Market Overview

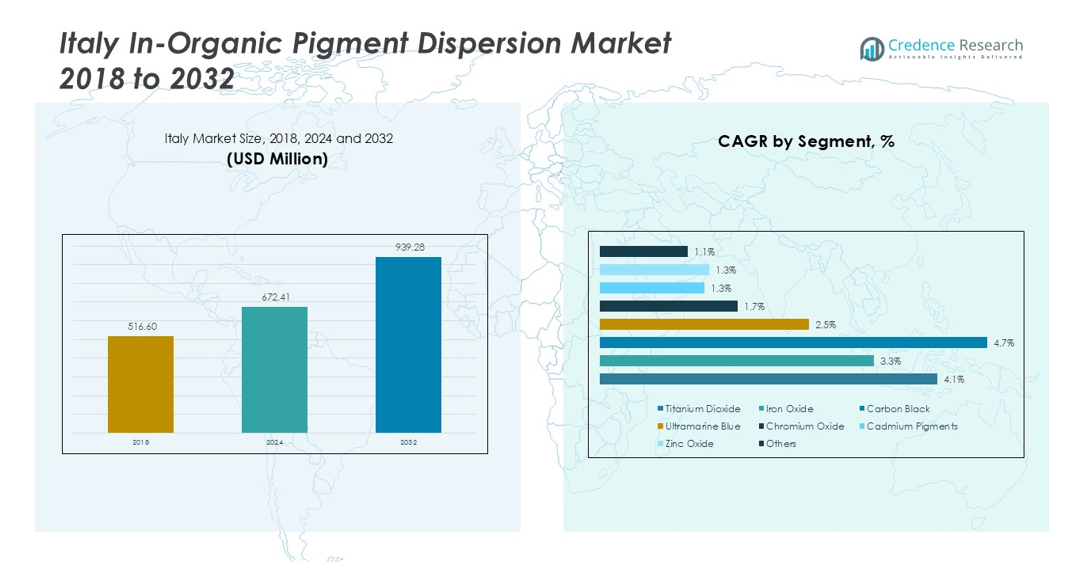

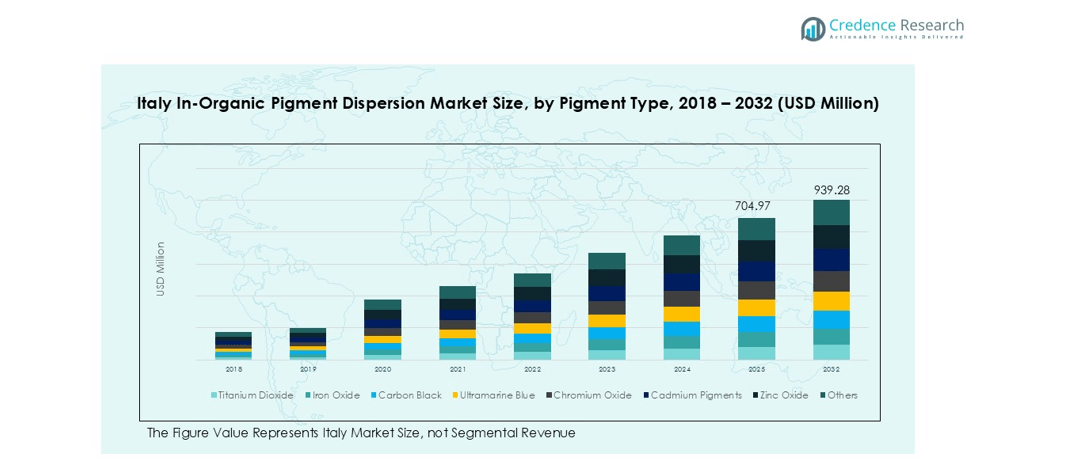

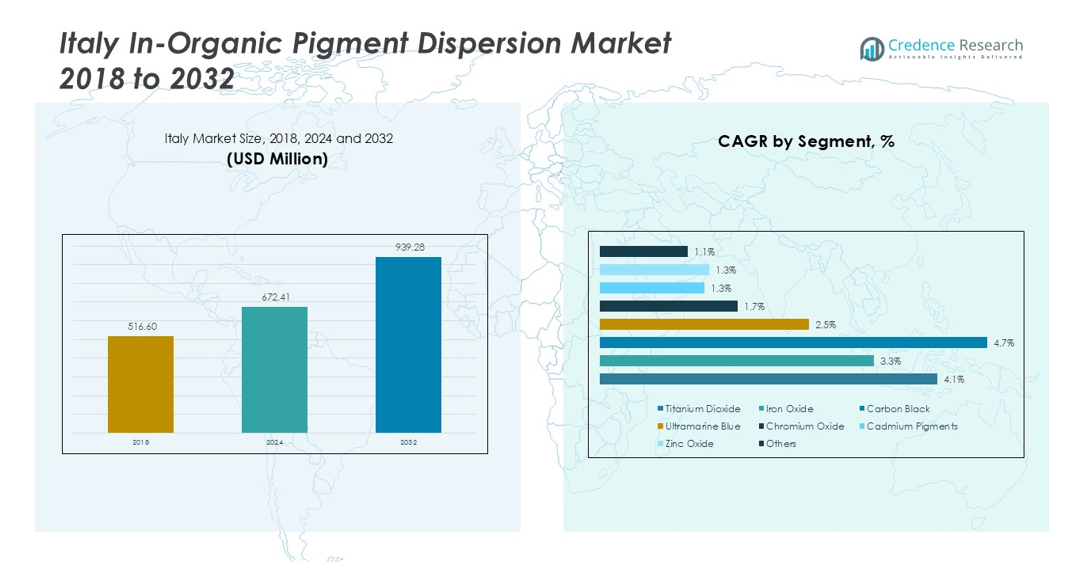

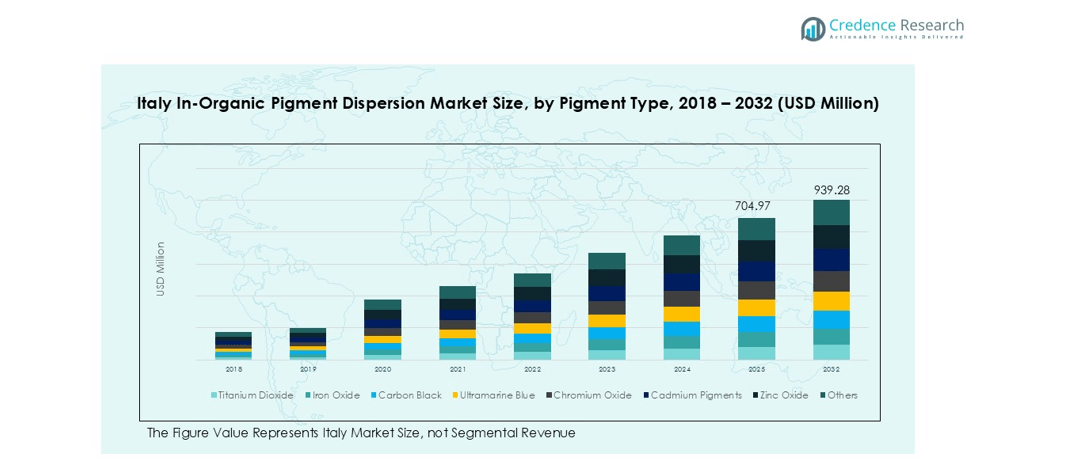

The Italy in-organic pigment dispersion market size was valued at USD 516.60 million in 2018 and reached USD 672.41 million in 2024. It is anticipated to grow further and hit USD 939.28 million by 2032, registering a CAGR of 4.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy In-Organic Pigment Dispersion Market Size 2024 |

USD 672.41 million |

| Italy In-Organic Pigment Dispersion Market, CAGR |

4.18% |

| Italy In-Organic Pigment Dispersion Market Size 2032 |

USD 939.28 million |

BASF SE, Clariant AG, Heubach GmbH, Lanxess AG, Venator Materials PLC, and Cabot Corporation are the key players shaping the Italy in-organic pigment dispersion market. These companies offer a wide portfolio of titanium dioxide, iron oxide, and specialty pigment dispersions catering to paints, coatings, plastics, and construction materials. BASF and Clariant lead in sustainable, low-VOC solutions, while Heubach and Lanxess focus on high-performance pigments for automotive and industrial coatings. Northern Italy dominates the market with over 40% share, driven by strong industrial and construction activity in Milan, Turin, and Venice, followed by Central and Southern Italy with nearly equal shares.

Market Insights

- The Italy in-organic pigment dispersion market was valued at USD 672.41 million in 2024 and is projected to reach USD 939.28 million by 2032, growing at a CAGR of 4.18%.

- Growth is driven by rising construction, infrastructure modernization, and demand for durable paints, coatings, and plastics. Increasing use of titanium dioxide and iron oxides in architectural and industrial coatings supports strong consumption.

- Trends include adoption of eco-friendly, lead-free, and low-VOC pigment dispersions, along with technological advancements in dispersion milling for improved stability and color performance.

- Competition is moderately consolidated, with BASF SE, Clariant AG, Heubach GmbH, Lanxess AG, and Venator Materials PLC leading the market through product innovation and sustainability-focused strategies.

- Northern Italy dominates with over 40% share, followed by Central and Southern Italy at nearly 30% each; paints and coatings remain the leading segment with more than 45% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Pigment Type

Titanium dioxide dominated the Italy in-organic pigment dispersion market in 2024, capturing over 40% share. Its superior opacity, brightness, and UV resistance make it the preferred pigment across paints, plastics, and coatings. Demand is further supported by its role in architectural and industrial coatings, where durability and weather resistance are critical. Iron oxide and carbon black follow as key sub-segments, driven by their use in construction materials, plastics, and inks. Rising adoption of ultramarine blue and chromium oxide in decorative coatings supports niche demand, while cadmium pigments and zinc oxide hold smaller but specialized applications.

- For instance, as of 2025, Venator Materials no longer operates a significant titanium dioxide (TiO₂) production capacity in Europe. The company ceased European TiO₂ production in 2024 as part of a restructuring plan, including the closure of its plant in Duisburg, Germany.

By Application

Paints and coatings emerged as the leading application segment, accounting for more than 45% share in 2024. Growth is fueled by Italy’s robust construction activity, rising renovation projects, and increasing demand for high-performance architectural finishes. Industrial coatings for automotive and marine sectors further boost consumption of inorganic pigments. Printing inks represent the second-largest application, driven by packaging sector expansion and demand for vibrant, durable colors. Plastics and construction materials also contribute significantly as manufacturers integrate pigment dispersions for enhanced aesthetics, UV stability, and long-term color retention in products exposed to harsh outdoor conditions.

- For instance, PPG Industries is a significant supplier of architectural coatings in Europe, with a notable presence in the Italian construction sector

Market Overview

Rising Construction and Infrastructure Development

Growth in residential and commercial construction across Italy is a major demand driver. Titanium dioxide and iron oxide dispersions are widely used in architectural paints, coatings, and concrete products to improve durability and aesthetics. Increasing renovation projects, supported by government incentives for energy-efficient buildings, boost pigment consumption in decorative and protective coatings. Infrastructure modernization, including bridges and public spaces, is driving higher adoption of weather-resistant and UV-stable pigments, ensuring long-lasting color performance and structural protection under Italy’s varied climate conditions.

- For instance, Venator Materials manufactures titanium dioxide for various applications, including architectural coatings. However, its supply capacity has been significantly reduced by recent insolvency filings and plant closures.

Expansion of Automotive and Industrial Coatings

Italy’s automotive sector plays a crucial role in pigment demand, driven by refinishing, OEM coatings, and plastic components. Inorganic pigment dispersions, especially titanium dioxide and carbon black, are essential for high-performance coatings that offer corrosion resistance, gloss retention, and UV stability. Industrial applications, such as machinery and marine coatings, further add to demand as manufacturers prioritize durable and environmentally compliant formulations. Continuous innovation in pigment dispersion technology enables better color strength and reduced VOC emissions, aligning with EU sustainability and emissions regulations for automotive and industrial sectors.

- For instance, BASF Coatings, a global leader in automotive coatings, supplies major European automakers like Stellantis from its network of production plants across Europe.

Shift Toward Sustainable and Non-Toxic Pigments

Increasing regulatory pressure under EU REACH and rising consumer awareness are fueling the shift toward eco-friendly, lead-free pigments. Manufacturers are investing in high-purity inorganic pigments such as zinc oxide and chromium oxide, which meet safety and performance standards. Demand for low-VOC coatings in residential, automotive, and packaging applications further supports the adoption of environmentally sustainable pigment dispersions. This shift is opening opportunities for producers to develop next-generation dispersions with improved dispersibility, reduced heavy metal content, and compatibility with water-borne and bio-based coating systems, ensuring compliance with green building and product labeling requirements.

Key Trends & Opportunities

Adoption of Advanced Dispersion Technologies

Companies are increasingly deploying high-energy milling and surface treatment technologies to produce finely dispersed pigments with superior consistency and stability. These innovations improve color strength, gloss, and opacity while reducing formulation costs for end-users. Nanotechnology-based inorganic dispersions are gaining traction for premium coatings and plastics, offering enhanced weatherability and heat resistance. This trend allows suppliers to differentiate their products in a competitive market and meet the demand for high-performance, application-specific dispersions that cater to automotive, construction, and packaging industries.

- For instance, Altana AG made significant investments across its divisions in 2023, including expanding BYK’s U.S. site in Wallingford and acquiring Imaginant Inc. to enhance BYK’s portfolio. However, BYK’s sales declined by 12% in 2023 due to the prevailing economic conditions.

Growth in Specialty Applications

The market is witnessing rising demand from niche applications such as cosmetics, ceramics, and glass manufacturing. Ultramarine blue and chromium oxide dispersions are increasingly used in luxury packaging, decorative ceramics, and high-end glassware. The cosmetics industry is driving consumption of safe, non-toxic pigments, especially zinc oxide, for sunscreens and skincare formulations. These specialty applications present opportunities for manufacturers to create customized dispersion solutions that offer superior purity, color vibrancy, and compliance with stringent health and safety standards, supporting premium product positioning in both domestic and export markets.

- For instance, Vibrantz Technologies (formerly Ferro Corporation) is a leading global producer of ultramarine pigments, which are manufactured at several international sites for use in applications such as premium ceramics and packaging inks.

Key Challenges

Regulatory Compliance and Environmental Restrictions

Stringent EU regulations regarding heavy metal pigments and VOC emissions pose a challenge for manufacturers. The need to replace cadmium pigments and other hazardous substances requires significant investment in R&D and reformulation of existing products. Compliance with REACH and other directives also increases production costs and limits the use of certain raw materials. Companies must adapt by developing safer, eco-compliant dispersions without compromising color performance, which can delay time-to-market for new products and impact profitability in a competitive environment.

Volatility in Raw Material Prices

Fluctuating prices of raw materials such as titanium dioxide, iron oxides, and solvents impact production costs and profit margins. Supply chain disruptions, geopolitical tensions, and energy price fluctuations in Europe further exacerbate cost pressures on manufacturers. This volatility makes it challenging for producers to offer stable pricing to customers, particularly in price-sensitive segments like construction and packaging. Companies must implement strategic sourcing and cost-optimization measures to mitigate risks while ensuring consistent quality and timely delivery of pigment dispersions.

Regional Analysis

Northern Italy

Northern Italy accounted for over 40% of the in-organic pigment dispersion market share in 2024, making it the leading region. Milan and Turin drive demand through their strong automotive, industrial coatings, and packaging sectors. Venice contributes through construction and decorative coatings for heritage restoration projects. High concentration of manufacturing hubs and export-oriented industries boosts consumption of titanium dioxide, iron oxides, and carbon black dispersions. Investment in infrastructure modernization, coupled with demand for durable, weather-resistant coatings, supports market growth. The region’s focus on sustainable production and adoption of low-VOC formulations aligns with EU environmental regulations and consumer preferences.

Central Italy

Central Italy held nearly 30% market share in 2024, led by Rome, Florence, and Bologna. Rome drives demand through public infrastructure, government-led restoration projects, and large-scale residential renovations. Florence supports specialty pigment use in ceramics, glass, and luxury product packaging, reflecting its strong design and artisan base. Bologna’s industrial clusters contribute to coatings and plastic applications, boosting pigment consumption across automotive and machinery sectors. Rising adoption of eco-friendly, lead-free pigments aligns with local sustainability initiatives. Strong demand for premium paints, decorative coatings, and UV-stable dispersions continues to drive growth, particularly in heritage preservation and cultural tourism infrastructure.

Southern Italy

Southern Italy captured close to 30% of the market share in 2024, with Naples, Palermo, and Bari as key demand centers. The region’s growing construction and tourism sectors drive the use of high-performance paints and coatings for hotels, residential projects, and public spaces. Naples leads in infrastructure-related pigment demand, while Palermo and Bari show rising use in packaging, ceramics, and marine coatings. The market benefits from government incentives for urban redevelopment and coastal protection projects. Increasing awareness of environmentally safe pigments, combined with demand for cost-effective dispersions, supports adoption across small-scale industries and local manufacturers.

Market Segmentations:

By Pigment Type

- Titanium Dioxide

- Iron Oxide

- Carbon Black

- Ultramarine Blue

- Chromium Oxide

- Cadmium Pigments

- Zinc Oxide

- Others

By Application

- Paints & Coatings

- Printing Inks

- Plastics

- Construction Materials

- Ceramics and Glass

- Cosmetics

- Others

By Geography

- Northern Italy

- Milan

- Turin

- Venice

- Southern Italy

- Naples

- Palermo

- Bari

- Central Italy

- Rome

- Florence

- Bologna

Competitive Landscape

The Italy in-organic pigment dispersion market is moderately consolidated, with key players including BASF SE, Clariant AG, Heubach GmbH, Lanxess AG, Venator Materials PLC, and Cabot Corporation driving competition. These companies focus on expanding their product portfolios with high-performance titanium dioxide, iron oxide, and specialty pigment dispersions to meet demand from paints, coatings, and plastics sectors. Local manufacturers and regional distributors play a crucial role in supplying customized pigment solutions for construction and ceramics applications. Strategic activities such as mergers, capacity expansions, and collaborations with coating formulators are common to strengthen market presence. Players are also investing in eco-friendly, lead-free, and low-VOC dispersions to comply with EU regulations and appeal to sustainability-driven customers. Continuous innovation in dispersion technology, cost optimization, and regional distribution network expansion remains central to maintaining competitive advantage in this growing and regulation-sensitive market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Clariant AG

- Heubach GmbH

- Lanxess AG

- Venator Materials PLC

- Cabot Corporation

- Ferro Corporation

- DIC Corporation

- Sudarshan Chemical Industries

- Huntsman Corporation

- Chromaflo

Recent Developments

- In March 2025, Sudarshan Chemical Industries Limited (SCIL) completed its acquisition of the Heubach Group, establishing a global pigment leader with operations across 19 sites worldwide. The combined company will offer a wide, technologically advanced pigment portfolio and strengthen its presence in key markets like Europe and the Americas.

- In January 2023, BASF announced an investment to expand its polymer dispersions production capacity at its Merak site in Indonesia. The expansion aimed to meet the rising demand for styrene-butadiene and acrylic dispersions, driven by the growth of new paper mills and the high-quality packaging sector across Southeast Asia, Australia, and New Zealand. The Merak site, strategically located near key raw material suppliers and customers, played a vital role in supporting this regional demand.

- In January 2023, Cabot Corporation expanded its inkjet production facility in Haverhill, Massachusetts, to meet growing demand for digital printing applications. The expansion will increase capacity for aqueous inkjet dispersions, which support the shift from analog to digital printing by offering benefits like greater design customization, faster speed to market, and improved sustainability through reduced waste. Recent upgrades at the facility also include enhanced manufacturing equipment and processes that improve operational efficiency and reduce water usage. This investment positions Cabot to better serve the rapidly evolving inkjet market with a broader product portfolio and reliable global supply.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for titanium dioxide and iron oxide dispersions will continue to dominate across major applications.

- Growth in sustainable construction and eco-friendly coatings will drive adoption of low-VOC dispersions.

- Automotive and industrial coatings will boost demand for high-performance, weather-resistant pigments.

- Technological advancements in dispersion milling will enhance color strength and stability.

- Specialty pigments for ceramics, cosmetics, and glass will gain share in premium applications.

- Local manufacturers will invest in capacity expansion to meet rising domestic demand.

- Regulatory compliance will push producers to develop lead-free and safer pigment solutions.

- Increasing use of water-borne and bio-based coating systems will create new opportunities.

- Northern Italy will maintain leadership, supported by strong industrial and construction activities.

- Strategic collaborations and mergers among key players will strengthen distribution networks and innovation.