Market Overview

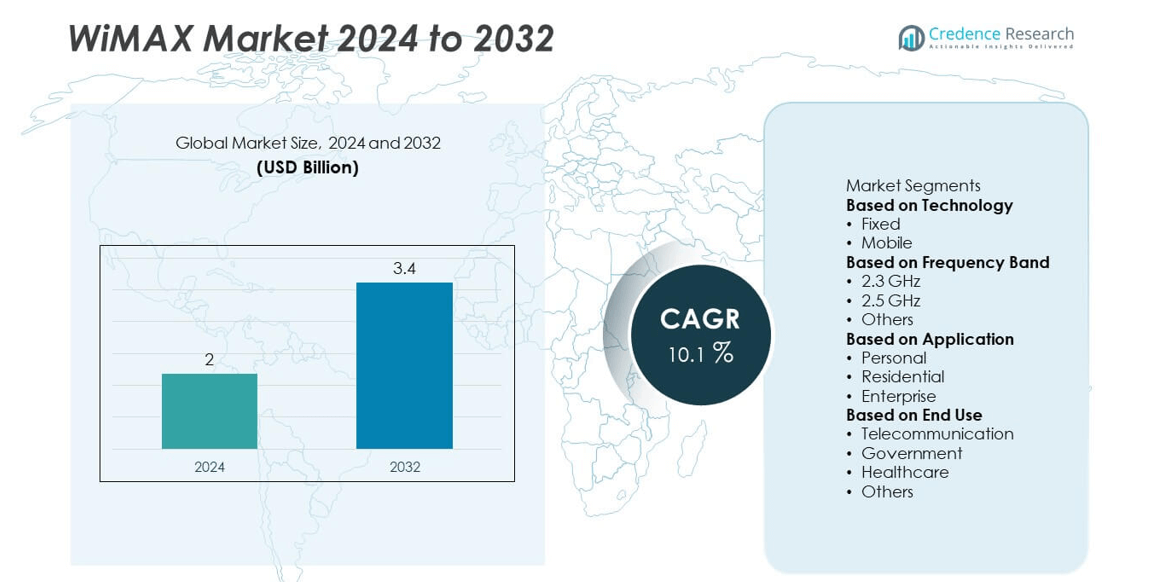

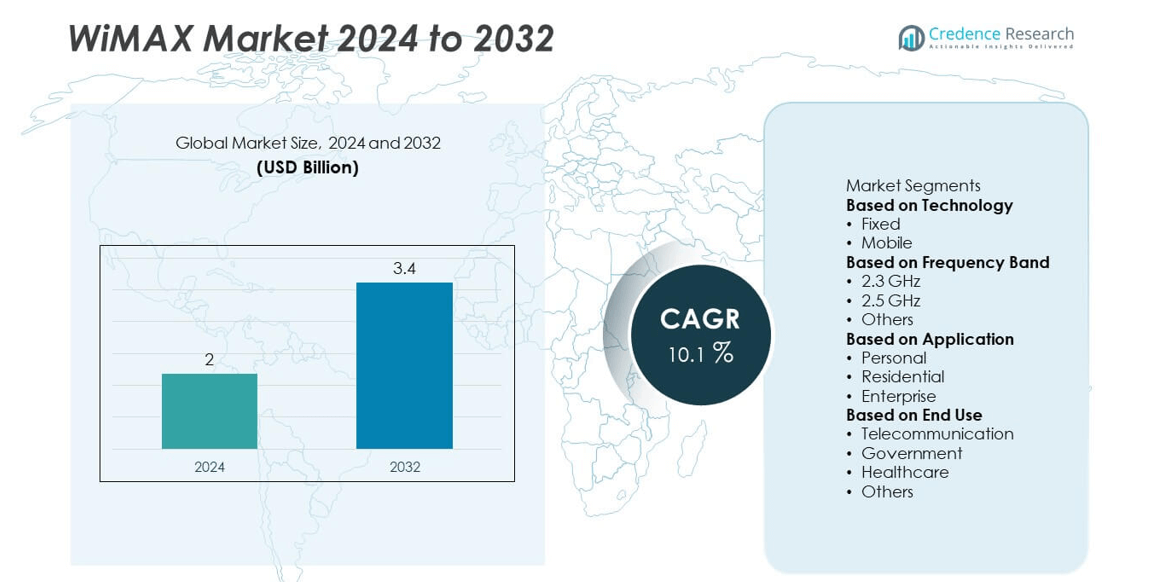

The WiMAX market was valued at USD 2 billion in 2024 and is projected to reach USD 3.4 billion by 2032, registering a CAGR of 10.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| WiMAX Market Size 2024 |

USD 2 billion |

| WiMAX Market, CAGR |

10.1% |

| WiMAX Market Size 2032 |

USD 3.4 billion |

The WiMAX market is driven by leading players such as Huawei, Alvarion Ltd, ZTE Corporation, Nokia, Samsung, BSNL, Airspan Networks, Intel, Motorola, and Alcatel Lucent. These companies focus on expanding WiMAX network deployments, integrating hybrid WiMAX-5G solutions, and providing cost-effective broadband for residential and enterprise users. Asia-Pacific leads the market with 31% share, supported by large-scale rural broadband initiatives and government-backed digital inclusion programs. North America holds 33% share, driven by enterprise IoT applications and rural coverage projects, while Europe accounts for 27% share with significant adoption in underserved areas and event-based temporary connectivity solutions.

Market Insights

- The WiMAX market was valued at USD 2 billion in 2024 and is projected to reach USD 3.4 billion by 2032, growing at a CAGR of 10.1% during the forecast period.

- Rising demand for high-speed broadband and cost-effective last-mile connectivity drives growth, with mobile WiMAX holding over 55% share due to its wide coverage and mobility support.

- Key trends include hybrid WiMAX-5G deployments, adoption of IoT-enabled networks for enterprises, and increasing use of portable WiMAX solutions for disaster recovery and remote operations.

- The market is competitive with players like Huawei, Nokia, ZTE Corporation, and Airspan Networks focusing on network expansion, R&D for low-latency solutions, and collaborations with governments for rural connectivity.

- North America holds 33% share, Asia-Pacific 31%, and Europe 27%, while Latin America and Middle East & Africa collectively contribute 9% share, driven by rural broadband projects and enterprise private network deployments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Mobile WiMAX dominated the WiMAX market in 2024, holding over 55% share due to rising demand for high-speed, wireless broadband connectivity on-the-go. Its ability to support mobility, seamless handovers, and wide coverage makes it ideal for urban and semi-urban deployments. Telecom operators are adopting mobile WiMAX to provide affordable last-mile connectivity, especially in emerging markets. Fixed WiMAX continues to serve rural and underserved regions, offering cost-effective broadband solutions where fiber deployment is not feasible. Growing focus on bridging the digital divide supports steady demand for both technologies.

- For instance, Intel showcased its new Xeon 6 system-on-chip (SoC) for 5G network infrastructure at Mobile World Congress (MWC) in March 2025. The obsolete WiMAX, this modern networking processor supports advanced 5G workloads.

By Frequency Band

The 2.5 GHz frequency band led the market with over 45% share in 2024, driven by its widespread adoption for high-capacity broadband services and compatibility with existing infrastructure. It offers an optimal balance of coverage and throughput, making it preferred for both mobile and fixed deployments. The 2.3 GHz band follows, used for specialized applications and regional deployments where spectrum availability favors its adoption. Other frequency bands, including 3.5 GHz, are gaining traction in select markets for niche enterprise and government network requirements.

- For instance, Huawei released new base stations for its 5G-Advanced (5.5G) solutions in June 2024. The company showcased technology for multiple bands, including 2.5 GHz operations, with advanced multi-antenna configurations. These solutions support high-throughput rates for services like fixed wireless access in rural deployments and indoor coverage.

By Application

Enterprise applications accounted for over 40% share of the WiMAX market in 2024, as businesses adopt WiMAX for secure, high-speed connectivity to support remote offices, campus networks, and industrial IoT applications. The ability to deploy private broadband networks without reliance on wired infrastructure makes WiMAX cost-effective for enterprises. Residential use follows, benefiting from the growing demand for high-speed internet in rural areas. Personal applications are emerging as portable WiMAX devices gain popularity among consumers seeking reliable, wireless broadband for remote work, streaming, and communication.

Market Overvie

Rising Demand for High-Speed Broadband Connectivity

The growing need for affordable, high-speed internet is a primary driver, contributing to over 40% of new WiMAX deployments in 2024. WiMAX technology enables quick broadband rollout in urban and rural areas without expensive fiber infrastructure. Governments and telecom providers are investing in WiMAX to bridge the digital divide and enhance internet penetration. Its ability to deliver reliable connectivity for streaming, e-learning, and telemedicine makes it a preferred choice for developing regions with limited wired network availability.

- For instance, BSNL deployed 827 WiMAX base stations to cover 1,000 rural block headquarters as part of a Phase-I project. The original intention was to provide broadband coverage to tens of thousands of Common Service Centers (CSCs) and village panchayats, the final deployment connected approximately 10,279 rural CSCs and 14,591 village panchayats through this initial project.

Cost-Effective Last-Mile Connectivity Solutions

WiMAX is widely adopted for cost-effective last-mile connectivity, holding over 35% share of enterprise and residential installations in 2024. It eliminates the need for extensive trenching or cabling, reducing deployment costs and time. Internet service providers leverage WiMAX to reach underserved communities and small businesses quickly. The scalability and flexibility of WiMAX networks make them ideal for supporting both fixed and mobile users, helping operators expand their customer base efficiently while maintaining competitive pricing.

- For instance, VIAVI Solutions, offers the TeraVM virtualized test solution, which is used for modern 5G and other wireless network testing, rather than the older WiMAX technology.

Growing Adoption in Enterprise and Industrial IoT Applications

Enterprises accounted for over 40% of WiMAX market share in 2024, using it for secure campus networks, remote site connectivity, and IoT-enabled operations. Industries such as oil & gas, manufacturing, and utilities deploy WiMAX for real-time data transfer and monitoring of distributed assets. Its high bandwidth and low latency support mission-critical applications, including video surveillance and automation systems. The trend toward private LTE and dedicated enterprise networks further strengthens demand for WiMAX as a flexible and reliable broadband solution.

Key Trends & Opportunities

Integration with 5G and Hybrid Network Models

A major trend is the integration of WiMAX with 5G networks, allowing operators to extend coverage and improve service quality. Hybrid solutions combining WiMAX for last-mile access and 5G for core network capacity are gaining popularity. This creates opportunities for network providers to offer affordable, high-speed broadband in semi-urban and rural areas while preparing for future 5G expansion.

- For instance, Nokia did introduce hybrid 4G-5G gateways in its FastMile portfolio for Fixed Wireless Access (FWA), which use both 4G LTE and 5G radio connections simultaneously. However, the product featuring Wi-Fi 7, the FastMile 5G Gateway 4, was officially launched in March 2025

Rising Role in Disaster Recovery and Emergency Communications

WiMAX is increasingly used for emergency communication systems, providing quick-deploy broadband in disaster-hit regions. Governments and NGOs are adopting WiMAX for temporary connectivity during floods, earthquakes, or large-scale events. This presents opportunities for vendors to supply portable, easy-to-install WiMAX solutions for public safety, defense, and humanitarian operations, supporting business continuity and critical communication needs.

- For instance, Motorola Solutions partnered with Nokia to provide next-generation tactical communications networks for U.K. defense agencies, featuring modular, deployable hubs that combine TETRA, 4G, and 5G technologies. The system enables resilient and secure voice, data, and real-time video streaming in challenging environments.

Key Challenges

Competition from LTE and Fiber Broadband Solutions

WiMAX faces stiff competition from LTE, 5G, and fiber broadband technologies that offer higher speeds and widespread availability. Many operators are shifting investments toward LTE/5G, which can limit long-term growth for WiMAX deployments. To remain competitive, WiMAX vendors must innovate and focus on niche markets where wired connectivity is unfeasible.

Spectrum Availability and Regulatory Barriers

Limited availability of licensed spectrum and regulatory hurdles in some regions slow WiMAX network expansion. Delays in spectrum allocation and high licensing costs make it challenging for operators to scale services quickly. This can restrict network coverage and reduce market penetration in high-demand areas, affecting overall growth potential.

Regional Analysis

North America

North America accounted for 33% share in 2024, supported by strong demand for high-speed broadband and early adoption of wireless technologies. The United States leads the region, deploying WiMAX for rural broadband coverage under government-funded connectivity programs. Enterprises in energy, utilities, and transportation sectors are using WiMAX networks for industrial IoT applications and private connectivity. Canada is investing in fixed WiMAX solutions to improve connectivity in remote regions. High internet penetration, strong regulatory support, and advanced telecom infrastructure continue to drive growth, with vendors focusing on network upgrades and hybrid WiMAX-5G solutions.

Europe

Europe held 27% share in 2024, driven by ongoing efforts to provide broadband coverage to underserved areas and meet EU digital inclusion targets. Countries like Germany, the U.K., and France are deploying WiMAX networks to support residential and enterprise applications where fiber installation is expensive. WiMAX is also used for temporary connectivity during infrastructure projects and events. The region’s focus on sustainable, cost-efficient solutions favors wireless broadband deployments. Growth is supported by partnerships between governments and telecom operators to expand last-mile connectivity, particularly in Eastern and Southern European markets.

Asia-Pacific

Asia-Pacific led the global WiMAX market with 31% share in 2024, making it the fastest-growing region. Large-scale deployments in China, India, and Southeast Asia support rural broadband expansion and digital inclusion initiatives. Governments are heavily investing in wireless networks to bridge connectivity gaps and support economic growth. WiMAX is preferred in remote and semi-urban areas where laying fiber is challenging. Telecom operators are adopting mobile WiMAX for affordable broadband delivery to consumers and enterprises. Rapid urbanization, rising internet demand, and expanding industrial IoT applications continue to fuel market growth across the region.

Latin America

Latin America captured 5% share in 2024, with demand driven by efforts to improve internet access in rural and underserved regions. Countries such as Brazil, Mexico, and Chile are adopting WiMAX to complement fiber and LTE networks. Growth is supported by government digitalization initiatives and partnerships with service providers to extend affordable broadband services. Enterprises in mining, oil and gas, and utilities are leveraging WiMAX for connectivity in remote operations. Challenges such as limited spectrum availability and economic constraints slow adoption, but opportunities exist for low-cost, scalable wireless broadband solutions.

Middle East & Africa

The Middle East & Africa region held 4% share in 2024, with adoption concentrated in Gulf nations, South Africa, and Nigeria. Governments are deploying WiMAX networks to expand broadband access in rural areas and improve connectivity for education, healthcare, and e-government services. Oil and gas companies use WiMAX for secure communication across remote facilities. The technology’s ability to provide rapid, large-area coverage supports its use in infrastructure and smart city projects. Vendors focusing on cost-effective, rugged, and scalable WiMAX solutions are well-positioned to capture opportunities in this price-sensitive but growing market.

Market Segmentations:

By Technology

By Frequency Band

By Application

- Personal

- Residential

- Enterprise

By End Use

- Telecommunication

- Government

- Healthcare

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the WiMAX market includes major players such as Huawei, Alvarion Ltd, ZTE Corporation, Nokia, Samsung, BSNL, Airspan Networks, Intel, Motorola, and Alcatel Lucent. These companies focus on expanding network infrastructure, enhancing spectrum efficiency, and delivering cost-effective broadband solutions for both urban and rural deployments. Strategies include partnerships with telecom operators, collaborations with governments for digital inclusion programs, and development of hybrid WiMAX-5G solutions to ensure future readiness. Many players are investing in R&D to improve network performance, reduce latency, and support enterprise IoT applications. The competitive environment is shaped by efforts to offer scalable, energy-efficient solutions and cater to diverse applications such as residential broadband, enterprise connectivity, and public safety networks. Vendors are also concentrating on emerging markets in Asia-Pacific and Africa, where WiMAX provides a viable alternative to fiber and LTE for last-mile connectivity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huawei

- Alvarion Ltd

- ZTE Corporation

- Nokia

- Samsung

- BSNL

- Airspan Networks

- Intel

- Motorola

- Alcatel Lucent

Recent Developments

- In 2024, Huawei launched its Alpha series next-generation antenna solution in late 2024, focusing on efficiency, digitalization, and ease of deployment for the mobile AI era, and won a GLOMO award for its green antenna series.

- In 2024, Huawei did showcase advancements in AI and 5G-A at MWC Shanghai 2024, focusing on AI for network efficiency and experience-driven services

- In 2024, BSNL conducted a trial of its new Direct-to-Device (D2D) technology in partnership with VIASAT, enabling users to communicate directly without traversing through base stations or core networks.

Report Coverage

The research report offers an in-depth analysis based on Technology, Frequency Band, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for WiMAX will grow as governments push digital inclusion and rural connectivity programs.

- Mobile WiMAX will remain the dominant technology due to its mobility and wide coverage benefits.

- Integration of WiMAX with 5G networks will expand its role in hybrid broadband solutions.

- Enterprises will increasingly adopt WiMAX for secure private networks and industrial IoT applications.

- Asia-Pacific will remain a key growth driver supported by large-scale deployments in China and India.

- Portable WiMAX solutions will gain traction for disaster recovery and emergency communication needs.

- Network upgrades will focus on reducing latency and improving spectrum efficiency.

- Partnerships between telecom operators and equipment vendors will intensify to expand coverage.

- Adoption will grow in education, healthcare, and e-governance to support remote services.

- Vendors will focus on cost-effective, scalable solutions to compete with LTE and fiber broadband.