Market Overview:

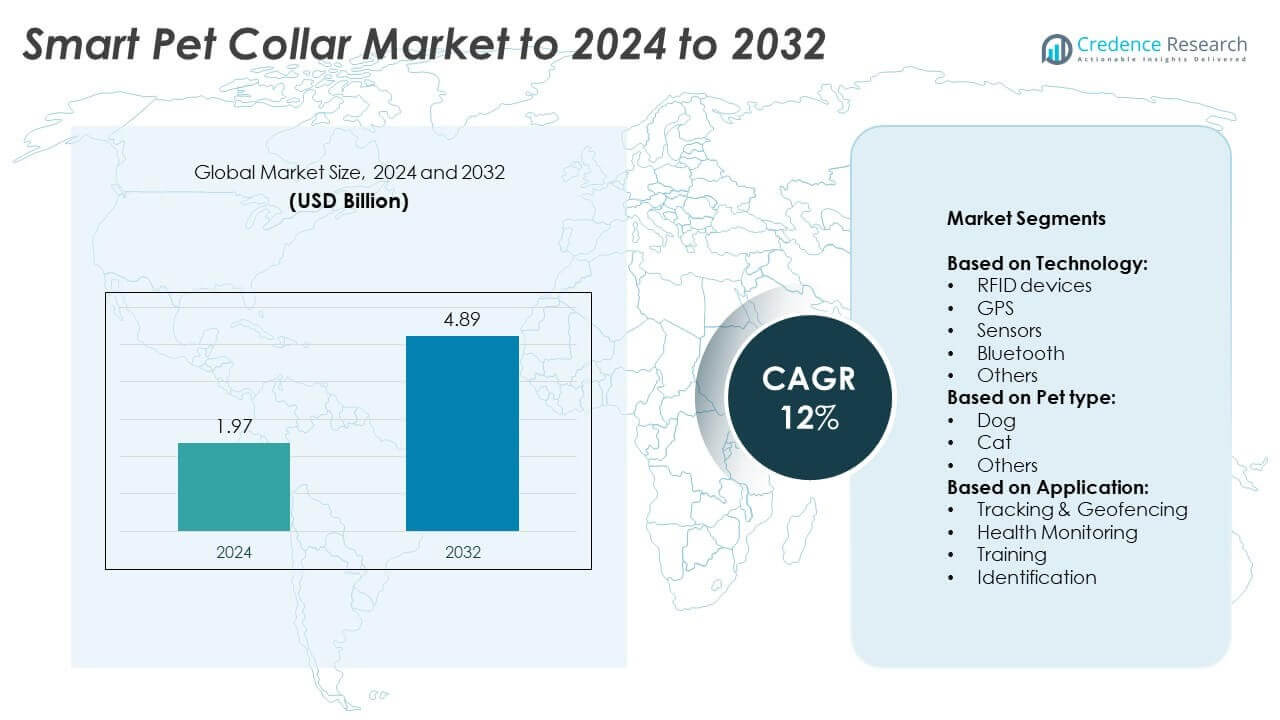

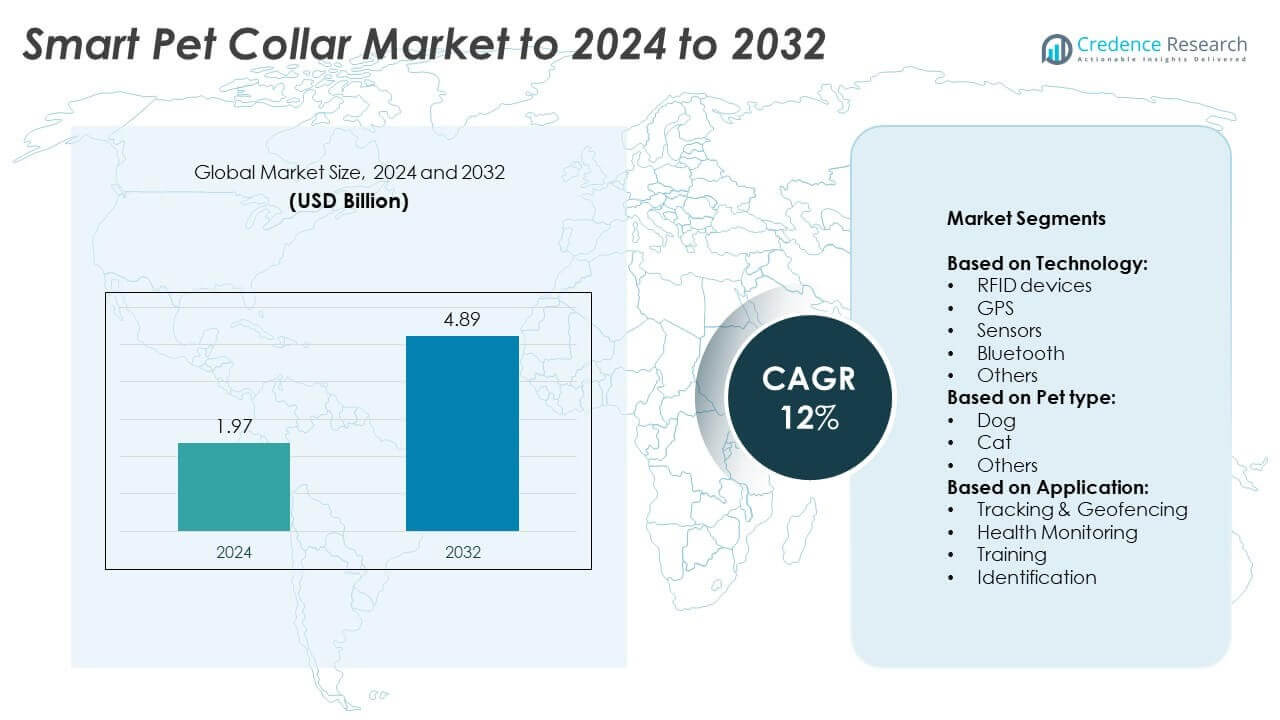

Smart Pet Collar Market size was valued USD 1.97 Billion in 2024 and is anticipated to reach USD 4.89 Billion by 2032, at a CAGR of 12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Pet Collar Market Size 2024 |

USD 1.97 Billion |

| Smart Pet Collar Market, CAGR |

12% |

| Smart Pet Collar Market Size 2032 |

USD 4.89 Billion |

The Smart Pet Collar market is shaped by leading players including Tractive, Halo Collar, Fi (Series 3), Garmin Ltd., Whistle Labs, Link My Pet, Pod Trackers, FitBark, PetPace, Link AKC, Pawtrack, and Wagz Inc. These companies drive innovation by integrating GPS tracking, health monitoring, and AI-powered analytics to enhance pet safety and wellness. Strategic focus on subscription-based services and smartphone integration strengthens user engagement. Regionally, North America dominated the market in 2024 with 38% share, supported by high pet ownership and advanced technology adoption. Europe followed with 27% share, while Asia Pacific accounted for 24%, driven by rapid urbanization and rising disposable incomes.

Market Insights

- The Smart Pet Collar market was valued at USD 1.97 Billion in 2024 and is projected to reach USD 4.89 Billion by 2032, growing at a CAGR of 12%.

- Rising pet ownership, growing humanization of pets, and demand for health monitoring solutions are the major drivers supporting market expansion.

- Market trends highlight the integration of AI and IoT for predictive analytics, along with increasing adoption of subscription-based data services that enhance long-term user engagement.

- The market is highly competitive, with players focusing on innovation in GPS tracking, biometric sensors, and battery life improvements while expanding distribution through e-commerce and veterinary networks.

- Regionally, North America led with 38% share in 2024, followed by Europe at 27% and Asia Pacific at 24%, while Latin America held 7% and the Middle East & Africa accounted for 4%; by segment, GPS technology dominated with over 40% share, reflecting strong demand for real-time tracking and geofencing features.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

The GPS segment dominated the Smart Pet Collar market in 2024, capturing over 40% share. GPS-enabled collars are widely adopted due to their accuracy in real-time tracking and geofencing, ensuring enhanced pet safety. Increasing demand among urban pet owners to prevent pet loss and provide outdoor freedom has accelerated adoption. Additionally, integration of GPS with mobile applications enables remote monitoring, improving user convenience. Rising investments in connected pet devices and growing smartphone penetration further support this growth. Other technologies such as RFID, sensors, and Bluetooth continue to expand with niche applications in identification and health tracking.

- For instance, the Garmin Alpha 200i can track and train up to 20 dogs, offering real-time monitoring with a 2.5-second update rate from up to 9 miles away (depending on the dog device).

By Pet Type

Dogs held the leading share of over 60% in 2024 within the pet type segment. The dominance is linked to the higher ownership rates of dogs compared to cats and other pets, along with rising adoption of smart devices for their training and safety. Dog owners are increasingly investing in collars with GPS and health monitoring features to track activity and detect potential health issues. The trend of pet humanization and increased spending on premium pet accessories are also fueling demand. Meanwhile, smart collars for cats are gaining traction due to their compact designs and indoor-outdoor monitoring capabilities.

- For instance, the Fi Series 3 dog collar can deliver up to 3 months of battery life under ideal conditions (e.g., when the dog is at home and connected to Wi-Fi most of the time).

By Application

Tracking & Geofencing accounted for the largest share of more than 45% in 2024, making it the most dominant application segment. This leadership stems from growing concerns about pet safety and the need to reduce cases of lost pets. GPS-based tracking systems paired with geofencing technology allow owners to set virtual boundaries and receive alerts when pets stray beyond them. Increasing urbanization, where pets face higher risks of traffic or theft, strengthens this demand. Health monitoring and training applications are also growing rapidly, supported by rising awareness of preventive care and behavioral improvement among pet owners.

Key Growth Drivers

Rising Pet Ownership and Humanization

The global rise in pet ownership, especially among urban households, is a key growth driver. Owners are increasingly treating pets as family members, boosting demand for advanced safety and health monitoring solutions. Smart collars with features such as GPS tracking and geofencing appeal to pet parents concerned about safety. The trend of pet humanization also supports higher spending on premium and tech-enabled accessories. This shift is further reinforced by increasing disposable incomes, making smart collars a mainstream product for modern pet care.

- For instance, the Garmin Alpha LTE collar has a standalone battery life of 11 hours with a 10-second update rate and up to 45 hours with a 2-minute update rate. When paired with a compatible VHF handheld device, such as the Alpha 200i or Alpha 300, the battery life extends to 12 hours for 10-second updates and up to 75 hours for 2-minute updates.

Advancements in IoT and Wearable Technology

The integration of IoT and wearable technologies acts as another major growth driver. Smart pet collars now feature real-time location tracking, biometric sensors, and cloud connectivity for continuous monitoring. These innovations improve user convenience by offering smartphone integration and customizable alerts. Growing investments in smart device ecosystems are further advancing product functionality. Enhanced connectivity through Bluetooth, Wi-Fi, and mobile networks makes collars more reliable. The increasing consumer preference for connected devices across daily life supports rising adoption in pet care applications.

- For instance, Link My Pet’s Smart Collar delivers up to 14 days of battery life on a single charge, verified in 2023 product specifications.

Growing Focus on Pet Health and Wellness

Rising awareness of preventive healthcare for pets is a significant growth driver. Smart collars that monitor heart rate, activity levels, and calories burned are gaining traction among health-conscious owners. The growing incidence of obesity and chronic conditions in pets has led to a demand for early detection tools. Veterinarians also encourage such devices for proactive care and treatment planning. Pet wellness apps linked to collars create a digital ecosystem, enhancing owner engagement. This focus on holistic pet well-being is expected to drive sustained growth in the market.

Key Trends & Opportunities

Integration with AI and Data Analytics

A key trend in the market is the integration of AI and data analytics for predictive insights. Smart collars now analyze activity patterns and health metrics to detect potential health risks early. This AI-driven approach enhances veterinary diagnostics and strengthens the preventive healthcare model. Data collected from collars also feeds into personalized care plans, offering owners tailored recommendations. As data-driven pet care expands, companies have opportunities to build subscription services and platforms that deliver continuous value. This innovation is expected to shape long-term growth in the industry.

- For instance, PetPace 2.0 captures millions of data points continuously and offers near real-time health alerts.

Expansion of E-Commerce and Omni-channel Sales

Another key opportunity arises from the rapid growth of e-commerce and omni-channel sales platforms. Online pet product retailers and marketplaces are expanding access to smart collars, increasing consumer reach. Subscription-based models for upgrades and data services are gaining traction. Omni-channel strategies, including direct-to-consumer channels, allow brands to enhance customer engagement and deliver better after-sales services. The global surge in digital purchasing behavior, coupled with pet owners’ demand for convenience, provides strong potential for market penetration. This trend also supports the entry of startups and niche brands.

- For instance, Fi introduced its “Fi Mini” tracker weighing 0.56 ounces (≈16 grams).

Rising Adoption in Emerging Economies

Emerging economies present a significant opportunity as rising incomes and urban lifestyles increase demand for advanced pet care products. Countries in Asia-Pacific and Latin America are witnessing rapid growth in pet adoption and ownership. With increasing smartphone penetration, awareness of connected pet devices is spreading quickly. Local brands and international players are introducing affordable smart collars tailored for these regions. Governments and NGOs promoting animal welfare also contribute to awareness. The untapped market potential in these regions creates opportunities for long-term revenue growth and product innovation.

Key Challenges

High Cost and Affordability Issues

One of the key challenges in the smart pet collar market is affordability. Premium collars with GPS, health monitoring, and AI-enabled features often come with high price tags. This restricts adoption among middle-income households, especially in price-sensitive regions. Limited awareness about long-term benefits also reduces willingness to invest in such products. While cost reductions may occur with mass production, affordability remains a major barrier. Addressing this challenge requires innovative pricing models, financing options, and partnerships to make devices more accessible to a wider consumer base.

Concerns Over Data Security and Reliability

Another critical challenge is the issue of data security and device reliability. Since smart collars collect sensitive health and location data, breaches could pose risks to both pets and owners. Connectivity issues such as poor GPS signals or battery limitations also affect reliability. Concerns about data misuse can discourage adoption in digitally cautious markets. Manufacturers must invest in robust encryption, secure platforms, and improved battery life to address these issues. Ensuring reliability and trust will remain essential for strengthening consumer confidence and supporting long-term market growth.

Regional Analysis

North America

North America held the largest share of 38% in the Smart Pet Collar market in 2024. The region’s dominance is driven by high pet ownership rates, advanced technology adoption, and strong consumer spending on premium pet care products. The United States leads with widespread adoption of GPS-enabled and health-monitoring collars, supported by well-established e-commerce and retail distribution. Growing awareness of pet wellness and integration of IoT devices further enhances demand. Canada also contributes to growth, with rising urban pet ownership. The region remains a hub for innovation, with leading players introducing advanced AI-integrated pet monitoring solutions.

Europe

Europe accounted for 27% of the Smart Pet Collar market in 2024, supported by high awareness of pet welfare and strong regulatory frameworks. Countries like Germany, France, and the United Kingdom lead demand, driven by growing investments in premium pet accessories and wellness devices. Increasing adoption of GPS tracking for outdoor pets and rising pet insurance penetration also contribute to regional growth. The expansion of e-commerce platforms further strengthens accessibility, while startups in wearable pet technology are gaining visibility. Rising demand for sustainability-focused collars also supports innovation, positioning Europe as a strong growth region in the forecast period.

Asia Pacific

Asia Pacific held a 24% market share in 2024, emerging as one of the fastest-growing regions. Rapid urbanization, rising disposable incomes, and increasing pet adoption in China, India, and Japan are fueling demand for smart collars. Growing smartphone penetration and familiarity with connected devices also drive adoption across urban households. International players are expanding into this region with cost-effective offerings tailored for middle-income consumers. Local manufacturers are also introducing affordable models, making smart collars more accessible. The region shows strong potential for long-term growth, supported by expanding e-commerce channels and heightened focus on companion animal health monitoring.

Latin America

Latin America represented 7% of the Smart Pet Collar market in 2024, driven by rising pet adoption and a growing middle class. Countries such as Brazil and Mexico lead demand, where urban households are increasingly investing in pet safety and wellness products. The expansion of online retail channels has improved access to international brands, boosting market penetration. Affordability remains a challenge, but local players are introducing competitively priced models. Growing awareness of preventive health care for pets supports gradual adoption. The region presents untapped opportunities as consumer spending on connected pet accessories continues to increase steadily.

Middle East & Africa

\The Middle East & Africa accounted for 4% of the Smart Pet Collar market in 2024. The region’s growth is supported by increasing pet adoption in urban centers, particularly in the United Arab Emirates and South Africa. Rising disposable incomes and the trend of pet humanization are driving demand for connected accessories. However, limited awareness and high product costs continue to slow widespread adoption. E-commerce expansion and the availability of global brands are gradually improving accessibility. With growing investments in pet care infrastructure, the region is expected to witness moderate but consistent growth during the forecast period.

Market Segmentations:

By Technology:

- RFID devices

- GPS

- Sensors

- Bluetooth

- Others

By Pet type:

By Application:

- Tracking & Geofencing

- Health Monitoring

- Training

- Identification

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

Competitive landscape in the Smart Pet Collar market features key players such as Tractive, Halo Collar, Fi (Series 3), Garmin Ltd., PitPat, Whistle Labs, Link My Pet, Pod Trackers, FitBark, PetPace, Link AKC, Pawtrack, and Wagz Inc. The market is characterized by intense competition, with companies focusing on product innovation and integration of advanced technologies such as GPS, sensors, and AI-driven health monitoring. Strategic emphasis is placed on enhancing battery performance, improving device reliability, and offering real-time data through mobile applications. Firms are also expanding global reach via partnerships with e-commerce platforms and veterinary networks, ensuring greater accessibility. Competitive strategies include pricing differentiation, introduction of subscription-based models for data analytics, and development of region-specific offerings to attract diverse consumer bases. Investments in research and development continue to play a crucial role, as companies aim to strengthen brand loyalty and secure long-term growth in the rapidly expanding pet technology industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tractive

- Halo Collar

- Fi (Series 3)

- Garmin Ltd.

- PitPat

- Whistle Labs

- Link My Pet

- Pod Trackers

- FitBark

- PetPace

- Link AKC

- Pawtrack

- Wagz Inc.

Recent Developments

- In 2025, Fi (Series 3) launch a Series 3 Plus with AI-powered behavior tracking and improved GPS.

- In 2023, Halo Collar secured a multi-million dollar growth funding package to support expansion, product development, and distribution. They also launched the Halo Collar 3, featuring AI-driven PrecisionGPS™ for improved accuracy by discarding false satellite signals caused by reflections from buildings and objects.

- In 2023, Link My Pet announced a partnership with MWI/Amerisource Bergen for the LinkVet animal health solution. This collaboration aims to enhance pet care by providing vets and pet owners with a device and smartphone application featuring tailored activity monitoring and GPS tracking.

Report Coverage

The research report offers an in-depth analysis based on Technology, Pet Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising global pet ownership.

- Smart collars will integrate advanced AI for predictive health monitoring.

- GPS-based tracking will remain the most preferred feature among pet owners.

- Demand will rise in emerging economies due to increasing disposable incomes.

- E-commerce will play a key role in boosting product accessibility.

- Subscription-based data services will become a common business model.

- Collaboration with veterinarians will enhance adoption of health monitoring collars.

- Battery efficiency and device reliability will improve through innovation.

- Data privacy and security solutions will shape consumer trust.

- Sustainability-focused designs will gain traction among eco-conscious consumers.