Market Overview:

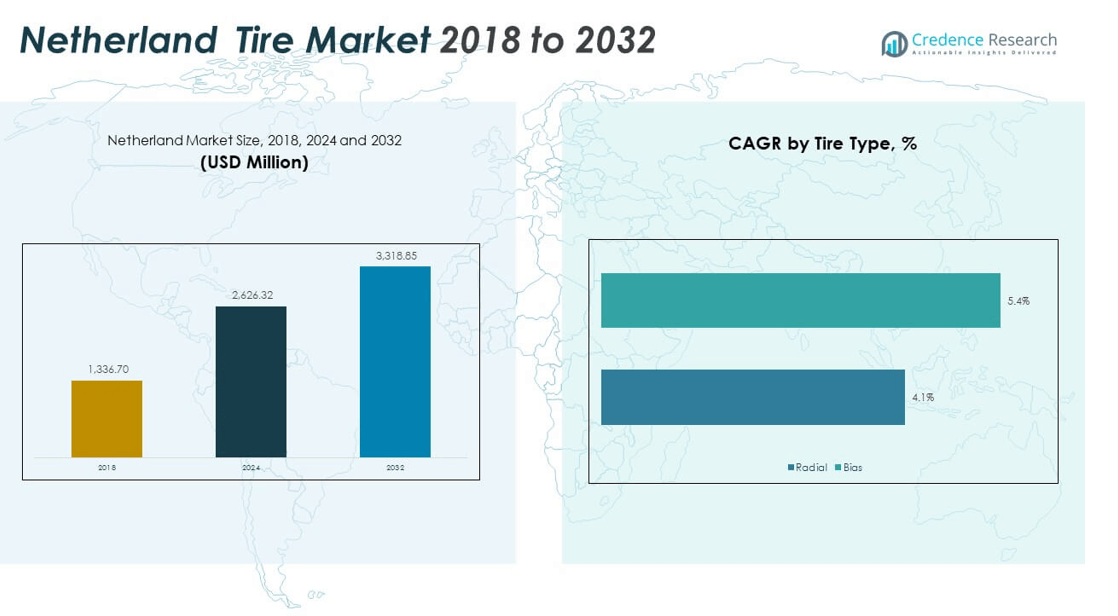

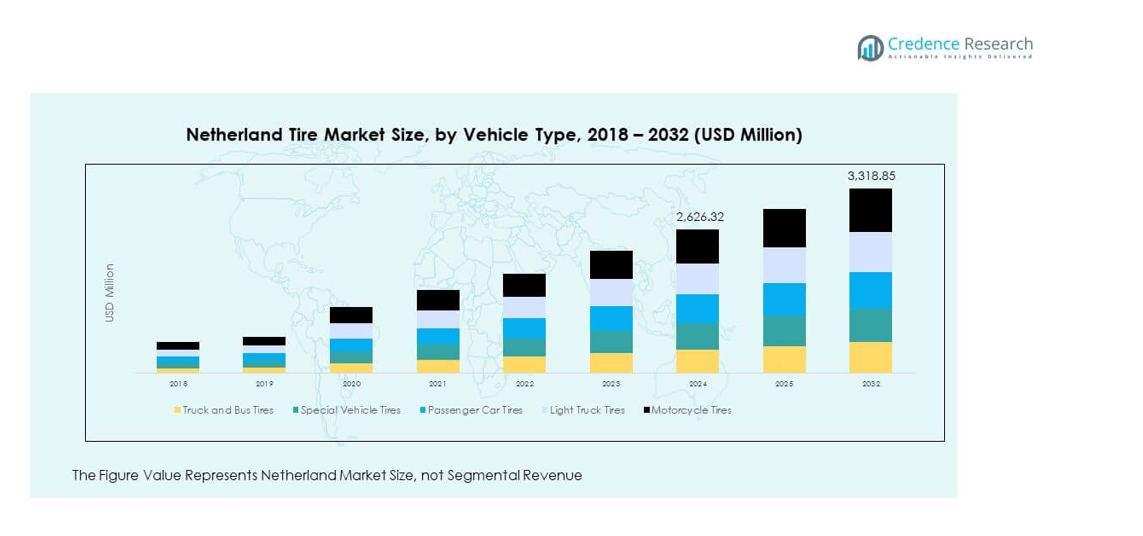

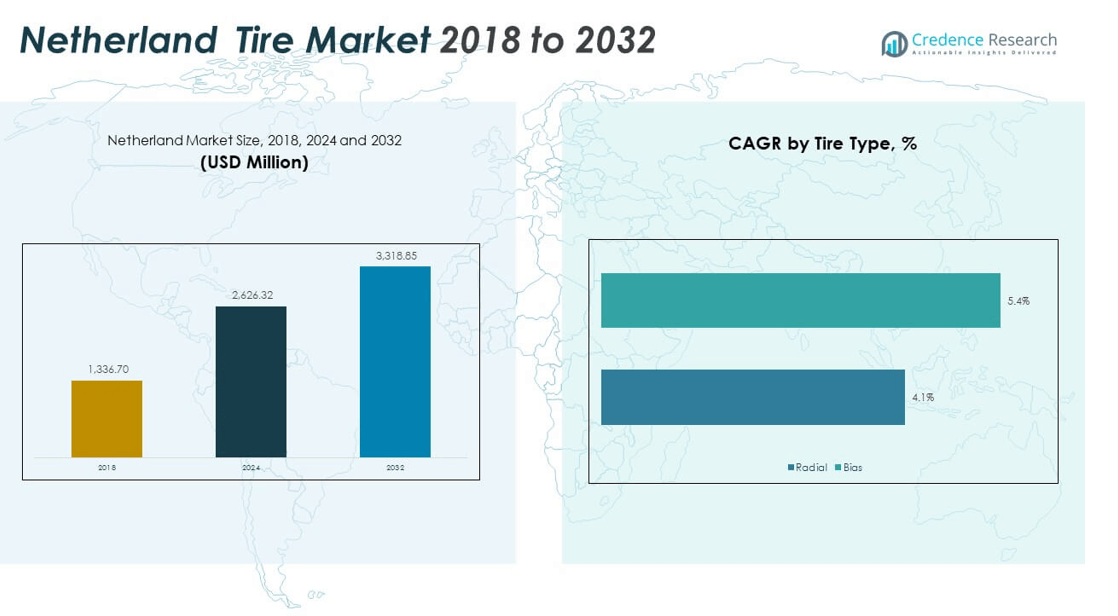

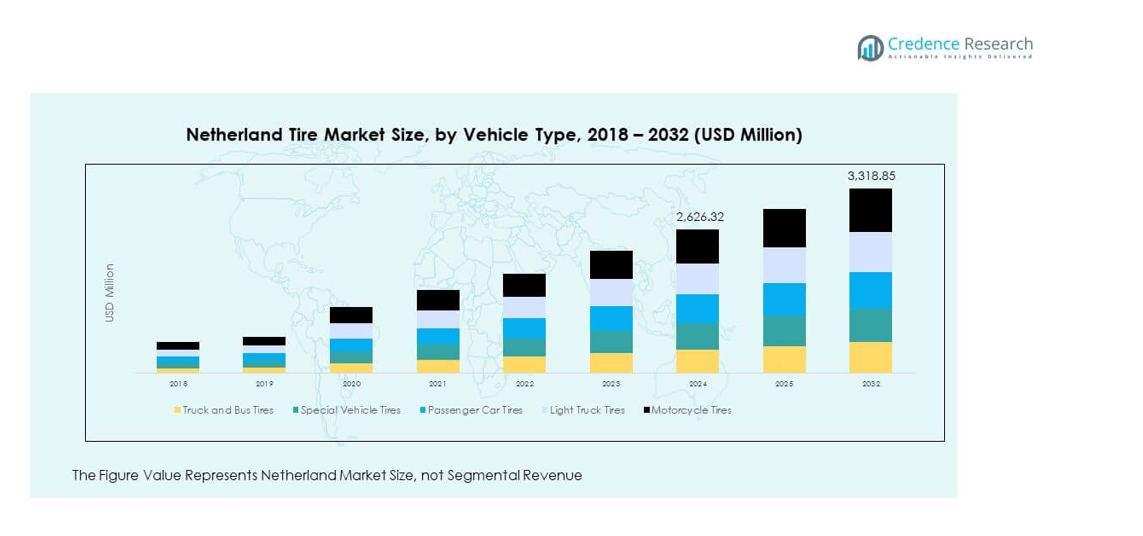

The Netherland Tire Market size was valued at USD 1,336.70 million in 2018 to USD 2,626.32 million in 2024 and is anticipated to reach USD 3,318.85 million by 2032, at a CAGR of 2.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Netherland Tire Market Size 2024 |

USD 2,626.32 million |

| Netherland Tire Market, CAGR |

2.97% |

| Netherland Tire Market Size 2032 |

USD 3,318.85 million |

The market is driven by increasing vehicle ownership, stringent safety standards, and the rising adoption of premium tire categories. Replacement demand remains robust due to regular inspection rules that enforce tire changes. Growing electric vehicle sales further create opportunities for specialized tire models offering low rolling resistance and enhanced durability. Manufacturers focus on sustainable materials and advanced technologies to address evolving consumer needs. This dynamic fosters continuous innovation and ensures competitive positioning across segments.

Regionally, the Western Netherlands leads due to dense urban centers, advanced transport infrastructure, and high consumer spending capacity. Southern regions gain traction from industrial clusters and cross-border trade activity that strengthen commercial tire demand. Northern and Eastern areas show growing importance, supported by agricultural and rural demand for cost-effective tire solutions. Emerging mobility trends and online distribution channels expand accessibility across all subregions, driving balanced national growth.

Market Insights

- The Netherland Tire Market was valued at USD 1,336.70 million in 2018, reached USD 2,626.32 million in 2024, and is projected at USD 3,318.85 million by 2032, growing at a CAGR of 2.97%.

- Western Netherlands led with 42% share due to urban density, high spending, and logistics hubs, while Southern Netherlands held 31% supported by cross-border trade and industrial clusters.

- Northern and Eastern Netherlands together held 27% share and represent the fastest-growing regions, driven by agricultural demand and rural mobility expansion.

- Passenger car tires dominated with 46% share in 2024, supported by high ownership levels and frequent replacement cycles.

- Truck and bus tires accounted for 23% share, reflecting strong logistics and public transport requirements across the national network.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Vehicle Ownership and Strong Replacement Demand Across Passenger and Commercial Segments

The Netherlands continues to witness steady vehicle ownership growth supported by both passenger and commercial fleets. A high replacement cycle remains central to market expansion, with consumers prioritizing safety and compliance with road regulations. Seasonal tire changeovers drive demand for premium winter and summer tires, ensuring consistent sales. Fleet operators contribute by upgrading to durable models that minimize downtime and maintenance costs. The Netherland Tire Market benefits from these dynamics, reinforcing its long-term stability. Electric vehicles further drive demand for advanced tires designed for low rolling resistance and extended durability. Consumers remain highly aware of the link between tire quality and fuel efficiency. Manufacturers capture this demand with innovative tire offerings that balance performance, comfort, and cost-effectiveness.

- For instance, in 2023 the Bridgestone Turanza All Season 6 was independently tested by TÜV SÜD, showing best-in-class wet braking at 27.2 meters (80–20 km/h), and a 20% improvement in mileage over its predecessor, with availability covering 96% of high-rim tires for both passenger and commercial vehicles in Europe.

Stringent Safety Standards and Regulations Driving Tire Innovation and Replacement Needs

Government regulations on road safety remain a significant driver of the tire market. Strict inspection rules ensure regular replacement of worn-out tires to maintain vehicle compliance. Tire labeling regulations emphasizing fuel efficiency, wet grip, and noise levels shape purchasing preferences among consumers. The Netherland Tire Market responds with manufacturers designing eco-friendly and high-performance products to meet compliance requirements. Regular safety checks conducted by authorities ensure high replacement rates, particularly in urban areas with dense traffic. Commercial transport operators face rigorous enforcement, making compliance with tire standards non-negotiable. It strengthens the role of premium tire manufacturers that focus on product quality. These regulations drive consistent revenue for both domestic distributors and global brands active in the region.

- For instance, Michelin’s Pilot Sport EV tire, launched for the European market, achieved a Wet Grip “B” rating on the European labelling scale and maintained wet grip performance above the R117 European regulation threshold even when worn matching safety and compliance expectations for high-density traffic regions.

Expanding Electric Vehicle Adoption Driving Need for Specialized Tire Models

The shift toward electric mobility is transforming tire demand patterns across the Netherlands. EV adoption creates new requirements for tires capable of handling higher torque and reduced noise. The Netherland Tire Market adapts through advanced solutions with reinforced sidewalls and optimized tread patterns. EV tires prioritize energy efficiency, improving driving range and performance consistency. Domestic and international manufacturers invest in R&D to address this demand for specialized designs. The government’s EV subsidies and charging infrastructure expansion accelerate adoption, further boosting tire demand. EV owners are highly attentive to the importance of specialized tires tailored for performance. It provides a key growth avenue for brands offering cutting-edge technologies in their product portfolios.

Premiumization Trend Driving Consumer Preference for High-Performance Tire Solutions

Dutch consumers demonstrate a rising preference for premium tire categories emphasizing safety, comfort, and brand reliability. The Netherland Tire Market witnesses strong traction for high-performance and ultra-high-performance segments catering to luxury and sports vehicles. This trend is reinforced by consumer spending capacity and awareness of quality benefits. Premium brands invest in digital platforms and advanced marketing to strengthen market visibility. Rising online sales provide an efficient channel for promoting premium tire lines with competitive pricing. High-performance tires align with the growing demand for advanced driving experiences across urban centers. It highlights the ongoing shift from basic utility purchases toward premium lifestyle-oriented choices. The consumer base in the Netherlands continues to value innovation, boosting adoption of technologically advanced tire models.

Market Trends

Digital Sales Platforms Transforming Tire Purchase and Distribution Landscape

The rapid growth of e-commerce has redefined how consumers buy and replace tires. Online platforms provide easy access to detailed product comparisons, influencing purchasing decisions. The Netherland Tire Market experiences a shift in consumer preference toward transparent and convenient digital channels. Retailers integrate AI-driven recommendations to guide buyers toward suitable products. The logistics network ensures fast delivery and installation services, strengthening consumer trust. Hybrid models combining online ordering with offline service centers gain popularity. It opens opportunities for manufacturers to build direct engagement with end customers. The digital transformation strengthens distribution networks while reducing dependency on traditional retail stores.

Sustainability and Circular Economy Principles Guiding Tire Manufacturing and Disposal

Sustainability has become a defining trend in tire production and recycling across Europe. Consumers increasingly demand eco-friendly products manufactured with reduced environmental footprints. The Netherland Tire Market reflects this shift with manufacturers adopting recycled rubber and bio-based materials. Tire recycling initiatives create structured supply chains for reprocessed raw materials. Companies introduce green-certified models that emphasize low emissions and extended lifecycles. The government supports sustainable production through incentives and strict waste management policies. It strengthens industry efforts toward a circular economy model promoting environmental responsibility. Sustainability enhances brand positioning and consumer loyalty in a highly regulated market.

- For example, in June 2024, Circtec acquired Granuband B.V., which operates a recycling plant in the port of Amsterdam with a 50,000-ton end-of-life tire processing capacity the largest in the Benelux region and announced the construction of a new, fully integrated recycling facility in Delfzijl, Netherlands.

Smart Tire Technologies Integrating Sensors for Enhanced Safety and Efficiency

The introduction of smart tires equipped with embedded sensors is gaining traction. These models monitor tire pressure, tread wear, and road conditions in real-time. The Netherland Tire Market recognizes the importance of technology-driven safety improvements. Smart tire systems help reduce accidents and improve fleet management efficiency. Automotive OEMs collaborate with tire manufacturers to integrate digital monitoring in vehicles. Consumers respond positively to safety features linked with longer product lifespan. It positions smart tires as a premium product category with strong growth potential. Advanced data analytics ensures tire performance optimization across passenger and commercial vehicles.

Urbanization and Infrastructure Growth Fueling Demand for Specialized Tire Categories

Urban development continues to drive traffic density and new mobility requirements. The Netherland Tire Market adapts by offering specialized tires suited for urban driving conditions. Compact vehicles, EVs, and shared mobility platforms stimulate rising demand. Manufacturers respond with models optimized for short-distance durability and low noise. Infrastructure improvements in highways and logistics hubs also expand heavy-duty tire demand. Urban logistics operators emphasize cost-effective solutions for high-volume distribution fleets. It shapes demand for commercial tires with reinforced performance features. Infrastructure and mobility developments continue to shape the tire product mix across urban regions.

- For example, in June 2023, Goodyear also introduced the Urban Max BSA EV tire, engineered specifically for urban electric buses and metro fleets, delivering increased load capacity and lower rolling resistance to enhance range for public transportation providers.

Market Challenges Analysis

Fluctuating Raw Material Prices Impacting Profitability and Production Planning

The volatility in natural rubber, synthetic rubber, and crude oil derivatives significantly impacts cost structures. Manufacturers face challenges in stabilizing margins while competing in a price-sensitive environment. The Netherland Tire Market encounters pressure as suppliers adjust pricing strategies to maintain competitiveness. Frequent shifts in input costs make long-term planning more complex for both producers and distributors. Global supply chain disruptions further complicate procurement and inventory management. It creates financial risks for small and mid-sized players operating with limited resources. Larger companies may offset costs through advanced sourcing strategies and vertical integration. The industry continues to address volatility through innovation in alternative materials and efficiency measures.

Intense Competitive Landscape Limiting Differentiation and Profit Growth Opportunities

The tire industry in the Netherlands experiences stiff competition from domestic distributors and global brands. Market fragmentation increases pricing pressure and limits differentiation opportunities for manufacturers. The Netherland Tire Market requires players to constantly innovate product lines to sustain visibility. Mid-tier brands struggle to capture market share against premium and low-cost competitors. Distribution networks must adapt quickly to evolving consumer preferences and digital adoption. It creates challenges in aligning marketing, supply, and customer service strategies. Competitive intensity reduces profit margins, forcing companies to streamline operations. The industry’s success depends on balancing cost efficiency with product innovation and service excellence.

Market Opportunities

Growth of Electric and Hybrid Vehicle Segment Creating New Tire Demand Avenues

The accelerating adoption of EVs and hybrid vehicles generates demand for tires tailored to advanced needs. Specialized tire models address higher torque, noise reduction, and energy efficiency requirements. The Netherland Tire Market responds with investments in research for durable and efficient solutions. Automotive manufacturers increasingly partner with tire brands for OEM collaborations. It ensures compatibility with new mobility technologies and promotes product innovation. Rising EV adoption across urban and semi-urban centers boosts this opportunity further. Companies that offer specialized tire categories gain a competitive edge. The sector’s direction aligns with consumer demand for environmentally responsible and high-performance vehicles.

Expansion of Premium Tire Segment Supported by Rising Consumer Awareness and Spending

Consumers demonstrate strong interest in premium products offering safety, comfort, and durability. The Netherland Tire Market leverages this trend by expanding high-performance and luxury segments. Online platforms create easy access for consumers to evaluate and purchase premium models. It strengthens the growth potential for brands investing in advanced product portfolios. Partnerships with dealerships and service providers reinforce premium segment visibility. Marketing campaigns highlight innovation, aligning with lifestyle-focused purchasing behavior. Premium categories command higher margins and deliver sustainable profitability. Growing awareness of safety standards and vehicle efficiency drives long-term premium demand in the region.

Market Segmentation Analysis

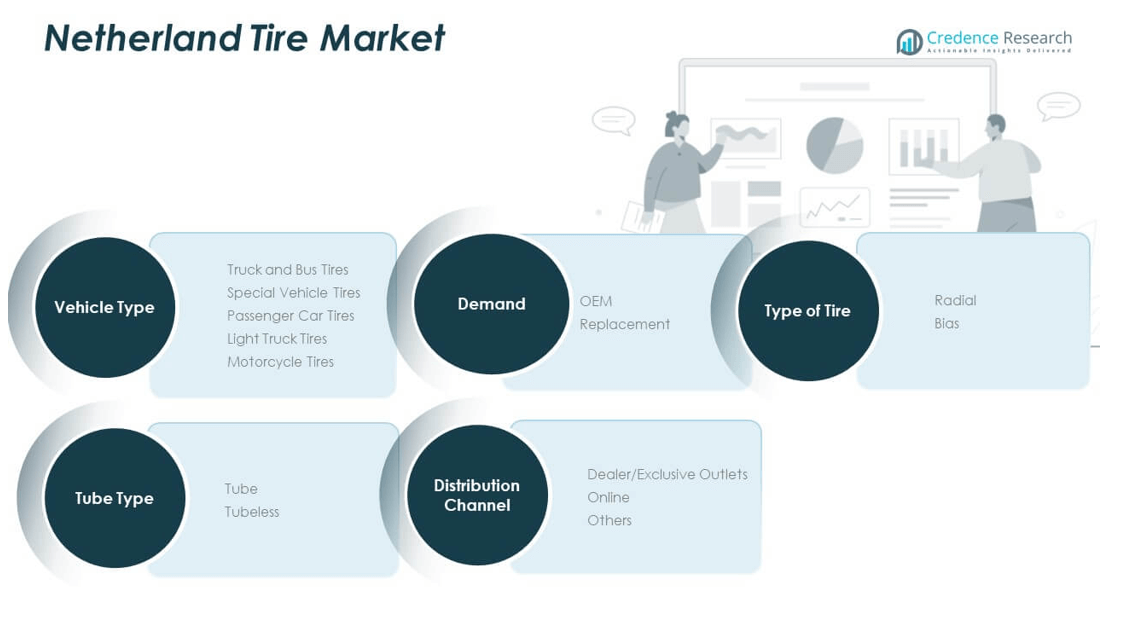

By vehicle type, passenger car tires hold the dominant share of the Netherland Tire Market, supported by high ownership levels and frequent replacement cycles. Truck and bus tires contribute steadily due to logistics and public transportation demand. Light truck and motorcycle tires record moderate growth, while special vehicle tires remain niche, driven by agriculture and construction activity. It highlights a balanced mix of consumer and commercial demand shaping overall market performance.

By demand, the replacement segment leads strongly, driven by strict inspection rules and regular tire changes. OEM sales contribute through partnerships with automotive manufacturers, particularly in electric and premium vehicle categories. The Netherland Tire Market relies heavily on the replacement segment for recurring revenue streams. It reinforces the importance of aftermarket distribution networks across urban and rural regions.

- For instance, Dutch vehicle owners are required to comply with the APK inspection rule, which mandates regular tire checks for tread depth and condition, driving consistent replacement demand in the market. This regulation directly influences consumer purchasing and ensures frequent adoption of premium tires designed to meet or exceed minimum tread depth standards.

By type of tires, radial tires dominate due to superior durability, fuel efficiency, and performance benefits. Bias tires retain a smaller share, serving specific heavy-duty and agricultural applications.

- For instance, Continental’s Conti Hybrid HS5 steer axle tire offers ultra-high mileage for regional fleet operations, attributable to a new tread compound with a high amount of natural rubber and full-width 3D matrix sipes for optimal durability and performance throughout the tire’s lifetime.

By tube type, tubeless tires lead, supported by safety and convenience advantages, while tube tires remain limited to older or specialized vehicles.

By distribution channel, dealer and exclusive outlets maintain strong presence, but online platforms record rapid expansion with digital adoption. It shows shifting consumer preferences and highlights new opportunities for wider accessibility.

Segmentation

By Vehicle Type

- Truck and Bus Tires

- Special Vehicle Tires

- Passenger Car Tires

- Light Truck Tires

- Motorcycle Tires

By Demand

By Type of Tires

By Tube Type

By Distribution Channel

- Dealer/Exclusive Outlets

- Online

- Others

Regional Analysis

Western Netherlands

The Western Netherlands leads the market with a 42% share, driven by dense urban centers such as Amsterdam, Rotterdam, and The Hague. High vehicle ownership and advanced transport infrastructure support consistent demand for passenger and commercial tires. The Netherland Tire Market benefits from strong replacement cycles, supported by strict inspection rules that require frequent tire changes. Logistics hubs around Rotterdam port also contribute significantly, with commercial fleets generating sustained demand for durable tires. Premium and high-performance categories find strong adoption among urban consumers with higher spending capacity. It strengthens the region’s position as the central hub for tire distribution and innovation.

Southern Netherlands

The Southern Netherlands accounts for 31% of the market share, supported by cross-border trade and industrial activity. Cities like Eindhoven and Maastricht host thriving automotive and manufacturing clusters that enhance tire demand. Replacement sales dominate in this subregion due to high commuter traffic and growing mobility services. The Netherland Tire Market in this subregion also gains traction from the expansion of electric mobility infrastructure. Consumers adopt eco-friendly and specialized tire models aligned with regulatory priorities on emissions and safety. Strong logistics and highway connectivity create additional opportunities for commercial tire demand. It positions the southern region as a critical driver of future growth in both OEM and aftermarket segments.

Northern and Eastern Netherlands

The Northern and Eastern Netherlands collectively hold 27% share of the market, reflecting growing potential supported by rural and semi-urban demand. Agricultural and special vehicle tires record steady uptake due to the importance of farming and construction activities. The Netherland Tire Market in these regions shows increasing adoption of cost-effective solutions suited for longer replacement cycles. Consumers demonstrate preference for mid-range and budget tire segments that balance durability with affordability. Expansion of online distribution channels enhances accessibility for buyers outside major cities. It highlights the regions’ role as emerging contributors to overall national growth while offering opportunities for wider penetration by global and domestic tire brands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bridgestone

- Continental

- Goodyear

- Michelin

- Pirelli

- Hankook

- Kumho

- Nokian

- Sumitomo Rubber Industries

- Toyo Tire & Rubber

Competitive Analysis

The Netherland Tire Market is characterized by strong competition between global giants and regional distributors. Leading players such as Bridgestone, Michelin, Continental, Goodyear, and Pirelli dominate the premium and high-performance segments with extensive product portfolios. It maintains market strength through established distribution networks, OEM partnerships, and innovation in eco-friendly tire technologies. Hankook, Kumho, and Nokian capture demand in mid-range and value-driven categories by offering cost-efficient solutions. Sumitomo Rubber Industries and Toyo Tire expand their presence through strategic launches targeting niche segments such as EV-compatible and specialty tires. Competition intensifies with companies adopting digital sales platforms and omnichannel strategies to strengthen customer engagement. The Netherland Tire Market faces rising consolidation, with mergers and partnerships shaping brand positioning and service offerings. It creates opportunities for players that invest in sustainability, advanced materials, and smart tire technologies. Market leaders emphasize R&D spending to improve durability, rolling resistance, and performance standards. Regional distributors focus on aftermarket sales to remain competitive against global players. It highlights a balanced mix of premium, mid-range, and budget segments, ensuring a diverse market structure.

Recent Developments

- In August 2025, Pirelli reached its milestone 500th Formula 1 Grand Prix at the Dutch Grand Prix in Zandvoort. Pirelli supplied C2, C3, and C4 compound tires for the event, highlighting the company’s ongoing involvement with Dutch motorsports through tire technology and motorsport partnerships.

- In March 2025, Nokian launched the Seasonproof 2 all-season tire for the Central European market, with production at the new zero CO2 emission factory in Romania. The new product features up to 38% recycled and renewable materials and is available throughout Europe, including Dutch consumers, by autumn 2025.

- In February 2025, Goodyear expanded its Eagle F1 Asymmetric 6 ultra-high-performance summer tire lineup by launching 42 new SKUs in Europe, including the Netherlands. This brings their total offering to 233 SKUs, optimized for larger rim sizes and electric vehicles, with advanced technologies such as SoundComfort and SealTech.

- In January 2025, Hankook announced it would become the exclusive tire supplier to the World Rally Championship (WRC), including Junior WRC. The 2025 season begins with the Monte Carlo Rally, and Hankook’s innovation will be showcased at 14 rounds across Europe, including the Netherlands

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Demand, Type of Tires, Tube Type and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of electric and hybrid vehicles will generate steady demand for specialized tire models.

- Expansion of premium and high-performance categories will remain supported by consumer preference for quality and safety.

- Strong replacement cycles will continue to drive consistent revenue, reinforced by strict inspection rules and safety standards.

- Digital distribution platforms will transform consumer purchasing behavior, expanding accessibility across urban and rural regions.

- Sustainability requirements will push manufacturers to invest in eco-friendly materials and recycling initiatives.

- Smart tire technologies will emerge as a differentiator, with embedded sensors improving safety and fleet efficiency.

- OEM collaborations will gain momentum as automotive brands seek specialized tires for advanced vehicle designs.

- Regional growth in Southern Netherlands will accelerate, supported by industrial clusters and cross-border trade activity.

- Competitive intensity will rise, with global leaders focusing on innovation while regional players target aftermarket sales.

- Investment in R&D will shape the future of durability, noise reduction, and rolling resistance optimization.