Market Overview:

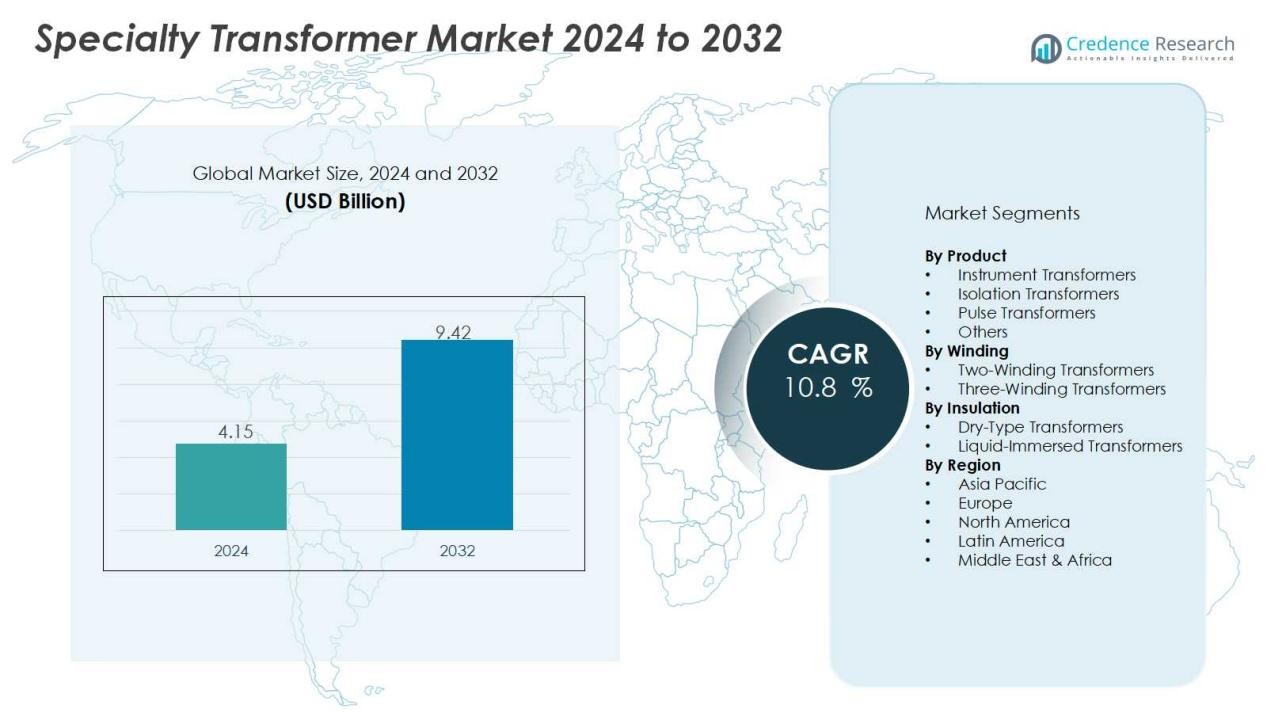

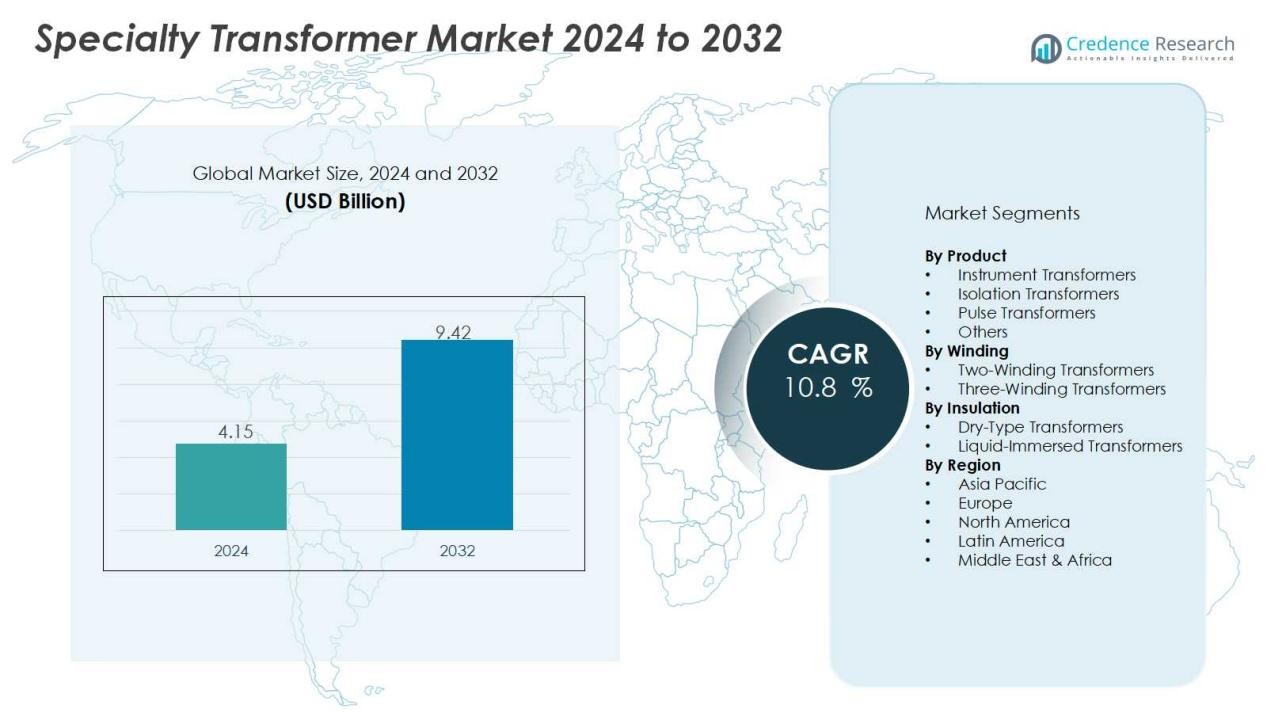

The specialty transformer market size was valued at USD 4.15 billion in 2024 and is anticipated to reach USD 9.42 billion by 2032, at a CAGR of 10.8 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Specialty Transformer Market Size 2024 |

USD 4.15 Billion |

| Specialty Transformer Market, CAGR |

10.8 % |

| Specialty Transformer Market Size 2032 |

USD 9.42 Billion |

Key drivers include the growing integration of renewable energy sources into power grids, which requires specialized transformers for grid stability and energy efficiency. The expansion of data centers, electric vehicles, and medical imaging devices further drives adoption of compact, high-performance transformers tailored for advanced applications. Additionally, rising safety standards and regulatory frameworks push industries to adopt energy-efficient, low-loss transformers that reduce operational costs and environmental impact. Manufacturers are responding with innovative designs, advanced insulation materials, and digital monitoring features.

Regionally, North America and Europe remain key markets due to robust infrastructure modernization and strong presence of leading manufacturers. Asia Pacific, however, is the fastest-growing region, fueled by rapid industrialization, urban electrification projects, and rising renewable energy installations in China and India. Meanwhile, Latin America and the Middle East & Africa present emerging opportunities through infrastructure expansion and energy diversification programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The specialty transformer market was valued at USD 4.15 billion in 2024 and is projected to reach USD 9.42 billion by 2032 at a CAGR of 10.8%.

- Rising demand for renewable energy integration drives the market as solar and wind projects require specialized transformers to stabilize variable supply and maintain grid efficiency.

- The expansion of data centers boosts adoption, with customized transformers ensuring uninterrupted operations, minimal losses, and compliance with strict energy regulations.

- Electric mobility strengthens growth as charging stations and fast-charging networks depend on specialized transformers to enhance efficiency and grid compatibility.

- Strict regulatory frameworks and safety standards encourage industries to adopt low-loss, energy-efficient transformers with advanced insulation and monitoring features.

- North America led with 36% share in 2024, followed by Europe at 29%, supported by strong infrastructure, industrial bases, and modernization policies.

- Asia Pacific accounted for 25% share in 2024, emerging as the fastest-growing region with rapid urbanization, renewable energy investments, and expanding EV infrastructure.

Market Drivers:

Rising Demand for Renewable Energy Integration:

The specialty transformer market benefits from the global shift toward renewable power generation. Solar and wind projects require transformers that manage variable voltages and intermittent energy supply. These systems rely on compact, efficient units that ensure grid stability and long-term reliability. Governments supporting clean energy expansion continue to increase demand for advanced transformer solutions.

- For instance, in August 2025, Hitachi Energy and SMA reached a significant milestone by delivering their 3,000th specialty transformer designed for renewable energy integration, supporting solar and wind infrastructure expansion worldwide.

Expansion of Data Centers and Digital Infrastructure:

The specialty transformer market gains momentum from the rapid growth of cloud computing and data storage facilities. Data centers require customized transformers to manage high power loads with minimal losses. It supports uninterrupted operations, efficient cooling, and compliance with energy regulations. Growing dependence on digital infrastructure drives investment in reliable and application-specific transformers.

- For instance, WEG announced a $77 million investment in September 2025 to expand its specialty transformer manufacturing facility in Washington, Missouri, specifically targeting production capacity for transformers with power ratings from 1 to 10 MVA to support U.S. data center expansion, resulting in a 50% increase in production capacity.

Growth in Electric Mobility and Charging Infrastructure:

The specialty transformer market experiences growth from the expanding electric vehicle ecosystem. Charging stations and fast-charging networks require specialized transformers to handle variable voltages safely. It supports grid compatibility and enhances energy efficiency at scale. National EV policies and consumer adoption trends reinforce the market’s potential in transportation-related power systems.

Rising Standards for Safety, Efficiency, and Reliability:

The specialty transformer market is supported by strict regulatory frameworks and evolving safety codes. Industries demand transformers that reduce energy losses while offering long service life. It encourages manufacturers to focus on advanced insulation, low-loss cores, and monitoring features. Rising awareness about operational safety and environmental impact increases adoption across healthcare, transport, and industrial sectors.

Market Trends:

Increasing Focus on Smart, Energy-Efficient, and Digitally Enabled Solutions:

The specialty transformer market is moving toward energy-efficient models with advanced digital features. Smart monitoring systems are being integrated to track performance, predict failures, and improve energy management. It supports industries where downtime and inefficiency can lead to significant losses. Manufacturers are investing in low-loss cores, high-quality insulation, and eco-friendly materials to comply with global efficiency standards. Demand is rising for compact designs that reduce installation costs while improving reliability. Growing emphasis on sustainability further pushes companies to innovate with recyclable materials and lower carbon footprints.

- For instance, distribution transformer manufacturers have implemented amorphous metal cores that achieve up to 70 percent reduction in core losses compared to traditional silicon steel cores, significantly enhancing energy efficiency and reducing electricity wastage.

Growing Customization Across Industries and Emerging Applications:

The specialty transformer market is witnessing strong demand for highly customized solutions tailored to specific industrial applications. Healthcare equipment, railway networks, and renewable energy projects require transformers designed for unique voltage, frequency, or safety needs. It allows manufacturers to differentiate and capture niche markets with specialized offerings. Advancements in design flexibility and modular production support rapid adoption in new industries. Rising investment in electric mobility and smart grids creates further opportunities for innovative configurations. Regional markets in Asia Pacific and the Middle East are adopting customized systems to match rapid infrastructure development.

- For instance, Hitachi Energy and SMA Solar Technology reached a partnership milestone by delivering 3,000 specialized transformers for photovoltaic applications in July 2024, designed specifically for solar inverter applications to efficiently convert and integrate renewable energy into the electrical grid.

Market Challenges Analysis:

High Production Costs and Complex Design Requirements:

The specialty transformer market faces pressure from the high costs of advanced materials and engineering complexity. Manufacturers must invest in precision design, specialized insulation, and low-loss components to meet industry standards. It raises overall production costs, making products less accessible in price-sensitive regions. Smaller companies often struggle to compete with larger players that have broader supply chains. Limited economies of scale further restrict profitability in niche applications. Volatility in raw material prices, particularly copper and steel, continues to impact cost stability.

Regulatory Compliance and Technical Barriers to Adoption:

The specialty transformer market also encounters challenges from strict regulatory requirements and technical limitations. Compliance with international safety, efficiency, and environmental standards demands continuous testing and certification. It creates longer lead times and increases overall development costs. Integration into renewable energy projects or electric mobility networks requires specialized knowledge and advanced design capabilities. Many end users lack technical expertise, which slows adoption and reduces deployment efficiency. Regional disparities in regulations complicate global market expansion for manufacturers.

Market Opportunities:

Expanding Role in Renewable Energy and Electric Mobility:

The specialty transformer market holds strong opportunities in renewable energy integration and electric mobility. Solar and wind projects require advanced transformers that handle fluctuating inputs with stability. It supports grid reliability and energy efficiency, making renewable projects more viable. Growing investment in electric vehicle infrastructure also creates sustained demand for customized transformers. Charging stations and fast-charging networks depend on specialized units to ensure safe and efficient power distribution. Governments promoting green energy and mobility programs provide a favorable environment for long-term adoption.

Increasing Adoption Across Healthcare, Data Centers, and Industrial Sectors:

The specialty transformer market benefits from rising applications in healthcare, data centers, and industrial automation. Medical imaging systems and hospital equipment require reliable transformers designed for sensitive operations. It enables uninterrupted performance while meeting strict safety standards. Expanding data center construction worldwide further boosts the need for high-capacity, energy-efficient designs. Industrial automation projects also drive demand for custom-built transformers that meet specific process requirements. Emerging economies with rapid infrastructure growth present new opportunities for suppliers to expand their reach.

Market Segmentation Analysis:

By Product:

The specialty transformer market includes distribution transformers, power transformers, and instrument transformers. Distribution transformers dominate due to their widespread use in utilities, commercial spaces, and residential projects. Power transformers hold significant demand in industries and renewable energy plants requiring high-capacity load management. Instrument transformers support precision in measurement and protection applications across industrial and grid systems. It is supported by rising deployment in sectors that demand efficiency and customized performance.

- For instance, Hammond Power Solutions launched its specialized EV charging distribution transformer in May 2025, featuring K-factor ratings of 9 to handle harmonic distortion currents and reduce neutral currents for high-volume charging applications

By Winding:

The specialty transformer market by winding type is divided into two-winding and auto-transformers. Two-winding transformers lead the segment with broad adoption in distribution and industrial operations. Auto-transformers grow steadily, offering cost efficiency, compact design, and higher energy savings in specialized projects. It provides greater flexibility for voltage regulation in renewable energy and transport networks. Both segments remain important to meet varying technical and operational requirements across industries.

- For Instance, Siemens Energy strengthened its position as a major provider of power transformers, focusing on strategic large-scale projects and advanced grid solutions.

By Insulation:

The specialty transformer market by insulation type includes dry-type and liquid-immersed transformers. Dry-type units gain traction in healthcare, commercial, and residential applications due to safety, reduced fire risk, and minimal maintenance. Liquid-immersed transformers dominate high-capacity projects requiring enhanced cooling and performance under heavy loads. It continues to be favored in renewable energy plants, industrial sites, and power distribution networks. Growing safety regulations and environmental concerns drive innovation in both insulation categories.

Segmentations:

By Product:

- Instrument Transformers

- Isolation Transformers

- Pulse Transformers

- Others

By Winding:

- Two-Winding Transformers

- Three-Winding Transformers

By Insulation:

- Dry-Type Transformers

- Liquid-Immersed Transformers

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe:

North America held 36% share of the specialty transformer market in 2024, while Europe accounted for 29%. Both regions benefit from advanced power infrastructure, strong industrial bases, and strict energy efficiency regulations. The market in North America is driven by demand from renewable energy projects, data centers, and healthcare systems requiring highly reliable transformers. It is further supported by federal policies promoting grid modernization and electric mobility adoption. In Europe, countries such as Germany, the UK, and France emphasize sustainable energy transitions. Manufacturers focus on eco-friendly materials, digital monitoring, and compliance with EU regulations to remain competitive.

Asia Pacific:

Asia Pacific accounted for 25% share of the specialty transformer market in 2024, making it the fastest-growing region. Rapid urbanization, industrialization, and strong renewable energy investments in China, India, and Japan fuel expansion. The region’s governments support electrification projects and renewable integration, creating strong demand for specialized transformers. It benefits from a large manufacturing base that provides cost advantages in production and export. Rising adoption of electric vehicles and fast-charging infrastructure further accelerates growth. Local and global manufacturers are increasing investments to capture opportunities in large-scale infrastructure development.

Latin America and Middle East & Africa:

Latin America held 6% share of the specialty transformer market in 2024, while the Middle East & Africa accounted for 4%. Both regions are emerging markets supported by infrastructure modernization and energy diversification initiatives. Growth in Latin America is driven by renewable energy projects in Brazil, Chile, and Mexico. It also benefits from industrial expansion requiring customized transformers for manufacturing operations. In the Middle East & Africa, investments in power distribution, oil and gas, and transport sectors support market development. International players are expanding partnerships with local firms to address region-specific demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABB (Switzerland)

- Schneider Electric (France)

- Siemens (Germany)

- Mitsubishi Electric Corporation (Japan)

- Eaton (Ireland)

- Alstom (France)

- GE Power (U.S.)

- Powerstar (England)

- CG Power and Industrial Solutions Limited (India)

- Ormazabal (Spain)

- SPX Transformer Solutions Inc. (U.S.)

- Triad Magnetics (U.S.)

Competitive Analysis:

The specialty transformer market is defined by the presence of global leaders offering advanced and customized solutions. Key players include ABB (Switzerland), Schneider Electric (France), Siemens (Germany), Mitsubishi Electric Corporation (Japan), Eaton (Ireland), Alstom (France), GE Power (U.S.), and Powerstar (England). These companies maintain strong positions through diversified portfolios, global distribution networks, and investments in innovation. It focuses on energy efficiency, compact design, and digital features to meet rising demand across renewable energy, data centers, and industrial automation. Leading players expand their reach through partnerships, acquisitions, and regional collaborations to strengthen supply chains and product adaptability. They also emphasize compliance with environmental standards by developing eco-friendly insulation systems and low-loss cores. Local and regional firms compete by offering cost-effective, niche-specific products tailored to domestic markets. Intense competition encourages continuous R&D and pushes the industry toward high-performance, reliable, and sustainable transformer solutions.

Recent Developments:

- In March 2025, Siemens and Accenture launched the Accenture Siemens Business Group to reinvent engineering and manufacturing through software-defined factories and AI integration.

- In September 2025, ABB Robotics entered into a partnership with LandingAI to accelerate the development of AI-driven robotics software applications.

Report Coverage:

The research report offers an in-depth analysis based on Product, Winding, Insulation and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The specialty transformer market will see rising demand from renewable energy integration and smart grid expansion.

- It will benefit from electric vehicle adoption, creating new opportunities in charging infrastructure.

- Healthcare will remain a strong segment as medical equipment requires highly reliable transformer solutions.

- Data centers will drive consistent demand with growth in cloud computing and digital infrastructure.

- Manufacturers will focus on eco-friendly materials and energy-efficient designs to meet regulations.

- It will adopt advanced monitoring technologies to improve reliability and predictive maintenance.

- Customization will expand further, supporting niche applications in railways, aerospace, and industrial automation.

- Emerging economies will present strong opportunities through infrastructure growth and urban electrification projects.

- Collaborations between global and regional players will strengthen supply chains and product innovation.

- The specialty transformer market will continue to evolve toward compact, digital-ready, and sustainable solutions.