Market overview

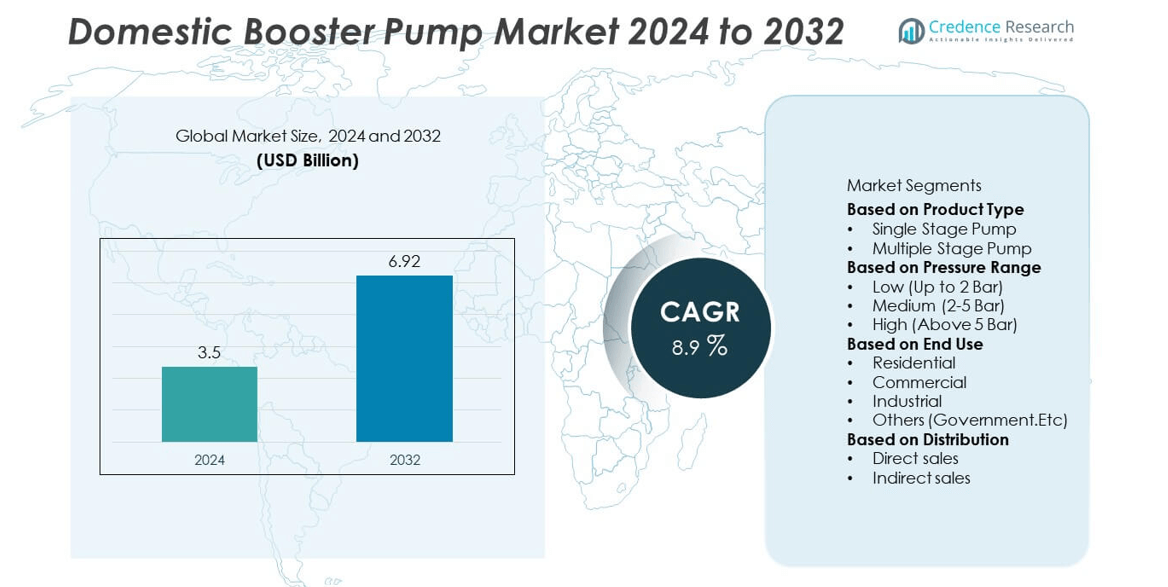

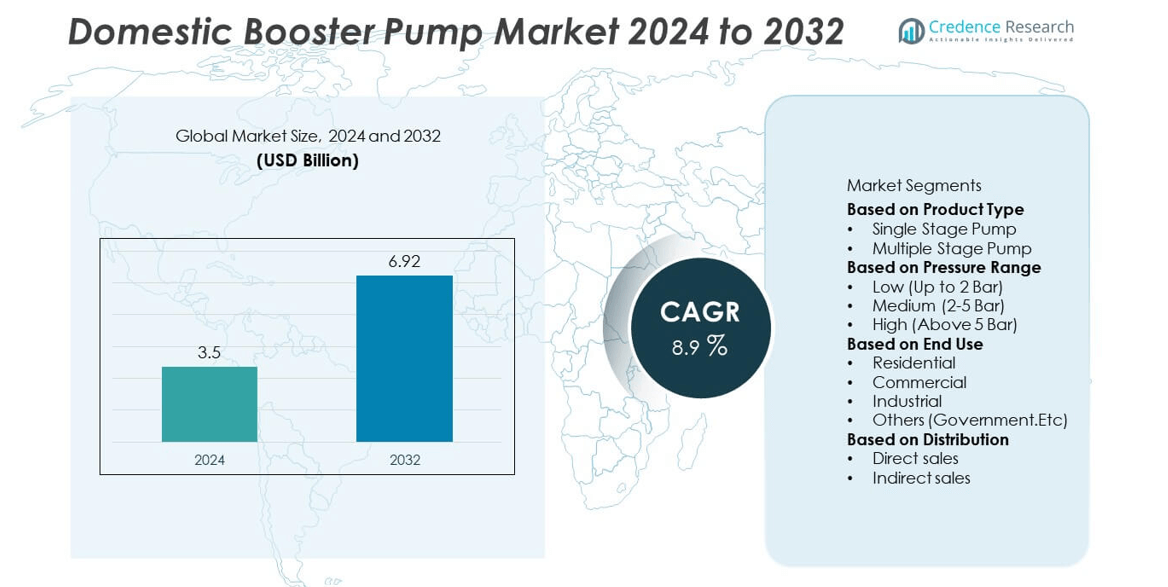

The domestic booster pump market was valued at USD 3.5 billion in 2024 and is projected to reach USD 6.92 billion by 2032, expanding at a CAGR of 8.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Domestic Booster Pump Market Size 2024 |

USD 3.5 billion |

| Domestic Booster Pump Market, CAGR |

8.9% |

| Domestic Booster Pump Market Size 2032 |

USD 6.92 billion |

The domestic booster pump market is led by major players including Donaldson, Franklin Electric, Grundfos, Aqua Groups, Ebara, Kirloskar Brothers, Euro Molten Pumps, Mann Hummel, CRI Pumps, and Lydall. These companies dominate through advanced hydraulic designs, efficient motor systems, and strong aftersales service networks. North America leads the market with a 36% share, driven by high adoption of energy-efficient and smart water management systems. Europe follows with a 30% share, supported by strict energy regulations and widespread use in residential complexes. Asia-Pacific holds a 25% share, fueled by rapid urbanization, infrastructure expansion, and increasing adoption of automated water supply systems.

Market Insights

- The domestic booster pump market was valued at USD 3.5 billion in 2024 and is projected to reach USD 6.92 billion by 2032, expanding at a CAGR of 8.9% during the forecast period.

- Rising demand for efficient water pressure systems in residential and commercial buildings is a key market driver, supported by growing urbanization and increased water consumption.

- Smart and energy-efficient booster pumps integrated with IoT and variable frequency drives are shaping market trends toward automation and sustainability.

- Leading players such as Grundfos, Franklin Electric, and Kirloskar Brothers focus on innovation, durable designs, and strategic expansion to strengthen competitiveness.

- North America leads with a 36% share, followed by Europe at 30% and Asia-Pacific at 25%, while the single-stage pump segment dominates with 54% share due to its low maintenance, compact design, and suitability for domestic water systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The single stage pump segment dominated the domestic booster pump market in 2024 with a 57% share, driven by its simplicity, cost-effectiveness, and widespread use in residential water supply systems. These pumps are preferred for small-scale applications such as household water pressure boosting and garden irrigation. Their compact design, ease of installation, and low maintenance make them ideal for domestic users. Rising urbanization and demand for consistent water flow in multi-story buildings are further fueling growth. Manufacturers are focusing on energy-efficient and noise-reduced models, enhancing their adoption in modern homes and apartments.

- For instance, Franklin Electric offers the Inline 400 pressure boosting system, which features a 1/3 horsepower motor. The pump has a maximum capacity of 20 GPM, or approximately 76 liters per minute.

By Pressure Range

The medium pressure range segment held the largest share of 46% in 2024, supported by its suitability for both household and small commercial applications. Pumps within the 2–5 bar range offer an optimal balance between energy consumption and output pressure. Increasing use in residential complexes, hotels, and educational institutions is driving demand. Medium pressure pumps ensure reliable water delivery for bathrooms, kitchens, and irrigation systems. Their versatility and ability to maintain steady water pressure under fluctuating supply conditions continue to strengthen their dominance in the domestic booster pump market globally.

- For instance, Grundfos developed the SCALA2 medium-pressure booster pump equipped with an intelligent pressure sensor that automatically adjusts motor speed to maintain 2–5 bar output pressure. The unit features a 550-watt motor with a maximum flow rate of 80 liters per minute and operates at a noise level below 47 dB(A). This precision control allows consistent water pressure delivery across multiple outlets, even when inlet supply fluctuates.

By End Use

The residential segment accounted for a 54% share of the domestic booster pump market in 2024, driven by the growing need for consistent water pressure in households and apartments. Rising construction of multi-story residential buildings and expansion of urban housing projects are key contributors. Booster pumps enhance water flow from storage tanks and municipal supplies, improving household convenience. Increasing awareness about energy-efficient water systems and technological advancements in automatic pressure control further support segment growth. The adoption of compact, user-friendly pumps for domestic applications continues to make this the leading end-use category worldwide.

Key Growth Drivers

Rising Urbanization and Residential Infrastructure Development

Rapid urbanization and expansion of residential infrastructure are major factors driving the domestic booster pump market. Growing construction of high-rise apartments and gated communities increases the need for efficient water pressure management systems. Urban households rely on booster pumps to ensure consistent water flow from storage tanks or municipal lines. Governments and private developers are investing heavily in smart housing and urban projects, further supporting adoption. The demand for compact, energy-efficient, and automatic pumps is increasing as cities expand and water distribution challenges intensify.

- For instance, Kirloskar Brothers Limited developed the K-Booster domestic pressure pump, featuring a 0.37 kW (0.5 HP) motor and a maximum head of 28 meters. The pump operates at 2,800 RPM and delivers a maximum flow rate of 2,050 liters per hour (approximately 34 liters per minute).

Growing Demand for Energy-Efficient Water Systems

The shift toward energy-efficient and sustainable water management solutions is significantly driving market growth. Consumers are increasingly adopting domestic booster pumps equipped with variable frequency drives (VFDs) and automatic pressure controls to minimize energy use. Rising awareness of environmental conservation and electricity savings supports this trend. Manufacturers are introducing eco-friendly designs with reduced operational noise and enhanced durability. Regulatory initiatives promoting energy-efficient home appliances also boost market adoption, as homeowners prioritize performance and sustainability in modern residential water supply systems.

- For instance, Grundfos offers the CMBE series booster pump, which integrates a variable frequency drive to automatically adjust the motor speed based on water demand. This maintains a constant, comfortable water pressure in domestic and light commercial applications.

Expansion of Smart and Automated Pumping Technologies

The integration of smart technologies into water systems is transforming the domestic booster pump industry. IoT-enabled and sensor-based pumps allow real-time monitoring, pressure regulation, and automatic shutoff, enhancing convenience and safety. These systems are increasingly used in smart homes and modern housing complexes. Advancements in digital control panels and remote operation features have improved efficiency and reduced maintenance. As consumers embrace home automation and connected living, the adoption of intelligent booster pump systems continues to grow, providing a key driver for long-term market expansion.

Key Trends and Opportunities

Integration of IoT and Smart Home Connectivity

The growing trend of smart home adoption is driving the integration of IoT-enabled booster pumps. Consumers seek real-time control, remote access, and predictive maintenance through mobile applications. Manufacturers are developing pumps compatible with smart assistants and digital control systems. These innovations enhance convenience, optimize energy use, and extend product lifespan. As smart home infrastructure expands globally, particularly in North America and Asia-Pacific, the demand for connected water management systems is expected to rise, creating strong opportunities for advanced domestic booster pump manufacturers.

- For instance, Ebara Corporation offers various modern pump control systems, including the EP MOBILE Wi-Fi controlled panels and the E-SPD+ inverter. A subsidiary, Ebara Densan, also provides intelligent controllers and an Industry IoT platform for monitoring and control.

Increasing Adoption of Noise-Reduction and Compact Designs

Compact and low-noise booster pumps are gaining traction among urban households and apartment dwellers. Technological advancements in motor design and vibration control are leading to quieter and smaller systems without compromising performance. Compact units are easier to install in limited spaces, supporting demand in metropolitan areas. Manufacturers are introducing modern designs with corrosion-resistant materials and enhanced durability to cater to long-term domestic use. The trend toward compact, silent, and maintenance-free pumps is expected to shape future product innovation and consumer preference.

- For instance, CRI Pumps developed the Dino Series of pumps with a dynamically balanced rotor to reduce vibration, and the motor features high-grade enamel-coated copper windings for increased durability.

Key Challenges

High Installation and Maintenance Costs

While demand for domestic booster pumps is increasing, high installation and maintenance costs remain a major challenge. Advanced systems with smart controls or VFDs often require professional installation and regular servicing, adding to total ownership expenses. Price-sensitive consumers in developing regions tend to opt for cheaper, less efficient alternatives. Manufacturers must balance performance with affordability by offering modular designs and localized service networks. The development of low-maintenance, easy-to-install systems is crucial to overcome this financial barrier and broaden market penetration.

Limited Awareness in Rural and Developing Areas

Despite growing urban demand, market adoption remains limited in rural and developing regions due to low awareness of booster pump benefits. Many households still rely on gravity-fed or manual water distribution systems. Lack of technical knowledge, unreliable electricity supply, and minimal access to branded products hinder adoption. Awareness campaigns and affordable product options are needed to bridge this gap. Expanding distribution networks and promoting compact, solar-compatible models could help manufacturers tap into underserved markets and expand the global reach of domestic booster pumps.

Regional Analysis

North America

North America dominated the domestic booster pump market in 2024 with a 36% share, driven by rising adoption of smart water management systems and strong residential infrastructure development. The U.S. leads regional demand due to widespread use of pressure-regulated water supply systems in high-rise and suburban homes. Increasing preference for automated and energy-efficient pumps supports market expansion. Government initiatives promoting water conservation and sustainable home technologies further drive adoption. Continuous advancements in IoT-enabled pump systems and consumer focus on convenience are strengthening the region’s leadership in the global domestic booster pump market.

Europe

Europe accounted for a 27% share of the domestic booster pump market in 2024, supported by rapid urban development and stringent energy efficiency regulations. Countries such as Germany, France, and the U.K. are witnessing high demand for advanced, low-noise, and eco-friendly pumping systems. Rising replacement of conventional pumps with smart, variable-speed models is a key trend. Increasing emphasis on sustainable building practices and integration of automation in water systems further supports growth. Additionally, expanding residential renovation projects and government support for energy-efficient home appliances continue to enhance Europe’s market position.

Asia-Pacific

Asia-Pacific held a 25% share of the domestic booster pump market in 2024, driven by rapid urbanization, rising middle-class income, and increasing construction of multi-story residential buildings. China, India, and Japan are leading markets due to expanding housing projects and improving water distribution infrastructure. Growing awareness of efficient water pressure systems and government initiatives promoting smart city developments are fueling adoption. The rising demand for compact, cost-effective, and automatic pump systems in developing economies supports strong regional growth, positioning Asia-Pacific as one of the fastest-expanding markets globally.

Latin America

Latin America captured a 7% share of the domestic booster pump market in 2024, driven by infrastructure modernization and increasing residential water supply challenges. Brazil and Mexico lead regional demand due to expanding urban populations and ongoing housing developments. Government initiatives focusing on water efficiency and sustainable construction practices are supporting adoption. The growing popularity of compact and energy-efficient pumps among households enhances market penetration. However, limited awareness in rural areas and high import dependency pose challenges. Continued investment in affordable pump technologies and distribution networks is expected to strengthen regional growth.

Middle East & Africa

The Middle East & Africa region accounted for a 5% share of the domestic booster pump market in 2024, supported by rising urbanization and growing water scarcity concerns. The UAE and Saudi Arabia dominate demand due to increasing adoption in villas, residential complexes, and government housing projects. Investment in desalination and water infrastructure upgrades further drives the market. In Africa, improving access to electricity and growing focus on home water supply systems are fueling gradual adoption. Despite cost constraints, expanding construction activity and technological advancements continue to create growth opportunities across the region.

Market Segmentations:

By Product Type

- Single Stage Pump

- Multiple Stage Pump

By Pressure Range

- Low (Up to 2 Bar)

- Medium (2-5 Bar)

- High (Above 5 Bar)

By End Use

- Residential

- Commercial

- Industrial

- Others (Government.Etc)

By Distribution

- Direct sales

- Indirect sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

Competitive landscape of the domestic booster pump market is defined by strong product innovation and expanding global distribution networks among key players such as Donaldson, Franklin Electric, Grundfos, Aqua Groups, Ebara, Kirloskar Brothers, Euro Molten Pumps, Mann Hummel, CRI Pumps, and Lydall. These companies focus on enhancing energy efficiency, automation, and noise reduction in their product lines to meet evolving residential and commercial demands. Manufacturers are adopting smart technologies, including IoT-based monitoring and variable frequency drives (VFDs), to improve performance and water pressure regulation. Strategic mergers, partnerships, and R&D investments are strengthening global competitiveness. Furthermore, increased focus on sustainable materials and compact designs is driving the development of eco-friendly and user-friendly domestic booster pumps. The growing emphasis on reliability, durability, and integration with modern plumbing systems continues to shape the competitive dynamics of the market worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, CRI Pumps secured orders for 6,894 solar-based pumping systems under programs including MEDA, HAREDA, and PEDA, enhancing sustainable water supply in rural households.

- In May 2025, Grundfos expanded its production footprint in Brookshire, Texas, to scale manufacturing capacity for building and residential pump systems.

- In April 2024, Kirloskar Brothers introduced upgraded versions of its ANNIKA-II and ANISA-II Mini Series booster pumps, featuring improved impeller design and motor efficiency for domestic use.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Pressure Range, End Use, Distribution and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient and smart booster pumps will continue to rise globally.

- Integration of IoT and automation will enhance performance monitoring and control capabilities.

- Single-stage pumps will maintain dominance due to their cost efficiency and easy installation.

- Residential construction growth will drive product demand in developing economies.

- Manufacturers will focus on variable frequency drive integration to reduce energy consumption.

- Compact and noise-reduced pump designs will gain popularity among urban households.

- Asia-Pacific will emerge as the fastest-growing region driven by rapid urbanization.

- Water conservation initiatives will encourage adoption of efficient and low-maintenance pumps.

- Collaborations between pump makers and smart home solution providers will expand market reach.

- Continuous R&D investment will lead to innovations in corrosion-resistant and high-performance materials.