Market Overview

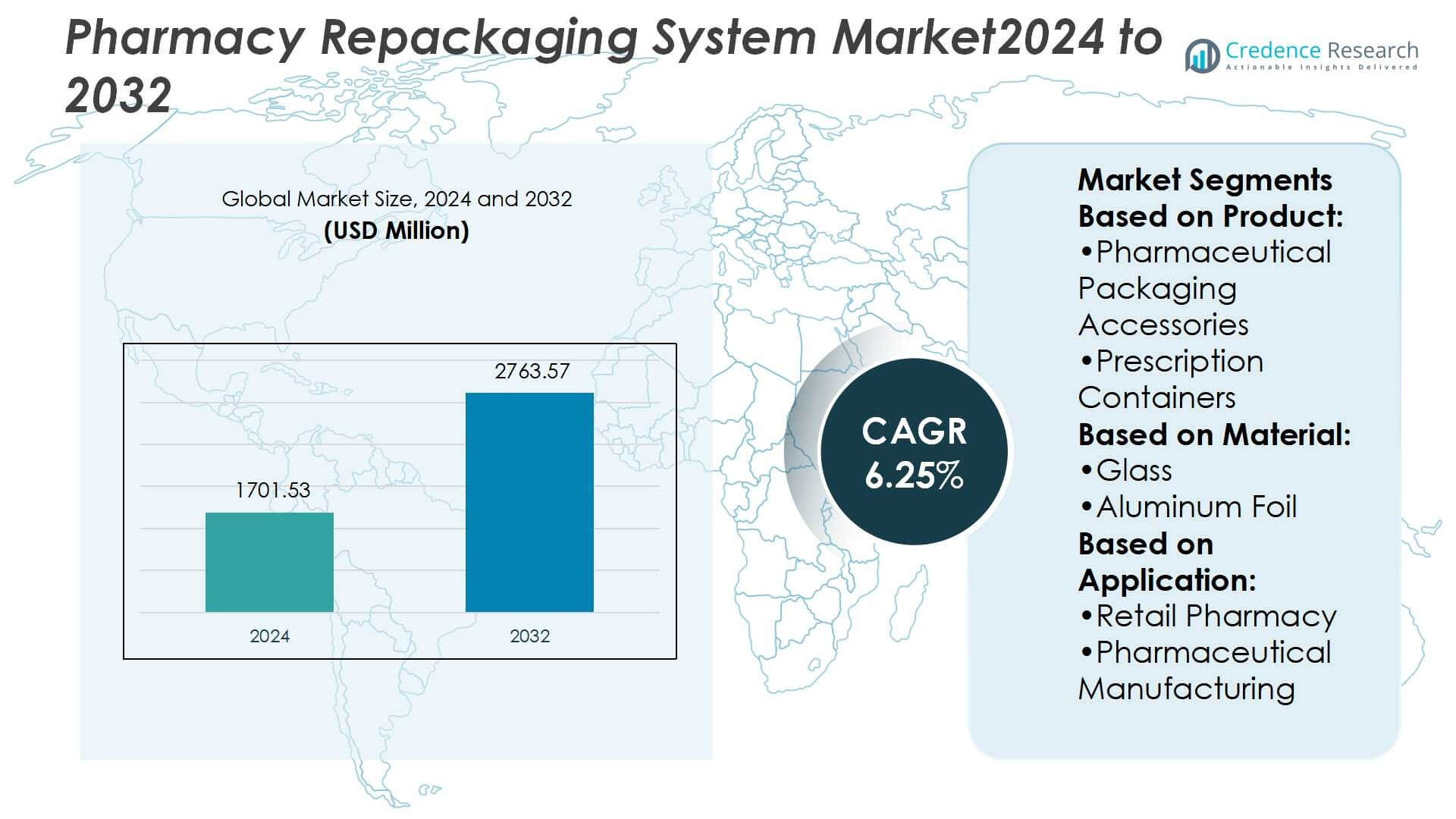

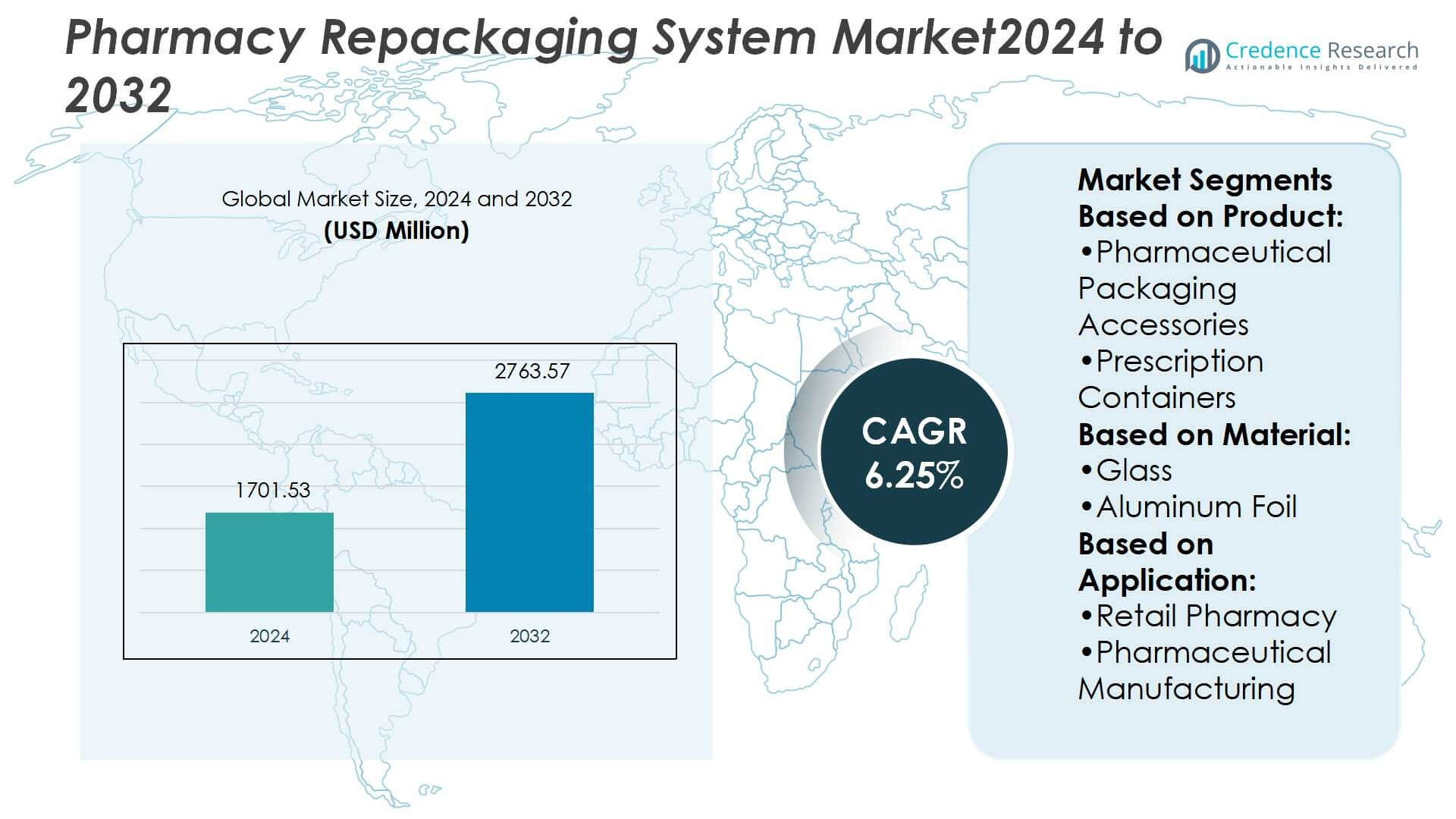

Pharmacy Repackaging System Market size was valued USD 1701.53 million in 2024 and is anticipated to reach USD 2763.57 million by 2032, at a CAGR of 6.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pharmacy Repackaging System Market Size 2024 |

USD 1701.53 Million |

| Pharmacy Repackaging System Market, CAGR |

6.25% |

| Pharmacy Repackaging System Market Size 2032 |

USD 2763.57 Million |

The Pharmacy Repackaging System Market is shaped by major players such as Owens Illinois Inc., Gerresheimer AG, AptarGroup, Inc., SGD S.A., West Pharmaceutical Services Inc., Amcor Plc, Becton, Dickinson and Company, Schott AG, Drug Plastics Group, and Berry Global, Inc. These companies compete through innovations in automated repackaging, sustainable packaging solutions, and advanced drug safety technologies. North America leads the market with a 39% share in 2024, supported by strong healthcare infrastructure, high prescription volumes, and stringent regulatory compliance requirements. The presence of established pharmaceutical networks and advanced technology adoption reinforces North America’s dominant position in this global market.

Market Insights

Market Insights

- The Pharmacy Repackaging System Market was valued at USD 1701.53 million in 2024 and is projected to reach USD 2763.57 million by 2032, growing at a CAGR of 6.25%.

- Market drivers include rising demand for medication safety, patient compliance, and automation in retail and institutional pharmacies, supported by an aging population requiring long-term care.

- Key trends highlight sustainability in packaging materials, adoption of RFID and barcode systems for traceability, and increasing reliance on contract packaging services across pharmaceutical supply chains.

- Competitive analysis shows strong presence of global players innovating in automated repackaging and eco-friendly designs, with North America holding 39% market share and leading technological adoption.

- Market restraints include high capital costs and complex regulatory requirements, while primary packaging dominates product segments with over 45% share, reinforcing its importance in ensuring safe and efficient medication distribution worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

In the Pharmacy Repackaging System Market, the primary packaging segment leads with over 45% market share. Blister packs dominate within this category due to their strong ability to protect medicines from moisture and contamination. Demand for blister packs is rising in both retail and institutional pharmacies as they ensure unit-dose accuracy and compliance. Prescription containers and parenteral containers also play important roles, yet blister packs remain preferred for their cost-effectiveness and convenience. Growth is driven by the rising focus on patient safety, medication adherence, and expanding pharmaceutical retail chains.

- For instance, Gerresheimer is a well-established systems and solutions provider to the pharma, biotech, and cosmetics industries. Over 40 Production Sites in 16 Countries.

By Material

Plastics and polymers account for the largest share of the market, holding 52% in 2024. Polypropylene (PP) leads within this segment, valued for its durability, cost-effectiveness, and suitability in pharmaceutical packaging. PP containers are widely used in bottles, closures, and blister formats, ensuring safe storage and distribution. Polyethylene (PE) and PET also contribute significantly, particularly in prescription containers. While glass maintains relevance in parenteral packaging, plastics dominate due to lighter weight and reduced breakage risks. Drivers include the expansion of generic drugs, preference for recyclable packaging, and increasing automation in pharmacy repackaging lines.

- For instance, Aptar Pharma operates 15 GMP certified manufacturing sites with a combined footprint of about 120,000 m², producing around 8 billion drug delivery systems per year used by over 1,500 customers.

By Application

Retail pharmacy remains the dominant application area, representing 41% of the market share in 2024. The segment benefits from high patient interaction, growing prescription volumes, and the need for efficient repackaging to improve workflow. Automated repackaging solutions in retail settings support medication adherence and reduce errors. Pharmaceutical manufacturing and institutional pharmacies follow, supported by large-scale production and internal medication management needs. Contract packaging services also gain traction with outsourcing trends. Growth in retail pharmacy is driven by rising healthcare spending, urbanization, and the emphasis on patient-centered care that requires accessible, precise, and safe drug dispensing.

Key Growth Drivers

Rising Demand for Medication Safety and Compliance

Medication errors remain a major healthcare concern, driving the adoption of pharmacy repackaging systems. Automated repackaging improves accuracy, reduces human error, and ensures compliance with dosing requirements. Hospitals, retail pharmacies, and institutional settings increasingly rely on unit-dose packaging to enhance patient safety. The growing elderly population and the need for long-term medication management also strengthen demand. With healthcare providers under pressure to improve treatment outcomes and minimize liability risks, the emphasis on safe and accurate drug dispensing continues to fuel market growth.

- For instance, SGD Pharma’s global production capacity is over 8 million vials per day across its 5 plants. Their Velocity® Vials reduce glass particulates by up to 96% during fill-and-finish operations.

Expansion of Retail and Institutional Pharmacies

The expansion of retail pharmacy chains and institutional healthcare facilities is accelerating the adoption of repackaging systems. High prescription volumes and increasing patient traffic demand efficiency, automation, and speed in drug dispensing. Repackaging solutions help pharmacies streamline workflow, save labor costs, and improve inventory management. Institutional pharmacies, particularly in long-term care facilities, use automated systems to ensure precise medication delivery. Market growth is supported by rising healthcare access, expanding insurance coverage, and the integration of repackaging systems into modern pharmacy operations for higher productivity.

- For instance, West Pharmaceutical Services has invested in automated production, including a new automated SmartDose line, to expand capacity. While financial results vary by quarter, the company’s Q2 2025 results showed net sales of 766.5 million and a gross profit margin of 35.7%.

Technological Advancements in Packaging Automation

Advances in automation, robotics, and software integration are transforming the pharmacy repackaging system market. Modern systems feature barcode scanning, RFID tracking, and real-time data integration to improve efficiency and traceability. Automated repackaging also reduces material waste and supports compliance with strict regulatory standards. The adoption of smart packaging solutions enhances patient adherence through clear labeling and dosage accuracy. Growing investment in AI-enabled solutions and digital monitoring platforms is further strengthening the market. These innovations allow pharmacies and manufacturers to improve productivity, accuracy, and cost-efficiency in medication handling.

Key Trends & Opportunities

Sustainability and Eco-Friendly Packaging Solutions

Pharmacies and manufacturers are increasingly shifting to sustainable materials in repackaging systems. Demand for recyclable plastics, biodegradable blister packs, and reduced packaging waste solutions is growing. Regulations promoting eco-friendly packaging encourage the adoption of alternatives like PET and paper-based formats. Companies investing in sustainable solutions gain competitive advantages while meeting consumer and regulatory expectations. This trend offers opportunities for system providers to develop innovative eco-conscious solutions that align with global sustainability goals and appeal to environmentally aware consumers.

- For instance, Amcor achieved a 16.67% reduction in plastic use for its flexible tubes in the Bulldog Skincare line, cutting annual plastic consumption by 8.5 metric tonnes, and incorporates over 62% post-consumer recycled (PCR) plastic in the tubes.

Rising Adoption of Contract Packaging Services

Outsourcing repackaging tasks to contract packaging providers is emerging as a key opportunity. Pharmaceutical companies and hospitals increasingly rely on third-party services to reduce operational costs and ensure compliance. Contract packaging providers offer advanced automation, specialized expertise, and scalability, making them attractive for high-volume operations. Growing demand from generics and specialty drug segments is also fueling adoption. This trend is creating opportunities for technology providers to partner with contract packaging firms and expand service portfolios across different regions.

- For instance, Schott’s new TOPPAC® Nest 160 increases fill-and-finish throughput by 60% compared to the previous nest configuration for prefillable polymer syringes, and improves efficiency by up to 67%, while cutting product carbon footprint by 17%.

Key Challenges

High Capital Investment and Operational Costs

Pharmacy repackaging systems require significant upfront investment in automation, machinery, and technology integration. Maintenance and software updates add to operational costs, making adoption difficult for small and mid-sized pharmacies. Budget constraints limit penetration in emerging markets where healthcare spending remains lower. High costs also restrict upgrades from manual to automated systems in many regions. Vendors must address affordability challenges by offering scalable, modular systems or flexible financing models to increase adoption across diverse pharmacy environments.

Regulatory and Compliance Barriers

Strict regulatory requirements surrounding drug labeling, traceability, and safety create challenges for system providers. Pharmacies and manufacturers must ensure compliance with guidelines set by regulatory bodies such as the FDA and EMA. Frequent changes in packaging and labeling standards increase compliance costs and complexity. Non-compliance can result in penalties, recalls, and reputational damage. These regulatory hurdles slow adoption rates, especially among smaller players lacking the resources to adapt quickly. Companies need to prioritize compliance-ready systems and continuous monitoring solutions to overcome this challenge.

Regional Analysis

North America

North America holds the largest share of the Pharmacy Repackaging System Market, accounting for 39% in 2024. The region benefits from strong healthcare infrastructure, advanced automation adoption, and a high focus on medication safety. U.S. hospitals and retail pharmacies actively integrate automated repackaging systems to reduce errors and improve compliance with regulatory standards. Growing demand from long-term care facilities further drives adoption. The presence of leading system providers and robust investment in digital healthcare solutions strengthen the market. Rising healthcare expenditure and supportive government initiatives continue to reinforce North America’s dominant position in this market.

Europe

Europe captures 28% of the Pharmacy Repackaging System Market share in 2024, driven by stringent regulatory frameworks and strong demand for patient safety. Countries such as Germany, France, and the U.K. are early adopters of automated repackaging technologies due to well-established healthcare systems. Increasing emphasis on compliance with European Medicines Agency (EMA) guidelines is pushing pharmacies to modernize packaging practices. The expanding generic drug market and institutional pharmacy networks further support growth. Sustainability goals also fuel innovation in eco-friendly packaging materials. The region’s mature regulatory landscape ensures continued investment in efficient and compliant repackaging systems across healthcare settings.

Asia-Pacific

Asia-Pacific represents 21% of the Pharmacy Repackaging System Market share in 2024 and is the fastest-growing region. Rapid urbanization, increasing healthcare expenditure, and expanding retail pharmacy networks are fueling growth. Countries such as China, India, and Japan are investing heavily in automation to improve drug dispensing efficiency and patient safety. Rising chronic disease prevalence and aging populations create higher demand for precise medication management. Government initiatives promoting modern healthcare infrastructure support the adoption of advanced repackaging systems. Growing outsourcing to contract packaging providers also accelerates market expansion, positioning Asia-Pacific as a major contributor to future global growth.

Latin America

Latin America accounts for 7% of the Pharmacy Repackaging System Market share in 2024. Market growth is supported by expanding pharmaceutical manufacturing and the increasing role of institutional pharmacies. Brazil and Mexico dominate adoption due to large populations and growing healthcare reforms. The focus on reducing medication errors and improving accessibility in public hospitals drives investments in repackaging technologies. Budget limitations slow the pace of automation, yet contract packaging services are gaining traction. The gradual modernization of healthcare infrastructure across the region is expected to increase adoption, making Latin America an emerging growth market in this sector.

Middle East & Africa

The Middle East & Africa hold 5% of the Pharmacy Repackaging System Market share in 2024. Growth is fueled by expanding healthcare infrastructure, rising chronic disease prevalence, and increasing adoption of automated systems in urban hospitals. Wealthier Gulf countries such as Saudi Arabia and the UAE lead adoption due to strong investments in digital healthcare solutions. However, limited resources and high capital costs restrict widespread adoption across Africa. International partnerships and government-led healthcare initiatives are promoting modernization. While the region currently lags in market penetration, ongoing investment in smart healthcare systems offers long-term growth potential.

Market Segmentations:

By Product:

- Pharmaceutical Packaging Accessories

- Prescription Containers

By Material:

By Application:

- Retail Pharmacy

- Pharmaceutical Manufacturing

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Pharmacy Repackaging System Market players including Owens Illinois Inc., Gerresheimer AG, AptarGroup, Inc., SGD S.A., West Pharmaceutical Services Inc., Amcor Plc, Becton, Dickinson and Company, Schott AG, Drug Plastics Group, and Berry Global, Inc. The Pharmacy Repackaging System Market is characterized by intense competition, driven by continuous innovation in packaging design, automation, and sustainability. Companies focus on delivering solutions that improve medication safety, ensure regulatory compliance, and support efficiency in both retail and institutional pharmacies. The adoption of unit-dose packaging, smart labeling, and tamper-evident formats reflects the market’s commitment to patient safety and adherence. Growing emphasis on eco-friendly materials and recyclable packaging has become a critical differentiator, aligning with global sustainability goals. Competitive strategies also include expanding production capacity, investing in R&D for intelligent packaging technologies, and forming strategic alliances with pharmaceutical manufacturers and healthcare providers. These efforts collectively strengthen market positioning and accelerate the global adoption of advanced pharmacy repackaging systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Owens Illinois Inc.

- Gerresheimer AG

- AptarGroup, Inc.

- SGD S.A.

- West Pharmaceutical Services Inc.

- Amcor Plc

- Becton, Dickinson and Company

- Schott AG

- Drug Plastics Group

- Berry Global, Inc.

Recent Developments

- In Dec 2024, Gerresheimer expanded its production capacity in North Macedonia to increase its production of syringes, helping them to expand on a global scale.

- In Oct 2024, Bormioli Pharma partners with Chiesi to supply the first pharma primary packaging in Carbon Capture PET. Bormioli Pharma today announced bottles will be further useful for the packaging of medication used for seasonal and perennial allergic rhinitis and prophylaxis.

- In March 2024, MM Group, a secondary packaging specialist, became the first European company to achieve triple A certification from the Carbon Disclosure Project (CDP). This achievement gave the company global recognition. This landmark accreditation built a strong image of the company in the market as well.

- In February 2024, Schreiner Group, a Germany-based company specializing in pharmaceutical labeling and packaging solutions, launched a new sustainable closure seal called Needle-Trap Closure Seal. This product is designed to prevent needles from being reused and to ensure the integrity of pharmaceutical packaging.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for medication safety and compliance.

- Automated repackaging systems will see wider adoption across retail and institutional pharmacies.

- Growing aging populations will drive the need for precise medication management solutions.

- Sustainability will influence packaging design with eco-friendly and recyclable materials gaining traction.

- Integration of RFID and barcode systems will enhance traceability and reduce errors.

- Contract packaging services will gain importance as pharmaceutical companies outsource operations.

- Emerging markets will adopt repackaging systems as healthcare infrastructure modernizes.

- Advances in AI and digital monitoring will improve efficiency and data-driven decision-making.

- Regulatory compliance will remain a key driver shaping system design and innovation.

- Strategic partnerships and global expansion will strengthen competition among leading players.

Market Insights

Market Insights