Market Overview

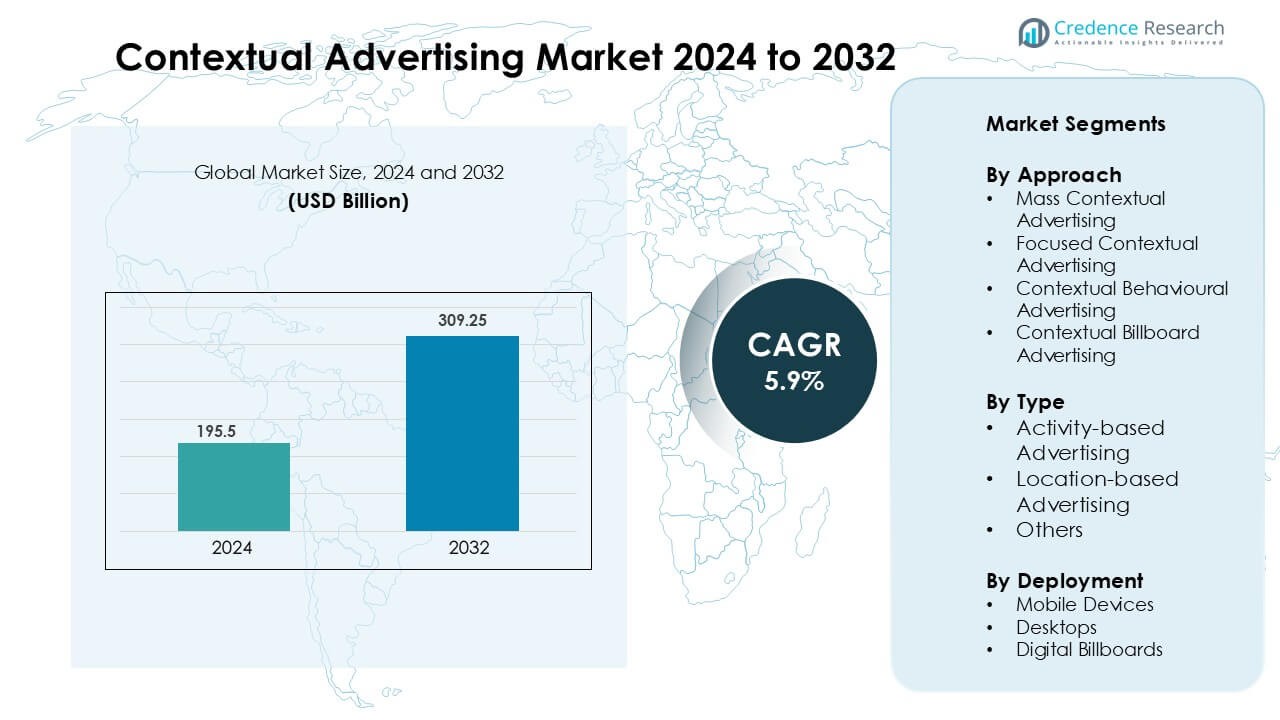

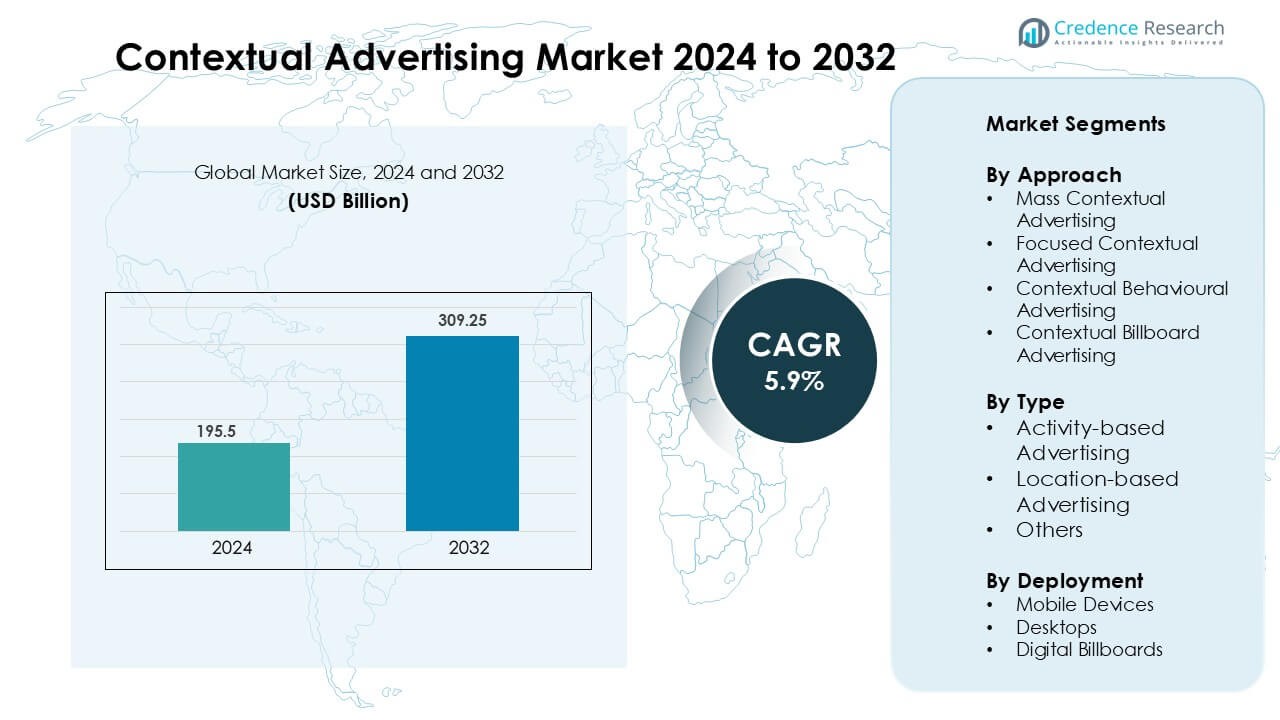

Contextual Advertising Market was valued at USD 195.5 billion in 2024 and is anticipated to reach USD 309.25 billion by 2032, growing at a CAGR of 5.9 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Contextual Advertising Market Size 2024 |

USD 195.5 Billion |

| Contextual Advertising Market, CAGR |

5.9% |

| Contextual Advertising Market Size 2032 |

USD 309.25 Billion |

The contextual advertising market includes major players such as Google LLC, Amazon.com Inc., Meta (Facebook Inc.), Adobe Systems, Yahoo, Amobee Inc., Media.net, Millennial Media LLC, Twitter Inc., and Act-On Software Inc. These companies compete through AI-based targeting, programmatic buying, brand-safety filters, and real-time content analysis. Google and Amazon lead with large publisher networks and strong ad-tech ecosystems, while Adobe and Media.net offer integrated analytics and cross-channel automation. North America remains the top regional market, holding 35% of global market share, supported by high digital spending, strong cloud adoption, and strict privacy standards that accelerate the shift from cookie-based tracking to contextual targeting.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The contextual advertising market reached USD 195.5 in 2024 and is projected to grow at a CAGR of 5.9% during the forecast period, supported by rising digital ad budgets and programmatic adoption.

- Privacy regulations and the decline of third-party cookies drive advertisers toward content-based targeting, improving brand safety and user trust while reducing dependence on personal data in retail, media, banking, and OTT platforms.

- Key trends include AI-driven keyword analysis, video and audio contextual placement, and growth in digital out-of-home screens; activity-based advertising holds the largest segment share due to strong conversion rates and intent-based matching.

- Competition involves Google, Amazon, Meta, Adobe, Yahoo, Amobee, Media.net, and others integrating NLP, fraud detection, and cross-device automation; however, high competition from social media targeting and the challenge of real-time content scanning act as restraints.

- North America leads with 35% regional share, followed by Europe and Asia-Pacific; mobile devices dominate deployment as smartphone penetration expands and advertisers target in-app and streaming audiences.

Market Segmentation Analysis:

By Approach

Mass contextual advertising leads this category with a market share near one-third of global revenue. Brands use broad audience targeting to reach high-traffic web pages, OTT platforms, and search engines. The approach delivers high impressions at scale and supports brand awareness campaigns across retail, FMCG, and entertainment. Growth is driven by rising online video consumption, programmatic ad buying, and multi-language content placements. Focused contextual advertising follows as businesses shift toward relevance-driven ads matched to specific keywords, product categories, and niche content. Contextual behavioral advertising and contextual billboard advertising continue to gain steady adoption through AI-based intent analysis and digital out-of-home formats.

- For instance, CVS Pharmacy s sponsorship of the contextual Flu Insights with Watson tool via The Weather Company reached over 42 million unique visitors and served 644 million ad impressions in a relevant health-planning context.

By Type

Activity-based advertising holds the leading share as companies analyze user actions such as clicks, viewing patterns, search behavior, and website navigation. This data helps marketers place ads that align with purchase intent, resulting in higher conversions and lower wasted impressions. The rise of personalized commerce, content streaming, and shoppable ads strengthens this segment. Location-based advertising is growing due to GPS-enabled smartphones, geofencing, and hyperlocal retail campaigns. The “Others” segment includes demographic and interest-based placements, supporting cross-channel customer engagement.

- For instance, in a campaign run by Burger King using geofencing around competitor locations, the app recorded over five million downloads through the promotion and the campaign moved from ninth into first place in the App Store’s food & drink category.

By Deployment

Mobile devices dominate deployment with a major share driven by increasing smartphone penetration, social media usage, and mobile app advertising. Advertisers benefit from precise targeting through app activity, screen time, and micro-moment interactions. Desktops continue to serve corporate and e-commerce audiences, offering detailed browsing data for contextual ad placement. Digital billboards show fast growth as outdoor advertising shifts to dynamic displays integrated with real-time content and automated bidding platforms, helping brands run localized and time-sensitive campaigns.

Key Growth Drivers

Rising Privacy Regulations and Shift Away from Third-Party Cookies

Privacy rules push brands to replace cookie-based tracking with safe targeting methods. Contextual advertising fits these rules well because ads match page content instead of tracking a person. This reduces compliance risks for advertisers and protects user privacy. Google, Apple, and other tech firms are blocking third-party cookies on major browsers. As a result, companies move budgets toward context-driven ads for scale and safety. Agencies also prefer contextual models because they work without personal data and still reach the right audience. The method increases trust among users, regulators, and publishers. Growth rises as banks, retailers, and healthcare firms avoid sensitive data collection. As privacy laws expand across the U.S., Europe, and Asia, contextual tools replace behavioral tracking at a rapid pace. These changes make contextual advertising a long-term, compliant replacement for traditional targeting methods.

- For instance, Google did roll out “Tracking Protection” to 1% of Chrome users globally on January 4, 2024.

Increase in Digital Content Consumption and Programmatic Buying

Consumers spend more time on streaming platforms, news websites, gaming apps, and social media. Brands follow this shift by placing ads that match videos, articles, and search categories. Programmatic platforms place contextual ads at scale using real-time bidding and automated engines. This helps advertisers reach millions of relevant impressions without manual work. High-speed mobile internet and smart devices boost engagement with online content. Video ads, shoppable posts, sports streaming, and mobile gaming add more ad slots each year. Publishers prefer contextual ads because they are less intrusive and improve click rates. They also protect brand safety by blocking ads on harmful or unsuitable content. These factors create a strong demand cycle and expand spending on context-driven formats across industries.

- For instance, in a campaign run via The Trade Desk for GSK’s Iodex product in India, the average video completion rate was 90 %, with one streaming platform delivering a 94 % completion rate.

Better AI, Natural Language Processing, and Real-Time Data Analysis

Modern contextual platforms use AI to scan web pages, audio, and video frames. Natural language models read tone, keywords, and intent to place relevant ads. This increases accuracy and lowers the risk of mismatched ads. Real-time analytics help advertisers choose the best keywords and content categories. Machine learning improves campaigns by predicting what themes trigger high engagement. Ad platforms also combine page context with first-party data such as location, device type, or time of day. Brands gain higher reach, fewer ad skips, and stronger ROI. Publishers gain steady revenue because contextual ads load fast and do not rely on cookies. As AI tools become cheaper and faster, more small and mid-size companies adopt contextual targeting. This expands the market and encourages deeper automation across campaigns.

Key Trends & Opportunities

Growth in Video, Audio, and Digital Out-of-Home (DOOH) Contextual Advertising

Video streaming platforms, YouTube channels, podcasts, and online radio offer new spaces for contextual ads. AI can detect scenes, speech, captions, and objects inside video content. This helps place relevant ads in sports, cooking, travel, gaming, and education clips. Audio-based recognition matches ads with spoken words on podcasts. Outdoor billboards also shift to digital screens that run location-based contextual ads. These screens update messages based on time, traffic, or weather. This wider use of multi-format content creates a strong opportunity for media owners and advertisers. Media companies earn higher revenue by selling targeted slots instead of static banners. Brands gain better reach because video and audio content attract younger audiences.

- For instance, Govee ran a programmatic DOOH campaign on 233 screens across three U.S. states.

Rising Demand for Brand Safety and Hate-Speech Filtering

Brands want safe ad placements to protect reputation. Contextual tools use sentiment analysis to screen harmful pages such as fake news, violence, or adult content. This ensures ads appear only on trusted pages and verified publishers. Companies prefer vendors who offer keyword exclusion, live page scanning, and risk scoring. This trend is strong in banking, healthcare, and kids’ content platforms. Agencies select contextual ads because they blend relevance with safety. As misinformation and unsafe pages grow online, brand safety tools become a priority. This pushes investment in contextual filters and high-quality publisher networks.

Key Challenges

Difficulty Maintaining Accuracy Across Fast-Changing Online Content

Online pages update within seconds. Articles change headlines, videos get new scenes, and social feeds refresh non-stop. Platforms must scan millions of pages to avoid mis-matched ads. A travel brand could appear next to disaster news if scanning tools lag. Smaller publishers with low metadata also make it hard to judge context. AI helps, but automation still needs human review to avoid errors. Limited page transparency and hidden keywords create context gaps. These challenges raise filtering costs and require constant model training.

- For instance, the ad-tech vendor GumGum processes about 40 million unique pages per day and through their visual + textual intelligence system flag-identified unsafe content, they reported that scene recognition improved classification accuracy of unsafe vs safe environments to 86% and reduced false positive rate to 3% in one test set.

High Competition from SocialMedia Targeting and In-App Advertising

Brands still spend large budgets on social apps and influencer marketing. These platforms offer massive user bases and first-party data insights. Contextual models must compete with fast campaign setup, personalized feeds, and lower cost per click. Small advertisers choose social apps because they are easy to use. Contextual platforms need more education, setup time, and testing. This slows adoption among new marketers. To compete, vendors must offer better dashboards, lower pricing, and automated campaign tools.

Regional Analysis

North America

North America holds the leading position with nearly 35% market share, supported by strong digital ad spending, advanced programmatic platforms, and strict data privacy rules. Advertisers prefer contextual models to avoid cookie restrictions and user-tracking issues. Major brands deploy AI-driven content targeting across news portals, OTT platforms, and social media. Growth remains strong in the U.S., where technology vendors partner with publishers to deliver brand-safe, compliant ads. Retail, banking, and media invest heavily in contextual video ads and e-commerce placements. Rising adoption of real-time analytics and cross-device targeting continues to strengthen market leadership.

Europe

Europe accounts for roughly 28% market share, driven by strict data protection frameworks such as GDPR and the shift away from third-party cookies. Businesses in the UK, Germany, France, and the Nordics invest in contextual tools to stay compliant with privacy laws and maintain user trust. Publishers monetize premium online content including news, sports, entertainment, and lifestyle media. Strong adoption of AI-based keyword filtering and brand-safety solutions boosts demand. Retailers and automotive brands lead in programmatic contextual buying, while digital out-of-home screens in urban hubs expand exposure and mobile-based targeting.

Asia-Pacific

Asia-Pacific holds close to 25% market share and shows the fastest growth due to expanding smartphone usage, social media adoption, and high streaming consumption. China, India, Japan, and South Korea drive demand through mobile-first advertising strategies. E-commerce, gaming, and fintech brands use contextual placements to reach large digital audiences. Rising investment in video content platforms and regional OTT apps boosts ad inventory. Local publishers adopt AI-driven targeting to increase click-through rates and protect viewer experience. Growing start-ups and programmatic ad exchanges support rapid market expansion across emerging economies.

Latin America

Latin America represents nearly 7% market share, with growth led by Brazil, Mexico, and Argentina. Rising internet access, digital payments, and mobile app usage drive demand for context-driven ads. Brands use contextual placements to reach young social media users and mobile gamers. News portals and streaming platforms expand ad slots as traditional media declines. Publishers adopt brand-safe ad models to attract global advertisers. However, investment remains sensitive to economic conditions, limiting large-scale deployment. Even so, improved programmatic trading and multilingual content support steady market development.

Middle East & Africa

The Middle East & Africa region holds about 5% market share, supported by digital transformation in the UAE, Saudi Arabia, and South Africa. Retail, travel, telecom, and entertainment brands adopt contextual ads to reach mobile-centric users. Digital billboards and DOOH networks in major cities add new revenue streams. Government initiatives promoting smart cities and 5G networks encourage advertisers to expand online spending. However, market growth faces challenges such as limited local content inventory and slower adoption of advanced AI targeting tools. Despite this, rising e-commerce and youth-driven social media usage support future expansion.

Market Segmentations:

By Approach

- Mass Contextual Advertising

- Focused Contextual Advertising

- Contextual Behavioral Advertising

- Contextual Billboard Advertising

By Type

- Activity-based Advertising

- Location-based Advertising

- Others

By Deployment

- Mobile Devices

- Desktops

- Digital Billboards

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The contextual advertising market features strong competition among global tech giants, programmatic ad platforms, analytics vendors, and digital media companies. Major players such as Google, Amazon, Meta, Adobe, and Yahoo invest in AI-driven engines that analyze keywords, page relevance, video frames, and user intent in real time. These companies focus on partnerships with publishers, streaming platforms, and e-commerce sites to expand ad inventory and improve brand safety. Mid-size vendors such as Amobee, Media.net, and Act-On Software compete by offering flexible pricing, automated dashboards, and industry-specific targeting models for retail, BFSI, healthcare, and travel. Many providers integrate natural language processing and advanced filtering to avoid unsafe or non-brand-suitable content. Product innovations include customizable keyword libraries, fraud prevention tools, cross-device tracking, and privacy-compliant targeting. As third-party cookies disappear, competition intensifies as more advertisers shift budgets to contextual formats. Ongoing mergers, ad-tech acquisitions, and AI-focused upgrades continue to shape the competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In Aug 2025, Amazon DSP added multi-language keyword contextual targeting worldwide. This improves scale for global campaigns. The feature is generally available.

- In Apr 2025, Nexxen launched a Health offering with privacy-safe targeting. It supports TV and digital activation with verticalized controls.

- In Feb 2025, Amazon Ads detailed AI-powered contextual techniques in Amazon DSP. The update targets relevance without third-party cookies. It expands context signals and modelling.

Report Coverage

The research report offers an in-depth analysis based on Approach, Type, Deployment and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Advertisers will increase spending on contextual tools as privacy rules tighten and cookie tracking fades.

- AI models will scan video, audio, and images to deliver more accurate content matching.

- Digital out-of-home screens will use real-time data such as time, weather, and location to trigger dynamic ads.

- E-commerce platforms will expand contextual placements on product pages, search results, and live shopping streams.

- Publishers will adopt stronger brand-safety filters to attract premium advertisers and protect user experience.

- Mobile-first targeting will grow as app usage, gaming, and short-video platforms scale across global markets.

- First-party data from retailers, streaming apps, and telecom networks will blend with contextual engines to improve relevance.

- Small and mid-size businesses will adopt automated dashboards for low-cost, self-serve campaigns.

- Contextual analytics will integrate with CRM and marketing automation platforms to improve campaign measurement.

- Global tech firms will continue mergers and partnerships to expand ad inventory and accelerate AI innovation.