Market Overview:

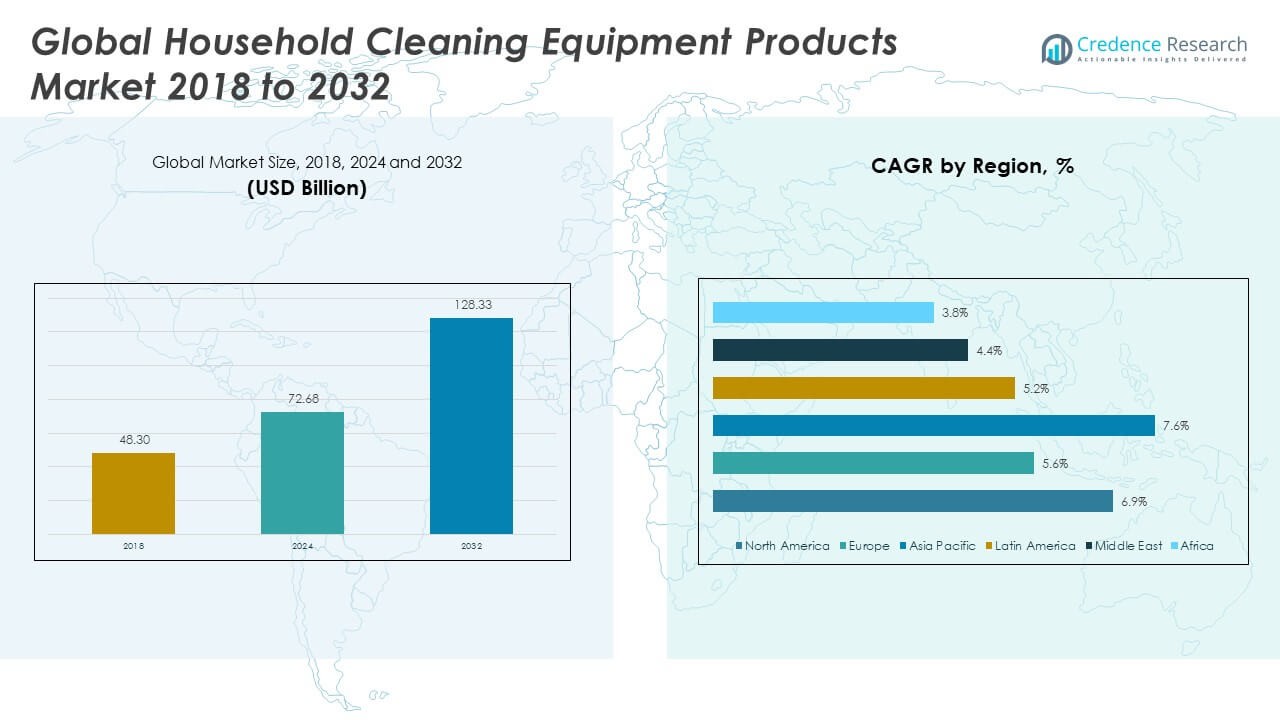

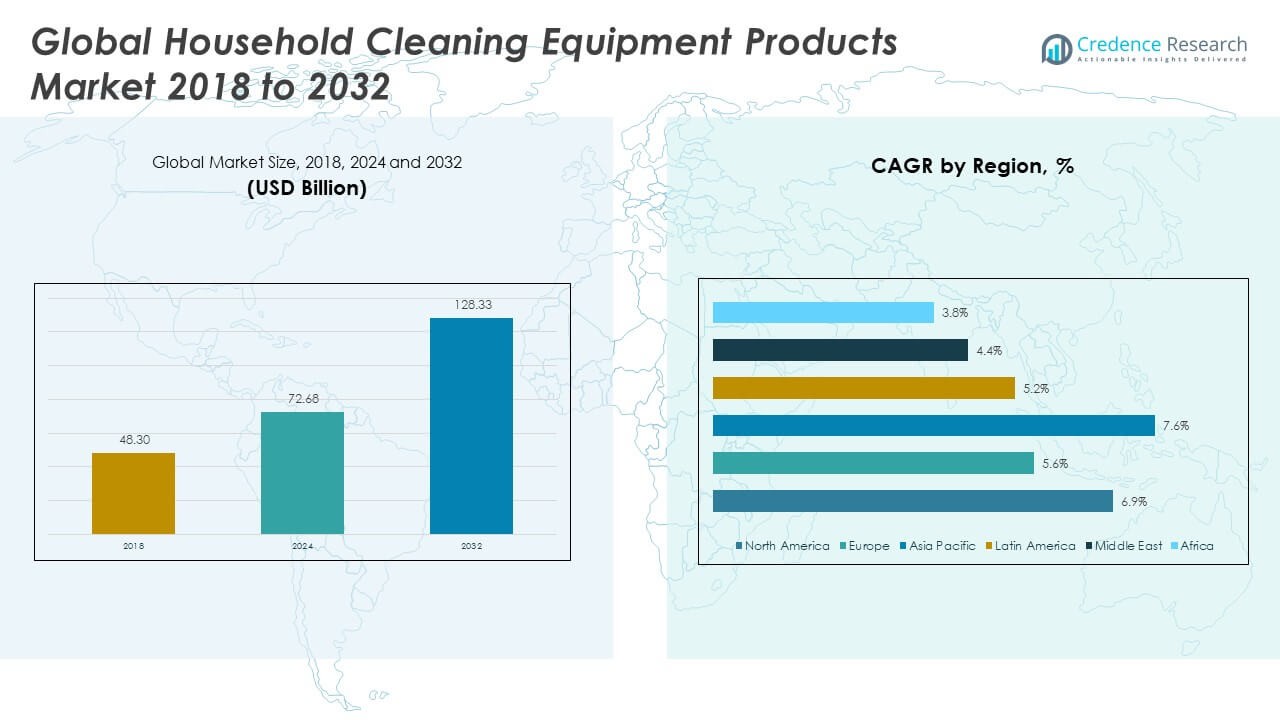

The Global Household Cleaning Equipment Products Market size was valued at USD 48.30 billion in 2018 to USD 72.68 billion in 2024 and is anticipated to reach USD 128.33 billion by 2032, at a CAGR of 6.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Household Cleaning Equipment Products Market Size 2024 |

USD 72.68 Billion |

| Household Cleaning Equipment Products Market, CAGR |

6.86% |

| Household Cleaning Equipment Products Market Size 2032 |

USD 128.33 Billion |

Growth in this market is driven by rising hygiene awareness, changing lifestyles, and the adoption of modern cleaning solutions. Consumers seek efficient, time-saving, and eco-friendly products that align with sustainability goals. Smart technologies, including robotic and cordless vacuum cleaners, are gaining strong traction in urban households. It benefits further from growing disposable incomes and higher consumer focus on healthier living environments.

North America and Europe lead the market due to advanced technology adoption, strong distribution networks, and consumer preference for premium products. Asia Pacific emerges as the fastest-growing region, fueled by urbanization, a rising middle-class population, and increasing demand in countries such as China and India. Latin America, the Middle East, and Africa present steady opportunities, supported by improving household standards and expanding access to affordable cleaning solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Household Cleaning Equipment Products Market was valued at USD 48.30 billion in 2018, reached USD 72.68 billion in 2024, and is projected to hit USD 128.33 billion by 2032, registering a CAGR of 6.86%.

- Asia Pacific led with 45.35% share in 2024, followed by North America at 28.69% and Europe at 17.20%, driven by strong demand, advanced technologies, and sustainability-focused consumers.

- Asia Pacific is the fastest-growing region, supported by urbanization, rising disposable incomes, and expanding middle-class households in China, India, and Southeast Asia.

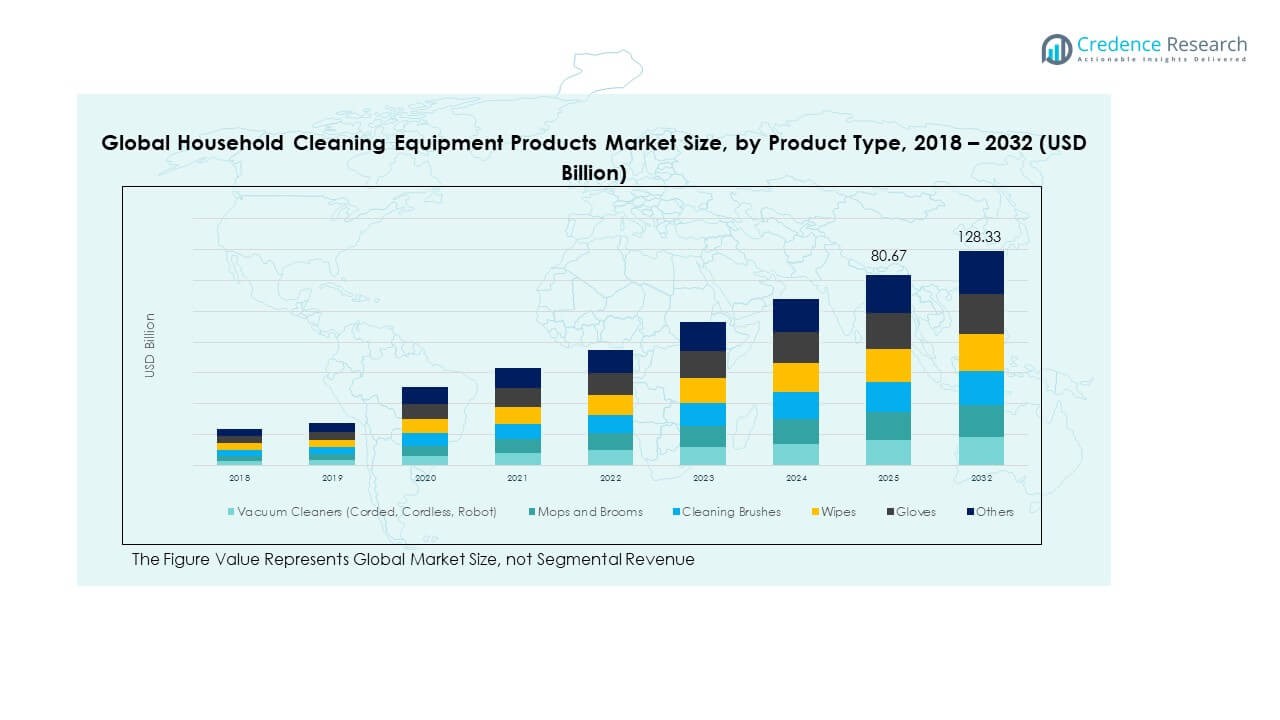

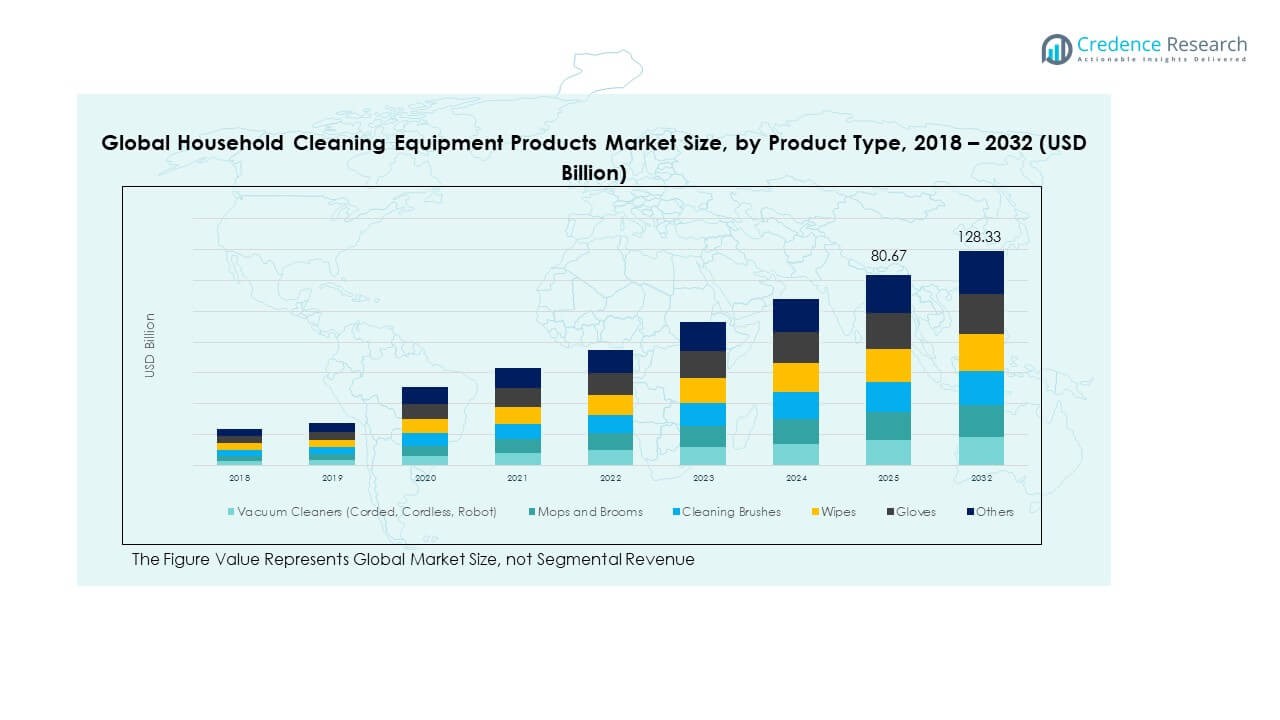

- Vacuum cleaners accounted for 34.5% of the Global Household Cleaning Equipment Products Market in 2024, reflecting strong demand for robotic and cordless models that enhance convenience and efficiency.

- Mops and brooms held 22.7% share in 2024, making them the second-largest segment due to their wide usage in both traditional and modern households globally.

Market Drivers

Rising Consumer Focus on Health and Household Hygiene

Consumers worldwide are more aware of the importance of hygiene in daily life. The rise of health-related concerns has created demand for effective cleaning solutions. Urban households show increased preference for products that reduce germs and bacteria. Manufacturers introduce advanced devices to support this trend. The Global Household Cleaning Equipment Products Market benefits from this growing consciousness. It is driving purchases of smart appliances designed to maintain healthier homes. Changing lifestyles continue to influence buying behavior. This trend strengthens the market outlook and boosts product adoption.

- For example, Dyson’s V15 Detect cordless vacuum uses a green laser diode set at a 1.5° angle, 7.2 mm from the floor, to reveal dust invisible to the naked eye. Its acoustic piezo sensor counts and categorizes dust particles in real time, displaying the data on the LCD screen.

Growing Adoption of Smart and Automated Cleaning Devices

Smart technologies are gaining strong traction in home cleaning. Automated vacuum cleaners, mops, and robotic solutions are attracting modern households. Busy lifestyles create demand for products that save time and effort. Connectivity features like app control increase product appeal. It drives growth for companies focusing on smart innovation. The Global Household Cleaning Equipment Products Market reflects the shift toward connected devices. It highlights consumer demand for convenience and digital integration. Automation remains a key driver for industry expansion.

- For example, Roomba j9+ features a 3-stage cleaning system with dual multi-surface rubber brushes, an edge-sweeping brush, and strong suction. It includes a self-emptying base that holds up to 60 days of debris. The robot learns room priorities (via “Dirt Detective”) and leverages iRobot OS for smart navigation and scheduling.

Expansion of Middle-Class Population and Disposable Incomes

Emerging economies witness a growing middle-class segment with higher incomes. Rising purchasing power supports the adoption of premium household cleaning products. Families seek branded equipment offering durability and performance. Companies target these regions with innovative solutions at competitive prices. The Global Household Cleaning Equipment Products Market benefits from this expansion. It is enabling manufacturers to scale production and distribution networks. Urbanization adds further momentum by increasing product demand in cities. This factor creates lasting opportunities for revenue growth.

Sustainability and Eco-Friendly Cleaning Solutions as Key Drivers

Environmental concerns influence consumer choices in home cleaning products. Eco-friendly solutions are gaining popularity in developed and emerging regions. Products with reduced energy use and minimal water consumption gain strong acceptance. Companies invest in recyclable materials and energy-efficient technologies. The Global Household Cleaning Equipment Products Market integrates these features into modern designs. It addresses both environmental responsibility and consumer expectations. Manufacturers that embrace sustainability achieve stronger brand loyalty. This driver continues shaping the long-term industry direction.

Market Trends

Integration of Artificial Intelligence and Advanced Robotics in Household Cleaning

Artificial intelligence has entered household cleaning with innovative product launches. Robotic cleaners now use smart mapping and obstacle detection for efficiency. Features like self-charging and learning adapt to user preferences. It increases reliability and boosts consumer confidence in automation. The Global Household Cleaning Equipment Products Market embraces these technologies quickly. It indicates a shift toward highly intelligent household solutions. AI-powered tools improve cleaning effectiveness across various surfaces. The trend positions smart robotics as a long-term growth catalyst.

Multi-Functional Equipment Offering Versatility and Convenience for Households

Households now prefer cleaning devices capable of performing multiple tasks. Products combine vacuuming, sweeping, and mopping in single equipment. Consumers value versatility that reduces the need for several devices. Companies design products that switch functions with ease. It reflects a consumer-driven move toward practicality and cost savings. The Global Household Cleaning Equipment Products Market shows higher adoption of such solutions. It demonstrates how versatility drives product innovation and household demand. This trend ensures efficient product use across different home sizes.

- For example, the Roborock S7 MaxV Ultra features 5,100 Pa suction, sonic mopping at ~3,000 cycles/minute, and an Empty-Wash-Fill dock that auto-empties the dustbin, washes the mop, and refills water. It runs up to 180 minutes on a full charge.

Customization and Personalized Features Driving Product Design Innovation

Personalization has emerged as a defining trend in consumer preferences. Equipment now includes adjustable modes for specific cleaning requirements. Features like variable suction power and adjustable handles enhance usability. Companies design products with flexible solutions that fit diverse lifestyles. It increases consumer satisfaction and brand differentiation. The Global Household Cleaning Equipment Products Market reflects rising demand for such personalization. It encourages manufacturers to tailor product designs with customer feedback. This trend enhances competitive advantage across global markets.

- For example, the Ecovacs Deebot X2 OMNI delivers up to 8,000 Pa suction power, features customizable water flow for mopping, and includes a 15 mm mop-lifting function to avoid carpets. Its OMNI station automatically empties dust, washes and dries mop pads, and refills water for hands-free cleaning.

Shift Toward Compact, Portable, and Space-Saving Household Devices

Urban living often requires smaller appliances to suit compact homes. Consumers prefer lightweight, portable, and easy-to-store cleaning equipment. Compact vacuum cleaners and foldable mops are witnessing higher adoption. Portability increases convenience for households with limited storage. It aligns with modern housing trends in cities worldwide. The Global Household Cleaning Equipment Products Market adapts by offering compact solutions. It shows how product design responds to changing lifestyles and space constraints. This trend is expected to continue driving innovation.

Market Challenges Analysis

High Product Costs and Intense Competitive Pressure Limiting Wider Adoption

Premium cleaning equipment often comes with high upfront costs. Price sensitivity restricts adoption in lower-income households. Manufacturers struggle to balance affordability and innovation. The Global Household Cleaning Equipment Products Market faces strong competition among established players. It creates pressure on margins and forces continuous innovation. Counterfeit and low-cost alternatives also affect brand reputation. This challenge impacts the ability of companies to secure long-term loyalty. Overcoming cost barriers remains a significant task for manufacturers.

Limited Awareness in Emerging Economies and Maintenance-Related Issues

Awareness gaps reduce adoption in less-developed regions. Rural households often rely on traditional cleaning practices. Limited infrastructure reduces access to advanced equipment. The Global Household Cleaning Equipment Products Market also struggles with maintenance challenges. It is affected by high servicing costs and spare part availability. Technical failures discourage consumers from reinvesting in premium devices. Lack of skilled repair networks worsens the issue in remote areas. These factors slow adoption and present barriers to expansion.

Market Opportunities

Rising Scope for Smart Integration and Connected Household Ecosystems

Smart home integration creates significant opportunities for new product development. Equipment linked to voice assistants and mobile apps gains higher demand. Connectivity features provide monitoring and control benefits. The Global Household Cleaning Equipment Products Market leverages this opportunity through continuous innovation. It enables companies to expand product portfolios and capture tech-savvy consumers. It also creates revenue through software-based services linked to devices. This opportunity strengthens long-term growth potential in global markets.

Expansion into Emerging Economies with Strong Urbanization Trends

Emerging regions present large growth opportunities for manufacturers. Urbanization increases household demand for advanced cleaning equipment. Companies expand distribution channels to target new consumer groups. The Global Household Cleaning Equipment Products Market benefits from this expansion. It is supported by rising disposable incomes and modern lifestyle adoption. Partnerships with local distributors create stronger market entry strategies. This opportunity allows manufacturers to scale production and secure higher revenue. It positions emerging economies as central growth hubs.

Market Segmentation Analysis:

The Global Household Cleaning Equipment Products Market is segmented

By product type

Into vacuum cleaners, mops and brooms, cleaning brushes, wipes, gloves, and others. Vacuum cleaners dominate due to high adoption of robotic and cordless models that deliver convenience and efficiency. Mops and brooms continue to serve as widely used tools, particularly in emerging economies. Cleaning brushes and wipes find steady demand in daily household use, while gloves support safety and hygiene practices during cleaning activities. It reflects a broad spectrum of consumer needs across traditional and modern solutions.

- For example, the OXO Compact Toilet Brush & Canister earns ~4.5 stars from 251 reviews on Target.com, praised for its durable bristles and self-opening canister. Target Its dimensions are approx 44 cm (17¼ “) high and 12.5 cm (5”) in diameter.

By application

The market is divided into bedroom, kitchen, living room, toilet/bathroom, and others. Kitchens and bathrooms represent the leading segments due to high sanitation requirements and frequent cleaning routines. Bedrooms and living rooms also record strong growth, supported by consumer preference for healthier and dust-free environments. The Global Household Cleaning Equipment Products Market addresses these diverse applications with tailored product designs and functionalities.

- For instance, Dyson reports its vacuum cleaners are present in over 7 million French households as of 2021, according to Statista data, with Rowenta leading in France with 7.4 million users.

By end user

The market covers residential and commercial segments. Residential households hold the largest share, supported by rising hygiene awareness, urbanization, and smart home integration. The commercial segment grows steadily, with demand from offices, hotels, and institutional facilities that require durable and high-performance equipment. It highlights the dual role of cleaning equipment in both personal and professional environments, ensuring sustained market expansion.

Segmentation:

By Product Type

- Vacuum Cleaners (Corded, Cordless, Robot)

- Mops and Brooms

- Cleaning Brushes

- Wipes

- Gloves

- Others

By Application

- Bedroom

- Kitchen

- Living Room

- Toilet/Bathroom

- Others

By End User

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Household Cleaning Equipment Products Market size was valued at USD 14.07 billion in 2018 to USD 20.85 billion in 2024 and is anticipated to reach USD 36.96 billion by 2032, at a CAGR of 6.9% during the forecast period. North America accounts for 28.69% of the global market share in 2024. The region leads with strong adoption of advanced cleaning equipment across both residential and commercial sectors. Consumers prefer robotic vacuum cleaners, cordless devices, and eco-friendly solutions. It benefits from high purchasing power and established retail distribution channels. Manufacturers leverage digital integration and sustainability-focused innovation to maintain competitiveness. The Global Household Cleaning Equipment Products Market in this region grows steadily due to technological advancements and consistent consumer demand. Expansion in smart home penetration further accelerates adoption rates.

Europe

The Europe Global Household Cleaning Equipment Products Market size was valued at USD 8.81 billion in 2018 to USD 12.51 billion in 2024 and is anticipated to reach USD 20.03 billion by 2032, at a CAGR of 5.6% during the forecast period. Europe holds 17.20% of the global market share in 2024. The region emphasizes sustainability, eco-friendly designs, and energy-efficient appliances. Consumers prioritize durable and high-quality equipment, influenced by strict regulatory standards. It experiences consistent demand across urban households and commercial facilities. Brands highlight recyclable materials and smart technologies to align with evolving regulations. The Global Household Cleaning Equipment Products Market in Europe remains strong due to consumer awareness of environmental responsibility. Adoption of premium cleaning products strengthens the competitive landscape. Market growth continues through innovation in robotic and smart household solutions.

Asia Pacific

The Asia Pacific Global Household Cleaning Equipment Products Market size was valued at USD 21.12 billion in 2018 to USD 32.96 billion in 2024 and is anticipated to reach USD 61.74 billion by 2032, at a CAGR of 7.6% during the forecast period. Asia Pacific represents 45.35% of the global market share in 2024, making it the largest regional market. Rapid urbanization, rising disposable incomes, and growing middle-class populations drive adoption of cleaning equipment. It benefits from strong demand in China, India, Japan, and Southeast Asia. Local and international companies expand production capacities to meet rising demand. The Global Household Cleaning Equipment Products Market in this region grows rapidly with higher penetration of robotic and cordless devices. E-commerce platforms enhance product accessibility across diverse markets. Expanding awareness of hygiene and modern lifestyles support robust growth potential.

Latin America

The Latin America Global Household Cleaning Equipment Products Market size was valued at USD 2.28 billion in 2018 to USD 3.39 billion in 2024 and is anticipated to reach USD 5.30 billion by 2032, at a CAGR of 5.2% during the forecast period. Latin America contributes 4.66% of the global market share in 2024. Rising urbanization and growing middle-income households fuel demand for modern cleaning tools. Consumers seek affordable solutions with efficiency and durability. It is supported by the expansion of retail distribution and e-commerce penetration. The Global Household Cleaning Equipment Products Market in Latin America shows gradual growth driven by Brazil and Mexico. Manufacturers target these markets with cost-effective, mid-range products. Demand for energy-efficient and multipurpose devices continues to expand across households.

Middle East

The Middle East Global Household Cleaning Equipment Products Market size was valued at USD 1.27 billion in 2018 to USD 1.73 billion in 2024 and is anticipated to reach USD 2.54 billion by 2032, at a CAGR of 4.4% during the forecast period. The region accounts for 2.38% of the global market share in 2024. Higher standards of living and urban development drive moderate adoption. Consumers in affluent areas prefer premium cleaning solutions with modern features. It reflects growing interest in eco-friendly and technologically advanced products. The Global Household Cleaning Equipment Products Market in the Middle East remains niche but steadily expands. GCC countries lead demand with higher income levels. Regional expansion strategies include premium product offerings for smart homes and modern apartments.

Africa

The Africa Global Household Cleaning Equipment Products Market size was valued at USD 0.75 billion in 2018 to USD 1.24 billion in 2024 and is anticipated to reach USD 1.75 billion by 2032, at a CAGR of 3.8% during the forecast period. Africa represents 1.70% of the global market share in 2024. The region is in an early adoption stage with limited penetration of advanced equipment. Traditional cleaning methods remain common in rural areas. It gains momentum through rising urbanization and expanding access to affordable cleaning products. The Global Household Cleaning Equipment Products Market in Africa grows steadily, supported by South Africa and Egypt. Distribution challenges and lower purchasing power limit widespread adoption. Companies target growth with entry-level, cost-effective products tailored to local needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Procter & Gamble

- 3M Company

- Freudenberg Group

- Butler Home Products

- Libman Company

- Dyson Ltd

- Bissell Inc.

- SharkNinja Operating LLC

- Hoover (Techtronic Industries)

- Vileda

Competitive Analysis:

The Global Household Cleaning Equipment Products Market is highly competitive, with both multinational corporations and regional players shaping the landscape. Leading companies such as Procter & Gamble, Dyson, Bissell, SharkNinja, and 3M focus on innovation, product quality, and brand strength to secure market share. It emphasizes advanced technologies like robotic automation, cordless solutions, and eco-friendly designs to meet changing consumer needs. Regional manufacturers compete on affordability and localized distribution, expanding penetration in emerging markets. Strong retail networks, e-commerce platforms, and strategic partnerships enhance visibility and consumer reach. It drives continuous product launches and portfolio diversification to stay relevant in a dynamic market. Companies also prioritize sustainability, integrating recyclable materials and energy-efficient designs into their product lines. Competitive pressure fosters rapid adoption of smart features, with differentiation becoming key to long-term leadership. The market remains dynamic, shaped by innovation, evolving consumer behavior, and pricing strategies.

Recent Developments:

- In April 2025, UK-based eco-friendly cleaning brand Astonish launched seven new household cleaning innovations. These newly released products included multi-surface cleaners, fresh-scent fabric refreshers, and versatile disinfectants, expanding the company’s commitment to eco-friendly cleaning solutions while addressing diverse household needs.

- In April 2025, LG Electronics USA partnered with the Marriott Design Lab to launch a commercial-grade autonomous robotic vacuum cleaning device. After successful pilot implementation at Marriott International properties, LG officially introduced the Robotic Vacuum Cleaner for use in the hospitality sector, underlining a move toward smart and automated household cleaning equipment.

- In April 2025, Unilever PLC expanded its Wonder Wash lineup (originally launched in 2024) by releasing new variants Dazzling Whites and Sensitive. These short-cycle laundry liquids gained rapid market adoption due to their efficiency and gentleness, helping Unilever achieve high repeat purchase rates and capture additional market share with fast-wash formulations.

- In May 2025, Reckitt launched Harpic DrainXpert, a newly formulated drain cleaner positioned as India’s fastest kitchen drain cleaning solution. The company promoted its ability to unclog kitchen drains within just 15 minutes, further solidifying Harpic’s reputation for powerful, fast-acting cleaning products in key global markets.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Household Cleaning Equipment Products Market will continue expanding with strong demand for automated and smart devices.

- Sustainability-focused product designs will gain more attention, pushing manufacturers to innovate eco-friendly solutions.

- Integration of IoT features and app-based controls will reshape consumer preferences for connected cleaning devices.

- Compact and multi-functional equipment will rise in demand due to urban housing trends and space limitations.

- Premium products offering durability and high performance will capture growing middle-class and affluent households.

- The market will witness stronger e-commerce penetration, making advanced products accessible across emerging economies.

- Strategic mergers, acquisitions, and product launches will drive competition and increase market consolidation.

- Commercial adoption of durable and energy-efficient cleaning solutions will accelerate growth beyond residential households.

- Local players in Asia Pacific and Latin America will expand presence with cost-effective offerings.

- Rising hygiene awareness across developing regions will fuel steady adoption, securing long-term growth momentum.