Market Overview:

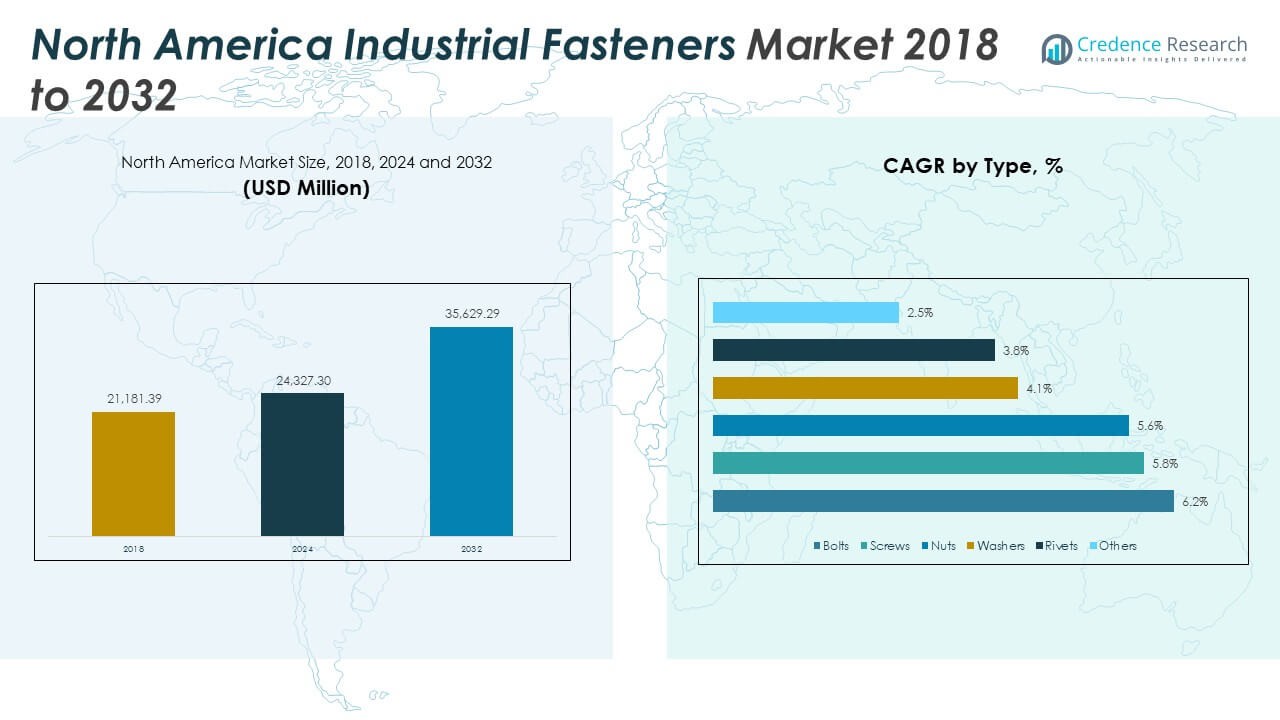

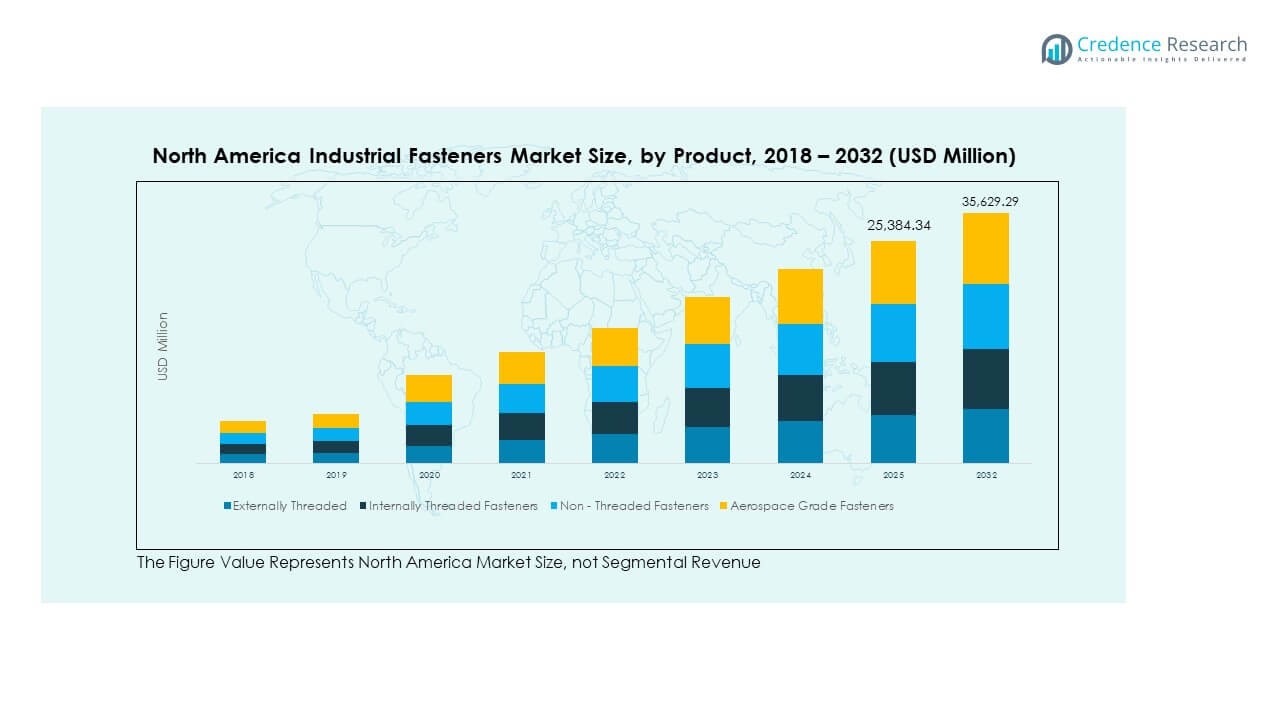

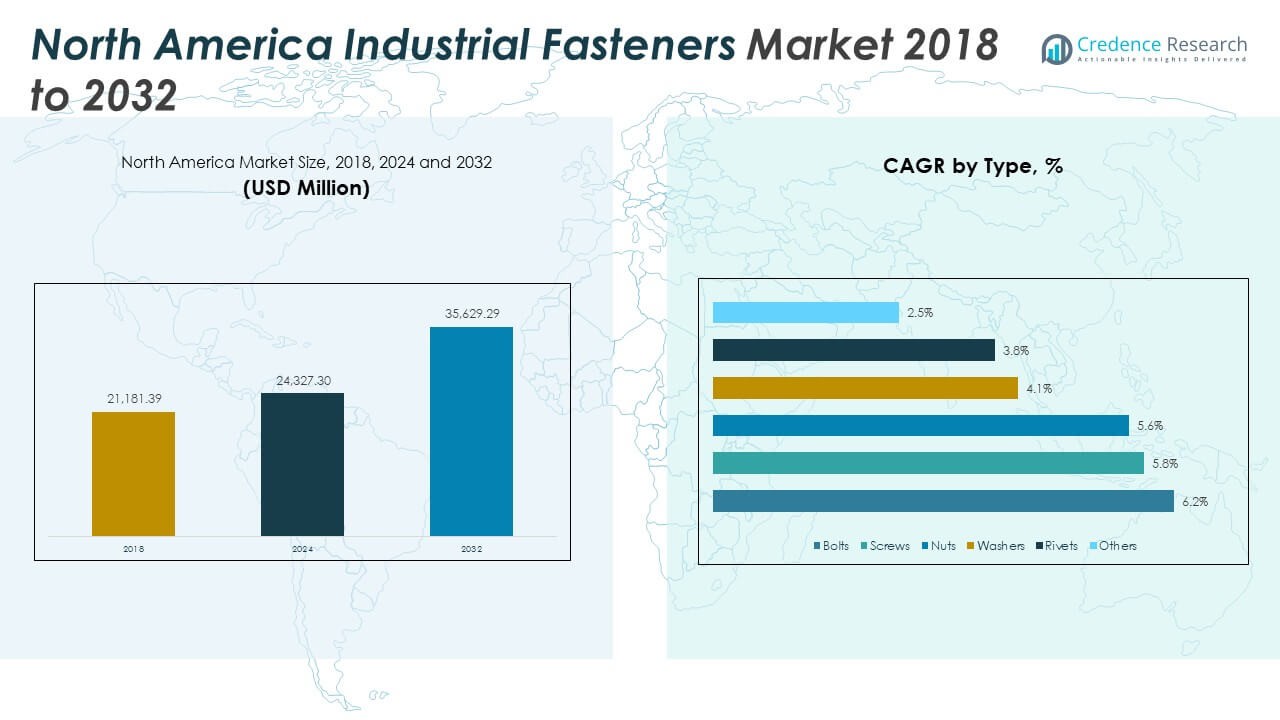

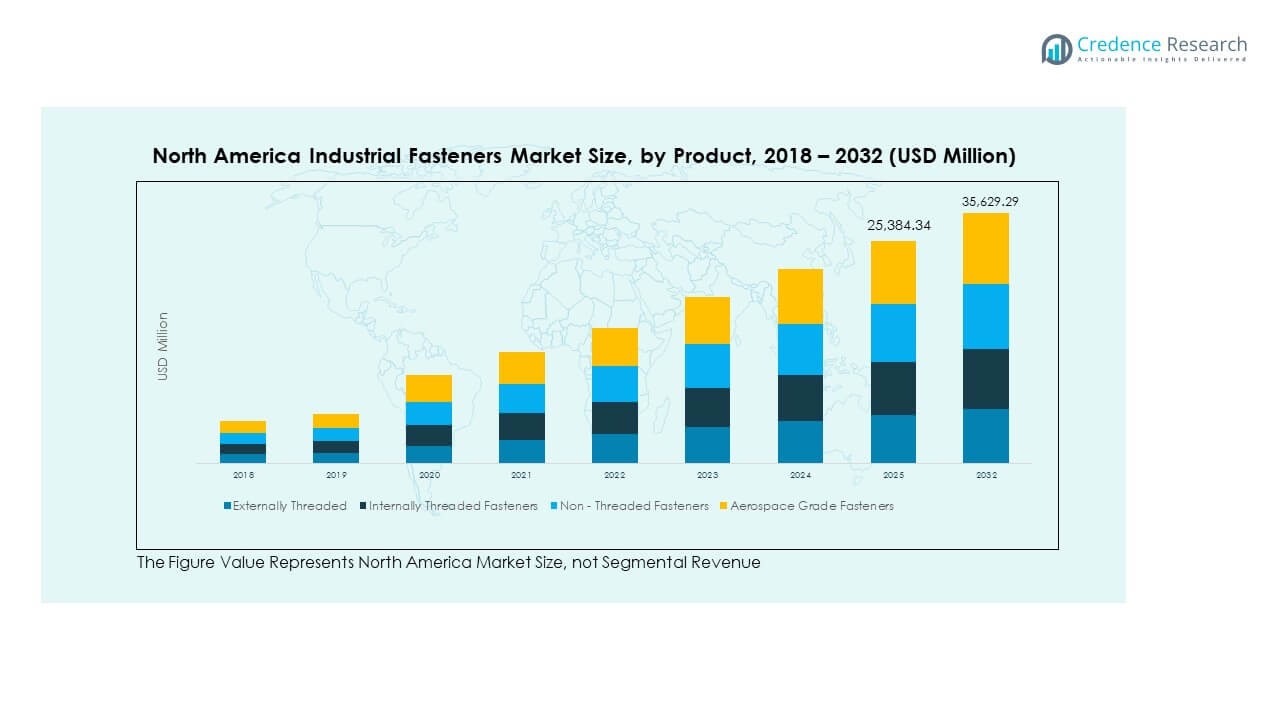

The North America Industrial Fasteners Market size was valued at USD 21,181.39 million in 2018 to USD 24,327.30 million in 2024 and is anticipated to reach USD 35,629.29 million by 2032, at a CAGR of 4.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Industrial Fasteners Market Size 2024 |

USD 24,327.30 Million |

| North America Industrial Fasteners Market, CAGR |

4.89% |

| North America Industrial Fasteners Market Size 2032 |

USD 35,629.29 Million |

Growth in this market is fueled by the expansion of automotive, aerospace, and construction industries across the region. Rising demand for lightweight and high-strength fasteners supports innovation in materials such as aluminum and composites. Increased infrastructure development, combined with stricter safety standards, encourages adoption of advanced fastening solutions. Manufacturers are also focusing on precision engineering to meet the needs of modern machinery and equipment. This combination of industry growth and technological advancement strengthens the market outlook.

Geographically, the United States leads the North America Industrial Fasteners Market, supported by its large manufacturing base and ongoing infrastructure investments. Canada shows steady demand, especially in automotive and aerospace sectors, while Mexico is emerging as a fast-growing hub due to rising industrial output and supportive trade agreements. These dynamics create a diverse regional market, where mature economies focus on innovation and quality, while developing regions expand production capacity and cost competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Industrial Fasteners Market was valued at USD 21,181.39 million in 2018, reached USD 24,327.30 million in 2024, and is projected to achieve USD 35,629.29 million by 2032, growing at a CAGR of 4.89%.

- The United States leads with over 70% share, supported by its strong manufacturing base, Canada follows with about 15% share from aerospace and construction projects, while Mexico holds nearly 15% due to its expanding automotive sector.

- Mexico is the fastest-growing region, driven by its cost-effective manufacturing, rising automotive production, and favorable trade agreements supporting export opportunities.

- Externally threaded fasteners hold the largest segment share, supported by their versatility across automotive, machinery, and construction industries.

- Aerospace grade fasteners represent a growing premium segment, supported by strong demand in defense and aviation for high-performance fastening systems.

Market Drivers:

Expansion of Automotive and Aerospace Manufacturing Across North America:

The automotive and aerospace sectors are major contributors to the demand for industrial fasteners. Automakers rely on lightweight and durable fasteners to improve vehicle efficiency and meet emission standards. Aerospace manufacturers demand precision-engineered fasteners to handle extreme environments and structural stress. This continuous reliance on advanced fastening solutions strengthens growth for suppliers. The North America Industrial Fasteners Market benefits from consistent investment in these industries. Rising adoption of electric vehicles also accelerates new product development. Aerospace modernization projects in defense and commercial aviation sustain demand.

- For instance, Illinois Tool Works launched new lightweight fastener solutions specifically designed for electric vehicle battery pack assembly, addressing the unique requirements of thermal management and high-voltage electrical isolation, supporting thousands of EV production units in North America. Aerospace manufacturers demand precision-engineered fasteners to handle extreme environments and structural stress.

Rising Infrastructure Development and Construction Investments in the Region:

Ongoing infrastructure upgrades across highways, bridges, and smart city projects create significant demand. Construction requires a wide range of structural fasteners, from heavy-duty bolts to specialty connectors. Governments in the region prioritize infrastructure safety and modernization. These initiatives push contractors to adopt higher-quality fastening products. The North America Industrial Fasteners Market gains momentum from large-scale investments. Residential and commercial construction also boosts fastener usage. This growth trajectory encourages manufacturers to diversify product lines to serve multiple projects. Safety regulations further increase adoption of certified fastening solutions.

- For instance, in March 2021, Valley Forge & Bolt introduced its “High-Temp Maxbolt” capable of withstanding temperatures up to 650°F. While this product provides higher-quality fastening for extreme temperature environments, it was announced months before the U.S. Infrastructure Investment and Jobs Act (IIJA) was signed into law in November

Advancements in Materials and Design for Enhanced Durability and Performance:

Innovation in fastener materials is driving significant opportunities in the regional market. Manufacturers use alloys, composites, and coatings to improve corrosion resistance and strength. These features extend the lifespan of critical equipment in harsh environments. It also enhances performance in industries like oil and gas and heavy machinery. The North America Industrial Fasteners Market leverages this demand for advanced products. Customization for industry-specific applications creates long-term partnerships with OEMs. Continuous R&D investments enable the production of lighter yet stronger fastening options. This focus improves safety, efficiency, and overall cost savings.

Growth in Industrial Machinery and Equipment Manufacturing Activities:

The machinery and equipment sector plays a vital role in fastener adoption. Heavy machines require high-strength fasteners to maintain reliability and safety. Expansion of manufacturing facilities across the region supports higher consumption levels. It also drives innovation in fastening solutions designed for precision assembly. The North America Industrial Fasteners Market thrives under these dynamics. Machinery exports from the region reinforce supplier networks and boost demand. Manufacturers invest in automation, increasing the need for durable fastening components. This sector remains a consistent driver of long-term market growth.

Market Trends:

Shift Toward Sustainable and Eco-Friendly Manufacturing of Fasteners:

Sustainability is emerging as a critical focus for regional manufacturers. Companies adopt eco-friendly materials and production methods to reduce environmental impact. Fasteners with recyclable content and low-energy coatings are gaining traction. It aligns with broader corporate responsibility commitments and government standards. The North America Industrial Fasteners Market adapts by investing in green technologies. Customers increasingly favor suppliers with transparent sustainability practices. Demand for eco-certified products continues to expand across industries. This shift enhances brand value and market competitiveness for manufacturers.

- For instance, LISI Automotive has partnered with ArcelorMittal to use “XCarb® recycled and renewably produced steel,” which is derived from a high percentage of scrap. LISI is focused on reducing its environmental footprint and has implemented energy-saving measures, such as a heat recovery project for a furnace.

Integration of Digital Technologies and Smart Fastening Solutions:

The adoption of smart fastening systems is gaining attention in modern industries. These solutions integrate sensors to monitor tension, torque, and wear in real time. It improves safety and reduces maintenance costs in critical applications. Aerospace and defense sectors show strong interest in digital fastening technologies. The North America Industrial Fasteners Market is embracing this trend for innovation. Data-driven tools help optimize performance and predict failures. Smart solutions also support Industry 4.0 initiatives across manufacturing plants. This integration strengthens long-term operational reliability and efficiency.

- For instance, Stanley Black & Decker’s STANLEY® Engineered Fastening division provides advanced assembly systems, including DC-electric torque tools, for the aerospace and defense sectors. These systems enable real-time tightening verification and data collection on assembly lines, which helps improve fastening quality and reduce maintenance failures in critical components. Aerospace and defense sectors show strong interest in these digital fastening technologies to ensure precision, safety, and reliability.

Customization and Specialized Fasteners for Industry-Specific Applications:

Rising demand for application-specific solutions encourages tailored product development. Industries such as medical devices, renewable energy, and electronics seek precision fasteners. It creates opportunities for suppliers offering customized designs and coatings. The North America Industrial Fasteners Market adapts by focusing on niche requirements. Manufacturers design specialized products to meet unique performance standards. Customization enhances reliability, safety, and ease of installation. It also fosters strong customer relationships and repeat business. The trend toward bespoke solutions expands market diversity and scope.

Growing Demand for Lightweight Fasteners in Electric Vehicle Production:

The EV industry is accelerating the demand for lightweight fastening components. Manufacturers require strong yet light solutions to support efficiency and battery safety. It is reshaping the design priorities of automotive fastener producers. The North America Industrial Fasteners Market benefits from this shift in vehicle architecture. Aluminum, titanium, and composite-based fasteners are gaining prominence. The focus on energy efficiency aligns with consumer and regulatory expectations. This trend creates a pipeline for innovation in design and manufacturing. Suppliers investing in EV-oriented products strengthen their long-term competitiveness.

Market Challenges Analysis:

Volatility in Raw Material Prices and Supply Chain Disruptions:

Fluctuating raw material costs continue to affect manufacturer profitability. Steel, aluminum, and specialty alloys experience frequent price swings. It creates uncertainty for producers planning long-term contracts. Supply chain disruptions further complicate availability and delivery schedules. The North America Industrial Fasteners Market faces higher operational risks from these challenges. Logistics delays impact project timelines across construction and automotive sectors. Manufacturers also deal with increased costs in transportation and labor shortages. These issues hinder overall stability and growth potential.

Rising Competition From Low-Cost Import Alternatives:

Intense competition from imported fasteners poses a serious threat to regional suppliers. Low-cost alternatives from Asia impact pricing and margins. It pressures local manufacturers to focus on differentiation through quality and innovation. Compliance with stricter regulations adds cost layers for domestic producers. The North America Industrial Fasteners Market must navigate this pricing challenge strategically. Many buyers prioritize affordability over advanced specifications. This trend limits the ability of local companies to expand rapidly. Sustaining grow th requires stronger branding and technological superiority.

Market Opportunities:

Adoption of Advanced Fasteners in Renewable Energy and Infrastructure Projects:

he expansion of renewable energy projects creates new opportunities for manufacturers. Wind turbines and solar farms require specialized fastening solutions for durability. It enhances market scope in sectors moving toward sustainable energy. The North America Industrial Fasteners Market is well-positioned to meet these needs. Infrastructure modernization projects further accelerate demand for high-strength products. Manufacturers offering tailored solutions for these sectors gain competitive advantages. Strategic partnerships with renewable energy developers reinforce future growth potential.

Expansion of Aftermarket Services and Distribution Networks Across the Region:

Aftermarket sales represent a growing opportunity for suppliers. Industries increasingly seek reliable fastener replacement and maintenance solutions. It allows manufacturers to strengthen revenue streams beyond OEM contracts. The North America Industrial Fasteners Market benefits from expanding distribution networks. E-commerce platforms provide direct access to a broader customer base. Regional players leverage aftermarket demand to improve brand presence. Value-added services such as technical support and custom packaging enhance loyalty. This focus secures long-term customer engagement and profitability.

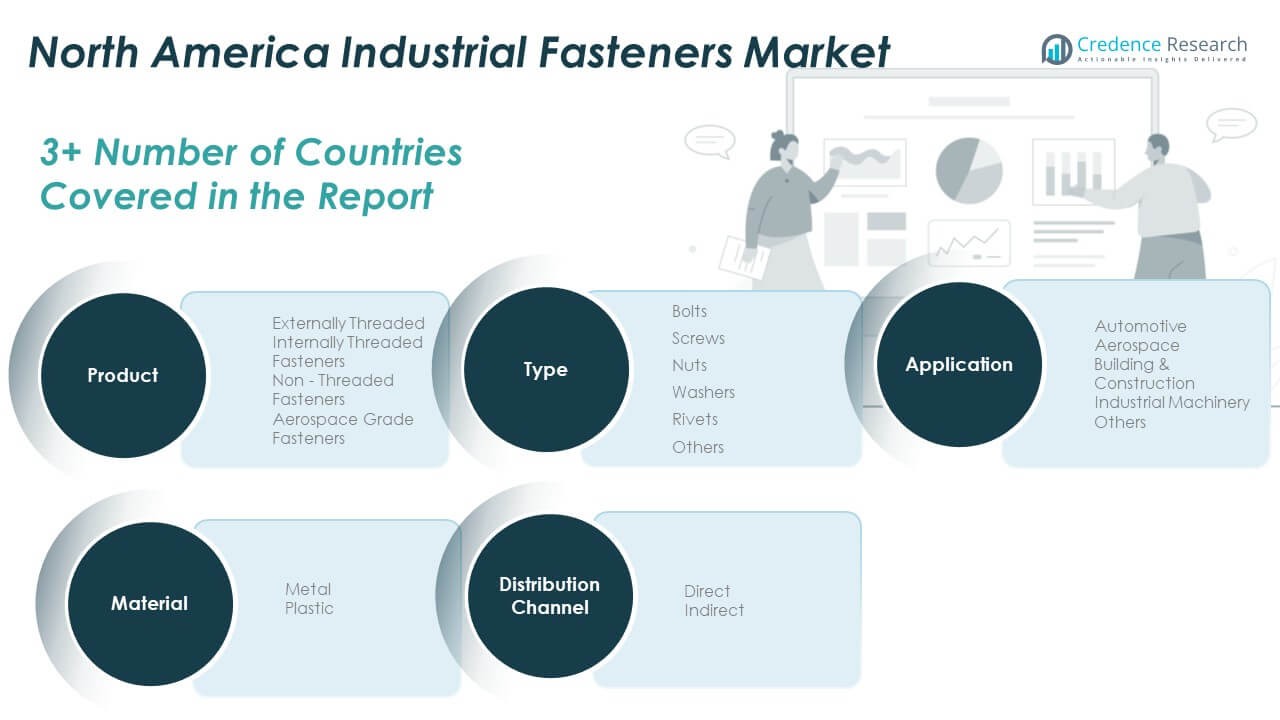

Market Segmentation Analysis:

By Type

Bolts and screws dominate usage due to their wide application across automotive, machinery, and construction. Nuts and washers provide critical support for structural integrity. Rivets serve aerospace and specialized industries, while other fasteners meet niche requirements. The North America Industrial Fasteners Market benefits from this broad demand base, driven by high-strength and precision-engineered products.

- For instance, Bulten AB expanded its presence in North America, often through joint ventures and partnerships, to supply specialized high-strength fasteners to the vehicle and heavy machinery industries. While high-strength bolts are designed with fatigue resistance in mind, and Bulten has manufacturing facilities in the region, the claim of “over 1 million units annually” is not publicly verifiable. In general, nuts and washers provide critical support for structural integrity, with washers distributing load and nuts securing the joint.

By Product

Externally threaded fasteners hold the largest share due to versatility in multiple sectors. Internally threaded and non-threaded fasteners complement machinery and construction needs. Aerospace grade fasteners remain a premium category, designed for extreme durability and safety. It reflects growing defense and aviation demand, where reliability is crucial.

- For example, PennEngineering manufactures specialized fasteners for electric vehicle battery enclosures and other demanding applications. Their products, which include externally threaded, internally threaded, and non-threaded fasteners, are engineered to streamline the assembly process and improve production throughput.

By Material

Metal fasteners dominate the market owing to their strength, durability, and established use in heavy industries. Plastic fasteners are gaining traction in electronics, automotive interiors, and lightweight assemblies. It highlights rising preference for corrosion-resistant and cost-efficient solutions.

By Application

Automotive remains a leading segment due to large-scale production and rising EV adoption. Aerospace follows with strong demand for high-performance components. Building and construction projects sustain steady consumption, while industrial machinery accounts for consistent growth. Other sectors expand through tailored applications.

By Distribution Channel

Direct sales dominate large industrial contracts, ensuring supply reliability and quality assurance. Indirect channels, including distributors and retailers, support aftermarket and small-scale demand. It allows wide accessibility across diverse customer segments, reinforcing growth in both B2B and retail markets.

Segmentation:

By Type

- Bolts

- Screws

- Nuts

- Washers

- Rivets

- Others

By Product

- Externally Threaded

- Internally Threaded Fasteners

- Non-Threaded Fasteners

- Aerospace Grade Fasteners

By Material

By Application

- Automotive

- Aerospace

- Building & Construction

- Industrial Machinery

- Others

By Distribution Channel

By Country

Regional Analysis:

United States Leading Market Share

The United States dominates the North America Industrial Fasteners Market with over 70% share, driven by its robust automotive, aerospace, and construction sectors. The country benefits from large-scale manufacturing facilities and strong demand for high-performance fasteners. Infrastructure modernization projects and defense investments further strengthen market prospects. It continues to lead innovation in advanced fastening materials and digital integration. Strong OEM presence supports steady growth across both domestic and export markets. Rising adoption of lightweight fasteners in electric vehicles also positions the U.S. as a central hub.

Canada’s Steady Growth Path

Canada accounts for around 15% of the regional share, supported by its expanding aerospace and construction industries. The market benefits from government-backed infrastructure upgrades and rising demand for sustainable fasteners. It is witnessing growth in industrial machinery applications where durability and precision are essential. Canadian suppliers increasingly focus on customized and eco-friendly products to enhance competitiveness. Proximity to U.S. markets allows for strong trade integration and steady exports. The country’s emphasis on green building practices creates opportunities for future expansion.

Mexico’s Emerging Role

Mexico holds nearly 15% of the North America Industrial Fasteners Market share, fueled by its growing automotive production base. The country has become a major manufacturing hub due to cost advantages and favorable trade agreements. It is experiencing rising demand from construction projects and export-oriented industries. Local suppliers benefit from partnerships with global manufacturers seeking regional expansion. The focus on low-cost production aligns with rising export opportunities across North and South America. Mexico’s competitive edge in labor and infrastructure supports its growing role in the regional fasteners landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The North America Industrial Fasteners Market is highly competitive with a mix of global leaders and regional players. Companies compete on product quality, innovation, and supply chain efficiency. Established firms focus on aerospace, automotive, and construction industries with precision-engineered solutions. It is marked by continuous investment in R&D to enhance material performance and durability. Partnerships and acquisitions strengthen market positions while expanding geographical reach. The competitive environment also emphasizes sustainability and customization, catering to diverse client needs. Strong distribution networks further support brand visibility and long-term growth.

Recent Developments:

- Marmon Holdings Inc., a Berkshire Hathaway company, bolstered its aerospace and defense segment by acquiring Marine Tech Wire & Cable, Inc., a specialized manufacturer of circuit integrity cables used in U.S. Navy ships, announced December 2024. This acquisition enhances Marmon Aerospace & Defense’s product offerings with expertise in power, lightweight, low smoke, silicone, and watertight cabling for mission-critical shipboard applications.

- Fontana Gruppo completed the acquisition of MNP Corporation, a major North American fastener manufacturer, marking a significant step in its global expansion announced early 2025. This deal integrates two family-owned fastener companies, enhancing Fontana’s resources and reach in North America.

- Illinois Tool Works (ITW) reported solid operational and financial performance in 2024, with $15.9 billion in revenue for the year. Although specific new product launches or acquisitions were not highlighted, ITW emphasized ongoing digital transformation initiatives and investments in technologies such as AI, IoT, and cloud-based enterprise systems to enhance competitiveness and efficiency in its operations.

- Stanley Black & Decker completed the sale of its STANLEY Infrastructure business to Epiroc AB in March 2024 for $760 million in cash. This move strategically optimizes Stanley Black & Decker’s portfolio by divesting its infrastructure and construction attachments segment, primarily focused in North America, to a global leader in mining and construction equipment.

- Nifco Inc. started a joint development initiative in September 2024 with LexxPluss Inc., to automate automotive maintenance tasks using advanced technology. Nifco also became an investor in LexxPluss’ Series A round, reflecting efforts to address challenges in the automotive maintenance industry such as technician shortages and advancing safety features.

Report Coverage:

The research report offers an in-depth analysis based on type, product, material, application, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for high-strength fasteners will rise in automotive and aerospace sectors.

- Sustainable materials and eco-friendly coatings will gain prominence in product design.

- Electric vehicle production will boost the need for lightweight fastening solutions.

- Advanced aerospace projects will create demand for precision-engineered fasteners.

- Infrastructure modernization will sustain long-term growth across construction markets.

- Smart fastening technologies with sensors will enhance adoption in manufacturing.

- Regional suppliers will focus on customized and niche applications for competitiveness.

- Aftermarket sales and e-commerce will expand distribution channels across industries.

- Strategic acquisitions and partnerships will reshape the competitive landscape.

- Continuous R&D investment will drive innovations in materials and performance.