Market Overview

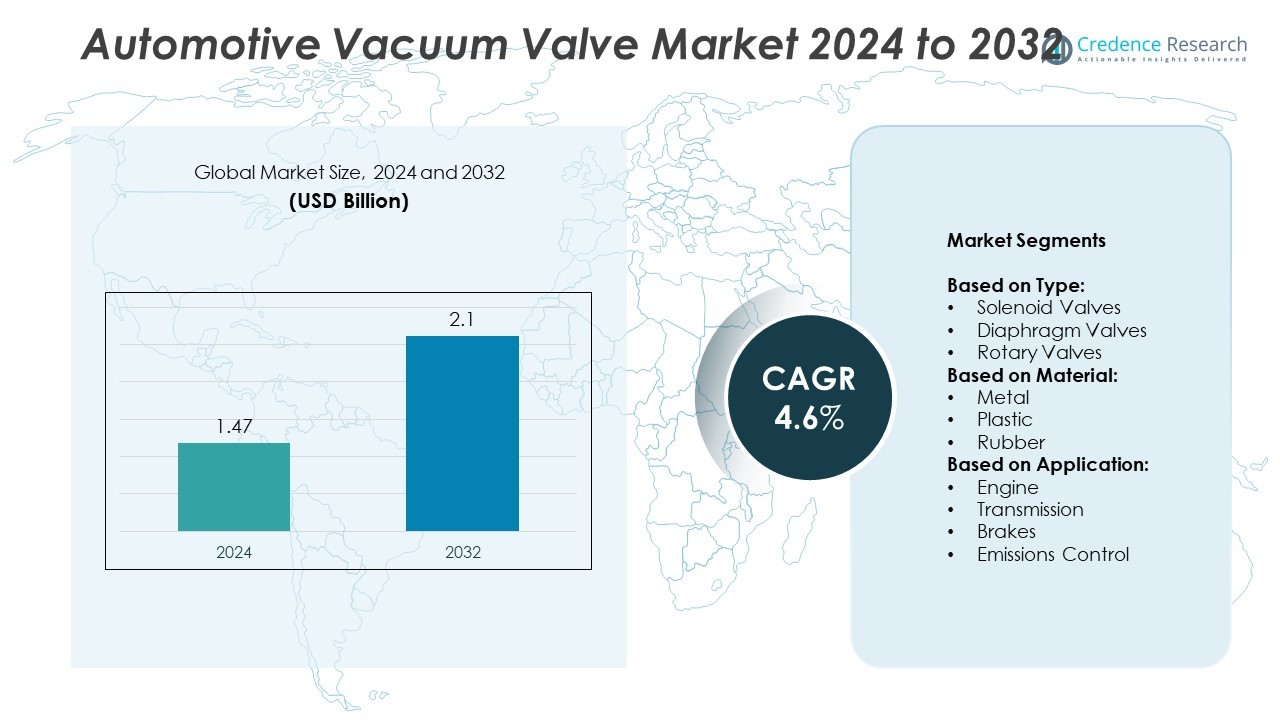

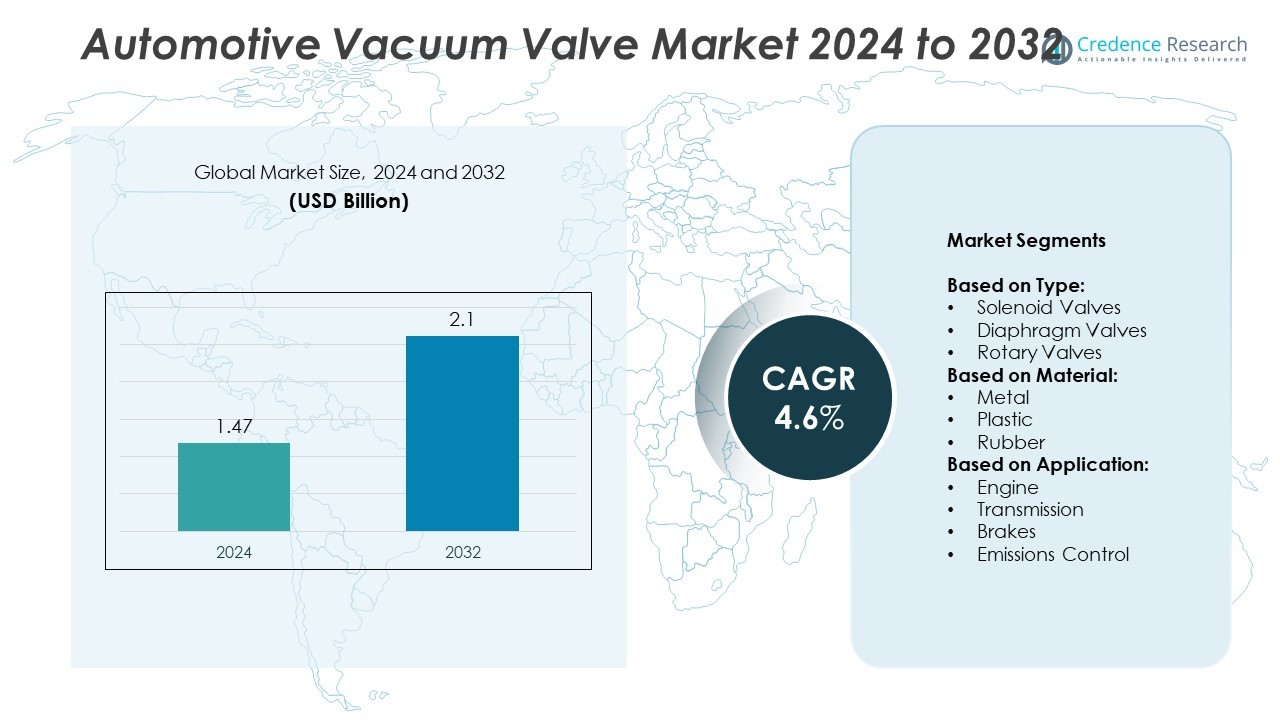

The automotive vacuum valve market size was valued at USD 1.47 billion in 2024 and is projected to reach USD 2.1 billion by 2032, registering a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Vacuum Valve Market Size 2024 |

USD 1.47 Billion |

| Automotive Vacuum Valve Market, CAGR |

4.6% |

| Automotive Vacuum Valve Market Size 2032 |

USD 2.1 Billion |

The automotive vacuum valve market is driven by major players such as BorgWarner, Robert Bosch, DENSO, Continental, MAHLE, Parker, and Delphi Technologies, who focus on innovation and precision engineering to meet emission regulations and efficiency targets. These companies invest in R&D to develop electronically actuated valves with enhanced performance and durability. Asia Pacific leads the market with over 34% share in 2024, supported by strong vehicle production in China, Japan, and India. Europe and North America follow, driven by stringent emission standards and increasing adoption of turbocharged engines, boosting demand for advanced vacuum control solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The automotive vacuum valve market was valued at USD 1.47 billion in 2024 and is projected to reach USD 2.1 billion by 2032, growing at a CAGR of 4.6%.

- Rising adoption of emission control systems and turbocharged engines is driving demand for precise vacuum control solutions.

- Key trends include increased use of electronically controlled solenoid valves, lightweight materials, and compact valve designs to meet efficiency and regulatory targets.

- The market is competitive, with global players focusing on R&D, automation, and collaborations with OEMs to deliver customized solutions and expand regional presence.

- Asia Pacific holds the largest share at over 34%, followed by North America at 32% and Europe at 28%, while solenoid valves dominate with over 48% share across applications such as engines, brakes, transmissions, and emission control systems.

Market Segmentation Analysis:

By Type

Solenoid valves dominate the automotive vacuum valve market, holding over 48% share in 2024. Their ability to provide precise flow control and fast response makes them ideal for modern engine management systems. The increasing adoption of electronic control units (ECUs) in vehicles further drives demand for solenoid valves in emission systems and turbochargers. Diaphragm valves follow with strong usage in cost-sensitive applications where simple on/off control is required. Rotary valves remain niche but are preferred in performance vehicles for their ability to manage higher flow rates under variable load conditions.

- For instance, Garrett Motion Inc.’s 2024 10-K report indicates that global turbocharger production decreased from approximately 50 million units in 2023 to 49 million units in 2024. The report attributes this decline to increasing electric vehicle (EV) penetration and softening demand for internal combustion engine (ICE) components.

By Material

Metal-based vacuum valves lead the market with over 55% share in 2024 due to their superior durability and resistance to high temperatures, making them suitable for engine and exhaust environments. Stainless steel and aluminum alloys are widely used for their corrosion resistance and structural strength. Plastic valves are gaining traction in lightweight vehicle designs, reducing overall vehicle weight and improving fuel efficiency. Rubber components are mostly used for seals and diaphragms, ensuring airtight performance and extending valve life under continuous thermal cycling.

- For instance, Bosch is expanding its global production of the iBooster, an electromechanical brake booster. A press release from September 20, 2022, announced the start of iBooster production at its Tochigi, Japan, plant, and estimated that 22 million units would have been produced globally by the end of 2022.

By Application

Engine applications account for the largest share, exceeding 50% in 2024, as vacuum valves are essential for turbocharging, intake manifold control, and EGR systems. The rise in fuel-efficient engine technologies and stricter emission norms boost demand in this segment. Transmission applications also utilize vacuum valves for shift control, improving smoothness and reducing energy losses. Brake systems rely on vacuum-assisted brake boosters, keeping demand steady. Emissions control remains a fast-growing area, driven by regulatory compliance requirements and the integration of advanced exhaust gas recirculation (EGR) systems.

Key Growth Drivers

Rising Adoption of Emission Control Systems

Stringent emission regulations worldwide are driving the adoption of advanced emission control technologies in vehicles. Automotive vacuum valves play a critical role in exhaust gas recirculation (EGR) systems and evaporative emission control systems, ensuring compliance with Euro 6 and EPA Tier 3 standards. Growing demand for cleaner combustion and reduced NOx emissions fuels the use of precision-controlled vacuum valves. Manufacturers are increasingly integrating electronically actuated valves, boosting accuracy and efficiency. This regulatory push remains a primary driver for the sustained demand for vacuum valves across passenger and commercial vehicles.

- For instance, Pierburg produced its 1,000,000th electric vacuum pump in July 2019. Series production began in 2017

Surge in Turbocharged Engine Production

The rise in global production of turbocharged engines significantly boosts demand for automotive vacuum valves. Turbochargers rely on vacuum control systems for wastegate and bypass valve operations, ensuring optimal boost pressure and engine performance. Automakers are adopting smaller, turbocharged engines to meet fuel efficiency and CO₂ reduction targets without compromising power. This trend is particularly strong in Europe and Asia-Pacific, where downsized engines are becoming standard in compact and mid-sized vehicles. Increased use of vacuum valves in boost control applications drives market growth.

- For instance, in spring 2024, Valeo extended its EGR valve range for the aftermarket by adding 46 new references. This expansion brought its total EGR valve offering in Europe to 85 references, which covers more than 80 million vehicles.

Increasing Electronic Integration in Vehicles

Automotive systems are becoming more electronically integrated, creating higher demand for electronically controlled vacuum valves. Electronic solenoid valves offer fast response, precise actuation, and improved reliability, aligning with the trend toward connected and smart vehicles. Integration with ECUs enables real-time adjustments to optimize performance and emissions. As vehicles move toward hybrid and electric powertrains, vacuum valve technology is adapting to support auxiliary systems, such as regenerative braking and thermal management. This evolution fuels the adoption of advanced valve solutions across all vehicle categories.

Key Trends & Opportunities

Lightweight Materials and Compact Designs

Automotive manufacturers are focusing on lightweight and compact vacuum valves to reduce overall vehicle weight and improve fuel efficiency. The shift to high-strength plastics and aluminum components supports downsizing without compromising durability. This trend aligns with global efforts to improve vehicle mileage and meet emission targets. Compact vacuum valve designs also free up engine bay space, allowing for better packaging of other components. Suppliers are investing in advanced material research to deliver high-performance, corrosion-resistant valves with longer service life.

- For instance, in September 2019, General Motors recalled approximately 3.77 million vehicles in the U.S. and Canada due to a vacuum pump issue that could lead to reduced power brake assist. The primary recall covered 3.46 million U.S. pickup trucks and SUVs, including the Cadillac Escalade, Chevrolet Silverado, Chevrolet Tahoe, GMC Sierra, Chevrolet Suburban, and GMC Yukon from model years 2014–2018. This recall also included approximately 310,000 vehicles in Canada that had been recalled earlier in 2019.

Growth in Hybrid and Electric Vehicles

The rapid growth of hybrid and electric vehicles presents new opportunities for vacuum valve applications. While EVs have reduced reliance on traditional engine vacuum, they still require valves for battery thermal management, cabin HVAC systems, and brake assist systems. Hybrid vehicles, in particular, integrate advanced vacuum pump systems where valves regulate pressure precisely. Suppliers developing energy-efficient, electronically controlled valves are well-positioned to capture this growing demand. The transition to electrified powertrains will drive innovation in vacuum valve technology tailored for next-generation vehicles.

- For instance, Toyota’s exhaust gas recirculation (EGR) vacuum switching valve (VSV) has specific resistance specifications that vary by vehicle model and years, some models have an EGR VSV resistance specification of 33–39 Ω at 20 °C, as documented in service information for certain vehicles. In contrast, other models, such as those with a 1KZ-TE engine, have a resistance specification of 37–44 Ω at 20 °C.

Key Challenges

High Cost of Advanced Valve Technologies

The adoption of electronically actuated vacuum valves adds significant cost to vehicle production. Advanced valves require precise manufacturing and integration with electronic control units, increasing system complexity. This cost factor is a challenge for automakers targeting entry-level or cost-sensitive markets. Price pressure from OEMs limits profit margins for suppliers, making it difficult to balance quality, performance, and affordability. Cost optimization through automation, modular design, and economies of scale will be crucial for maintaining market competitiveness.

Shift Toward Electric Vehicles Reducing Demand

The transition toward fully electric vehicles poses a challenge to vacuum valve demand. Battery electric vehicles (BEVs) eliminate traditional internal combustion engines, reducing the need for engine-related vacuum control systems. Although opportunities remain in auxiliary systems, the overall volume of vacuum valves per vehicle may decline. Suppliers must adapt by diversifying product portfolios and focusing on applications in EV thermal management and brake systems. Strategic investments in R&D will help mitigate the long-term impact of declining ICE vehicle production.

Regional Analysis

North America

North America accounts for around 32% share of the automotive vacuum valve market in 2024, supported by strong vehicle production in the U.S. and Mexico. Rising adoption of turbocharged gasoline engines and strict emission regulations drive demand for precision vacuum control systems. The region’s focus on fuel-efficient vehicles and compliance with EPA standards encourages automakers to integrate electronically controlled solenoid valves. Growth in electric and hybrid vehicle sales is also creating opportunities for advanced vacuum valve solutions used in brake boosters and thermal management systems. Technological innovation from key suppliers strengthens the regional market outlook.

Europe

Europe holds approximately 28% market share, driven by widespread adoption of turbocharged and downsized engines across passenger cars. Stringent Euro 6 emission norms encourage automakers to use advanced EGR and evaporative emission systems, fueling demand for high-performance vacuum valves. Germany, France, and the U.K. lead production, supported by strong R&D activities from automotive component suppliers. Lightweight materials and compact valve designs are increasingly adopted to meet EU fuel efficiency targets. The shift toward hybrid and plug-in hybrid vehicles further supports demand for electronically actuated vacuum valves integrated with powertrain control modules.

Asia Pacific

Asia Pacific leads the global market with over 34% share in 2024, supported by high vehicle production in China, Japan, and India. Rapid urbanization and rising disposable incomes are driving passenger car sales, boosting vacuum valve demand for engines and emission systems. Governments in the region are enforcing strict emission standards, prompting automakers to adopt advanced control technologies. Expansion of local manufacturing by global suppliers such as Denso and Aisin is strengthening supply chains. The growing adoption of hybrid and electric vehicles in China is creating new opportunities for vacuum valve applications in auxiliary systems.

Latin America

Latin America represents close to 4% market share, with Brazil and Mexico being the key production hubs. Rising automotive production and investments by OEMs are fueling moderate growth in demand for vacuum valves. Emission regulations are gradually aligning with global standards, pushing adoption of EGR and evaporative emission systems in passenger and commercial vehicles. The market is also witnessing a shift toward cost-effective and durable valve solutions to suit regional economic conditions. Suppliers are expanding their presence through partnerships with local distributors to strengthen aftersales networks and cater to the growing vehicle parc.

Middle East and Africa

Middle East and Africa account for around 2% share of the market, primarily driven by demand from GCC countries and South Africa. Rising sales of light commercial vehicles and SUVs support the use of vacuum valves in engines and brake systems. The region’s relatively lenient emission standards are slowly tightening, encouraging OEMs to integrate modern vacuum control technologies. Increasing investments in local assembly plants and rising imports of passenger vehicles from Europe and Asia contribute to market growth. However, price sensitivity in several African markets drives demand for cost-effective and durable vacuum valve solutions.

Market Segmentations:

By Type:

- Solenoid Valves

- Diaphragm Valves

- Rotary Valves

By Material:

By Application:

- Engine

- Transmission

- Brakes

- Emissions Control

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the automotive vacuum valve market features key players such as BorgWarner, Master Pneumatic, Robert Bosch, MAHLE S, DENSO, Beswick, Continental, Norgren, Clippard, Festo, Aisin Seiki, Parker, Delphi Technologies, Legris, and SMC Corporation. The market is highly consolidated, with global and regional players focusing on product innovation and advanced valve technologies to meet tightening emission regulations and rising demand for fuel efficiency. Companies are investing in R&D to develop electronically controlled solenoid valves with faster response times and higher durability. Strategic collaborations with OEMs support customized solutions for engine, transmission, and emissions control applications. Many players are expanding manufacturing capacities in Asia Pacific to leverage cost advantages and serve growing vehicle production. Continuous efforts are directed toward lightweight material adoption, precision engineering, and integration with electronic control units, ensuring superior performance and compliance with stringent regulatory standards worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BorgWarner

- Master Pneumatic

- Robert Bosch

- MAHLE S

- DENSO

- Beswick

- Continental

- Norgren

- Clippard

- Festo

- Aisin Seiki

- PARKER

- Delphi Technologies

- Legris

- SMC Corporation

Recent Developments

- In 2025, Bosch added 82 new aftermarket part numbers including valves to cover nearly 63 million vehicles in operation.

- In 2025, BorgWarner supplied Variable Cam Timing (VCT) technology for a major East Asian automaker’s hybrid and gasoline engines, which optimizes valve timing for efficiency and emissions improvements. Production is scheduled to start in early 2026.

- In 2025, Aisin Seiki exhibited at the Automotive Engineering Exposition 2025, showcasing next-generation automotive components, including integrated electric units that likely involve advanced valve technologies.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow with stricter global emission regulations requiring advanced vacuum control systems.

- Adoption of electronically controlled solenoid valves will rise for precise engine and exhaust management.

- Turbocharged and downsized engine production will continue to boost vacuum valve installations.

- Hybrid and electric vehicle growth will create opportunities in brake assist and thermal management systems.

- Lightweight materials and compact designs will gain traction to support fuel efficiency targets.

- Asia Pacific will remain the largest production hub due to strong automotive manufacturing growth.

- Suppliers will invest in automation and smart manufacturing to reduce production costs.

- Integration with electronic control units will become standard for improved performance and diagnostics.

- Aftermarket demand will increase with the aging global vehicle fleet requiring replacement parts.

- Strategic partnerships between OEMs and component makers will accelerate innovation in valve technology.