Market Overview:

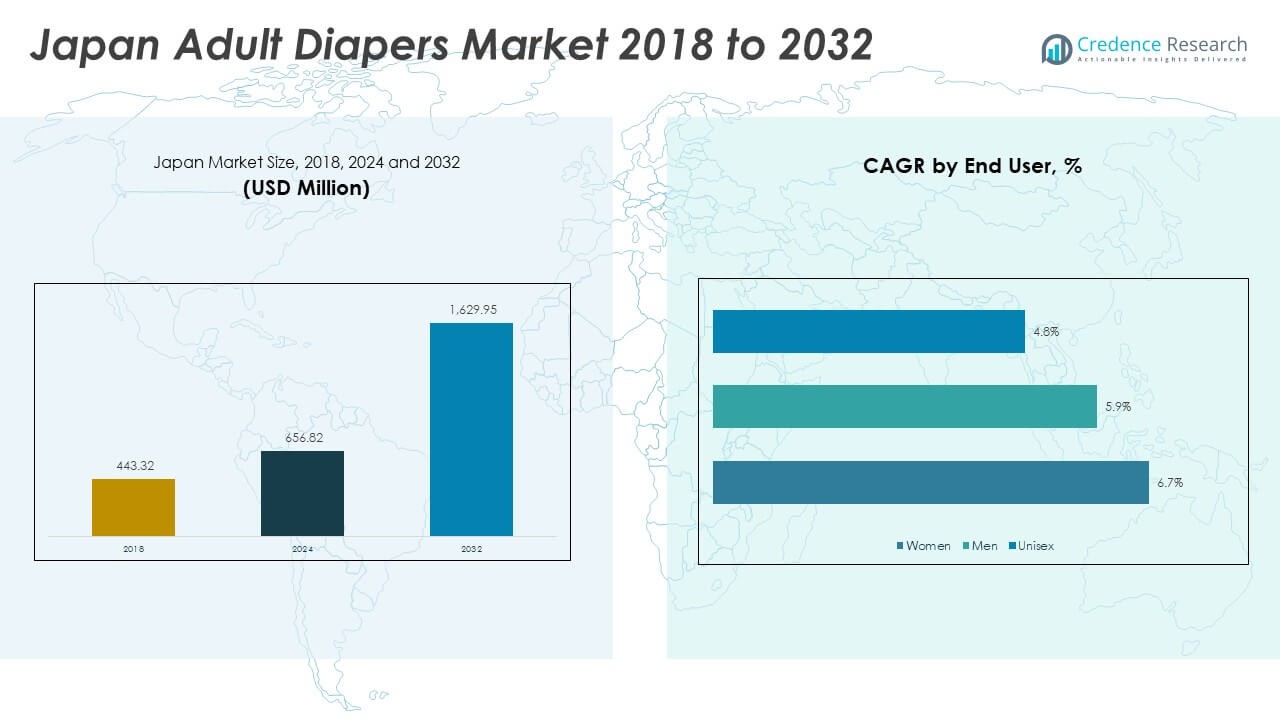

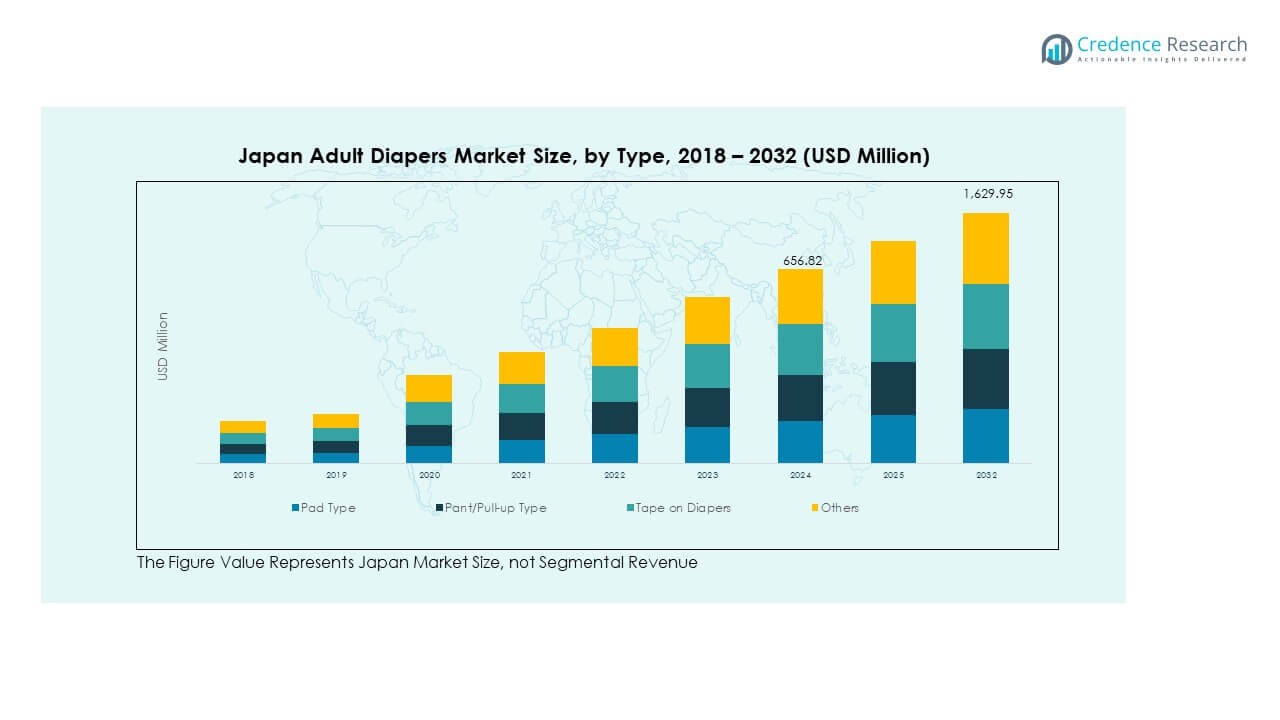

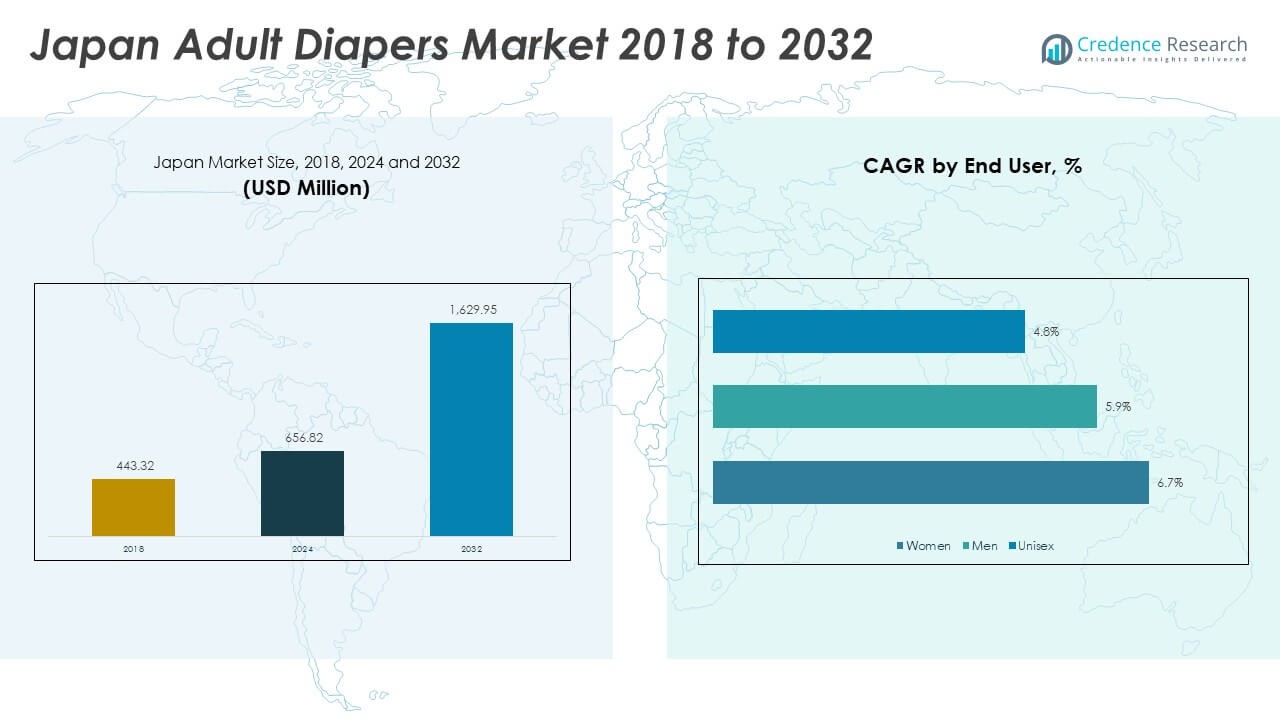

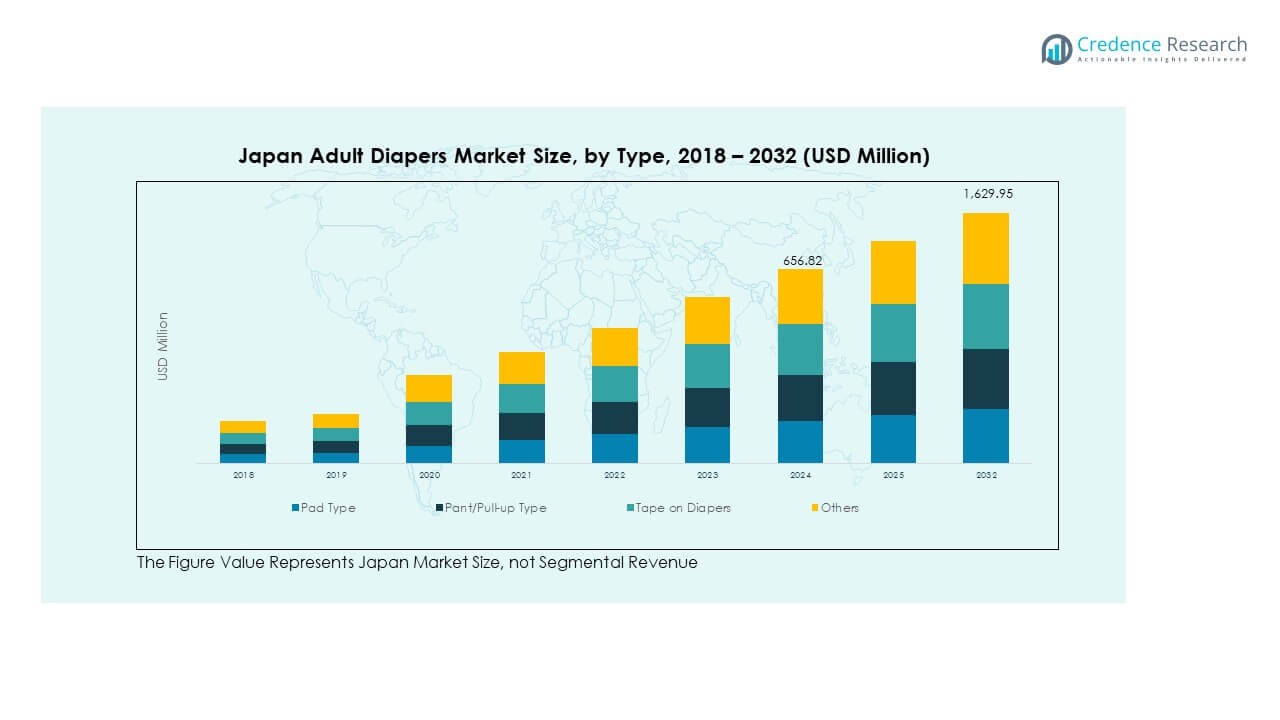

The Japan Adult Diapers Market size was valued at USD 443.32 million in 2018 to USD 656.82 million in 2024 and is anticipated to reach USD 1,629.95 million by 2032, at a CAGR of 12.03% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Adult Diapers Market Size 2024 |

USD 656.82 Million |

| Japan Adult Diapers Market, CAGR |

12.03% |

| Japan Adult Diapers Market Size 2032 |

USD 1,629.95 Million |

Growing awareness about hygiene, rising elderly population, and lifestyle-related health conditions are driving demand. Japan’s rapidly aging society increases the need for incontinence care products. Innovation in product design, such as improved absorbency, odor control, and comfort, supports greater acceptance among consumers. The shift toward home-based elder care also boosts sales, while retail and online channels provide wider accessibility. Increasing brand marketing campaigns encourage both caregivers and individuals to adopt these products more openly.

Regionally, Japan leads the adult diapers market due to its demographic profile and advanced healthcare infrastructure. The country has one of the highest proportions of elderly citizens globally, fueling strong demand. Urban areas drive market penetration as they offer better distribution networks and retail presence. Meanwhile, rural regions show emerging growth with expanding awareness and healthcare support. Neighboring Asian countries observe Japan’s innovations, making it a benchmark market in product adoption and development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan Adult Diapers Market was valued at USD 443.32 million in 2018, reached USD 656.82 million in 2024, and is projected to hit USD 1,629.95 million by 2032, growing at a CAGR of 12.03%.

- Eastern Japan led with 38% share in 2024 due to Tokyo’s large elderly base and advanced healthcare. Western Japan followed with 32%, supported by Kansai and Chubu’s aging demographics, while Northern and Southern Japan together contributed 30%.

- Southern Japan, including Kyushu and Okinawa, is the fastest-growing region with 14% share, driven by rapid aging, healthcare expansion, and improving retail penetration.

- Pant or pull-up type accounted for the largest segment at around 40% of total sales, supported by high demand for comfort and independence among elderly consumers.

- Tape-on diapers represented close to 30% share, with strong adoption in hospitals and care facilities where caregiver-managed products are widely used.

Market Drivers:

Growing Elderly Population Driving Strong and Consistent Product Demand Across Japan

The Japan Adult Diapers Market benefits greatly from its aging population, one of the highest worldwide. Rising life expectancy and a shrinking birth rate have shifted demographics significantly toward older adults. These citizens often face incontinence issues, creating steady demand for adult diaper products. The healthcare sector actively promotes their use as part of elderly care routines. Families also recognize their importance for home-based care, reducing hospitalization needs. Government awareness programs further normalize adoption among aging groups. This demographic shift ensures consistent growth for manufacturers and retailers.

- For instance, AVM Super Dry’s premium adult diapers, manufactured in India by Kamal Healthcare Products, utilize a 3D multi-layered pulp and Japanese SAP mixed core technology. This provides superior absorbency and features an anti-bacterial core for odor control. The product, marketed to adults with incontinence in India, provides up to 8 hours of leakage protection.

Increased Awareness of Hygiene and Comfort Boosting Market Acceptance Levels

Awareness about personal hygiene continues to grow in Japanese society, extending beyond younger demographics. Older individuals now embrace adult diapers without stigma due to effective awareness campaigns. The Japan Adult Diapers Market benefits from this cultural shift as comfort features gain importance. Brands are designing products that reduce skin irritation, eliminate odors, and ensure longer wear. These improvements create trust among caregivers and users alike. Hospitals and elderly care facilities reinforce hygiene standards by promoting reliable products. Increased education on elderly care also strengthens household-level adoption. This factor expands the consumer base steadily.

- For instance, Romsons Dignity Premium Pull-Up Adult Diapers provide leakage protection for up to 12 hours with breathable textile back sheets to reduce skin irritation, ensuring high comfort and hygiene standards in care facilities.

Product Innovation and Technology Advancements Improving User Experience and Satisfaction

Manufacturers are investing in technologies that improve absorbency and comfort. Smart sensors and thinner yet stronger materials enhance user confidence. The Japan Adult Diapers Market experiences rising demand due to these innovations. New product designs focus on lightweight construction, making diapers less bulky and more discreet. Features like moisture indicators and breathable fabrics raise acceptance among modern consumers. Brands emphasize convenience to encourage repeat purchases from caregivers. Innovation ensures that products remain relevant to evolving needs. This cycle drives competitive growth across the industry.

Expanding Retail and Online Distribution Channels Enhancing Market Penetration Nationwide

Retail outlets, pharmacies, and supermarkets offer broad accessibility across cities and towns. The Japan Adult Diapers Market gains further traction from rising e-commerce platforms. Online shopping provides discreet purchase options, appealing to customers who value privacy. Subscription services simplify recurring purchases for long-term users. Retail chains promote premium and budget-friendly product categories to address diverse income groups. Direct-to-consumer strategies strengthen brand visibility while boosting loyalty. Digital advertising highlights comfort and dignity, reducing social barriers to use. Strong distribution networks expand product reach beyond urban centers into rural markets.

Market Trends:

Shift Toward Premium and Eco-Friendly Products Meeting Consumer Preferences and Values

Consumers increasingly prefer premium diapers offering comfort, skin protection, and eco-friendly materials. The Japan Adult Diapers Market responds with biodegradable and sustainable options. Brands highlight organic cotton, recyclable packaging, and reduced chemical use. Eco-conscious purchasing appeals to socially aware buyers and caregivers. Premium features like softness, breathability, and odor-neutralization drive sales among urban populations. Consumers link eco-friendly products with health benefits, fueling demand further. Sustainable options support corporate social responsibility initiatives. This trend differentiates leading brands in a competitive market.

- For instance, Dailee adult diapers by Unicare Company in Japan emphasize superior absorbency with skin-friendly design and eco-conscious manufacturing, contributing to sustainability efforts while maintaining user comfort.

Integration of Smart Technology and Sensor-Based Monitoring Features in Products

Technology plays a growing role in adult diaper design. The Japan Adult Diapers Market incorporates sensor-based solutions for real-time monitoring. Products with wetness indicators help caregivers manage patients efficiently. Smart diapers connect with apps, allowing remote monitoring in care facilities. These innovations reduce discomfort and prevent skin-related issues. Hospitals adopt such products to streamline patient care routines. Home-based caregivers benefit from improved convenience and time savings. Technology integration strengthens product appeal and enhances compliance in elderly care. This trend demonstrates alignment with Japan’s advanced digital infrastructure.

- For instance, Triple W’s DFree wearable technology, used in over 500 senior care facilities, employs ultrasound sensors to discreetly notify the user when the bladder is full, enhancing timely care and comfort.

Customization and Gender-Specific Product Lines Driving Consumer Adoption Rates

Brands are increasingly offering gender-specific products tailored to different needs. The Japan Adult Diapers Market expands its range with customized fits and absorbency levels. Male and female-specific designs improve comfort and usability. Customized sizing addresses varying body structures among elderly users. Such options reduce leakage and enhance satisfaction for both patients and caregivers. Marketing campaigns promote these specialized products as high-quality solutions. Care facilities prefer tailored items to improve patient dignity and reduce costs. Customization continues to attract new buyers seeking reliability.

Growth of Home Healthcare and Long-Term Care Facilities Stimulating Demand Expansion

Japan’s strong focus on elderly care fuels demand for home healthcare products. The Japan Adult Diapers Market benefits from rising investments in nursing homes and long-term care. Families increasingly adopt home-based caregiving supported by government programs. Hospitals integrate adult diapers into standard protocols for incontinence management. Growth in private elderly care services boosts institutional demand. Insurance support for incontinence care products adds further momentum. Urban centers with aging populations see the highest adoption rates. Long-term care growth ensures sustainable demand across the country.

Market Challenges Analysis:

High Product Costs and Limited Affordability Among Price-Sensitive Consumers

The Japan Adult Diapers Market faces challenges from high product pricing. Premium features increase costs, making them unaffordable for certain households. Price-sensitive consumers often shift toward cheaper alternatives or reduce purchase frequency. Despite quality improvements, affordability remains a barrier to mass adoption. Healthcare facilities face budget constraints in adopting premium brands for patients. Subsidy programs offer partial relief but do not cover all expenses. Rising raw material prices further pressure production costs. This situation limits uniform growth across all consumer segments.

Social Stigma and Limited Awareness in Rural Populations Restricting Market Growth

Cultural perceptions still associate adult diapers with embarrassment. The Japan Adult Diapers Market encounters reluctance among rural and semi-urban populations. Limited awareness campaigns in non-urban regions restrict acceptance. Many elderly avoid using diapers due to perceived loss of dignity. Caregivers also hesitate to purchase openly due to stigma. Distribution in rural areas remains weaker compared to urban regions. This reduces exposure and hinders consistent adoption nationwide. Overcoming stigma requires targeted education, local outreach, and awareness-driven marketing.

Market Opportunities:

Rising Demand for Eco-Friendly and Biodegradable Adult Diaper Products in Japan

The Japan Adult Diapers Market has opportunities in eco-friendly products. Sustainable materials attract consumers prioritizing environmental responsibility. Biodegradable diapers reduce disposal concerns, aligning with government sustainability goals. Urban consumers show high willingness to pay for eco-safe options. Brands can expand premium lines targeting this demand. Hospitals and care homes adopting green products boost bulk orders. This creates long-term opportunities for growth.

Expansion of Digital Platforms and Subscription-Based Distribution Models Nationwide

The Japan Adult Diapers Market benefits from growing online retail. Subscription-based services offer convenience for caregivers and elderly patients. Automated deliveries ensure uninterrupted supply while maintaining discretion. Digital platforms allow brands to target consumers directly with promotions. E-commerce strengthens brand visibility in both urban and rural Japan. Bundled offers and loyalty rewards further enhance customer retention. Digital adoption creates scalable opportunities for consistent revenue growth.

Market Segmentation Analysis:

By Type

The Japan Adult Diapers Market is segmented into pad type, pant or pull-up type, tape-on diapers, and others. Pant or pull-up type products hold significant demand due to convenience and comfort. Tape-on diapers maintain steady adoption in healthcare facilities where caregivers manage usage. Pad type products appeal to users seeking cost-effective and lighter alternatives. Innovation in design and absorbency is boosting the appeal of premium categories. Brands invest in specialized solutions to meet diverse requirements. This segmentation highlights how product variety supports broader consumer acceptance.

- For instance, the pant-style adult diapers segment held about 46% of the market share in 2022.

By End-User

Women form a leading consumer group owing to higher life expectancy and a greater share of elderly females. Men represent a growing segment with products designed to address anatomical needs. Unisex products serve a wide base, ensuring flexibility in supply chains. The Japan Adult Diapers Market benefits from targeted marketing that positions products for comfort and dignity across genders. End-user segmentation enables companies to design solutions tailored to lifestyle, health, and caregiving contexts.

- For instance, research indicates that the women’s segment dominates the market due to higher prevalence of incontinence among females, and products in this segment include specialized odor control and discreet packaging to address female consumer preferences.

By Distribution Channel

Offline channels, including supermarkets, pharmacies, and specialty stores, dominate sales due to accessibility and immediate availability. E-commerce continues to expand, driven by rising digital adoption and the appeal of discreet purchases. Subscription models in online platforms provide steady supply for long-term users. It is expected that both channels will continue to complement each other in reaching urban and rural markets.

Segmentation:

By Type

- Pad Type

- Pant / Pull-up Type

- Tape-on Diapers

- Others

By End-User

By Distribution Channel

- E-Commerce

- Offline Channel

Regional Analysis:

Eastern Japan: Tokyo and Surrounding Prefectures Leading the Market

Eastern Japan, with Tokyo and its surrounding prefectures, dominates the Japan Adult Diapers Market with nearly 38% share. The region’s large elderly population, advanced healthcare infrastructure, and strong retail networks fuel consistent demand. Tokyo serves as a hub for innovation, with leading brands launching premium and technology-driven products. Urban consumers show higher acceptance of adult diapers due to better awareness campaigns and strong hospital adoption. The presence of multinational and domestic companies strengthens product accessibility and consumer confidence. It continues to set the benchmark for product development and market penetration across the country.

Western Japan: Kansai and Chubu Regions Driving Steady Growth

Western Japan, led by the Kansai and Chubu regions, accounts for around 32% of the market share. Population aging, especially in Osaka and Nagoya, drives rising adoption of incontinence care products. Offline distribution remains dominant, supported by established retail chains and pharmacies. The region benefits from healthcare collaborations and caregiver programs that promote reliable diaper usage. Consumers here are price-sensitive yet open to mid-range products offering comfort and durability. It represents a balanced market where both premium and budget products find steady demand.

Northern and Southern Japan: Emerging Regions with Expanding Adoption

Northern Japan, including Hokkaido, and Southern Japan, covering Kyushu and Okinawa, collectively contribute about 30% of the Japan Adult Diapers Market. These regions are emerging with rising awareness and expanding healthcare support for elderly care. Rural areas show gradual adoption as government programs extend access to affordable products. E-commerce platforms play a vital role by addressing supply gaps and offering discreet purchase options. Southern Japan demonstrates faster growth due to its aging demographics and regional distribution improvements. It is expected that these regions will witness stronger demand in the coming years, supporting nationwide market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Unicharm Corporation

- Daio Paper Corporation

- Nippon Paper Industries Co., Ltd.

- Kao Corporation

- Pigeon Corporation

- Kimberly-Clark Corporation

- Procter & Gamble Co.

- Hengan International Group Company Limited

- Chiaus (Fujian) Industry Development Co., Ltd.

- Fujian Hengan Group Ltd.

Competitive Analysis:

The Japan Adult Diapers Market is highly competitive with strong participation from domestic and international players. Unicharm Corporation and Daio Paper Corporation dominate due to their extensive distribution and strong product portfolios. Global leaders such as Procter & Gamble and Kimberly-Clark strengthen competition through innovation and brand presence. It continues to attract new entrants focusing on eco-friendly and cost-efficient products. Companies invest in research and development to improve absorbency, comfort, and sustainability. Partnerships with healthcare providers and retail channels enhance accessibility. Competitive intensity remains high, supported by marketing strategies and rapid e-commerce expansion.

Recent Developments:

- In Japan, Unicharm Corporation continues to lead the adult diaper market with a focus on innovative and comfortable products that cater to the aging population. In February 2025, Unicharm announced plans to expand manufacturing capacity globally, particularly highlighting a new plant in India, emphasizing quality and convenience for developing countries.

- Daio Paper Corporation has increased production of adult diapers with growing market demand in Japan, as of July 2024. Their facility near Mount Fuji reported significant year-over-year production increases, with marketing focused on products that provide comfort and discretion for wearers engaged in active lifestyles.

- Nippon Paper Industries Co., Ltd. is also ramping up operations in the adult diaper segment, in response to Japan’s demographic trends. The company, alongside Daio, is expanding manufacturing capacity to meet rising demand for incontinence products driven by the elderly population.

- Pigeon Corporation entered a strategic partnership with Japan Activation Capital in May 2025 to drive sustainable growth, which supports their business development including hygiene-related products such as adult diapers.

Report Coverage:

The research report offers an in-depth analysis based on type, end-user, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Aging demographics will continue to sustain high demand across urban and rural regions.

- E-commerce platforms will expand, offering discreet purchases and subscription models.

- Eco-friendly and biodegradable products will see stronger adoption among consumers.

- Premium product categories will grow with innovations in comfort and absorbency.

- Smart sensor-enabled diapers will gain traction in healthcare facilities and home care.

- Gender-specific products will strengthen adoption among targeted elderly groups.

- Offline retail will remain dominant while online channels record the fastest growth.

- Domestic leaders will focus on R&D while international brands expand portfolios.

- Rural markets will emerge with government-led awareness and distribution programs.

- Marketing campaigns will reinforce dignity and normalize usage, boosting acceptance.