Type

By Material

- Steel

- Aluminum

- Wood

- Others

By End-User

By Geography

- North America

- Europe

- Germany

- France

- The U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the automatic garage door market features leading players such as Chamberlain Group LLC, Teckentrup GmbH & Co. KG, Overhead Door Corporation, Cardale Garage Doors Ltd., Yingkou Jinlian Machinery Co., Ltd., Raynor Garage Doors, Assa Abloy AB, SKB Shutters Corporation Bhd, Novoferm GmbH, and Shenzhen Wangtong Locks Co., Ltd. The market is moderately consolidated, with key players focusing on product innovation, smart connectivity, and energy-efficient designs to strengthen their positions. Strategic mergers, partnerships, and distribution network expansions are common approaches to gain market share. Companies invest in advanced technologies like IoT-enabled controllers, enhanced safety sensors, and mobile app integrations to meet rising consumer expectations. Customization options, quick installation services, and superior after-sales support play a critical role in driving customer loyalty. Competitive pressure encourages continuous R&D efforts, enabling players to introduce differentiated products that cater to both residential and commercial demand globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Chamberlain Group LLC

- Teckentrup GmbH & Co. KG

- Overhead Door Corporation

- Cardale Garage Doors Ltd.

- Yingkou Jinlian Machinery Co., Ltd.

- Raynor Garage Doors

- Assa Abloy AB

- SKB Shutters Corporation Bhd

- Novoferm GmbH

- Shenzhen Wangtong Locks Co., Ltd.

Recent Developments

- In August 2025, Cardale Garage Doors Ltd. re-launched its Iconic Timber Door Range, offering motorized up-and-over and sectional automatic garage doors tailored for aesthetic appeal and robust performance.

- In 2025, Raynor openers do feature smart technology including remote access, security features, automated safety functions, and Bluetooth connectivity.

- In December 2024, myQ (Chamberlain) partnered with Kia America so compatible 2024-2025 Kia vehicles can control garage doors via the vehicle’s touchscreen.

- In August 2024, Overhead Door Brand introduced an Air Curtain option for its 991 RapidFlex® commercial doors to maintain hygiene and temperature-control in cool environments.

Report Coverage

The research report offers an in-depth analysis based on Type, Controller Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand for automated and smart garage solutions.

- Residential renovations will continue to drive installations of sectional and overhead doors.

- Smart home integration will boost adoption of Wi-Fi-enabled and IoT-connected garage doors.

- Commercial and industrial facilities will expand usage of roll-up and heavy-duty doors.

- Demand for insulated and energy-efficient doors will rise to meet green building standards.

- Manufacturers will invest in advanced security features and remote monitoring technologies.

- Partnerships with smart home platform providers will enhance product compatibility and reach.

- Asia-Pacific will witness fastest growth supported by urbanization and housing projects.

- Competition will intensify, encouraging product innovation and quick installation services.

- Cybersecurity solutions will gain importance to protect connected garage systems from breaches.