Market overview

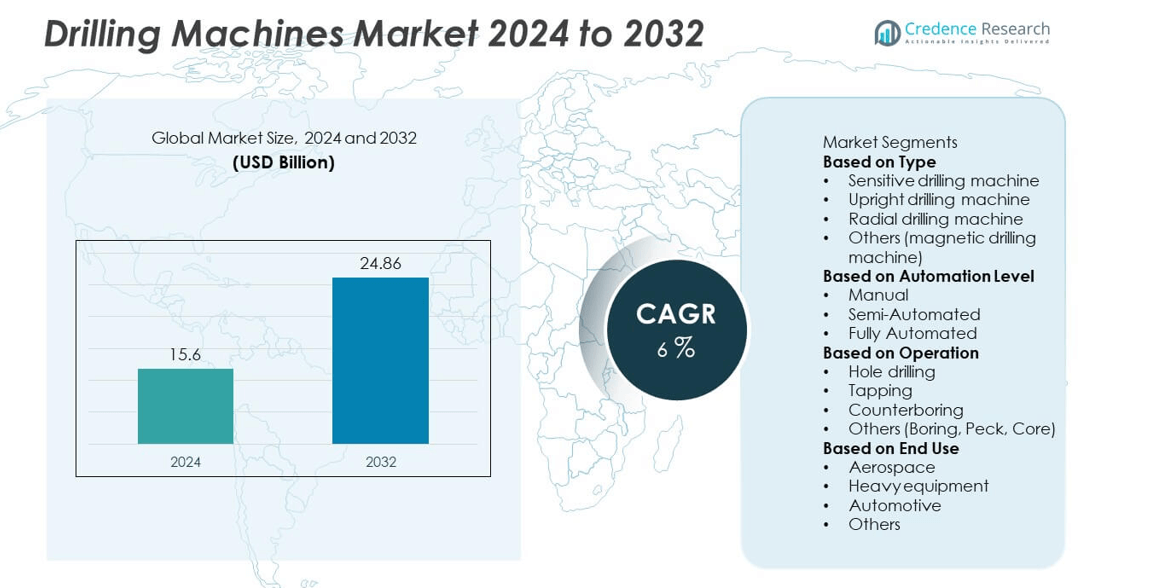

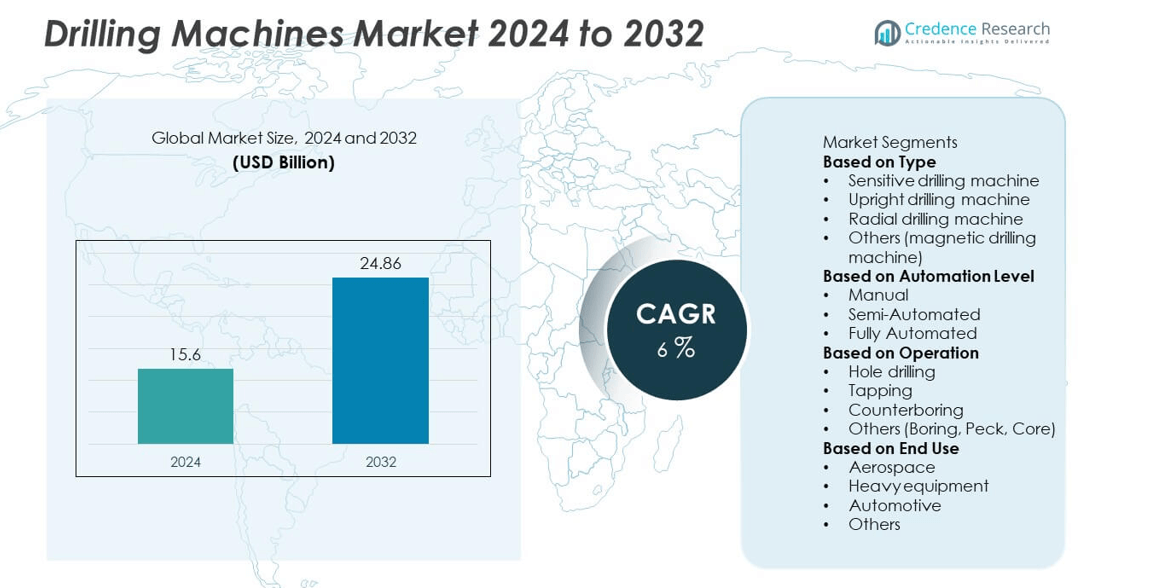

The Drilling Machines market was valued at USD 15.6 billion in 2024 and is projected to reach USD 24.86 billion by 2032, growing at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drilling Machines Market Size 2024 |

USD 15.6 billion |

| Drilling Machines Market, CAGR |

6% |

| Drilling Machines Market Size 2032 |

USD 24.86 billion |

The drilling machines market is led by major players such as Epiroc AB, Hitachi Construction Machinery Ltd, Bauer Maschinen GmbH, Boart Longyear, Cheto Corporation SA, Atlas Copco, ERLO Group, Beretta S.r.l. P, Dezhou Hongxin Machine Tool Co Ltd, and Caterpillar. These companies strengthen their positions through automation, precision engineering, and innovative drilling solutions for construction, mining, and manufacturing sectors. North America leads the global market with a 34% share, supported by high demand from automotive and aerospace industries. Europe follows with 29%, driven by advanced manufacturing technologies, while Asia-Pacific holds 27%, emerging as the fastest-growing region due to rapid industrialization and infrastructure development.

Market Insights

- The drilling machines market was valued at USD 15.6 billion in 2024 and is projected to reach USD 24.86 billion by 2032, growing at a CAGR of 6%.

- Rising demand from automotive, aerospace, and construction industries is driving the need for high-precision and automated drilling systems.

- The market trend highlights growing adoption of CNC-integrated and semi-automated machines that enhance accuracy, efficiency, and productivity.

- Key players such as Epiroc AB, Atlas Copco, and Caterpillar lead through innovation, automation, and strategic partnerships across industrial applications.

- North America holds a 34% share, followed by Europe at 29% and Asia-Pacific at 27%, while the radial drilling machine segment dominates the market with a 36% share, supported by widespread industrial use and durability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The radial drilling machine segment dominated the drilling machines market in 2024 with a 36% share. Its ability to handle large and heavy workpieces with precision makes it essential in metal fabrication, construction, and shipbuilding industries. The versatility and wide range of movement offered by radial drills enhance efficiency in industrial applications. Increasing demand for high-accuracy drilling in automotive and heavy engineering sectors drives this segment’s growth. Meanwhile, sensitive drilling machines are gaining popularity in small-scale workshops and electronic manufacturing for light and precise drilling operations.

- For instance, ERLO Group’s B.70 radial drilling machine is capable of drilling steel components up to 70 mm in diameter. The system integrates a variable-speed drive and digital readout control, improving hole alignment precision during continuous production in fabrication facilities.

By Automation Level

The semi-automated segment held the largest share of 42% in the drilling machines market in 2024. This dominance is attributed to its balance between productivity and cost-effectiveness. Semi-automated machines are widely adopted across medium-sized manufacturing units for their ability to improve accuracy while minimizing manual labor. The growing trend toward partial automation in developing economies supports the segment’s expansion. Fully automated machines are gaining traction due to advancements in CNC integration and Industry 4.0 technologies, enabling smart manufacturing and enhanced production efficiency in precision engineering applications.

- For instance, Cheto Corporation SA developed its IXN2000 Deep Hole Drilling Center with a multi-axis CNC interface, achieving a combined maximum drilling stroke of 2,500 mm. The machine is capable of processing alloy blocks weighing up to 20,000 kg and includes automated tool-changing features. This technology is used in aerospace and mold manufacturing plants.

By Operation

The hole drilling segment led the drilling machines market in 2024 with a 47% share. This operation remains the most common and essential process across automotive, aerospace, and construction industries. Increasing demand for precision drilling in metal, wood, and composite materials fuels segment growth. Manufacturers are adopting CNC and multi-spindle drilling systems to enhance productivity and consistency. Tapping and counterboring operations also show steady growth as component assembly in machinery and electronics becomes more complex. The expansion of automated machining centers further supports efficient, high-volume hole drilling applications globally.

Key Growth Drivers

Rising Demand from Automotive and Aerospace Industries

The growing use of drilling machines in the automotive and aerospace sectors is a key market driver. Manufacturers rely on precision drilling for engine components, transmission systems, and aircraft parts. Increasing production of electric vehicles and lightweight aircraft structures boosts demand for high-speed, multi-axis drilling solutions. CNC-integrated and automated drilling systems enhance accuracy and repeatability, supporting large-scale manufacturing efficiency. The shift toward advanced materials such as composites and alloys also drives innovation in drilling technologies across global industrial applications.

- For instance, a Bauer BG 45 Prime drilling rig is used for large-scale civil engineering projects such as constructing deep foundations for high-rise buildings and bridges, and not for high-precision aerospace fabrication. The BG 45 is a heavy-duty rotary drilling rig capable of achieving drilling depths up to 100 meters with a torque output of 461 kNm, significantly higher and for different applications than what is required for aerospace parts.

Advancements in Automation and CNC Technology

Automation and CNC integration are transforming the drilling machines market. Automated systems provide higher accuracy, faster cycle times, and reduced human error, making them ideal for mass production. The adoption of digital control, IoT connectivity, and robotics improves operational efficiency and process monitoring. Industries are increasingly investing in smart drilling solutions to enhance productivity and reduce downtime. These advancements align with Industry 4.0 initiatives, enabling manufacturers to achieve cost savings, consistent quality, and greater flexibility in complex manufacturing environments.

- For instance, Epiroc AB implemented its SmartROC D65 drill rig equipped with autonomous operation software. The rig’s control system and real-time Measure While Drilling (MWD) data provide greater accuracy and consistency, enhancing productivity and safety in mining and quarrying applications.

Expanding Infrastructure and Construction Activities

Rapid infrastructure development and construction growth worldwide are significantly fueling demand for drilling machines. Governments and private sectors are investing in transportation, energy, and commercial projects that require advanced drilling equipment for foundations, metal frameworks, and pipeline installations. Portable and heavy-duty radial drills are widely used for large-scale operations. The expansion of renewable energy infrastructure, including wind and solar installations, further supports market growth. These applications create consistent demand for high-power, durable, and efficient drilling machines across global industrial and construction sites.

Key Trends & Opportunities

Integration of Smart and Energy-Efficient Machines

Manufacturers are increasingly focusing on developing smart and energy-efficient drilling machines. These machines feature advanced control systems, sensors, and automated monitoring to reduce energy consumption and improve accuracy. The integration of IoT and AI enables predictive maintenance, minimizing downtime and extending equipment lifespan. Sustainable production goals are driving the adoption of energy-optimized drilling systems, especially in Europe and North America. This trend presents strong opportunities for manufacturers offering digitalized, eco-friendly, and productivity-focused drilling solutions across industrial sectors.

- For instance, Caterpillar Inc. introduced its MD6250 Autonomous Drill equipped with advanced electronic control systems and technology, such as variable volume air control, to increase fuel efficiency. It also features semi-autonomous drilling and precision machine guidance to ensure holes are accurately placed and drilled to the proper depth, optimizing overall drilling performance.

Growing Adoption of Portable and Multi-Spindle Drilling Machines

The demand for portable and multi-spindle drilling machines is rising due to their flexibility and ability to perform simultaneous drilling operations. These machines are widely used in construction, automotive, and heavy engineering industries to enhance operational efficiency. Multi-spindle systems enable higher output and precision, especially in mass production environments. Portable drilling units are gaining traction for on-site maintenance and installation projects. This trend supports the development of compact, lightweight, and customizable drilling machines catering to diverse industrial applications worldwide.

- For instance, Boart Longyear introduced its LX11 Portable Core Drill, a multipurpose rig capable of both diamond coring and reverse circulation drilling. The rig’s top-drive single rotary drill head features a maximum torque of 7.8 kNm at 100 rpm and can reach depths of up to 1,450 meters using NQ rods. Its compact, track-mounted design allows for easy site access and maneuverability.

Key Challenges

High Initial Investment and Maintenance Costs

The cost of advanced CNC and automated drilling machines remains a significant challenge for small and medium-sized manufacturers. High procurement and installation costs, along with regular maintenance and skilled labor requirements, increase overall operational expenses. These factors can limit adoption in cost-sensitive industries. Additionally, upgrading from conventional systems to digitally controlled machinery requires substantial capital investment. Manufacturers are addressing this issue through modular machine designs and leasing options, but affordability continues to influence market penetration in developing economies.

Shortage of Skilled Operators and Technical Expertise

Operating advanced drilling machines demands skilled technicians with expertise in CNC programming, automation, and maintenance. Many regions face a shortage of trained personnel, hindering the effective use of modern equipment. Inadequate technical knowledge often leads to machine downtime and lower production efficiency. The rapid pace of technological change also creates a need for continuous skill development. To overcome this challenge, manufacturers and training institutions are collaborating to offer specialized programs aimed at upskilling operators for smart and automated drilling environments.

Regional Analysis

North America

North America held the largest share of 34% in the drilling machines market in 2024. The region’s dominance is driven by the strong presence of automotive, aerospace, and construction industries requiring high-precision drilling solutions. The United States leads with extensive adoption of CNC and automated drilling systems for industrial manufacturing and metalworking. Growing investments in renewable energy infrastructure and oil exploration further support market expansion. Canada also contributes significantly, driven by mining activities and industrial modernization initiatives, fueling steady demand for heavy-duty and portable drilling machines across various sectors.

Europe

Europe accounted for 29% of the global drilling machines market in 2024. The region benefits from advanced manufacturing capabilities and a high focus on automation and sustainability. Germany, Italy, and France are key contributors, driven by strong automotive and aerospace production bases. European manufacturers increasingly adopt energy-efficient and precision-controlled drilling systems to enhance productivity. Ongoing infrastructure renovation and smart factory initiatives also drive demand. The presence of leading machine tool companies and technological innovation in CNC systems further strengthen Europe’s competitive position in the global drilling machinery market.

Asia-Pacific

Asia-Pacific captured a 27% share of the drilling machines market in 2024 and remains the fastest-growing region. Rapid industrialization, urban infrastructure expansion, and growing automotive production in China, India, and Japan are major drivers. The region’s low manufacturing costs and increasing foreign investments in industrial automation enhance growth. Rising demand for precision engineering and metal fabrication supports widespread adoption of advanced drilling systems. Government initiatives promoting industrial modernization and renewable energy development continue to boost demand, making Asia-Pacific a key hub for drilling equipment manufacturing and consumption.

Latin America

Latin America held a 6% share of the drilling machines market in 2024. The region’s growth is fueled by expanding construction, mining, and oil exploration activities in countries such as Brazil and Mexico. Investments in industrial machinery modernization and infrastructure development projects support steady demand. The adoption of semi-automated drilling machines is increasing among mid-sized manufacturers seeking to improve efficiency. However, fluctuating raw material prices and economic instability limit faster market expansion. Strategic collaborations with global machine tool suppliers are expected to enhance technological capabilities and product availability in the coming years.

Middle East & Africa

The Middle East & Africa region accounted for a 4% share of the drilling machines market in 2024. Strong demand from the oil and gas, construction, and mining industries drives market growth. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are investing in industrial infrastructure and manufacturing diversification. The need for durable, high-capacity drilling equipment supports steady adoption. Infrastructure expansion linked to smart city and energy projects also boosts demand. However, limited local production capacity and reliance on imports continue to challenge regional growth potential in the short term.

Market Segmentations:

By Type

- Sensitive drilling machine

- Upright drilling machine

- Radial drilling machine

- Others (magnetic drilling machine)

By Automation Level

- Manual

- Semi-Automated

- Fully Automated

By Operation

- Hole drilling

- Tapping

- Counterboring

- Others (Boring, Peck, Core)

By End Use

- Aerospace

- Heavy equipment

- Automotive

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The drilling machines market is highly competitive, with leading players including Epiroc AB, Hitachi Construction Machinery Ltd, Bauer Maschinen GmbH, Boart Longyear, Cheto Corporation SA, Atlas Copco, ERLO Group, Beretta S.r.l. P, Dezhou Hongxin Machine Tool Co Ltd, and Caterpillar. These companies dominate through technological innovation, product diversification, and global distribution networks. Market leaders focus on developing precision-based, automated, and energy-efficient drilling systems to meet rising demand across construction, mining, and industrial sectors. Continuous investment in R&D enhances machine durability, speed, and control accuracy. Strategic mergers, acquisitions, and partnerships help players strengthen market presence and expand product portfolios. Additionally, many manufacturers are integrating digital technologies and IoT-based monitoring systems to improve operational efficiency and predictive maintenance. Growing emphasis on sustainable drilling equipment and hybrid models further defines competition, as key companies aim to balance performance, environmental responsibility, and cost-effectiveness in both emerging and developed markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Hitachi Construction Machinery unveiled its LANDCROS One excavator concept at Bauma, integrating modular cabs, AI interfaces, and multi-mode propulsion (electric, hydrogen, combustion).

- In July 2024, Boart Longyear launched its LF160 Surface Coring Drill Rig equipped with Freedom Loader automation, capable of handling 6-meter core barrels and operating at rotation speeds up to 1,200 rpm, improving safety and productivity in exploration drilling.

- In January 2024, Epiroc launched the Pit Viper 271 XC E, which is capable of drilling single-pass holes up to 18m (59ft) with diameters up to 270mm (10-5/8in).

- In November 2023, Sandvik AB launched the CT55 and CT67 top hammer tool systems. The unique design increases efficiency and reduces cost while saving fuel and simplifying automated drilling in surface bench and underground longhole applications

Report Coverage

The research report offers an in-depth analysis based on Type, Automation Level, Operation, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated and CNC-based drilling machines will continue to rise across industries.

- Integration of smart sensors and IoT connectivity will enhance machine monitoring and precision.

- Portable and multi-spindle drilling machines will gain traction for on-site and high-volume applications.

- Growth in aerospace and automotive manufacturing will drive adoption of high-speed drilling systems.

- Energy-efficient and low-maintenance drilling machines will become a key focus for manufacturers.

- Expansion of renewable energy and infrastructure projects will boost market demand.

- Asia-Pacific will experience rapid growth with industrial modernization and automation adoption.

- Manufacturers will increase investments in digital control and predictive maintenance technologies.

- Custom-designed drilling systems for advanced materials will create new market opportunities.

- Strategic collaborations and R&D investments will strengthen innovation and competitive positioning.