Market Overview

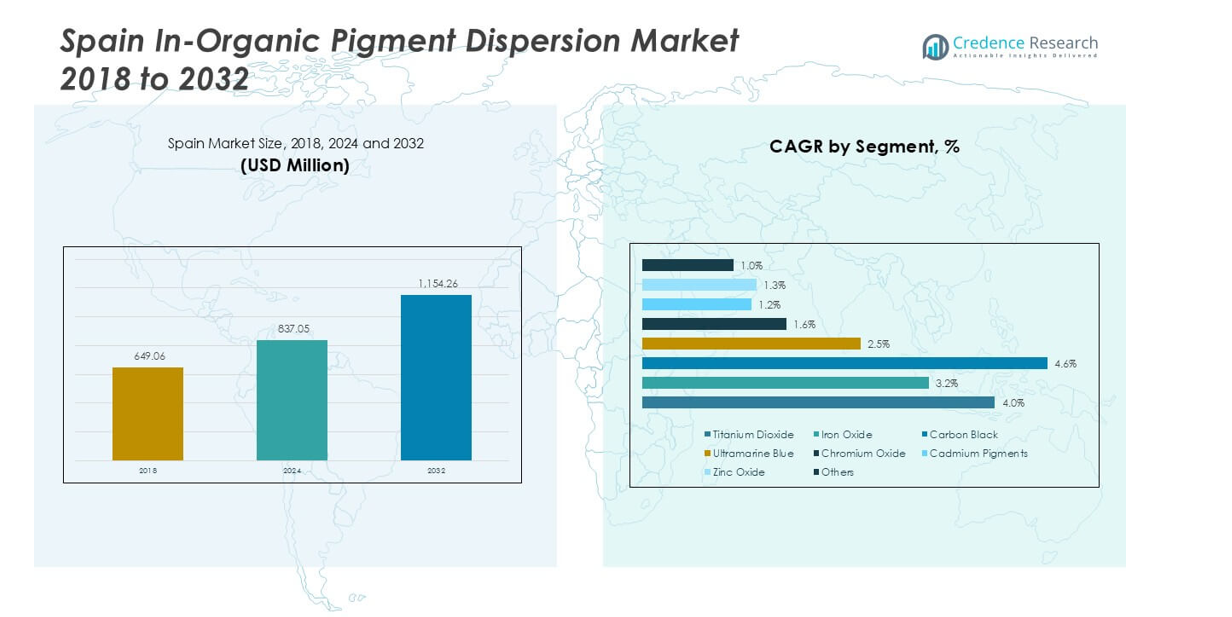

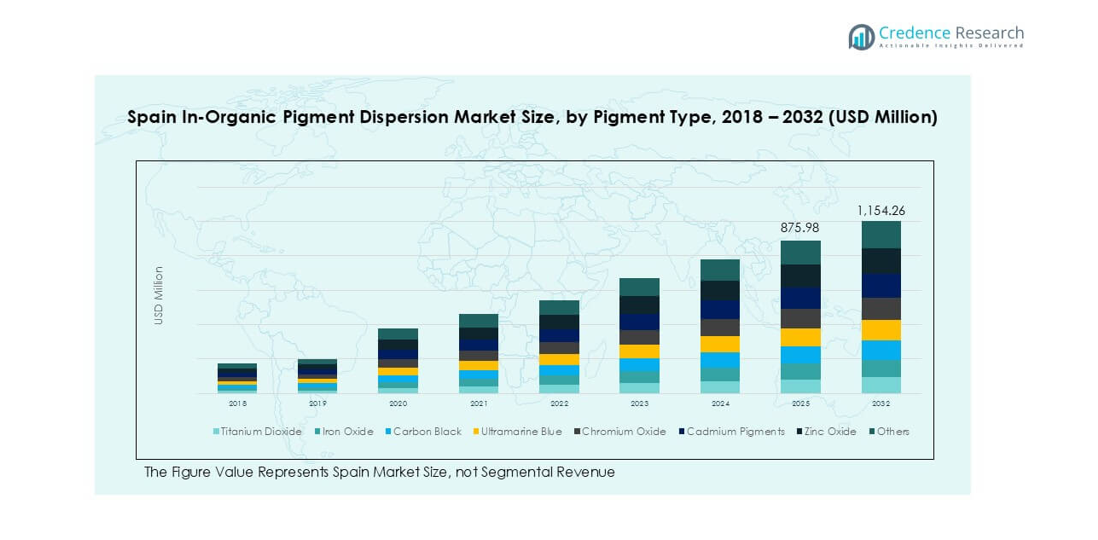

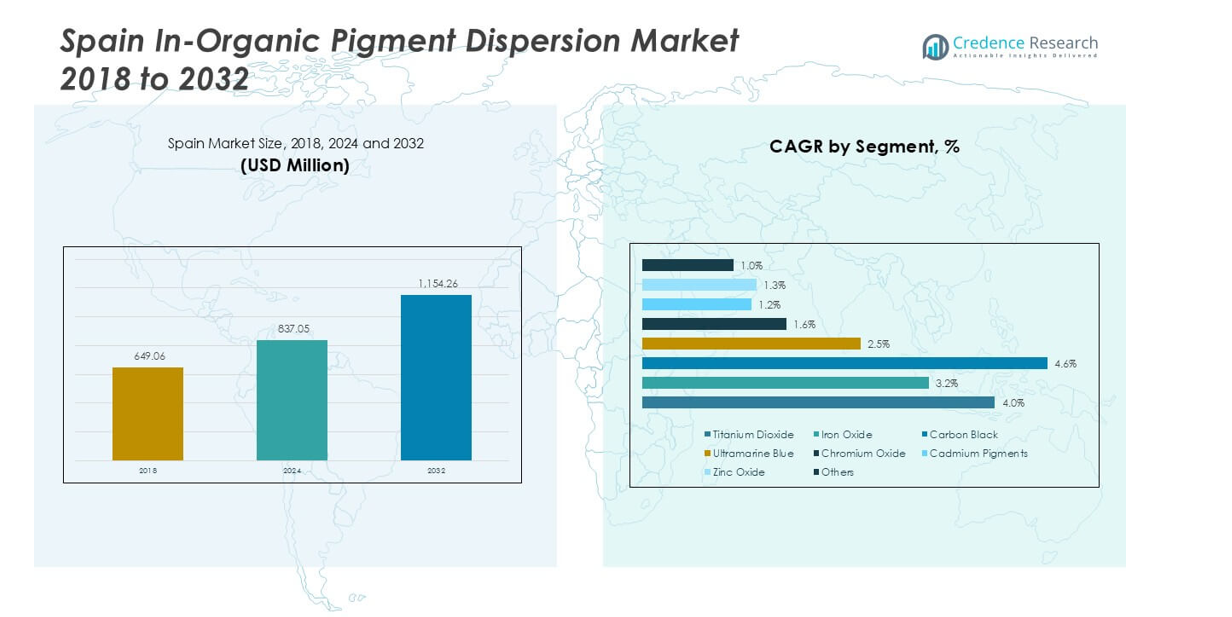

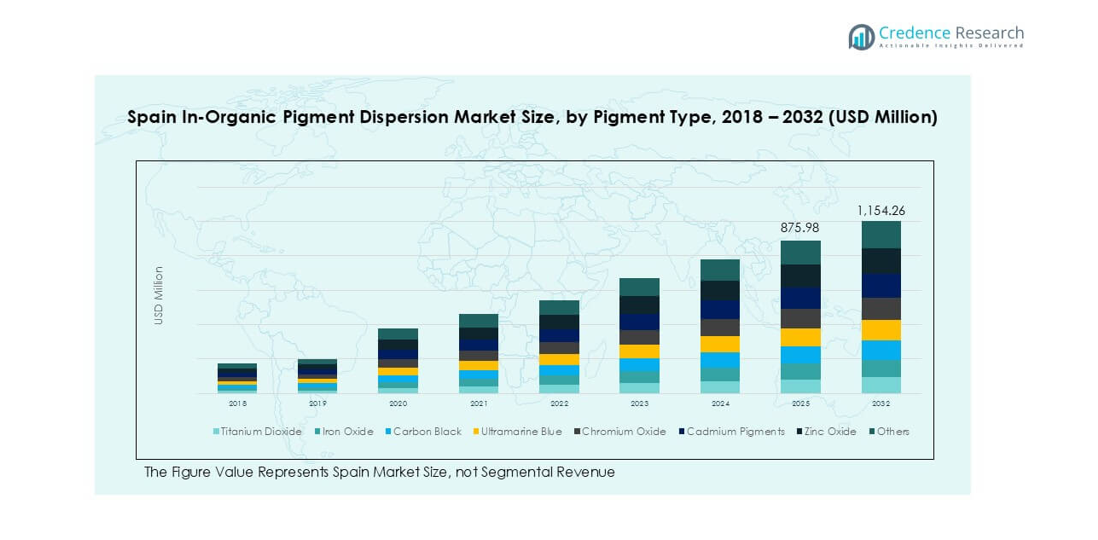

Spain In-Organic Pigment Dispersion market size was valued at USD 649.06 million in 2018, grew to USD 837.05 million in 2024, and is anticipated to reach USD 1,154.26 million by 2032, at a CAGR of 4.02% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain In-Organic Pigment Dispersion Market Size 2024 |

USD 837.05 million |

| Spain In-Organic Pigment Dispersion Market, CAGR |

4.02% |

| Spain In-Organic Pigment Dispersion Market Size 2032 |

USD 1,154.26 million |

BASF SE, Clariant AG, Heubach GmbH, and Lanxess AG dominate the Spain in-organic pigment dispersion market, supported by their wide portfolios of titanium dioxide, iron oxide, and specialty pigments. Venator Materials PLC and Cabot Corporation strengthen the market with carbon black and performance pigments, while Sudarshan Chemical Industries, Huntsman Corporation, DIC Corporation, Ferro Corporation, and Chromaflo cater to customized and cost-efficient solutions. Urban centers such as Madrid and Barcelona lead regional demand, holding over 45% market share in 2024, driven by large-scale construction, infrastructure projects, and industrial coatings.

Market Insights

- The Spain in-organic pigment dispersion market was valued at USD 837.05 million in 2024 and is projected to reach USD 1,154.26 million by 2032, growing at a CAGR of 4.02%.

- Growth is driven by strong demand from paints and coatings, which hold over 45% share, supported by infrastructure renovation, automotive refinishing, and rising construction spending across urban areas.

- Key trends include the shift toward eco-friendly, REACH-compliant pigment dispersions and adoption of advanced digital color-matching systems for improved efficiency and color consistency.

- BASF SE, Clariant AG, Heubach GmbH, and Lanxess AG lead the market, with Venator Materials PLC, Cabot Corporation, and Sudarshan Chemical Industries focusing on niche and cost-effective solutions.

- Urban centers such as Madrid and Barcelona dominate with over 45% regional share, followed by rural areas at nearly 30% and coastal regions at around 25%, reflecting diverse end-use consumption patterns.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Pigment Type

Titanium dioxide dominated the Spain in-organic pigment dispersion market in 2024, accounting for over 35% market share. Its strong demand is driven by high opacity, brightness, and UV resistance, making it essential for coatings and plastics. Iron oxide followed, supported by its cost-effectiveness and wide use in construction materials, while carbon black gained traction for automotive and industrial applications requiring high tinting strength. Ultramarine blue and chromium oxide cater to niche applications in cosmetics, plastics, and decorative coatings. Zinc oxide and cadmium pigments are used selectively for specialty applications due to regulatory and safety considerations.

- For instance, Lanxess produces more than 375,000 metric tons of iron oxide pigments annually, supplying European concrete and asphalt producers.

By Application

Paints and coatings led the market in 2024, capturing over 45% share. This dominance is supported by rising infrastructure spending, automotive refinishing, and demand for protective coatings. Printing inks followed, driven by packaging growth and demand for high-quality graphic printing. Plastics remain a significant segment as manufacturers seek enhanced color stability and UV protection in consumer goods and automotive components. Construction materials and ceramics are also growing users, supported by demand for durable pigments. Cosmetics applications are gaining momentum with the rising trend of mineral-based formulations in personal care products.

- For instance, AkzoNobel delivers protective and marine coatings to customers across Europe, with distribution that includes Spain’s significant shipbuilding and industrial sectors.

Market Overview

Rising Demand from Paints & Coatings

Paints and coatings remain the largest consumer of inorganic pigment dispersions in Spain, driving strong market demand. The growth is fueled by increasing infrastructure renovation, residential housing projects, and automotive refinishing activities. Titanium dioxide and iron oxide pigments dominate due to their opacity, color stability, and UV protection. Industrial and protective coatings also contribute, as manufacturers prioritize durability and weather resistance. The growing focus on eco-friendly, low-VOC coatings further boosts pigment consumption, with dispersion technology advancements ensuring better compatibility and improved color consistency across a wide range of applications.

- For instance, Venator Materials has significantly reduced its titanium dioxide (TiO₂) production capacity through closures and asset sales in 2024 and 2025. In early 2024, the company announced a plan to rationalize 130,000 metric tons of European TiO₂ capacity, including the shutdown of its Duisburg, Germany, plant and the continued offline status of its Scarlino, Italy, facility. In July 2024, Venator sold its 50% stake in the Louisiana Pigment Company joint venture, which accounted for 156,000 metric tons of TiO₂ capacity.

Expansion of Construction and Infrastructure Sector

Spain’s construction industry continues to recover, supporting rising use of iron oxide and chromium oxide pigments for concrete coloring, paving materials, and architectural coatings. Infrastructure projects, including roadways, commercial complexes, and public buildings, stimulate demand for high-performance pigments with excellent lightfastness and weather resistance. Government investments in urban development and refurbishment of aging structures further sustain market growth. The shift toward aesthetically enhanced construction materials drives adoption of durable and vibrant pigment dispersions, strengthening their role in long-term projects and supporting steady growth throughout the forecast period.

- For instance, Lanxess produces 375,000 metric tons of iron oxide pigments annually, supplying European concrete and paving material manufacturers, including those in Spain.

Growing Adoption in Plastics and Specialty Applications

Plastics represent a key growth driver as manufacturers seek pigments for high UV stability and consistent coloration. Demand is rising from packaging, consumer goods, and automotive sectors, where inorganic pigments ensure color retention under heat and light exposure. Specialty applications such as ceramics, glass, and cosmetics also contribute to growth, driven by increasing demand for mineral-based, safe, and stable pigments. Ultramarine blue and zinc oxide pigments are seeing increased uptake for their non-toxic properties and suitability in personal care products, adding diversity to market opportunities and supporting sustained volume growth.

Key Trends & Opportunities

Shift Toward Sustainable and Regulatory-Compliant Pigments

The market is witnessing a significant shift toward eco-friendly and regulatory-compliant pigment dispersions. Manufacturers are investing in heavy metal-free, low-VOC, and REACH-compliant solutions to meet EU environmental standards. Demand for sustainable pigments supports development of advanced dispersion systems with minimal environmental impact. This trend presents opportunities for companies offering innovative, non-toxic alternatives that deliver strong performance. The move toward circular economy practices in Spain, including recycled coatings and green construction initiatives, further encourages adoption of environmentally responsible pigment technologies, driving long-term market penetration across industries.

- For instance, Clariant launched its EcoTain® certified pigment portfolio, with more than 200 products evaluated for sustainability and REACH compliance.

Advancement in Dispersion Technology and Digital Color Solutions

Technological improvements in dispersion processes are enabling higher color strength, uniformity, and faster mixing times, reducing production costs for end-users. Digital color-matching and automated dosing systems are gaining traction, allowing manufacturers to achieve precise shades with minimal waste. This enhances operational efficiency for paint, ink, and plastic producers. Opportunities exist for pigment suppliers to offer pre-dispersed, ready-to-use solutions that simplify manufacturing workflows. These advancements strengthen customer loyalty and create a competitive advantage, especially for companies focused on delivering high-quality, consistent pigment solutions across diverse end-use sectors.

- For instance, Altana AG elevated its overall investments by 34% in 2023, totaling 138 million euros, focusing on site expansion and digitalization efforts.

Key Challenges

Stringent Environmental and Safety Regulations

Compliance with European regulations such as REACH and CLP presents a challenge for pigment manufacturers. Restrictions on hazardous substances, including cadmium and certain chromium compounds, require reformulation of products and investment in safer alternatives. This leads to higher production costs and extended development timelines. Companies must also ensure workplace safety and minimize emissions during manufacturing, adding to operational complexity. Failure to comply can result in penalties or market access restrictions, making regulatory adherence a critical but challenging aspect of business operations in this sector.

Volatility in Raw Material Prices

Fluctuating prices of raw materials such as titanium dioxide, iron oxide, and energy inputs impact profitability for pigment producers. Supply chain disruptions, driven by global demand fluctuations or geopolitical factors, can lead to cost spikes and product shortages. Small and mid-sized manufacturers are particularly vulnerable to margin pressures. Companies are adopting long-term supply agreements and efficiency measures to mitigate risk, but sustained price instability remains a key challenge. This volatility often leads to pricing adjustments downstream, affecting customer purchasing decisions and overall market growth rates.

Regional Analysis

Urban Centers (Madrid, Barcelona)

Urban centers such as Madrid and Barcelona held the largest share of over 45% in 2024. Demand is driven by high consumption of paints, coatings, and construction materials in infrastructure and residential projects. Rapid urbanization and renovation of commercial spaces fuel titanium dioxide and iron oxide pigment usage for premium architectural finishes. The presence of key manufacturers and distribution hubs supports strong availability and competitive pricing. Automotive and industrial coating applications further contribute to demand, making urban centers the dominant market segment and a primary growth driver through 2032.

Rural Areas

Rural areas accounted for nearly 30% of the market share in 2024, driven by demand for affordable coatings and construction pigments for housing and agricultural infrastructure. Iron oxide pigments are widely used for coloring concrete and roofing materials in rural development projects. Lower population density and slower industrialization limit consumption compared to urban centers, but government rural housing initiatives continue to support steady growth. Rising awareness about durable and weather-resistant coatings is also improving pigment adoption, gradually shifting the segment toward higher-value pigment dispersions with better performance and environmental compliance.

Coastal Regions

Coastal regions captured around 25% market share in 2024, supported by robust tourism-related construction and maintenance activities. Demand for high-performance pigments is driven by the need for corrosion-resistant and UV-stable coatings in marine environments. Titanium dioxide and chromium oxide pigments are preferred for protective and decorative coatings used in hotels, resorts, and port facilities. Growth in shipbuilding and repair activities further boosts carbon black and zinc oxide dispersions. The coastal market benefits from increasing investment in infrastructure resilience projects designed to withstand saline conditions, ensuring steady pigment consumption in the coming years.

Market Segmentations:

By Pigment Type

- Titanium Dioxide

- Iron Oxide

- Carbon Black

- Ultramarine Blue

- Chromium Oxide

- Cadmium Pigments

- Zinc Oxide

- Others

By Application

- Paints & Coatings

- Printing Inks

- Plastics

- Construction Materials

- Ceramics and Glass

- Cosmetics

- Others

By Geography

- Urban Centers (Madrid, Barcelona)

- Rural Areas

- Coastal regions

Competitive Landscape

The Spain in-organic pigment dispersion market is moderately consolidated, with key players focusing on technological advancements and sustainable solutions to maintain market share. BASF SE, Clariant AG, Heubach GmbH, and Lanxess AG lead the market with extensive product portfolios, including high-performance titanium dioxide, iron oxide, and specialty pigment dispersions. Venator Materials PLC and Cabot Corporation focus on developing high-quality carbon black and color solutions for coatings and plastics. Regional and mid-sized players such as Sudarshan Chemical Industries and Chromaflo are strengthening their presence through customized pigment solutions and competitive pricing strategies. Companies are actively investing in eco-friendly dispersions, regulatory-compliant formulations, and digital color-matching technologies to meet growing sustainability demands. Strategic collaborations, capacity expansions, and new product launches remain central to maintaining a competitive edge and capturing demand from construction, automotive, packaging, and cosmetics industries across urban, rural, and coastal markets in Spain.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Clariant AG

- Heubach GmbH

- Lanxess AG

- Venator Materials PLC

- Cabot Corporation

- Ferro Corporation

- DIC Corporation

- Sudarshan Chemical Industries

- Huntsman Corporation

- Chromaflo

Recent Developments

- In March 2025, Sudarshan Chemical Industries Limited (SCIL) completed its acquisition of the Heubach Group, establishing a global pigment leader with operations across 19 sites worldwide. The combined company will offer a wide, technologically advanced pigment portfolio and strengthen its presence in key markets like Europe and the Americas.

- In January 2023, BASF announced an investment to expand its polymer dispersions production capacity at its Merak site in Indonesia. The expansion aimed to meet the rising demand for styrene-butadiene and acrylic dispersions, driven by the growth of new paper mills and the high-quality packaging sector across Southeast Asia, Australia, and New Zealand. The Merak site, strategically located near key raw material suppliers and customers, played a vital role in supporting this regional demand.

- In January 2023, Cabot Corporation expanded its inkjet production facility in Haverhill, Massachusetts, to meet growing demand for digital printing applications. The expansion will increase capacity for aqueous inkjet dispersions, which support the shift from analog to digital printing by offering benefits like greater design customization, faster speed to market, and improved sustainability through reduced waste. Recent upgrades at the facility also include enhanced manufacturing equipment and processes that improve operational efficiency and reduce water usage. This investment positions Cabot to better serve the rapidly evolving inkjet market with a broader product portfolio and reliable global supply.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for titanium dioxide and iron oxide pigments will continue to rise with infrastructure growth.

- Paints and coatings will remain the dominant application, supported by residential and commercial construction projects.

- Eco-friendly and heavy-metal-free pigment dispersions will gain higher adoption due to EU regulations.

- Technological advances in dispersion processes will improve color consistency and production efficiency.

- Automotive and industrial coating applications will drive steady carbon black consumption.

- Rising use of mineral-based cosmetics will expand demand for ultramarine blue and zinc oxide pigments.

- Local manufacturers will invest in capacity expansions to meet growing domestic demand.

- Strategic collaborations between pigment suppliers and coating producers will boost market penetration.

- Urban centers will remain the largest regional consumer, with rural and coastal areas showing gradual growth.

- Digital color-matching systems and automated dosing solutions will shape future market competitiveness.