Market Overview:

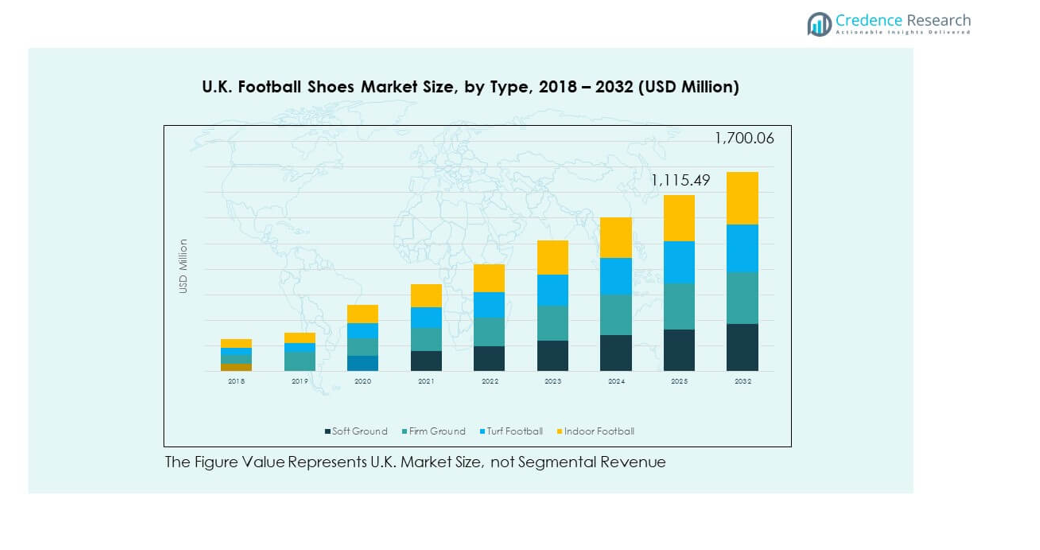

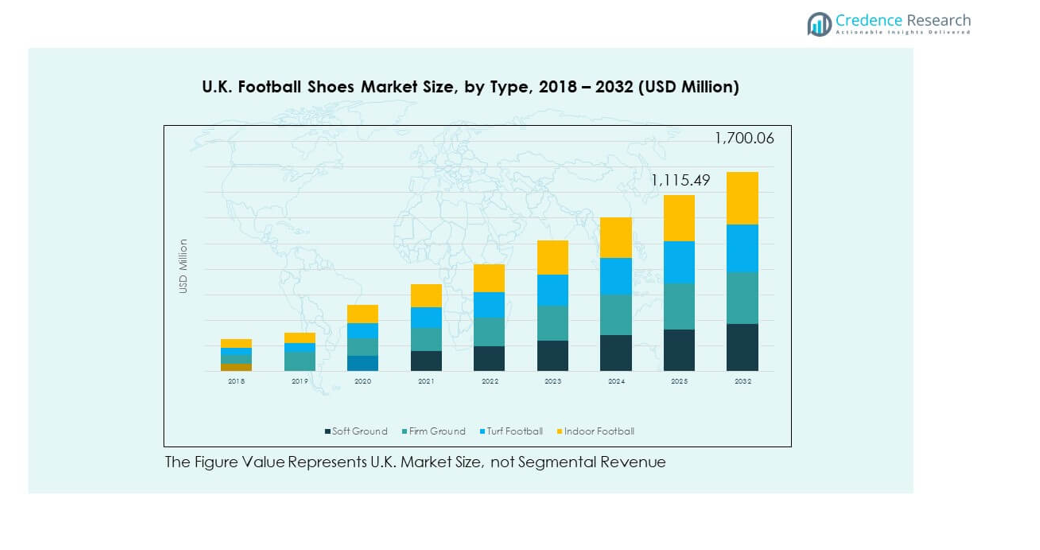

The UK Football Shoes Market size was valued at USD 768.04 million in 2018 to USD 1,054.93 million in 2024 and is anticipated to reach USD 1,700.06 million by 2032, at a CAGR of 6.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Football Shoes Market Size 2024 |

USD 1,054.93 million |

| UK Football Shoes Market, CAGR |

6.15% |

| UK Football Shoes Market Size 2032 |

SD 1,700.06 million |

Growth is driven by rising football participation across professional, amateur, and youth levels. The popularity of the Premier League enhances brand visibility and stimulates consumer demand for performance-focused footwear. Innovation in lightweight materials, traction technologies, and improved comfort features attracts both players and enthusiasts. Expanding grassroots programs and school-level engagement sustain recurring demand. Retail and digital platforms expand access to products, boosting adoption among wider demographics. It benefits from endorsement deals with elite athletes that create aspirational value.

Regionally, England leads due to its strong football culture, well-established leagues, and broad consumer base. Scotland follows with steady adoption supported by active club participation and community-level initiatives. Wales and Northern Ireland are emerging markets where growing youth programs and futsal activities are expanding demand. The presence of academies and regional investment strengthens adoption across both professional and recreational segments. It highlights the role of geographic diversity in shaping market growth across the UK.

Market Insights

- The UK Football Shoes Market was valued at USD 768.04 million in 2018, reached USD 1,054.93 million in 2024, and is projected to attain USD 1,700.06 million by 2032, expanding at a CAGR of 6.15%.

- England held 58% share in the UK Football Shoes Market due to its strong football culture, professional leagues, and consumer spending, while Scotland captured 19% supported by club participation and community programs, and Wales and Northern Ireland together contributed 23% driven by grassroots initiatives.

- Wales and Northern Ireland represent the fastest-growing region with 23% share, supported by rising futsal demand, youth programs, and expanding regional investments in football development.

- Firm ground football shoes accounted for 46% share of the market, reflecting widespread use across natural grass pitches, training fields, and competitive matches.

- Indoor football shoes held 18% share, fueled by the rising popularity of futsal and recreational activities in community spaces.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Participation in Football Across Youth and Amateur Levels

The UK Football Shoes Market gains strength from the steady rise in football participation across youth and amateur levels. Expanding grassroots programs promote early engagement and nurture long-term players. Demand grows from school-level competitions and regional clubs that encourage active involvement. Parents increasingly seek durable yet lightweight footwear that supports performance and reduces injuries. Product adoption is stronger among younger demographics seeking professional-grade designs. This growing consumer base drives consistent sales across entry-level and premium segments. Expanding community leagues also encourage higher purchasing frequency. It reinforces the role of football as a mainstream sport across the nation.

Growing Influence of Professional Leagues and Elite Players

The UK football culture thrives on the visibility of its top-tier leagues and elite athletes. High-profile tournaments showcase advanced footwear technologies, influencing consumer preferences across segments. Endorsements by global and local players boost trust and aspiration among fans. The Premier League serves as a major catalyst, with global broadcasts strengthening product awareness. Consumers replicate their favorite athletes by adopting the same footwear lines. It generates a cycle of demand that benefits both established and emerging brands. Visibility of professional-level performance creates a benchmark for quality. Market adoption accelerates when brands highlight on-field performance during competitive events.

- For instance, in March 2025, Puma was officially announced as the Premier League’s new ball supplier, ending a 25-year partnership with Nike and ensuring all official matches now feature engineered Puma technology for the league’s global audience.

Technological Advancements in Footwear Design and Materials

The market benefits from ongoing improvements in football shoe technology and material science. Lightweight synthetics improve agility, while reinforced soles enhance traction and stability. Consumers expect footwear that adapts to both natural grass and synthetic turf. Brands invest in research to create models that reduce fatigue and improve control. Enhanced cushioning and adaptive fit technologies support player comfort during long matches. It drives a preference for shoes that combine durability with modern styling. Innovation aligns with consumer demand for performance differentiation across competitive levels. Continuous updates in design maintain the momentum of market growth.

- For example, Nike’s Flyknit technology engineers yarns and fabric variations with precision placement to deliver targeted support and flexibility. The Flyknit Racer, one of its lightest models, features an upper and tongue weighing 34 grams and a total shoe weight of 160 grams (5.6 ounces).

Expanding Retail Channels and Strong Digital Commerce Growth

Distribution expansion supports wider availability of football footwear across physical and digital platforms. Major sports retailers invest in larger assortments to meet rising demand. Online marketplaces create a convenient channel with customizable purchasing experiences. Direct-to-consumer platforms highlight exclusive releases and limited-edition models. It ensures faster reach to younger audiences who prefer online shopping. Mobile apps with AR fitting tools improve personalization and reduce return rates. Hybrid retail models combining store trials with online fulfillment gain traction. Widening channel access enhances affordability and increases consumer awareness across diverse regions.

Market Trends

Rising Popularity of Customization and Personalized Product Features

Consumers increasingly demand personalization in football footwear to reflect unique styles and performance needs. Platforms offer customization options including colors, graphics, and soleplate configurations. It enhances consumer connection with the brand while promoting exclusivity. Younger demographics value the ability to design footwear that stands out. Brands utilize digital tools to expand customization services across physical and online stores. Personalized shoes often command premium prices, boosting revenue for manufacturers. This trend reflects a broader shift toward individual expression in sports gear. The UK Football Shoes Market embraces personalization as a core differentiation factor.

- For example, Nike’s official Nike By You platform enables consumers to personalize football boots by selecting colors, materials, and adding personal IDs. Nike also confirms its digital ecosystem of apps, including Nike and SNKRS, engages more than 170 million global users.

Sustainability Driving Material Innovation and Eco-Friendly Practices

Sustainability is reshaping the design and production strategies of leading footwear brands. Consumers actively prefer products created with recycled materials or renewable resources. Companies introduce models featuring bio-based synthetics and low-impact adhesives. It aligns with increasing awareness of environmental responsibility among younger buyers. Recycling programs targeting worn-out football shoes strengthen circular economy models. Sustainability credentials are now highlighted in product marketing to attract eco-conscious customers. Supply chains integrate greener manufacturing techniques to reduce waste and emissions. The UK Football Shoes Market evolves with sustainability as a long-term competitive driver.

- For example, Adidas announced on 21 April 2023 that 96% of polyester used in its products is now recycled polyester, marking a major milestone toward its goal of replacing virgin polyester by 2024.

Integration of Smart Technologies in Football Footwear Designs

Technological integration extends beyond material innovation into connected footwear solutions. Sensors embedded in soles provide performance tracking for speed, agility, and balance. It enables players to analyze metrics and improve training efficiency. Integration with mobile applications enhances the interactive experience for athletes. Professional clubs experiment with smart footwear for advanced coaching insights. The broader market shows interest as technology costs reduce and accessibility increases. Brands view connected shoes as premium offerings within competitive segments. The UK Football Shoes Market adapts by merging footwear with digital sports analytics.

Strong Lifestyle Adoption of Football Shoes Beyond Sporting Arenas

Football shoes are increasingly embraced as casual lifestyle wear outside of professional play. Streetwear culture incorporates football footwear into daily fashion statements. It appeals to urban consumers who value sporty aesthetics in casual wardrobes. Brands collaborate with fashion designers to release limited lifestyle editions. Retailers expand collections positioned specifically for lifestyle use. This blurring of lines between sport and fashion broadens the consumer base. Lifestyle adoption strengthens brand presence beyond competitive sports. The UK Football Shoes Market benefits from dual-purpose shoes serving both athletic and lifestyle needs.

Market Challenges Analysis

Intense Market Competition and High Consumer Price Sensitivity

The UK Football Shoes Market faces strong competition from established global brands and rising local players. Heavy marketing campaigns create pressure to differentiate products in saturated segments. Smaller brands struggle to match the visibility of premium competitors. It intensifies pricing battles, reducing margins across mid-tier categories. Consumers often compare prices online, creating challenges for consistent revenue growth. Loyalty is harder to maintain when consumers shift toward discounted or promotional models. Price sensitivity is higher in younger demographics with limited budgets. Competitive intensity demands continuous innovation while managing cost efficiency.

Counterfeit Products and Distribution Channel Complexities

The presence of counterfeit products poses a significant challenge for legitimate brands. Fake models often mimic premium designs but compromise on quality and durability. It erodes consumer trust and damages long-term brand reputation. Distribution networks must adapt to monitor authenticity and safeguard customers. Online marketplaces remain vulnerable to counterfeit listings with attractive pricing. It adds to operational costs for companies investing in anti-counterfeit measures. Complexities in cross-border e-commerce amplify the issue of product authenticity. The UK Football Shoes Market must address these risks to sustain consumer confidence.

Market Opportunities

Expanding Grassroots Programs and Community Football Development

Growth opportunities emerge from investments in grassroots football initiatives across schools and local clubs. Expanding participation increases demand for entry-level and performance-focused footwear. It encourages recurring purchases as young players progress through competitive levels. Brands supporting community tournaments strengthen trust and visibility within target audiences. Local sponsorships and player development programs foster long-term market engagement. Rising demand for affordable models ensures volume growth in retail channels. Collaborative initiatives between schools and clubs sustain steady product adoption. The UK Football Shoes Market captures these opportunities by aligning with community engagement.

Rising Digital Platforms and New-Age Consumer Engagement Channels

Digital platforms create significant opportunities for expanding product reach and customer interaction. Social media promotions build strong brand engagement with younger demographics. It allows brands to highlight new launches and innovative product features effectively. E-commerce platforms enable rapid access to limited-edition and exclusive designs. AR and VR tools enhance consumer decision-making through immersive product experiences. Interactive apps strengthen loyalty programs and personalized promotions. Expanding digital ecosystems improve visibility across both domestic and global markets. The UK Football Shoes Market advances by leveraging digital platforms for sustained growth.

Market Segmentation Analysis

By type, the UK Football Shoes Market is segmented into soft ground, firm ground, turf football, and indoor football. Firm ground shoes dominate due to widespread use on natural pitches and training fields. Soft ground models hold relevance for professional play in wet conditions, while turf football shoes cater to artificial pitches growing in number across the UK. Indoor football shoes capture steady demand through futsal and recreational games, supporting diversity in the segment. It demonstrates strong adaptability across multiple playing environments.

- For instance, Nike’s Mercurial line was the most-played football shoe globally, worn by 27% of footballers in 2023–2024, with Adidas X ranked second at 19%, as verified by usage statistics.

By stud type, the market is divided into metal studs, rubber studs, and flat soles. Metal studs maintain high preference among professional athletes requiring superior traction on moist pitches. Rubber studs provide balance for semi-professional and amateur levels with versatile performance. Flat sole models dominate indoor play, particularly in futsal and community halls. It reflects the importance of stud configuration in aligning footwear with surface-specific performance.

By sales channel, the market is categorized into retail channels, e-commerce, and direct to consumer. Retail channels continue to generate significant sales through specialty sports stores and multi-brand outlets. E-commerce platforms deliver faster access to new releases and customization services. Direct to consumer models allow brands to showcase exclusive launches and enhance margins. It ensures broader reach while reinforcing stronger consumer engagement.

- For instance, Decathlon’s specialty sports stores remain a major retail channel by prominently stocking diverse football footwear brands and models, cited as a key competitor and physical supplier in the global football shoe market during 2023.

Segmentation

By Type

- Soft Ground

- Firm Ground

- Turf Football

- Indoor Football

By Stud

- Metal Studs

- Rubber Studs

- Flat Sole

By Sales Channel

- Retail Channels

- E-commerce

- Direct to Consumer

Regional Analysis

England leads the UK Football Shoes Market with 58% share, driven by its established football culture and the dominance of Premier League clubs. Strong fan engagement and sponsorship deals foster demand for premium models. Retail presence is widespread, supported by flagship stores and digital platforms. Football academies across major cities further stimulate purchases of both performance and youth footwear. It remains the largest market due to consistent consumer spending and brand visibility. Strategic collaborations with clubs strengthen market penetration in this subregion.

Scotland holds 19% share, supported by its deep-rooted football heritage and growing participation at grassroots levels. Local leagues and community-driven initiatives generate steady demand for mid-range and entry-level products. Consumers display loyalty toward established international brands, although regional clubs influence product adoption. Market presence is reinforced by specialty retailers catering to varied playing conditions, from natural grass to artificial turf. It benefits from rising youth academies and school-level programs across cities such as Glasgow and Edinburgh. Strategic marketing campaigns sustain momentum in this subregion.

Wales and Northern Ireland together account for 23% share, with growing interest in football creating promising opportunities. Expansion of youth leagues and community football projects increases adoption of affordable models. Demand for specialized footwear tailored to indoor and futsal formats is gaining traction. International brands invest in regional distribution networks to strengthen access. It reflects rising enthusiasm for grassroots development supported by local associations. Emerging consumer interest positions both subregions as important growth contributors within the broader market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nike Inc.

- Adidas AG

- Puma SE

- Umbro

- Mizuno

- Lotto Sport Italia

- New Balance

- Gola

- Skechers

- Sokito

- Other Key Players

Competitive Analysis

The UK Football Shoes Market is defined by the dominance of global brands such as Nike, Adidas, and Puma, which collectively control a significant share of revenue. These companies leverage sponsorships with top clubs and athletes to reinforce their visibility. It maintains competitive intensity through frequent product innovations, integrating lightweight materials, advanced stud configurations, and sustainability-focused designs. Umbro, Mizuno, and Lotto Sport Italia compete by focusing on niche consumer groups and maintaining strong heritage associations. New Balance, Skechers, and emerging players like Sokito expand by targeting value-driven consumers and emphasizing eco-friendly offerings. Gola secures recognition by focusing on lifestyle and retro-inspired football footwear. Direct-to-consumer platforms enable brands to enhance margins while building closer relationships with buyers. Competition is further shaped by the rise of e-commerce and digital customization services, giving agile brands more access to diverse consumer segments. It continues to be a highly contested landscape where differentiation, brand loyalty, and technological advancements determine long-term success.

Recent Developments

- In September 2025, WSL Football announced a significant multi-year partnership with Nike to expand support for women’s football in England. As part of this collaboration, Nike will supply free football boots and goalkeeper gloves to all players in the Women’s Super League (WSL) and the second-tier WSL 2, marking a major step in supporting grassroots professional athletes. This new five-year deal not only extends Nike’s role as ball supplier but will also see the launch of the league’s first branded lifestyle merchandise collection later this month.

- In March 2025, Adidas AG announced a landmark multi-year partnership with Liverpool Football Club in the UK, becoming the club’s official kit partner from August 1, 2025, with new kits set to launch for the 2025/26 season; this move marks a significant return for Adidas to one of England’s iconic clubs.

Report Coverage

The research report offers an in-depth analysis based on Type, Stud and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK Football Shoes Market will witness rising adoption of lightweight and performance-driven footwear tailored for varying pitch conditions.

- Growing demand for sustainable and eco-friendly materials will push brands to innovate product design.

- Expansion of grassroots programs and youth academies will stimulate higher recurring demand across entry-level categories.

- Digital customization platforms will attract younger consumers seeking personalized footwear designs.

- Lifestyle integration of football shoes into streetwear fashion will expand the consumer base beyond professional players.

- E-commerce growth and direct-to-consumer channels will reshape distribution strategies across the market.

- Smart technologies and connected footwear will emerge as premium offerings for performance tracking.

- Collaborations with professional clubs and athletes will strengthen brand visibility and adoption trends.

- Regional markets such as Wales and Northern Ireland will create new growth opportunities through grassroots engagement.

- Competitive intensity will drive continuous investment in innovation, marketing, and sustainability practices across the industry.