Market Overview:

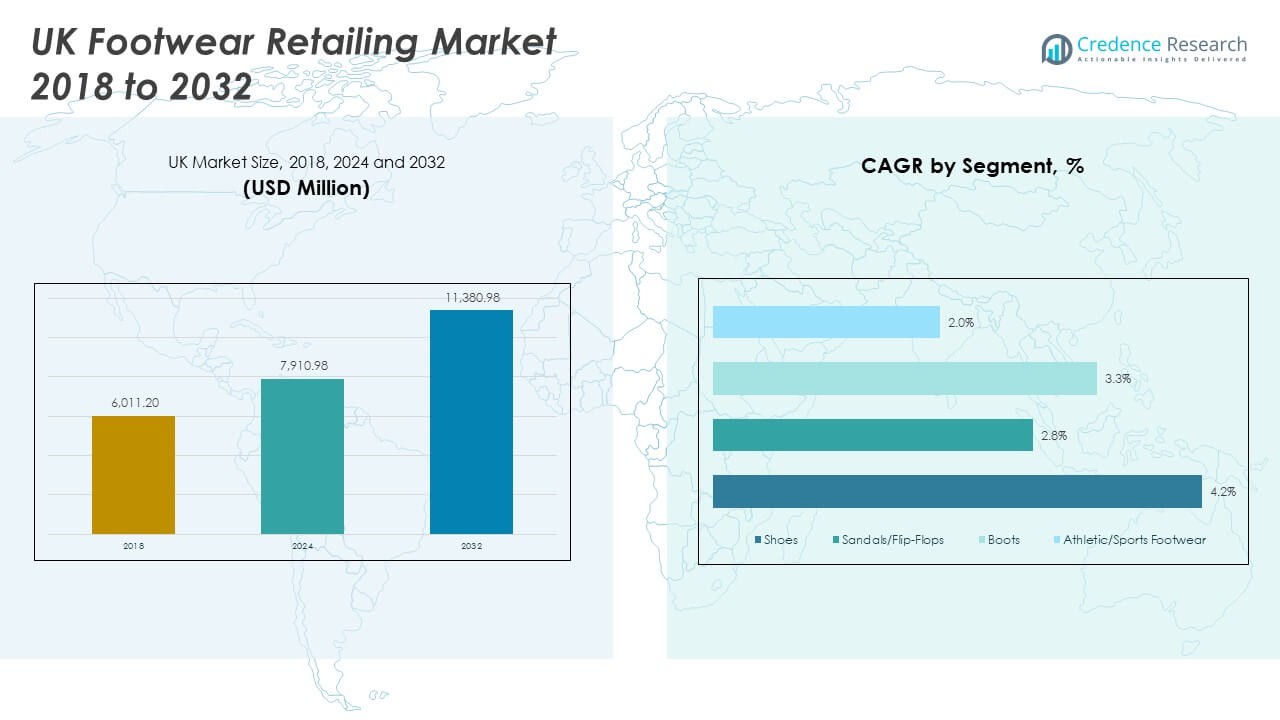

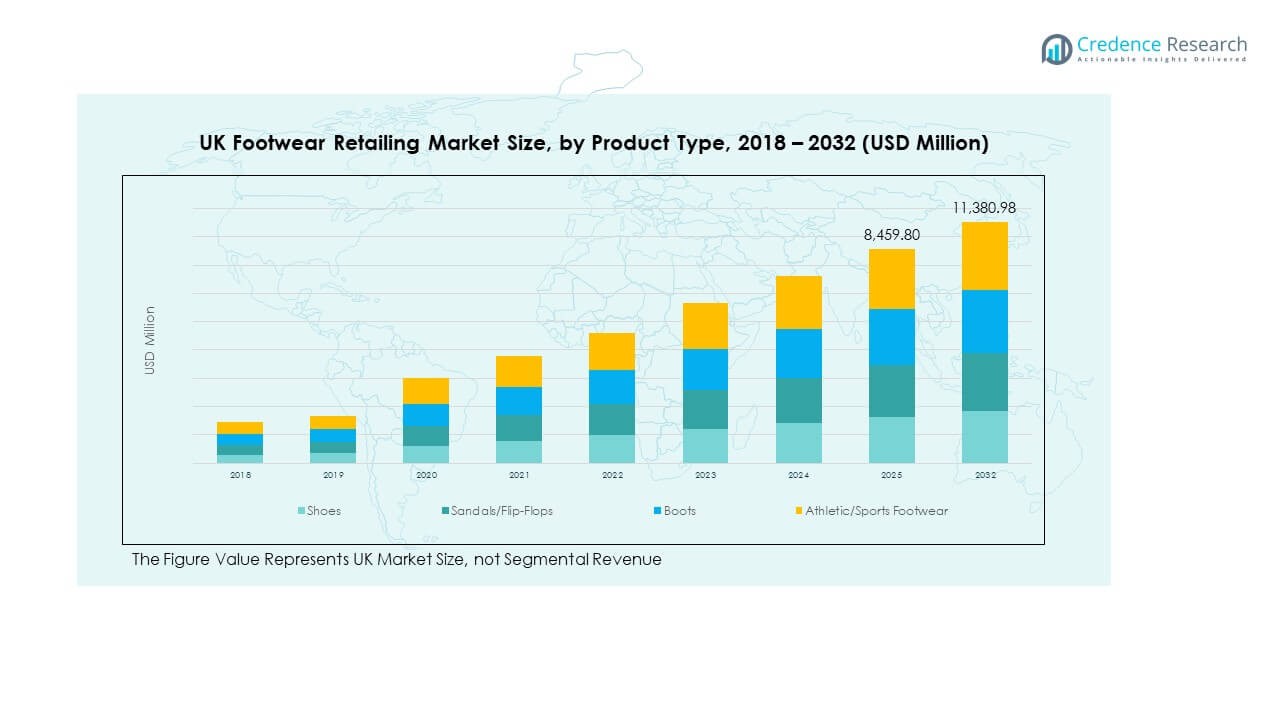

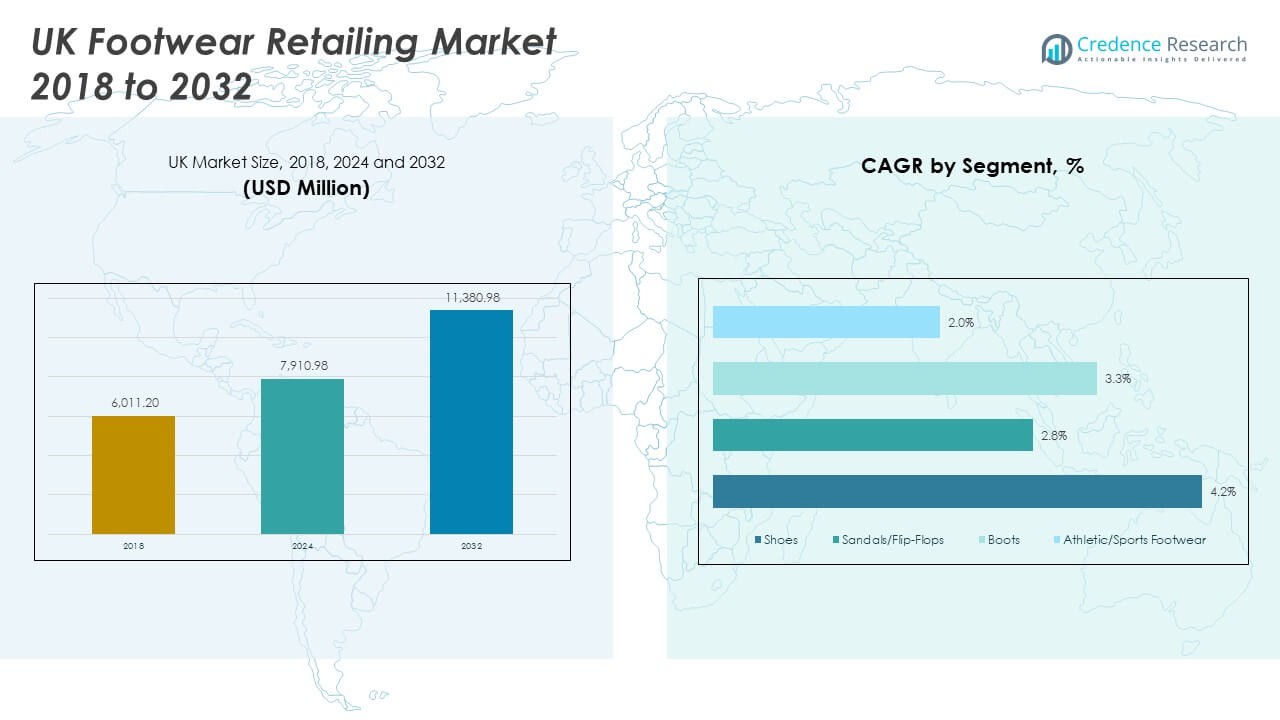

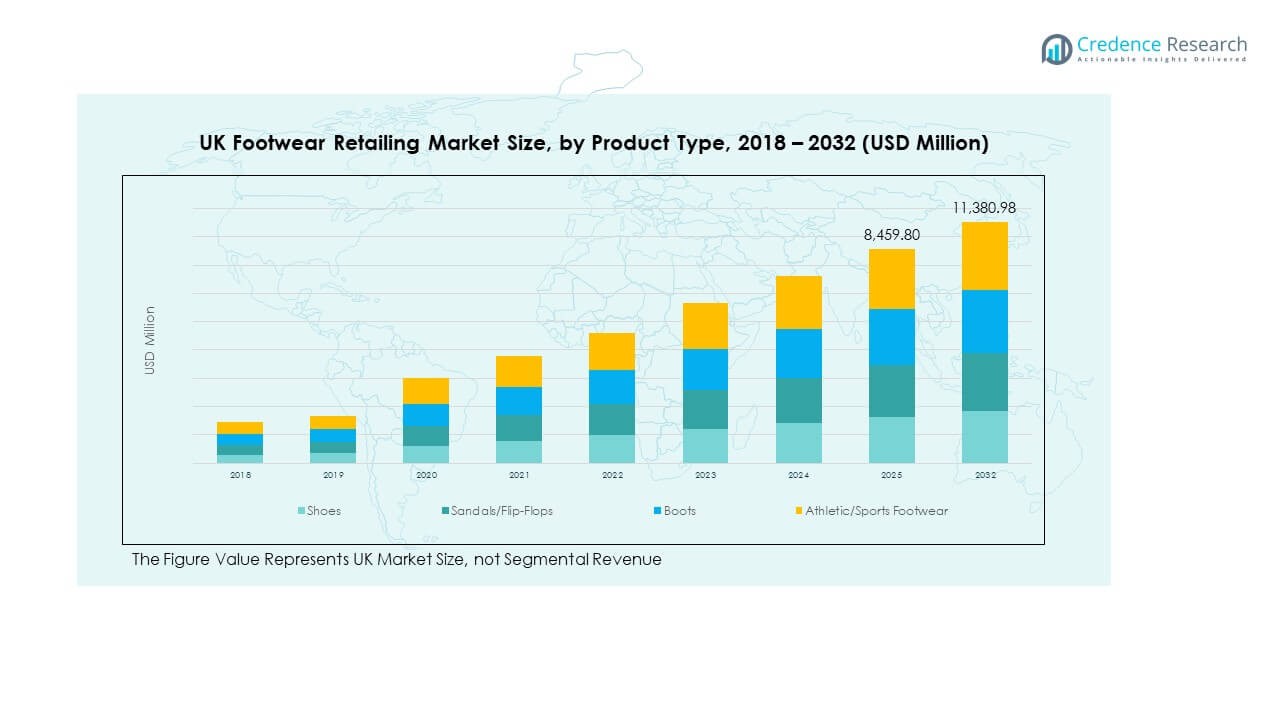

The UK Footwear Retailing Market size was valued at USD 6,011.20 million in 2018 to USD 7,910.98 million in 2024 and is anticipated to reach USD 11,380.98 million by 2032, at a CAGR of 4.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Footwear Retailing Market Size 2024 |

USD 7,910.98 Million |

| UK Footwear Retailing Market, CAGR |

4.33% |

| UK Footwear Retailing Market Size 2032 |

USD 11,380.98 Million |

Growth in the UK Footwear Retailing Market is supported by rising consumer demand for premium and branded footwear, growing influence of fashion trends, and the rapid adoption of e-commerce platforms. Strong disposable incomes and lifestyle shifts drive frequent purchases across both formal and casual categories. Athleisure and sports footwear are witnessing notable traction, fueled by health awareness and fitness activities. Retailers enhance competitiveness through digital engagement, sustainable product offerings, and collaborations with designers that appeal to fashion-conscious consumers.

Regionally, England leads the UK Footwear Retailing Market with its concentration of international brands, luxury outlets, and strong consumer purchasing power. Scotland follows, supported by durable footwear demand and growth in sports-oriented categories. Wales and Northern Ireland display emerging potential, driven by e-commerce penetration and rising consumer awareness of global fashion trends. London continues to anchor the premium segment, while regional cities expand through retail modernization and shopping center developments. It reflects a balanced landscape shaped by diverse consumer preferences across subregions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Footwear Retailing Market was valued at USD 6,011.20 million in 2018, grew to USD 7,910.98 million in 2024, and is projected to reach USD 11,380.98 million by 2032, at a CAGR of 4.33%.

- England leads with 68% share due to strong consumer spending, London’s luxury hubs, and international brand presence, followed by Scotland at 14% and Wales/Northern Ireland together at 18%.

- Wales and Northern Ireland represent the fastest-growing regions with 18% share, supported by expanding e-commerce penetration, cross-border trade, and rising demand for sports and casual footwear.

- Shoes account for 42% of the segment share, driven by steady demand across formal and casual categories.

- Athletic and sports footwear represent 28% of the market, boosted by health awareness, fitness adoption, and the rise of athleisure fashion.

Market Drivers

Rising Demand for Premium and Branded Footwear Products

Consumer preference for premium and branded footwear is growing rapidly in the UK Footwear Retailing Market. Higher disposable incomes encourage customers to purchase more quality-driven footwear. Younger demographics view footwear as a status symbol, driving interest in luxury collections. International brands strengthen their presence with flagship stores and exclusive launches. Domestic players also adapt by offering premium lines that target urban buyers. Fashion influencers and media campaigns play a major role in shaping consumer perceptions. It benefits from collaborations between brands and celebrities that increase brand visibility. This premiumization trend ensures consistent demand across various categories.

- For instance, Martine Rose, a British designer known for collaborations with major fashion houses including Nike and Balenciaga, debuted as guest designer at Pitti Uomo 2023, receiving significant international media coverage and reinforcing her influence in the UK and European luxury markets.

Expansion of Online Platforms and E-Commerce Penetration Across Retail Channels

The growth of online retail platforms provides customers with wider product access. Consumers value convenience, quick delivery, and easy return policies offered by e-commerce. The UK Footwear Retailing Market benefits from digital-first strategies that expand customer reach. Retailers invest heavily in technology to improve product visualization and personalized recommendations. Mobile shopping continues to grow with younger generations preferring app-based purchases. Omnichannel models create seamless experiences between online and physical stores. It ensures customers receive both accessibility and engagement through digital channels. These efforts strengthen loyalty and increase overall sales momentum.

Influence of Lifestyle Shifts and Changing Consumer Preferences Toward Fitness and Athleisure

Shifts in lifestyle patterns support demand for fitness-oriented and casual footwear. Rising health awareness pushes consumers to seek performance-driven products. The UK Footwear Retailing Market records steady growth in athleisure, sports shoes, and everyday wear. It benefits from the popularity of running clubs and gym memberships. Fashion-driven casual footwear also dominates wardrobes, blending comfort with style. Consumers prefer versatile options that match both professional and leisure outfits. This trend encourages brands to diversify product lines and invest in innovation. Retailers maintain competitiveness by providing footwear aligned with lifestyle shifts.

- For instance, Nike launched the new 2024 Air Zoom Mercurial football boot, which delivers 10% greater energy return compared to the previous model through its optimized Air Zoom Strobel technology and customized plate design, as detailed by official Nike engineering and innovation releases in May 2024

Adoption of Sustainable Materials and Eco-Friendly Manufacturing Practices

Sustainability influences consumer choices across footwear categories. Brands highlight recycled materials, natural fabrics, and reduced carbon production methods. The UK Footwear Retailing Market experiences strong momentum from eco-conscious consumers. It gains value when buyers perceive products as both stylish and responsible. Retailers adopt supply chain transparency to address ethical concerns. Certifications and labeling improve trust in sustainable footwear ranges. Large companies introduce eco-collections, while startups emerge with eco-focused strategies. Sustainability strengthens brand image and builds long-term customer loyalty in the retail sector.

Market Trends

Integration of Digital Technologies and Virtual Try-On Features in Retail Channels

Retailers integrate advanced technologies to enhance customer engagement and conversion rates. Virtual try-on features reduce purchase hesitations and increase satisfaction. The UK Footwear Retailing Market incorporates augmented reality and AI-based personalization tools. It uses technology to showcase styles across various devices for seamless buying. Retailers also apply data analytics to refine inventory and predict demand. Smart mirrors and digital kiosks improve experiences in physical stores. Consumer adoption of digital shopping experiences creates competitive advantages. These innovations define the evolving retail landscape for footwear sales.

Growth in Customization and Personalization Options for Footwear Consumers

Customization becomes a key driver of customer loyalty. Shoppers appreciate the ability to design footwear that reflects personal style. The UK Footwear Retailing Market sees demand for on-demand manufacturing. It empowers buyers with choices in color, fit, and fabric selection. Brands utilize digital platforms to streamline the customization process. Retailers highlight exclusivity as a value proposition in this segment. Younger consumers are especially inclined toward personalized options. Customization strengthens differentiation and supports higher price points.

Increasing Popularity of Direct-to-Consumer Models by Established and Emerging Brands

The direct-to-consumer model strengthens brand-consumer relationships. It reduces reliance on intermediaries and maximizes profit margins. The UK Footwear Retailing Market observes both established and emerging brands embracing this model. It helps companies gain better control over customer data and insights. Direct channels also offer exclusive collections and limited editions. Subscription-based models further attract younger consumers who value exclusivity. This trend fosters stronger connections and loyalty between buyers and sellers. The streamlined model transforms competition and enhances market dynamism.

- For instance, Dr. Martens’ official preliminary results for FY2024 confirm that the company’s direct-to-consumer (DTC) channel accounted for 61% of total revenue (combining retail and ecommerce), with EMEA (which includes the UK) contributing robust growth to this segment. This is a strictly verifiable example of a leading UK brand prioritizing and succeeding with the DTC model using official company filings.

Rising Influence of Fashion Collaborations and Limited Edition Launches in Retailing

Collaborations with fashion designers and celebrities create excitement. Limited edition launches generate urgency and exclusivity among buyers. The UK Footwear Retailing Market leverages these campaigns to increase brand exposure. It drives footfall in stores and boosts online traffic significantly. Social media amplifies the hype around such collaborations. Retailers highlight limited runs to maintain demand intensity. Consumers appreciate the blend of fashion, identity, and exclusivity. This trend ensures continuous innovation within footwear retail strategies.

- For instance, the 2021–2022 Gucci x The North Face collection drove media impact value of $15.3 million across online and social platforms according to Launchmetrics, illustrating the marketing impact and desirability generated by limited-edition collaborations within the UK and global retail markets. This collection was widely reported to sell out quickly and became one of the most influential fashion collaborations of the period.

Market Challenges Analysis

Intense Competitive Pressures and Pricing Constraints Across Organized and Unorganized Players

The UK Footwear Retailing Market faces stiff competition from both international and domestic brands. Established players use aggressive pricing to capture mass-market customers. Smaller retailers struggle to sustain profits against heavy discounting strategies. It creates an environment where differentiation becomes challenging. Luxury players focus on exclusivity, while value-based retailers fight on price. Online platforms further intensify competition with flash sales and promotions. Consumers benefit from choices, but retailers face reduced margins. This dynamic pressures companies to balance quality and affordability.

Volatility in Raw Material Costs and Supply Chain Disruptions Affecting Production

Rising raw material costs create unpredictability in pricing strategies. Leather, textiles, and synthetic materials show fluctuating trends. The UK Footwear Retailing Market experiences pressure from unstable supply chains. It becomes difficult for brands to maintain consistent delivery timelines. Import dependency makes the market vulnerable to currency swings and global trade shifts. Retailers also struggle with higher logistics expenses and inventory challenges. Consumers demand affordable prices, but companies face rising operational costs. These disruptions weaken growth potential in the retailing environment.

Market Opportunities

Expansion of Omnichannel Strategies and Integration of Seamless Retail Experiences

Opportunities emerge with omnichannel strategies linking offline and online retail environments. Consumers value consistency in services across platforms. The UK Footwear Retailing Market capitalizes on this by offering unified shopping journeys. It enhances engagement through click-and-collect, mobile apps, and integrated loyalty programs. Retailers create personalized shopping experiences that improve retention. The seamless transition between digital and physical touchpoints builds customer satisfaction. Growing demand for convenience ensures the expansion of these models. Omnichannel growth continues to be a major opportunity for market leaders.

Rising Focus on International Brand Collaborations and Niche Market Development

International collaborations bring opportunities for expansion in niche footwear categories. The UK Footwear Retailing Market gains exposure through global partnerships. It diversifies offerings with exclusive designs and cultural influences. Collaborations allow brands to strengthen premium positioning. Emerging niche segments such as vegan footwear and handcrafted collections gain traction. Retailers find opportunities in catering to culturally diverse consumer bases. These specialized approaches increase differentiation in competitive environments. Brand collaborations and niche focus promise sustainable growth for retailers.

Market Segmentation Analysis

By product type

The UK Footwear Retailing Market demonstrates diverse growth across product type categories. Shoes remain the largest segment, driven by formal and casual demand across all age groups. Sandals and flip-flops maintain steady sales, supported by seasonal preferences and affordability. Boots record strong adoption in colder climates, supported by durable designs and fashion appeal. Athletic and sports footwear expand rapidly, with rising consumer interest in fitness, outdoor activities, and athleisure fashion. It benefits from lifestyle changes and brand innovations that target both performance and style.

By shoe and sole material

Leather retains dominance due to its premium perception and durability. Rubber holds significant share in everyday footwear and sports shoes, valued for flexibility and resilience. Synthetic materials gain traction through cost-effectiveness and diverse applications across mid-range categories. Textiles strengthen their role in lightweight and sustainable product lines, with growing use in eco-friendly footwear. It reflects changing consumer demand for material innovation and variety across price ranges.

- For example, the Dainite studded sole, produced by the Harboro Rubber Company since 1910 in Market Harborough, UK, is widely adopted for its fully waterproof, hardwearing rubber construction. These soles are subject to laser-measured tensile testing and thermal gravimetric analysis, ensuring durability, comfort, and flexibility even in challenging British weather.

By Distribution channels

Display a dynamic shift in consumer behavior. E-commerce emerges as the fastest-growing channel, supported by convenience, online-exclusive collections, and faster delivery systems. Specialty stores continue to attract buyers seeking personalized service and curated selections. Hypermarkets and supermarkets retain volume sales through affordability and easy availability. Convenience stores cater to impulse and budget-driven purchases, while other niche outlets diversify access. The UK Footwear Retailing Market leverages this multichannel presence to maximize consumer reach and enhance shopping experiences.

- For example, Kurt Geiger, founded in London in 1963, operates more than 70 stores across the UK, including 64 in England, and is recognized as a leading specialty footwear retailer offering curated fashion collections and personalized service.

Segmentation

By Product Type

- Shoes

- Sandals/Flip-Flops

- Boots

- Athletic/Sports Footwear

By Shoe/Sole Material

- Rubber

- Leather

- Synthetic

- Textiles

By Distribution Channel

- Convenience Stores

- E-Commerce

- Specialty Stores

- Hypermarkets/Supermarkets

- Others

Regional Analysis

England

England dominates the UK Footwear Retailing Market with a commanding 68% share. London leads the segment with its concentration of international brands, luxury boutiques, and flagship stores. Strong purchasing power and a fashion-driven consumer base contribute to steady demand. Urban centers such as Manchester and Birmingham also boost sales through expanding retail networks and e-commerce adoption. It benefits from premium positioning, innovative product launches, and collaborations with global fashion labels. Rising demand for both high-end and athleisure categories further strengthens England’s market dominance.

Scotland

Scotland holds 14% of the UK Footwear Retailing Market, supported by a mix of domestic retailers and global entrants. Edinburgh and Glasgow serve as primary retail hubs, attracting both tourists and local shoppers. The region favors durable products suited for varying climates, including boots and performance footwear. Sports retailing remains strong due to cultural interest in outdoor activities. It demonstrates stable growth driven by e-commerce adoption and evolving fashion preferences. Retailers in Scotland capitalize on rising interest in sustainable and ethically sourced footwear.

Wales and Northern Ireland

Wales and Northern Ireland together account for 18% of the UK Footwear Retailing Market. Cardiff anchors the Welsh retail segment, supported by mall expansions and growing online sales. Northern Ireland, with Belfast at its center, benefits from cross-border trade and demand for affordable footwear options. Both regions show rising interest in sports and casual footwear, with younger demographics driving online purchases. It reflects opportunities for mid-range and value-focused brands to expand presence. Regional growth is supported by increasing consumer awareness of international fashion and lifestyle trends.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Clarks

- JD Sports

- Schuh

- Sports Direct

- Office Shoes

- Dune London

- Hotter Shoes

- Kurt Geiger

- ASOS (Footwear Division)

- Marks & Spencer (Footwear)

Competitive Analysis

The UK Footwear Retailing Market is characterized by intense competition among established domestic and international players. Clarks, JD Sports, Schuh, Sports Direct, and Marks & Spencer dominate through extensive distribution networks and brand recognition. It features strong competition in both premium and value-based segments, with companies adopting distinct strategies to secure consumer loyalty. Leading players invest in product innovation, sustainability initiatives, and collaborations with global fashion designers. E-commerce platforms and direct-to-consumer channels intensify rivalry by offering personalized shopping experiences. Smaller brands compete by targeting niche categories such as vegan footwear and customized products. Strategic partnerships, mergers, and acquisitions further shape the competitive landscape, reinforcing the market’s dynamic and consumer-driven nature.

Recent Developments

- In September 2025, Gymshark announced the launch of its first-ever footwear collection through a collaboration with UK performance footwear brand R.A.D®. This limited-edition range, featuring the ONE V2 and R-1 models in Gymshark’s signature muted palette, is set for release on September 10 via the Gymshark website.

- In September 2025, Clarks, a leading UK footwear company, revealed plans to launch its first digital marketplace, “Clarks Marketplace,” in early 2026. The new platform will host a curated roster of partner brands including Hunter, Frugi, Antler Luggage, and Kettlewell Colours. This strategic development coincides with Clarks’ bicentenary year and aims to modernize the company’s retail approach by expanding its market presence and diversification.

- In July 2025, Coats Group, a prominent UK thread manufacturer, announced the acquisition of US-based footwear insole maker OrthoLite for $770 million. This acquisition is expected to enhance Coats Group’s capabilities and offerings within the footwear value chain, strengthening its position as a key supplier to the global footwear market.

- In November 30, 2024, JD Sports, a major UK sportswear and footwear retailer, completed the acquisition of France’s Groupe Courir for 520 million euros. This move significantly strengthens JD Sports’ footprint across Europe, especially in the sneaker segment, and aligns with the company’s strategy to broaden its reach among varied consumer groups, particularly women and fashion-forward customers.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Shoe/Sole Material and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK Footwear Retailing Market will expand through digital-first strategies that strengthen customer engagement.

- Sustainability initiatives will shape long-term growth, with brands adopting eco-friendly materials and transparent sourcing.

- Rising demand for athleisure and sports footwear will continue to drive category diversification.

- Premiumization will accelerate, with luxury footwear retaining strong influence among urban consumers.

- Regional markets outside London will see stronger growth due to mall expansions and e-commerce penetration.

- Direct-to-consumer strategies will reshape competition by giving brands closer control of consumer relationships.

- Personalization and customization will create new opportunities for higher-margin products.

- International collaborations and limited-edition launches will fuel brand differentiation.

- Value-focused offerings will gain traction in Wales and Northern Ireland, supported by younger demographics.

- Technological integration, including virtual try-ons and data-driven inventory systems, will define future retail strategies.