Market Overview:

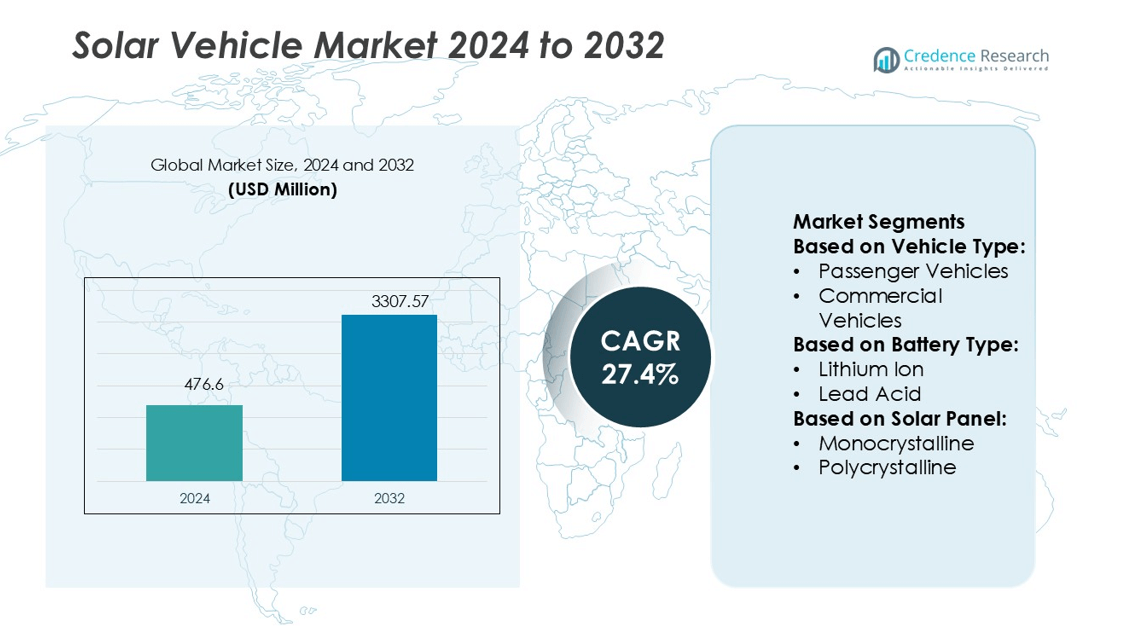

Solar Vehicle Market size was valued USD 476.6 million in 2024 and is anticipated to reach USD 3307.57 million by 2032, at a CAGR of 27.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solar Vehicle Market Size 2024 |

USD 476.6 million |

| Solar Vehicle Market, CAGR |

27.4% |

| Solar Vehicle Market Size 2032 |

USD 3307.57 million |

The solar vehicle market is driven by leading players including Daimler AG, Mahindra & Mahindra Limited, Sono Motors GmbH, Tesla, Inc, Ford Motor Company, Lightyear, Toyota Motor Corporation, VENTURI, Volkswagen AG, and Nissan. These companies focus on integrating high-efficiency solar panels, advanced batteries, and lightweight designs to extend vehicle range and enhance performance. Startups such as Lightyear and Sono Motors pioneer fully solar-powered models, while established automakers expand solar-electric hybrid offerings to capture wider markets. Regionally, Asia-Pacific leads the market with a 36% share in 2024, supported by large-scale manufacturing, government incentives, and rapid adoption of renewable mobility solutions.

Market Insights

- The solar vehicle market size was valued at USD 476.6 million in 2024 and is projected to reach USD 3307.57 million by 2032, growing at a CAGR of 27.4%.

- Growing demand for sustainable mobility and government incentives for clean energy adoption are driving strong market growth.

- Key players focus on high-efficiency solar panels, advanced lithium-ion batteries, and lightweight designs, with startups introducing fully solar-powered cars and established automakers offering hybrid solutions.

- High initial costs and limited energy conversion efficiency of solar panels remain major restraints for large-scale adoption.

- Asia-Pacific leads with 36% share in 2024 due to manufacturing strength and incentives, North America follows with 34% share, and Europe holds 29%, while passenger vehicles dominate the market by vehicle type.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle Type

Passenger vehicles dominate the solar vehicle market with the largest share, driven by rising consumer adoption of sustainable mobility solutions. Growing demand for eco-friendly personal transport and government incentives for clean energy vehicles enhance this segment’s growth. Passenger cars also benefit from advancements in lightweight solar panels that improve efficiency without affecting design or performance. In contrast, commercial vehicles adopt solar integration at a slower pace, limited by higher upfront costs and technical challenges. However, fleet operators exploring long-term savings in fuel and maintenance costs are expanding potential applications.

- For instance, Architect has deployed more than 91 GW of solar tracking and racking systems globally as with utility-level projects accounting for a majority of this capacity, showcasing its technological ability to scale renewable integration.

By Battery Type

Lithium-ion batteries hold the dominant share in the solar vehicle market due to their higher energy density, longer lifecycle, and faster charging capabilities compared to lead acid and other types. Their lightweight design supports better efficiency and vehicle range, making them the preferred choice for both passenger and commercial vehicles. Continuous advancements in lithium-ion technology, such as improved thermal management and declining costs, further strengthen this segment’s dominance. Lead acid batteries remain relevant in low-cost applications, but their limited energy efficiency reduces competitiveness. Alternative chemistries attract interest but remain at an early stage.

- For instance, GameChange Solar’s MaxSpan fixed-tilt racking system uses a low number of posts per megawatt (MW), with recent reports indicating as few as 96 posts per MW. Configurations like the 3-up portrait have used as few as 120 posts per MW, while earlier 2-up portrait designs have used higher post counts.

By Solar Panel

Monocrystalline solar panels lead the market with the highest share, supported by their superior efficiency rates, compact design, and ability to generate higher power output in limited space. Their integration into vehicle rooftops enhances range extension and reduces dependency on external charging infrastructure. Automakers prefer monocrystalline panels for premium models due to their durability and strong performance in diverse weather conditions. Polycrystalline panels, while more affordable, lag behind because of lower efficiency and larger space requirements. The push for long-term sustainability and advanced mobility solutions continues to favor monocrystalline adoption as the dominant solar panel type.

Market Overview

Rising Demand for Sustainable Mobility

The growing emphasis on reducing carbon emissions is a major driver of the solar vehicle market. Consumers increasingly prefer eco-friendly transportation, and solar-powered vehicles address both fuel dependency and environmental concerns. Government policies supporting renewable energy integration in mobility further accelerate adoption. Tax benefits, purchase incentives, and zero-emission targets push manufacturers to expand production. Automakers are aligning strategies with global sustainability goals, integrating solar technology into mainstream vehicle designs. This driver ensures strong momentum across both developed and emerging markets.

- For instance, AllEarth Renewables manufactures a dual-axis solar tracker system that supports a fixed number of solar modules per structure, typically 20 or 24 panels.

Advancements in Solar and Battery Technologies

Rapid technological progress in solar panels and battery systems enhances the efficiency and feasibility of solar vehicles. Monocrystalline panels offer higher power density, enabling greater energy output in limited space. Meanwhile, lithium-ion batteries dominate with better lifecycle performance and faster charging speeds. R&D efforts by automakers and battery producers are lowering costs, improving thermal management, and increasing driving ranges. Such advancements not only address consumer performance concerns but also broaden solar vehicle applications in passenger and commercial segments. This synergy fuels continuous innovation and long-term market expansion.

- For instance, ArcelorMittal offers the Magnelis® ZM800 steel coating, which provides durability for ground-buried poles for up to 25 years. The coating also ensures the longevity of aerial components, with some specifications indicating a potential lifetime of up to 40 years.

Supportive Government Regulations and Incentives

Governments worldwide are implementing favorable policies to promote solar and electric vehicles. Subsidies, grants, and tax exemptions lower adoption costs for consumers, while stricter emission standards pressure automakers to innovate. Infrastructure development, such as solar-powered charging stations, complements vehicle adoption and enhances user confidence. Countries with strong renewable energy policies are leading adoption rates, influencing global market growth. These measures also encourage private investments in R&D, boosting production capabilities. Supportive regulation ensures both consumer affordability and industry profitability, solidifying solar vehicles as a key player in sustainable mobility.

Key Trends & Opportunities

Integration of Solar Panels into Electric Vehicles

A notable trend is the integration of high-efficiency solar panels into existing electric vehicle platforms. Automakers are embedding monocrystalline panels into rooftops and body surfaces to extend driving range. This approach reduces reliance on charging infrastructure and enhances energy independence for users. Companies like Toyota and Sono Motors are pioneering solar-electric hybrids, demonstrating commercial viability. The trend creates opportunities for vehicle differentiation, with solar integration becoming a premium feature in both passenger and fleet vehicles. Adoption of this innovation is expected to expand steadily.

- For instance, Product datasheets and reports confirm that panels in the LG NeON H series typically came in configurations of 120 or 144 half-cells [1, 4]. LG NeON H BiFacial 72-cell module (equivalent to 144 half-cells) was a specific product configuration.

Expansion into Commercial Vehicle Fleets

The commercial vehicle segment presents significant growth opportunities as logistics and public transport sectors pursue sustainability. Fleet operators benefit from reduced fuel costs and lower emissions by adopting solar-powered buses, vans, and trucks. Governments are also piloting solar-integrated public transport systems to meet climate goals. The large surface area of commercial vehicles enables higher solar panel integration, improving efficiency. With rising e-commerce and last-mile delivery services, this trend creates a strong opportunity for solar adoption. It positions commercial fleets as a key growth frontier in the market.

- For instance, Panasonic previously manufactured high-performance HIT® solar modules, such as the N330/N335 series, which were known for their low degradation rates, often below 0.3% annually, and stable performance, especially in high temperatures.

Rising R&D Collaborations and Investments

Growing collaboration between automakers, solar panel manufacturers, and research institutions is shaping new opportunities. Joint ventures and technology-sharing agreements accelerate innovation in solar cell efficiency and battery integration. Venture capital firms and government funds are channeling investments into solar vehicle startups, boosting commercialization. These collaborations also focus on scaling production to reduce costs and make solar vehicles more accessible. As competition intensifies, partnerships ensure faster deployment of advanced technologies and strengthen market presence. This trend indicates a dynamic future driven by innovation-led growth opportunities.

Key Challenges

High Initial Costs of Solar Vehicles

Despite environmental benefits, solar vehicles face limited adoption due to high upfront costs. The integration of advanced solar panels and lithium-ion batteries significantly raises production expenses. For consumers, purchase prices remain higher compared to conventional or even standard electric vehicles. This cost barrier restricts adoption among middle-income buyers, particularly in price-sensitive markets. While long-term savings in fuel and maintenance are attractive, the initial affordability gap poses a major challenge. Achieving economies of scale and further technological cost reductions remain essential to overcoming this obstacle.

Limited Energy Conversion Efficiency

Another key challenge is the limited efficiency of current solar panels in vehicle applications. Even high-quality monocrystalline panels convert only a fraction of solar energy into usable power, restricting range extension. Weather dependence further affects energy generation, reducing practicality in low-sunlight regions. This limitation curbs consumer confidence and slows large-scale adoption. To address this, companies must invest heavily in R&D to improve efficiency levels and design optimized panel integration. Until these technological barriers are overcome, the challenge of limited energy conversion will remain a restraint on growth.

Regional Analysis

North America

North America holds a strong position in the solar vehicle market with a 34% share in 2024. The region benefits from advanced automotive manufacturing, high consumer awareness, and robust government incentives for renewable transportation. The United States drives adoption with federal tax credits, state-level subsidies, and active R&D programs. Canada supports deployment through clean energy initiatives and public transport electrification. Increasing demand for sustainable passenger vehicles and solar-powered fleets further strengthens market penetration. With growing investments in solar panel efficiency and charging infrastructure, North America is expected to maintain its leadership during the forecast period.

Europe

Europe accounts for 29% of the solar vehicle market in 2024, driven by stringent emission reduction targets and strong government regulations. Germany leads adoption with innovation in solar-integrated electric vehicles, supported by R&D funding and partnerships with automakers. The Netherlands and France expand deployment through incentives and charging infrastructure projects. Rising demand for clean public transport also boosts solar-powered bus initiatives. Growing consumer acceptance of eco-friendly cars, combined with strict CO₂ reduction policies, supports steady growth. Europe’s focus on sustainability ensures that the region remains a central hub for technological innovation and large-scale solar vehicle adoption.

Asia-Pacific

Asia-Pacific dominates the solar vehicle market with the highest share of 36% in 2024. China leads with significant investments in renewable mobility and large-scale production capabilities. Japan advances adoption through solar-electric hybrids and government-backed innovation programs. India shows strong potential as clean mobility initiatives expand with government incentives and solar integration in public transport. Rapid urbanization, rising fuel costs, and consumer demand for eco-friendly vehicles further drive growth. The region’s manufacturing strength and favorable policies make it the fastest-growing market, offering both large-scale production capacity and strong opportunities for future expansion.

Latin America

Latin America captures 6% of the solar vehicle market in 2024, with adoption still in its early stages. Brazil leads the region, supported by clean energy policies and pilot projects in solar-integrated electric buses. Mexico shows potential through growing EV adoption and partnerships with global automakers. High solar energy availability creates opportunities for cost-effective vehicle integration, but economic constraints and limited infrastructure hinder widespread adoption. Despite these challenges, increasing government focus on sustainability and renewable mobility suggests gradual expansion. Latin America presents long-term growth prospects, particularly in public transport and fleet applications.

Middle East & Africa

The Middle East & Africa region holds a 5% share of the solar vehicle market in 2024. Countries like the UAE and Saudi Arabia are investing in clean mobility as part of diversification strategies under Vision 2030 initiatives. Abundant solar resources provide a natural advantage, enabling large-scale solar integration in vehicles and infrastructure. South Africa also shows emerging interest in renewable mobility solutions. However, high upfront costs and limited adoption of EV infrastructure remain barriers. Ongoing projects, government-led initiatives, and international collaborations highlight growth potential, positioning the region as an emerging market with long-term opportunities.

Market Segmentations:

By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

By Battery Type:

By Solar Panel:

- Monocrystalline

- Polycrystalline

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the solar vehicle market features prominent players such as Daimler AG, Mahindra & Mahindra Limited, Sono Motors GmbH, Tesla, Inc, Ford Motor Company, Lightyear, Toyota Motor Corporation, VENTURI, Volkswagen AG, and Nissan. The competitive landscape of the solar vehicle market is shaped by continuous innovation, strategic partnerships, and growing investments in renewable mobility. Companies are focusing on integrating high-efficiency solar panels, advanced lithium-ion batteries, and lightweight materials to enhance performance and extend vehicle range. Startups and established automakers alike are exploring new business models, including solar-powered passenger cars, fleet applications, and public transport solutions. Collaborations with research institutes and government programs further support advancements in efficiency and cost reduction. This competitive environment fosters rapid technological progress, positioning solar vehicles as a transformative solution in the global mobility sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Swap Robotics received an undisclosed investment from Silicon Ranch to expand solar robotic operations and product development. The company will focus on utility-scale solar construction and maintenance technologies that could influence vehicle-integrated photovoltaic manufacturing processes.

- In January 2025, Aptera announced progress toward market readiness with its production-intent solar electric vehicle, demonstrating advancements in solar-only vehicle architectures and specialized aerodynamic design for extended solar range.

- In September 2024, Lightyear successfully secured over in funding to develop advanced solar systems for vehicles. This investment aims to enhance the efficiency and range of electric cars by integrating solar technology.

- In January 2023, Sono Group N.V., a key player in solar mobility solutions, secured funding from CINEA (European Climate, Infrastructure, and Environment Executive Agency) to enhance the development of solar technology

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Battery Type, Solar Panel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The solar vehicle market will expand with rising global demand for sustainable mobility.

- Advancements in solar panel efficiency will improve driving range and vehicle performance.

- Integration of solar roofs in electric vehicles will become a mainstream feature.

- Government incentives and emission reduction targets will accelerate adoption.

- Commercial fleets will increasingly adopt solar vehicles for cost savings and sustainability goals.

- Collaborations between automakers and solar technology firms will drive innovation.

- Improved battery technologies will enhance energy storage and charging capabilities.

- Emerging markets will create new growth opportunities through clean mobility initiatives.

- Infrastructure development, including solar-powered charging stations, will support market growth.

- Rising consumer awareness of renewable mobility will strengthen long-term adoption.