Market Overview

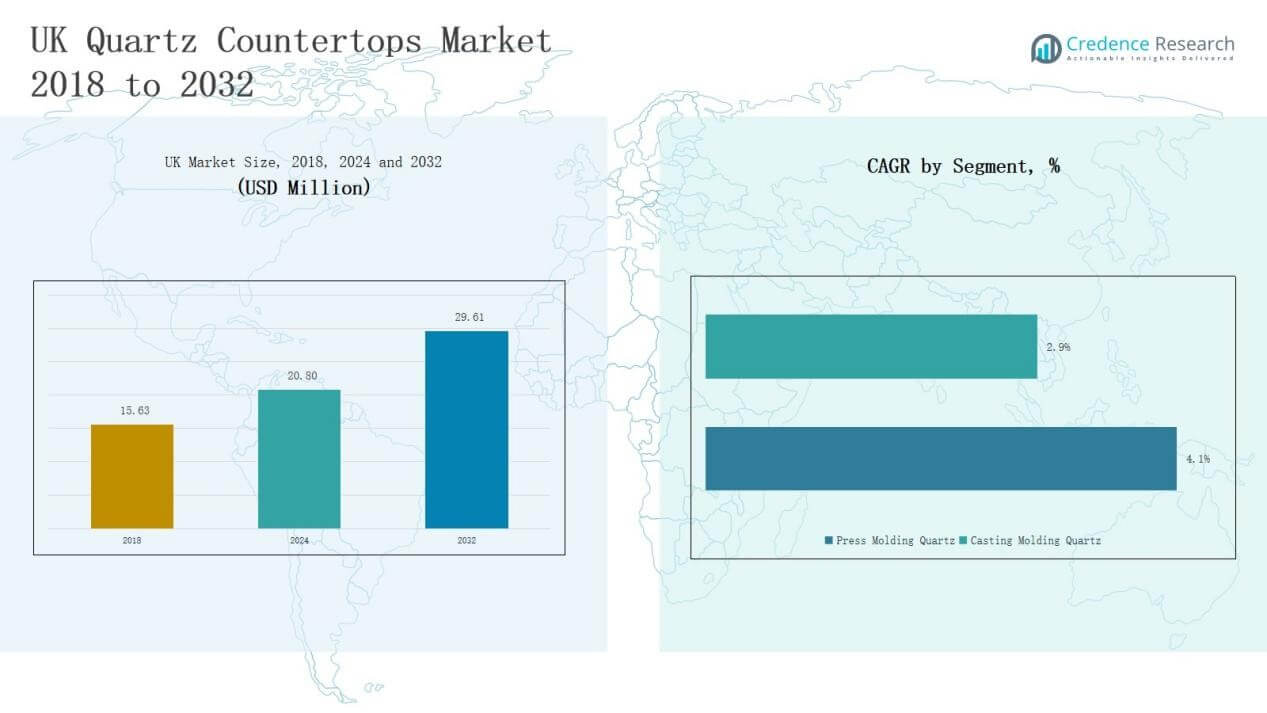

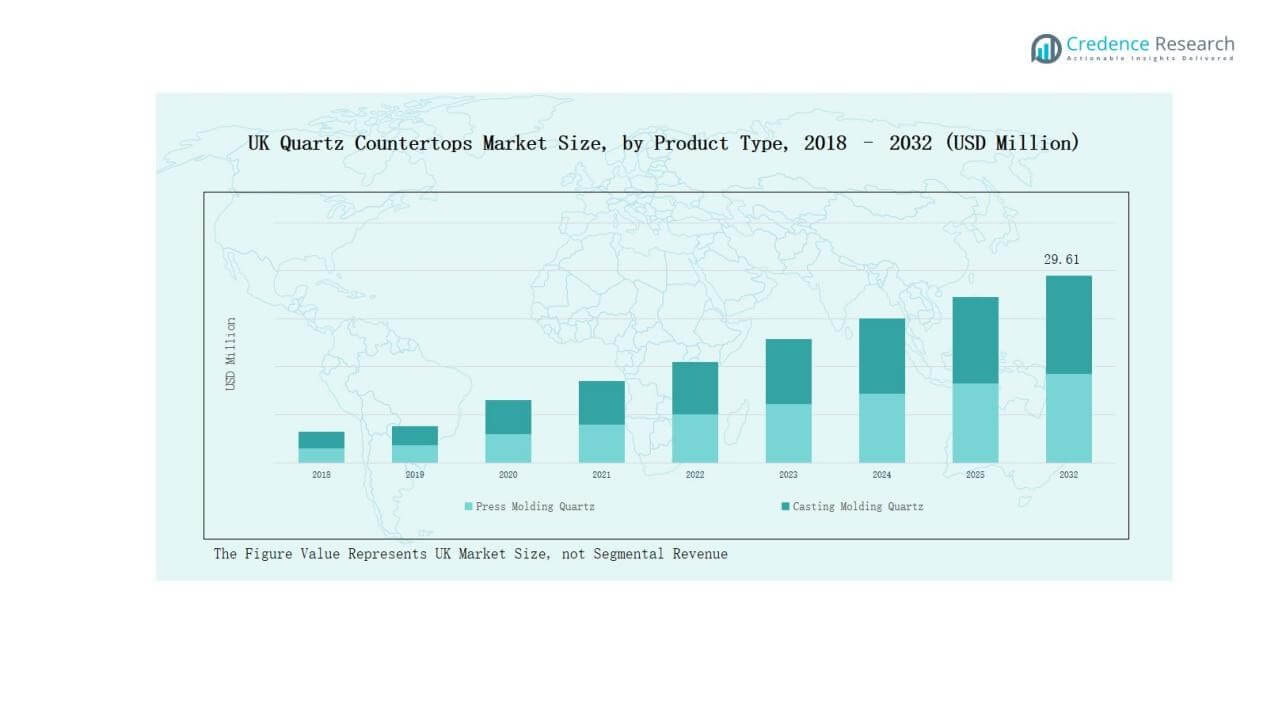

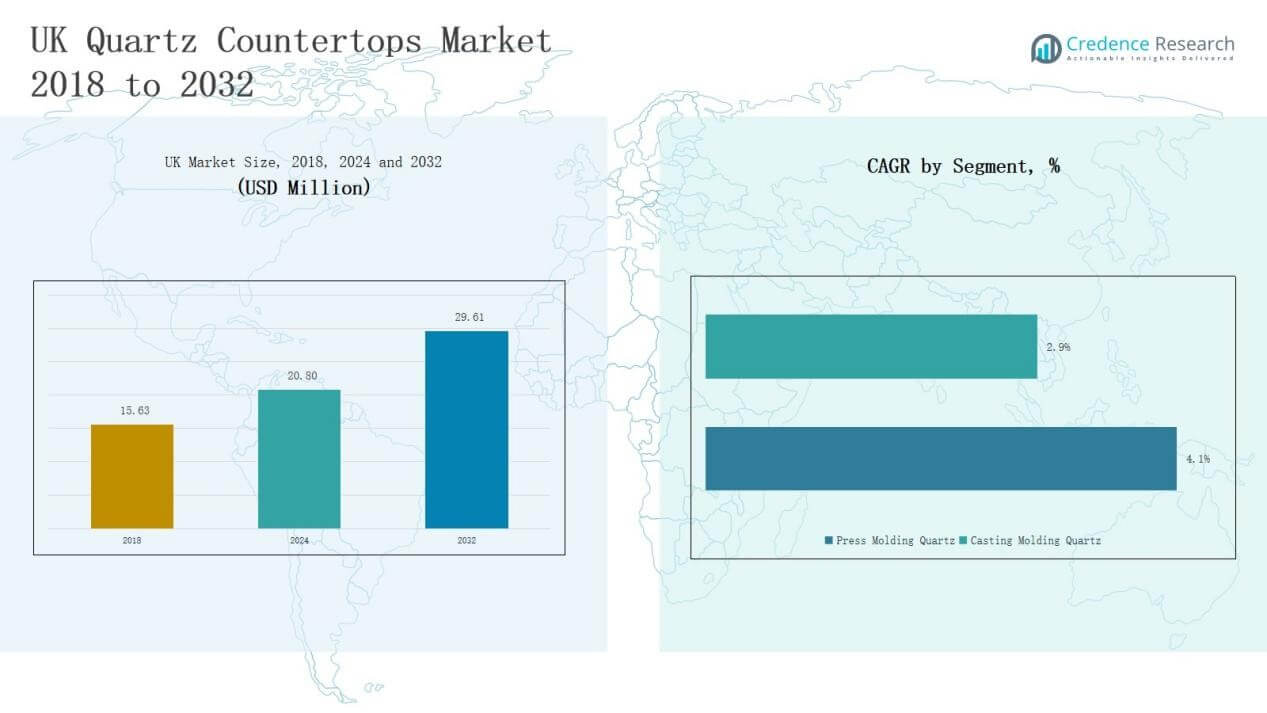

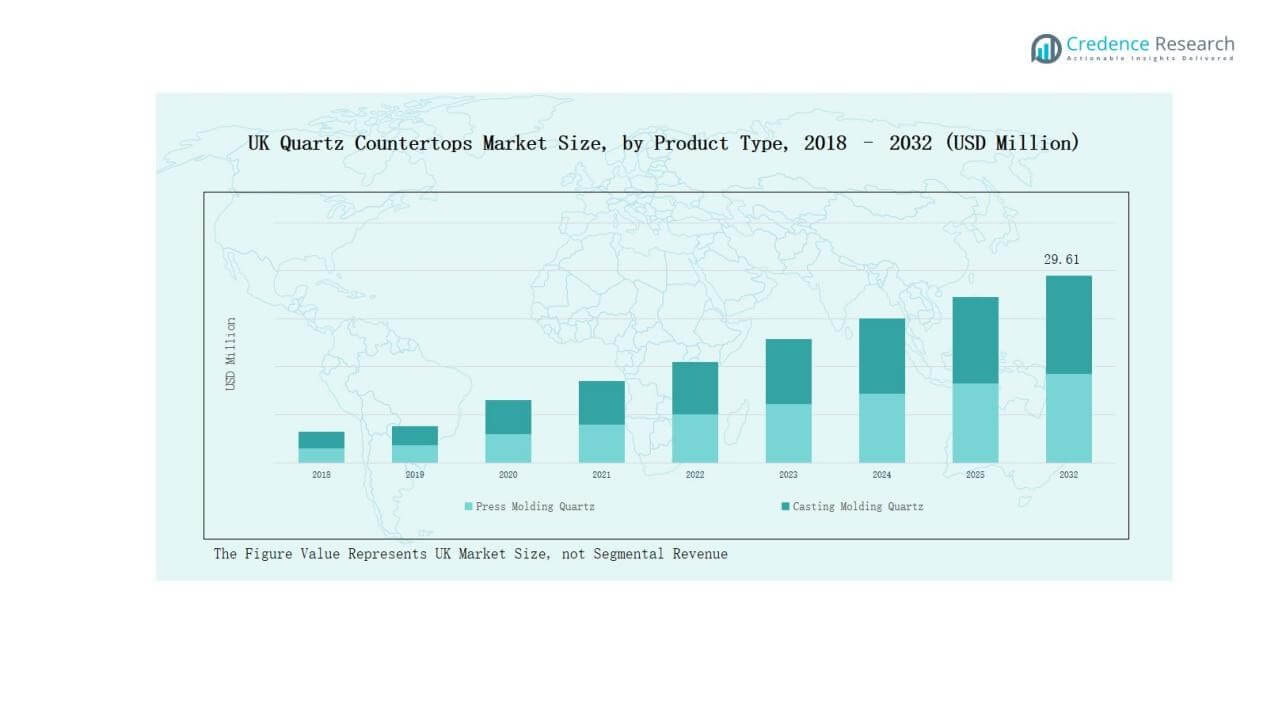

The UK Quartz Countertops Market size was valued at USD 15.63 million in 2018, reached USD 20.80 million in 2024, and is anticipated to reach USD 29.61 million by 2032, at a CAGR of 4.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Quartz Countertops Market Size 2024 |

USD 20.80 Million |

| UK Quartz Countertops Market, CAGR |

4.20% |

| UK Quartz Countertops Market Size 2032 |

USD 29.61 Million |

The UK Quartz Countertops Market features strong competition among global and regional players, with leading companies such as Cosentino S.A., Caesarstone, Compac, Technistone, Breton S.p.A., Santa Margherita, Quarella, Lapitec, Quartzforms, and Stone Italiana driving market growth through wide product portfolios, innovative designs, and sustainable solutions. These companies emphasize durability, premium finishes, and eco-friendly offerings to capture demand across residential and commercial applications. Regionally, England led the market with 52% share in 2024, supported by robust residential construction, remodeling projects, and a strong distribution network that ensures consistent availability and adoption.

Market Insights

Market Insights

- The UK Quartz Countertops Market grew from USD 15.63 million in 2018 to USD 20.80 million in 2024 and will reach USD 29.61 million by 2032 at 4.20% CAGR.

- Press molding quartz held 61% share in 2024, driven by durability, design versatility, and cost efficiency, while casting molding quartz gained traction in premium applications.

- The residential segment led with 64% share in 2024, supported by modern kitchens, bathrooms, and remodeling demand, followed by commercial at 27% and others at 9%.

- England dominated with 52% share in 2024, supported by strong residential construction, remodeling activities, and robust distributor networks, while Scotland, Wales, and Northern Ireland followed.

- Leading players include Cosentino S.A., Caesarstone, Compac, Technistone, Breton S.p.A., Santa Margherita, Quarella, Lapitec, Quartzforms, and Stone Italiana, focusing on premium finishes and sustainable designs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Press molding quartz dominated the UK Quartz Countertops Market in 2024 with nearly 61% share, supported by strong adoption in residential and commercial construction projects. Its popularity stems from superior durability, design versatility, and cost efficiency compared to casting molding quartz. Casting molding quartz, though smaller in share, is gaining momentum in high-end applications due to enhanced customization and premium finish. Growth in remodeling activities and demand for modern aesthetics continues to drive both sub-segments forward.

For instance, Cambria launched quartz surfaces with enhanced stain resistance, supporting growth in modern renovation projects focused on both functionality and aesthetics.

By Application

The residential segment led the UK Quartz Countertops Market in 2024 with about 64% share, driven by rising demand for modern kitchens, premium interiors, and durable bathroom surfaces. Homeowners favor quartz for its non-porous, stain-resistant properties and wide design variety. Commercial spaces such as offices, hotels, and retail outlets represented around 27% share, supported by growing hospitality projects. The “Others” category, holding nearly 9% share, includes institutional and public facilities adopting quartz for durability and ease of maintenance.

For instance, Compac expanded its Obsidiana range, made with up to 100% recycled glass, which has been utilized in schools and healthcare facilities due to its strength and sustainable profile.

Key Growth Drivers

Rising Home Renovation and Remodeling Activities

The UK Quartz Countertops Market benefits from steady growth in home renovation and remodeling projects. Homeowners increasingly prefer quartz countertops for modern kitchens and bathrooms due to their durability, aesthetic appeal, and low maintenance. Growing demand for stylish and long-lasting surfaces aligns with changing lifestyle trends. The shift toward premium housing upgrades continues to expand quartz adoption. This driver strengthens the residential segment and supports consistent demand in both new installations and replacement projects across the UK market.

For instance, Cosentino, a key player, has enhanced its Silestone quartz line with new resin technology, improving durability and stain resistance, which appeals to homeowners seeking stylish and low-maintenance surfaces.

Expanding Commercial Construction and Hospitality Sector

Commercial spaces, particularly in hospitality, retail, and office developments, drive quartz adoption in the UK. Developers and architects specify quartz for its design flexibility, resistance to wear, and ability to withstand high-traffic environments. Hotels and restaurants prefer quartz for reception counters, flooring, and dining areas where both aesthetics and durability are essential. The sector’s growth, supported by rising tourism and corporate investments, fosters long-term opportunities. This trend also contributes to higher demand in the premium design segment, expanding commercial market share.

Advancements in Manufacturing and Product Innovation

Technological innovations in manufacturing support growth in the UK Quartz Countertops Market. Advanced digital printing, improved resins, and automated production enhance design variety, finish quality, and cost efficiency. These developments allow manufacturers to meet diverse consumer preferences, from marble-look finishes to bold contemporary styles. Sustainability-focused innovations, such as eco-friendly resins and recycled quartz content, align with environmental regulations and consumer awareness. Product innovation not only expands customer base but also strengthens competitive positioning, enabling companies to differentiate in a crowded marketplace.

For instance, Cosentino introduced Silestone Sunlit Days, a quartz series manufactured with its HybriQ+ technology, incorporating at least 20% recycled glass and utilizing renewable energy in the production process

Key Trends & Opportunities

Growing Preference for Sustainable and Eco-Friendly Materials

Sustainability is becoming a significant opportunity in the UK Quartz Countertops Market. Consumers and developers increasingly seek eco-friendly materials with lower environmental impact. Manufacturers introduce quartz products with recycled content and reduced carbon footprints, appealing to environmentally conscious buyers. Stricter government regulations and green building certifications further push demand for sustainable options. This trend offers scope for differentiation, as eco-conscious quartz solutions gain favor in both residential and commercial projects, boosting long-term adoption and enhancing brand value for market leaders.

For instance, Universal Quartzz, a UK-based manufacturer, emphasizes sustainable production by incorporating eco-friendly resins and low-silica minerals while adopting clean water reuse processes and minimizing emissions

Rising Customization and Premium Aesthetic Demand

Consumers in the UK are showing strong preference for customized quartz countertops with premium finishes and unique designs. Demand for marble-look and matte finishes continues to grow, especially in luxury housing and commercial interiors. The ability to customize color, texture, and edge profiles allows quartz manufacturers to cater to diverse preferences. Rising disposable incomes and lifestyle upgrades strengthen this opportunity, as homeowners and developers increasingly view quartz as a premium investment. Customization remains a strong driver of competitive advantage in the market.

For instance, Cambria also launched new marble-inspired designs such as Brittanicca Gold and Colton, allowing homeowners to blend luxury aesthetics with durability.

Key Challenges

Key Challenges

Intense Market Competition and Price Pressure

The UK Quartz Countertops Market faces stiff competition among international and regional players. Price sensitivity among consumers creates challenges for premium quartz adoption, particularly against alternative materials like granite and laminate. While leading companies compete through design and quality, smaller players often focus on low-cost offerings, creating downward pressure on margins. This competitive environment forces established brands to balance pricing strategies with innovation and marketing investments to maintain profitability, while simultaneously ensuring product differentiation and value-added services.

High Production and Raw Material Costs

Rising costs of raw materials such as quartz, resins, and energy increase production expenses for manufacturers. Fluctuating supply chains and reliance on imported raw materials also contribute to cost pressures. These factors make it difficult for producers to maintain competitive pricing without compromising margins. Smaller firms are especially vulnerable to cost volatility, limiting their ability to scale. Addressing this challenge requires investment in local sourcing, efficiency improvements, and advanced technologies to streamline production while ensuring consistent product quality.

Supply Chain Disruptions and Import Dependence

The UK market relies heavily on imports for quartz slabs and related materials, exposing it to global supply chain disruptions. Events like port delays, transportation bottlenecks, and trade restrictions can significantly impact product availability and delivery timelines. Such challenges increase lead times and costs, affecting both manufacturers and customers. Post-Brexit trade complexities further add to supply chain risks. To overcome this challenge, industry players are focusing on diversifying sourcing strategies, developing local partnerships, and building resilient distribution networks.

Regional Analysis

England

England accounted for 52% share of the UK Quartz Countertops Market in 2024. Strong residential construction activity and demand for premium kitchen surfaces drive growth in this region. Homeowners favor quartz for its durability and design range, making it a preferred choice in both urban and suburban housing. The commercial sector, including hotels and retail outlets, also strengthens demand with modern interior projects. Product innovation and the presence of leading distributors support widespread adoption. England remains the core growth hub for the market.

Scotland

Scotland held 18% share of the UK Quartz Countertops Market in 2024. Growth is supported by increasing renovation projects and rising preference for luxury home interiors. The residential sector remains the largest consumer, while tourism-related commercial spaces add significant demand. Sustainable and eco-friendly quartz options gain traction in line with environmental regulations. Import dependence for materials poses challenges, but rising local design innovation offsets some risks. Scotland continues to expand its market position with a focus on quality-driven demand.

Wales

Wales represented 15% share of the UK Quartz Countertops Market in 2024. The market in this region benefits from demand in residential projects, particularly new housing developments and remodeling activities. Consumers value quartz for its strength and low-maintenance properties, supporting consistent growth. The commercial sector, especially in hospitality and retail, also contributes to adoption. Limited local production capacity increases reliance on imports, which influences pricing. Despite these challenges, Wales maintains steady expansion with lifestyle upgrades fueling countertop installations.

Northern Ireland

Northern Ireland contributed 15% share of the UK Quartz Countertops Market in 2024. Rising construction projects and investments in modern housing developments drive demand in this region. Quartz countertops attract consumers with their premium look and resistance to wear, particularly in high-traffic kitchens. Commercial projects, including office and hospitality spaces, further support adoption. Trade complexities impact supply chain efficiency, but distributors strengthen local availability. Northern Ireland continues to provide growth opportunities, especially with increasing urban development and consumer lifestyle improvements.

Market Segmentations:

Market Segmentations:

By Product Type

- Press Molding Quartz

- Casting Molding Quartz

By Application

- Residential

- Commercial

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK Quartz Countertops Market is characterized by strong competition among global leaders and regional suppliers, each leveraging diverse strategies to secure market presence. Leading companies such as Cosentino S.A., Caesarstone, Compac, Technistone, Breton S.p.A., Santa Margherita, Quarella, Lapitec, Quartzforms, and Stone Italiana hold significant positions by offering wide product portfolios, advanced manufacturing technologies, and sustainable solutions. They focus on innovation in design, durability, and eco-friendly materials to align with evolving consumer preferences in both residential and commercial spaces. Regional distributors and niche manufacturers compete through cost-effective offerings and localized distribution networks, serving customers seeking affordability and faster delivery. Increasing emphasis on customization, premium finishes, and digital design solutions also shapes competition. Companies invest in marketing and partnerships with architects and contractors to expand market share. The competitive environment encourages continuous product development and brand differentiation, ensuring sustained rivalry across the UK market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Cosentino S.A.

- Caesarstone

- Compac

- Technistone

- Breton S.p.A.

- Santa Margherita

- Quarella

- Lapitec

- Quartzforms

- Stone Italiana

Recent Developments

- In September 2025, TOPSCO broadened the availability of its grey kitchen and bathroom quartz worktops across new UK regions.

- In January 2025, Vadara Quartz Surfaces entered the UK market through a distribution partnership with The Thomas Group.

- In April 2024, DuPont Corian Design unveiled new color aesthetics under its Corian® Quartz offering.

- In 2025, Cosentino UK expanded its Sensa by Cosentino® line by adding four new quartzite-inspired surfaces.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for quartz countertops will rise with increasing home renovation and remodeling projects.

- Residential applications will continue to dominate, supported by growing preference for premium interiors.

- Commercial adoption will expand with new hotel, retail, and office developments across the UK.

- Sustainable quartz products with recycled content will gain stronger acceptance among eco-conscious buyers.

- Digital design and advanced manufacturing technologies will enhance customization and product variety.

- Regional players will strengthen their position by offering cost-effective solutions and faster delivery.

- Premium marble-look and matte finishes will remain popular in both residential and commercial projects.

- Import dependence will drive companies to explore local sourcing and supply chain resilience.

- Collaborations with architects and contractors will play a key role in market expansion.

- Consumer preference for low-maintenance, durable, and stylish surfaces will sustain long-term demand.

Market Insights

Market Insights Key Challenges

Key Challenges Market Segmentations:

Market Segmentations: