Market Overview

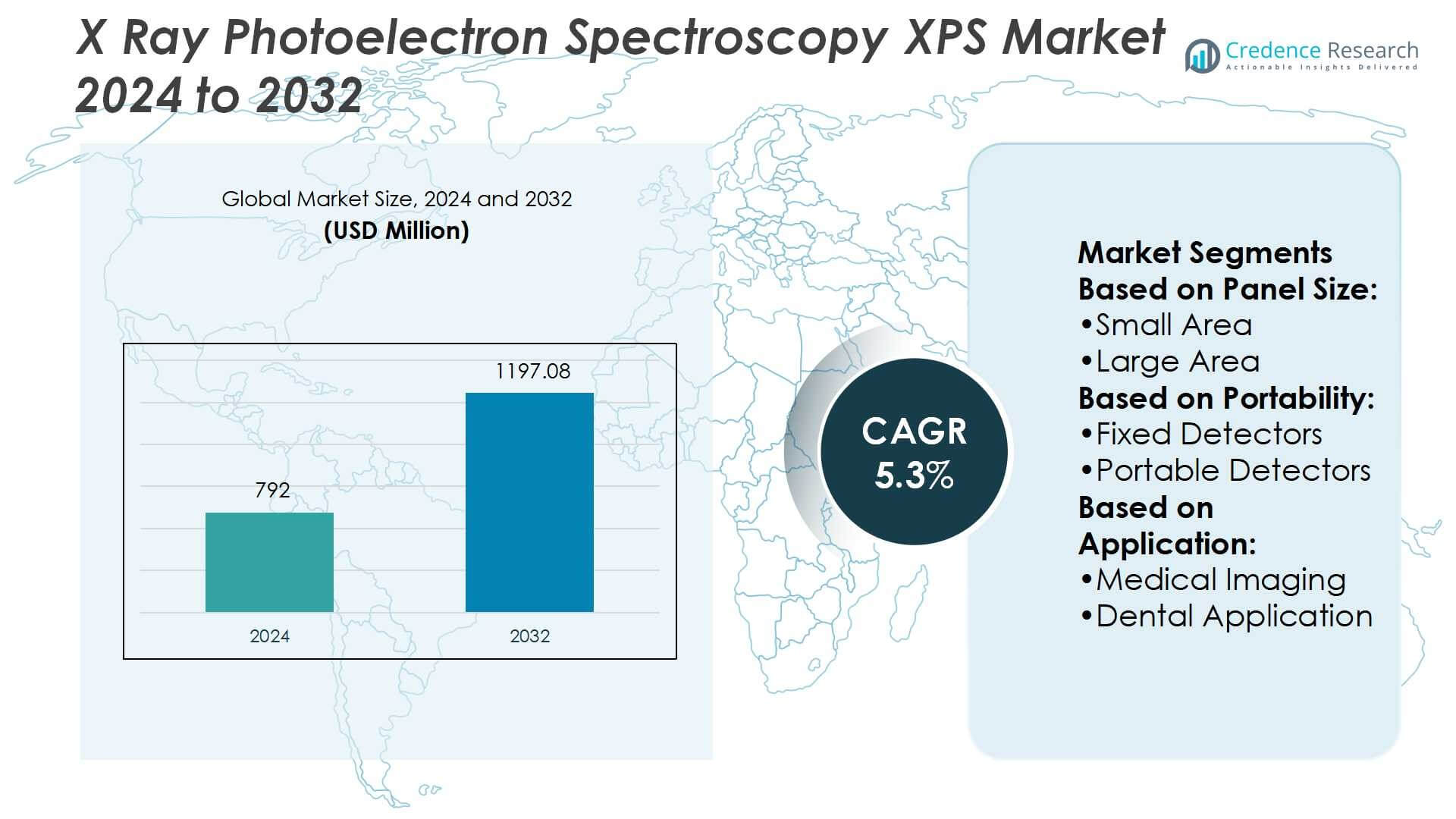

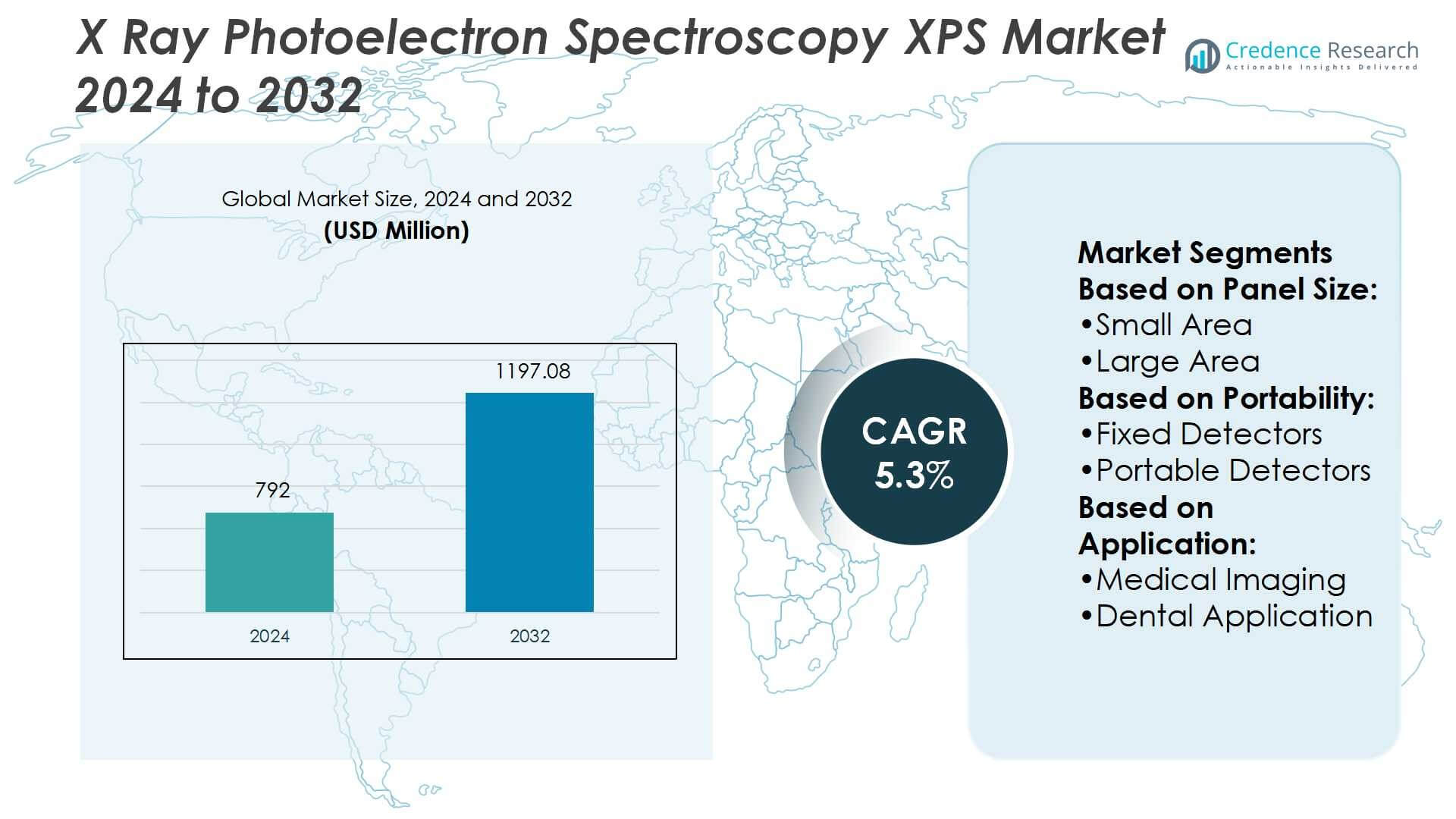

X-ray Photoelectron Spectroscopy (XPS) Market size was valued USD 792 million in 2024 and is anticipated to reach USD 1197.08 million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| X-ray Photoelectron Spectroscopy Market Size 2024 |

USD 792 Million |

| X-ray Photoelectron Spectroscopy Market, CAGR |

5.3% |

| X-ray Photoelectron Spectroscopy Market Size 2032 |

USD 1197.08 Million |

The X-ray photoelectron spectroscopy (XPS) market is shaped by leading players such as Thermo Fisher Scientific, HORIBA Scientific, Shimadzu Corporation, Bruker, Kratos Analytical, SPECTRO Analytical, Excillum, EasyXAFS, Fluxana GmbH & Co. KG, and Amptek. These companies compete through technological innovation, advanced detectors, and integration of automation and AI-driven data analysis, addressing growing demand across semiconductors, healthcare, and material science. North America leads the global market with a 35% share, supported by strong research infrastructure, high R&D investment, and widespread adoption in universities, government laboratories, and industrial sectors, reinforcing its position as the dominant regional hub.

Market Insights

Market Insights

- The X-ray photoelectron spectroscopy (XPS) market was valued at USD 792 million in 2024 and is projected to reach USD 1197.08 million by 2032, growing at a CAGR of 5.3%.

- Rising demand in semiconductors, healthcare, and material science drives adoption, with medical imaging holding over 35% share as the dominant application segment.

- Leading players such as Thermo Fisher Scientific, HORIBA Scientific, Shimadzu Corporation, Bruker, and Kratos Analytical focus on technological innovation, advanced detectors, and AI-driven data analysis to maintain competitiveness.

- High equipment and maintenance costs act as restraints, limiting adoption among small and mid-sized laboratories, while the shortage of skilled professionals restricts effective utilization.

- North America leads the market with a 35% regional share, followed by Europe at 28% and Asia-Pacific at 30%, with Asia-Pacific expected to record the fastest growth due to strong semiconductor and electronics manufacturing capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Panel Size

In the X-ray photoelectron spectroscopy (XPS) market, large area panels hold the dominant share, accounting for over 60% of total demand. Their capability to analyze wide surface areas makes them highly valuable in material science, semiconductor research, and advanced coating studies. Large panels also support higher throughput, which is critical in industrial R&D and quality control. The demand is further driven by the rising adoption of nanotechnology and the need for surface characterization in high-performance materials, where precision and scalability play a vital role in driving growth.

- For instance, Excillum’s MetalJet E1+ X-ray source delivers exceptionally high brightness by operating at up to 160 kV and 1000 W. The source can produce high X-ray flux in a 15 µm focal spot.

By Portability

Fixed detectors dominate the portability segment with over 70% of the market share. These detectors provide superior stability, sensitivity, and accuracy, making them the preferred choice for laboratories and large research facilities. Their ability to support high-resolution imaging and long-duration experiments enhances their adoption across academic, industrial, and pharmaceutical research. Growing investment in advanced research infrastructure and the integration of automation into lab systems further boost demand for fixed detectors, ensuring strong growth prospects in this segment over the forecast period.

- For instance, While specific performance depends on the detector model, energy resolutions of 145 eV (FWHM) at Mn Kα have been achieved with SDDs from various manufacturers.

By Application

Medical imaging emerges as the leading application, contributing more than 35% to the XPS market share. The ability of XPS to deliver precise surface chemical analysis supports advanced diagnostics, biomaterial evaluation, and drug research. Rising demand for non-invasive diagnostic techniques, coupled with continuous advancements in medical device coatings and implants, drives adoption. Furthermore, healthcare R&D investments, especially in oncology and regenerative medicine, reinforce the use of XPS. While dental, veterinary, and security applications are growing, the medical imaging segment remains the prime growth engine due to its wide clinical and research applications.

Market Overview

Key Growth Drivers

Rising Demand in Material Science and Nanotechnology

The increasing use of X-ray photoelectron spectroscopy (XPS) in material science and nanotechnology is a major driver. XPS enables precise surface chemistry analysis, critical for studying thin films, coatings, and advanced nanomaterials. With industries developing lightweight composites, semiconductors, and high-performance polymers, the need for accurate surface characterization continues to rise. Research institutions and manufacturers adopt XPS to optimize material properties, enhance product durability, and meet performance requirements. This growing focus on advanced materials strongly supports market expansion across industrial and academic research sectors.

- For instance, HORIBA’s spectrometer-OEM product line includes imaging spectrometers with focal lengths ranging from 70 mm to 1250 mm, paired with cooled CCD, CMOS, or InGaAs detectors.

Expansion of Semiconductor and Electronics Industry

The rapid growth of the semiconductor and electronics industry fuels XPS adoption. Semiconductor manufacturing relies on surface-level precision, and XPS provides unmatched insights into contamination, oxidation states, and elemental composition. With rising global demand for integrated circuits, microchips, and optoelectronics, manufacturers increasingly invest in XPS systems for quality control and process validation. Moreover, the miniaturization of devices requires advanced tools to ensure atomic-level accuracy. This critical role in ensuring reliability and performance strengthens XPS demand, making it an indispensable technology in the electronics value chain.

- For instance, Fluxana’s FLUXearch® database offers access to over 26,000 reference materials (certified and non-certified) for calibration of spectroscopic and elemental analysis instruments.

Increasing Healthcare and Life Sciences Applications

Healthcare and life sciences represent a growing end-user segment for XPS. Its ability to analyze biomaterial surfaces supports the development of medical implants, drug delivery systems, and diagnostic devices. Research on coatings for stents, orthopedic implants, and regenerative medicine products leverages XPS to ensure safety and performance. Rising R&D spending in oncology and biotechnology accelerates adoption further. As healthcare innovations increasingly rely on surface-level chemical interactions, XPS has become a vital tool for both research and product development in the global life sciences market.

Key Trends & Opportunities

Integration of Automation and Artificial Intelligence

Automation and artificial intelligence (AI) are transforming XPS systems, making operations faster and more efficient. Automated sample handling, real-time data interpretation, and AI-driven analysis reduce human error and increase throughput. These advancements improve productivity in large research facilities and industrial laboratories. Companies are focusing on user-friendly interfaces and AI-enabled software to make XPS more accessible to non-experts. This trend opens opportunities for broader adoption in mid-scale industries and academic institutions, helping expand the market beyond traditional high-end research centers.

- For instance, Thermo Fisher’s Nexsa G2 XPS System offers fully automated surface analysis and supports spot sizes from 10 µm to 400 µm, adjustable in 5 µm increments, via its optimized X-ray monochromator.

Growing Focus on Green and Sustainable Materials

The global shift toward sustainability drives demand for XPS in analyzing eco-friendly and recyclable materials. Manufacturers of packaging, polymers, and coatings increasingly use XPS to validate surface treatments, biodegradability, and chemical stability. As regulatory standards tighten around sustainability, industries rely on precise surface analysis to meet compliance requirements. This creates strong opportunities for XPS suppliers, particularly in automotive, energy storage, and renewable energy applications, where advanced materials are tested for performance and environmental impact. Sustainability-focused R&D continues to create new growth avenues.

- For instance, Kratos’ AXIS Supra+ instrument delivers imaging-XPS with an ultimate spatial resolution of 1 µm at highest magnification. Its large area spectra collection mode supports analysis areas up to 300 × 700 µm region for survey scans.

Key Challenges

High Equipment and Maintenance Costs

The high capital cost of XPS systems remains a major barrier for adoption, especially among small and mid-sized laboratories. Advanced detectors, vacuum chambers, and specialized software contribute to significant upfront investment. In addition, ongoing maintenance and calibration expenses increase the total cost of ownership. These factors limit adoption to large research facilities and industrial players with strong budgets. The lack of affordable alternatives slows down market penetration in developing economies, creating a challenge for vendors seeking wider customer bases.

Shortage of Skilled Professionals

Operating XPS systems requires highly trained professionals with expertise in surface chemistry and spectroscopy. The shortage of skilled analysts in both developed and emerging markets restricts effective system utilization. Without proper training, users face challenges in data interpretation, system handling, and maintenance. This skills gap delays project timelines and reduces efficiency in R&D. Vendors must address this challenge by offering training programs, simplified interfaces, and AI-powered data analysis to make XPS more user-friendly and expand adoption across broader end-user segments.

Regional Analysis

North America

North America holds a leading position in the X-ray photoelectron spectroscopy (XPS) market with 35% share. Strong adoption stems from advanced research infrastructure, particularly in the U.S., where universities, national laboratories, and private industries invest heavily in material science and nanotechnology. The region benefits from significant funding in healthcare R&D and semiconductor manufacturing, both of which demand precise surface analysis. Robust collaborations between academic institutions and commercial players further accelerate market growth. Increasing regulatory standards in medical devices and environmental monitoring also strengthen demand, positioning North America as a core hub for innovation in XPS technologies.

Europe

Europe accounts for 28% of the global XPS market, driven by its strong base of material science research and industrial applications. Countries such as Germany, France, and the UK lead adoption through extensive use in automotive, aerospace, and renewable energy sectors. Stringent EU regulations on product safety and environmental standards boost reliance on surface characterization tools like XPS. The region also benefits from investments in nanotechnology and advanced coatings, particularly in academic and government research facilities. Growing demand for sustainable and recyclable materials further fuels adoption, ensuring Europe remains a vital contributor to global XPS market expansion.

Asia-Pacific

Asia-Pacific represents 30% of the XPS market and shows the fastest growth potential. China, Japan, and South Korea dominate regional demand, fueled by strong semiconductor, electronics, and industrial manufacturing bases. Rising investments in nanotechnology and renewable energy materials also drive adoption. The healthcare and life sciences sector in countries like Japan and India further strengthens growth, as XPS is used for biomaterial and pharmaceutical research. Government support for R&D and expanding university-industry collaborations enhance regional innovation. With rapid industrialization and a strong focus on advanced materials, Asia-Pacific is poised to increase its market share in coming years.

Latin America

Latin America contributes 4% of the global XPS market, with growth supported by emerging research infrastructure and increasing focus on industrial applications. Brazil and Mexico lead regional adoption, particularly in mining, material science, and environmental monitoring. While the market remains smaller compared to developed regions, rising healthcare R&D and investments in energy storage and sustainable materials provide new opportunities. Limited funding and high equipment costs remain constraints, but gradual improvements in university-led research initiatives are expanding adoption. As industries in the region modernize, the demand for advanced surface characterization tools is expected to grow steadily.

Middle East & Africa

The Middle East & Africa hold a modest 3% share of the global XPS market. Growth is primarily driven by increasing investment in oil and gas, energy, and industrial research, where surface analysis is essential for material durability and performance. Countries like Saudi Arabia, South Africa, and the UAE are expanding research capabilities through collaborations with global institutions. Adoption in healthcare and environmental monitoring is also gradually emerging. However, limited access to skilled professionals and high costs hinder widespread use. Despite these challenges, ongoing industrial diversification efforts will support gradual adoption of XPS in the region.

Market Segmentations:

By Panel Size:

By Portability:

- Fixed Detectors

- Portable Detectors

By Application:

- Medical Imaging

- Dental Application

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of the X-ray photoelectron spectroscopy (XPS) market features leading players including Excillum (Sweden), EasyXAFS (U.S.), HORIBA Scientific (Japan), Fluxana GmbH & Co. KG (Germany), Thermo Fisher Scientific (U.S.), Kratos Analytical (U.K.), Shimadzu Corporation (Japan), Bruker (U.S.), Amptek (U.S.), and SPECTRO Analytical (Germany). The competitive landscape of the X-ray photoelectron spectroscopy (XPS) market is characterized by strong innovation, technological advancements, and strategic collaborations. Companies in this space focus on developing high-resolution detectors, integrating automation, and enhancing software capabilities to improve accuracy and ease of use. Demand from industries such as semiconductors, healthcare, and material science drives continuous product upgrades, with manufacturers investing heavily in research and development. Emphasis on sustainability and energy-efficient systems also shapes product design, aligning with global regulatory standards. Furthermore, robust distribution networks and after-sales support play a crucial role in strengthening market presence and customer retention.

Key Player Analysis

- Excillum (Sweden)

- EasyXAFS (U.S.)

- HORIBA Scientific (Japan)

- Fluxana GmbH & Co. KG (Germany)

- Thermo Fisher Scientific (U.S.)

- Kratos Analytical (U.K.)

- Shimadzu Corporation (Japan)

- Bruker (U.S.)

- Amptek (U.S.)

- SPECTRO Analytical (Germany)

Recent Developments

- In March 2025, Align launched the Align™ X-ray Insights, a new software-based computer-aided detection solution that uses artificial intelligence to automatically analyze 2D radiographs in European Union countries and the United Kingdom.

- In February 2025, Detection Technology, a global leader in X-ray detector solutions, expanded its X-ray flat-panel detector portfolio by featuring over 60 products. The portfolio includes advanced amorphous silicon, indium gallium zinc oxide (IGZO), and complementary metal-oxide semiconductor technology-based detectors, optimised for a wide range of industrial, medical, and security X-ray imaging applications.

- In March 2024, Vehant Technologies, a smart surveillance and security solution, received orders for Dual-View X-ray baggage and Multi-Energy scanners from the Airport Authority of India (AAI).

- In March 2024, Base Molecular Resonance Technologies received the patent for the element detection devices on the periodic table. The devices can detect 200 types of cancer.

Report Coverage

The research report offers an in-depth analysis based on Panel Size, Portability, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for surface analysis in advanced materials.

- Semiconductor miniaturization will drive adoption of XPS for precise contamination detection.

- Healthcare applications will grow with increasing use in biomaterials and implant research.

- Automation and AI integration will enhance system efficiency and data accuracy.

- Sustainability trends will boost demand for XPS in eco-friendly and recyclable materials testing.

- Academic and government research investments will continue to strengthen global adoption.

- Portable and compact systems will gain traction among smaller laboratories and institutions.

- Emerging economies will contribute more as research infrastructure and funding improve.

- Collaborative projects between universities and industries will accelerate technological advancements.

- Continuous innovation in detectors and software will sustain competitiveness in the market.

Market Insights

Market Insights